Content

Liquid Silicone Rubber Market Size and Share 2034

The global liquid silicone rubber market size was valued at USD 3.55 billion in 2024 and is estimated to hit around USD 8.06 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.55% during the forecast period 2025 to 2034. The growing demand from industries like consumer goods, electrical & electronics, automotive, medical & healthcare, and technological advancements in formulation drive the market growth.

![]()

Liquid Silicone Rubber Market Key Takeaways

- The U.S. liquid silicone rubber market is projected to grow from USD 1.06 billion in 2025 to USD 2.39 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 9.32% during the forecast period (2025- 2034)

- The North America liquid silicone rubber market dominated the global market in terms of revenue share of 39.47% in 2023.

- The Asia Pacific is experiencing the fastest growth in the market due to the growing automotive and electronics manufacturing industry.

- By grade, the industrial segment accounted for a larger revenue share of 55% in 2024

- By grade, the medical segment is expected to grow at a CAGR of 9.26% during the forecast period.

- By application, the automotive segment accounted for a larger revenue share of 36.19% in 2024

- By application, the electronic & electrical segment is projected to grow at a CAGR of 8.45% during the forecast period.

Expansion of LSR in Modern Manufacturing

Liquid silicon rubber (LSR) is a biocompatible silicon rubber that consists of two-part dispensable silicon materials. These materials are rapidly heat-cured and readily mixed into durable elastomers. It consists of properties like biocompatibility, flexibility, and durability; due to this, it is widely used in various industries. It is a low-viscosity liquid that is easily injected into molds.

Liquid silicon rubber offers high-speed processing, creation of intricate and complex parts, precise control over dimensions, and clean manufacturing of various products. Liquid silicon rubber is categorized into various types like self-lubricating, electrically conductive, heat-stabilized, extra-low viscosity, self-adhesives, and coolant resistant.

The rapid growth in online shopping increases demand for high-performance packaging, which increases demand for liquid silicon rubber due to its biocompatibility. The growing demand for various consumer products like toys, baby products, personal care, and kitchenware helps in the growth of the market.

Factors like growing demand from various industries like electrical, healthcare, construction, automotive & electronics, growing versatility, growing regional demand, and ongoing technological advancements and innovations contribute to the overall growth of the liquid silicone rubber market.

- The total of 1560 suppliers of liquid silicone rubber are present.

- SHENZHEN ZHIHUA CHEMICAL CO LTD is the leading supplier of liquid silicone rubber, accounting for 22% of total shipments with 162 shipments.

- Germany exported 1173 shipments of liquid silicone rubber.

- Japan exported 664 shipments of liquid silicone rubber.

The Healthcare Industry is Driving LSR Demand

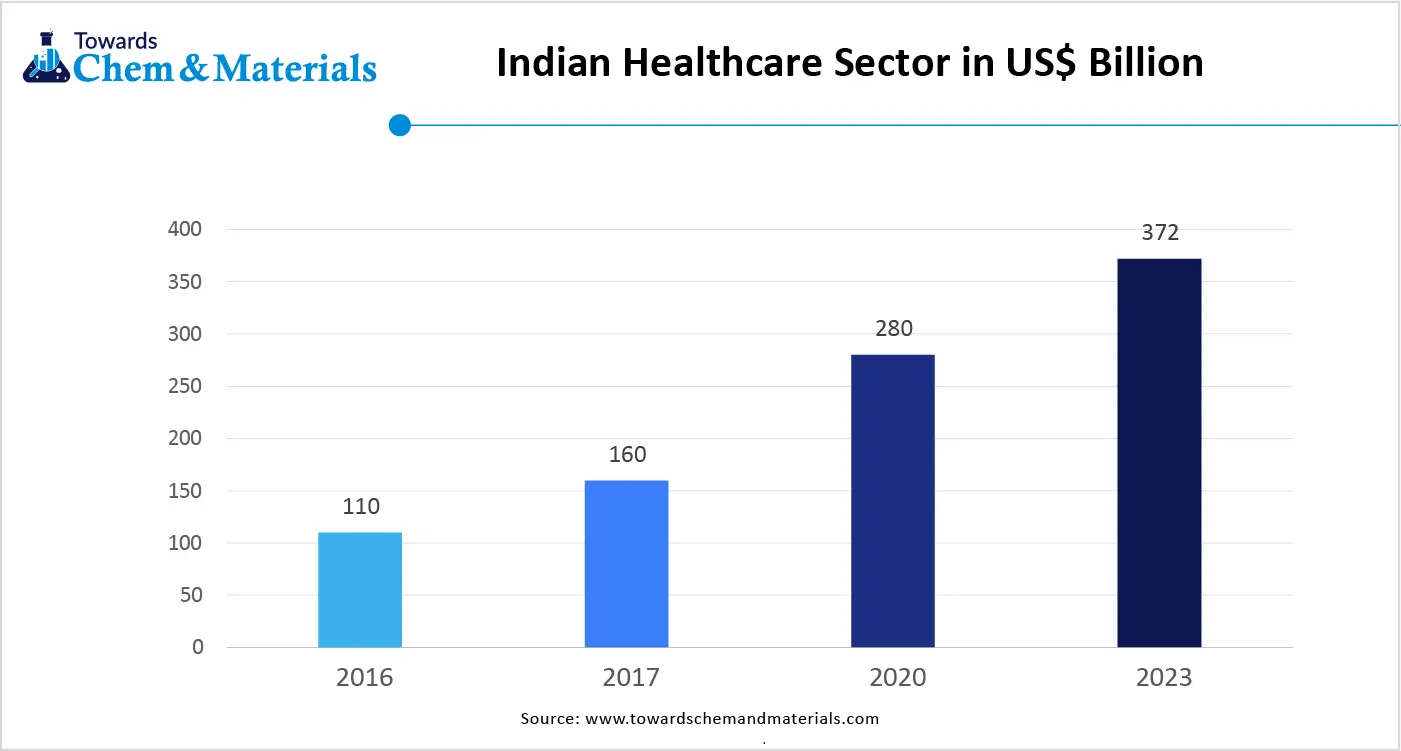

The aging population, availability of digital health solutions, growing population, increased healthcare awareness, and growing chronic diseases due to changing lifestyles help in the growth of the healthcare sector. The growing various health issues increases demand for high-performance medical devices, which fuels demand for liquid silicon rubber.

The growing demand for biocompatibility, like respiratory masks, prosthetics, and catheters, in the healthcare industry, increases demand for liquid silicon rubber to minimize the risk of adverse reactions. The growing utilization of the sterilization method in healthcare increases demand for hygiene & safety, which helps in the market growth. In the healthcare system growing demand for implantable devices, patient comfort devices, various diagnostic devices, pharmaceuticals, oncology, and cardiology increases demand for liquid silicon rubber. The rapid growth of the healthcare sector in various regions and the growing demand for various medical applications like drug delivery systems, masks, surgical sleeves, and respirators a key driver for the growth of the liquid silicone rubber market.

Liquid Silicone Rubber Market Trends

- Growing sustainability focus: The growing focus on sustainability in various industries increases demand for liquid silicon rubber due to its environmental benefits, like adherence to quality standards & stringent safety, recyclability, and low carbon footprint. The growing demand for sustainable products in various applications like consumer products, automotive components, medical devices, and electronics helps in liquid silicone rubber market growth.

- Technological advancements: The growing technological advancements, like advancements in material applications & properties, 3D printing, and improvements in manufacturing processes like liquid injection molding, help in the growth of the market. Technological innovations expand applications in various industries, enhance production efficiency, and create complex shapes & geometries. Advancements help to improve biocompatibility, improve chemical resistance, and enhance durability.

- Growing demand for electronics products: The growing demand for various electronics products like smartwatches, smartphones, laptops, computers, and many more increases the demand for liquid silicon rubber to enhance electrical insulation, heat resistance, and chemical resistance. The growing demand from North America and the Asia Pacific for electronic devices helps in market growth. It is widely used in various applications of electronic devices like connectors, keypads, and encapsulation of other electronic components.

Market Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 3.85 Billion |

| Expected Market Size By 2034 | USD 8.06 Billion |

| Growth Rate from 2025 to 2034 | CAGR 8.55% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| High Dominant Region | North America |

| Segment Covered | By Grade , By Application, By Region |

| Key Companies Profiled | Elkem ASA, Avantor Inc., Momentive Performance Materials, Dow,Shin-etsu Chemical Co., Ltd, SIMTEC Silicone Parts, LLC,Trelleborg AB, Wynca Tinyo Silicone Co. Ltd, Wacker Chemie AG, Stockwell Elastomerics |

Liquid Silicone Rubber Market Opportunity

LSR Surge in Consumer Goods

The rapid growth in e-commerce, increasing disposable income, growing consumer awareness regarding brands, and increasing urbanization help in the growth of the consumer goods sector. Consumers are buying various products like durable goods, premium items, personal care items, and many more through online or offline platforms.

The growing sales of consumer goods increase demand for liquid silicon rubber to enhance the performance of products. The growing utilization of various appliances like water heaters, dishwashers, gas furnaces, and many more appliances demands diaphragms, gaskets, seals, and other components that increase demand for liquid silicon rubber. The growing demand for kitchenware products like food storage containers, baking molds, and ice cube trays is fueling demand for liquid silicon rubber to withstand high chemical resistance & extreme temperatures. The growing demand for consumer goods like home appliances, baby products, and consumer electronics creates an opportunity for the growth of the liquid silicone rubber market.

Liquid Silicone Rubber Market Challenge

High Production Cost Limits LSR Demand

Despite several benefits of liquid silicon rubber in various industries, the high production cost may restrict the growth of the market. Production cost depends on various factors like raw materials, the requirement of specialized equipment, and complex manufacturing processes. Liquid silicon rubber needs specialized equipment like advanced machinery, advanced injection molding, and various molds, and the cost of this equipment is high. A complex manufacturing process increases the overall operational cost. The raw material required for production is resource-intensive & energy-intensive, which increases the overall cost. The production needs extensive quality control and skilled labor, fueling overall cost that hampers the liquid silicone rubber market growth.

Regional Insights

LSR leadership in North America

North America dominated the liquid silicone rubber market in 2024. The well-established manufacturing infrastructure and high production of liquid silicon rubber in the region help in the growth of the market. The extensive investment in the research & development of new materials & applications of liquid silicon rubber drives the market growth. The growing demand for high-performance applications like automotive components and medical devices in the region increases demand for liquid silicon rubber.

The well-established healthcare sector fuels demand for liquid silicon rubber. The presence of key processors & manufacturers and favorable government regulations drives the market growth. Furthermore, growing demand from end-user industries like construction, automotive, and electronics contributes to the growth of the market.

The United States is Shaping the LSR Industry

The United States holds the largest share of the liquid silicone rubber market. The robust automotive industry increases demand for hoses, engine seals & other automotive applications, driving the market growth. The well-established electronics industry in the region increases demand for electronic control units, flexible circuit boards, and connectors, which increases demand for liquid silicon rubber. The strong investment in research & development and a well-established manufacturing base help in the market growth. Additionally, a strong financial base and an extensive industrial base, and a diverse industrial sector like construction, electronics, automotive, and healthcare support the growth of the market.

- The United States exported 776 shipments of liquid silicone rubber.

LSR Boom In Asia Pacific

Asia Pacific expects the fastest growth in the liquid silicone rubber market during the forecast period. The rapid expansion of the automotive industry in countries like Japan, China, and India is fueling demand for electrical connectors, gaskets, seals, and other components that help in the growth of the market.

The growing healthcare sector increases demand for implants and medical devices, which fuels demand for liquid silicon rubber. The well-established manufacturing sector in countries plays an important role in manufacturing consumer goods, electronics, and automotive components, driving the market growth. The lower manufacturing costs and strong investment in automation and advanced molding technologies increase demand for liquid silicon rubber. The growing electronics industry and favorable government policies contribute to the market growth.

Rise of LSR in China

China is growing in the liquid silicone rubber market. The extensive presence of the electronics industry and the rapidly growing automotive sector help in the growth of the market. The growing expansion of the healthcare sector increases demand for medical manufacturing, fueling demand for liquid silicon rubber. The growing investments in electronics manufacturing and technological advancements in automation and molding technology help in the market growth. Additionally, growing demand from various sectors like construction & electrical drives the market growth.

- China exported 4431 shipments of liquid silicone rubber.

India’s role in the LSR market

India is contributing to the growth of the liquid silicone rubber market. The growing healthcare industry increases demand for implants & medical devices helps in the market growth. The rapid expansion of the electronics sector fuels demand for reliable & durable electronics devices, increasing demand for liquid silicon rubber. The strong government initiatives in the country help in the market growth. For instance, the initiative Make in India aims to assemble, develop, and manufacture various products in India. Furthermore, growing demand from food & beverages, construction, and aerospace sectors drives the market growth.

Segmental Insights

Grade Insights

The industrial segment dominated the liquid silicone rubber market in 2024. The growing requirement for high-performance properties of materials like withstand high stress, extreme temperature, and corrosive chemicals in various industries drives the growth of the market. The various industrial applications increase demand for the creation of complex molds and shapes, fueling demand for liquid silicon rubber. The growing various industries in the Asia Pacific increase demand for liquid silicon rubber for various industrial applications. Furthermore, growing industrial applications in various sectors like electrical, automotive, and electronics support the market growth.

The medical segment is the fastest growing in the liquid silicone rubber market during the forecast period. The growing aging population and awareness of health concerns increase demand for implants and medical devices, which helps in the market growth. The growing demand for medical implants like catheters & feeding tubes, pacemaker components, hydrocephalic shunts, and intravenous infusion therapy increases demand for liquid silicon rubber.

The increasing demand for respiratory devices like breathing masks, tubes, respirators, and bellows is fueling demand for liquid silicon rubber. The growing production of surgical instruments like surgical grips, syringe components, valve seals, and scalpel handles drives the market growth. Additionally, stringent regulations in the medical industry and growing demand for advanced medical applications contribute to the market growth.

Application Insights

The automotive segment held the largest share of the liquid silicone rubber market in 2024. The growing demand for windshield wiper blades, seals, gaskets, electrical connectors, and many other components in the automotive industry helps in the growth of the market. The expansion of the automotive industry in various regions, growing vehicle production, and technological advancements in vehicles increase demand for liquid silicon rubber.

![]()

The increasing demand for high-performance and versatile automotive components fuels demand for liquid silicon rubber. The growing advancements in vehicle technology and the rising demand for lightweight materials in vehicles increase the demand for liquid silicon rubber. Additionally, the growing production and adoption of electric vehicles in various regions support the market growth.

The electronic & electrical segment is the fastest growing in the liquid silicone rubber market during the forecast period. The growing versatility and customization demand for various electrical & electronics components increases the demand for liquid silicon rubber helps in the growth of the market. The growing demand for electrical insulation, electronic circuit protection, and thermal management in electronics fuels demand for liquid silicon rubber. The growing miniaturization of electronic systems and electronic devices helps in the market growth. The wide range of applications, like keyboards, gaskets, connectors, seals, cables, and many more, increases demand for liquid silicon rubber. The rapid growth in the electronic & electrical sector in various regions drives the market growth.

Liquid Silicone Rubber Market Recent Developments

Dow

- Launch: In January 2023, Dow launched liquid silicon rubbers new series SILASTIC SA 994X. The new series is designed for automotive applications like radiator gaskets, connector seals, and battery vent gaskets for hybrid & electric vehicles, and for lidar & radar housing environmental protection seals for autonomous vehicles. The product offers a 12-month shelf life, durable adhesion under heat & humidity, robust adhesion to various metal & plastic substrates, and rapid development of bond strength.

Shenzhen Tenchy Silicon and Rubber Co., Ltd.

- Launch: In October 2024, Shenzhen Tenchy Silicone and Rubber Co., Ltd. launched medical-grade silicone tubing for critical healthcare applications. These new applications ensure durability, safety, and hygiene, and are made from 100% medical-grade silicone. The tubing withstands sterilization through various methods like radiation, CIP, autoclave, and SIP. The features of the new tube are high sanitation level, non-toxic, biocompatible, aging & tear resistance, and unmatched versatility across various medical applications.

Elkem Silicones

- Launch: In November 2024, Elkem Silicones launched new silicone elastomers: AMSil 92102 series and AMSil 20503 series for 3D printing applications. The new AMSil 20503 series is made up using liquid silicone rubber formulations, and it consists of high durability, extended shelf life, enhanced productivity, and high physicochemical performance. AMSil 92102 series enables more efficient & complex structures and allows refined surface printing.

Top Companies List

![]()

- Elkem ASA

- Avantor Inc.

- Momentive Performance Materials

- Dow

- Shin-etsu Chemical Co., Ltd

- SIMTEC Silicone Parts, LLC

- Trelleborg AB

- Wynca Tinyo Silicone Co. Ltd

- Wacker Chemie AG

- Stockwell Elastomerics

Segments Covered in the Report

By Grade

- Industrial

- Medical

- Food

By Application

- Automotive

- Electronics & Electrical

- Medical

- Consumer Goods

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait