Content

What is the Current Lay-up Composites Market Size and Volume?

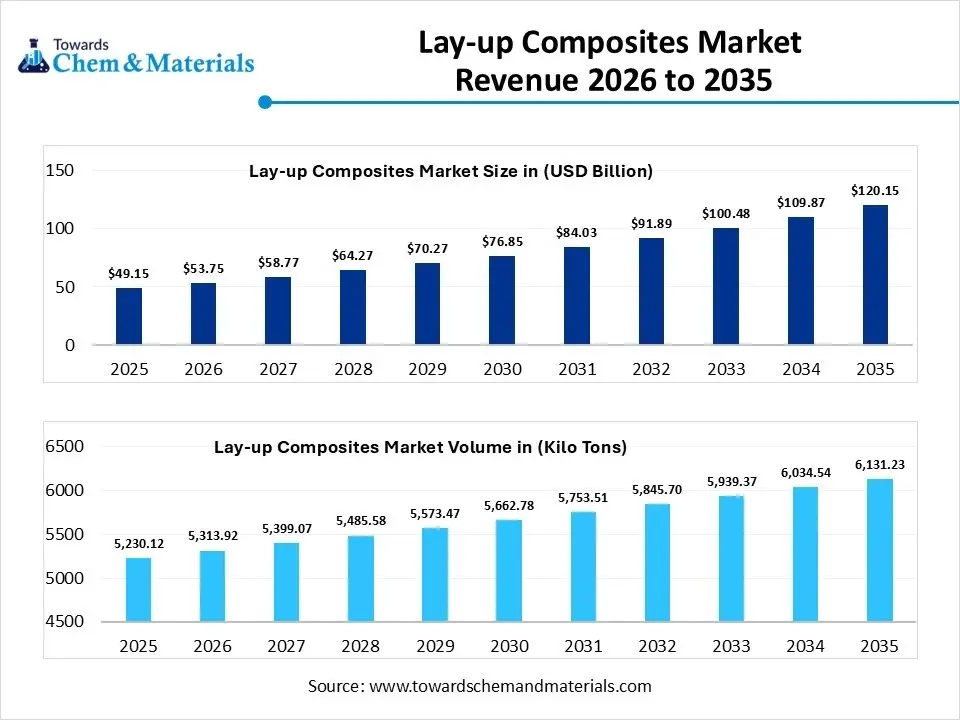

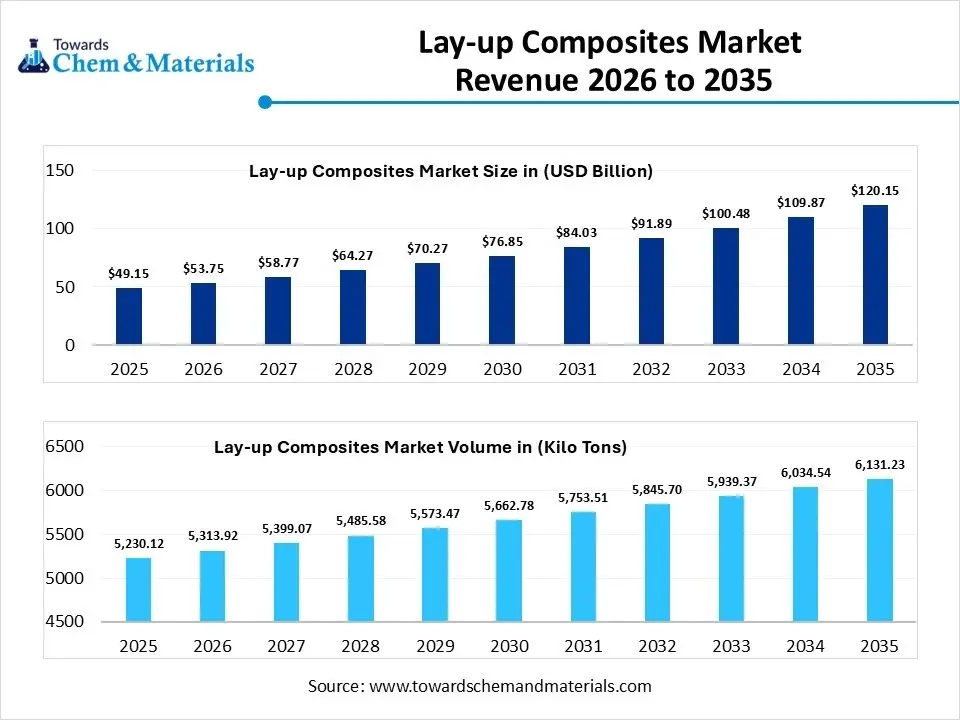

The global lay-up composites market size was estimated at USD 49.15 billion in 2025 and is expected to increase from USD 53.75 billion in 2026 to USD 120.15 billion by 2035, growing at a CAGR of 9.35% from 2026 to 2035. In terms of volume, the market is projected to grow from 5230.12 kilo tons in 2025 to 6131.23 kilo tons by 2035. growing at a CAGR of 1.60% from 2026 to 2035. Asia Pacific dominated the lay-up composites market with the largest volume share of 46.0% in 2025.The growing demand for high-strength and lightweight materials is the key factor driving market growth. Also, growing adoption of thermoplastic composites, coupled with the ongoing shift towards sustainable processes, can fuel market growth further.

Market Highlihgts

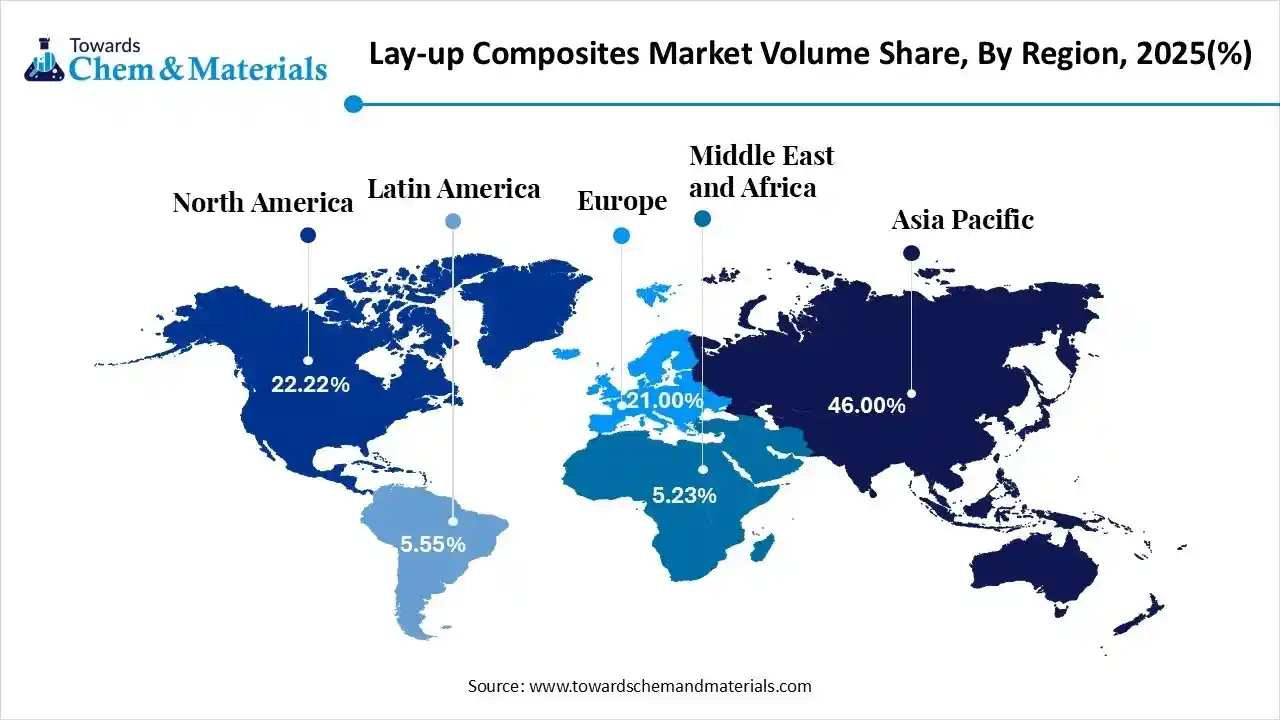

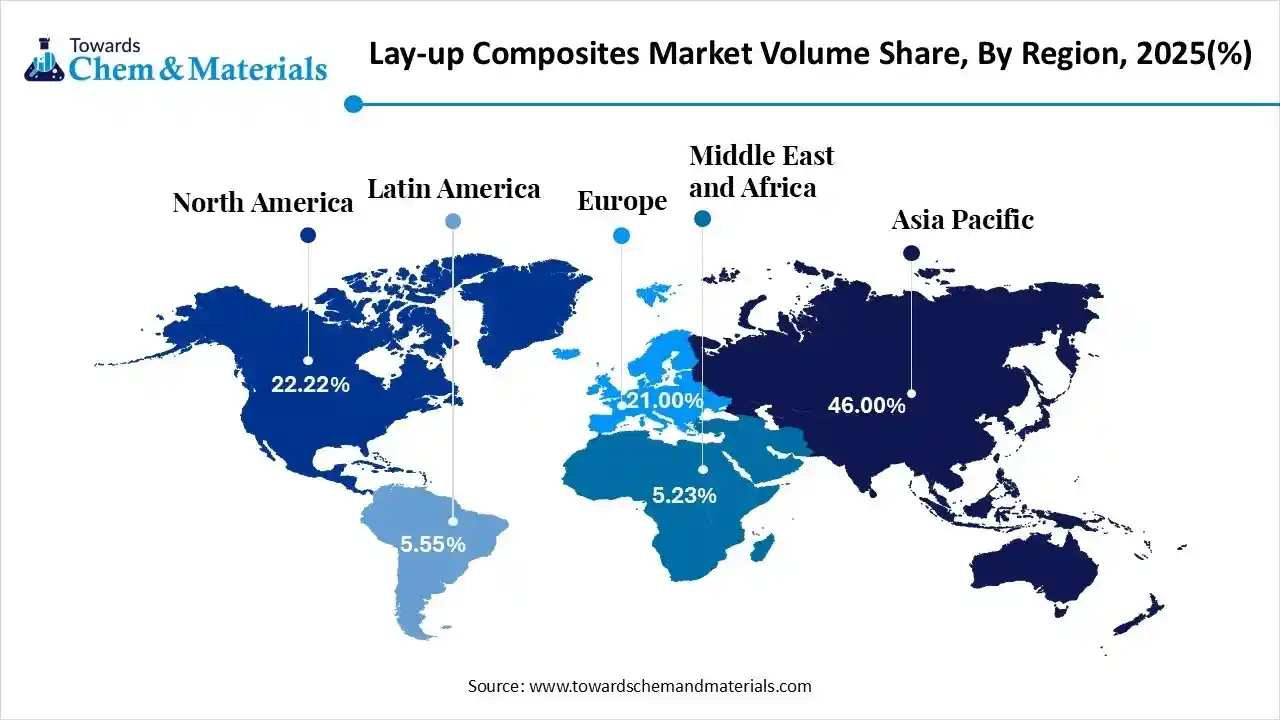

- The Asia Pacific dominated the global lay-up composites market with the largest volume share of 46.0% in 2025.

- The lay-up composites market in North America is expected to grow at a substantial CAGR of 3.66% from 2026 to 2035.

- The Europe lay-up composites market segment accounted for the major volume share of 21.0% in 2025.

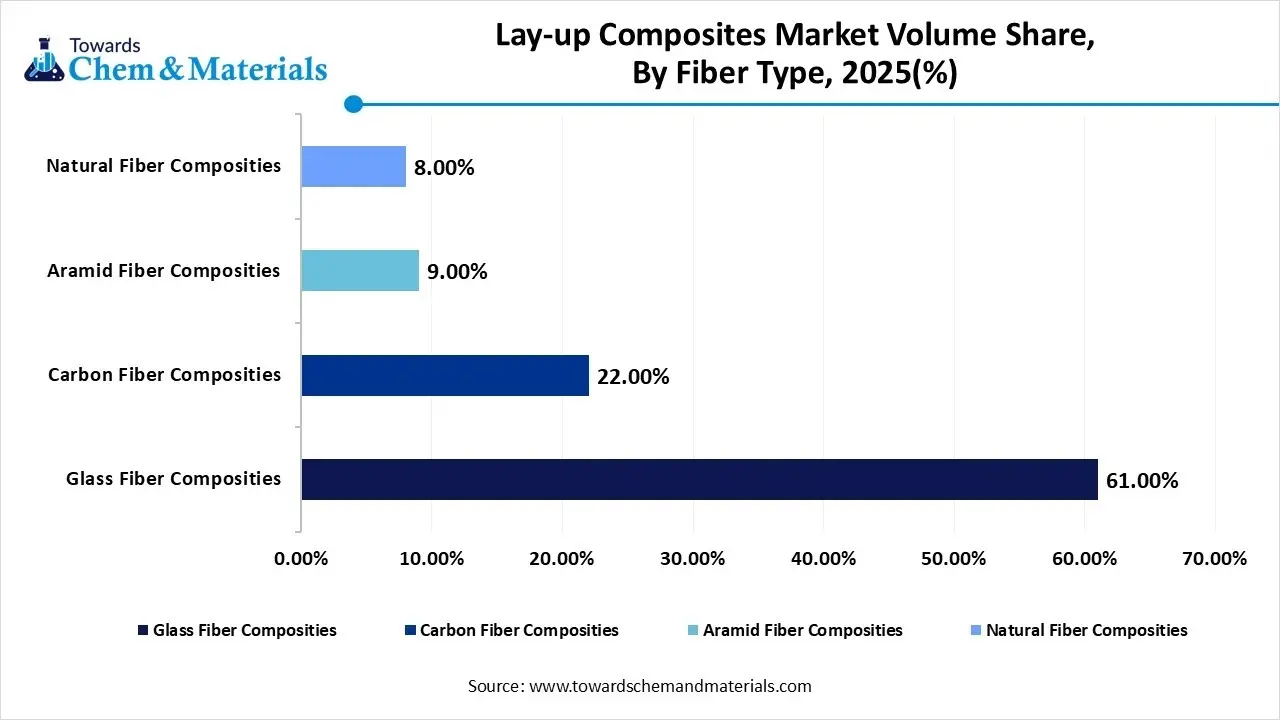

- By fiber type, the glass fiber segment dominated the market and accounted for the largest volume share of 60.5% in 2025.

- By fiber type, the carbon fiber composites segment is expected to grow at the fastest CAGR of 3.29% from 2026 to 2035 in terms of volume.

- By process, the hand lay-up segment led the market with the largest revenue volume share of 35.0% in 2025.

- By resin type, the thermoset composites segment dominated the market and accounted for the largest volume share of 56.2% in 2025.

- By resin type, the thermoplastic composites segment led the market with the largest revenue volume share of 43.8% in 2025.

- By end user industry, the aerospace & defense dominated the market and accounted for the largest volume share of 35.1% in 2025.

- By sales channel, the direct sale segment led the market with the largest revenue volume share of 68.0% in 2025.

What are Lay-up Composites Market?

The lay-up composites market encompasses the manufacturing and supply of fiber-reinforced polymer (FRP) materials produced using layering techniques, including manual hand lay-up, spray-up, and vacuum bagging. This market involves the integration of high-performance fibers such as glass, carbon, and aramid with resin matrices like epoxy, polyester, and vinyl ester to create lightweight, high-strength structural components. The market is primarily driven by the escalating demand for fuel-efficient aircraft in the aerospace sector.

Lay-up Composites Market Trends

- There is an ongoing shift towards customized composite solutions catering to specific industry demand, which is the latest trend in the market. This emphasis on specialization suggests that market players are responding to unique obstacles faced by various sectors.

- The integration of Industry 4.0 technologies, such as digital twins and automated fiber placement (AFP), is enhancing production precision and reducing material waste, further propelling market growth.

- The rapid transition towards renewable energy sources is substantially impacting the market growth. The surge in demand for efficient and larger wind turbines is fuelling the need for innovative composite materials that can bear harsh environmental conditions.

- Technological advancements in manufacturing processes, like the adoption of tools such as automation, predictive analytics, and advanced resin systems, are enhancing the quality control, reducing waste, and boosting market growth soon.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 53.75 Billion / 5313.92 Kilo Tons |

| Revenue Forecast in 2035 | USD 120.15 Billion / 6131.23 Kilo Tons |

| Growth Rate | CAGR 9.35% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Fiber Type, By Process, By Resin Type, By End-User Industry, By Sales Channel, By Region |

| Key companies profiled | Toray Industries, Inc, Hexcel Corporation, Teijin Limited (Japan), Solvay S.A. (Belgium), SGL Carbon SE (Germany), Mitsubishi Chemical Group Corporation (Japan), Owens Corning (US) Gurit Holding AG (Switzerland), Huntsman Corporation (US), China Jushi Group Co., Ltd. (China), BASF SE (Germany), Johns Manville (US),Evonik Industries AG (Germany), TPI Composites, Inc. (US),Compounding Solutions (US), Axiom Materials, Inc. (US),Safran S.A. (France),Kineco Limited (India),PPG Industries, Inc. (US), Binani Industries Ltd. (India) |

How Cutting-Edge Technologies Are Revolutionizing the Lay-up Composites Market?

Advanced technologies are transforming the conventional market by introducing advanced materials, automation, and digital tools to improve efficiency, minimize costs, and enhance the overall performance and quality of composite parts. Furthermore, the integration of nanoparticles like graphene and carbon nanotubes improves electrical conductivity and thermal stability.

Trade Analysis of Lay-up Composites Market: Import & Export Statistics

- Between June 2024 and May 2025, the United States imported 16,464 shipments of composites, representing a 46% increase over the previous year. These imports were provided by 2,250 international exporters to a total of 5,322 U.S. buyers.

- From May 2024 to April 2025 (TTM), India exported 3,389 shipments of materials composite, indicating a 12% growth rate compared to the preceding twelve months. These exports were managed by 240 Indian suppliers and delivered to 497 buyers.

Lay-up Composites Market Value Chain Analysis

- Feedstock Procurement : It is the crucial process of sourcing and acquiring necessary raw materials, mainly reinforcing fibers and polymer resins from suppliers, to manufacture composite products.

- Major Players: Toray Industries, Inc, Teijin Limited.

- Chemical Synthesis and Processing: It involves the basic formulation of resins and the specialized techniques utilized to create composite structures through automated or manual layering.

- Major Players: Solvay S.A., Teijin Limited.

- Packaging and Labelling: It refers to the crucial stage of the production process where finished composite parts are created for transit and identified for supply chain management.

- Major Players: Amcor plc, International Paper Company.

- Regulatory Compliance and Safety Monitoring: It involves adhering to stringent regulations to ensure the quality, reliability, and safety of materials and products across their life cycle. This is important for ensuring product certification and safety.

- Major Players: Owens Corning, SGL Carbon SE.

Lay-up Composites Market 's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| United States (US) | The regulatory environment involves a mix of federal and state government policies and industry-led initiatives through bodies like the American Composites Manufacturers Association (ACMA). |

| European Union (EU) | The EU has a significant new regulation (EU) 2023/2055, which restricts intentionally added synthetic polymer microparticles (microplastics) in products and mixtures. |

| China | China's Environmental Protection Law has led to strict enforcement, higher fines, and factory closures for non-compliance, pushing manufacturers in all sectors, including composites, to adopt greener practices and reduce emissions. |

Segmental Insights

Fiber Type Insights

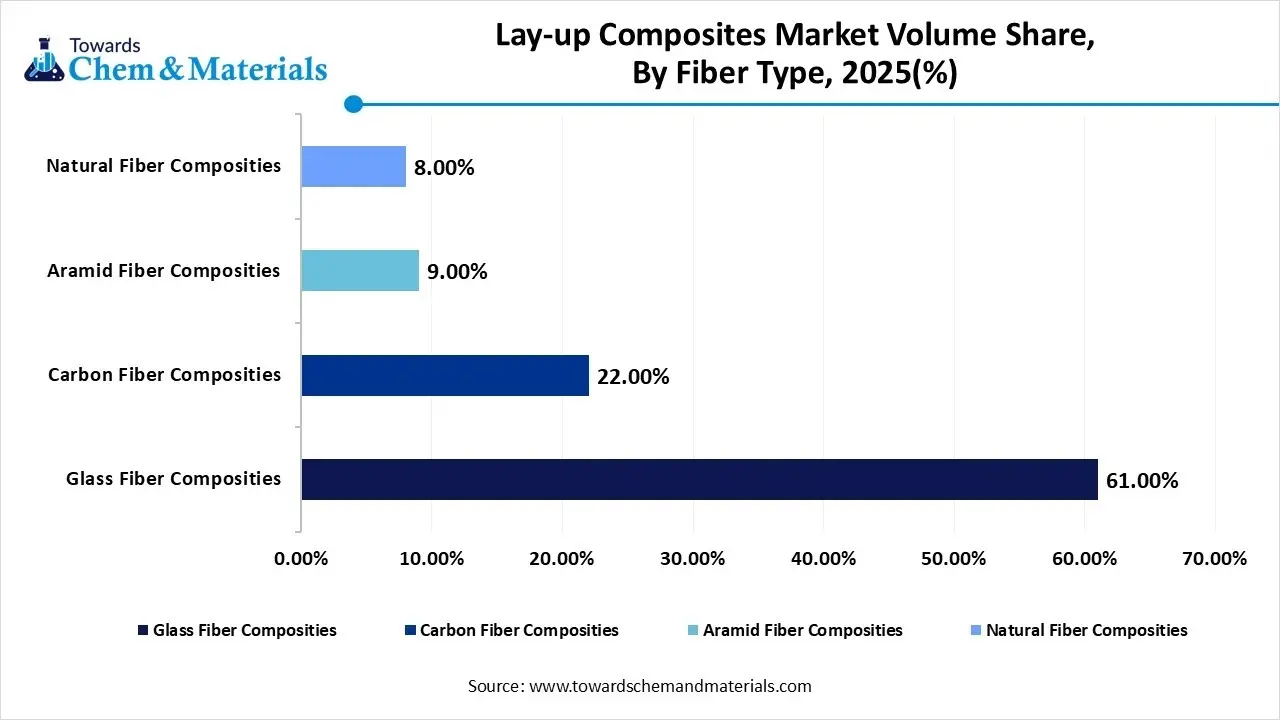

How Much Share Did the Glass Fiber Composites Segment Held in 2025?

The glass fiber composites volume was valued at 3190.37 kilo tons in 2025 and is projected to reach 3507.68 kilo tons by 2035, expanding at a CAGR of 1.06% during the forecast period from 2025 to 2035. The glass fiber composites segment dominated the market with nearly 60.5% share in 2025. The dominance of the segment can be attributed to its cost-effectiveness, high corrosion resistance, and wide applicability across wind energy, marine, and construction sectors. In addition, it is compatible with various resin systems and available in different forms such as woven fabrics and mats, optimising easy production.

The carbon fiber composites segment volume was valued at 1150.63 kilo tons in 2025 and is projected to reach 1540.16 kilo tons by 2035, expanding at a CAGR of 3.29% during the forecast period from 2025 to 2035. The carbon fiber composites segment held nearly 22.0% market share in 2025.The growth of the segment can be credited to its rapid adoption in aerospace, EVs, and high-performance automotive applications due to superior strength-to-weight ratios. These composites have exceptional strength, fatigue resistance, and low weight, which makes them ideal for various applications.

Lay-up Composites Market Volume and Share, By Fiber Type, 2025-2035

| By Fiber Type | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Glass Fiber Composities | 61.00% | 3190.37 | 3507.68 | 1.06% | 57.21% |

| Carbon Fiber Composities | 22.00% | 1150.63 | 1540.16 | 3.29% | 25.12% |

| Aramid Fiber Composities | 9.00% | 470.71 | 524.22 | 1.20% | 8.55% |

| Natural Fiber Composities | 8.00% | 418.41 | 559.17 | 3.27% | 9.12% |

Process Insights

Which Process Type Segment Dominated Lay-up Composites Market in 2025?

The hand lay-up segment dominated with nearly 35.0% market share in 2025. The dominance of the segment can be linked to its low tooling cost, design flexibility, and suitability for low-to-medium production volumes. Moreover, this process provides low initial tooling costs, which makes it economically feasible for large, custom, or intricate components.

The automated lay-up (AFP/ATL) segment held approximately 19.5% market share in 2025 and is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by rising demand for precision, repeatability, and reduced labor dependency. These systems enable steered tow placement, allowing the creation of load-optimized and complex geometries, which are challenging to achieve manually.

Resin Type Insights

Which Resin Type Segment Dominated Lay-up Composites Market in 2025?

The thermoset composites segment dominated the market with nearly 56.2% share in 2025. The dominance of the segment is owed to the growing renewable energy and infrastructure demand from the emerging countries, along with the versatility of thermoset resins. Furthermore, they have excellent mechanical properties, thermal stability, and established use in aerospace, wind energy, and marine applications.

The thermoplastic composites segment held nearly 43.8% market share in 2025 and is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to faster processing times, recyclability, and superior impact resistance, aligning well with automotive mass production and sustainability goals. Thermoplastic can be remolded and melted, enabling smooth end-of-life recycling.

End-User Industry Insights

How Much Share Did the Aerospace & Defense Segment Held in 2025?

The aerospace & defense segment dominated with nearly 35.1% market share in 2025. The dominance of the segment can be attributed to the continuous demand for lightweight, high-strength materials for aircraft structures and defense platforms. In addition, aircraft such as A350XWB include substantially more composites in fuselages, wings, and interiors, fuelling segment expansion soon.

The wind energy segment held approximately 26.0% market share in 2025 and is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the increasing installations of larger turbine blades. Also, an ongoing transition away from fossil fuels to fulfil climate goals substantially drives demand for wind turbines, which are largely dependent on composites.

Sales Channel Insights

How Much Share Did the Direct Sale Segment Held in 2025?

The direct sale segment dominated the market with nearly 68.0% share in 2025. The dominance of the segment can be linked to the large OEMs and Tier-1 suppliers' preference for long-term supply agreements to ensure material consistency, quality assurance, and technical collaboration. It often involves a high percentage of technical support and service, for on-site expertise and complex lay-up projects.

The indirect sales segment held a nearly 32.0% market share in 2025 and is expected to grow at the fastest CAGR over the study period. The growth of the segment can be driven by growing product demand from the sector that necessitates large-scale, customized, and high-performance components, hence, favouring a direct supplier relationship. Indirect sales remain relevant for small-to-mid-sized manufacturers, aftermarket applications, and regional distribution networks.

Regional Insights

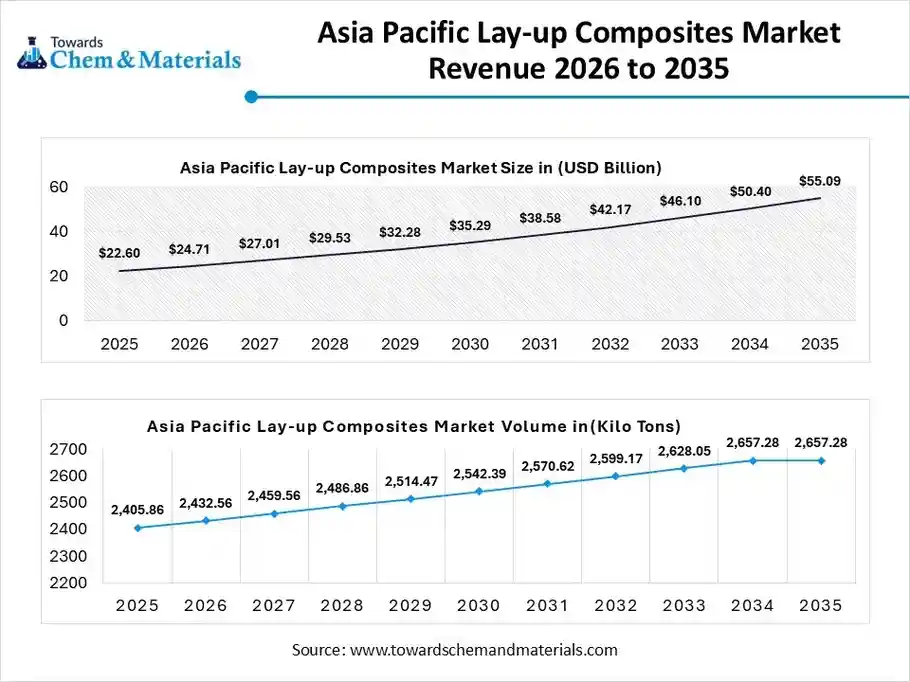

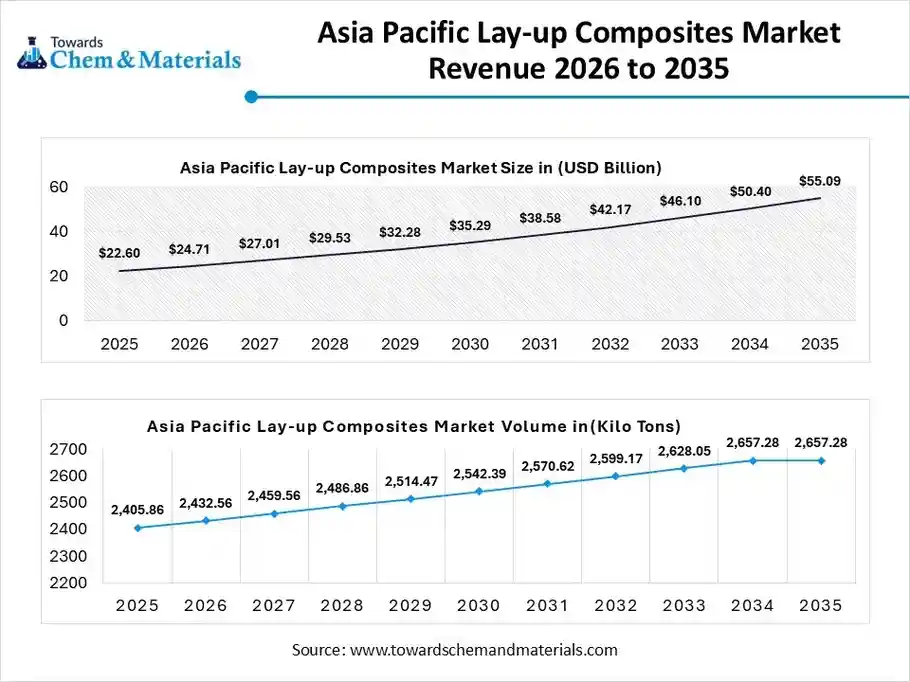

The Asia Pacific lay-up composites market size was valued at USD 22.60 billion in 2025 and is expected to be worth around USD 55.09 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 9.32% over the forecast period from 2026 to 2035.

The Asia Pacific lay-up composites market volume was estimated at 2405.86 kilo tons in 2025 and is projected to reach 2657.28 kilo tons by 2035, growing at a CAGR of 1.11% from 2026 to 2035.Asia Pacific dominated the market with nearly 46.0% share in 2025. The dominance of the region can be attributed to its robust manufacturing base and expanding end-use sectors such as aerospace, automotive, and wind energy. In addition, a surge in EV manufacturing and stringent fuel emissions standards compels automakers to use the composites for lightweighting, to enhance overall sustainability and performance.

China Lay-up Composites Market Trends

In the Asia Pacific, China dominated the market owing to the rapid urbanisation, surge in domestic manufacturing capabilities, and push towards renewable energy. Also, the country is the leading manufacturer of carbon fibers and glass, with a highly advanced supply chain and large-scale manufacturing capabilities.

North America Lay-up Composites Market Trends

The North America lay-up composites market volume was estimated at 1162.13 kilo tons in 2025 and is projected to reach 1605.77 kilo tons by 2035, growing at a CAGR of 3.66% from 2026 to 2035.North America held nearly 27.5% market share in 2025. The growth of the region can be credited to the increasing demand for stronger, lighter materials for new commercial aircraft and other defence applications. Increasing emphasis on renewable energy, green construction, and sustainable materials promotes rapid adoption of composites, driving market growth further.

U.S. Lay-up Composites Market Trends

In North America, the U.S. led the market due to a rapid expansion in commercial space production, such as SpaceX and Virgin Galactic. Coupled with the increase in electric vehicle (EV) production in the country. Moreover, strong R&D programs and cutting-edge manufacturing infrastructure facilitate innovations in automated processes.

Europe Lay-up Composites Market Trends

The lay-up composites market volume was estimated at 1098.33 kilo tons in 2025 and is projected to reach 1233.60 kilo tons by 2035, growing at a CAGR of 1.30% from 2026 to 2035.Europe held approximately 21.0% market share in 2025. The growth of the region can be driven by rapid technological innovations in the manufacturing process and stringent government policies supporting green solutions. Additionally, a surge in production of EVs requires lighter materials to improve range and efficiency, with composites providing better strength-to-weight.

Germany Lay-up Composites Market Trends

In Europe, Germany dominated the market owing to the growing emphasis on sustainability & EVs, along with the advancements in applications such as hydrogen storage and wind energy. Ongoing investment in research and development boosts the adoption of advanced materials. Well-established infrastructure in the country will impact positive market growth soon.

South America Lay-up Composites Market Trends

The South America lay-up composites market volume was estimated at 290.27 kilo tons in 2025 and is projected to reach 327.41 kilo tons by 2035, growing at a CAGR of 1.35% from 2026 to 2035. The growth of the market in South America can be fuelled by growing product demand in transportation, construction, and energy sectors, propelled by the need for more durable, lightweight, and cost-effective materials. Furthermore, the region is increasingly adopting hand lay-up composites in various infrastructure projects, driven by the need for corrosion-resistant hulls.

Brazil Lay-up Composites Market Trends

In South America, Brazil led the market due to the growing demand for complex, large composite parts such as wind turbine blades, coupled with the rise in need for lightweight and durable materials for building and infrastructure. The marine sector in the country is rapidly using lay-up composites for boat construction, leading to market growth soon.

Lay-up Composites Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 22.22% | 1162.13 | 1605.77 | 3.66% | 26.19% |

| Europe | 21.00% | 1098.33 | 1233.60 | 1.30% | 20.12% |

| Asia Pacific | 46.00% | 2405.86 | 2657.28 | 1.11% | 43.34% |

| South America | 5.55% | 290.27 | 327.41 | 1.35% | 5.34% |

| Middle East & Africa | 5.23% | 273.54 | 307.17 | 1.30% | 5.01% |

Middle East & Africa Lay-up Composites Market Trends

The Middle East & Africa Lay-up Composites Market volume was estimated at 273.54 kilo tons in 2025 and is projected to reach 307.17 kilo tons by 2035, growing at a CAGR of 1.30% from 2026 to 2035. The growth of the market in the Middle East & Africa can be propelled by growing demand for CNG/hydrogen storage, carbon fiber, and the increasing prevalence of air travel in the region. Moreover, rapid innovations in techniques such as Automated Fiber Placement (AFP) and Resin Transfer Molding (RTM) enable high-performance and cater to composite solutions, impacting positive regional growth.

Saudi Arabia Lay-up Composites Market Trends

Saudi Arabia held a significant market share in 2025. The growth of the country can be boosted by extensive investment in infrastructure projects and construction, which fuels demand for composites in architectural, structural, and other applications. Government initiatives emphasize local production, driving demand for advanced materials across different sectors.

Recent Developments

- In May 2024, Hard tech startup Layup Parts, based in Huntington Beach, CA, secured $9 million in seed financing, led by Founders Fund, to accelerate and transform composites manufacturing. Lux Capital and Haystack also participated in the funding round.(Source: techcrunch.com)

Top Lay-up Composites Market Companies

- Toray Industries, Inc: Toray Industries, Inc. is a leading global player and "star player" in the lay-up composites market, primarily due to its robust carbon fiber and prepreg product range used across various high-performance applications like aerospace, automotive, and wind energy.

- Hexcel Corporation: Hexcel Corporation is a global leader in advanced composites technology and a key player in the lay-up composites market, supplying high-performance materials like carbon fiber, specialty reinforcements, and prepregs, primarily for the aerospace industry.

- Teijin Limited (Japan)

- Solvay S.A. (Belgium)

- SGL Carbon SE (Germany)

- Mitsubishi Chemical Group Corporation (Japan)

- Owens Corning (US)

- Gurit Holding AG (Switzerland)

- Huntsman Corporation (US)

- China Jushi Group Co., Ltd. (China)

- BASF SE (Germany)

- Johns Manville (US)

- Evonik Industries AG (Germany)

- TPI Composites, Inc. (US)

- Compounding Solutions (US)

- Axiom Materials, Inc. (US)

- Safran S.A. (France)

- Kineco Limited (India)

- PPG Industries, Inc. (US)

- Binani Industries Ltd. (India)

Segments Covered in the Report

By Fiber Type

- Glass Fiber Composites

- Carbon Fiber Composites

- Aramid Fiber Composites

- Natural Fiber Composites

By Process

- Hand Lay-up

- Spray-up

- Vacuum Bagging

- Automated Lay-up (AFP/ATL)

By Resin Type

- Thermoset Composites

- Thermoplastic Composites

By End-User Industry

- Aerospace & Defense

- Wind Energy

- Automotive & Transportation

- Marine

- Construction & Infrastructure

- Pipes & Tanks

By Sales Channel

- Direct Sale

- Indirect Sale (Distributors)

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa