Content

Industrial Enzymes Market Prices, News, Monitor, Market Analysis & Demand

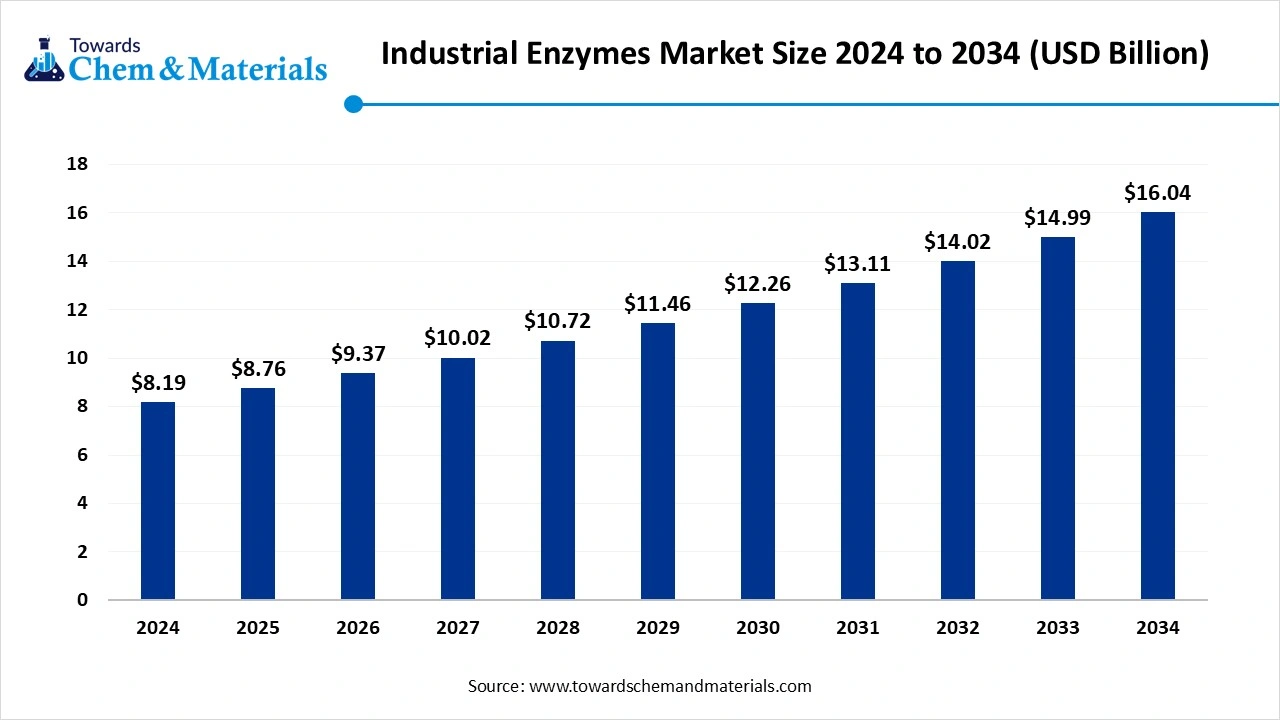

The global industrial enzymes market size reached USD 8.19 billion in 2024 and is projected to hit around USD 16.04 billion by 2034, expanding at a CAGR of 6.95% during the forecast period from 2025 to 2034. Rising need from various industries, including food and beverages, biofuel, and pharmaceuticals, demands industrial enzymes to enhance product quality and shelf life, boost the market.

Key Takeaways

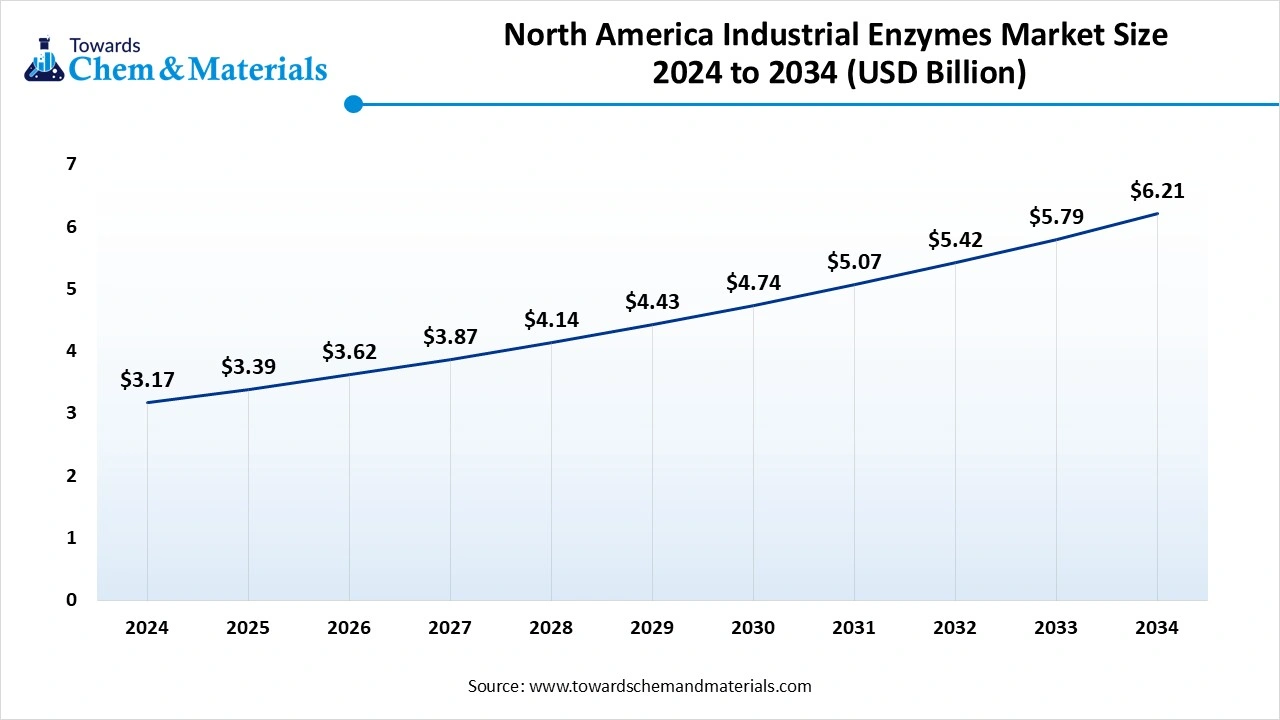

- The U.S. industrial enzymes market size is estimated at USD 2.37 billion in 2025, and is expected to reach USD 4.66 billion by 2034, at a CAGR of 7.70% during the forecast period 2025-2034

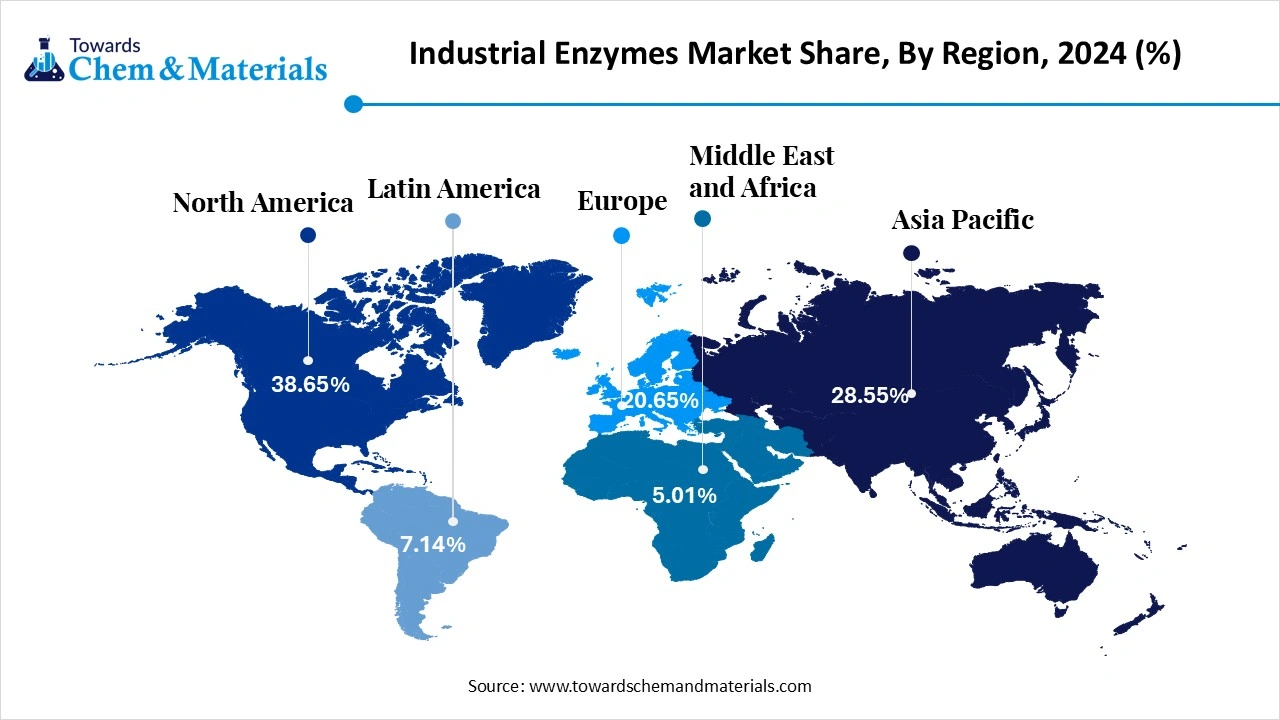

- North America dominated the market with the highest revenue share of 38.65% in 2024, due to strong biotechnology sector and robust research and development sector.

- Asia Pacific expects significant growth in market during the forecast period, due to strong growth in food and beverages, healthcare, and chemical industries.

- By product, the carbohydrase segment dominated the market with the highest revenue share of 49.34% in 2023. , attributed to increasing demand in food processing, animal feed, and biofuel production.

- By product, protease segment observed to grow at a significant rate during the forecast period, due to its wide range of applications and versatility in breaking down proteins.

- By application, The food and beverage segment dominated the market with the highest revenue share of 22.65% in 2023, due to increased use of enzyme in various food processing and beverage application.

- By application, animal feed segment observed to grow at a significant rate during the forecast period, due to key role of enzyme in improving livestock health and feed efficacy.

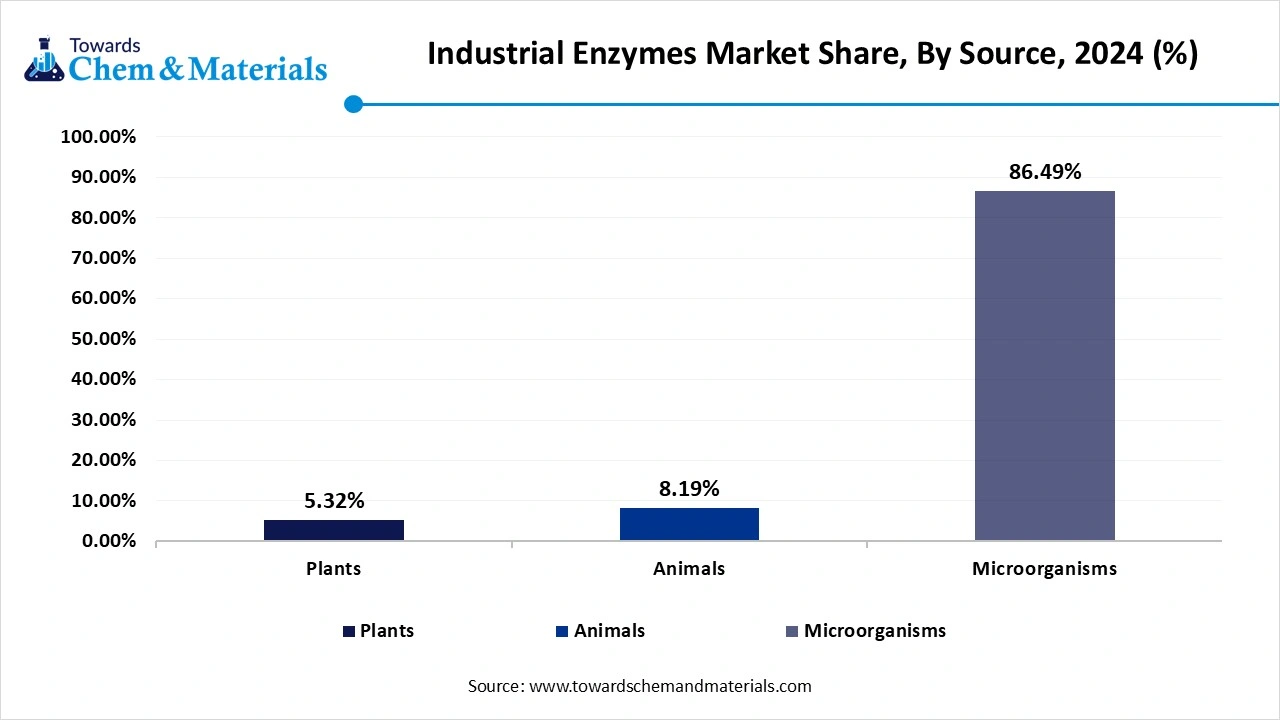

- By source, The microorganisms segment dominated the market with the highest revenue share of 86.49% in 2024, due to its cost effectiveness and high efficiency.

- By source, plant-based enzymes segment observed to grow at a significant rate during the forecast period due to its wider availability and sustainability.

Increasing Demand For Sustainable And Efficient Processes In Various Industries And Advancement In Biotechnology, Accelerate Market Expansion of Industrial Enzymes

Industrial enzymes are proteins used in various commercial processes to catalyze specific reactions. They are used in various manufacturing processes to accelerate chemical reactions and improve efficiency. They are produced by microorganisms, such as bacteria, yeasts, and fungi, and are utilized in industries like food and beverage, detergents, and biofuel.

Advancement in biotechnology allows for the modification of enzymes via protein engineering and directed evolution, leads to the creation of enzymes with enhanced stability and efficiency. Enzymes possess numerous advantages over traditional chemical processes, making them ideal for a variety of industrial applications. New applications for industrial enzymes including the production of high-value chemicals and materials, and the utilization of waste biomass, may drive the industrial enzymes market in future.

Industrial Enzymes Market Trends

- Advancements in Biotechnology: The application of of recombinant DNA technology and enzyme engineering is becoming trend to produce diverse and more effective enzymes for various industrial processes. These techniques allow for the efficient production of enzymes with tailored properties and improved stability, making them more suitable for industrial processes.

- Growing Demand in Various Sectors: Increasing need for sustainable and eco friendly process in various industries including food and beverage, pharmaceuticals, biofuel, and textiles, demands industrial enzymes. The use of enzymes in industrial processes can reduce energy and water consumption, contribute to market growth.

- Sustainable and Green Manufacturing: Increasing demand for environmentally friendly and resources efficient production processes boost the industrial enzymes market. Industries are adopting enzymes because it is good alternative to the harsh chemicals and energy intensive process. Industries are widely using enzymes due to their low carbon footprint and lower energy consumption, further boost the market.

- Government Initiatives: Government initiatives specifically those promoting biotechnology and sustainable practices, are key drivers in the growth of the industrial enzymes market. National Bio-Energy Mission and the Ethanol Blended Petrol (EBP) program encourages the use of enzymes in various applications including food processing and textiles, accelerate the market expansion.

Market Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 8.76 Billion |

| Expected Market Size by 2034 | USD 16.04 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.95% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Dominant Region | North America |

| Segment Covered | By Product, By Source, By Application |

| Key Companies Profiled | Chr. Hansen Holding A/S, Lesaffre, Adisseo, BASF SE, Novozymes, DuPont Danisco, DSM, NOVUS INTERNATIONAL, Associated British Foods Plc,BioProcess Algae, LLC, Koninklijke DSM N.V |

Industrial Enzymes Market Opportunity

Biofuel Production

Enzyme facilitates faster and more complete conversion of biomass into biofuel which reduces need of the harsh chemicals and reduces overall production costs. This enzyme based processes generally requires less energy as compared to the traditional chemical-based processes, making them more environmentally friendly and cost-effective. It can be used in wide range of feedstock including crops, agriculture residue, and even waste materials, makes the biofuel production more sustainable and efficient. The researcher are continuously improving the technology in gene editing and immobilization techniques to enhance their catalytic performance and stability

Sustainable Manufacturing

Enzyme can replace harsh chemicals in various processes, significantly reduces chemical waste and pollution. They are biodegradable and can be easily broken down into harmless components, minimizing long-term environmental damage. Various advancement including biomanufacturing which develops sustainable manufacturing processes. Advancement in synthetic biology is enabling the development of engineered enzymes with enhanced properties and broader applications, shows future opportunities for industrial enzymes market.

Industrial Enzymes Market Challenges

Stringent Regulations

Strict regulation limits the industrial enzyme usage due to safety concern, environmental impact, and rigorous testing and approval. Many countries have their specific regulation for enzyme usage. For food enzymes toxicological studies including in vitro and in vivo genotoxicity and systemic toxicity, are often required. Enzyme used in animal feed may require the acute toxicity and dermal sensitization studies, limits the market of industrial enzyme.

Regional Insights

North America dominated industrial enzymes market in 2024. The North America industrial enzymes market size was valued at USD 3.17 billion in 2024 and is expected to be worth around USD 6.21 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.96% over the forecast period 2025 to 2034. Strong biotechnology sector, robust research and development, and wide range of industries that depend on enzymes contribute to market growth of industrial enzymes across this region. The region has well established food and beverages industry which widely use enzymes in various applications including food processing and baking. Strong pharmaceutical demands enzymes in drug manufacturing and research, driving the market of industrial enzyme. North America, specifically the United State, has strong biotechnology sector, with advanced infrastructure and presence of enzyme manufacturer, enhancing the innovation and production.

The region invests heavily in R&D activities, leading to the development of new and improved enzymes with enhanced efficiency and performance. Supportive regulatory framework establiblished by US Food and Drug Administration (FDA), ensures the transparency of enzyme based products which develops trust and adoption across various industries. The United States is the largest market for industrial enzymes in North America due to well-established industries and strong biotechnology sector, contribute to regional dominance. Regulations that promote clean and sustainable technologies with the government initiatives to encourage research and development further drive the industrial enzymes market across this region.

Asia Pacific expects significant growth in industrial enzymes market during the forecast period. Strong growth in food and beverages, healthcare, and chemical industries contribute to market growth of industrial enzyme across this region. Rising disposable income are fueling consumption of processed foods and beverages, further increasing the demand for enzymes. The increasing use of enzymes in bioethanol production, drive the market. Due to extensive food industry and growing pharmaceutical sector china is dominating the market across this region. Consumers are increasingly demands for processed foods and beverages, increases uses of industrial enzymes. Additionally sustainable farming practices and the use of agricultural enzymes to enhance soil fertility and plant growth are also contributing to the region's dominance.

- For Instance, In May 2023, Novozymes introduced the Novamyl® BestBite solution which is made for enhancing the texture and increase the shelf life of baked goods. The solution is aimed at enhancing the freshness and quality of bakery products by optimizing their texture and maintaining longer freshness.

Segmental Insights

Product Insights

The carbohydrate segments held the dominating share of industrial enzymes market in 2024. Increasing demand in food processing, animal feed, and biofuel production contribute to market growth of this segment. Carbohydrates enhance the quality of products like bread, beer, and dairy which improves texture, flavor and shelf life, boost the market. It also improves the digestibility and nutrient absorption so used in animal feed which improve the performance and productivity of animals. It is used in biofuel production due to its ability to convert the biomass into fermentable sugars. Additionally, carbohydrates are very cost effective because they can be produced on a large scale using microbial fermentation processes, further contribute to carbohydrate segment growth.

The protease segment observed was to grow at a significant rate in the industrial enzymes market during the forecast period. Wide range of applications and versatility in breaking down protein contribute to market growth of the protease segment. Proteases play a very important role in hydrolyzing proteins, which is a fundamental process in many industrial applications. This process is vital for breaking down proteins in animal feed. With increasing global consumption of protein due to rising awareness of its nutritional benefits, is boosting the demand for proteases, especially in the food and beverage industry. Due to their cost effectiveness and efficient production process microbial derived protease are gaining popularity. Protease is used in leather industry to replace traditional chemicals, I food processing to improve nutritional value, further drive the market.

Application Insights

The food and beverage segment held the dominating share of industrial enzymes market in 2024. Widespread use of enzyme in various food processing and beverage application contributes to market growth of this segment. Industrial enzymes are widely used in bakery, dairy, meat processing, and beverages to improve the quality, shelf life and production efficiency. The demand for processed food and functional food is continually increasing, driving the market of enzymes. Innovation developed by food industries including the new product formulation by using enzymes, further boosting demand for industrial enzymes. Rising demand for healthier, sustainable foods, growing popularity of plant-based products, and the increasing use of enzymes in food processing, drive the growth of the food and beverage segment.

The animal feed segment observed to grow at a significant rate in the industrial enzymes market during the forecast period. Increasing demand for animal protein and the role of enzyme in improving livestock health and feed efficacy contribute to market growth of this segment. As the global population increases, demands for meat egg, and dairy products. This increased demand for animal protein significantly increases need for efficient and cost effective feed formulas. Enzymes are added to animals feed to improve the digestibility of nutrients, which allows better nutrient absorption, significantly enhances overall productivity. Various government regulation and growing awerness of environmental sustainability increasing the demand for feed enzymes. Increasing demand for animal protein and growing awareness of benefits of feed enzyme, may contribute to market growth in future.

Source Insights

The microorganisms segment held the dominating share of industrial enzymes market in 2024 due to its cost effectiveness, efficiency and ability to produce wide range of enzymes under controlled conditions. Microorganism are inexpensive to cultivate, produces enzymes. Enzymes derived from microorganisms are used in various industries, including food and beverage, pharmaceuticals, detergents, and textiles. It can be genetically modified to enhance enzyme production and tailor them to specific industrial needs. Growing demand for sustainable manufacturing practice further demand microbial enzymes which is biodegradable and renewable, further boost the market.

The plant-based enzymes segment observed to grow at a significant rate during the forecast period. They are readily available from various sources including fruits, grains, and vegetables. The extraction method of plant based enzymes is also very simpler and cost effective, makes them ideal choice in industrial applications. They are used widely in food and beverages industry in baking, juice clarification, and dairy production. The growing demand for plant based alternative to the dairy and meat has increased use of plant based enzymes in improving overall functionability in these foods. Shifting consumer preferences for natural, sustainable, and ethical food products, further boost the market of plant based enzymes.

Industrial Enzymes Market Recent Developments

- In April 2023, Specialty Enzymes & Probiotics announced Pepzyme Pro™. It is a powerful protease enzyme which is suitable for vegan and vegetarians, which offers solutions to the negative effects of protein indigestion.

- In October 2024, Huvepharma added Huvezym® neXo to its NSPase portfolio. It is an enzymatic complex which is efficacious in improving the performance of animals fed complex fiber diets. This product is developed to degrade complex fiber structure in diet to ensure the animal gets most fiber content.

- In January 2023, dsm-firmenich has launched Maxilact Next. This enzyme is fastest and purest lactase on the market which enables manufacturer to produce the lactose free dairy products more efficiently. It reduces hydrolysis time by 25% compared to existing Maxilact solutions.

Top Companies List

- Chr. Hansen Holding A/S

- Lesaffre

- Adisseo

- BASF SE

- Novozymes

- DuPont Danisco

- DSM

- NOVUS INTERNATIONAL

- Associated British Foods Plc

- BioProcess Algae, LLC

- Koninklijke DSM N.V

Segments Covered in the Report

By Product

- Carbohydrase

- Proteases

- Lipases

- Polymerases & Nucleases

- Others

By Source

- Plants

- Animals

- Microorganisms

By Application

- Food & Beverages

- Detergents

- Animal Feed

- Biofuels

- Textiles

- Pulp & Paper

- Nutraceutical

- Personal Care & Cosmetics

- Wastewater

- Agriculture

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait