Content

Heat Treating Market Size and Growth 2025 to 2034

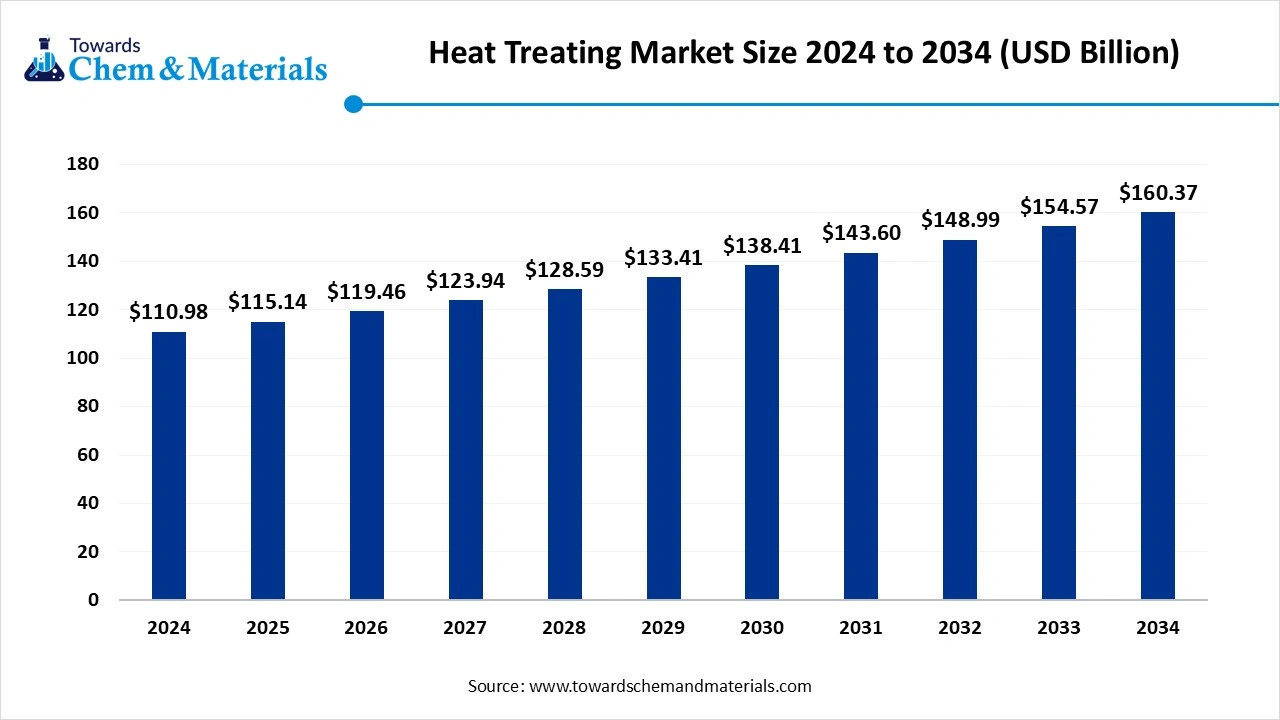

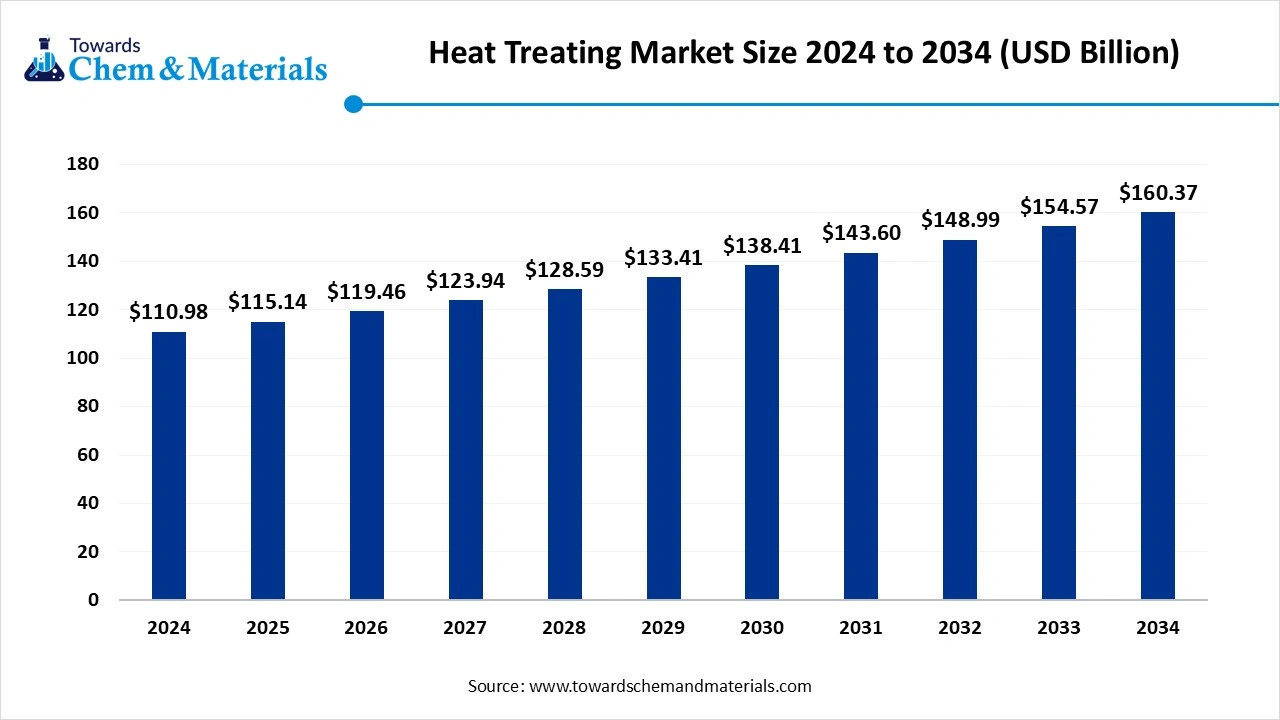

The global heat treating market size was reached at USD 110.98 billion in 2024 and is expected to be worth around USD 160.37 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.75% over the forecast period 2025 to 2034. The sudden shift towards fuel-efficient vehicles and lightweight materials has fueled industry potential in recent years.

Key Takeaways

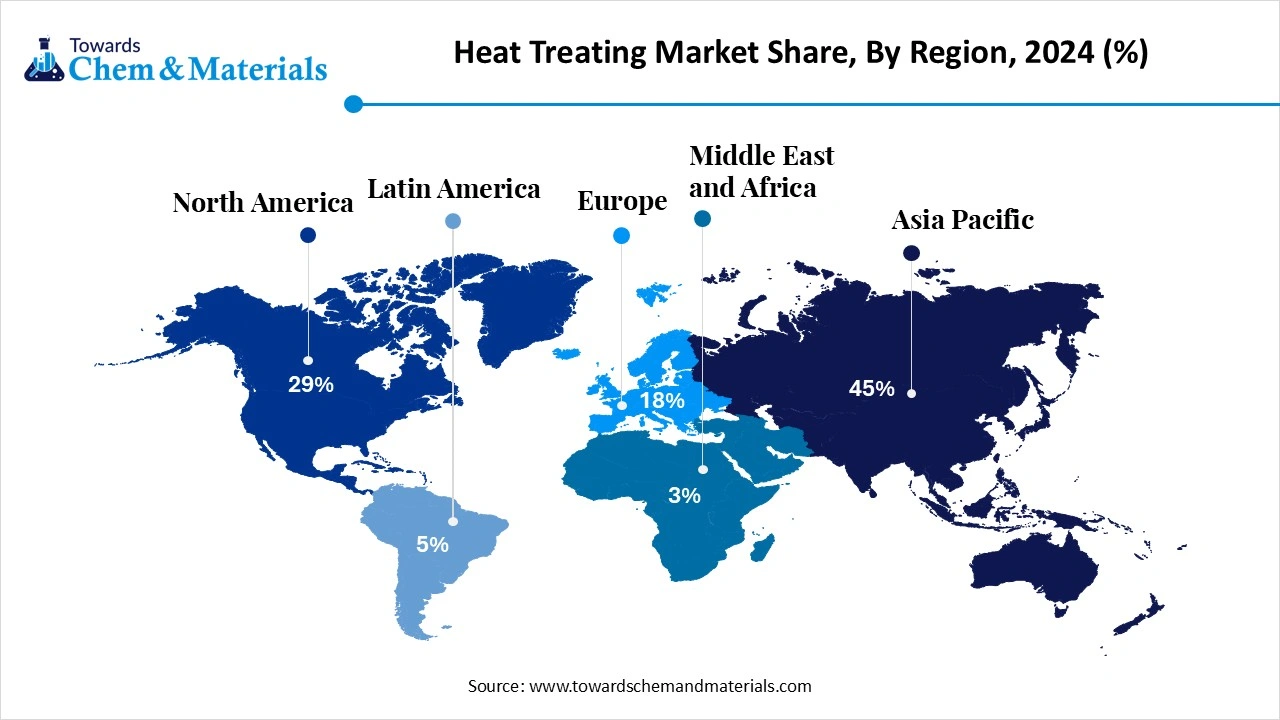

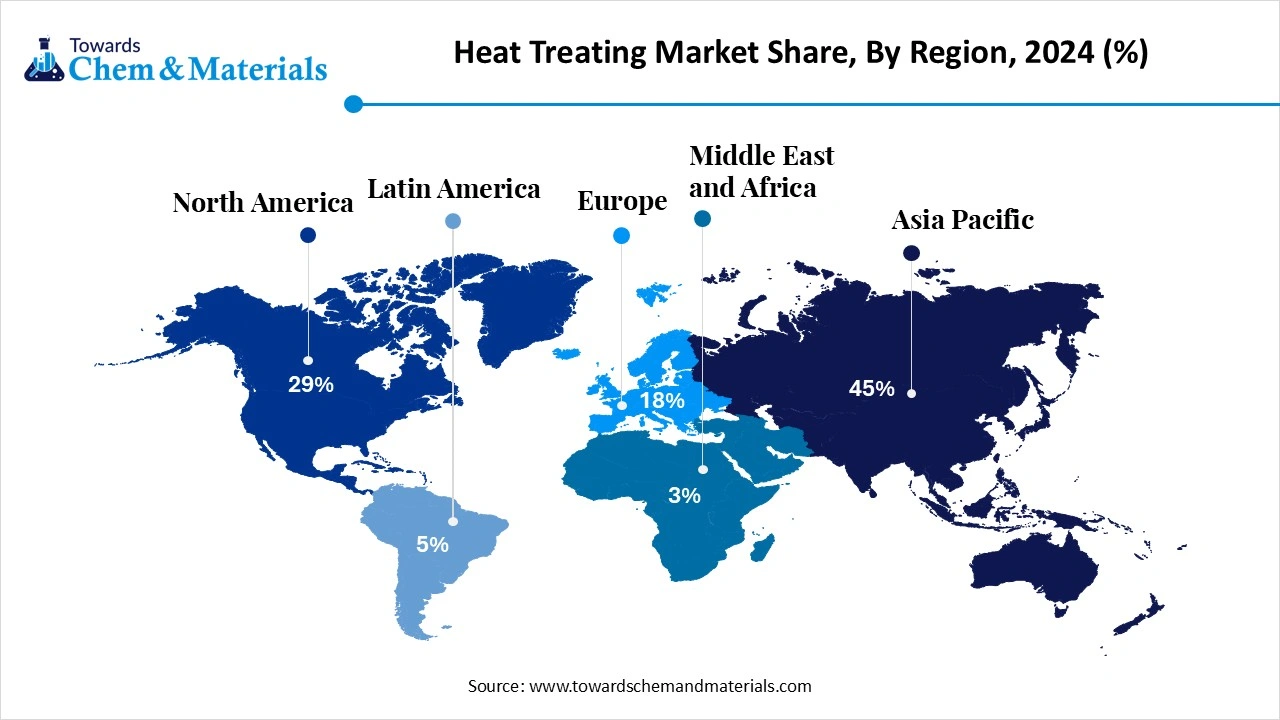

- By region, Asia Pacific dominated the heat treating market in 2024 with 45% of the industry share, akin to the enlarged manufacturing base and demand from the major

- By region, North America is expected to grow at a notable rate in the future, owing to greater focus on modern technology and demand from major industries like aerospace, medical devices, and electric vehicles.

- By type, the hardening and tempering segment led the heat treating market in 2024 with 35% market share, due to its being considered the crucial method in the steel and cast-iron industries.

- By type, the case hardening segment is expected to grow at the fastest rate in the market during the forecast period, akin to the increased need for lightweight and long-lasting parts in the current period.

- By equipment type, the industrial furnaces segment emerged as the top-performing segment in the market in 2024 with 50% industry share, due to factors such as cost-effectiveness, versatility, and sustainability for mass production.

- By equipment type, vacuum and induction furnaces is expected to lead the market in the coming years, akin to the increased need for advanced and energy-efficient solutions in recent years.

- By material type, the steel and cast iron segment led the heat treating market in 2024 with 70% market share because they are the most widely used materials in automotive, construction, machinery, and heavy equipment industries.

- By material type, the aluminum and specialty alloys segment is expected to capture the biggest portion of the market in the coming years, because of the global shift toward lightweight and high-performance materials.

- By mode of operation, the in-house heat-treating segment led the market in 2024 with 55% market share, because many large manufacturers prefer to keep the process within their facilities for better control over quality, timing, and customization.

- By mode of operation, the contract heat treating services segment is expected to grow at the fastest rate in the market during the forecast period, because it offers cost savings, advanced technologies, and flexibility without requiring manufacturers to invest in expensive equipment.

- By application, the automotive segment led the market in 2024 with 40% market share because it is one of the largest consumers of heat-treated components.

- By application, the aerospace and defence segment is expected to capture the biggest portion of the market in the coming years, due to the growing demand for lightweight, high-strength, and fatigue-resistant materials like titanium, aluminum alloys, and superalloys.

- By distribution channel, the direct sales segment led the market in 2024 with 60% market share, because manufacturers preferred selling equipment and services directly to large industrial customers.

- By distribution channel, the indirect sales segment is expected to grow at the fastest rate in the market during the forecast period, because distributors, resellers, and online platforms make it easier for small and medium-sized companies to access heat treating equipment and services.

Market Overview

The Backbone of Metal Durability: Inside the Heat Treating Market

The heat treating market covers the industrial processes, equipment, services, and technologies used to alter the physical, mechanical, and sometimes chemical properties of metals and alloys through controlled heating and cooling. Moreover, key processes include annealing, tempering, hardening, case hardening, carburizing, nitriding, quenching, and stress relieving. Heat treating is essential in industries such as automotive, aerospace, construction, energy, heavy machinery, oil & gas, and general manufacturing. The market comprises heat treating equipment (furnaces, ovens, induction heaters, quenching systems), services (contract heat treating providers), and consumables (quenchants, protective atmospheres, gases, salts).

What Factor is Driving the Heat Treating Market?

The sudden growth of the automotive industry globally has spearheaded the industry's growth in the past few years. Furthermore, the manufacturers of vehicles are actively seeking stronger, durable, and wear-resistant parts in recent years, which is providing greater attention to the heat-treating industry nowadays. Also, the sudden shift towards EV and lightweight vehicles has provided the sophisticated consumer to the industry in the current period, as per the recent industry survey.

Market Trends

- The increased adoption of lightweight materials is contributing to the industry's growth in recent years, as heat treating can play a major role in the upcoming period.

- The companies have been actively adopting eco-friendly furnaces and energy-saving processes in the past few years. Moreover, the lower operating cost can be a major concern for the upcoming years.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 115.14 Billion |

| Expected Size by 2034 | USD 160.37 Billion |

| Growth Rate from 2025 to 2034 | CAGR 3.75% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Process, By Equipment Type, By Material, By Mode of Operation, By Application / End-Use Industry, By Distribution Channel, By Region |

| Key Companies Profiled | Bluewater Thermal Solutions LLC, American Metal Treating Inc., East-Lind Heat Treat Inc., General Metal Heat Treating, Inc., Shanghai Heat Treatment Co. Ltd., Pacific Metallurgical, Inc., Nabertherm GmbH, Unitherm Engineers Limited, SECO/WARWICK Allied Pvt. Ltd., Triad Engineers, HighTemp Furnaces Limited, Deck India Engineering Pvt. Ltd., Sourabh Heat Treatments, AFECO Heating Systems, THERELEK |

Market Opportunity

Advanced Furnaces Technology Ignites New Growth in Heat Treating

The development of advanced furnace technology is expected to create lucrative opportunities for manufacturers in the upcoming years. As several manufacturers are seen under the heavy investment in R&D activities for easy and affordable manufacturing. Also, the sectors such as aerospace, defense, and automotive are actively looking for advanced technologies for accuracy and high precision, which is likely to provide greater industry attention to the manufacturers.

Market Challenge

Cost Barriers Threaten Expansion for Mid-Sized Heat Treating Firms

The increased cost of the heat treating machineries are one of the major factor which limits the growth of the market, the equipment like the vacuum furnaces and induction requires increased initial cost which limits the adoption of the equipment from the mid-sized businesses and new market entrants.

Regional Insights

Asia Pacific Heat Treating Market Trends

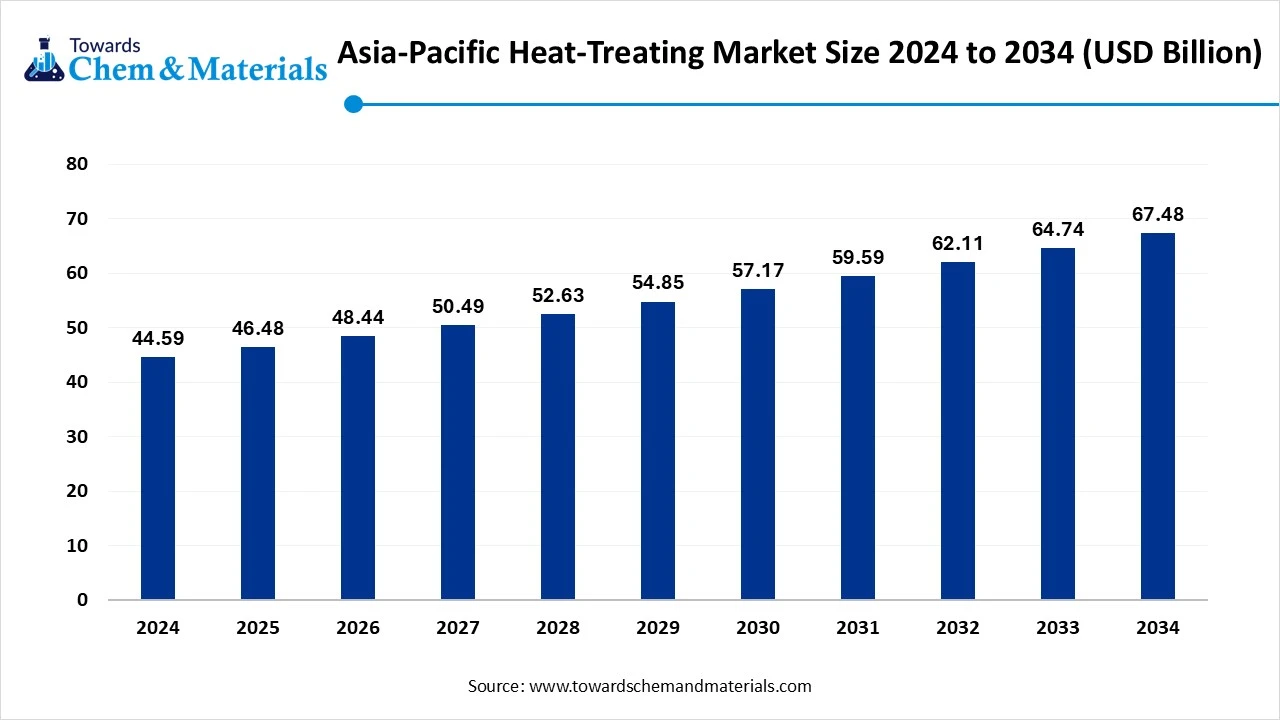

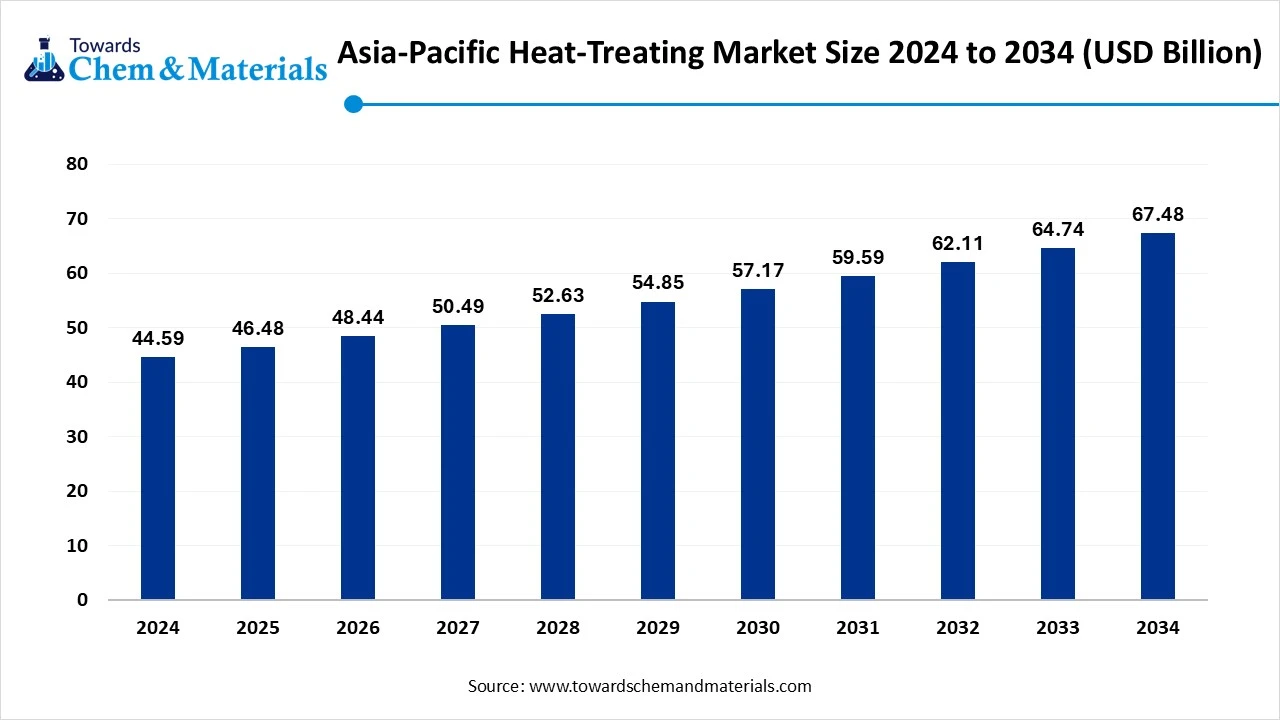

The Asia Pacific heat treating market size was estimated at USD 49.94 billion in 2024 and is anticipated to reach USD 72.26 billion by 2034, growing at a CAGR of 3.76% from 2025 to 2034 Asia Pacific dominated the market in 2024,

akin to the enlarged manufacturing base and demand from the major sectors such as the automotive, machinery, and construction. Furthermore, the regional countries like China, India, and Japan are considered as the major producers of steel, cast iron, and components, where the heat-treating industry has gained immense consumer attention in the upcoming years. Also, factors such as rapid industrialization and raw material availability are severely contributing to the industry's growth in the current period.

How Has China’s Manufacturing Power Boosted the Heat Treating Industry

China maintained its dominance in the market, owing to the country’s heavy manufacturing sector. Moreover, the country has one of the largest automotive sectors, which has led to the major growth of the heat-treating industry in recent years. Also, the country has major domestic needs with the presence of local production facilities, which has led to the industry's potential in the past few years, according to the recent survey.

North America Heat Treating Market Trends

North America is expected to capture a major share of the market, owing to greater focus on modern technology and demand from major industries like aerospace, medical devices, and electric vehicles. Furthermore, the region is known for its innovation and precision, where the heat-treating industry is expected to gain major market attention in the upcoming years, as per the future industry expectations.

Segment Insights

Type Insights

How did the Hardening and Tempering Segment Dominate the Heat Treating Market in 2024?

The hardening and tempering segment held the largest share of the market in 2024, due to its being considered the crucial method in the steel and cast iron industries. Moreover, this method is widely used in industries such as the construction, automotive, and machinery industries, driving the growth of the segment in recent years. Furthermore, by improving the strength, toughness, and wear resistance of the materials, the segment has gained immense industry attention in recent years.

The case hardening segment is expected to grow at a notable rate during the predicted timeframe, akin to the increased need for lightweight and long-lasting parts in the current period. Moreover, by giving hardness to the components by maintaining the correct toughness and flexibility, the case hardening segment is likely to gain a sophisticated consumer base during the forecast period.

Equipment Type Insights

Why does the Industrial Furnaces Segment Dominate the Heat Treating Market by the Equipment Type?

The industrial furnaces segment dominated the heat treating market in 2024, due to factors such as cost-effectiveness, versatility, and sustainability for mass production. Moreover, this suitability for the large production is primarily driving the segment growth in the versatile sectors such as the construction, automotive, and manufacturing industries.

The vacuum & induction furnaces segment is expected to grow at a notable rate, akin to the increased need for advanced and energy-efficient solutions in recent years. Also, industries such as aerospace, medical applications, and defense are actively using this equipment, where the accuracy and contamination-free results are a priority.

Material Type Insights

Why Did The Steel And Cast-Iron Segment Dominated The Heat Treating Market In 2024?

The steel and cast-iron segment dominated the market with the largest share in 2024 because they are the most widely used materials in automotive, construction, machinery, and heavy equipment industries. Their strength, durability, and affordability make them ideal for components like gears, shafts, tools, and structural parts. Heat treating improves their hardness, wear resistance, and fatigue strength, making them reliable for demanding applications.

The aluminum and specialty alloys segment is expected to grow at a significant rate because of the global shift toward lightweight and high-performance materials. The automotive industry is increasingly using aluminum to reduce vehicle weight and improve fuel efficiency, while aerospace and defense sectors depend on specialty alloys like titanium and nickel-based alloys for strength under extreme conditions.

Mode of Operation Insights

Why Did The In-House Heat-Treating Segment Dominated The Heat Treating Market In 2024?

The in-house heat-treating segment held the largest share of the market in 2024 because many large manufacturers prefer to keep the process within their facilities for better control over quality, timing, and customization. Automotive and machinery companies often have dedicated heat treating equipment to process steel and cast iron parts on-site. This reduces dependence on third-party providers, cuts down transportation costs, and ensures faster turnaround.

The contract heat treating services segment expects significant growth in the market during the predicted timeframe, because they offer cost savings, advanced technologies, and flexibility without requiring manufacturers to invest in expensive equipment. Many small and medium enterprises, as well as specialized industries like aerospace and defense, prefer outsourcing to experts with modern furnaces such as vacuum and induction systems.

Application Insights

Why Did The Automotive Segment Dominated The Heat Treating Market In 2024?

The automotive segment held the largest share of the market in 2024, dominated because it is one of the largest consumers of heat-treated components. Engines, transmissions, gears, shafts, and suspension parts require hardening, tempering, or case hardening to improve their strength and durability. As global vehicle production grew, so did the demand for large-scale heat-treating services.

The aerospace and defense segment is expected to grow at a significant rate due to the growing demand for lightweight, high-strength, and fatigue-resistant materials like titanium, aluminum alloys, and superalloys. These industries require advanced heat-treating processes such as vacuum hardening and induction treatment to ensure safety and reliability under extreme conditions.

Distribution Channel Insights

Why Did The Direct Sales Segment Dominated The Heat Treating Market In 2024?

The direct sales segment held the largest share of the market in 2024, because manufacturers preferred selling equipment and services directly to large industrial customers. Automotive and machinery companies often buy furnaces and services straight from suppliers to ensure reliability, lower costs, and faster delivery. Direct sales also allow better customer relationships, customized solutions, and after-sales support.

The indirect sales segment is expected to grow at a significant rate during the forecast period, because distributors, resellers, and online platforms make it easier for small and medium-sized companies to access heat treating equipment and services. As the market becomes more fragmented, businesses are looking for flexible purchasing options without directly dealing with large manufacturers.

Value Chain Analysis

- Distribution to Industrial Users : The heat treating is synthesized and processed through annealing, normalizing, quenching, tempering, and case hardening. Key Players: Unitherm Engineers, Thermax, and Aichelin Unitherm

- Chemical Synthesis and Processing : The heat treating is distributed to the energy, automotive, manufacturing, and construction industries.

Key Players: AFECO Heating Systems, Bluewater Thermal Solutions, Deck India Engineering - Regulatory Compliance and Safety Monitoring : Heat treatment processes require rigorous regulatory compliance and safety monitoring to ensure worker safety and product quality, like ISPM-15, CQI-9, and AMS2750.

Recent Developments

- In April 2025, Ipsen established its seventh service HUB recently. The motive behind the launch of these hubs is to support the heat treatment industry in Texas, as per the report published by the company.(Source: Ipsen launches seventh Service HUB to support heat treatment industry in Texas region)

- In February 2025, the Utrecht wastewater plant introduced an enlarged heat pump recently in the Netherlands. Also, the newly launched pump has the capacity of 65 million liters of treated wastewater daily as per the company's claim.(Source: Utrecht wastewater plant launches largest heat pump in Netherlands – pv magazine International)

Heat Treating Market Top Companies

- Bluewater Thermal Solutions LLC

- American Metal Treating Inc.

- East-Lind Heat Treat Inc.

- General Metal Heat Treating, Inc.

- Shanghai Heat Treatment Co. Ltd.

- Pacific Metallurgical, Inc.

- Nabertherm GmbH

- Unitherm Engineers Limited

- SECO/WARWICK Allied Pvt. Ltd.

- Triad Engineers

- HighTemp Furnaces Limited

- Deck India Engineering Pvt. Ltd.

- Sourabh Heat Treatments

- AFECO Heating Systems

- THERELEK

Segment Covered

By Process

- Annealing

- Hardening & Tempering

- Case Hardening (Carburizing, Nitriding, Carbonitriding)

- Quenching & Stress Relieving

- Normalizing

- Others (induction, solution treatment, cryogenic treatments)

By Equipment Type

- Industrial Furnaces (gas-fired, electric, vacuum, induction)

- Ovens & Kilns

- Quenching Systems (oil, water, gas, polymer-based)

- Ancillary Equipment (atmosphere generators, temperature controllers, cooling systems)

By Material

- Steel & Cast Iron

- Aluminum & Non-Ferrous Metals (copper, titanium, nickel alloys)

- Others (powder metals, specialty alloys, additive manufacturing metals)

By Mode of Operation

- In-House Heat Treating (within OEM/manufacturer facilities)

- Contract Heat Treating Services (outsourced to specialized providers)

By Application / End-Use Industry

- Automotive (engine parts, gears, crankshafts, bearings)

- Aerospace & Defense (aircraft engines, landing gear, turbine blades)

- Construction & Heavy Machinery

- Energy & Power Generation (wind, nuclear, oil & gas components)

- Industrial Equipment & Tools

- Electronics & Electrical Components

- Others (medical implants, precision instruments, additive manufacturing parts)

By Distribution Channel

- Direct Sales (equipment manufacturers and service providers to OEMs)

- Indirect Sales (distributors, integrators, service networks)

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait