Content

Flocculants and Coagulants Market Size and Growth 2025 to 2034

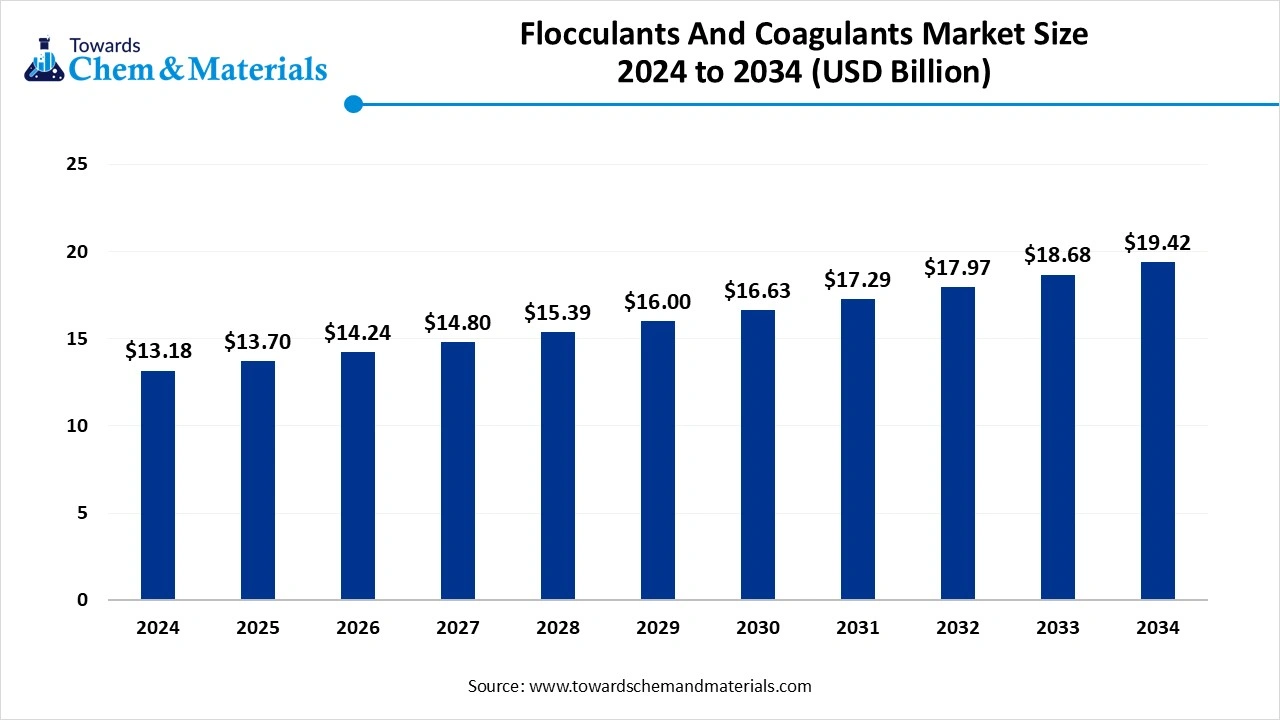

The global flocculants and coagulants market size is reached at USD 13.70 billion in 2025 and is expected to be worth around USD 19.42 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.95% over the forecast period 2025 to 2034. The sudden change in the wastewater treatment standards is fueling industry potential in the current period.

Key Takeaways

- By region, Asia Pacific dominated the market in 2024, owing to a sudden increased need for industrial manufacturing, regional water treatment, and the expansion of the mining sector in the region.

- By region, The Middle East and Africa are expected to grow at a notable rate in the future, akin to the increasing need for wastewater recycling and water scarcity issues in some of these regions.

- By product type, the coagulant segment led the market in 2024, due to the increasing manufacturing infrastructure and need for highly efficient materials across the wide PH ranges

- By product type, the flocculant segment is expected to grow at the fastest rate in the market during the forecast period, akin to a sudden increase in the discharge standards and industrial wastewater treatment

- By form type, the liquid segment emerged as the top-performing segment in 2024, due to having unique properties such as easy handling, long-term storage, and being ideal for industrial applications.

- By form type, the emulsion segment is expected to lead the market in the coming years, as it offers a longer shelf life and higher concentration than the liquid segment.

- By application, the water and wastewater treatment segment led the flocculants and coagulants market in 2024, as these chemicals are essential in removing suspended particles and contaminants.

- By application, the mining and mineral processing segment captured the biggest portion of the market in 2024, because these industries generate large amounts of wastewater with suspended solids.

- By end use industry, the municipal segment captured the biggest portion of the market in 2024, as the cities and towns are responsible for treating drinking water and sewage.

- By end use industry, the industrial segment is anticipated to expand at the highest rate in the coming years, as more factories adopt wastewater treatment systems to meet environmental rules.

- By distribution channel, the direct supply segment led the market in 2024 because large industrial and municipal users prefer buying directly from manufacturers or authorized dealers.

- By equipment type, the online portals segment is expected to grow at the fastest rate in the market during the forecast period as they offer convenience, price comparison, and easy ordering.

Market Overview

Essential Chemistry: How Flocculants and Coagulants are Cleaning the World

The flocculants and coagulants market represents the global industry dedicated to chemicals used for aggregating suspended particles in liquids, primarily for water and wastewater treatment. Coagulants neutralize particle charges, and flocculants facilitate agglomeration into larger particles for efficient removal. These chemicals are critical in municipal utilities, industrial processing, and resource-intensive sectors such as mining, oil & gas, and paper manufacturing. Increasing demand for clean water, coupled with tightening environmental regulations, continues to drive market growth.

Which Factor Is Driving the Flocculants and Coagulants Market?

The increased need for clean water is spearheading industry growth in the current period. Moreover, the huge global industrial activity and fast-paced urbanization contributed immensely to market growth in recent years. Furthermore, global governments are increasingly seen in implementing stricter water treatment regulations are actively driving the sales of flocculants and coagulants in recent years.

Market Trends

- The sudden shift toward eco-friendly and sustainable products is driving industry growth in the current period. As the demand for flocculants and coagulants, which are made from biobased materials like starch, chitosan, and other plant-based raw materials, has increased.

- The enlarged expansion of the mining and oil & gas industries has contributed to the industry's potential in the last few years, as the coagulants and flocculants are observed in huge usage for separating solids from wastewater and managing tailings in these industries

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 13.70 Billion |

| Expected Size by 2034 | USD 19.42 Billion |

| Growth Rate from 2025 to 2034 | CAGR 3.95% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Form, By Application, By End-Use Industry, By Distribution Channel, By Region |

| Key Companies Profiled | Ecolab Inc., SNF Group, Kemira Oyj , SUEZ Water Technologies & Solutions, BASF SE, Solvay SA, Hawkins Inc., Feralco Group, Ixom Operations Pty Ltd , Aries Chemical, Inc., Aditya Birla Chemicals , Shandong Polymer Bio-Chemicals Co., Ltd. , GE Water & Process Technologies, AkzoNobel N.V., DuPont Water Solutions, Kurita Water Industries Ltd., RisingSun Membrane Technology, GEO Specialty Chemicals, Accepta Ltd., Avista Technologies |

Market Opportunity

Bespoke Flocculants and Coagulants Open Doors to Long-Term Deals

The development of the customized flocculants and coagulants is expected to create lucrative opportunities for the manufacturers during the forecast period, as several huge industrial spaces are using the flocculants and coagulants for their specific work, where manufacturers can create a partnership with these industries and are expected to gain long-term profit margins in the coming years.

Market Challenge

Sludge Generation Emerges as a Barrier in Modern Water Treatment

The sludge generation after usage of flocculants and coagulants is anticipated to hamper industry growth during the projected period, as the global governments are actively introducing environmentally friendly initiatives where this sludge can violate these initiatives, and the traditional coagulants like aluminum or iron salts are seen to leave residue behind them.

Regional Insights

Asia Pacific

Asia Pacific dominated the market in 2024, akin to a sudden increased need for industrial manufacturing, regional water treatment, and the expansion of mining sector in the region. moreover, the regional countries such as India, China, and Japan are seen under the heavy investment for the wastewater management and sustainability standards which is providing the wide consumer base to the industry in the recent years.

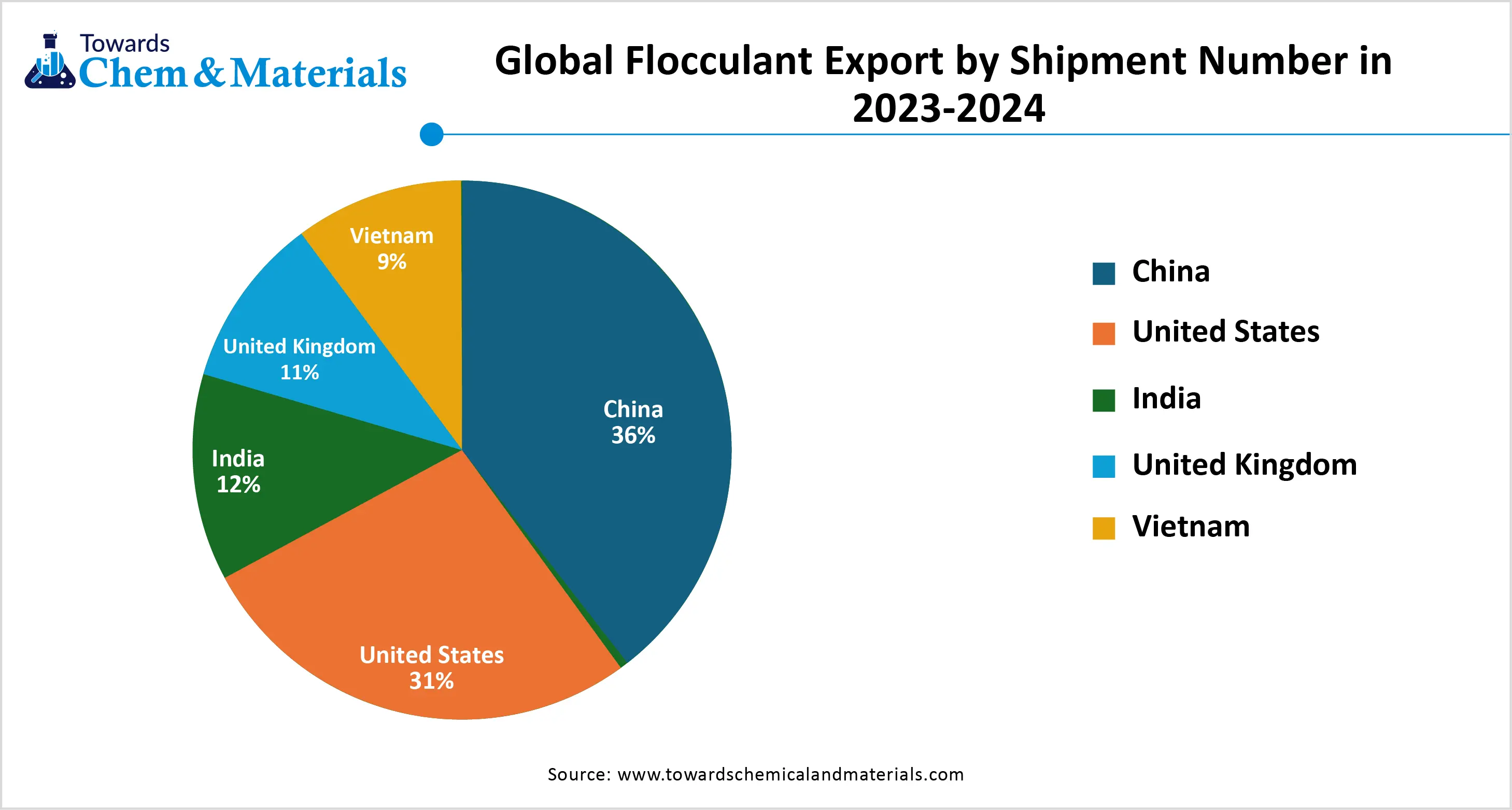

Is China Becoming the Global Hub for Advanced Wastewater Treatment?

China maintained its dominance in the flocculants and coagulants market, owing to the developed industrial infrastructure and large-scale water usage in the current period. Moreover, the government in the country is actively implementing the latest standards for wastewater management, as China recently observed massive pollution issues akin to its urban centres and factories. Furthermore, the textile and mining industries in the country are actively contributing to the sales of coagulants and flocculants, as per the recent observations.

Middle East & Africa

The Middle East & Africa are expected to capture a major share of the market during the forecast period, owing to the increasing need for wastewater recycling and water scarcity issues in some of the regions. Furthermore, the region is actively seen as an investment for desalination and wastewater treatment, which has been actively providing a sophisticated consumer base to the industry in recent years. Moreover, the government has been actively promoting sustainable waste management activities in recent years.

How are the Limited Freshwater Resources Fueling Innovation in Saudi Arabia and Africa?

Saudi Arabia and South Africa are expected to rise as dominant countries in the region in the coming years, owing to enlarged investment in desalination and wastewater recycling due as both regions have limited natural freshwater resources, as per the recent observation. Furthermore, in Saudi Arabia, governments have been heavily trying to reduce wastewater discharge with the sustainability in recent years. Where South Africa’s regional government is seen as actively implementing the stricter water discharge laws from the past few years.

Segmental Insights

Product Type Insights

How did the Coagulants Segment Dominated the Flocculants and Coagulants Market in 2024?

The coagulants segment held the largest share of the market in 2024, due to the increasing manufacturing infrastructure and need for highly efficient materials across the wide PH ranges. Under these, inorganic coagulants held a significant share in the market, akin to the low-cost initiative and wide availability in the current period. By removing the suspended solids and reducing the turbidity in high-microbiological water treatment, the inorganic coagulants have gained immense industrial attention in recent years.

The flocculants segment is expected to grow at a notable rate during the predicted timeframe due to a sudden increase in the discharge standards and industrial wastewater treatment. Also, by helping group fine particles together, which makes faster removal with more efficiency, the b flocculants are expected to heavily contribute in the future. Under these segment cationic flocculants are expected to hold a significant share akin to their strength in separating organic particles from heavy water outrage such as the municipal and industrial.

Form Type

Why Do Liquid Segments Dominated the Flocculants and Coagulants Market by Form Type?

The liquid segment held the largest share of the flocculants and coagulants market in 2024, owing to having unique properties such as easy handling, long-term storage, and being ideal for industrial applications. Furthermore, by having the application without dissolving and premixing, the liquid coagulants have seen a significant saving in time and reduced the operational complexity in recent years, which has attracted a wide consumer group.

The emulsion segment is expected to grow at a notable rate during the forecast period, owing to its offering a longer shelf life and higher concentration than the liquid segment. Furthermore, having a cost-effective and small amount of waste, the emulsion gained significant industry share in the large-scale industrial area, which has been seeking a cost-effective water treatment solution over the past few years. Moreover, several manufacturers are looking for compact and efficient products where emulsion can be recognized in the coming years, as per expectations.

Application Insights

Why Did the Water and Wastewater Treatment Segment Dominate the Flocculants and Coagulants Market in 2024?

The water and wastewater treatment segment dominated the market in 2024 owing as these chemicals are essential in removing suspended particles and contaminants. Municipalities and industries use them in primary and secondary treatment processes to clarify water before it's reused or released. Urbanization, population growth, and pollution make water purification a top priority worldwide. Governments and environmental agencies are increasing investment in centralized treatment plants, further boosting demand.

The mining and mineral processing segments are expected to grow at a notable rate because these industries generate large amounts of wastewater with suspended solids. Flocculants and coagulants help in separating valuable minerals from waste and in treating tailings water. As global mining operations expand and environmental regulations become stricter, mining companies are turning to better water management practices. Using these chemicals reduces water usage and makes operations more sustainable.

End User Insights

How does the Municipal Segment Maintain Dominance in the Application Type?

The municipal segment held the largest share of the market in 2024. As the cities and towns are responsible for treating drinking water and sewage. Municipal plants use flocculants and coagulants to remove dirt, organic matter, and pathogens from water. With rising urban populations, cities are treating more water than ever before. Governments are investing in centralized wastewater treatment infrastructure, especially in developing nations. Municipal systems also tend to operate on a large scale, making them major consumers of treatment chemicals.

The industrial segment is expected to grow at the fastest rate during the forecast period, as more factories adopt wastewater treatment systems to meet environmental rules. Industries like chemicals, textiles, paper, food, and metal processing use large amounts of water and produce contaminated effluent. These industries are now being pushed to clean and reuse water, leading to higher demand for flocculants and coagulants. Treating wastewater before discharge helps avoid fines and protects company reputations.

Distribution Channel Insights

Why is the Direct Supply Segment Dominating the Flocculants and Coagulants Market in 2024?

The direct supply segment led the market in 2024. Large industrial and municipal users prefer buying directly from manufacturers or authorized dealers. This ensures consistent quality, technical support, and better pricing for bulk orders. In direct supply, long-term contracts are common, and suppliers often provide tailored solutions or on-site services. It also allows quicker delivery and fewer intermediaries, which is important for continuous operations.

The online portals segment is expected to grow at the fastest rate in the market during the forecast period. They offer convenience, price comparison, and easy ordering. Small and medium industries prefer online platforms for quick access to various products without complex negotiations. As digitalization spreads, more suppliers are listing products on B2B e-commerce sites. These portals also offer datasheets, reviews, and delivery tracking, improving buyer confidence. In developing markets, online access helps users find new suppliers and products more easily.

Recent Developments

- In March 2025, DSM Firmenich introduced its latest coagulant enzyme. Moreover, the newly launched coagulant enzyme is named Maxiren EVO. The coagulant enzymes are mainly designed for the transformation of cheese production, as per the report published by the company recently.(Source: nuffoodsspectrum.in)

- In April 2024, Gradiant introduced its latest product line for wastewater treatment. Moreover, the newly launched product line is called CURE Chemicals, as per the report published by the company recently. This product line includes the latest coagulants and flocculants.(Source: www.gradiant.com)

Top Companies List

- Ecolab Inc.

- SNF Group

- Kemira Oyj

- SUEZ Water Technologies & Solutions

- BASF SE

- Solvay SA

- Hawkins Inc.

- Feralco Group

- Ixom Operations Pty Ltd

- Aries Chemical, Inc.

- Aditya Birla Chemicals

- Shandong Polymer Bio-Chemicals Co., Ltd.

- GE Water & Process Technologies

- AkzoNobel N.V.

- DuPont Water Solutions

- Kurita Water Industries Ltd.

- RisingSun Membrane Technology

- GEO Specialty Chemicals

- Accepta Ltd.

- Avista Technologies, Inc.

Segment Covered

By Product Type

- Coagulants

- Inorganic Coagulants

- Aluminum Sulfate (Alum)

- Ferric Chloride

- Ferric Sulfate

- Poly Aluminum Chloride (PAC)

- Organic Coagulants

- Polyamines

- PolyDADMAC

- Inorganic Coagulants

- Flocculants

- Anionic Flocculants

- Cationic Flocculants

- Non-ionic Flocculants

- Amphoteric Flocculants

By Form

- Liquid

- Powder

- Emulsion

By Application

- Water & Wastewater Treatment

- Oil & Gas

- Mining & Mineral Processing

- Pulp & Paper

- Food & Beverage Processing

- Chemicals & Petrochemicals

- Textiles

- Pharmaceuticals

By End-Use Industry

- Municipal

- Industrial

- Commercial

By Distribution Channel

- Direct Supply

- Distributors

- Online Portals

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE