Content

Butyric Acid Market Size and Growth 2025 to 2034

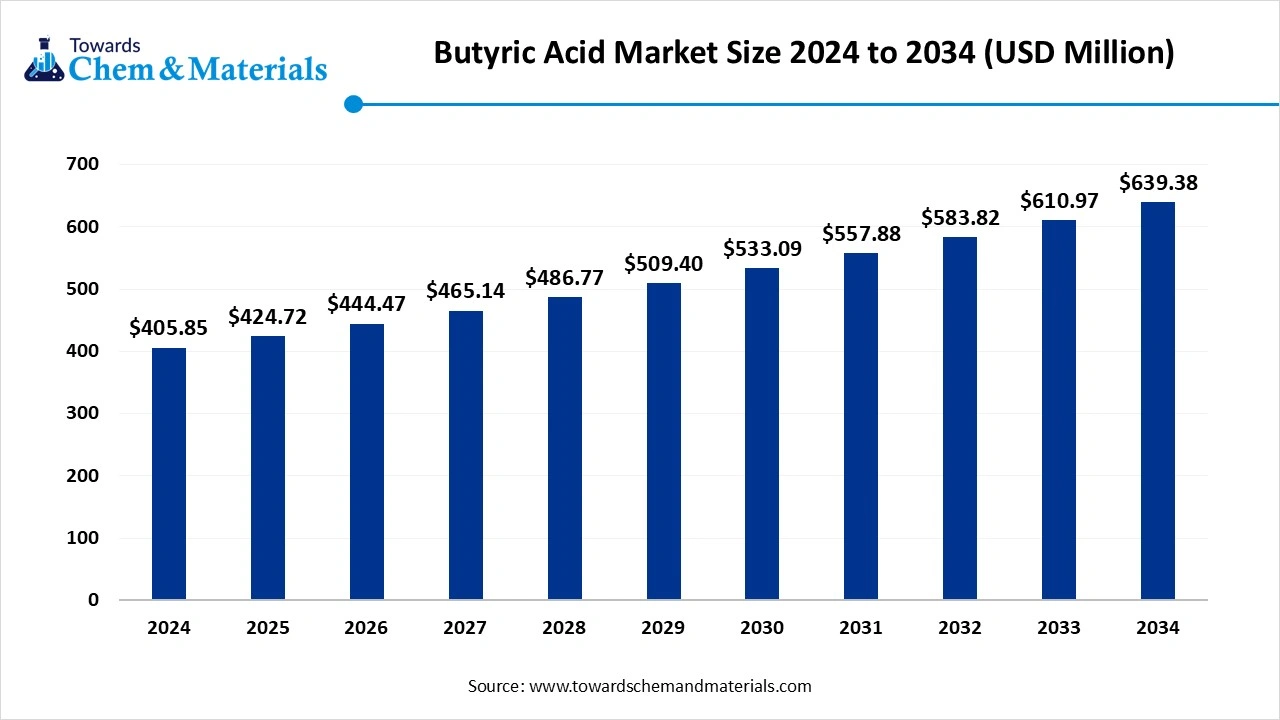

The global butyric acid market size is reached at USD 424.72 million in 2025 and is expected to be worth around USD 639.38 million by 2034, growing at a compound annual growth rate (CAGR) of 4.65% over the forecast period 2025 to 2034. The growing demand across end-user industries like pharmaceuticals, chemicals, animal feed, and food & beverages drives the growth of the market.

Key Takeaways

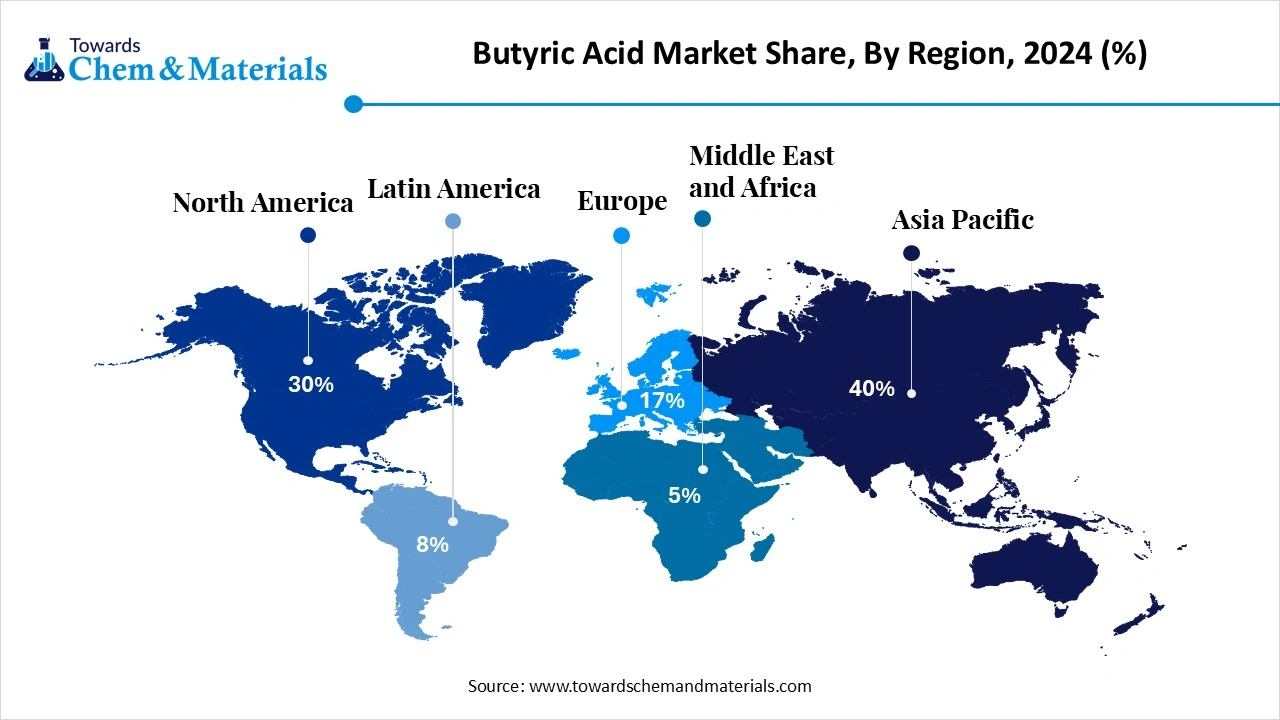

- The Asia Pacific butyric acid market size was estimated at USD 162.34 million in 2024 and is expected to reach USD 256.07 million by 2034, growing at a CAGR of 4.66% from 2025 to 2034.

- By region, Latin America is growing at the fastest CAGR in the market during the forecast period due to the strong focus on animal welfare.

- By type, the synthetic butyric acid segment held a 62% share in the butyric acid market in 2024 due to the increasing demand in the pharmaceutical industry.

- By type, the bio-based butyric acid segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing consumer demand for natural products.

- By form, the liquid butyric acid segment held a 55% share in the market in 2024 due to the easy blending and mixing processes.

- By form, the encapsulated salt forms segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing demand for processed food.

- By end-use industry, the animal husbandry segment held a 50% share in the market in 2024 due to the growing consumption of animal products.

- By end-use industry, the healthcare & bioplastics manufacturing segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing demand for bioplastic and various pharmaceutical products.

- By production process, the chemical synthesis segment held a 68% share in the market in 2024, due to the lower production cost.

- By production process, the fermentation-based/bio-derived segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing demand for bio-based products.

- By distribution channel, the direct segment led the market in 2024 due to the growing demand for customized solutions.

- By distribution channel, the distributors & traders segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing focus on handling potential technical support.

Butyric Acid: The Power Behind Gut Health and Nutritional Value

Butyric acid is a chain of fatty acids in the form of esters. The chemical formula of butyric acid is CH3CH2CH2COOH. It consists of a pungent odor and an unpleasant taste. Butyric acid helps in irritable bowel syndrome, colon cancer, insulin sensitivity, and Crohn’s disease. It is found in cow’s milk, sheep’s milk, red meat, ghee, butter, vegetable oils, sauerkraut, and many more. The molecular weight of butyric acid is 88.11 g/mol and is also known as butanoic acid. It is widely used in plasticizers, textile auxiliaries, plastics, and surfactants. The increasing prevalence of gastrointestinal diseases increases demand for butyric acid. The growing production of pharmaceuticals to treat various conditions like cancer, gastrointestinal diseases, and inflammation fuels demand for butyric acid.

Factors like increasing demand from the animal feed sector, development of bio-based solutions, growing expansion of the food& beverage industry, and a supportive regulatory environment contribute to the butyric acid market growth.

- From October 2023 to September 2024, China exported 1041 shipments of butyric acid with a growth rate of 8% compared to the previous twelve months.(Source: www.volza.com)

- China exported 5993 shipments of butyric acid.(Source: www.volza.com)

The United States exported 4839 shipments of butyric acid.(Source: www.volza.com) - Mexico exported 3690 shipments of butyric acid.(Source: www.volza.com)

Growing Food & Beverage Industry Surge Demand for Butyric Acid

The growing food & beverage industry in various regions increases demand for butyric acid for various applications. The increasing demand for snacks, confectionery, and dairy items like yogurt, cheese, and butter fuels demand for butyric acid to enhance the flavors. The increasing demand for packaged food fuels demand for butyric acid to act as a synthetic preservative.

The focus on clean-label food products and growing consumer preference for natural food fuels demand for butyric acid. The increasing consumer preference for promoting gut health fuels demand for butyric acid. The rising demand for meat products fuels demand for butyric acid to enhance texture and tenderness. The increasing demand for processed food and packaged foods is fueling demand for butyric acid. The growing expansion of the food & beverage industry is fueling demand for butyric acid. The growing food & beverage industry is a key driver for the butyric acid market.

Market Trends

- The Increasing Demand for Animal Feed: The rising demand for animal feed in swine and poultry increases demand for butyric acid to enhance nutrient absorption and improve gut health.

- Growing Focus on Gut Health: The growing consumer focus on gut health fuels demand for butyric acid to be used in functional foods and dietary supplements to avoid various digestive problems like IBS and many more.

- The Growing Demand for Natural Preservatives: The increasing demand for natural preservatives in the food & beverage industry fuels demand for butyric acid to support consumer demand for cleaner labels.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 424.72 Million |

| Expected Size by 2034 | USD 639.38 Million |

| Growth Rate from 2025 to 2034 | CAGR 4.65% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By Form, By End-User Industry, By Production Process, By Distribution Channels, By Region |

| Key Companies Profiled | Eastman Chemical Company, Perstorp Holding AB, OQ Chemicals (formerly Oxea GmbH), Blue Marble Biomaterials, Tokyo Chemical Industry Co., Ltd., Thermo Fisher Scientific BASF SE, Merck KGaA, Godavari Biorefineries, Central Drug House (CDH), Alfa Aesar (A Thermo Fisher Brand), Snowco Industrial Co., Ltd., Yufeng International Co., Ltd., Spectrum Chemical Mfg. Corp., Ennolys (Lesaffre Group), Silver Fern Chemical Inc., Zhengzhou Bainafo Bioengineering Co., Ltd., Kingchem Life Science LLC, Axxence Aromatic GmbH, Vigon International |

Market Opportunity

The Growing Expansion of the Pharmaceutical Industry

The increasing expansion of the pharmaceutical industry and production of various pharmaceutical products increases demand for butyric acid. The growing development of various drugs fuels demand for butyric acid for enhancing the effectiveness and absorption of drugs. The increasing production of cancer treatment fuels demand for butyric acid. The demand for various medical formulations and nutraceuticals is fueling demand for butyric acid.

The increasing gastrointestinal health problems like IBS and IBD fuel demand for butyric acid to maintain healthy gut health. The disorders like multiple sclerosis, Alzheimer’s, and Parkinson’s require butyric acid medications due to their neuroprotective properties. Butyric acid possesses antimicrobial and anti-inflammatory properties. The growing expansion of the pharmaceutical industry creates an opportunity for the growth of the butyric acid market.

Market Challenge

High Production Cost Limits Expansion of Butyric Acid

Despite several benefits of butyric acid in various industries, the high production cost restricts the market growth. Factors like the need for extensive energy for chemical synthesis, high cost of raw materials, and the cost need for the fermentation process are responsible for high production cost. The high cost of raw materials like propylene increases the overall production cost. The complex processes like oxidation and hydroformylation require a high cost. The need for extensive energy and specialized equipment increases the production cost.

The slow production rate of the biological fermentation process increases the cost. The downstream processing and strain limitation of biological fermentation increase the cost. The requirement for high energy for various processes like distillation, heating, and cooling fuels the cost. The need for specialized infrastructure for fermentation and chemical synthesis increases the overall cost. The high production cost hampers the growth of the butyric acid market.

Regional Insights

How Asia Pacific Dominated the Butyric Acid Market?

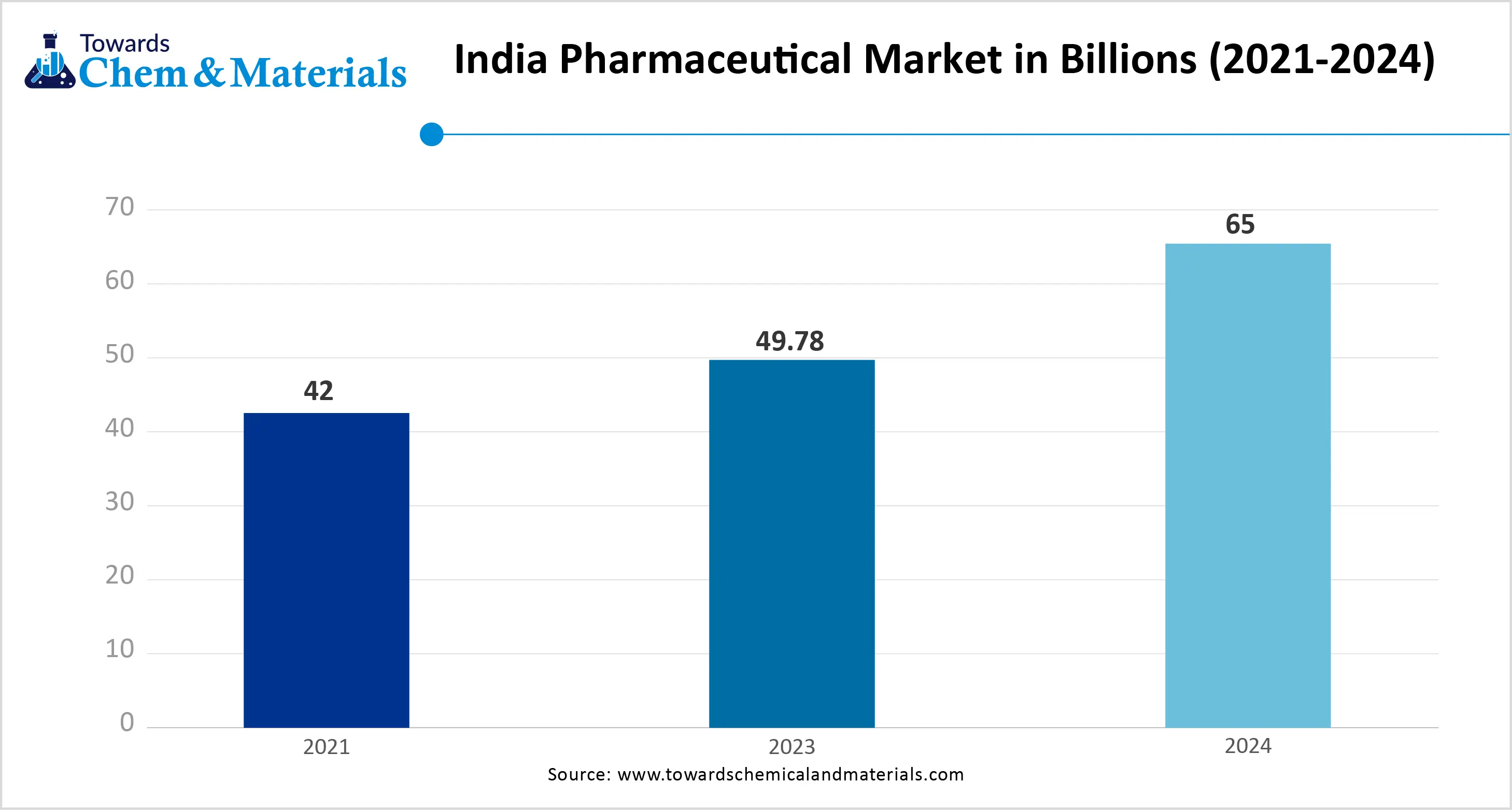

The Asia Pacific butyric acid market size was estimated at USD 162.34 million in 2024 and is anticipated to reach USD 256.07 million by 2034, growing at a CAGR of 4.66% from 2025 to 2034. Asia Pacific dominated the butyric acid market in 2024. The growing consumption of meat and the expansion of the meat production industry increase demand for butyric acid. The increasing expansion of the animal husbandry sector helps the market growth. The high demand for food & beverages increases the adoption of butyric acid to be used as flavoring agents and natural preservatives. The rapid growth in the pharmaceutical industry fuels demand for butyric acid for the production of medications & drugs. The increasing health consciousness among people and the strong presence of the chemical industry drive the overall growth of the market.

India Butyric Acid Market Trends

India is growing in the market. The rapid growth in dairy farming and poultry increases demand for butyric acid. The increasing expansion of the animal feed industry helps the market growth. The expansion of the food processing industry fuels demand for butyric acid for flavoring agents and food additives. The well-developed infrastructure for the production of butyric acid helps the market growth. The growing pharmaceutical industry fuels demand for butyric acid for the development of drugs. The expansion of the distribution networks of key players like Perstorp and Evonik supports the overall growth of the market.

- India exported 713 Shipments of butyric acid.(Source: www.volza.com)

- Tadimety Aromatics Pvt Ltd is the leading supplier of butyric acid in India.(Source: www.volza.com)

Why is Latin America the Fastest Growing in the Butyric Acid Market?

Latin America is experiencing the fastest growth in the market during the forecast period. The growing expansion of the food & beverage sector increases demand for butyric acid. The strong focus on alternative development for antibiotics and animal welfare helps the market growth. The increasing production of livestock fuels demand for butyric acid. The increasing awareness about health benefits and the production of digestive health supplements increases demand for butyric acid. The growing modernization of industries like chemical production and food processing drives the market growth.

Brazil Butyric Acid Market Trends

Brazil is significantly growing in the butyric acid market. The strong presence of the livestock industry increases the demand for butyric acid. The growing focus on biofuels derived from renewable biomass is fueling demand for butyric acid. The increasing focus on sustainability fuels demand for butyric acid in the plastic industry. The growing modernization of industry and investment in sustainable practices support the overall growth of the market.

Segmental Insights

Type Insights

Why did the Synthetic Butyric Acid Segment Dominate the Butyric Acid Market?

The synthetic butyric acid segment dominated the butyric acid market in 2024. The growing expansion of animal feed increases the demand for synthetic butyric acid to enhance growth performance and improve gut health. The lower production cost of synthetic butyric acid helps the market growth. The oxidation of butyraldehyde process is used for the production of synthetic butyric acid. The expansion of the food & beverage industry fuels demand for synthetic butyric acid to be used as an odorant, flavoring agent, and preservative. The increasing production of cellulose acetate butyrate and the rising demand in the pharmaceutical industry drive the overall growth of the market.

The bio-based butyric acid segment is the fastest-growing in the market during the forecast period. The growing consumer preference for organic and natural products increases demand for bio-based butyric acid. The increasing awareness of synthetic chemical impacts fuels demand for bio-based butyric acid, helping the market growth. The shift of the food industry towards clean label increases demand for bio-based butyric acid. The increasing demand for poultry and meat increases the adoption of bio-based butyric acid. The strong government support for bio-based chemicals supports the overall growth of the market.

Form Insights

How Liquid Butyric Acid Segment Held the Largest Share in the Butyric Acid Market?

The liquid butyric acid segment held the largest revenue share in the butyric acid market in 2024. The ease of handling in various industrial applications increases the demand for liquid butyric acid. It easily integrates with different formulations and simplifies blending & mixing processes. The increasing demand for applications like varnishes, perfumes, and flavorings helps the market growth. It easily dissolves in water & polar solvents and is cost-effective. The growing demand across various sectors like animal feed, food, and pharmaceuticals drives the market growth.

The encapsulated salt form segment is the fastest-growing in the market during the forecast period. The increasing demand for various food products increases the demand for encapsulated salt forms. The rapid growth in livestock and the increasing demand for animal products fuel the adoption of encapsulated salt forms, helping the market growth. The growing sustainable agriculture practices increase demand for encapsulated salt forms. The focus on reducing sodium content in food increases demand for encapsulated salt forms. The increasing production of various feeds and the rising demand for processed food support the overall growth of the market.

End-User Industry Insights

Which End-User Industry Dominated the Butyric Acid Market?

The animal husbandry segment dominated the butyric acid market in 2024. The growing consumption of animal products like dairy, meat, eggs, and many more increases the demand for butyric acid. The focus on maintaining the gut health of animals helps the market growth. The focus on reducing digestive disorders and increasing demand for supplementation in animal feed fuels demand for butyric acid. The focus on enhancing the growth performance of animals and increasing demand in various livestock, like ruminants, poultry, and swine, drives the market growth.

The healthcare & bioplastics manufacturing segment is experiencing the fastest growth in the market during the forecast period. The growing production of a wide range of pharmaceuticals increases demand for butyric acid. The increasing prevalence of gastrointestinal diseases like IBS helps the market growth. The increasing production of biodegradable plastics increases demand for butyric acid. The increasing demand for bioplastic in applications like consumer goods, packaging, and agriculture helps the market growth. The increasing production of dietary supplements & nutraceuticals and the growing demand for environment-friendly alternative traditional plastic support the overall growth of the market.

Production Process Insights

How Chemical Synthesis Dominates the Butyric Acid Market?

The chemical synthesis segment dominated the butyric acid market in 2024. The increasing demand for the large-scale production of butyric acid increases the adoption of the chemical synthesis process. The lower production cost and increasing demand for better control over the consistency & purity of fuels demand for chemical synthesis processes, helping the market growth. The easily available raw materials like propylene help the market growth. The availability of existing infrastructure and technologies for the production of butyric acid through the chemical synthesis process drives the overall growth of the market.

The fermentation-based/bio-derived segment is experiencing the fastest growth in the market during the forecast period. The growing focus on lowering environmental impact increases demand for fermentation-based butyric acid to minimize waste and reduce carbon footprint. It is manufactured through renewable resources like industrial waste and agricultural byproducts. The increasing consumer demand for organic and natural products fuels the adoption of bio-derived butyric acid. The increasing advancements in fermentation technology and growing demand for bio-based products support the overall growth of the market.

Distribution Channels Insights

How Direct Segment Held the Largest Share in the Butyric Acid Market?

The direct segment held the largest revenue share in the butyric acid market in 2024. The growing client demand for specific needs increases the adoption of direct sales. The increasing demand for direct interaction with manufacturers helps the market growth. The focus is on receiving feedback for product performance increases adoption of direct sales. The focus on building stronger relationships & trust and increasing demand for customized solutions drives the market growth.

The distributors & traders segment is the fastest growing in the market during the forecast period. The increasing demand for intermediaries from consumers and manufacturers fuels demand for distributors and traders. The increasing focus on managing the supply chain of butyric acid helps the market growth. The focus on handling potential technical support, logistics, and storage fuel demand for distributors & traders supports the market growth.

Recent Developments

- In July 2023, Willicroft launched fermented plant-based butter. The product is developed using precision fermentation, and it does not contain any artificial flavoring. The flavor of butyric acid is developed in butter by a precise fermentation process.(Source: www.theplantbasemag.com)

- In March 2025, METEX NØØVISTA collaborated with Alinova to launch the first bio-based butyric acid in France for animal nutrition. The initial production capacity of butyric acid in the Carling-Saint Avold Site is 1000 tonnes.(Source: www.arbios.org)

- In May 2024, Nutrashure launched ready-to-mix drinkable butyrate, BIOMEnd. The product consists of the I-lysine salt of butyric acid and L-Lysine butyrate. The product supports consumers' wellness goals and plays a key role in gut health.(Source: www.bevnet.com)

- In October 2023, Kemin launched encapsulated butyrate for next-gen gut health support. ButiShield provides integrity & strength to the intestinal wall. The benefits of products are regulating numerous metabolic processes, supporting intestinal barrier integrity, and promoting a healthy microbiome.

(Source: www.nutraingredients-usa.com) - In July 2024, the prices of iso-butyric acid increase in China. The increasing cost of propylene is responsible for the increased prices of iso-butyric acid.(Source: www.chemanalyst.com)

Top Companies List

- Eastman Chemical Company

- Perstorp Holding AB

- OQ Chemicals (formerly Oxea GmbH)

- Blue Marble Biomaterials

- Tokyo Chemical Industry Co., Ltd.

- Thermo Fisher Scientific

- BASF SE

- Merck KGaA

- Godavari Biorefineries

- Central Drug House (CDH)

- Alfa Aesar (A Thermo Fisher Brand)

- Snowco Industrial Co., Ltd.

- Yufeng International Co., Ltd.

- Spectrum Chemical Mfg. Corp.

- Ennolys (Lesaffre Group)

- Silver Fern Chemical Inc.

- Zhengzhou Bainafo Bioengineering Co., Ltd.

- Kingchem Life Science LLC

- Axxence Aromatic GmbH

- Vigon International

Segments Covered

By Type

- Synthetic Butyric Acid

- Renewable/Bio-based Butyric Acid

By Form

- Liquid Butyric Acid

- Encapsulated/Microencapsulated

By End-User Industry

- Animal Husbandry & Livestock

- Healthcare & Pharmaceutical

- Food & Beverage

- Chemical Manufacturing

- Personal Care & Cosmetics

- Packaging & Plastic

By Production Process

- Chemical Synthesis

- Fermentation-based/bio-derived

By Distribution Channels

- Direct (Industrial/Institutional Buyers)

- Distributors & Traders

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait