Content

Flat Steel Market Size, Share, Analysis and Forecast 2034

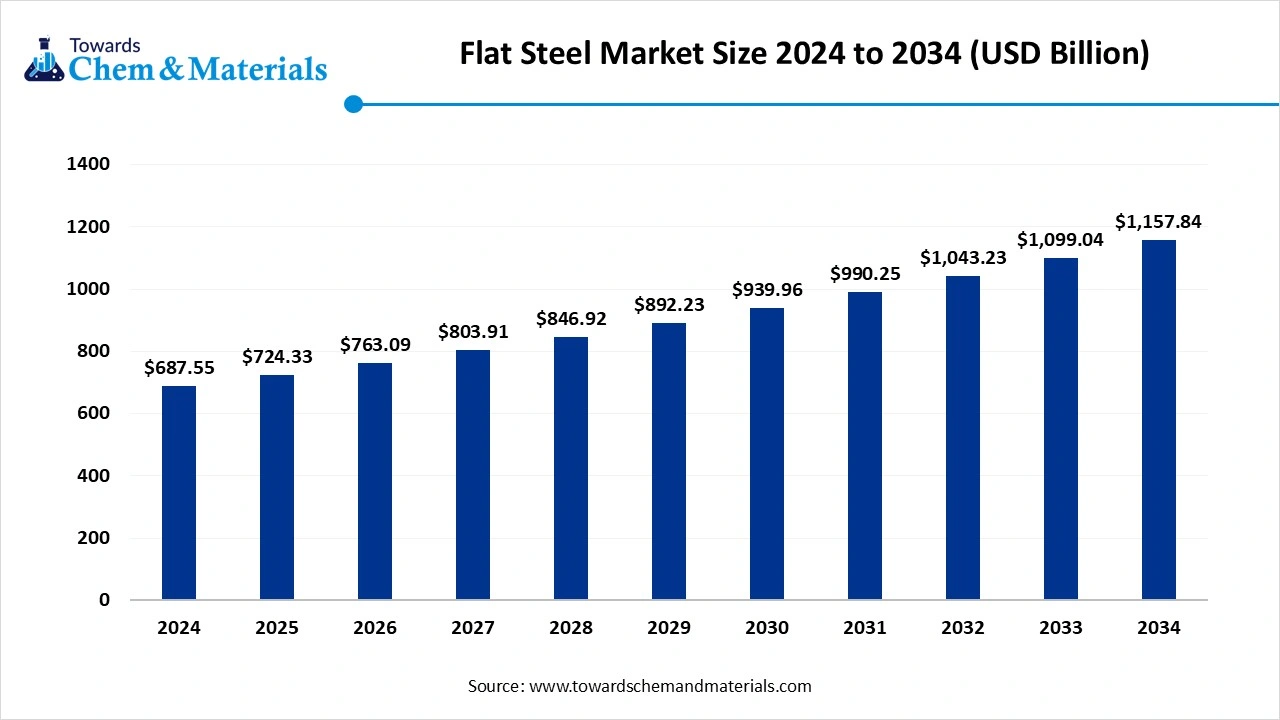

The flat steel market size accounted for USD 687.55 billion in 2024 and is predicted to increase from USD 724.33 billion in 2025 to approximately USD 1,157.84 billion by 2034, expanding at a CAGR of 5.35% from 2025 to 2034. The rapid urbanization and infrastructure development are the key factors driving market growth. Also, ongoing advancements in steel production processes, coupled with the growing private and government investment, can fuel market growth further.

Key Takeaways

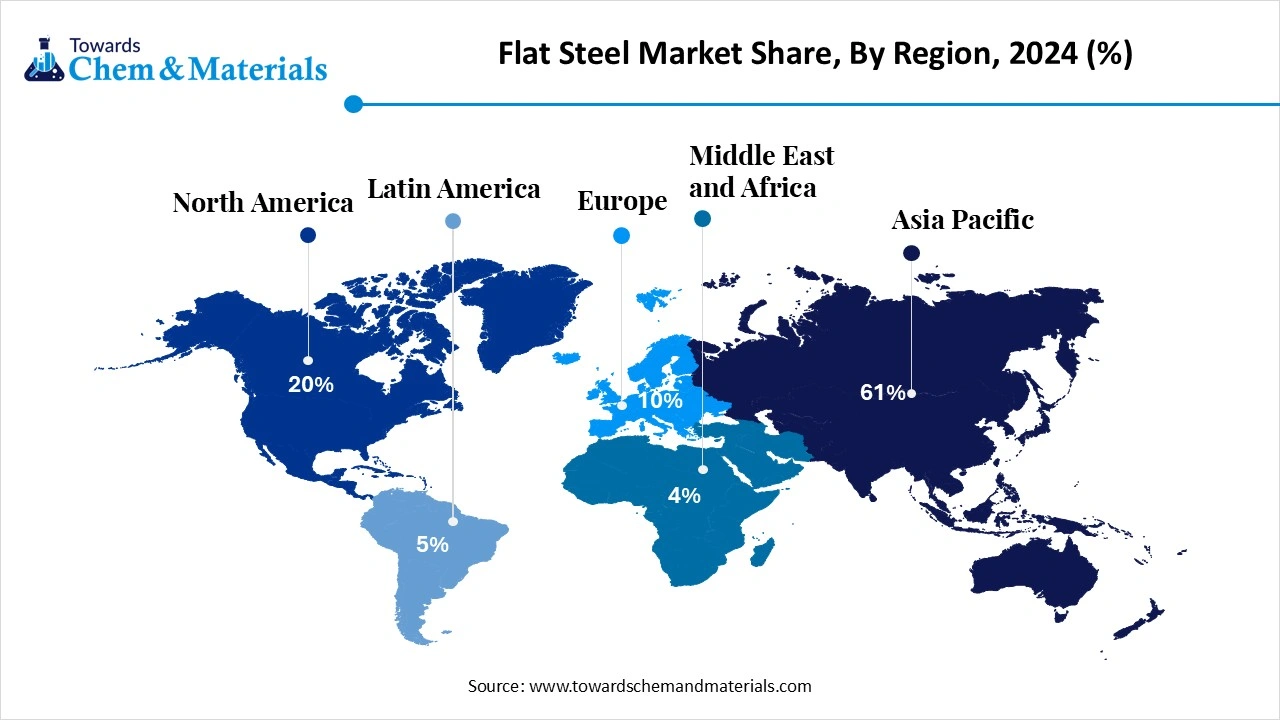

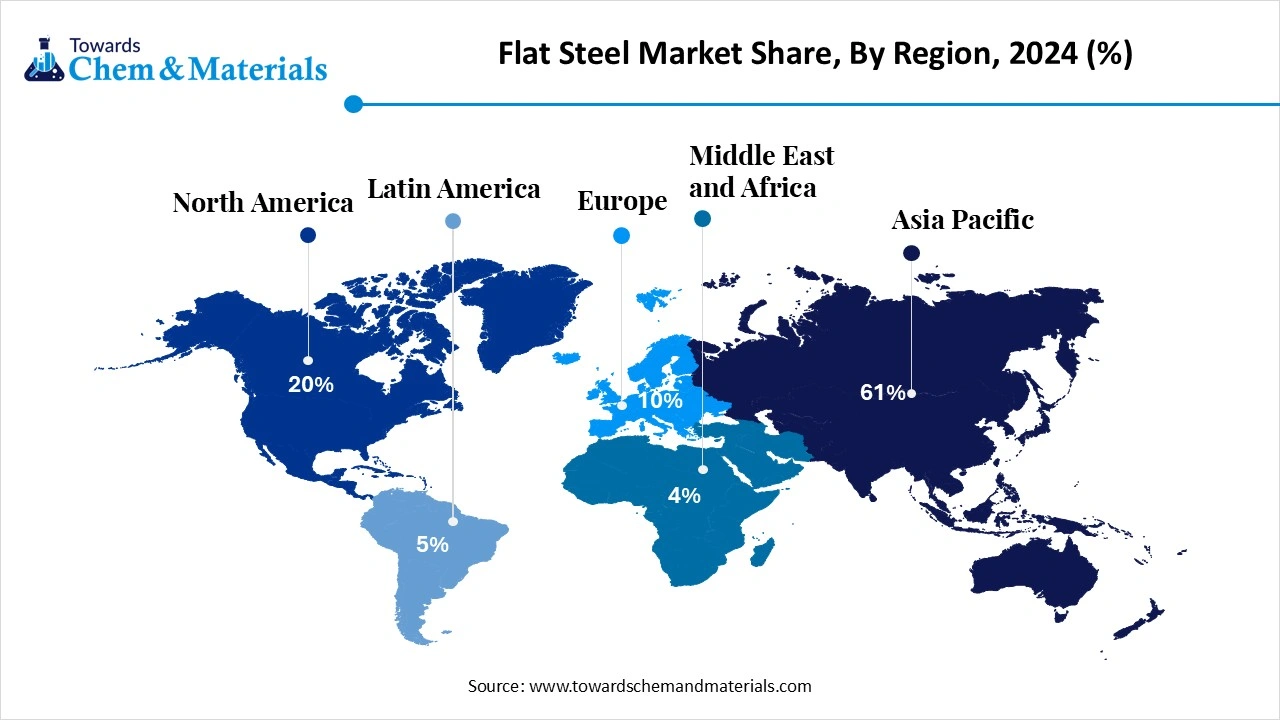

- By region, Asia Pacific dominated the market with a 61% share in 2024.

- By region, North America is expected to grow at the fastest CAGR over the forecast period.

- By product type, the plates segment dominated the market with a 66% share in 2024.

- By product type, the coated steel segment is expected to grow at the fastest CAGR over the forecast period.

- By material type, the carbon steel segment held a 70% market share in 2024.

- By material type, the stainless-steel segment is expected to grow at the fastest CAGR over the forecast period.

- By manufacturing process, the basic oxygen furnace (BOF) segment dominated the market with 60% share in 2024.

- By manufacturing process, the electric arc furnace (EAF) segment is expected to grow at the fastest CAGR over the projected period.

- By end-use industry, the building & construction segment dominated the market with 80% share in 2024.

- By end-use industry, the automotive & aerospace segment is expected to grow at the fastest CAGR over the study period.

What is Flat Steel?

The adoption of new manufacturing processes is enhancing overall market efficiency and propelling market growth. Flat steel is the steel that has been transformed into flat, strip, coils, or rectangular sheets through a rolling process that minimizes its thickness and shapes it.

It is a crucial category of steel products, along with products such as rails and beams, and comes in various forms, such as cold-rolled steel, hot-rolled steel and other types of coated steel. These products are essential in many sectors, from automobile and home appliance production.

Flat Steel Market Outlook:

- Industry Growth Overview: Between 2025-2034, the market is anticipated to witness substantial growth due to growing use of high-strength steel in construction and automotive applications to enhance structural integrity and fuel efficiency. Also, ongoing integration of digital tools such as Artificial Intelligence and IoT is facilitating smooth production processes and supply chains.

- Sustainability Trends: Sustainability in the market is distinguished by a push towards green steel manufacturing using direct reduced iron (DRI) and electric arc furnaces with green hydrogen, coupled with the rising adoption of circular economy models. The use of eco-friendly coatings in flat steel products improves durability and promotes green building standards.

- Global Expansion: Major market players such as China Baowu, Nippon Steel, and Tata Steel, with extensive growth strategies often involve mergers, acquisitions, and technological advancements by focusing on growth industries such as construction and renewables.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 724.33 Billion |

| Expected Size by 2034 | USD 1,157.84 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.35% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | Product Type, Material Type, Manufacturing Process, End-Use Industry, By Region |

| Key Companies Profiled | China Baowu Steel Group, JFE Steel Corporation, HBIS Group, Thyssenkrupp Steel, Voestalpine AG, United States Steel Corporation, Steel Dynamics, Inc., Nucor Corporation, SSAB AB, Gerdau S.A., JSW Steel, Hyundai Steel, Ansteel Group Shougang Group, Severstal, Essar Steel |

Key Technological Shifts in the Flat Steel Market:

Key technological shifts in the market are emphasized on development of advanced materials, decarbonization efforts, and extensive digitalization to fuel efficiency and quality. Moreover, these changes address the rising demand for superior product performance and sustainability from the automotive, construction, and renewable energy sectors.

Companies such as Nippon Steel and POSCO are developing hydrogen-based steelmaking processes to minimize CO2 emissions. Nippon Steel provides certified green steel products that utilize mass balance methodology to reduce the CO2 emission by fulfilling demand from sectors such as automotive.

Trade Analysis of Flat Steel Market : Import & Export Statistics

- The countries with the largest trade surpluses in flat-rolled steel in 2023 were Japan ($4.98 billion), China ($3.78 billion), and Austria ($1.57 billion).

- The European Commission is preparing to introduce tariffs of 25-50% on iron and steel product imports from China.

- Hot Rolled Coil/Strip (HRC) was the most imported item, constituting 43% of total finished steel imports.

Market Opportunity

Growing Demand for Flat Steel from the Construction Sector

The growing trend towards nuclearization among the population, along with the rapid urbanisation, is a major factor creating lucrative opportunities in the market. The construction sector uses flat steel for structural support and construction frames in roofing, staircases, and shed applications.

Furthermore, the construction projects like skyscrapers and steel bridges necessitate a substantial amount of steel plates.

Market Challenge

Trade Tensions and Regulations

Tariffs and other trade challenges can disrupt the global market by creating uncertainty, which is the major factor hindering market growth. Moreover, labor shortages, logistics hurdles, and geopolitical events can affect the flow and availability of raw materials and finished products, leading to market hindrance further.

Value Chain Analysis of Flat Steel Market:

- Feedstock Procurement : It involves the sourcing of the raw materials and minimizing agents required for steel manufacturing.

- Chemical Synthesis and Processing : It refers to the chemical reactions and treatments used over the production process to add alloying elements, remove impurities, and apply protective coatings.

- Packaging and Labelling : It is the methods and materials used to safeguard, identify, and prepare flat steel products, like coils and sheets, for storage, handling, and transportation.

- Regulatory Compliance and Safety Monitoring : It involves adhering to stringent regulations and standards to ensure lawful, safe, and sustainable operations.

Flat Steel Market ‘s Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| India | In August 2025, India finalized a three-year safeguard measure on certain flat steel products. It includes a staggered import duty of 12% in the first year, 11.5% in the second, and 11% in the third. |

| European Union (EU) | As of March 2025, the EU is implementing stricter rules to prevent the circumvention of tariffs. This rule dictates that the origin of a steel product is determined by where it was melted, rather than its final processing location. |

| China | In February 2025, China released new guidelines to move its steel industry toward higher quality and sustainable development. |

Segmental Insights

Product Type Insights

Which Product Type Segment Dominated the Flat Steel Market in 2024?

The plates segment dominated the market with a 66% share in 2024. The dominance of the segment can be attributed to the rapid infrastructure development and rising urbanisation, especially in emerging economies such as China and India. Additionally, the steel sector is experiencing innovations in technology, such as advanced alloys and processing methods, which are specific to various needs across several sectors.

The coated steel segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the rapid technological innovations in steel production and applications, along with the increasing emphasis on sustainable practices. Also, the automotive sector is a major consumer of flat steel, and expansion in this sector directly contributes to growth in the coated steel segment.

Material Type Insights

How Much Share Did the Carbon Steel Segment Held in 2024?

The carbon steel segment held a 70% market share in 2024. The dominance of the segment can be linked to the expanding infrastructure and construction sector, particularly in developing economies, coupled with the rapid development of energy projects. In addition, carbon steel's high durability, strength, and relatively low cost compared to other materials can drive segment growth soon.

The stainless-steel segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by a surge in automotive production and increasing product demand from the construction sector. Furthermore, advancements in steel production and processing make flat steel more lightweight, reliable, and versatile, expanding its applications across different sectors.

Manufacturing Process Insights

Which Manufacturing Process Segment Dominated the Flat Steel Market in 2024?

The basic oxygen furnace (BOF) segment dominated the market with a 60% share in 2024. The dominance of the segment is owed to the growing product demand from automotive, construction, and mechanical equipment. This manufacturing process uses oxygen to oxidize impurities, which is an exothermic reaction that smoothly melts big iron and scrap into steel.

The electric arc furnace (EAF) segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment is due to the ongoing transition towards electric-based steelmaking, especially in developed regions such as Europe and North America. Moreover, EAFs depend heavily on scrap metal, which makes them central to the circular economy by improving their growth prospects.

End-Use Industry Insights

How Much Share Did the Building & Construction Segment Held in 2024?

The building & construction segment dominated the market with an 80% share in 2024. The dominance of the segment can be attributed to the rapid infrastructure development and urbanization, boosted by population growth along with the growing middle-class affluence. Also, the construction sector's growing emphasis on sustainable building materials fuels the demand for flat steel products.

The automotive & aerospace segment is expected to grow at the fastest CAGR over the study period. The growth of the segment can be credited to the growing demand for high-strength and lightweight materials to enhance overall fuel efficiency and performance in both sectors. Furthermore, advancements in material design and production processes are improving the efficiency and quality of flat steel production soon.

Regional Insights

Asia Pacific Flat Steel Market Size, Industry Report 2034

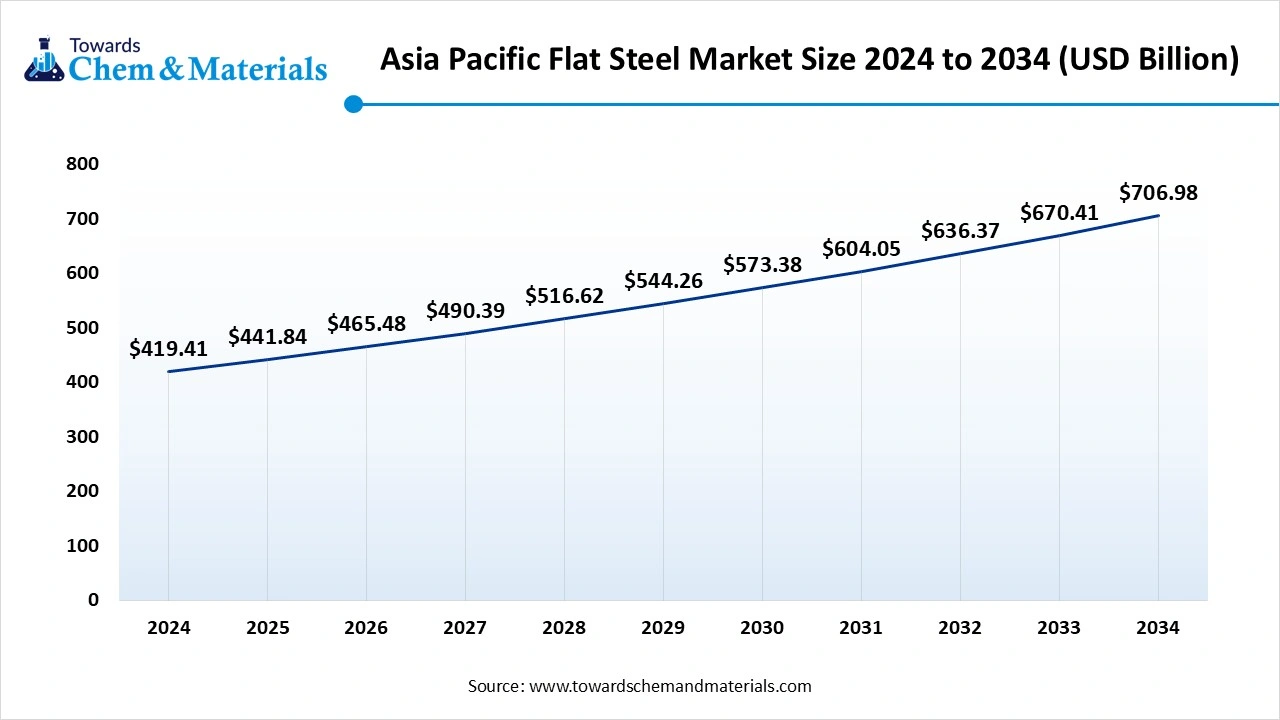

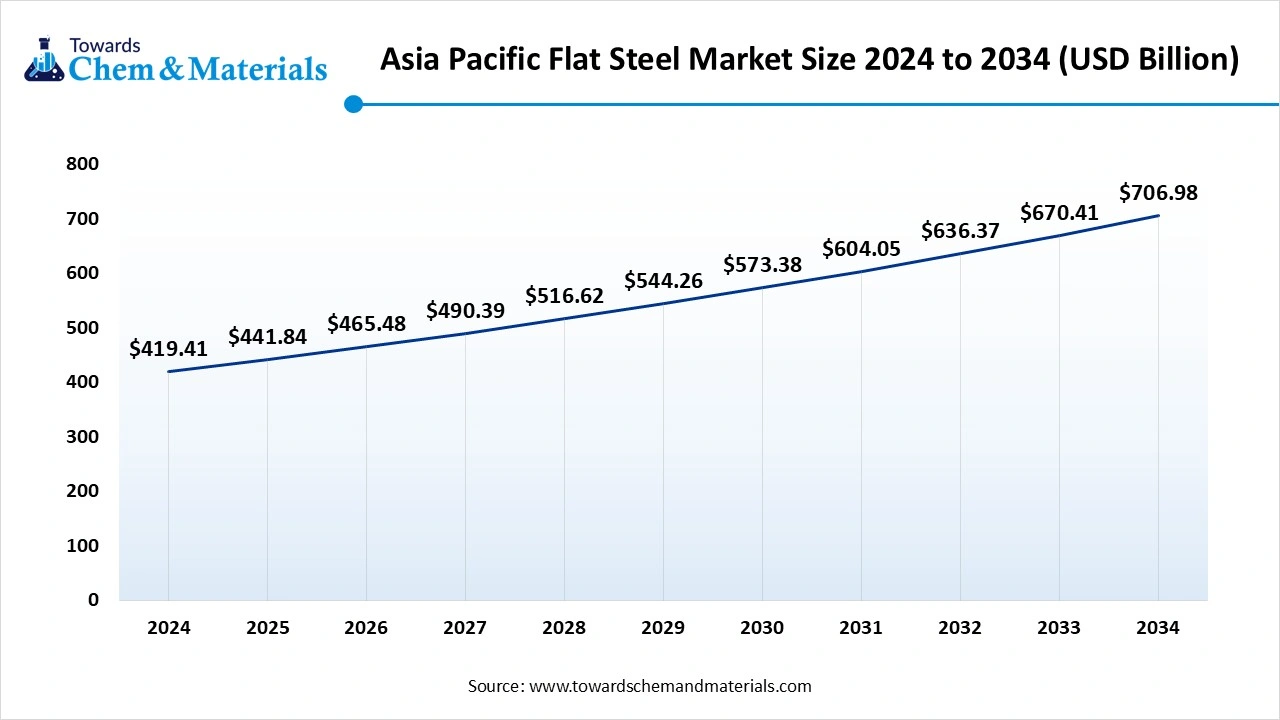

The Asia Pacific flat steel market size was valued at USD 419.41 billion in 2024 and is expected to surpass around USD 706.98 billion by 2034, expanding at a compound annual growth rate (CAGR) of 5.37% over the forecast period from 2025 to 2034. Asia Pacific dominated the market with a 61% share in 2024.

The dominance of the segment can be attributed to the rapid urbanization and industrialization, which lead to increased demand from expanding automotive and construction sectors. In addition, the region also benefits from a strong industrial base, large-scale manufacturing capabilities, and established steel production infrastructure.

North America is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the growing product demand from major sectors such as construction and automotive, coupled with the rapid infrastructure development projects. Furthermore, governments are increasingly investing in revitalizing and expanding infrastructure, like bridges and highways, which raises the demand for steel.

Country-level Investments & Funding Trends for the Flat Steel Market:

- United States: Significant investments are being made in steel recycling and green steel production technologies. Domestic production is also favoured by government measures, including tariffs.

- China: China leads the Asia Pacific market. Investments are driven by large-scale infrastructure projects, rapid urbanization, and a booming automotive sector.

- Saudi Arabia: Saudi Arabia's Vision 2030 initiatives emphasize infrastructure development.

Recent Developments

- In May 2025, ArcelorMittal Nippon Steel India unveiled the launch of two products, namely, Optigal Pinnacle and Optigal Prime, in its latest colour-coated steel portfolio, Optigal. Optigal Prime is convenient for moderately corrosive and urban environments, giving a 15-year warranty.(Source: www.business-standard.com)

Top Vendors in Flat Steel Market & Their Offerings:

- ArcelorMittal: ArcelorMittal is a global leader in the flat steel market, manufacturing a wide range of products including hot and cold rolled coils, plates, and coated products for different industries.

- Nippon Steel Corporation: It is a major steel manufacturer specializing in high-grade flat steel products like sheets and plates, crucial for appliance, automotive, and construction industries.

- Tata Steel: It is a global steel producer, known for its substantial presence in the flat steel market with products such as coils, sheets, and plates serving sectors such as automotive and construction.

Other Players

- China Baowu Steel Group

- JFE Steel Corporation

- HBIS Group

- Thyssenkrupp Steel

- Voestalpine AG

- United States Steel Corporation

- Steel Dynamics, Inc.

- Nucor Corporation

- SSAB AB

- Gerdau S.A.

- JSW Steel

- Hyundai Steel

- Ansteel Group

- Shougang Group

- Severstal

- Essar Steel

Segment Covered

Product Type

- Hot-Rolled Steel Sheets & Strips

- Cold-Rolled Steel Sheets & Strips

- Coated Steel Sheets

- Galvanized Steel

- Galvalume Steel

- Pre-painted Steel

- Plates

- Structural Plates

- Boiler & Pressure Vessel Plates

- Shipbuilding Plates

- Heavy Plates

- Electrical Steel

- Tinplate

Material Type

- Carbon Steel

- Low Carbon

- Medium Carbon

- High Carbon

- Stainless Steel

- Austenitic

- Ferritic

- Martensitic

- Alloy Steel

- Low-Alloy

- High-Alloy

- Manufacturing Process

- Basic Oxygen Furnace (BOF)

- Electric Arc Furnace (EAF)

- Open Hearth Furnace (OHF)

- Induction Furnace

End-Use Industry

- Building & Construction

- Automotive & Aerospace

- Mechanical Equipment

- Consumer Goods & Appliances

- Shipbuilding

- Oil & Gas

- Energy & Power

- Railways

- Others (Packaging, Electrical Equipment, Medical Devices)

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait