Content

What is the Europe Textile Market Size?

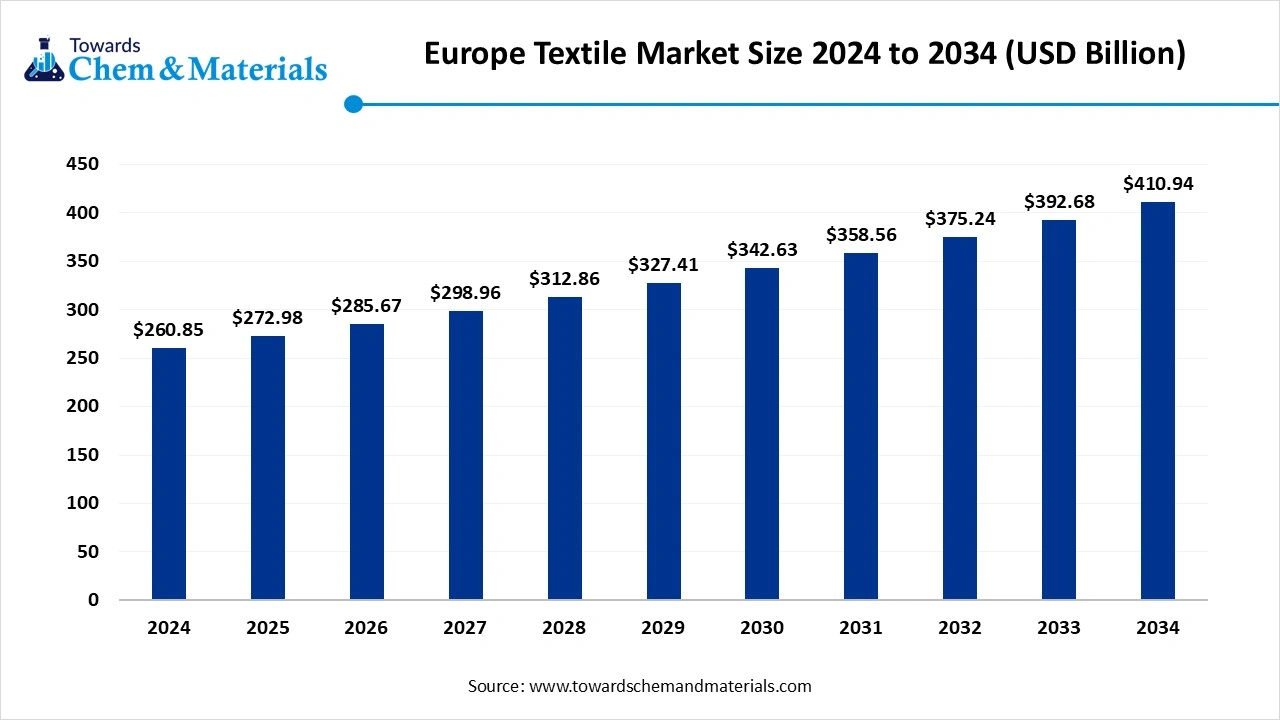

The Europe textile market size was reached at USD 260.85 Billion in 2024 and is expected to be worth around USD 410.94 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.65% over the forecast period 2025 to 2034.The rise in technical textiles and the trend of online shopping d rive the market growth.

Key Takeaways

- By application, the clothing segment dominated the market in 2024.

- By application, the industrial or technical segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By material type, the synthetics segment held a largest share in the market in 2024.

- By material type, the cotton segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By process type, the woven textiles segment held a largest share in the market in 2024.

- By process type, the non-woven segment is expected to grow at the fastest CAGR in the market during the forecast period.

What is Stitching the Europe Textile Market Growth?

The Europe textile market growth is driven by factors like the growing adoption of eco-friendly textiles, the rise in online shopping, the development of high-performance textiles, a strong focus on manufacturing smart textiles, high adoption of premium home textiles, and the expansion of technical textiles.

What is Textile?

Textile is a material made up of synthetic or natural fibers thro ugh processes like felting, knitting, and weaving. Textile helps in expressing personal style and offer a sense of comfort. The diverse types of textiles are blended textiles, natural textiles, and synthetic textiles. They are widely used in bedding, curtains, geotextiles, apparel, towels, upholstery, and medical supplies.

Europe Textile Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the industry is expanding in high-margin niches such as online shopping, technical textiles, and textile-to-textile recycling. Growth is being reinforced by the growing demand for technical textiles in countries like France, Germany, and Italy.

- Sustainability Trends: Sustainability is reshaping the Europe textile landscape, with rising demand for plant-based fibers, advanced recycling, and preferred fibers. For instance, Spinnova, a Finnish company, uses a chemical-free mechanical process to manufacture textile fiber from wood pulp.

- Major Investors: Venture capital firms, multinational corporations, and large retail groups are actively investing in European textiles to expand the manufacturing of textiles. For instance, Zalando Germany-based e-commerce fashion retailer company, heavily invests in partnerships & technology for the development of lifestyle & fashion products multi-service platforms.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 285.67 Billion |

| Expected Size by 2034 | USD 410.94 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.77% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Application, By Material Type, By Process Type, |

| Key Companies Profiled | H&M Group, Inditex, Kering SA, Adidas AG, Hugo Boss AG, Aquafil S.p.A., Marzotto Group, Prada S.p.A. , BASF SE, Teijin Limited, Freudenberg Group, Tessitura Monti S.p.A., Toray Industries, Inc., Klopman International S.r.I. |

Key Technological Shifts in the Europe Textile Market:

The Europe textile market is undergoing key technological shifts driven by the demand for customization, high-performance materials, and sustainability. One of the most significant transformations is the development of smart textiles, which lowers the consumption of energy, offers interactive experiences, and minimizes waste. Smart textiles integrate sensors, conductive yarns, and nanomaterials for the creation of new products. Smart textiles help various applications like sports, military, healthcare, and fashion.

- For instance, Born GmbH, a German-based company specializing in knitting smart textiles to manufacture advanced products like EasyMotionSkin electro-muscle and others for various applications like sports, medical, and others.

Trade Analysis of the Europe Textile Market: Import & Export Statistics

- Germany exported $30.7B of textiles in 2023.(Source: oec.world)

- Spain exported €18.5B of textiles in 2024.(Source: oec.world)

- Spain exported €484M of cotton in 2024.(Source: oec.world)

- Poland exported $116M of textiles for technical uses in 2023.(Source: oec.world)

- Switzerland exported $2.79B of textiles in 2023.(Source: oec.world)

- Italy imported $209M of wool in 2023.(Source: oec.world)

- Germany exported $13.7M of wool in 2023.(Source: oec.world)

Europe Textile Market Value Chain Analysis

- Feedstock Procurement: Feedstock procurement is the sourcing of raw materials like textile waste, synthetic fibers, natural fibers, and regenerated fibers.

- Key Players: Belrey Fibers, Hivesa Textil, Infinited Fiber Company, Green Tailor, Lebenskleidung

- Chemical Synthesis and Processing : The chemical synthesis and processing involve steps like pretreatment processes such as desizing, bleaching, singeing, scouring, & mercerizing, dyeing & printing, and finishing processes.

- Key Players: Atlanta AG, BASF SE, DyStar Group, Solvay S.A., ERCA, Archroma

- Quality Testing and Certifications: The quality testing involves the evaluation of properties like colorfastness, heavy metals, tensile strength, dyes, crease resistance, pH level, flammability, & shrinkage, and certifications like Global Organic Textile Standard, EU Ecolabel, & SA8000 Certification.

From Fiber to Fashion: Unfolding Europe’s Textile Manufacturing Journey

| Steps | Major European Countries | Technology Used | Key Companies |

| Sourcing Raw Materials |

|

|

|

| Yarn Production |

|

|

|

| Fabric Production |

|

|

|

| Finishing |

|

|

|

| Garment Production |

|

|

|

Segmental Insights

Application Insights

Which Application Dominated the Europe Textile Market?

The clothing segment dominated the market in 2024. The high spending on seasonal, casual, formal wear, and fast fashion trends helps the market growth. The growing online shopping and well-established production facilities in countries like Germany, Italy, & France increase demand for clothing. The increasing purchase of apparel and the growing young consumer demand for new clothing drive the overall market growth.

The industrial or technical segment is the fastest-growing in the market during the forecast period. The growing sectors like agriculture, automotive, and construction increase demand for technical textiles. The presence of advanced production processes and integration with AI increases the production of industrial textiles. The rise in manufacturing of eco-friendly technical textiles and strong government support for the development of technical textiles support the overall market growth.

Material Type Insights

How did the Synthetics Segment hold the Largest Share in the Europe Textile Market?

The synthetics segment held the largest revenue share in the market in 2024. The cheaper production cost and diverse properties like colorfastness, elasticity, & moisture-wicking of synthetics help the market growth. The growing demand for technical textiles, clothing, and home furnishing increases the adoption of synthetics. The increased adoption of nylon & polyester and ease of production drives the overall market growth.

The cotton segment is experiencing the fastest growth in the market during the forecast period. The strong consumer focus on sustainable materials and increased use of high-quality materials increases demand for cotton. The growing production of technical textiles, premium clothes, and luxury clothes increases demand for cotton. The growing consumer preference for natural fibers and the increasing development of certified cotton support the overall market growth.

Process Type Insights

Why Woven Segment Dominates the Europe Textile Market?

The woven segment dominated the market in 2024. The growing production of apparel and the increasing use of technical textiles increase demand for woven fabrics. The presence of high wear resistance, performance, and tear resistance in woven fabrics helps market growth. The growing demand for high-end home textiles and the expansion of geotextiles require woven fabrics, driving the overall market growth.

The non-woven segment is the fastest-growing in the market during the forecast period. The growing production of medical items like drapes, masks, & gowns increases the adoption of non-woven fabrics. The strong focus on sustainability and increasing production of filtration systems, interior panels, & carpets in the automotive sector requires non-woven fabrics. The increasing development of non-woven geo-textiles and the high demand for personal hygiene products support the overall market growth.

Country-Level Insights

How Germany Influences the Europe Textiles Landscape?

Germany is a major contributor to the Europe textile market in 2024. The significant presence of the fashion industry and high investment in research & development increase the production of textiles. The increasing manufacturing of technical textiles and a well-established manufacturing base help the market growth. The growing sustainable textile production and the high export of textiles & fashion drive the overall growth of the market.

- Germany exported $12M of raw cotton in 2023.(Source: oec.world)

- Germany exported $1.94B of polyamides: nylons in 2023.(Source: oec.world)

Crafting Elegance: France at the Forefront of Premium Textiles

France is a key contributor to the Europe textile market in 2024. The growing use of technical textiles and the increasing production of high-quality decorative products help the market growth. The rising linen production and increasing spending on home furnishing increase demand for textiles. The rise in the expansion of e-commerce and the need for high-fashion apparel support the overall market growth.

- France exported $14.3B of textiles in 2023.(Source: oec.world)

From Prato to Milan: Italy’s Timeless Story Behind Every Thread

Italy is growing in the Europe textile market. The well-established hub for luxury & premium textiles, and a strong focus on the adoption of technical textiles, help the market growth. The strong focus on sustainability and research & development increases the production of sustainable textiles. The growing demand for luxury apparel and high-end fashion drives the overall market growth.

- Italy exported $9.51M of wool in 2023. (Source: oec.world)

Recent Developments

- In October 2025, Lenzing collaborated with OceanSafe to launch next-generation performance textiles featuring naNea and TENCEL Lyocell-A100. The company offers a product range including athleisure clothing, footwear, bags, performance wear, home textiles, and technical textiles.(Source: www.textileworld.com)

- In April 2023, Freudenberg launched its first fusible interlinings range 46XX for shirts. The range lowers the environmental impact and supports sustainability objectives. The product has diverse weight classes, including 4618, 4605, & 4616, and is made up of 100% biodegradable polymer. The product is available in white and widely used in blouse collars, plackets, shirts, & cuffs.(Source: textileinsights.in)

- In April 2024, SA-Dynamics, a German-based startup, launched bio-based aerogel insulation fibers. The fibers lower the carbon footprint and energy consumption. The fibers contain 90% air and are made up of bio-based raw materials.(Source: www.fibre2fashion.com)

Top Europe Textile Market Companies

Lenzing AG

Corporate Information

- Name: Lenzing AG (headquartered in Lenzing, Upper Austria)

- Business: Developer and manufacturer of regenerated cellulosic (wood based) specialty fibres (viscose, modal, lyocell) under brands like TENCEL™, LENZING™, LENZING™ ECOVERO™, VEOCEL™.

- Key figures (2024): Revenue ~ EUR 2.66 billion, fibre nominal capacity ~ 1,110,000 tonnes.

History and Background

- Origins trace back to a paper mill founded by Emil Hamburger in Lenzing in 1892.

- In 1938, the predecessor company Zellwolle Lenzing AG was founded (during the era of Austria’s incorporation into the German Reich).

- Over the decades, the company shifted from a paper/pulp/wood business to a dedicated fibre producer, changing its name to Chemiefaser Lenzing AG in 1962, then to Lenzing AG in 1984.

Key Developments and Strategic Initiatives

The company’s “Better Growth” strategy (and more recently refined in 2025) emphasises moving into premium, high margin fibre segments and expanding into nonwoven, hygiene, filtration, medical and industrial applications.

- In 2025, Lenzing announced a strategic review of its Indonesian production site (including a potential sale and impairment of up to ~EUR 100 m) as part of its asset footprint optimisation.

Mergers & Acquisitions

- While Lenzing is less known for large M&A in recent years (relative to some other fibre/chemical companies), there have been strategic acquisitions:

- Example: In the early 2010s, Lenzing acquired remaining shares of Biocel Paskov (Czech pulp company

Shareholding change: In June 2024, Suzano S.A. (Brazilian pulp producer) became a ~15% shareholder in Lenzing, signalling strategic alignment with upstream pulp supply.

Partnerships & Collaborations

- Lenzing engages in extensive collaborations across the value chain: fibre producers, brands, nonwoven manufacturers, recycling partners.

- Examples: Partnership with Södra (Swedish pulp producer) for textile recycling: joint project in Austria starting 2023 to collect used textiles for pulp/fibre production.

- Collaboration with Leather alternative expert Recyc Leather and fashion brand GANNI to bring the hybrid material Pélinova® (TENCEL™ + recycled leather) to market.

Product Launches / Innovations

- In August 2023: LENZING™ ECOVERO™ with REFIBRA™ technology (up to 20% post consumer textile waste content) rolled out worldwide.

- In 2024/2025: introduction of waterless dyeing technology (ECOHUES™) for regenerated cellulose fibres, reducing water use by ~95% and dye consumption by ~40%.

- Sélection of new hybrid materials for footwear (Pélinova®) combining TENCEL™ lyocell and recycled leather fibre.

Key Technology Focus Areas

- Regenerated cellulosic fibre production (wood/plant pulp-viscose/modal/lyocell) with sustainable sourcing.

- Circular economy: Recycling textile waste (pre consumer and post consumer), introducing recycled content into fibres through REFIBRA™ technology and other initiatives.

R&D Organisation & Investment

- Lenzing emphasizes innovation heavily: historically (c. 2012) ~170 employees in R&D, ~1,400 patents/patent applications in 57 countries.

- Recent Reports: R&D investment figure ~EUR 30.4 m (in Austria) indicated by B & C Group data.

- Dedicated innovation centres and partnerships: global textile & nonwoven innovation, pilot production facilities for new fibre technologies.

SWOT Analysis

Strengths:

Leader in regenerated cellulose fibres with strong brand equity (TENCEL™, ECOVERO™).

- Strong sustainability credentials and recognized for circular economy efforts.

- Global footprint with production & sales network across Europe, Asia, Americas.

- Innovation strength, established R&D, patents and ability to launch new fibre technologies.

- Resilient business model focusing on higher margin specialty fibre segments.

Weaknesses:

- Exposure to commodity viscose/standard fibre markets that face margin pressure (for which company is now withdrawing).

- Significant cost pressures from raw materials, energy, labour & global sourcing /trade uncertainties (noted in strategic review).

- Asset footprint in low cost regions may require re investment or divestment (Indonesian site under review).

Opportunities:

- Increasing demand for sustainable, circular textile materials across apparel, home textiles, nonwovens, hygiene and industrial markets.

- Growth in nonwoven and technical fibre applications beyond traditional apparel.

- Partnerships & collaborations with brands and downstream players to embed fibre innovations into consumer products (e.g., footwear, leather alternatives).

- Expansion of recycling business: increasing capacity to process textile waste into new fibre feedstock.

Threats:

- Intense competition from commodity fibre producers (especially in Asia) that can underprice/regulate margins.

- Global macro uncertainties: trade conflicts, cost inflation (energy, raw materials), subdued consumer demand.

- Technological disruption: new materials (e.g., synthetic bio fibres) may erode cellulosic fibre demand.

- Supply chain disruptions (wood pulp availability, certification, environmental regulation) and sustainability compliance risks.

Recent News & Strategic Updates

- Sept 29 2025: Lenzing refined strategy for a challenging environment confirming EBITDA guidance for 2025, focusing on premium fibres, cost savings and asset optimization including Indonesian site review.

- Aug 25 2025: Lenzing accelerates energy transition: expanded photovoltaic capacity at Lenzing site (to 8.3 MWp), wind energy and hydropower projects in pipeline.

- H&M Group: The Swedish-based design & fashion company offers a diverse product range including accessories, footwear, apparel, home textiles, and cosmetics.

- Inditex: The World's largest fashion retailer company offers a wide range of products, including clothing, home furnishing, and textiles.

- Kering SA: The French-based company manages luxury brands like Saint Laurent, Balenciaga, Gucci, Alexander McQueen, DoDo, Boucheron, and Bottega Veneta.

- Adidas AG: The German-based company manufactures accessories, footwear, and apparel to support sports & athletic lifestyles.

- Hugo Boss AG

- Aquafil S.p.A.

- Marzotto Group

- Prada S.p.A.

- BASF SE

- Teijin Limited

- Freudenberg Group

- Tessitura Monti S.p.A.

- Toray Industries, Inc.

- Klopman International S.r.I.

Segments Covered

By Application

- Clothing

- Industrial/Technical

By Material Type

- Synthetics

- Cotton

By Process Type

- Woven Textiles

- Non-Woven Textiles