Content

Energy Dense Materials Market Size and Forecast 2025 to 2034

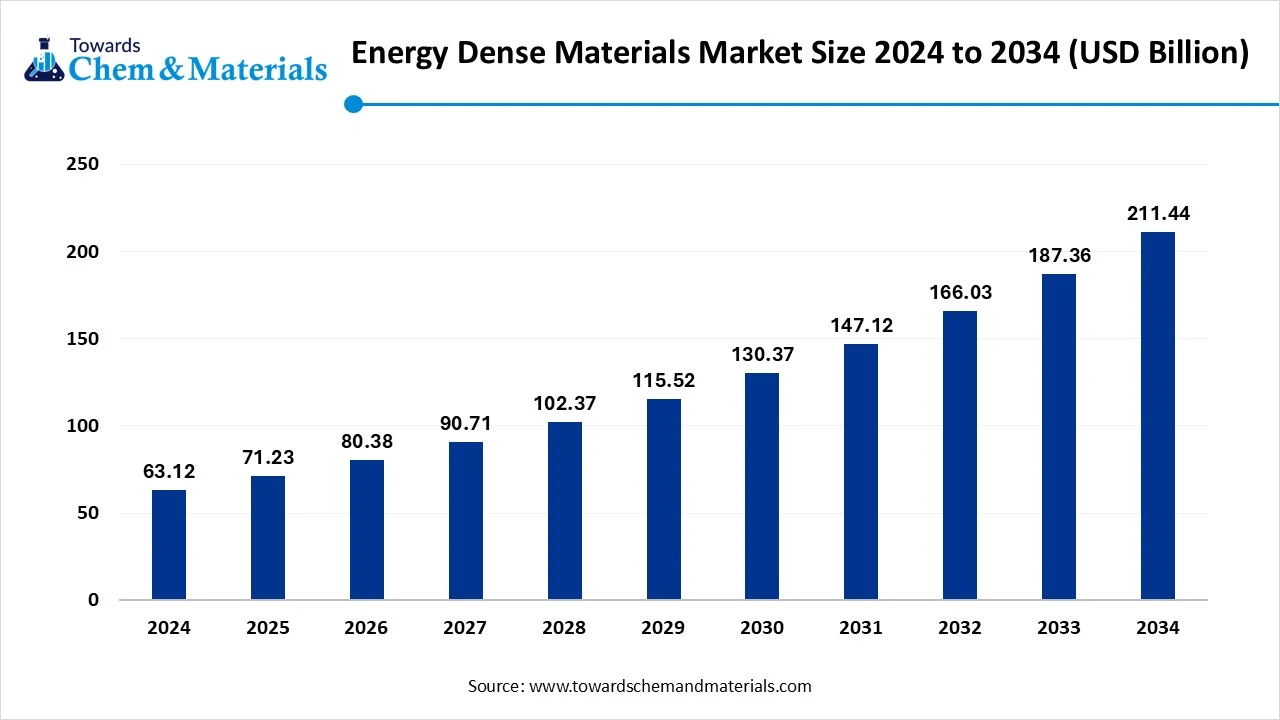

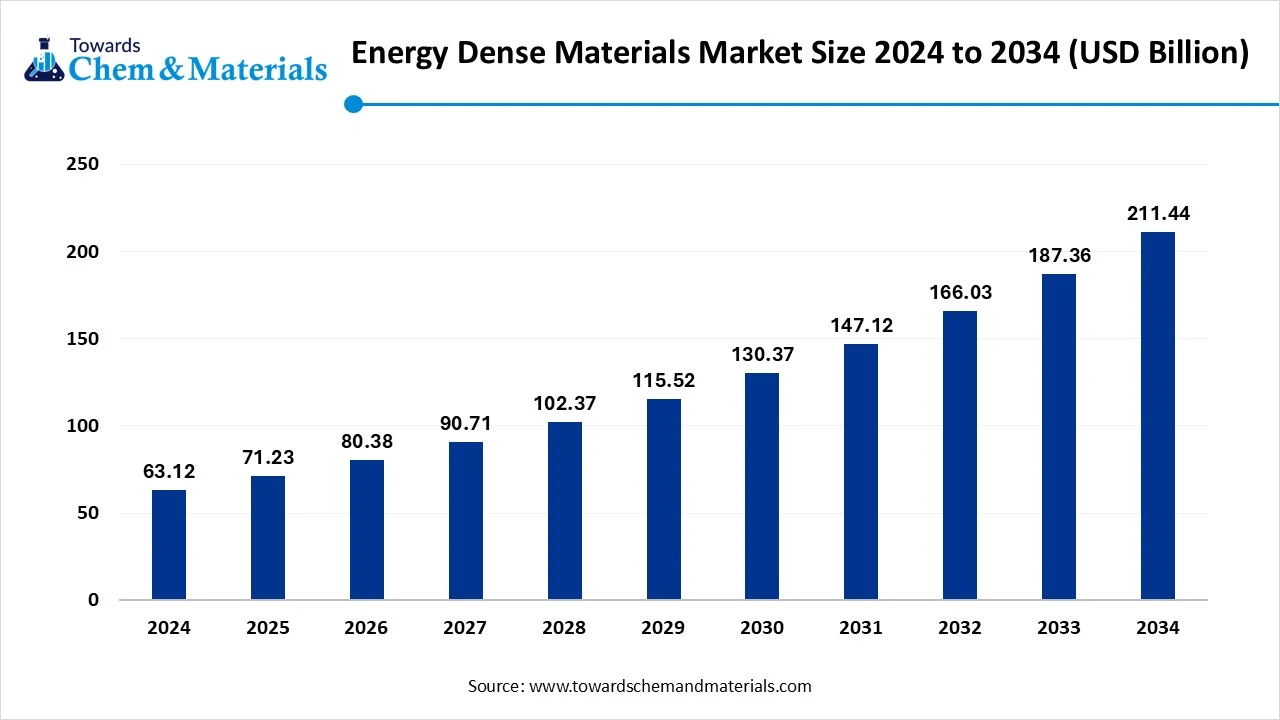

The global energy dense materials market size was reached at USD 63.12 billion in 2024 and is expected to be worth around USD 211.44 billion by 2034, growing at a compound annual growth rate (CAGR) of 12.85% over the forecast period 2025 to 2034. Increasing adoption of renewable energy sources is the key factor driving market growth. Also, innovations in battery and material technology, coupled with the expanding electric vehicle (EV) sector, can fuel market growth further.

Key Takeaways

- By region, Asia Pacific dominated the energy dense materials market with approximately 45% share in 2024. The dominance of the region can be attributed to the ongoing industrialization and urbanization.

- By region, North America is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing consumer demand for sustainable solutions.

- By material type, the lithium-based compounds (Li-ion) segment dominated the market with approximately 40% share in 2024. The dominance of the segment can be attributed to the increased use of Li-ion batteries in grid energy storage.

- By material type, the hydrogen & ammonia segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the rapid innovations in ammonia production.

- By application, the electric vehicles & mobility segment held approximately 35% market share in 2024. The dominance of the segment can be linked to the supportive government policies and incentives.

- By application, the renewable energy storage & space exploration segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the growing need for grid stability.

- By end user, the automotive & transportation segment led the market by holding approximately 40% share in 2024. The dominance of the segment can be attributed to the surge in vehicle production and demand, especially for commercial and electric vehicles.

- By end user, the aerospace & defense segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the ongoing adoption of advanced technologies.

- By technology, the electrochemical materials segment dominated the market with approximately 50% share in 2024. The dominance of the segment can be linked to the growing demand for efficient renewable energy storage.

- By technology, the hybrid & advanced nanomaterials segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be driven by its unique properties, such as graphene and carbon nanotubes.

- By distribution channel, the direct supply to OEMs & defense contractors segment held approximately 55% market share in 2024. The dominance of the segment is linked to the growing defense spending and surge in demand for commercial aircraft.

- By distribution channel, the government procurement programs segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the growing need for energy security.

Technological Advancements are Expanding Market Growth

The global energy-dense materials market covers the development, production, and utilization of high-energy-density substances designed to store or release large amounts of energy per unit mass or volume. These materials include advanced batteries, supercapacitors, energetic chemicals (explosives & propellants), hydrogen carriers, synthetic fuels, and next-generation energy storage composites.

They are used in defense, aerospace, automotive, renewable energy storage, and industrial power applications. Market growth is driven by rising demand for lightweight, high-capacity energy storage systems, electrification of transport, space exploration, renewable energy integration, and defense modernization.

What Are the Key Trends Influencing the Energy Dense Materials Market?

- Ongoing advancements like the use of bio-based materials and nanotechnology in coatings are the latest trend in the market. The consumer demand for energy-efficient products and innovations in technology is about to shape the future market scenario in the upcoming years.

- The growing focus on sustainability initiatives and environmental awareness is another trend shaping positive market growth. These initiatives are being boosted by the rising need to reduce carbon footprints, protect ecosystems, and decrease overall energy consumption.

- There is increasing emphasis on enhancing anode materials, especially with the exploration of lithium-metal and silicon-based anodes to increase overall storage capacity and enable faster charging. Also, the expanding EV sector is a major driver, as automakers need more energy-dense and larger batteries to raise their driving ranges.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 71.23 Billion |

| Expected Size by 2034 | USD 211.44 Billion |

| Growth Rate from 2025 to 2034 | CAGR 12.85% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Material Type, By Application, By End-User Industry, By Technology, By Distribution Channel |

| Key Companies Profiled | Tesla, Inc., Panasonic Corporation, Samsung SDI Co., Ltd., LG Energy Solution, Contemporary Amperex Technology Co. Limited (CATL) |

Market Opportunity

Growing Demand for Renewable Energy Sources

The increasing demand for efficient energy sources is the major factor creating lucrative opportunities in the market. The rising concerns over climate change and environmental degradation have resulted in a substantial shift towards green energy sources such as solar and wind power. Furthermore, government policies and regulations aimed at minimizing carbon emissions to deal with climate change are expected to result in growing demand for renewable energy sources.

- In April 2025, Amprius Technologies, Inc. unveiled its latest 450 Wh/kg SiCore™ lithium-ion battery product. This new range battery provides good energy density with manufacturing scale availability for electric and aviation mobility facilities.(Source: www.businesswire.com)

Market Challenge

Manufacturing & Processing Hurdles

Some materials, such as transition metal oxides, include a tedious production and processing compared to others, which is the key factor hindering market expansion. Moreover, regulatory bodies are very cautious to approve innovative materials for large-scale commercial deployment, particularly those with safety risks, which can negatively impact market growth.

Regional Insight

Asia Pacific Energy Dense Materials Market Trends

Asia Pacific dominated the market with a 45% share in 2024. The dominance of the region can be attributed to the ongoing industrialization and urbanization, along with the strong emphasis on renewable energy and climate goals. Moreover, ongoing collaborations between automotive market players, material suppliers, and battery producers are boosting advancements and fuelling regional growth further.

China Energy Dense Materials Market Trends

In the Asia Pacific, China dominated the market owing to the robust government support for the latest energy technologies and growing product demand from industrial production. Also, China's central government has increasingly supported new energy products and energy storage technologies, considering them as important for job creation and industrial upgrading.

North America Energy Dense Materials Market Trends

North America is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing consumer demand for sustainable solutions coupled with the rapid technological innovations that enhance battery lifespan, energy density, and safety. Furthermore, favourable government policies like grants, tax breaks, and programs for EV charging infrastructure are creating lucrative demand for energy storage systems.

Segmental Insight

Material Type Insight

Which Material Type Segment Dominated the Energy Dense Materials Market in 2024?

The lithium-based compounds (Li-ion) segment dominated the market with approximately 40% share in 2024. The dominance of the segment can be attributed to the increased use of Li-ion batteries in grid energy storage, consumer electronics, and industrial applications globally. Additionally, the extensive utilisation of Li-ion batteries in laptops, smartphones, and other portable electronics will fuel segment growth soon.

The hydrogen & ammonia segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the rapid innovations in ammonia production and green hydrogen technologies, such as electrolysis, and ongoing decarbonization efforts. In addition, green ammonia's easier transportability and energy density make it an ideal option for storing renewable energy.

Application Insight

Why Electric Vehicles & Mobility Segment Dominated the Energy Dense Materials Market in 2024?

The electric vehicles & mobility segment held approximately 35% market share in 2024. The dominance of the segment can be linked to the supportive government policies and incentives, a surge in environmental consciousness, and innovations in battery technology. Moreover, EVs offer lower cost as compared to conventional internal combustion engine (ICE) vehicles because they have less maintenance and fuel expenses.

The renewable energy storage & space exploration segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the growing need for grid stability, the rise in renewable energy adoption, and the decreasing costs of battery technology. Growing demand for GPS services, satellite-based internet, and remote sensing capabilities propels the market for space-based infrastructure.

End User Industry Insight

How Much Share Did the Automotive & Transportation Segment Held in 2024?

The automotive & transportation segment led the market by holding approximately 40% share in 2024. The dominance of the segment can be attributed to the surge in vehicle production and demand, especially for commercial and electric vehicles, coupled with the strong growth in developing economies such as China and India. The growing complexity of supply chains fuels demand for more technologically advanced and efficient logistics solutions to reduce costs.

The aerospace & defense segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the ongoing adoption of advanced technologies such as autonomous systems and Artificial Intelligence (AI), with the surge in geopolitical tensions and defense budgets across the globe. Furthermore, the growing use of AI-driven unmanned platforms in many defence applications will propel market growth soon.

Technology Insight

Which Electrochemical Materials Segment Dominated Energy Dense Materials Market in 2024?

The electrochemical materials segment dominated the market with approximately 50% share in 2024. The dominance of the segment can be linked to the growing demand for efficient renewable energy storage and rapid innovations in supercapacitor and battery technologies. Research into new materials like organic electrodes and solid electrolyte materials aims to enhance energy safety, density, and ionic conductivity.

The hybrid & advanced nanomaterials segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be driven by its unique properties, such as those of graphene and carbon nanotubes. Also, innovations in machine learning and nano-encapsulation aid in optimizing these materials and their systems for extensive adoption.

Distribution Channel Insight

Why Did the Direct Supply to OEMs & Defense Contractors Segment Held the Largest Energy Dense Materials Market Share in 2024?

The direct supply to OEMs & defense contractors segment held approximately 55% market share in 2024. The dominance of the segment is linked to the growing defense spending, surge in demand for commercial aircraft and drones, along with the technological innovations in lightweight and high-performance materials. Furthermore, OEMs and defense contractors are emphasizing enhancing operational efficiency, thereby driving segment growth soon.

The government procurement programs segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the growing need for energy security and the increasing demand to minimize dependence on imported critical minerals such as lithium. Additionally, the global transition towards grid-scale energy storage and electric vehicles (EVs) is boosting the demand for high-energy-density batteries.

Energy Dense Materials Market Value Chain Analysis

- Feedstock Procurement: This is a crucial stage that involves sourcing, securing, and transporting various raw materials used to manufacture EDMs like industrial chemicals.

- Chemical Synthesis and Processing: It encompasses the development and production of materials for applications in high-energy fuels and energy storage. The market of these materials is mainly boosted by increasing demand for high-performance fuels in various applications.

- Packaging and Labelling: This stage focuses on protecting the product to ensure its proper safety and meet stringent regulatory requirements. The technologies and materials used are crucial for protecting the sensitive materials.

Regulatory Compliance and Safety Monitoring

It is an important segment in the market, which addresses the high risks related to these powerful technologies. It includes various systems, standards, and services created to mitigate environmental impact and ensure safety.

Recent Developments

- In August 2025, POSCO FUTURE M created cutting-edge battery materials for standard electric vehicles and emerging electric vehicle materials. The company aims to respond to an extensive range of customers' needs and demands through mass production of the latest materials.(Source: www.poscofuturem.com)

Energy Dense Materials Market Top Companies

- Tesla, Inc.

- Panasonic Corporation

- Samsung SDI Co., Ltd.

- LG Energy Solution

- Contemporary Amperex Technology Co. Limited (CATL)

Segments Covered

By Material Type

- Lithium-Based Compounds

- Hydrogen & Ammonia

- Energetic Chemicals & Propellants

- Synthetic Hydrocarbons & E-Fuels

- Supercapacitor & Hybrid Nanomaterials

- Others

By Application

- Defense & Aerospace

- Electric Vehicles & Mobility

- Renewable Energy Storage

- Industrial Power & Backup Systems

- Marine & Aviation Fuels

- Space Exploration

By End-User Industry

- Defense & Military

- Aerospace & Space Agencies

- Automotive & Transportation

- Energy & Utilities

- Chemicals & Specialty Materials

- Marine & Aviation

By Technology

- Chemical Energy Dense Materials

- Electrochemical Materials

- Hydrogen & Synthetic Fuels

- Hybrid & Advanced Nanomaterials

By Distribution Channel

- Direct Supply to OEMs & Defense Contractors

- Industrial Material Distributors

- Government Procurement Programs

- Research & Development Partnerships

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait