Content

Circular Plastics Market Size and Share 2034

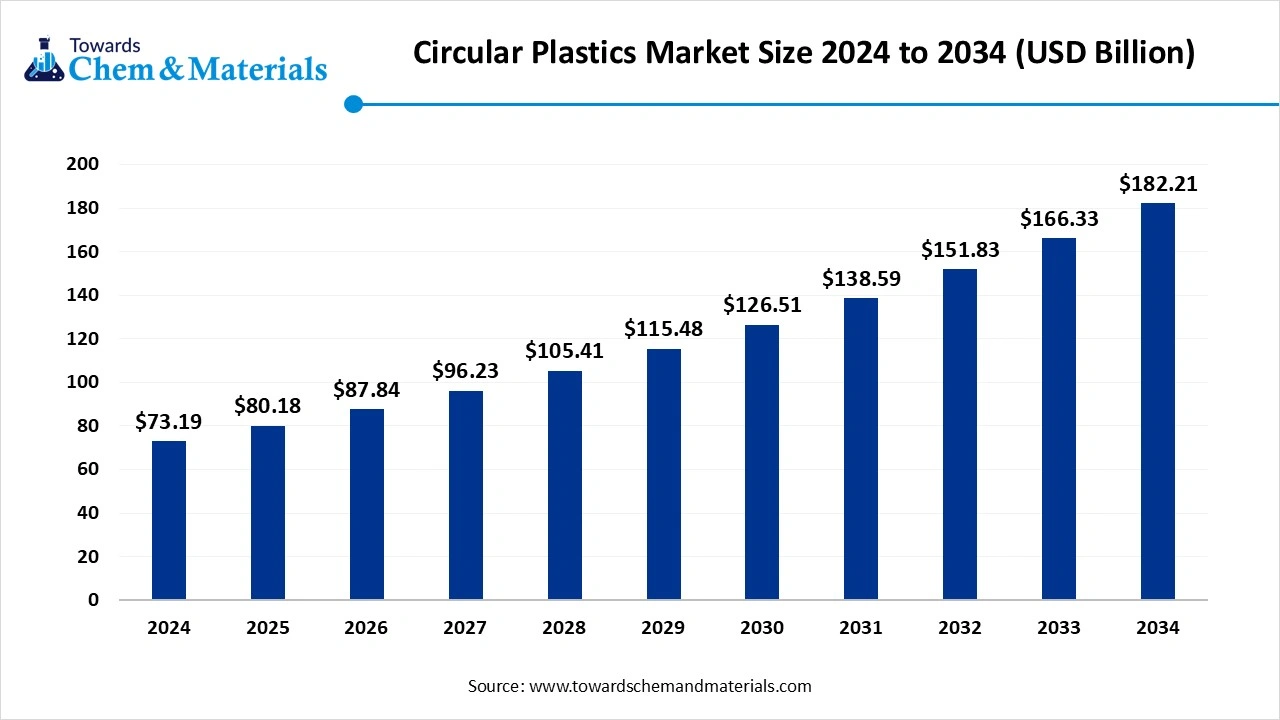

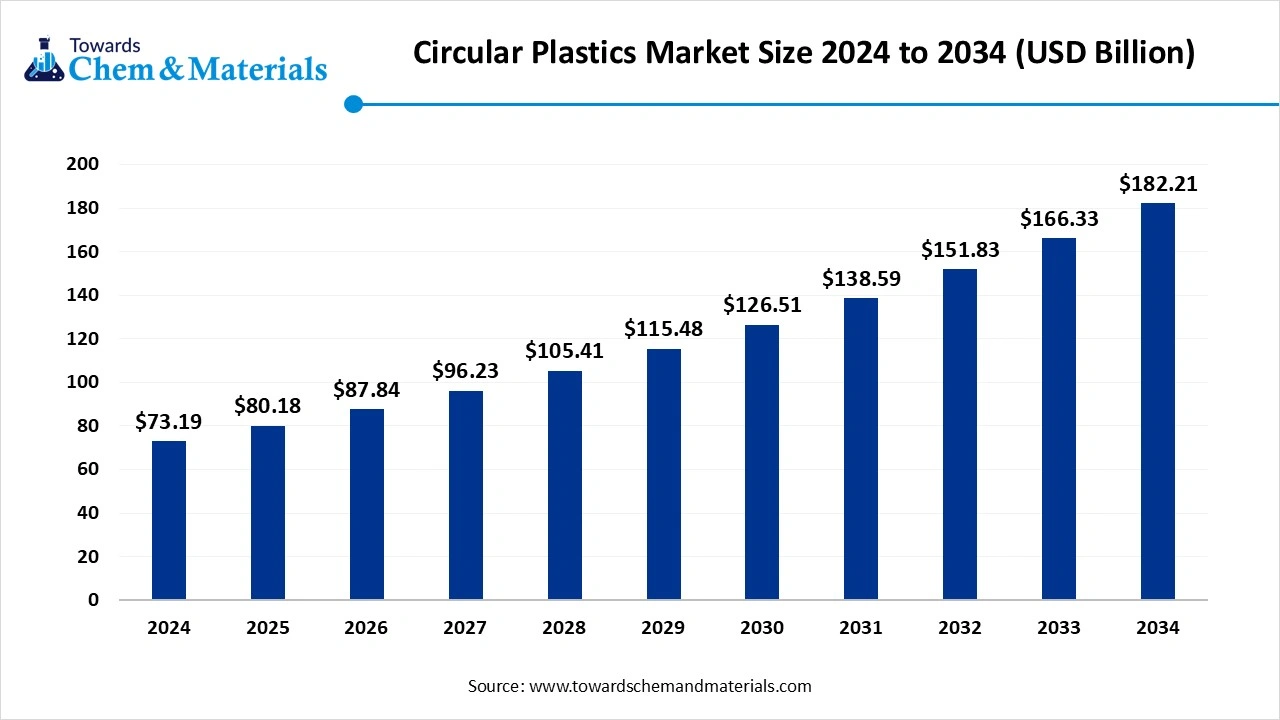

The global circular plastics market size was reached at USD 73.19 billion in 2024 and is expected to be worth around USD 182.21 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.55% over the forecast period 2025 to 2034. The growing demand for sustainable packaging, advancements in recycling technologies, and increasing food packaging drive the market growth.

Key Takeaways

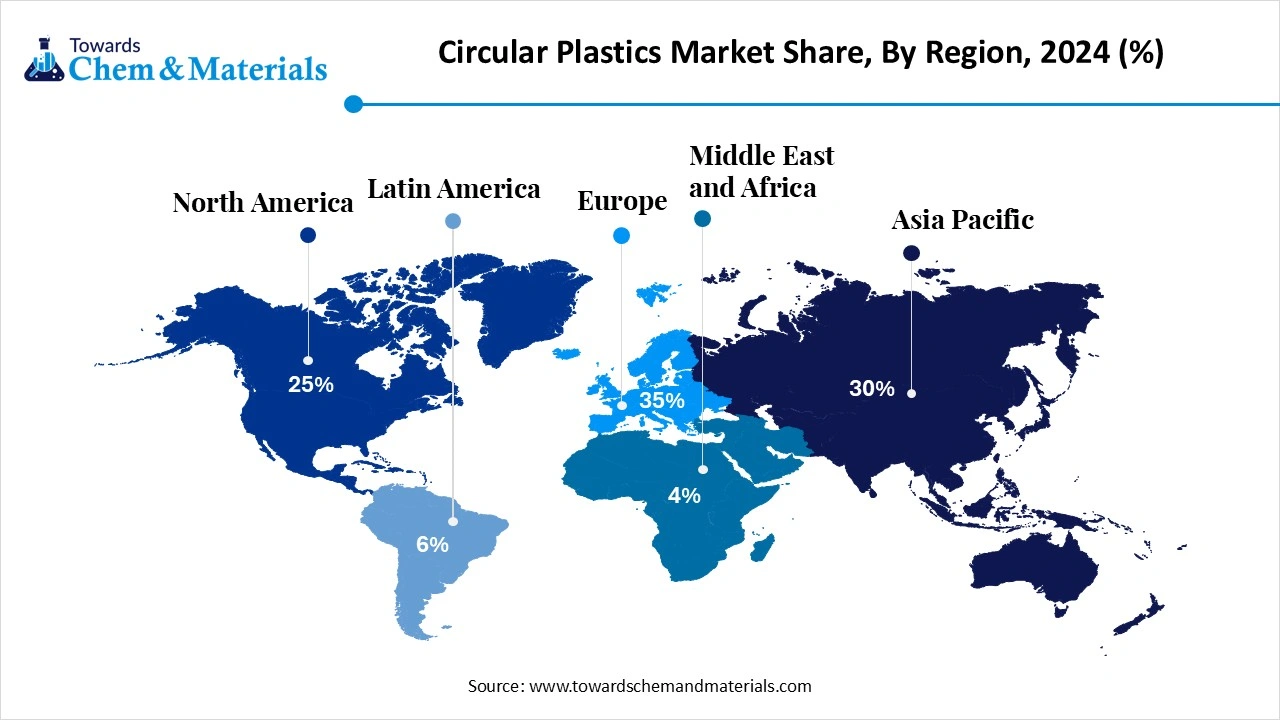

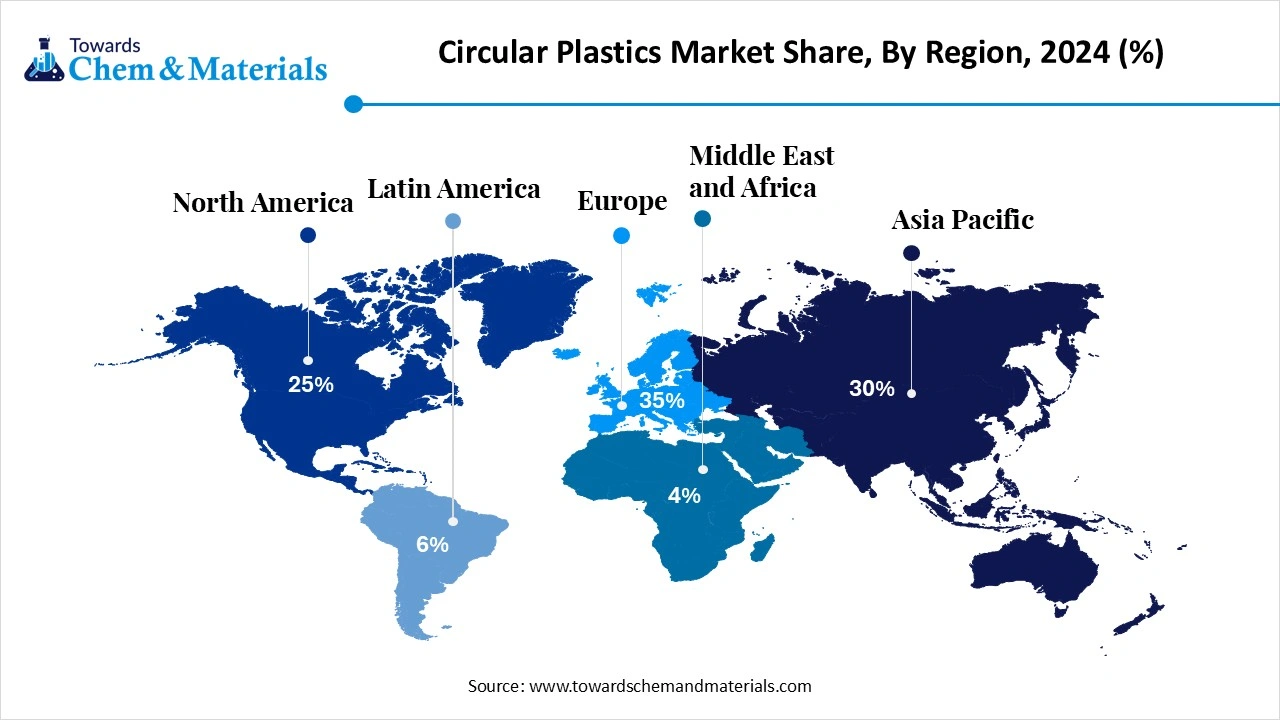

- By region, Europe held a 35% share in the circular plastics market in 2024 due to the growing investment in recycling technology.

- By region, Asia Pacific is growing at the fastest CAGR in the market during the forecast period due to the growing manufacturing of automotive parts.

- By resin type, the PET segment held a 40% share in the market in 2024 due to the increasing production of food containers.

- By resin type, the HDPE segment is expected to grow at the fastest CAGR in the market during the forecast period due to the rapid growth in the e-commerce sector.

- By recycling technology, the mechanical recycling segment held a 60% share in the market in 2024 due to the lower consumption of energy.

- By recycling technology, the chemical recycling segment is expected to grow at the fastest CAGR in the market during the forecast period due to the ability to handle complex waste.

- By end-use industry, the packaging industry segment held a 45% share in the market in 2024 due to the rise in online shopping.

- By end-use industry, the automotive industry segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing focus on reducing vehicle weight.

- By source of recycled plastics, the post-consumer waste segment held a 70% share in the circular plastics market in 2024 due to the increasing utilization of plastic products.

- By source of recycled plastics, the post-industrial waste segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing manufacturing activity.

- By recycling process type, the in-house recycling segment held a 55% share in the market in 2024 due to the lower raw material prices.

- By recycling process type, the third-party recycling segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing e-commerce packaging waste.

Role of Circular Plastic in Sustainability and Waste-Free Future

Circular plastics are a plastic material that can be composted, reused, and recycled. It supports lowering plastic pollution and minimizing landfill waste. It minimizes reliance on virgin plastics and helps in designing products that are simple to recycle. Circular plastic uses various recycling methods, like chemical, biological, and mechanical recycling. Circular plastics offer benefits like resource conservation, sustainability, lower landfill waste, and reduced carbon dioxide emissions.

The growing environmental concerns like plastic pollution, greenhouse gas emissions, and others increase the demand for circular plastics. The stringent environmental regulations and growing demand for packaged foods increase the demand for circular plastics. The growing demand for circular plastics across various industries like construction, packaging, automotive, electronics, and food & beverage contributes to the market growth.

- Chinese Taipei exported $1.3B of polyethylene terephthalate in 2023. (Source: oec.world)

- The United States exported $2.6B of polyvinyl chloride in 2023.(Source: oec.world)

- Saudi Arabia exported $4.7B of polypropylene in 2023. (Source: oec.world)

- South Korea exported $1.92B of polypropylene in 2023. (Source: oec.world)

Growing Construction Activities Propel the Circular Plastics Market Growth

The rapid urbanization and growing construction activities in developing nations are leading to higher adoption of circular plastics for various construction applications. The growing commercial and residential construction projects increase demand for circular plastics. The increasing need for insulation, doors, piping, and windows increases demand for circular plastics.

The strong focus on sustainable building practices increases the adoption of circular plastics to lower the carbon footprint. The focus on reducing construction waste and extending the lifespan of buildings increases the adoption of circular plastic. The increasing focus on interior design of houses and offices increases demand for circular plastics. The adoption of green buildings and the development of construction materials require circular plastics. The growing construction activities are a key driver for the growth of the circular plastics market.

Market Trends

- Growing Environmental Concerns: The growing pollution of plastics and the increasing carbon & greenhouse gas emissions increase demand for increased adoption of circular plastics.

- Increasing Demand for Consumer Goods: The growing demand for various consumer goods and the increasing production of consumer goods increase demand for circular plastics to meet sustainability goals.

- Growth in Food Packaging: The increasing consumption of packaged foods and processed foods leads to higher demand for circular plastics due to their sealing properties and durability.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 80.18 Billion |

| Expected Size by 2034 | USD 182.21 Billion |

| Growth Rate from 2025 to 2034 | CAGR 9.55% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Europe |

| Segment Covered | By Resin Type, By Recycling Technology, By End-Use Industry, By Source of Recycled Plastics, By Recycling Process Type, By Region |

| Key Companies Profiled | Veolia Environmental Services, Covestro AG, BASF SE, Dow Chemical Company, Eastman Chemical Company, Indorama Ventures Public Company Limited, Suez Recycling and Recovery, Plastic Energy Ltd, Unilever PLC, SABIC, Tetra Pak, TOMRA Systems, Loop Industries Inc., PureCycle Technologies Inc., P&G (Procter & Gamble), PepsiCo Inc., Coca-Cola Company, Braskem, LyondellBasell Industries, NEXTEK |

Market Opportunity

Technological Advancements Unlock Opportunity for the Circular Plastics

The ongoing technological advancements, like digitalization, advancements in sorting technology, and chemical recycling, create a sustainable economy. The advancements in sorting technologies, like automated waste sorting, near-infrared spectroscopy, and integration with machine learning & AI, enhance speed and improve the accuracy of sorting.

The innovations in chemical recycling, like depolymerization, hydrothermal processing, pyrolysis, and solvolysis, enable high-quality recycling. The increasing adoption of digital technologies like track-and-trace systems, blockchain, and integration with mobile apps optimizes plastic materials' circularity and monitors flows of materials. The advancements, like enzymatic recycling and 3D printing, support sustainability. The technological advancements create an opportunity for the growth of the circular plastics market.

Market Challenge

High Development Cost Limits Expansion of the Circular Plastics Market

With several advantages of circular plastics for the environment, the high development cost restricts the market growth. Factors like expensive recycled materials, the need for specialized infrastructure, and complex processes are responsible for high development costs. The development of specialized recycling infrastructure increases the cost.

The development of advanced processing and sorting technologies is expensive. The high investment in recycling technologies like mechanical recycling and chemical recycling directly affects the market. The need for an efficient waste collection system and the development of new materials increase the cost. The high cost of recycled materials and the heavy investment in chemical recycling plants increase the development cost. The high development cost hampers the growth of the circular plastics market.

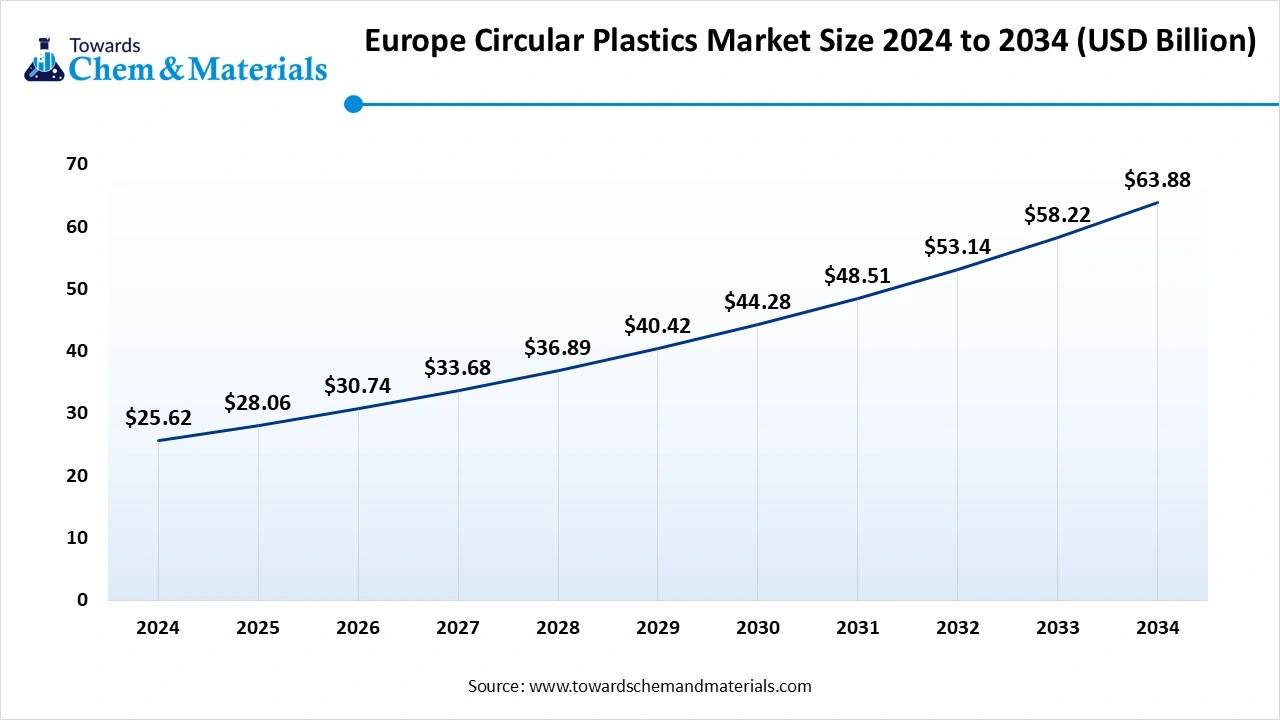

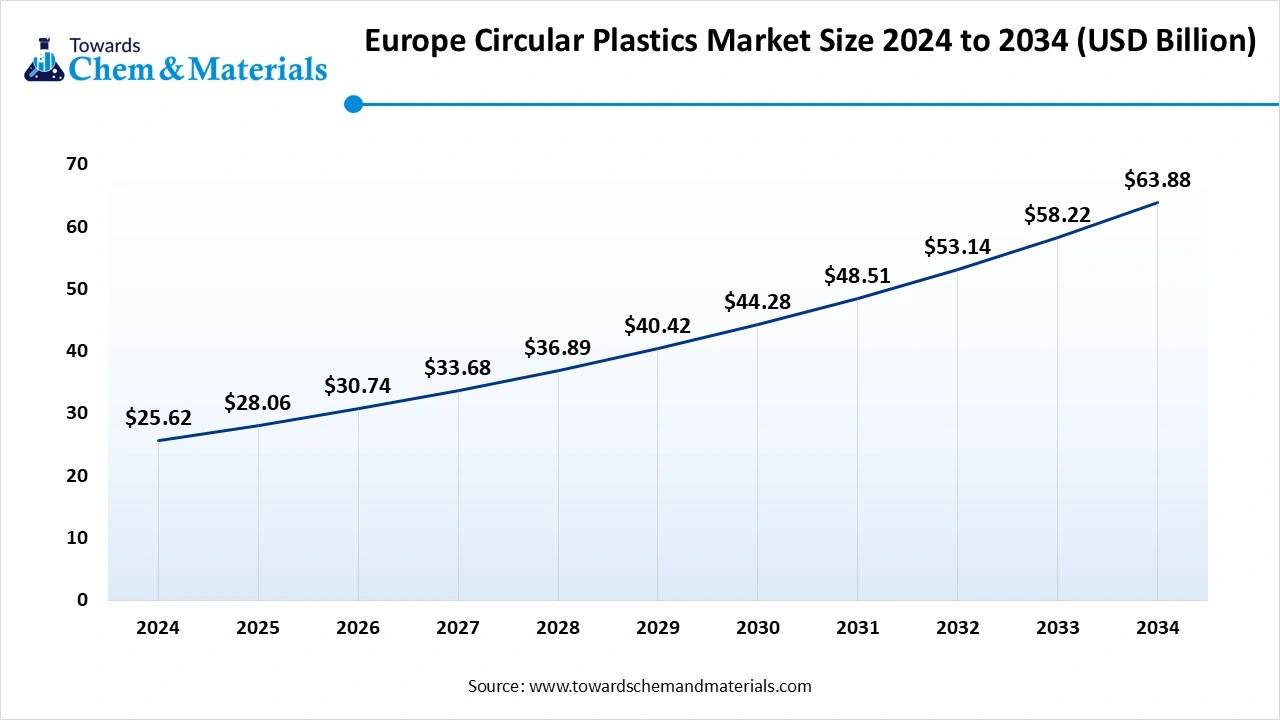

Europe Circular Plastics Market Size and Growth 2025 to 2034

The Europe circular plastics market size was estimated at USD 25.62 billion in 2024 and is projected to reach USD 63.88 billion by 2034, growing at a CAGR of 9.57% from 2025 to 2034.

Europe dominated the circular plastics market in 2024. The stricter government regulations, like the Circular Economy Package and Single-Use Plastics Derivatives, increase the adoption of circular plastics. The well-developed infrastructure for processing plastic waste and increasing investment in recycling technologies help the market growth. The increasing environmental concerns and growing consumer demand for sustainable products increase the adoption of circular plastics. The strong focus on improving waste management and the growing expansion of recycling capacity drive the overall growth of the market.

Germany Circular Plastics Market Trends

Germany is a major contributor to the market. The well-established infrastructure for sorting & collection of plastic waste increases demand for circular plastics. The stricter regulatory framework, like EU directives and the Packaging Act, increases the adoption of circular plastics. The growing automotive manufacturing increases demand for circular plastics. The growing investment in recycling technology and the strong presence of mechanical recycling support the market growth.

Asia Pacific Circular Plastics Market Trends

Asia Pacific is experiencing the fastest growth in the market during the forecast period. The increasing environmental awareness and rapid growth in industrial development increase demand for circular plastics. The growing utilization of recycled PET in containers & bottles helps the market growth. The increasing automotive manufacturing and expansion of the packaging industry increase demand for circular plastics. The growing advancements in recycling technologies, like chemical recycling and increasing investment in recycling technologies, increase demand for circular plastics. The growing electronics sector and the growth in construction activities increase demand for circular plastics, supporting the overall growth of the market.

China Circular Plastics Market Trends

China is a key contributor to the circular plastics market. The growing production of plastics and increasing food & beverage packaging increases the adoption of circular plastics. The strong government support for controlling pollution and a strong focus on sustainable packaging increase demand for circular plastics. The increasing investment in recycling technology and growing manufacturing in industries like automotive, packaging, and construction support the overall growth of the market.

- China exported $5.24B of polyethylene terephthalate in 2023.(Source: oec.world)

- China exported $2B of polyvinyl chloride in 2023.(Source: oec.world)

Segmental Insights

Resin Type Insights

Why did PET Segment Dominate the Circular Plastics Market?

The PET segment dominated the market in 2024. The growing expansion of the food & beverage industry increases demand for PET. The increasing production of food containers and beverage bottles fuels the adoption of PET. The increasing demand for highly recyclable plastics and the focus on the protection of packaged goods increase demand for PET. It offers an excellent barrier against moisture & oxygen and is a cost-effective option. The growing PET applications in electronics, textiles, and automotive parts drive the overall growth of the market.

The HDPE segment is the fastest-growing in the market during the forecast period. The growing expansion of e-commerce and increasing demand for packaging increase the adoption of HDPE. The stringent regulations on reducing plastic waste and growing advancements in HDPE manufacturing help the market growth. The focus on sustainable packaging and stricter regulations to reduce plastic increases demand for HDPE. The growing industries like pharmaceuticals, food & beverage, and personal care increase the adoption of HDPE, supporting the overall growth of the market.

Recycling Technology Insights

How the Mechanical Recycling Technology Segment Held the Largest Share in the Circular Plastics Market?

The mechanical recycling segment held the largest revenue share in the market in 2024. The stringent regulations and increasing consumer focus on eco-friendly products increase the adoption of mechanical recycling. The involvement of simple steps like sorting, grinding, collecting, and washing increases the adoption of mechanical recycling. The focus on lower consumption of energy and less complex technology increases demand for mechanical recycling. The focus on waste management and growing environmental awareness increases demand for mechanical recycling, driving the overall growth of the market.

The chemical recycling segment is experiencing the fastest growth in the market during the forecast period. The increasing production of new plastics and growing demand for food packaging increase the adoption of chemical recycling. The growing handling of complex waste, like contaminated materials and plastic types, increases the adoption of chemical recycling. The focus on lowering the carbon footprint and reducing landfill waste increases demand for chemical recycling, supporting the overall growth of the market.

End-use Industry Insights

Which End-Use Industry Dominated the Circular Plastics Market?

The packaging industry segment dominated the market in 2024. The growing demand for secure packaging in various industries and the growth in online shopping increase the demand for packaging. The growing food & beverage industry increases production of insulated containers and plastic containers for packaging. The increasing utilization of food delivery services and the expansion of e-commerce increase demand for packaging. The growing demand for packaging in industries like e-commerce, food & beverage, and personal care drives the overall growth of the market.

The automotive industry segment is the fastest-growing in the market during the forecast period. The focus on improving the fuel efficiency of vehicles and reducing the weight of vehicles increases demand for circular plastics. The stringent emission regulations and focus on enhancing the lifespan of vehicle materials increase the adoption of circular plastics. The rapid growth in electric vehicles increases demand for circular plastics for enhancing energy efficiency and optimizing battery performance. The focus on the recyclability of vehicles and advancements in the creation of exterior & interior parts of vehicles increases demand for circular plastics, supporting the overall growth of the market.

Source of Recycled Plastics Insights

How the Post-Consumer Waste Segment Held the Largest Share in the Circular Plastics Market?

The post-consumer waste segment held the largest revenue share in the market in 2024. The growing utilization of plastic in everyday life increases the production of post-consumer waste. The growing awareness about environmental concerns and stringent regulations for plastic waste management increases the adoption of post-consumer waste. The growth in online shopping and increasing demand for items like electronics, food, & personal care increases the post-consumer waste, driving the overall growth of the market.

The post-industrial waste segment is experiencing the fastest growth in the market during the forecast period. The growing manufacturing processes and advancements in recycling technology increase post-industrial waste. The growing production of automotive parts and the expansion of the packaging industry increase post-industrial waste. The increasing production of various consumer goods increases post-industrial waste, supporting the overall growth of the market.

Recycling Process Type Insights

What Made the In-House Recycling Segment Dominate the Circular Plastics Market?

The in-house recycling segment dominated the market in 2024. The focus on reducing raw material costs and lowering transportation costs increases demand for in-house recycling. The strong focus on reducing landfill waste and increasing demand for tailored solutions increases the adoption of in-house recycling. The need to minimize contamination and lower environmental impact increases demand for in-house recycling.

The stricter government regulations and focus on enhancing sustainability increase the adoption of in-house recycling, driving the overall growth of the market. The third-party recycling segment is the fastest-growing in the market during the forecast period. The increasing utilization of recycled plastics in products and focus on reducing environmental impact increases demand for third-party recycling.

The presence of a vast amount of waste and the increasing demand for better traceability of materials increase the adoption of third-party recycling. The stricter government policies and the growing packaging waste of e-commerce increase the adoption of third-party recycling, supporting the overall growth of the market.

Circular Plastics Market Value Chain Analysis

Feedstock Procurement : The feedstock procurement for circular plastics involves bio-based feedstocks (agricultural waste, plant waste) and recycled plastic (pre-consumer & post-consumer plastic waste).

- Key Players:- Covestro, Agilyx, Dow, APChemi, and SABIC

Chemical Synthesis and Processing : The chemical synthesis of circular plastics involves depolymerization (hydrolysis, ammonolysis, methanolysis), thermo-chemical conversion (solvolysis, pyrolysis, gasification), purification, and repurposing.

- Key Players:- PureCycle Technologies, Agilyx, LyondellBasell, and Shell

Regulatory Compliance and Safety Monitoring: The regulatory compliance for circular plastics involves the EU Circular Economy Action Plan and Plastic Waste Management Rules in India to ensure the quality and safety of products.

Recent Developments

- In June 2025, Pact launched food-grade recycled plastic for milk bottles. The recycled plastics HDPE is produced in Melbourne. The bottles are tested by sensory assessments and chemical end tests. The recycled plastic is useful in applications like cream, juice, milk, and sauce bottles. The recycled plastic reduces landfill waste and lowers carbon emissions.(Source: wastemanagementreview.com.au)

- In June 2025, Singapore’s CPC launched the PET bottle recycling plant in Vietnam. The plant consists of 30000 metric tonnes of annual capacity of PET flakes and 14000 of rPET flakes. The rPET is available for domestic use and export.(Source: www.chemanalyst.com)

- In February 2025, Evonik launched the Purocel Series for circular plastics. The series supports in purification of pyrolysis oil, and the series consists of a range including modular polishing units, advanced adsorbents, & rejuvenated hydrotreating catalysts.(Source: www.chemanalyst.com)

Circular Plastics Market Top Companies

- Veolia Environmental Services

- Covestro AG

- BASF SE

- Dow Chemical Company

- Eastman Chemical Company

- Indorama Ventures Public Company Limited

- Suez Recycling and Recovery

- Plastic Energy Ltd

- Unilever PLC

- SABIC

- Tetra Pak

- TOMRA Systems

- Loop Industries Inc.

- PureCycle Technologies Inc.

- P&G (Procter & Gamble)

- PepsiCo Inc.

- Coca-Cola Company

- Braskem

- LyondellBasell Industries

- NEXTEK

Segments Covered

By Resin Type

- PET (Polyethylene Terephthalate)

- HDPE (High-Density Polyethylene)

- PVC (Polyvinyl Chloride)

- LDPE (Low-Density Polyethylene)

- PP (Polypropylene)

- PS (Polystyrene)

- Other Plastics

By Recycling Technology

- Mechanical Recycling

- Chemical Recycling

- Feedstock Recycling

By End-Use Industry

- Packaging Industry

- Automotive Industry

- Textile Industry

- Consumer Electronics Industry

- Construction & Building Industry

- Agricultural Industry

- Others

By Source of Recycled Plastics

- Post-consumer Waste

- Post-industrial Waste

- Pre-consumer Waste

By Recycling Process Type

- In-house Recycling

- Third-party Recycling

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait