Content

What is the Current Bonding Adhesives Market Size and Share?

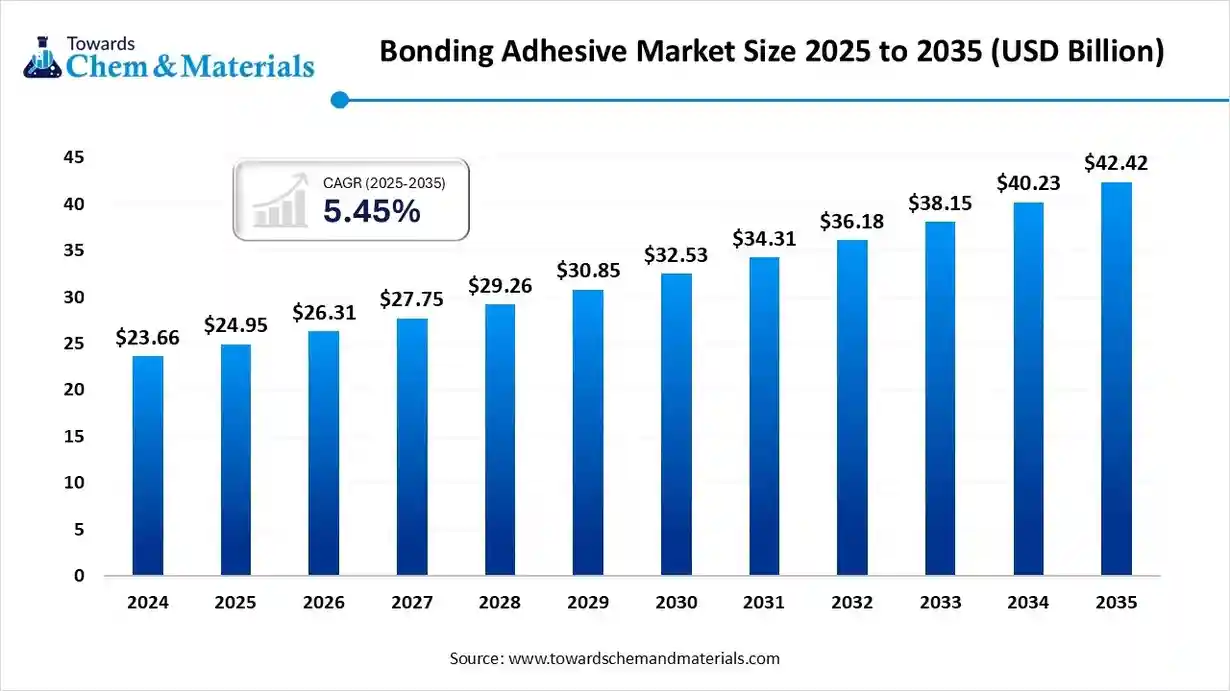

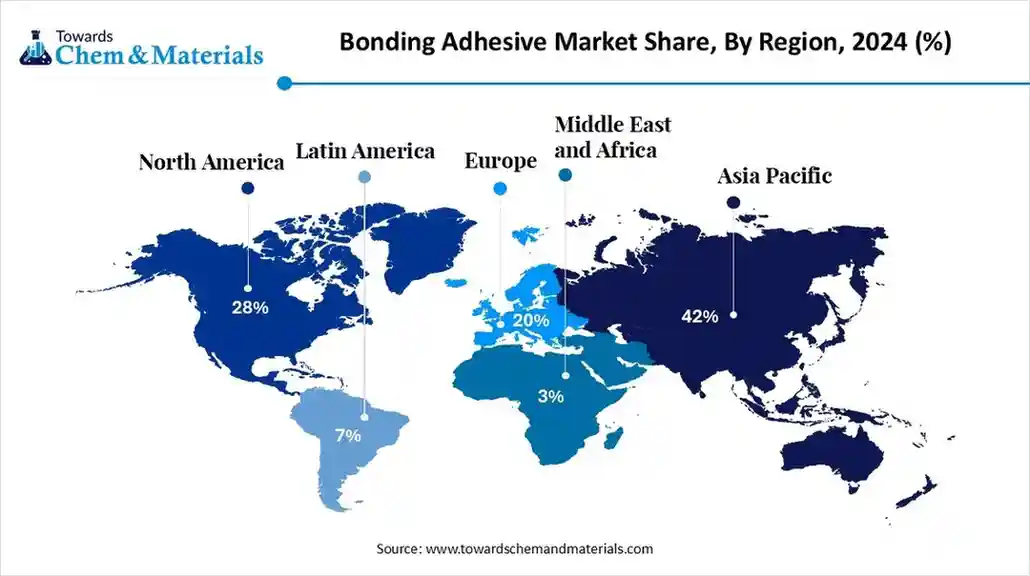

The global bonding adhesives market size is calculated at USD 24.95 billion in 2025 and is predicted to increase from USD 26.31 billion in 2026 and is projected to reach around USD 42.42 billion by 2035, The market is expanding at a CAGR of 5.45% between 2025 and 2035. Asia Pacific dominated the bonding adhesives market with a market share of 42% the global market in 2024. The growing advancements in adhesive technology, increasing need for replacement of mechanical fasteners, and rising demand for lightweight materials drive the market growth.

Key Takeaways

Key Takeaways

- By region, Asia Pacific dominated with approximately a 42% share in the bonding adhesives market in 2024 due to the growing construction activities.

- By adhesives chemistry, the epoxy-based adhesives segment dominated with approximately a 32% share in the market in 2024 due to the ease of application.

- By application, the automotive & transportation segment dominated with approximately a 35% share in the market in 2024 due to a focus on reducing vehicle weight.

- By curing mechanism, the room temperature cure segment dominated with approximately a 40% share in the market in 2024 due to the fast bonding capabilities.

- By performance, the high strength/structural bonding segment dominated with approximately a 38% share in the market in 2024 due to the focus on improving fuel efficiency in vehicles.

Bonding Adhesives: Power Behind Strong Bonds in Modern Manufacturing

Bonding adhesives are a method of joining surfaces using various adhesive materials like pastes, sheets, liquid adhesives, and tapes. The bonding adhesives process includes key components like curing method, adhesive material, and surfaces for bonding. The bonding adhesives offer benefits like stress distribution, reducing overall weight, stress distribution, fuel-efficiency, and electrochemical corrosion prevention. The various types of adhesives are acrylic, anaerobic, epoxy, urethane, and many more.

The surface preparation for bonding adhesives includes mechanical abrading, chemical treatments, and laser cleaning. Bonding adhesives bond various types of materials like ceramics, plastics, composites, metals, glass, and rubbers. The growing manufacturing in various industries like aerospace, electronics, automotive, packaging, and medical increases demand for bonding adhesives. Factors like growing infrastructure development, development of eco-friendly bonding adhesives, advancements in adhesive technology, and increasing need for lightweight materials in various industries are contributing to the growth of the bonding adhesives market.

- Vietnam exported 38,522 shipments of adhesive glue.(Source: www.volza.com)

- Turkey exported 3,230 shipments of tile adhesive.(Source: www.volza.com )

- The United States exported 8,763 shipments of epoxy adhesives.(Source: www.volza.com)

- The World exported 28.1K shipments of acrylic adhesive.(Source: www.volza.com)

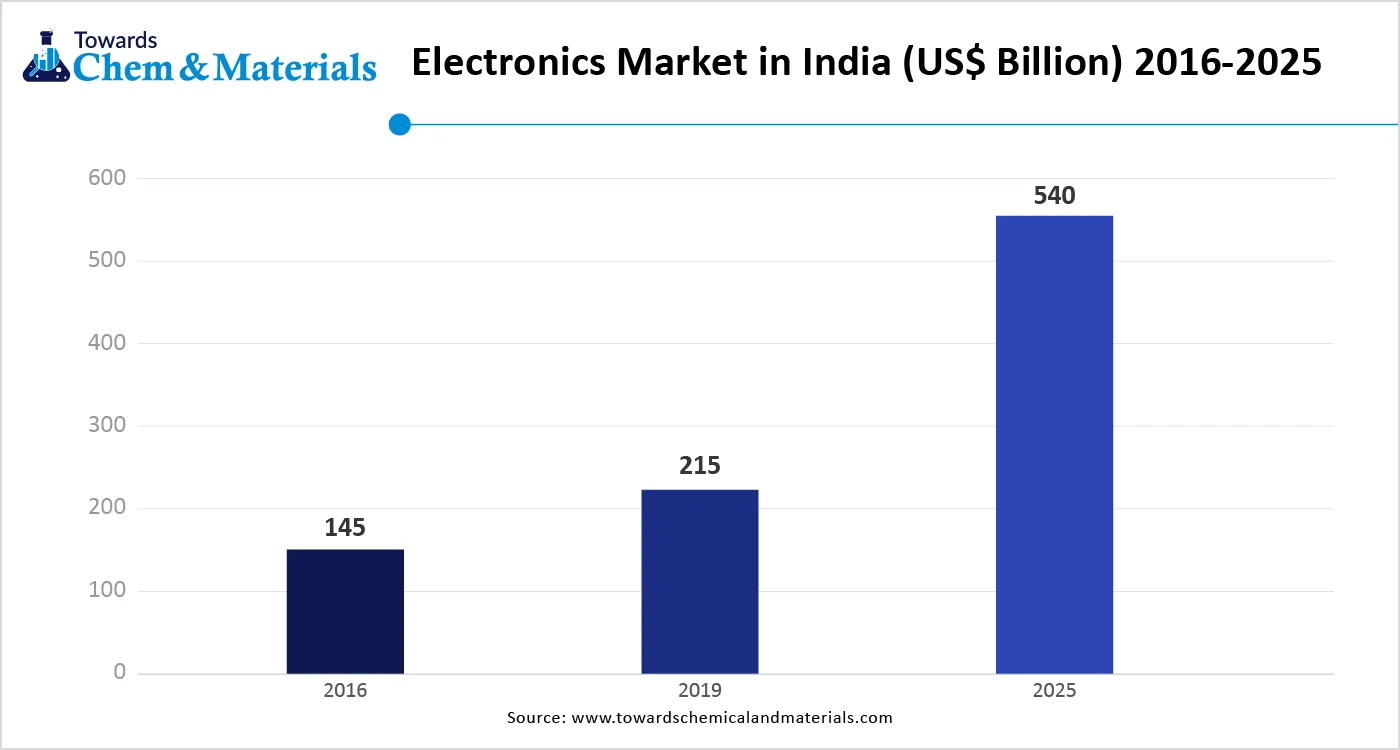

Growing Electronic Industry Propels Bonding Adhesives Market Growth

The growing electronic industry in various regions increases demand for bonding adhesives for electronic applications. The increasing focus on the miniaturization of electronic devices increases demand for bonding adhesives to bond tiny components. The growing adoption of various electronic devices like wearables, computers, smartphones, laptops, and tablets increases demand for bonding adhesives for reliable bonding.

The rise in Internet of Things and 5G infrastructure increases the adoption of bonding adhesives for providing reliable performance and handling high frequencies. The increasing need for thermal management in electronic devices for components like high-power semiconductors and LEDs increases the adoption of bonding adhesives. The growing development of foldable electronics increases the adoption of durable bonding adhesives. The increasing production of PCBs, flexible circuits, sensors, and infotainment systems increases demand for bonding adhesives. The growing electronic industry is a key driver for the growth of the bonding adhesives market.

Market Trends

- Growing Expansion of Aerospace Industry: The growing development of lightweight aircraft components increases demand for bonding adhesives for enhancing performance and lowering consumption of fuel. The increasing need for thermal conductivity, abrasion resistance, and vibration resistance in the aerospace industry increases demand for bonding adhesives.

- Increasing Development of Medical Devices: The growing development of medical devices like sensors, diagnostic equipment, wearable health monitors, prosthetics and implantable devices increases adoption of bonding adhesives for ensuring reliability and functionality.

- Growing Demand for Structural Bonding: The increasing demand for structural bonding in industries like aerospace and automotive increases the adoption of bonding adhesives to enhance performance, lower vehicle weight, and enhance fuel efficiency.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 26.31 Billion |

| Expected Size by 2035 | USD 42.42 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.45% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Leading Region | Asia Pacific |

| Fastest Growing Region | Middle East & Africa |

| Segment Covered | By Adhesive Chemistry, By Application, By Curing Mechanism, By Performance Attribute, Region |

| Key Companies Profiled | Henkel, H B Fuller Company, Ashland, Dymax Corporation, 3M Company, Permabond Engineering Adhesives, Dow Chemical Company, Bohle Group, KIWO, ThreeBond Holdings, Sika |

Market Opportunity

Growing Construction Activities Unlocks Bonding Adhesives Market Opportunity

The rapid urbanization and growing construction activities in various regions increase demand for bonding adhesives. The increasing investments in infrastructure development, like metro stations, airports, roads, and bridges, increase demand for bonding adhesives for panel installations, flooring, and expansion joints. The increasing development of residential construction and housing projects increases demand for bonding adhesives.

The increasing renovations in construction projects fuel demand for bonding adhesives for applications like wallpaper installations, flooring, and tiling. The increasing installations of various flooring materials like luxury vinyl tiles, tiles, and carpets increase the adoption of bonding adhesives. The growing need for insulation in roofs, walls, and other building parts fuels demand for bonding adhesives. The growth in non-residential and residential construction increases the adoption of bonding adhesives. The growing construction activities create an opportunity for the bonding adhesives market.

Market Challenge

High Production Cost Limits Expansion of Bonding Adhesives

Despite several benefits of the bonding adhesives in various industries, the high production cost restricts the market growth. Factors like need for specialized equipment, high cost of raw materials, stricter quality control measures, and complex manufacturing processes are responsible for high production costs. The need for petrochemical-based raw materials increases the production cost. The fluctuations in the prices of crude oil directly affect the market. The complex manufacturing processes, like high-temperature processes for shaping & mixing, increase the production cost.

The complex formulations and need for specialized equipment for curing, mixing, and application increase the production cost. The stricter regulations, like waste management and volatile organic compound emissions, increase the production cost. The high production cost hampers the growth of the bonding adhesives market.

Segmental Insights

Adhesive Chemistry Insights

Why did the Epoxy-Based Adhesives Segment Dominate the Bonding Adhesives Market?

- The epoxy-based adhesives segment dominated the bonding adhesives market in 2024. The increasing bonding of epoxy adhesives with various materials like plastics, ceramics, metals, composites, and glass helps the market growth. Epoxy adhesives offer high tensile strength and long-lasting bonds. They are resistant to moisture, chemicals, and solvents. The increasing focus on ease of application and customization increases demand for epoxy-based adhesives. The growing demand for epoxy-based adhesives across key industries like aerospace, construction, and automotive drives the overall growth of the market.

- The acrylic-based adhesives segment expects the fastest growth in the market during the forecast period. The increasing focus on the replacement of mechanical fasteners in industries like aerospace & automotive increases demand for acrylic-based adhesives. The growing demand for the creation of durable and strong bonds in construction activities increases the adoption of acrylic-based adhesives, helping the market growth. Acrylic-based adhesives bond with various substrates and offer excellent bonding strength. The growing electronic industry and increasing adoption of electronic devices increase demand for acrylic-based adhesives to enhance component performance, supporting the overall growth of the market.

Application Insights

Which Application Held the Largest Share in the Bonding Adhesives Market?

- The automotive & transportation segment held the largest revenue share in the bonding adhesives market in 2024. The focus on improving fuel efficiency and reducing vehicle weight increases demand for bonding adhesives. The rise in electric vehicles increases demand for bonding adhesives for various automotive components, battery packs, and thermal management systems. The stricter vehicle safety standards and emission regulations increase the adoption of bonding adhesives. The focus on structural bonding of various vehicle parts, like structural elements, body panels, and chassis components, increases the adoption of bonding adhesives. The growing demand for transportation services increases the adoption of bonding adhesives, driving the overall market growth.

- The aerospace & electronics segment expects the fastest growth in the market during the forecast period. The increasing need to reduce aircraft weight and focus on enhancing fuel efficiency increases demand for bonding adhesives. The growing aircraft maintenance and manufacturing industries increase the adoption of bonding adhesives. The increasing miniaturization of electronic devices and advancements in features like flexible displays increase demand for bonding adhesives. The growing expansion of the Internet of Things and 5G fuels demand for bonding adhesives. The growing demand for defense & commercial aircraft and increasing adoption of electronic devices support the overall growth of the market.

Curing Mechanism Insights

Why did the Room Temperature Cure Segment Dominate the Bonding Adhesives Market?

- The room temperature cure segment dominated the bonding adhesives market in 2024. The growing versatility of room temperature curing in various materials like plastics, composites, metals, and woods helps the market growth. Room-temperature curing doesn’t require heating equipment and offers faster curing time. It offers fast bonding capabilities and lowers the consumption of energy. The growing demand across end-user industries like construction, electronics, automotive, furniture, and packaging drives the overall market growth.

- The UV/light-cure segment expects the fastest growth in the market during the forecast period. The growing demand for high-speed manufacturing in industries like automotive & electronics increases the adoption of UV/light-cure. The increasing production of miniaturized & complex components in the medical devices & electronics industry increases demand for UV/light-cure. They offer a rapid curing time and are easily integrated with automated systems. The growing production of automotive materials like lightweight materials, bonding glass, and interior components increases demand for bonding adhesives, supporting the overall growth of the market.

Performance Attribute Insights

How High Strength/Structural Bonding Segment Held the Largest Share in the Bonding Adhesives Market?

- The high strength/structural bonding segment held the largest revenue share in the market in 2024. The increasing demand for handling harsh environmental conditions and heavy loads increases the adoption of high strength/structural bonding. The increasing focus on vehicle weight reduction and rising demand for lighter fasteners increases the demand for structural bonding. The focus on distributing stress evenly across bonded surfaces and ease of application on complex shapes increases adoption of high strength/structural bonding, driving the overall growth of the market.

- The thermal resistance/flexibility segment experiences the fastest growth in the market during the forecast period. The growing demand for thermal resistance in components like electronic circuits, engine parts, and exhaust systems helps the market growth. The growing installation of chimneys and industrial facilities in construction activities increases demand for thermal resistance. The increasing demand for withstanding impacts and vibrations in the automotive sector increases the adoption of flexibility. The growing demand across industries like electronics, aerospace, automotive, and construction supports the market growth.

Regional Insights

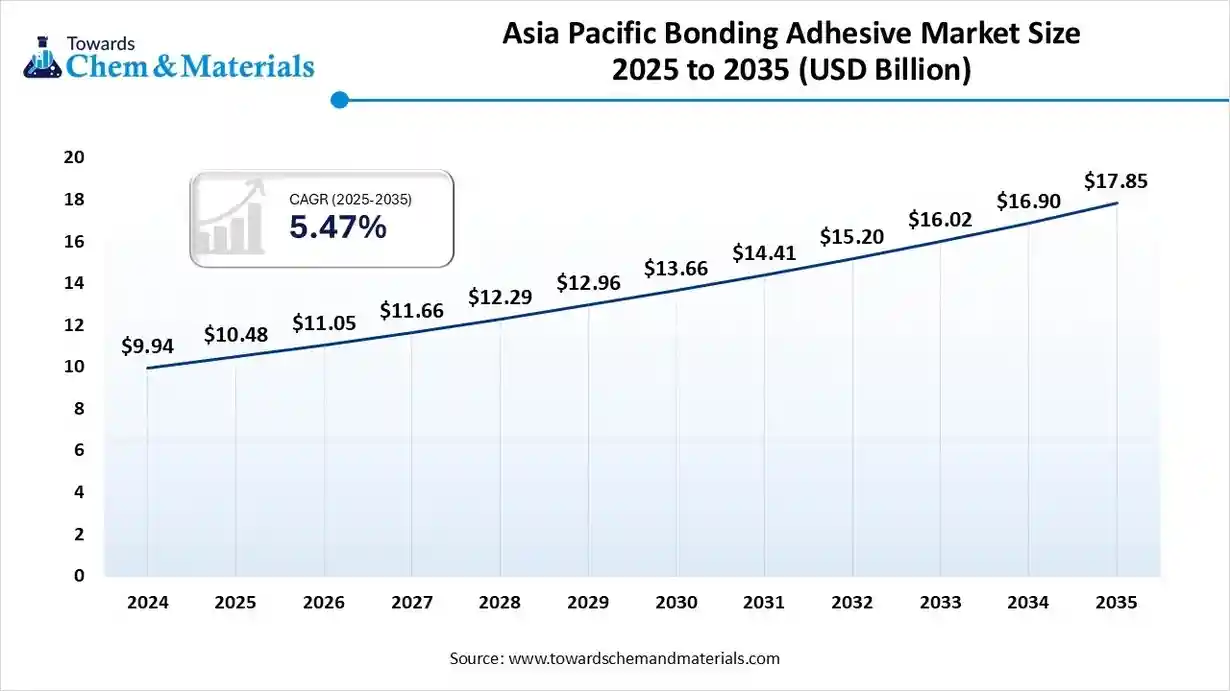

The Asia Pacific bonding adhesives market size was valued at USD 10.48 billion in 2025 and is expected to reach USD 17.85 billion by 2035, growing at a CAGR of 5.47% from 2025 to 2035. Asia Pacific dominated the bonding adhesives market in 2024. The growing industrialization in various countries like India & China increases the adoption of bonding adhesives. The growing construction activities and infrastructure development increase demand for bonding adhesives, helping the market growth.

The strong government support for manufacturing and increasing production of automobiles increases demand for bonding adhesives. The rise in e-commerce fuels demand for bonding adhesives for packaging. The well-established manufacturing infrastructure in sectors like electronics & automotive increases demand for adhesive bonding, driving the overall growth of the market.

China Bonding Adhesives Market Trends

China is a major contributor to the market. The robust manufacturing base in sectors like packaging, construction, and automotive increases demand for bonding adhesives. The increasing development of construction and infrastructure development increases the adoption of bonding adhesives. The rise in electric vehicles and the increasing production of automobiles increases demand for bonding adhesives for interior components, lightweight components, and battery assembly. The increasing demand for packaging and growing production of textiles increases demand for bonding adhesives, supporting the overall growth of the market.

- China exported 58,739 shipments of adhesive glue.(Source: www.volza.com )

- China exported 513 shipments of tile adhesive. (Source: www.volza.com)

- China exported 5,036 shipments of epoxy adhesives.(Source: www.volza.com )

Middle East & Africa Bonding Adhesives Market Trends

The Middle East & Africa are experiencing the fastest growth in the market during the forecast period. The growth in industrial activity and increasing manufacturing processes increases demand for bonding adhesives. The rapid urbanization and increasing investment in construction projects increase demand for bonding adhesives. The focus on the modernization of infrastructure and the development of new projects increases demand for bonding adhesives. The growing consumer demand for electronic devices like laptops, smartphones, tablets, computers, and other devices increases demand for bonding adhesives. The rapid adoption of electric vehicles and the increasing production of high-quality vehicles increase demand for bonding adhesives, driving the overall growth of the market.

Saudi Arabia Bonding Adhesives Market Trends

Saudi Arabia is significantly growing in the bonding adhesives market. The rapid urbanization and growing infrastructure, residential, and commercial construction activities increase demand for bonding adhesives. The growing development of large infrastructure projects like the Red Sea Project, King Salman Energy Park, NEOM, Qiddiya, and Riyadh Metro increases demand for bonding adhesives. The growing demand for plastic-based and paper packaging increases the adoption of bonding adhesives, supporting the overall growth of the market.

Recent Developments

- In April 2025, Sika launched SikaWall-3000 Rapid Bond adhesive for the installation of EFIS. The adhesive offers long-lasting durability, superior adhesion, and reduces installation time. The adhesives used in various substrates have a rapid curing time.(Source: www.prweb.com)

- In October 2024, Henkel launched bio-based hot melt adhesives, Technomelt Supra 079 Eco Cool for low-emission bonding. The adhesives are compatible with paper recycling, lower carbon dioxide emissions, and enhance process efficiency. The adhesives are designed for corrugated packaging, cartons, and other packaging.(Source: packagingeurope.com)

- In November 2024, Master Bond launched a non-cytotoxic epoxy, EP21LSCL-2Med, for medical device bonding. The shelf life of the bond is 6 months and is resistant to yellowing to a greater extent.(Source: www.specialchem.com)

Bonding Adhesives Market Top Companies

- Henkel

- H B Fuller Company

- Ashland

- Dymax Corporation

- 3M Company

- Permabond Engineering Adhesives

- Dow Chemical Company

- Bohle Group

- KIWO

- ThreeBond Holdings

- Sika

Segments Covered

By Adhesive Chemistry

- Epoxy-Based Adhesives

- One-Component Epoxy

- Two-Component Epoxy

- Acrylic-Based Adhesives

- Structural Acrylic

- Methyl Methacrylate (MMA)

- Polyurethane-Based Adhesives

- Moisture-Cure PU

- Two-Component PU

- Silicone-Based Adhesives

- Room-Temperature Vulcanizing (RTV) Silicone

- High-Temperature Silicone

- Cyanoacrylate Adhesives

- Others

- Modified Silane (MS) Polymers

- Hot Melt Adhesives

By Application

- Automotive & Transportation

- Body Panels & Frame Assembly

- Interior Components

- Electric Vehicle Battery Assembly

- Aerospace

- Composite Bonding

- Interior Cabin Structures

- Building & Construction

- Panels & Facades

- Flooring & Tile Bonding

- Windows & Doors Assembly

- Electronics

- PCB Bonding

- Component Encapsulation

- Marine

- Hull Assembly

- Deck & Interior Fixtures

- Medical Devices

- Disposable Device Assembly

- Durable Equipment Bonding

- Consumer Goods

- Appliances

- Furniture Assembly

By Curing Mechanism

- Heat-Cure

- Room Temperature Cure

- UV/Light-Cure

- Moisture-Cure

- Pressure-Sensitive

By Performance Attribute

- High Strength / Structural Bonding

- Flexibility & Impact Resistance

- Chemical Resistance

- Thermal Resistance

- Electrical Insulation / Conductivity

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait