Content

What is the Current Biohydrogen Market Size and Share?

The global biohydrogen market size is calculated at USD 76.78 million in 2025 and is predicted to increase from USD 82.51 million in 2026 and is projected to reach around USD 157.80 million by 2035, The market is expanding at a CAGR of 7.47% between 2025 and 2035. Asia Pacific dominated the biohydrogen market with a market share of 45.50% the global market in 2024. The rising demand for fuels is the key driver of market growth. Also, the rising need for clean hydrogen in transportation, along with the rise of biofuels and technological innovations, can further fuel market growth.

Key Takeaways

- By region, North America dominated the market with a 45.5% share in 2024.

- By region, Asia Pacific is expected to grow at the highest CAGR of 8.5% over the forecast period.

- By region, Europe is expected to grow at a notable CAGR over the forecast period.

- By production method, the fermentation segment dominated the biohydrogen market with a 47.6% share in 2024.

- By production method, the photobiological process segment is expected to grow at the fastest CAGR of 7.5% over the forecast period.

- By feedstock, the agricultural residues segment held a 43.1% market share in 2024.

- By feedstock, the algae & microorganisms' segment is expected to grow at the fastest CAGR of 7.9% over the forecast period.

- By application, the transportation segment dominated the biohydrogen market with a 42.4% share in 2024.

- By application, the power generation segment is expected to grow at the highest CAGR of 7.6% over the forecast period.

- By end-use industry, the energy & power segment dominated the market with a 45.5%share in 2024.

- By end-use industry, the transportation segment is expected to grow at the highest CAGR of 7.8% during the projected period.

What is Biohydrogen?

Increasing investments in green hydrogen infrastructure, supportive government policies, and advances in biotechnology and microbial engineering are driving the global transition toward sustainable hydrogen production. The biohydrogen market involves the production of hydrogen fuel through biological processes such as fermentation, photobiological conversion, and microbial electrolysis using biomass, algae, or waste materials. Biohydrogen is a clean, renewable energy carrier that emits only water upon combustion, making it crucial for decarbonizing transportation, power generation, and industrial applications.

Current Trends in Biohydrogen Market :

- Industry Growth Overview: According to the International Energy Agency (IEA), global hydrogen demand reached approximately 97 million tonnes in 2023, up 2.5% from 2022. However, low-emissions hydrogen (including biohydrogen) still accounted for less than 1 Mt globally in 2023. The gap between conventional hydrogen and bio-based routes implies substantial growth potential for biohydrogen as process costs decline and regulatory support improves.

- Sustainability Trends: A 2024 review found that biohydrogen production yields in advanced bioreactors reached up to 208.3 L H₂/L-day under specific conditions (sugar beet molasses substrate, pH 4.4, OLR 850 g COD/L-day). Research also indicates that biological hydrogen production cost remains high (in the range of USD 10–20 GJ⁻¹) compared with fossil-derived hydrogen. The important implication is that unless cost curves converge and feedstock supply is secured, the sustainability promise of biohydrogen may not convert into large-scale deployment quickly.

- Global Expansion: The IEA notes that demand for low-emissions hydrogen increased by nearly 10 % in 2024 but still represents less than 1 % of total hydrogen demand. Regions such as Europe, Asia-Pacific, and North America are actively developing hydrogen strategies and demonstrating projects that could create infrastructure for biohydrogen integration. For biohydrogen in particular, countries with strong biomass supplies and waste-to-energy systems may see earlier commercial entry, provided regulatory and policy frameworks support its scale-up.

- Major Investors: Government roadmaps, for example, from the U.S. Department of Energy, emphasise sizeable investment in low-carbon hydrogen pathways and technology readiness. Despite that, only a small portion of the large energy and chemical companies’ hydrogen investments are explicitly directed at strictly biological hydrogen production; most focus remains on electrolysis and fossil-based hydrogen with carbon capture.

- This underlines a key challenge for biohydrogen: attracting investor attention relative to more mature hydrogen technologies and demonstrating commercial viability at scale.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 82.51 Million |

| Expected Size by 2035 | USD 157.80 Million |

| Growth Rate from 2025 to 2035 | CAGR 7.47% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2026 - 2035 |

| Leading Region | North America |

| Fastest Growing Region | Asia Pacific |

| Segment Covered | By Production Method, By Feedstock, By Application, By End-Use Industry, By Region |

| Key Companies Profiled | Air Products and Chemicals, Inc., Linde plc , Air Liquide S.A. , ENGIE SA , Shell plc , Ballard Power Systems Inc, Plug Power Inc, Hydrogenics Corporation , Siemens Energy AG , SGH2 Energy Global LLC , Next Hydrogen Solutions Inc. , HyGear B.V. , H2Pro Ltd.., Green Hydrogen Systems A/S , Ergosup SA |

How Cutting Edge Technologies are revolutionizing the Biohydrogen Market?

- Advanced technologies are transforming the biohydrogen market by enabling higher-efficiency production, enhanced system durability, and more sustainable manufacturing and feedstock processes. According to a 2024 review in Advanced Composites and Hybrid

- Materials, nanotechnology applications (nanocatalysts, nanostructured materials) in biomass-based hydrogen production have significant potential for commercialisation, as they improve conversion efficiency and reduce process barriers.

- In particular, bioelectrochemical systems such as microbial electrolysis cells (MECs) are gaining traction: a recent review outlines how MECs enable hydrogen production from organic waste at lower applied voltages than conventional water electrolysis. The integration of digital manufacturing, reactor design optimisation, and artificial intelligence-enabled process control is enabling improved functionality and scalability of biohydrogen systems.

- For example, a 2024 systematic review of anaerobic-digestion-based biohydrogen production highlights emerging trends in AI-driven process optimisation and advanced reactor configurations.

Trade Analysis of Biohydrogen Market: Import & Export Statistics:

- Trade Analysis of Biohydrogen Market: Import and Export Perspectives Europe recorded hydrogen demand of about 7.9 million tonnes in 2023, a decline of about 3% from 2022. According to Hydrogen Europe, this reflects slower industrial activity but a continued long-term need for renewable hydrogen sources.

- The International Renewable Energy Agency (IRENA) reports that about 25 % of global hydrogen production could be traded internationally by 2050. This indicates that biohydrogen, once cost-competitive, may enter future cross-border hydrogen supply chains.

- A 2024 review on biohydrogen production noted strong regional differences in biofeedstock availability. For example, Asia has high volumes of agricultural residues, while Europe has robust municipal waste systems. These patterns suggest that future export hubs may emerge in regions with abundant biomass resources.

- Germany has already outlined a hydrogen import strategy. Reuters reports that Germany expects to require 95 to 120 TWh of hydrogen by 2030, with imports supplying between 50 and 70% of this demand. If biohydrogen qualifies under low-carbon certification rules, it may be included in these import flows.

- According to a 2025 study on hydrogen export economics, price variations of 36-47 % can occur depending on delivery flexibility. This means exporters of biohydrogen will need strong certification and logistics systems to remain competitive.

- Countries with high hydrogen demand but limited biomass, such as Japan and several Western European nations, may become future importers. Regions with strong biomass resources, such as Latin America, parts of Asia, and parts of Africa, may emerge as export-oriented biohydrogen production zones if investment and infrastructure expand.

Biohydrogen Market Value Chain Analysis

- Feedstock Procurement :This stage involves sourcing biomass, such as agricultural residues, organic waste, and industrial byproducts, as inputs for biological or thermochemical hydrogen production. Feedstock quality and availability strongly influence production cost and yield efficiency across the value chain.

- Major Players: Darling Ingredients Inc., Drax Group plc, Enerkem.

- Chemical Synthesis and Processing : This step includes large-scale conversion techniques, such as dark fermentation, photofermentation, gasification, and microbial electrolysis, that generate biohydrogen from biomass feedstocks. Companies involved in this stage focus on improving process efficiency, reducing energy use, and ensuring consistent hydrogen purity for industrial applications.

- Major Players: Linde plc, Air Products and Chemicals Inc., Shell plc.

- Packaging and Labelling :Hydrogen produced is stored in high-pressure cylinders, cryogenic tanks, or pipeline systems designed to maintain stability and prevent leakage during transport. Labelling standards ensure clear identification of hydrogen grade, storage conditions, and safety information required for distribution to industrial and commercial users.

- Major Players: Linde plc, Air Products and Chemicals Inc., Air Liquide.

- Regulatory Compliance and Safety Monitoring : This stage covers adherence to national and international standards for hydrogen handling, emissions control, storage infrastructure, and operational safety. Regulatory frameworks guide system design, workplace safety, and certification processes to ensure safe production and distribution of biohydrogen across all end-use sectors.

Biohydrogen Market's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| European Union (EU) | The "Fit for 55%" package and the REPowerEU Plan set ambitious targets for renewable hydrogen production and consumption in various sectors, but often overlook the specific potential of biohydrogen technologies. |

| United States (US) | Primarily uses financial incentives, notably the Hydrogen Production Tax Credit, to encourage low-emission hydrogen production—regulations for specific infrastructure and safety fall under the purview of existing bodies. |

| China | World's largest producer and consumer of hydrogen, rapidly scaling up electrolysis capacity with robust policies and investment. Regulations support large-scale demonstration projects and industrial applications. |

Segment Insights

Production Method Insights

How Much Share Did the Fermentation Segment Hold in 2024?

- The fermentation segment dominated the market, accounting for 47.6% in 2024. The segment's dominance can be attributed to growing government support for renewable energy and the drive to seek eco-friendly alternatives to fossil fuels amid climate change.

- The photobiological process segment is expected to grow at the highest CAGR of 7.5% over the forecast period. The growth of the segment can be credited to the rapid innovations in biotechnology and research, coupled with the rising demand for renewable and clean energy sources.

- The biomass gasification segment held a significant market share in 2024. The segment's growth can be fuelled by a surge in efforts to reduce greenhouse gas (GHG) emissions to tackle climate change. Governments globally are offering subsidies and financial incentives to support bioenergy projects.

- The growth of the microbial electrolysis segment can be boosted by a global push towards carbon-neutral and renewable fuels, along with the rapid innovations in MEC technology, such as enhanced electrode materials and reactor designs.

Feedstock Insights

Which Feedstock Type Segment Dominated the Biohydrogen Market in 2024?

- The agricultural residues segment held a 43.1% market share in 2024. The segment's dominance can be attributed to environmental sustainability goals, rapid research and development in biological processes, and a supply of renewable, low-cost feedstock.

- The algae & microorganisms segment is expected to grow at the highest CAGR of 7.9% over the forecast period. The growth of the segment can be driven by the ongoing development of cutting-edge bioreactor systems, such as hybrid processes which combine dark fermentation with photo-fermentation or microbial electrolysis.

- The industrial waste segment held a major market share in 2024. The segment's growth is boosted by stringent environmental regulations and an increasing commitment to decarbonizing the energy sector. Favourable government initiatives are also driving further positive segment growth.

- Waste management, environmental imperatives, and technological innovations can drive the growth of the municipal solid waste segment. Countries around the world are implementing national hydrogen strategies to increase future demand for biohydrogen.

Application Insights

Which Application Type Segment Dominated the Biohydrogen Market in 2024?

- The transportation segment dominated the market, accounting for 42.4% in 2024. The segment's dominance is owed to rapid innovations in storage and transportation technology, as well as global decarbonization efforts. Supportive government policies are offering a major incentive for developing transportation.

- The power generation segment is expected to grow at the highest CAGR of 7.6% over the forecast period. The segment's growth is driven by a surge in global energy demand and innovations in hydrogen production technology. Companies are heavily investing in hydrogen technologies across many sectors.

- The industrial energy segment held a significant market share in 2024. The growth of the segment can be fuelled by increased investments in hydrogen infrastructure and renewable energy, including manufacturing, storage, and distribution.

- The growth of the residential fuel segment can be driven by rising consumer interest in clean energy solutions and an inclination towards more reliable, potentially off-grid power sources. Biohydrogen can act as an efficient energy carrier for residential facilities.

End-Use Industry Insight

Which End-User Industry Segment Dominated the Biohydrogen Market in 2024?

- The energy & power segment dominated the market with a 45.5%share in 2024. The segment's dominance can be attributed to the growing emphasis on developing cost-effective manufacturing technologies, supportive government initiatives, and investments in hydrogen infrastructure.

- The transportation segment is expected to grow at the highest CAGR of 7.8% during the projected period. The segment's growth can be credited to increasing concerns over climate change, which are driving stringent environmental regulations.

- The chemical manufacturing segment held a major market share in 2024. The segment's growth can be driven by the growing need for sustainable clean feedstocks and by favourable government initiatives, grants, and policies supporting clean energy.

- The growth of the research institutes segment can be fuelled by strategic collaborations among technology providers, research institutions, and energy companies that optimise knowledge exchange, technology transfer, and commercial-scale projects.

Regional Insights

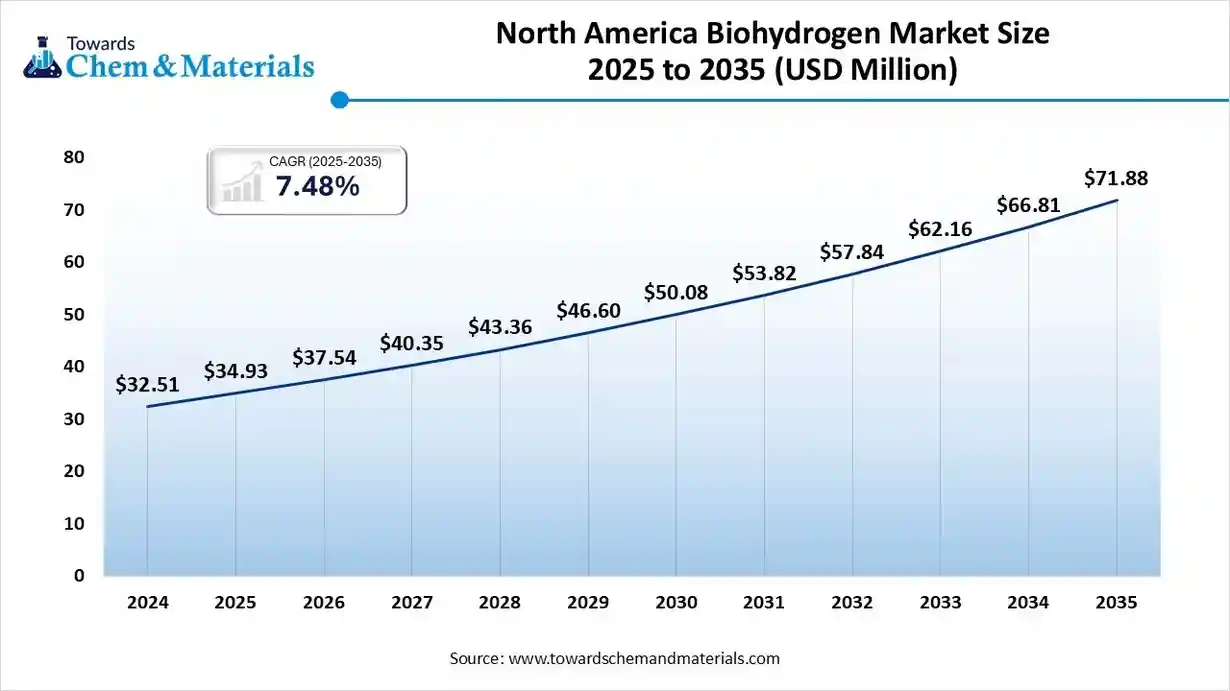

The North America biohydrogen market size was valued at USD 34.93 million in 2025 and is expected to reach USD 71.88 million by 2035, growing at a CAGR of 7.48% from 2025 to 2035. North America held a 45.5 percent share of the biohydrogen market in 2024, supported by strong clean energy targets and large-scale investments in low-carbon hydrogen infrastructure.

The region benefited from rising demand for renewable hydrogen for power generation, industrial heat, and transportation. Adoption of fuel cell electric vehicles continued to increase, driven by supportive state policies and fleet-level deployments in logistics and public transport. Industries across the United States and

Canada are also transitioning toward cleaner energy inputs, which is expected to further accelerate regional market expansion in the coming years.

In North America, the U.S. dominated the market owing to the innovations in production technologies, favourable government policies, and financial incentives. In addition, widespread adoption of hydrogen infrastructure, such as pipelines and storage facilities, helps optimize the commercialization and broader adoption of biohydrogen.

Why Is Asia Pacific Poised as the Next Frontier in the Biohydrogen Market

Asia Pacific is projected to record the fastest growth at a CAGR of 8.5 percent, supported by strong national commitments to hydrogen development across major economies. Governments in China, India, Japan, and South Korea are implementing policies that promote low-carbon hydrogen, industrial decarbonisation, and large-scale demonstration projects. Rising demand for cleaner fuels in transport, power generation, and manufacturing is further strengthening regional momentum. As hydrogen strategies move toward implementation, investment activity and domestic production capacity are expected to increase across the region.

In Asia Pacific, China led the market due to ongoing research and development driving technological innovations in hydrogen production, storage, and use. Moreover, the Chinese government offers support through significant investments in R&D and infrastructure development.

What Are the Trends in the European Biohydrogen Market?

Europe is expected to grow at a notable CAGR over the forecast period. The region's growth can be driven by rising emphasis on energy security and a substantial push towards hydrogen infrastructure and the adoption of hydrogen-powered vehicles. The region is also emphasising hydrogen to decarbonize energy-intensive industries such as chemicals and steel.

Germany Biohydrogen Market Trends

The German market is fuelled by the expansion of the national hydrogen pipeline network and storage capabilities, which optimize the efficient distribution and integration of biohydrogen into a much wider energy system.

Latin America held a significant market share in 2024, supported by strong renewable energy resources and increasing national commitments to decarbonisation. The region benefits from some of the world’s highest wind and solar capacities, which help lower the cost of green hydrogen production and create favourable conditions for future biohydrogen development. Several countries are introducing policies and pilot projects to integrate renewable hydrogen into industrial and transport sectors. As investment interest grows, Latin America is expected to emerge as a competitive production hub for clean hydrogen technologies.

Biohydrogen Market Share, By Region, 2024 (%)

| Regional | Revenue Share |

| North America | 45.50% |

| Europe | 16.11% |

| Asia Pacific | 28.50% |

| Latin America | 6.45% |

| Middle East and Africa | 3.44% |

Brazil Biohydrogen Market Trends

In Latin America, Brazil dominated the market due to the growing demand for low-carbon energy solutions and the rapid advancement of biotechnological processes. Brazil's robust bioenergy industry offers a unique benefit due to the large supply of low-cost organic materials.

Recent Developments

- In July 2025, Germany and Canada collaborated to launch a €400 million hydrogen tender under the H2Global initiative. This tender aims to bridge the cost gap for green hydrogen manufacturing, promoting global market expansion.(Source: fuelcellsworks.com)

- In February 2025, Plug Power introduced a spot pricing program for liquid green hydrogen. Hydrogen buyers can now purchase liquid green hydrogen directly from Plug's production plants without requiring long-term take-or-pay agreements.(Source: www.offshore-energy.biz)

Biohydrogen Market Companies

- Air Products and Chemicals, Inc. – Air Products is a global leader in industrial gas supply and hydrogen infrastructure, with growing investments in biohydrogen derived from biogas and renewable feedstocks. Its large-scale clean hydrogen projects support decarbonization across mobility, refining, and industrial sectors.

- Linde plc – Linde provides end-to-end hydrogen solutions, including production, purification, liquefaction, and storage, with active development in biohydrogen pathways using biogas reforming. The company supports European and global projects integrating renewable hydrogen into transport and industrial energy systems.

- Air Liquide S.A. – Air Liquide develops renewable and low-carbon hydrogen systems through biogas reforming and electrolysis. The company operates several pilot and commercial biohydrogen projects in Europe, advancing the distribution and blending of clean hydrogen in industrial networks.

- ENGIE SA – ENGIE is expanding into biohydrogen through projects that combine biogas, electrolysis, and renewable power. Its initiatives focus on supplying low-carbon hydrogen for industrial decarbonization, mobility applications, and integrated renewable energy hubs.

- Shell plc – Shell invests in biomass gasification, renewable hydrogen, and advanced biofuel projects to expand its clean fuel portfolio. The company integrates biohydrogen development with downstream distribution and hydrogen refueling for heavy transport and aviation sectors.

- Ballard Power Systems Inc. – Ballard develops fuel cell systems that can utilize hydrogen produced from bio-based sources. Its technology is applied in buses, trucks, rail, and stationary power, helping drive the adoption of renewable hydrogen in mobility.

- Plug Power Inc. – Plug Power produces fuel cell systems and develops renewable hydrogen generation via electrolysis and biomass-derived routes. The company is building a vertically integrated hydrogen network covering production, liquefaction, distribution, and end-use applications.

- Hydrogenics Corporation – Hydrogenics, now part of Cummins, provides electrolysis systems and fuel cell products that support both green and biohydrogen production. Its technology enables industrial integration of renewable hydrogen for power-to-gas, mobility, and grid storage.

- Siemens Energy AG – Siemens Energy develops electrolyzers and renewable hydrogen systems compatible with biogas upgrading. Its solutions combine digital controls and renewable integration for efficient, scalable, and low-emission hydrogen production.

- SGH2 Energy Global LLC – SGH2 produces hydrogen from waste biomass using plasma-enhanced gasification, generating high-purity hydrogen with very low lifecycle emissions. Its process converts a wide range of biogenic and residual waste streams into renewable hydrogen.

- Next Hydrogen Solutions Inc. – Next Hydrogen manufactures innovative modular electrolyzers that can operate with renewable electricity and biogas-based systems. Its technology is designed for flexible, distributed clean hydrogen production.

- HyGear B.V. – HyGear offers on-site hydrogen generation using small-scale reforming systems compatible with biogas feedstocks. The company provides localized, cost-efficient hydrogen supply for industrial clients seeking reduced emissions.

- H2Pro Ltd. – H2Pro develops E-TAC water-splitting technology that improves the efficiency and cost of hydrogen production. The company is exploring hybrid renewable and bio-integrated hydrogen pathways to support large-scale deployment.

- Green Hydrogen Systems A/S – Green Hydrogen Systems produces modular alkaline electrolyzers suitable for renewable and biogas-supported hydrogen generation. The company enables scalable hydrogen supply for industrial, mobility, and energy storage applications.

- Ergosup SA – Ergosup specializes in electrochemical hydrogen production and integrated compression, offering systems suited for localized biohydrogen generation. Its technology targets mobility refueling, distributed energy, and small-scale industrial use.

Segments Covered in the Report

By Production Method:

- Fermentation

- Photobiological Process

- Gasification of Biomass

- Microbial Electrolysis

By Feedstock:

- Agricultural Residues

- Algae & Microorganisms

- Industrial Waste

- Municipal Solid Waste

By Application:

- Transportation

- Power Generation

- Industrial Energy

- Residential Fuel

By End-Use Industry:

- Energy & Power

- Transportation Chemical Manufacturing

- Research Institutes

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa