Content

Asia-Pacific Heat-Treating Market Size and Forecast 2025 to 2034

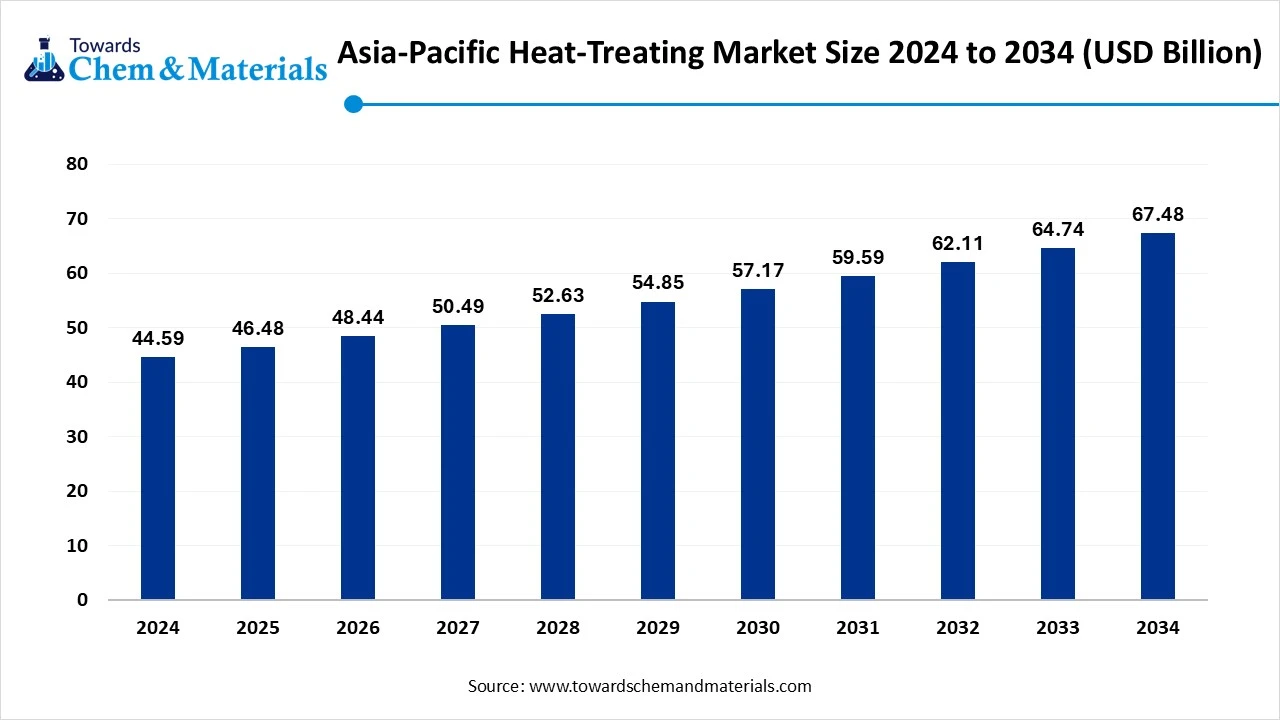

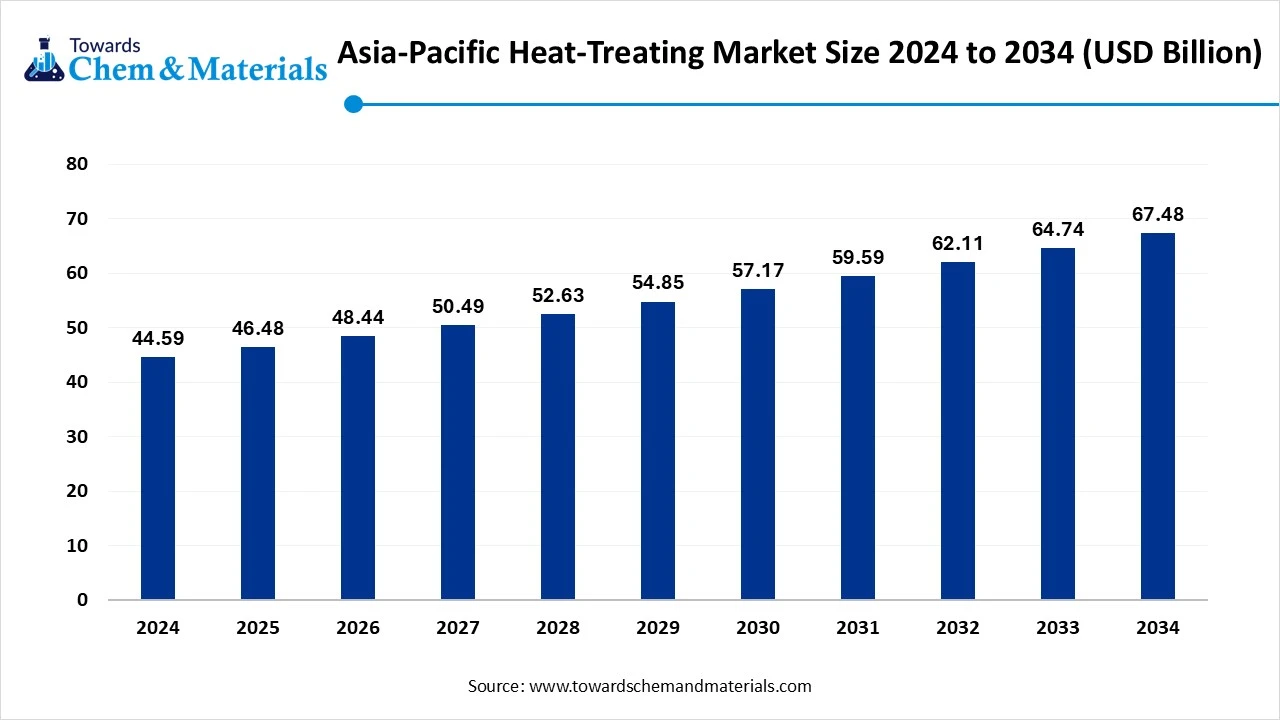

The Asia-Pacific heat-treating market size was reached at USD 44.59 billion in 2024 and is expected to be worth around USD 67.48 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.23% over the forecast period 2025 to 2034. The sudden expansion of the automotive sector has accelerated industry potential in the region in recent years.

Key Takeaways

- China dominated the Asia-Pacific heat-treating market in 2024 with 50% of the industry share, akin to the country being considered the world's largest manufacturing hub, specifically in sectors such the steel, heavy machinery, and automotive in the current period.

- India is expected to grow at a notable rate in the future, owing to factors such as rapid technology adoption, infrastructure development initiatives, and a domestic manufacturing push.

- By process type, the hardening and case hardening segment led the Asia-Pacific heat-treating market in 2024 with 35% market share, due to this method being considered as the crucial method, and it can make metal tougher and long-lasting.

- By process type, the quenching and tempering segment is expected to grow at the fastest rate in the market during the forecast period, akin to the increased need for the material, balancing between hardness and toughness.

- By equipment type, the electrically heated furnaces segment emerged as the top-performing segment in the Asia-Pacific heat-treating market in 2024 with 40% industry share, due to factors like efficiency, easy operation, and wide availability.

- By equipment type, vacuum furnaces is expected to lead the market in the coming years, due to the increased need for higher-quality material with precise properties in recent years.

- By material type, the steel and iron segment led the Asia-Pacific heat-treating market in 2024 with 60% market share because these materials are the backbone of industries such as automotive, construction, and machinery.

- By material type, the aluminum segment is expected to capture the biggest portion of the market in the coming years, as industries increasingly move toward lightweight materials.

- By application, the automotive segment led the Asia-Pacific heat-treating market in 2024 with 45% market share, because vehicles require a large number of heat-treated components to function reliably.

- By application, the aerospace segment is expected to grow at the fastest rate in the market during the forecast period, because it requires advanced materials that can withstand extreme conditions.

- By end user type, the OEM’s segment led the Asia-Pacific heat-treating market in 2024 with 55% market share, because they produce parts in large volumes and require in-house heat treating to ensure consistent quality.

- By end user type, the contract heat-treating companies’ segment is expected to grow at the fastest rate in the market during the forecast period, because outsourcing heat-treating is cost-effective for many small and medium manufacturers.

Market Overview

Precision and Power: The Rise of Heat Treating Across the Asia Pacific

The Asia-Pacific heat-treating market covers the processes, equipment, and services involved in the controlled heating and cooling of metals to alter their physical and mechanical properties without changing their shape. Heat treating enhances hardness, strength, ductility, wear resistance, and stress relief for a wide range of metal components.

In the Asia-Pacific region, the market is driven by rapid industrialization, expanding automotive and aerospace manufacturing, growth in construction and heavy machinery sectors, and the increasing need for precision-engineered parts. Key processes include case hardening, annealing, normalizing, quenching, and tempering, carried out using furnaces, induction heating systems, and vacuum equipment.

What Factor is driving the Asia-Pacific Heat-Treating Market?

The increased need from the automotive industry has spearheaded the industry's growth in recent years. As the automakers are actively trying to make their metal parts strong and long-lasting, heat treating plays a major to the expansion of the industry. Furthermore, the regional countries such as India, China, and Japan have the presence of the major automotive brands, which is likely to provide immense industry attention in the coming years.

Market Trends

- The sudden shift towards lightweight materials is contributing to the industry's growth in the current period. These lightweight materials, such as titanium and aluminum, need heating to maintain strength.

- The increased adoption of electric vehicles has driven industry potential in the past few years, as automakers are treating the parts, such as the motor components and battery casing.

Market Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 46.48 billion |

| Expected Size by 2034 | USD 67.48 billion |

| Growth Rate from 2025 to 2034 | CAGR 4.23% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Process, By Equipment Type, By Material, By Application, By End-User, By Country (Asia-Pacific Focus) |

| Key Companies Profiled | Bodycote Plc, Aalberts Surface Technologies, Nihon Parkerizing Company Limited, Bluewater Thermal Solutions, DOWA Thermotech Company Limited |

Manufacturers Eye Aerospace and Defense for Lucrative Returns

The manufacturers can benefit by supplying the advanced heat-treating equipment to industries such as the aerospace and defense is expected to create lucrative opportunities for the manufacturers in the upcoming years. Also, the development of advanced solutions, such as energy-efficient systems and technologically advanced vacuum furnaces, is likely to provide a wider consumer base in the region during the projected period.

Capital–Intensive Heat-Treating Equipment Slows Market Expansion

The high cost of the heat-treating equipment is anticipated to hinder the industry's potential in the coming years, as the furnaces, such as the induction and vacuum furnaces, require a higher initial investment, where the new market entrants and mid-sized businesses can face cost-related problems in the coming years, as per the future industry expectations.

Asia Pacific Asia-Pacific Heat-Treating Market Trends

Is the Automotive and Steel Boom Powering China’s Heat-Treating Surge?

China maintained its dominance in the Asia-Pacific heat-treating market, owing to the country being considered the world's largest manufacturing hub, specifically in sectors such the steel, heavy machinery, and automotive in the current period. Moreover, the increased need for the improvement of the material strength, performance, and durability, the industrial area is seen under the heavy dependence on the heat treating in the past few years. Furthermore, the greater government push for infrastructure and industrial development has led the industry growth in recent years in the country.

How is Foreign Investment Fueling India’s Rise?

India is expected to rise as a dominant country in the region in the coming years, owing to factors such as rapid technology adoption, infrastructure development initiatives, and a domestic manufacturing push. As india is witnessing the heavy growth in sectors such as aerospace and automotive, which is severely contributing to the regional growth. Also, the sudden increase in foreign investment has provided the industry attention to the country in recent years.

Segment Insights

By Process Type

How did the hardening and case hardening Segment Dominate the Asia-Pacific Heat-Treating Market in 2024?

The hardening and case hardening segment held the largest share of the market in 2024, due to this method being considered as the crucial method, and it can abel o make metal tougher and long-lasting. Moreover, by improving the performance of the parts, such as the shafts, gears, and bearings, the hardening and case hardening method has gained popularity in the machinery and automotive sectors in the past few years.

The quenching and tempering segment is expected to grow at a notable rate during the predicted timeframe, akin to the increased need for the material, balancing between hardness and toughness. Moreover, the high-strength steel and alloy component manufacturing industries are expected to provide the sophisticated consumer base to these methods in the upcoming years. Furthermore, the by provides rapid cooling to the material by increasing the hardness of the material, the quenching and tempering method is likely to gain major industry share during the projected period.

By the Equipment Type

Why does the Electrically Heated Furnaces Segment dominate the Asia-Pacific Heat-Treating Market by the Equipment Type?

The electrically heated furnaces segment held the largest share of the Asia-Pacific heat-treating market in 2024, due to factors like efficiency, easy operation, and wide availability. Moreover, by offering precise temperature control, the electrically heated furnaces have emerged as the ideal option in sectors such as the automotive and steel industries. Furthermore, these electrically heated furnaces have gained popularity due to their sustainability, as these furnaces are more eco-friendly than the gas-fired alternatives.

On the other hand, the vacuum furnaces segment is expected to grow at a notable rate due to the increased need for higher-quality material with precise properties in recent years. Mainly, these materials are actively demanded by the major sectors such as the medical devices, aerospace, and electronics, which is likely to lead to industry growth in the future. Moreover, allowing heat treating in a controlled, vacuum furnace is likely to gain major industry share in the upcoming years.

By Material Type

The steel & iron segment dominated the market with the largest share in 2024 because these materials are the backbone of industries such as automotive, construction, and machinery. Steel requires heat treating in almost every form to improve hardness, wear resistance, and durability.

The aluminum segment is expected to grow at a significant rate as industries increasingly move toward lightweight materials. Automotive and aerospace sectors are shifting to aluminum for fuel efficiency, reduced emissions, and improved performance. Heat treating helps aluminum parts achieve the necessary strength and durability for these applications. With electric vehicles and aircraft design focusing on lighter structures, demand for heat-treated aluminum will rise rapidly.

By Application

The automotive segment held the largest share of the market in 2024 because vehicles require a large number of heat-treated components to function reliably. Parts such as gears, crankshafts, camshafts, and bearings all undergo heat treating for strength and durability. With Asia Pacific being the world's largest automotive manufacturing region, the demand for heat treating in this sector is unmatched.

The aerospace segment is expected to grow at a notable rate during the predicted timeframe because it requires advanced materials that can withstand extreme conditions. Aircraft and spacecraft parts such as turbine blades, landing gear, and structural components need precise heat treating for performance and safety. With Asia Pacific expanding its aerospace sector, especially in China and India, demand for specialized heat treating will grow.

By End User Type

OEM’s segment held the largest share of the Asia-Pacific heat-treating market in 2024, because they produce parts in large volumes and require in-house heat treating to ensure consistent quality. Automotive, machinery, and equipment manufacturers prefer doing heat treating internally to maintain control over the process and reduce dependency on outside vendors.

On the other hand, the contract heat-treating companies’ segment is expected to grow at a notable rate because outsourcing heat-treating is cost-effective for many small and medium manufacturers. Instead of investing in expensive furnaces and infrastructure, companies can rely on specialized heat-treating service providers. These companies also offer advanced capabilities, such as vacuum furnaces, which smaller OEMs cannot afford to install.

Value Chain Analysis

Distribution to Industrial Users : The heat treating is synthesized and processed through annealing, normalizing, quenching, tempering, and case hardening.

- Key Players: Unitherm Engineers, Thermax, and Aichelin Unitherm

Chemical Synthesis and Processing : The heat treating is distributed to the energy, automotive, manufacturing, and construction industries.

- Key Players: AFECO Heating Systems, Bluewater Thermal Solutions, Deck India Engineering

Top Companies list

- Bodycote Plc

- Aalberts Surface Technologies

- Nihon Parkerizing Company Limited,

- Bluewater Thermal Solutions

- DOWA Thermotech Company Limited

Segment Covered

By Process

- Hardening & Case Hardening

- Annealing

- Normalizing

- Quenching & Tempering

- Stress Relieving

- Other Specialized Heat Treatments

By Equipment Type

- Fuel-Fired Furnaces

- Electrically Heated Furnaces

- Induction Heat Treating Equipment

- Vacuum Furnaces

By Material

- Steel & Iron

- Aluminum

- Copper & Other Alloys

By Application

- Automotive

- Aerospace

- Construction Machinery

- Metalworking & Fabrication

- Oil & Gas

- Electrical & Electronics

By End-User

- OEMs (Original Equipment Manufacturers)

- Aftermarket Service Providers

- Contract Heat Treating Companies

By Country (Asia-Pacific Focus)

- China

- Japan

- India

- South Korea

- Australia & New Zealand

- Rest of Asia-Pacific