Content

Rubber-Repair Adhesives Market Size and Share 2034

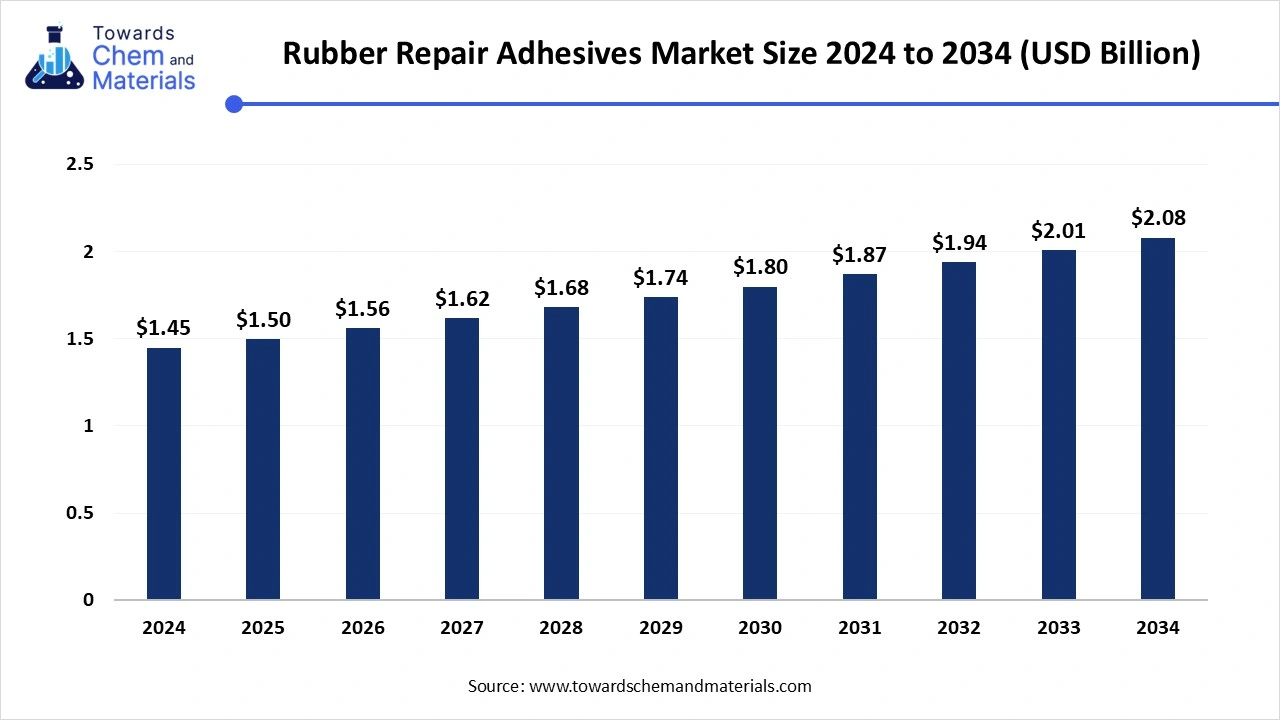

According to market projections, the rubber-repair adhesives market industry is expected to grow from USD 1.45 billion in 2024 to USD 2.08 billion by 2034, reflecting a CAGR of 3.68%.The expansion of the automotive industry and the need for lighter bonding solutions are supporting the market surge in the present conditions.

Rubber-Repair Adhesives Market Key Takeaways

- Asia Pacific led the market with the largest share in 2024.

- North America is seen to grow at the fastest rate.

- By vehicle type, the commercial vehicle segment held the dominating share of the rubber-repair adhesives market 2024

- By vehicle type, the passenger vehicle segment is expected to experience significant market growth in the future.

- By application, the retreading segment led the rubber-repair adhesives market in 2024

- By application, the repair segment is expected to grow at the fastest rate during the forecast period by application.

- By product type, the hot melt segment held the largest share of the market in 2024

- By product type, the precured patches segment is seen to grow at a notable rate during the predicted timeframe.

- By the curing process, the heat curing segment dominated the market with the largest share in 2024

- By the curing process, the UV curing segment is expected to grow at the fastest rate during the forecast period

- By end use, the automotive segment held the largest share of the market in 2024

- By end use, the construction segment is expected to experience significant market growth in the future.

Rubber-Repair Adhesives Market Overview

The rubber-repair adhesives market has experienced steady growth in the recent period. These rubber repair adhesives were used in many industries akin to construction, mining, automotive, and manufacturing. By extending the lifespan of rubber components in industries, rubber repair adhesives gained popularity over the years. These adhesives are expected to replace traditional stitching methods by providing long-lasting bonds with reliable solutions in the coming years. Furthermore, modern advancements in adhesive technology can create substantial market opportunities for the manufacturers during the forecast period.

The rapid expansion of the automotive industry has been driving market growth in recent years. Many vehicles actively rely on components such as seals, hoses, belts, and tires, which are primarily made of rubber. With the increasing need for securing the lifespan of these components and strong and durable bonding solutions, rubber repair adhesives are playing a major role in the current market environment. Moreover, heavy demand for EV vehicles, which are formerly lightweight, is significantly contributing to the growth of the rubber repair industry. Rubber repair adhesives are actively replacing traditional mechanical fasteners that

Recent Trends In Rubber-Repair Adhesives Market

- Growing use of rubber repair adhesive in the construction industry is significantly contributing to the market. As rubber repair adhesives are providing the ideal waterproofing solution for buildings and apartments.

- The increasing sustainability initiatives and adoption of Low – VOC adhesives are driving the growth of the adhesives industry. The manufacturers are increasingly investing in research and development programs to develop eco-friendly rubber adhesives in the current period. Moreover, the government is seen in providing benefits such as subsidies and easier tax policies nowadays.

- Technological advancements have been playing a major role in the adhesives industry over recent years. The rubber repair adhesive producers are applying new formulations for the improvement of the durability, strength, and flexibility of adhesives for extreme weather conditions.

Rubber-Repair Adhesive Market Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 1.50 Billion |

| Expected Market Size in 2034 | USD 2.08 Billion |

| Growth Rate | CAGR of 3.68% from 2025 to 2034 |

| Base Year of Estimaton | 2024 |

| Forecast Period | 2025-2035 |

| Dominant Region | Asia Pacific |

| Segments Covered | By Vehicle,Application,Product,curing method,End Use,Region |

| Key Companies Profile | LORD Corporation, Sika, Avery Dennison, Bostik, ITW Polymers Adhesives North America, 3M, Armacell, Arkema, Henkel, Trelleborg, H.B. Fuller. |

Rubber-Repair Adhesives Market Dynamics

Driver

Next-Gen Rubber Adhesives: Meeting EV Industry Demands

The adhesive industry is evolving rapidly with new advancements. The increasing adoption of EV vehicles can create significant opportunities for rubber repair adhesive manufacturers in the coming years. Vehicle manufacturers are looking for heat-resistant adhesives for their vehicle sealants nowadays. Also, electric vehicles exert different torque and pressure than traditional ones, thus, manufacturers are seeking specific rubber repair adhesives that are suitable for electric vehicles and can gain market attraction during the forecast period.

Restraint

Unstable Raw Material Costs Pose Long Term Market Risks

The price volatility of raw materials is expected to hamper market growth during the forecast period. Based on observation, the dependency of rubber repair adhesives on petroleum-based ingredients can impede market growth in the coming years due to price fluctuations of these types of raw materials. Moreover, the limited availability of the specialized chemicals is likely to slow down industry growth as several governments can introduce stringent regulations on some chemicals, such as accelerators, curing agents, and stabilizers, in the coming period.

Rubber-Repair Adhesives Market Regional Insights

Asia Pacific to Sustain the Dominance

Asia Pacific dominated the rubber-repair adhesives market in 2024, and is seen to sustain the dominance in the coming period. Factors such as heavy industrial development and increasing disposable income can significantly contribute to the market in the future. Countries such as China, Japan, India, and others will gain major industry share by developing innovative adhesive during the forecast period. Moreover, social pressure for eco-friendly adoption can create lucrative opportunities for adhesive manufacturers in the coming years.

China is expected to become a key country for the adhesive’s consumption during the forecast period.

The ongoing expansion of the mining and oil industry can lead to market growth of rubber repair adhesives in the forecast period. Moreover, the mining industrialists are seeking for the rubber repair adhesive which can allow rubber tyers to work in extreme temperature and harsh chemicals. Thus, the durable rubber repair adhesives can create substantial market dominance in such industries for the future time period.

North America’s Wide End-users to Boost the Market’s Growth

North America is seen to grow at the fastest rate during the forecast period. High industrial demand and modern technology have gained major market attraction in the current period. Furthermore. Heavy and high-end automotive industry presence and automotive supply are significantly leading industry growth in the region. By offering quality components and smart automotive parts, the manufacturers are seen in the increased use of rubber repair adhesives in the region recently.

United States Adhesives Market Thrives on Infrastructure and Aerospace Expansion

United States consumes a major market share in the liquid adhesives sales in the current period. The heavy investment in adhesive technology and the expansion of the construction industry are actively providing a wide consumer base for the adhesive industry. Projects such as building up commercial skyscrapers and repairing enlarged infrastructure repairs are seeking for the strong adhesion types which can withstand with materials in any weather conditions. Furthermore, the aerospace and defense industry will gain market attraction in the coming period in the country. As rubber repair adhesives will be used in repairing rubber components and maintaining aircraft structure.

Rubber-Repair Adhesives Market Segmental Comprehensions

By Vehicle Type

The commercial vehicle segment held the dominating share of the rubber-repair adhesives market in 2024. The high maintenance of these vehicles is driving the segment growth in the current period. as the commercial vehicles are mainly designed for heavy loads and long travel distance. This constant use leads to significant pressure on the rubber component, and it requires maintenance, which increases the usage of the rubber adhesives nowadays.

On the other hand, the passenger vehicle segment is expected to experience significant market growth in the future. The increasing demand for personal vehicle ownership can lead the segment growth during the forecast period. Car owners are actively looking for solutions to keeping vehicles for a longer period, which is likely to create demand for maintenance and repair products in the coming days. Also, individuals are seen in seeking for the cost-effective repairs instead of replacing rubber parts, which can

By Application

The retreading segment led the rubber-repair adhesives market in 2024. By having advantages such as sustainability and cost-effectiveness, the retreading segment gained popularity over the years. Moreover, the replacement of the worn-out tread of a tire with a new layer, the re-treading, allows the original structure to be kept intact, which can be cost-effective sometimes. Also, the commercial vehicle owners are heavily adopting

The repair segment is expected to grow at the fastest rate during the forecast period. The rising need for the restoration of rubber products is anticipated to drive segment growth in the upcoming days. Moreover, industrial and automotive maintenance can gain major market share in the segment growth. As industries have heavy maintenance of components such as seals, conveyor belts, and protective rubber linings.

By Product Type

The hot melt segment held the largest share of the market in 2024. Increased need for high flexibility, faster bonding capability, and strong adhesions are majorly contributing in the growth of the segment. Moreover, the hot melts adhesives are known for their curing time as hotmelts adhesives can solidify quickly when they cool down, which replaces the solvent and water-based adhesives for faster bonding solution need.

The precured patches segment is seen to grow at a notable rate during the predicted timeframe. The segment growth is attributed to their ease of use and suitability for large-scale rubber repairs. The precured patches can provide seamless bonding, which attracts market attraction by restoring rubber surfaces to their original strengths in the coming years. Furthermore, curing patches are mainly used in the conveyer belt repair, which ensures fast and strong repairs while minimizing downtime.

By Curing Process

The heat curing segment dominated the market with the largest share in 2024. The requirement of high temperatures enables enhanced adhesion strength for the heat curing process, and it is driving the growth of the segment in recent years. Also, having better chemical resistance and improved mechanical properties made the heat curing method a dominant curing method in past years. Also, the expansion of the tire industries is leading segment growth in the current period.

UV curing is expected to grow at the fastest rate during the forecast period. The factors such as energy efficiency, rapid curing time, and eco-friendly nature can contribute heavily to the segment growth in the future. The heavy manufacturing industries are increasingly adopting UV curing due to its instant curing abilities. As UV curing adhesives harden instantly when exposed to UV light, heat curing adhesives take hours to bond fully.

By End Use

The automotive segment held the largest share of the market in 2024. The having greater consumer rate and need for the durability, resistance, and consistency to the rubber component of vehicles is significantly leading segment growth in the current period. Moreover, the demand for lightweight vehicles is further creating opportunities for the segment, ensuring that rubber repair adhesives become the preferred choice for automakers.

The construction segment is expected to experience significant market growth in the future. Growing heavy infrastructure projects are anticipated to lead segment progression in the coming period as rubber riper adhesives become the ideal choice for the developers by providing and maintaining long-term durability of the construction.

Recent Developments In Rubber-Repair Adhesives Market

- In 2024, Scientists from the Nayang Technological University from Singapore introduced reusable and smart adhesives. These adhesives have a strength that can be more than ten times that of regular adhesives. Also, these adhesives are likely to handle heavy loads on both smooth and rough surfaces.

- In 2025, H.B Fuller unveiled the latest technology for commercial roofing adhesives, which can help reduce job site waste. the technology called ECO2 technology. These adhesives can reduce the dependence on chemical blowing agents and instead use naturally occurring atmospheric gases.

Top Companies in the Rubber-Repair Adhesives Market

- LORD Corporation

- Sika

- Avery Dennison

- Bostik

- ITW Polymers Adhesives North America

- 3M

- Armacell

- Arkema

- Henkel

- Trelleborg

- B. Fuller

Rubber-Repair Adhesives Market Segments Covered

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Industrial Equipment

By Application

- Retreading

- Repair

- Bonding

- Other

By Product Type

- Hot Melt Adhesives

- Cold Adhesives

- Rubberized Fabric

- Pre-cured Patches

- Others

By Curing Method

- Air Curing

- Heat Curing

- Cold Curing (RTV)

- UV Curing

By End Use

- Automotive

- Construction

- Mining

- Aerospace

- Other

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Argentina

- The Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait