Content

U.S. Methanol Market Size and Growth 2025 to 2034

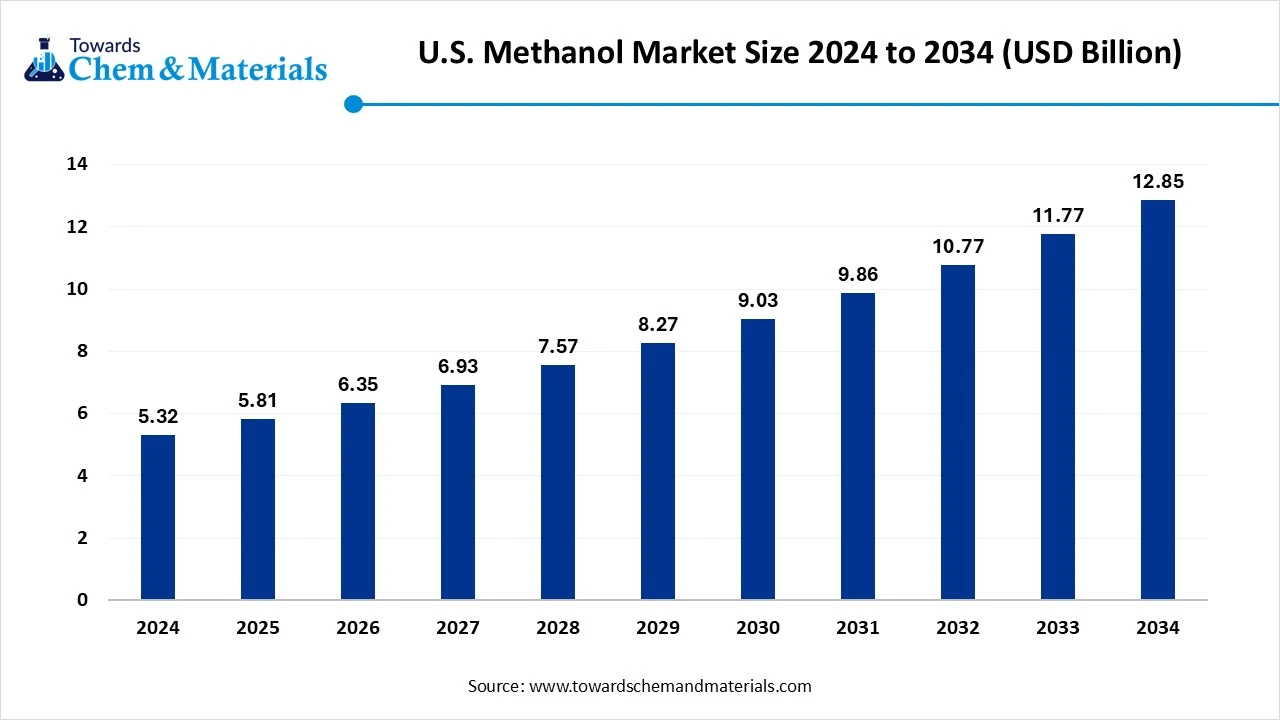

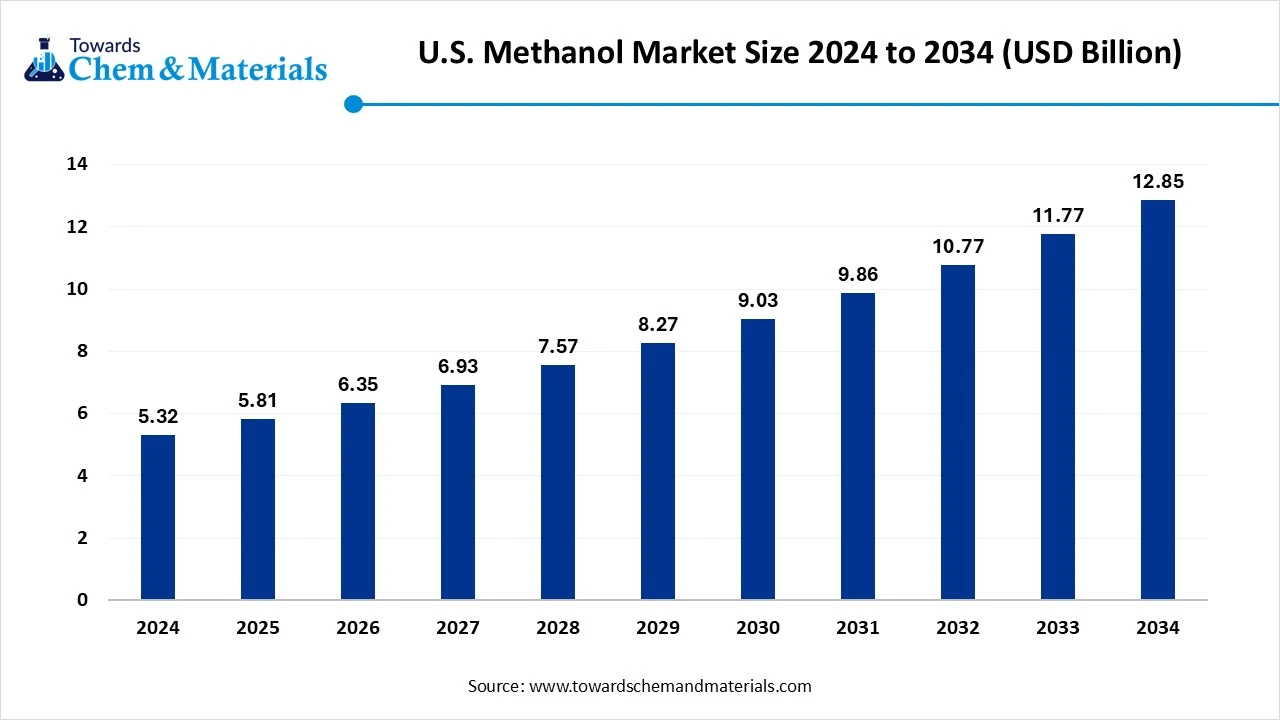

The U.S. methanol market size was reached at USD 5.32 billion in 2024 and is expected to be worth around USD 12.85 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.22% over the forecast period 2025 to 2034.The focus on clean energy, the growing chemical industry, and increasing green methanol production drive the market growth.

Key Takeaways

- By feedstock, the natural gas segment held approximately a 85–90% share in the market in 2024, due to the well-established methanol production infrastructure.

- By feedstock, the biomass & renewable sources segment is expected to grow at the fastest CAGR in the market during the forecast period due to the focus on reducing greenhouse gas emissions.

- By derivative, the formaldehyde segment held approximately a 35% share in the market in 2024 due to its excellent performance.

- By derivative, the methanol-to-olefins segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing demand for olefins.

- By application, the chemical intermediates segment held approximately a 50% share in the market in 2024 due to the growing demand for chemicals in various applications.

- By application, the fuels & energy segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing automotive industry.

- By technology, the conventional methanol segment held approximately a 90% share in the U.S. methanol market in 2024 due to the well-established production facilities.

- By technology, the renewable methanol segment is expected to grow at the fastest CAGR in the market during the forecast period due to the strong focus on reducing carbon emissions.

- By distribution channel, the direct supply to industrial users segment held approximately a 55% share in the market in 2024 due to the increasing purchasing of large quantities of methanol.

- By distribution channel, the energy & fuels blenders segment is expected to grow at the fastest CAGR in the market during the forecast period due to the strong government support.

U.S. Methanol : Power Behind Clean Fuel and Sustainable Energy

The U.S. Methanol Market covers the production, distribution, and utilization of methanol. The chemical formula of methanol is CH3OH and is a flammable & colorless liquid. It is produced from biomass, natural gas, and coal. The process for the production of methanol involves syngas production, conversion of syngas to methanol, and methanol distillation.

It is widely used as a feedstock in solvents, chemical production, pesticides, fuel, olefins, and many other applications. Factors like the growing energy sector, large reserves of natural gas, increasing demand in automotive & construction applications, investment in renewable methanol technologies, and increasing adoption of methanol-blended fuels contribute to the growth of the market.

- The United States exported $1.03B of methanol in 2023.(Source: oec.world)

- The United States exported 4,661 shipments of methanol.(Source: www.volza.com)

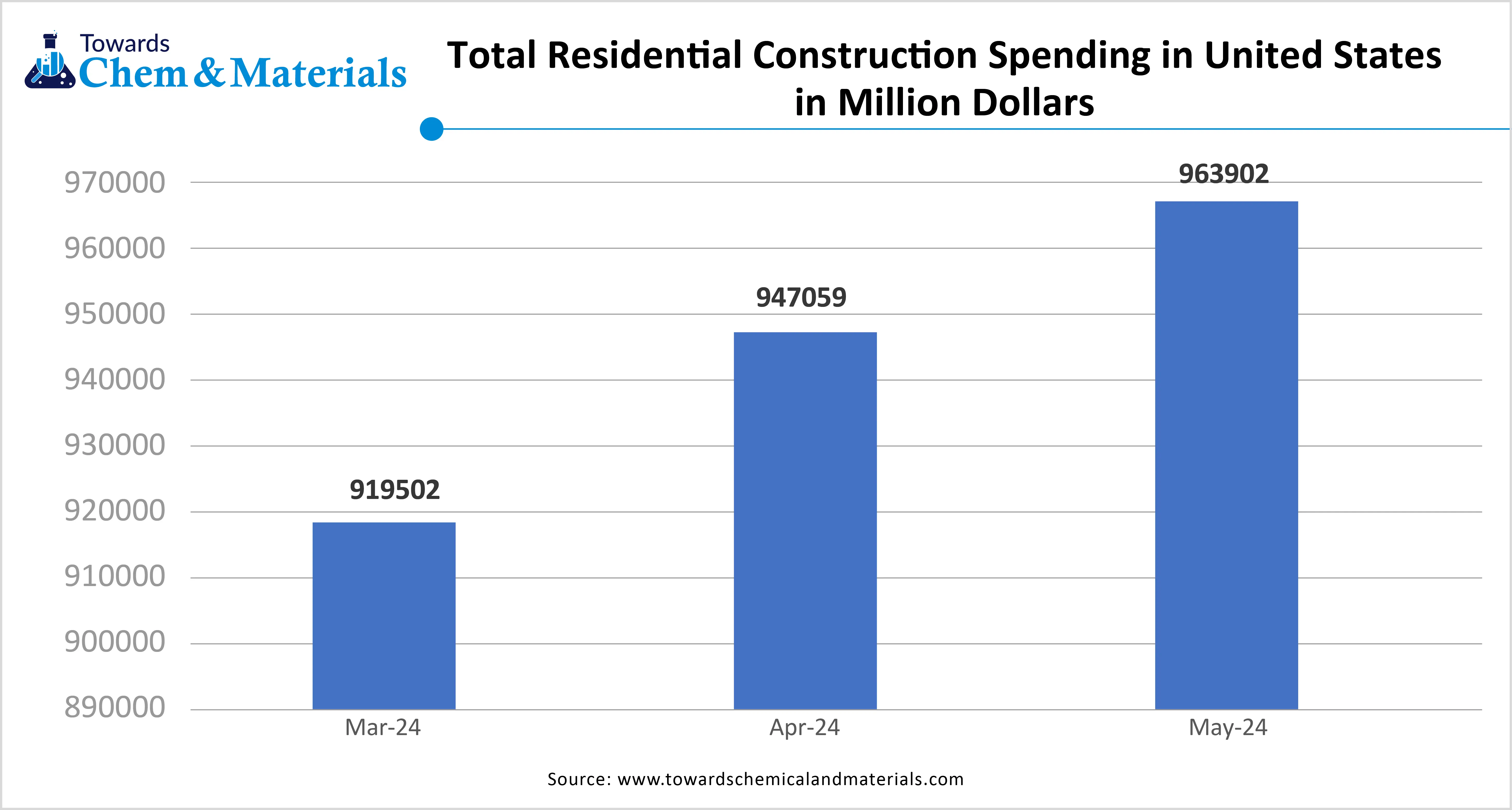

Growing Construction Activities Surge Demand for Methanol in the U.S.

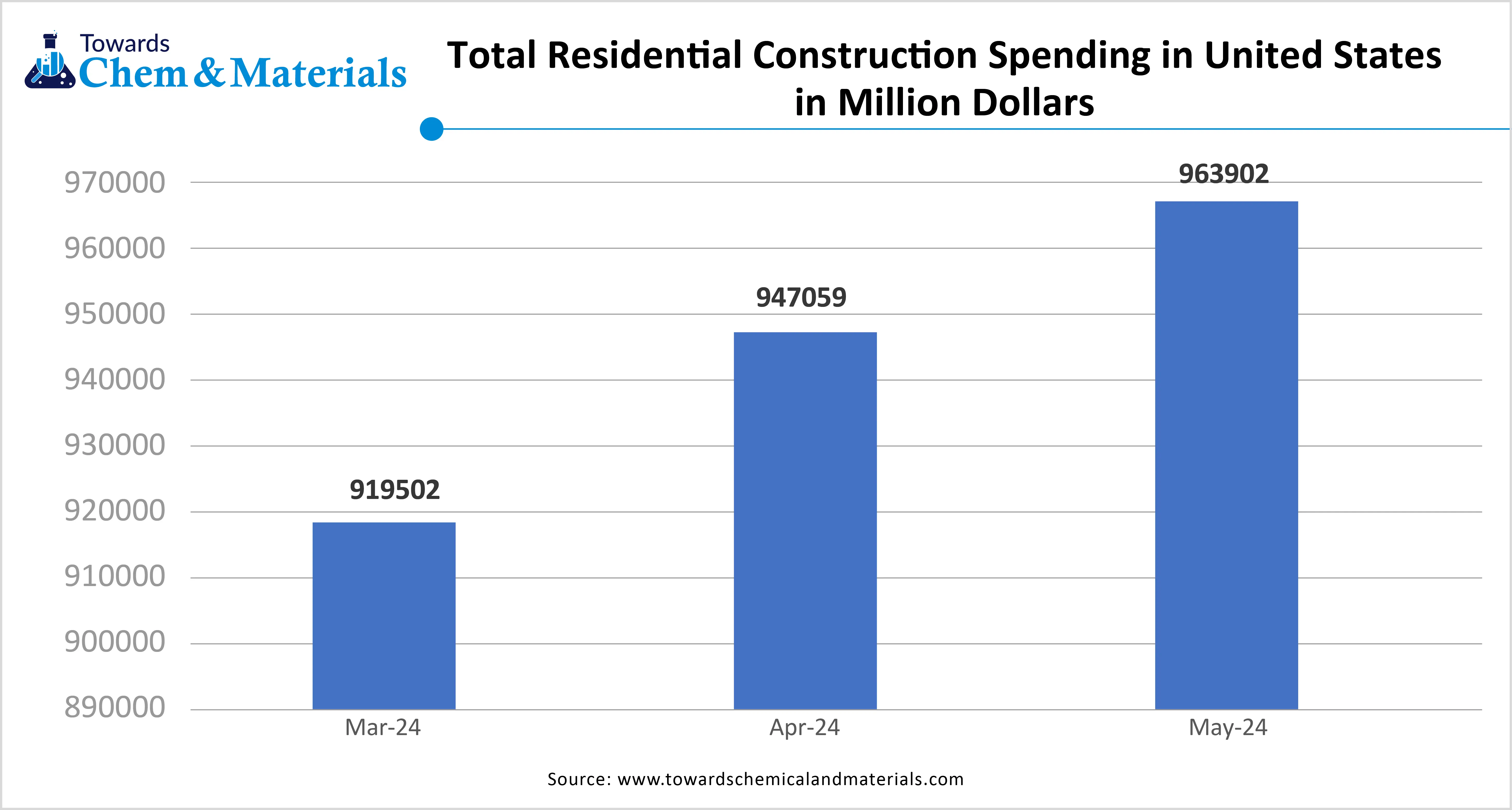

The rapid urbanization and growing commercial and residential construction activities increase demand for methanol for various applications. The increasing need to bind various construction materials like adhesives, plywood, and particleboard increases demand for methanol. The growing demand for sealants and insulation foams in construction activities increases the demand for methanol for the prevention of water damage & enhancing durability. The need for coatings and paints increases demand for methanol.

The strong focus on sustainable construction and green building increases the adoption of methanol. The high requirements of wooden products in construction and the growing development of infrastructure projects increase the adoption of methanol. The growing construction activities are a key driver for the growth of the U.S. methanol market.

Market Trends

- Growing Demand for Clean Fuels: The increasing demand for clean fuels in various sectors like power generation, marine, and automotive increases the adoption of methanol.

- Increasing Demand for Chemicals: The growing demand for chemicals like methyl methacrylate, formaldehyde, and acetic acid increases the adoption of methanol for applications like pharmaceuticals & adhesives.

- Technological Advancements: The ongoing technological advancements, like the production of green methanol and biomethanol, help in reducing carbon dioxide emissions.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 5.81Billion |

| Expected Size by 2034 | USD 12.85 Billion |

| Growth Rate from 2025 to 2034 | CAGR 9.22% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Feedstock, By Derivative/Product Type, By Application, By Technology, By Distribution Channel, |

| Key Companies Profiled | Celanese, Mitsubishi Gas Chemical Company, U.S. Methanol, Valero Energy, Boardwalk Pipeline Partners, Methanol Holdings (Trinidad) Limited, Global Chemical Solutions, Oxy Low Carbon Ventures, Methanex, LyondellBasell, Southern Chemical Corporation, MMR Holdings, Eastman Chemical Company |

High Production Cost Limits Expansion of Methanol Market in the U.S.

With several benefits of methanol in the United States, the high production cost restricts the market growth. Factors like fluctuations in feedstock prices, high investment in the development of plant infrastructure, high consumption of energy, and complex processes are responsible for high production costs. The fluctuating costs of natural gas and renewable feedstocks like biomass increase the production costs.

The complex processes like water distillation, gasification, & synthesis, and high consumption of energy increase the cost. The high investment for the development of new plant infrastructure and the need for specialized machinery increase the cost. The high production cost hampers the growth of the U.S. methanol market.

Market Opportunity

Growing Automotive Industry Unlocks Market Opportunity

The growing automotive industry and increasing production of various automotive vehicles increase demand for methanol for automotive applications. The increasing development of lightweight automotive components and the focus on improving the fuel efficiency of vehicles increase the adoption of methanol.

The stricter regulations on emissions of vehicles and the increasing demand for alternative fuel increase the adoption of methanol. The growing development of car parts like safety systems, consoles, and dashboards increases the adoption of methanol. The increasing need for tires, paints, plastics, safety glass, and adhesives in vehicles leads to higher demand for methanol. The growing automotive industry creates an opportunity for the growth of the U.S. methanol market.

Market Challenge

High Production Cost

Despite several benefits of methanol in the United States across various industries, the high production cost restricts the market growth. Factors like high consumption of energy, fluctuating feedstock prices, catalyst replacement, and the development of new plants are responsible for high production costs. The fluctuations in the prices of feedstocks like natural gas and biomass increase the cost.

The complex and energy-intensive processes like electrolysis & many more lead to higher production costs. The need for high investment in the development of new plants directly affects the market. The need for replacement of catalysts and the high consumption of energy increase the production cost. The high production cost hampers the growth of the U.S. methanol market.

Country Insights

Gulf Coast U.S. Methanol Market Trends

The Gulf Coast dominated the U.S. methanol market in 2024. The presence of vast reserves of natural gas and well-developed infrastructure increases the production of methanol. The well-established petrochemical facilities and favorable regulatory environment increase the production of methanol. Strong access to maritime shipping routes and government support for clean energy increase demand for methanol.

The growing demand for methanol across end-user industries like marine, chemical, & automotive, and the presence of the largest permitted methanol park in Plaquemines Parish, drive the overall growth of the market.

West Coast U.S. Methanol Market Trends

The West Coast is experiencing the fastest growth in the market during the forecast period. The growing investment in the production of methanol and the increasing demand for sustainable fuel are increasing the production of methanol. The strong focus on clean transportation and increasing investment in green methanol increases the production of green methanol. The strong focus on sustainability and the growing automotive industry leads to higher production of methanol. The stricter environmental regulations, like IMO, and the expansion of the petrochemical industry, fuel demand for methanol, supporting the overall growth of the market.

Segmental Insights

Feedstock Insights

Why did the Natural Gas Segment Dominate the U.S. Methanol Market?

The natural gas segment dominated the U.S. methanol market in 2024. The abundant presence of natural gas in the Middle East and North America helps market growth. The well-developed methanol production process and focus on lowering harmful emissions increase demand for natural gas. The growing end-user industries like electronics, construction, and automotive increase demand for natural gas. The well-established transport infrastructure and cost-effective large-scale production drive the overall growth of the market.

The biomass & renewable sources segment is the fastest-growing in the market during the forecast period. The growing climate change issues and focus on lowering greenhouse gas emissions increase demand for biomass sources. The strong government support through policies like the EPA and the US DOE for clean energy projects increases the production of biomass. The high availability of biomass and increasing consumer demand for sustainable products help the market growth. The growing demand for biomass in end-user industries like marine, transportation, and chemical supports the overall growth of the market.

Derivative / Product Type Insights

How Formaldehyde Segment Held the Largest Share in the U.S. Methanol Market?

The formaldehyde segment held the largest revenue share in the U.S. methanol market in 2024. The growing production of resins like phenol-formaldehyde and urea-formaldehyde for various applications helps market growth. The increasing demand for coatings, adhesives, and glues increases the demand for formaldehyde. The growing infrastructure development and construction activities increase demand for formaldehyde. The affordability, excellent performance, and growing production of chemical intermediates increase demand for formaldehyde. The growing demand for formaldehyde in end-user industries like furniture, construction, and automotive drives the market growth.

The methanol-to-olefins (MTO) segment is experiencing the fastest growth in the market during the forecast period. The growing demand for olefins in various industries and the low cost of natural gas increase the adoption of methanol-to-olefins. The high availability of feedstocks like renewable energy and biomass increases the use of MTO technology. The stricter environmental regulations and technological advancements in MTO support the overall growth of the market.

Application Insights

Which Application Dominated the U.S. Methanol Market?

The chemical intermediates segment dominated the U.S. methanol market in 2024. The growing demand for essential chemicals increases the production of methanol. The increasing demand for methyl tert-butyl ether, formaldehyde, and acetic acid increases the demand for methanol. The growing production of automotive components, plywood, and particleboard increases the production of chemical intermediates. The growing industries like plastic, textile, and paint increase demand for chemical intermediates. The increasing production of alternative fuel, chemicals, & solvents increases the adoption of chemical intermediates, driving the overall growth of the market.

The fuels & energy segment is the fastest-growing in the market during the forecast period. The focus on reducing greenhouse gas emissions and the adoption of clean energy sources increases demand for methanol. The strong focus on sustainable energy sources and the growing automotive industry increases the adoption of methanol. The increasing development of fuel cells and stringent emission standards in the maritime sector increases demand for methanol. The growing power generation and strong government support for clean fuels support the overall growth of the market.

Technology Insights

How Conventional Methanol Segment Held the Largest Share in the U.S. Methanol Market?

The conventional methanol segment held the largest revenue share in the U.S. methanol market in 2024. The abundant presence of natural gas and large-scale production facilities on the Gulf Coast increases the production of conventional methanol. The increasing production of chemicals like acetic acid, methyl methacrylate, olefins, & formaldehyde increases demand for conventional methanol. The applications, like power generation, fuel blending, and marine fuel, increase the adoption of conventional methanol, driving the overall growth of the market.

The renewable methanol segment is experiencing the fastest growth in the market during the forecast period. The focus on reducing carbon emissions and greenhouse gas emissions increases demand for renewable methanol. The increasing demand for low-carbon fuel in industries like the maritime and automotive sectors increases the adoption of renewable methanol. The growing industries like chemical manufacturing and transportation increase demand for renewable methanol, supporting the overall growth of the market.

Distribution Channel Insights

Why did Direct Supply to Industrial Users Segment Dominate the U.S. Methanol Market?

The direct supply to industrial users segment dominated the U.S. methanol market in 2024. The growing demand for purchasing methanol in large volumes increases the demand for direct supply to industrial users. The focus on consistent product supply and the need for maintaining long-term relationships increase the adoption of direct supply. The growing demand for methanol in end-user industries like construction, automotive, chemical synthesis, and energy fuels demands for direct supply to industrial users, driving the overall growth of the market.

The energy & fuel blenders segment is the fastest-growing in the market during the forecast period. The growing focus on reducing emissions and inexpensive production increases demand for energy & fuel blenders. The increasing need for energy security and blending methanol into gasoline increases demand for energy & fuel blenders. The high octane rating and the need for replacement of gasoline increase the adoption of fuel blenders. The strong government support and growing development of the methanol cell support the overall market growth.

U.S. Methanol Market Value Chain Analysis

- Feedstock Procurement :The feedstock procurement for the United States methanol is biomass like municipal solid waste, crop residues, & forest waste, and natural gas.

- Key Players:- BASF, LyondellBasell Industries, Celanese Corporation, Methanex Corporation

- Chemical Synthesis and Processing: The chemical synthesis and processing for methanol in the United States involves steps like syngas production, catalytic conversion, and purification of methanol.

- Quality Testing and Certification: The quality testing of methanol involves methods like GC-MS, gas chromatography, chromotropic acid methanol to test qualities like water content, visual appearance, purity, acidity, contamination, & many others, and certifications include ISCC, USP/NF.

Recent Developments

- In September 2023, OCI Global plans to double its green methanol capacity in Texas, United States. The doubled capacity is approximately 400000 metric tons and is useful in applications like industrial, road transport, & shipping. Green methanol is developed from green hydrogen, RNG, and other feedstocks.(Source: oci-global.com)

- In August 2025, Emvolon collaborated with Montauk to produce green methanol from biogas in Texas. The plant focuses on producing annually up to 50000 metric tonnes of green methanol, and useful in sectors like chemical manufacturing, shipping, and aviation.(Source: www.bioenergy-news.com)

- In April 2025, Worley collaborated with Topsoe to produce e-methanol in the United States. The facility focuses on producing 600 tonnes per day of e-methanol to help the shipping sector. The Worley company focuses on the development of green hydrogen facilities, and Topsoe on methanol synthesis technology.(Source: www.offshore-energy.biz)

U.S. Methanol Market Top Companies

- Celanese

- Mitsubishi Gas Chemical Company

- U.S. Methanol

- Valero Energy

- Boardwalk Pipeline Partners

- Methanol Holdings (Trinidad) Limited

- Global Chemical Solutions

- Oxy Low Carbon Ventures

- Methanex

- LyondellBasell

- Southern Chemical Corporation

- MMR Holdings

- Eastman Chemical Company

Segments Covered

By Feedstock

- Natural Gas

- Coal (import-based, limited)

- Biomass & Renewable Sources (green methanol, e-methanol)

By Derivative/Product Type

- Formaldehyde

- Acetic Acid

- MTBE / TAME

- Methanol-to-Olefins (MTO)

- Methyl Methacrylate (MMA)

- Dimethyl Ether (DME)

- Others (Solvents, Fuels, Specialty Chemicals)

By Application

- Chemical Intermediates (resins, plastics, adhesives, paints)

- Fuels & Energy (blending, biodiesel, marine fuels)

- Construction Materials (plywood, laminates, engineered wood)

- Automotive & Transportation

- Electronics & Appliances

- Pharmaceuticals & Healthcare

By Technology

- Conventional Methanol Production (from natural gas)

- Renewable Methanol (biomass, e-methanol from CO₂ + hydrogen)

By Distribution Channel

- Direct Supply to Industrial Users

- Chemical Distributors & Traders

- Energy & Fuel Blenders

- Export Channels (LNG & petrochemical hubs)