Content

U.S. Higher Alpha Olefins Market Size and Growth 2025 to 2034

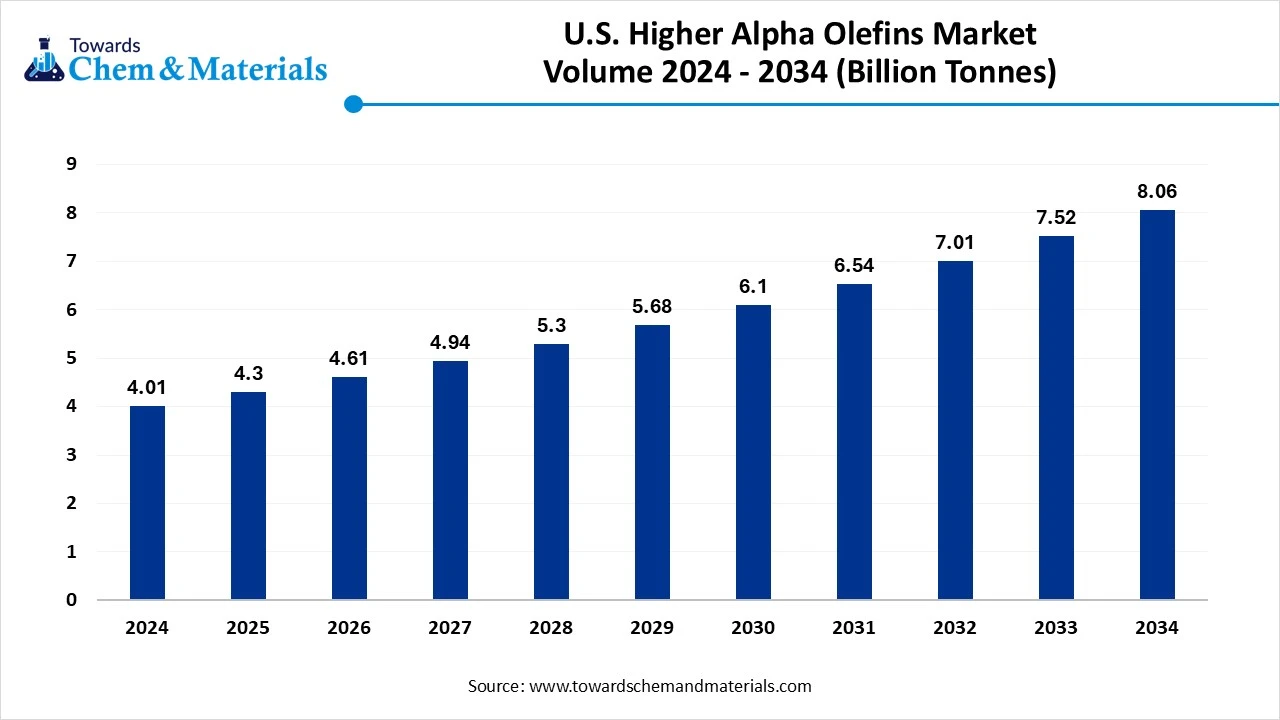

The U.S. higher alpha olefins market size was reached at USD 4.01 billion in 2024 and is expected to be worth around USD 8.06 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.23% over the forecast period 2025 to 2034. The growing lubricant industry, increasing demand for eco-friendly products, and abundance of natural gas drive the market growth.

Key Takeaways

- By product type, the C6 alpha olefins segment led the U.S. higher alpha olefins market in 2024 due to the increasing polyethylene production.

- By product type, the C10 alpha olefins segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing surfactants production.

- By production process, the ethylene oligomerization segment led the market in 2024 due to its cost-effectiveness.

- By production process, the Fischer-Tropsch synthesis segment is expected to grow at the fastest CAGR in the market during the forecast period due to the strong focus on process optimization.

- By end-use industry, the packaging segment led the market in 2024 due to the growth in online shopping.

- By end-use industry, the automotive & transportation segment is expected to grow at the fastest CAGR in the market during the forecast period due to the rise in the production of electric vehicles.

- By distribution channel, the direct sales segment led the market in 2024 due to the strong focus on quality control.

- By distribution channel, the online chemical marketplaces segment is expected to grow at the fastest CAGR in the market during the forecast period due to the ongoing digitalization.

Role of U.S Higher Alpha Olefins in Industrial Applications

U.S. higher alpha olefins (HAO) are a straight chain of hydrocarbons like C6, C8, C10, C12, C14, C16, C18, C20+. HAO is produced via Fischer-Tropsch synthesis and ethylene oligomerization. They consist of more than four carbon atoms and are highly reactive. They are widely used in the production of plastics like HDPE and LLDPE.

The growing industries like consumer goods, plastics, and automotive increase demand for HAO. Factors like growing production of cleaning products, increasing demand for personal care products, growing production of polyethylene, and growth of synthetic lubricants contribute to the growth of the U.S. higher alpha olefins market.

- The United States exported 21907 shipments of alpha olefin.(Source: www.volza.com)

- The United States exported 85 shipments of the linear alpha olefin.(Source: www.volza.com)

Growing Construction Industry Drives Market Growth

The rapid urbanization and growing construction activities increase demand for higher alpha olefins in the United States. The growing development of infrastructure projects like sewage systems, water distribution, and others increases demand for HAO for the production of polyethylene pipes. The growing commercial and residential construction activities increase demand for polyethylene-based materials.

The growing development of HDPE pipes and LLDPE films increases demand for HAO. The increasing demand for lightweight construction materials and durable materials increases the adoption of HAO. The increasing need for sealants and protective coatings increases demand for HAO. The strong focus on sustainability and the development of green buildings increases demand for HAO. The growing construction industry is a key driver for the growth of the U.S. higher alpha olefins market.

Market Trends

- Growing Demand for Polyethylene: The growing demand for polyethylene in various industries like construction, packaging, and automotive for the production of various materials & components increases the adoption of HAO.

- Increasing Production of Synthetic Lubricants: The growing automotive industry and high utilization of industrial machinery increase demand for synthetic lubricants, which requires HAO.

- Growing Utilization of Detergent & Surfactants: The growing awareness about hygiene increases demand for surfactants and detergents for industrial and household purposes, which requires HAO.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 4.30 Billion |

| Expected Size by 2034 | USD 8.06 Billion |

| Growth Rate from 2025 to 2034 | CAGR 7.23% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type, By Production Process, By End-Use Industry, By Distribution Channel |

| Key Companies Profiled | Chevron Phillips Chemical (CPChem), INEOS Oligomers, Shell Chemicals, ExxonMobil Chemical, Sasol Chemicals USA, SABIC Americas, LyondellBasell Industries, Dow Inc., Qatar Chemical Co. (Q-Chem, via CPChem JV), Idemitsu Kosan America, Honeywell UOP, INEOS O&P USA, Ascend Performance Materials, Westlake Chemical, Formosa Plastics Corp. USA |

Market Opportunity

Expansion of the Automotive Industry Unlocks Market Opportunity

The growing expansion of the automotive industry in the United States increases demand for higher alpha olefins. The strong focus on improving fuel efficiency and lowering emissions of fuels increases the adoption of HAO. The increasing advancements in vehicles and the growing need for lightweight vehicle components increase demand for HAO.

The increasing need for high-efficiency lubricants and advancements in engine design increase the adoption of HAO. The growth in hybrid and electric vehicles increases demand for HAO. The focus on enhancing the durability of automotive components and focus on lowering vehicle weight increases demand for HAO. The increasing need to improve engine longevity and the development of battery cooling systems increase the adoption of HAO. The expansion of the automotive industry creates an opportunity for the growth of the U.S. higher alpha olefins market.

Market Challenge

High Production Cost Limits Expansion of the HAO Market

With several benefits of the higher alpha olefins(HAO) in the United States, the high production cost restricts the market growth. Factors like need for specialized equipment, fluctuating raw material costs, capital-intensive technology, and complex manufacturing processes are responsible for high production costs. The fluctuations in the prices of feedstocks like natural gas & crude oil directly affect the market.

The complex manufacturing processes, like oligomerization and high consumption of energy, increase the costs. The need for specialized equipment and the higher cost of developing infrastructure increase the cost. The need for specialized catalysts and the development of greener manufacturing processes lead to higher costs. The high production cost hampers the growth of the market.

Country Insights

Gulf Coast U.S. Higher Alpha Olefins Market Trends

The Gulf Coast dominated the market in 2024. The abundance of natural gas and the easy availability of raw materials increase the production of HAO. The well-established petrochemical infrastructure and growing production of polyethylene increase demand for HAO. The growing production of synthetic lubricants and major transportation networks increases demand for HAO. The growing industries like automotive and packaging increase the adoption of HAO, driving the overall growth of the market.

West Coast U.S. Higher Alpha Olefins Market Trends

The West Coast is experiencing the fastest growth in the market during the forecast period. The growing demand for synthetic lubricants in industrial machinery and the automotive industry increases demand for HAO. The abundance of ethane and shale gas revolution increases the production of HAO. The growing demand for polyethylene in industries like automotive, packaging, and construction increases demand for HAO. The increasing production of surfactants and growing investment in HAO support the overall growth of the market.

Segmental Insights

Product Type Insights

Why did the C6 Segment Dominate the U.S. Higher Alpha Olefins Market?

The C6 (1-hexene) segment dominated the U.S. higher alpha olefins market in 2024. The growing polyethylene production and focus on enhancing the properties of HDPE and LLDPE increase demand for C6 as a co-monomer. The growing manufacturing of containers, films, and advancements in production technology, like metallocene catalysis & catalytic processes, increase the production of C6. The growing production of C6 in the U.S. Gulf Coast drives the overall growth of the market.

The C10 (1-decene) segment is the fastest-growing in the market during the forecast period. The growing demand for surfactants in industrial and consumer products increases demand for C10 alpha olefins. The increasing production of synthetic lubricants and the rise in electric vehicles increase demand for C10 alpha olefins. The increasing production of detergents and the growing utilization of energy-efficient industrial machinery increase demand for C10, supporting the overall growth of the market.

Production Process Insights

How Ethylene Oligomerization Held the Largest Share in the U.S. Higher Alpha Olefins Market?

The ethylene oligomerization segment held the largest revenue share in the market in 2024. The growing conversion of ethylene and the high availability of low-cost ethylene use ethylene oligomerization process. The Shell Higher Olefin Process increases the HAO production using ethylene oligomerization. The focus on improving the efficiency of HAO production and cost-effectiveness helps market growth. The growing use of ethylene oligomerization in the production of synthetic lubricants and polyethylene drives the overall growth of the market.

The Fischer-Tropsch synthesis segment is experiencing the fastest growth in the market during the forecast period. The abundance of feedstocks and increasing production of high-value products increase demand for the Fischer-Tropsch synthesis process. The focus on the direct conversion of syngas and the need for process optimization increases demand for Fischer-Tropsch synthesis. The growing production of detergents, polymers, & synthetic fibers uses Fischer-Tropsch, supporting the overall growth of the market.

End-Use Industry Insights

Which End-Use Industry Dominated the U.S. Higher Alpha Olefins Market?

The packaging segment dominated the market in 2024. The growing production of various packaging, like bags, rigid containers, films, and bottles, increases demand for HAO. The increasing demand for packaging in industries like consumer goods, food, and healthcare increases the adoption of HAO. The increasing consumption of packaged foods and increasing online shopping fuel demand for HAO. The rise in e-commerce and the expansion of the packaging industry drive the overall growth of the market.

The automotive & transportation segment is experiencing the fastest growth in the market during the forecast period. The growing advancements in engines and the increasing modernization of vehicles increase demand for HAO. The ongoing advancements in engine technology and stricter emission regulations increase the adoption of HAO. The growing production of hybrid & electric vehicles and the development of mechanical systems increase the demand for HAO. The focus on reducing vehicle weight and increasing the production of automotive components requires HAO, supporting the overall growth of the market.

Distribution Channel Insights

How the Direct Sales Segment Held the Largest Share in the U.S. Higher Alpha Olefins Market?

The direct sales segment held the largest revenue share in the market in 2024. The strong focus on building closer relationships and the need for a reliable supply increase the adoption of direct sales. The focus on quality control and large-scale HAO production increases the adoption of direct sales. The increasing demand for tailored solutions and the availability of technical expertise fuel demand for direct sales, driving the overall growth of the market.

The online chemical marketplaces segment is the fastest-growing in the market during the forecast period. The ongoing digitalization and focus on enhancing the transparency of processes increase the adoption of online chemical marketplaces. The focus on breaking geographical barriers and the need to connect sellers & buyers increases demand for online chemical marketplaces. The transparent pricing and strong focus on convenience increase buying from online platforms, supporting the overall market growth.

U.S. Higher Alpha Olefins Market Value Chain Analysis

- Feedstock Procurement: The feedstock procurement for higher alpha olefins in the United States includes ethane, naphtha, ethylene, and natural gas.

- Key Players:- ExxonMobil Chemical, Chevron Phillips Chemical, and INEOS Oligomers

- Chemical Synthesis and Processing: The chemical synthesis and processing involve processes like Fischer-Tropsch synthesis and ethylene oligomerization. The chemical synthesis uses ethylene for the production of HAO.

- Regulatory Compliance and Safety Monitoring: The regulatory compliance includes EPA regulations & FDA guidelines to lower greenhouse gas emissions and volatile organic compounds emissions.

Recent Developments

- In September 2023, ExxonMobil expanded its linear alpha olefins production facility in Baytown, Texas. The facility produces Exact-branded polymer modifiers and Vistamaxx, and the capacity is 400000 metric tons per year. The products are widely used in construction materials, packaging applications, automotive parts, and personal care & hygiene products.(Source: www.rigzone.com)

- In May 2025, Pilot Chemical Collaborated with Novvi to launch biobased surfactants in North America. The CalCare AOS sulfonates are useful across personal care, household, and industrial products. The production facility is present in Middletown, Ohio, and the products are fully biobased. (Source: www.chemanalyst.com)

U.S. Higher Alpha Olefins Market Top Companies

- Chevron Phillips Chemical (CPChem)

- INEOS Oligomers

- Shell Chemicals

- ExxonMobil Chemical

- Sasol Chemicals USA

- SABIC Americas

- LyondellBasell Industries

- Dow Inc.

- Qatar Chemical Co. (Q-Chem, via CPChem JV)

- Idemitsu Kosan America

- Honeywell UOP

- INEOS O&P USA

- Ascend Performance Materials

- Westlake Chemical

- Formosa Plastics Corp. USA

Segments Covered

By Product Type

- C6 Alpha Olefins

- C8 Alpha Olefins

- C10 Alpha Olefins

- C12 Alpha Olefins

- C14 Alpha Olefins

- C16 Alpha Olefins

- C18 Alpha Olefins

- C20+ Alpha Olefins

By Production Process

- Ethylene Oligomerization

- Fischer–Tropsch Synthesis

- Metallocene Catalysis

By End-Use Industry

- Packaging (Flexible & Rigid)

- Automotive & Transportation

- Consumer Goods & Personal Care

- Industrial Manufacturing

- Oil & Gas

- Construction

By Distribution Channel

- Direct Sales

- Distributors & Chemical Traders

- Online / Digital Chemical Marketplaces