Content

U.S. Diamond Coatings Market Size, Share | CAGR of 6.40%.

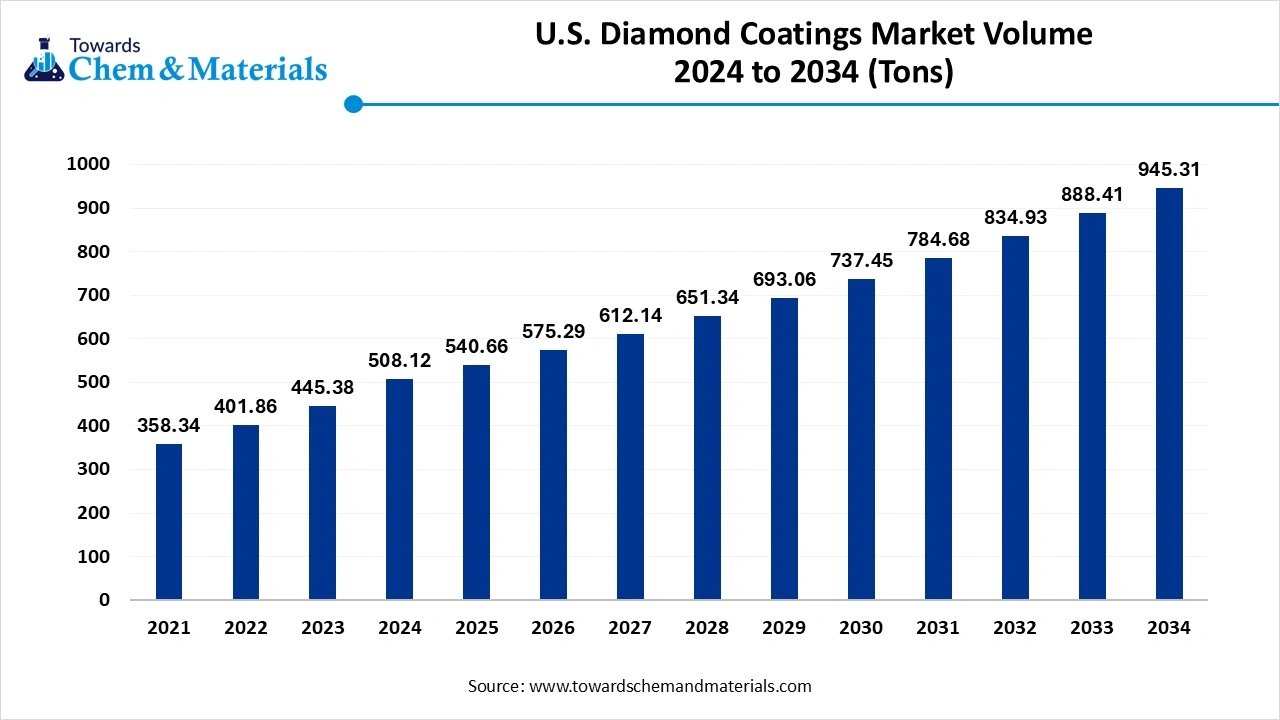

The U.S. diamond coatings market volume was reached at 508.12 tons in 2024 and is expected to be worth around 945.31 tons by 2034, growing at a compound annual growth rate (CAGR) of 6.40% over the forecast period 2025 to 2034. The growth of the market is driven by the growing industries in the U.S. like electrical and electronics, mechanical, industrial, medical and automotives which drives the growth of the market.

Key Takeaways

- By technology, the chemical vapor deposition (CVD) segment dominated the market in 2024. The plastic segment held a 71% share in the market in 2024. This method is widely used by many due to its applications.

- By technology, the electrochemical deposition segment is expected to grow significantly in the market during the forecast period. The enhanced and advanced method influences the demand.

- By substrate material, the metals segment dominated the market in 2024. The metals segment held a 32% share in the market in 2024. The ready availability and growth of the segment are key drivers.

- By substrate material, the polymers segment is expected to grow in the forecast period. The versatility drives the growth of the market.

- By product type, the polycrystalline diamond coatings segment dominated the market in 2024. The polycrystalline diamond coatings segment held a 43% share in the market in 2024. The growing demand due to the property and durability is a key growth driver of the segment.

- By product type, the ultra-nanocrystalline diamond coatings segment is expected to grow in the forecast period. The future outlook and applications influence the demand for the product.

- By end use, the industrial tools & machinery segment dominated the market in 2024. The industrial tools & machinery segment held a 37% share in the market in 2024. The key benefits and applications fuel the growth of the market.

- By end use, the medical & healthcare segment is expected to grow in the forecast period. The growing application of implants and other devices and methods fuels the growth.

- By coating thickness, the 1–5 microns segment dominated the market in 2024. The plastic segment held a 45% share in the market in 2024. Extensively used in electronics, which fuels the growth.

- By coating thickness, the <1 micron segment is expected to grow in the forecast period. Excellent surface hardness and thermal properties propel the growth and support the expansion.

- By distribution channel, the direct sale (OEM) segment dominated the market in 2024. The plastic segment held a 62% share in the market in 2024. The easy accessibility in real time drives the growth of the market.

- By distribution channel, the online sales segment is expected to grow in the forecast period. the convenience offered increases the growth of the market.

Market Overview

Rising Demand For Durable Materials: U.S. Diamond Coatings Market To Expand

The U.S. Diamond Coatings Market refers to the production, application, and sale of coatings composed of polycrystalline or nanocrystalline diamond films typically deposited using techniques such as chemical vapor deposition (CVD) across diverse industrial and consumer sectors. These coatings significantly enhance the hardness, thermal conductivity, chemical resistance, and wear life of substrates, including metals, ceramics, semiconductors, and polymers. The market primarily serves end-uses in cutting tools, electronics, medical devices, optical components, and aerospace systems.

What Are The Key Growth Drivers Responsible For The Growth Of The U.S. Diamond Coatings Market?

The US diamond coatings market is mainly driven by increasing demand for high-performance materials, technological improvements in coating processes, and growth in industries like medical devices and industrial manufacturing. Additionally, rising investments in R&D and the push for eco-friendly manufacturing methods also support market expansion. A key driver is the need for biocompatible, wear-resistant materials in implants and surgical tools. R&D plays a vital role in developing new applications, enhancing coating techniques, and boosting performance. These factors are some of the major drivers that support the growth and expansion of the market.

Market Trends

- Advanced Deposition Techniques: Ongoing progress in CVD and PVD technologies enhances coating quality and adhesion, broadening application possibilities.

- Focus on Biocompatibility: Research efforts are aimed at improving the biocompatibility of diamond coatings for medical implants.

- Sustainability: The industry is exploring sustainable practices, including the use of eco-friendly materials and processes.

- Rising Demand Across Sectors: The market's growth is supported by increasing demand from the medical, automotive, and electronics industries.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 540.66 Tons |

| Expected Volume by 2034 | 945.31 Tons |

| Growth Rate from 2025 to 2034 | CAGR 6.40% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Technology , By Substrate Material, By Product Type, By End-use Industry, By Coating Thickness, By Distribution Channel, |

| Key Companies Profiled | Advanced Diamond Technologies, Inc., D-Coat GmbH (U.S. subsidiary) , SP3 Diamond Technologies , Blue Wave Semiconductors , NeoCoat SA (U.S. operations), CemeCon Inc. , Element Six (De Beers Group) , Crystalline Mirror Solutions , Dymatec USA , J&M Diamond Tool , Sandvik Hyperion (Hyperion Materials & Technologies), Morgan Advanced Materials, Ionbond (U.S. division), United Protective Technologies, LLC, NanoLab Inc. , Startech Instruments Inc. , Radiant Diamond Technology , Duralar Technologies , KISCO Ltd. (U.S. presence), Plasmatec USA |

Market Opportunity

What Are The Key Growth Opportunities Responsible For The Growth Of The U.S. Diamond Coatings Market?

The U.S. diamond coatings market is experiencing robust growth with opportunities across sectors like electrical and electronics, mechanical, industrial, automotive, and medical. This growth stems from diamond coatings' unique properties, such as hardness, durability, and chemical inertness, which make them suitable for diverse applications. Advances in chemical vapor deposition (CVD) and physical vapor deposition (PVD) are expanding application areas and enhancing cost-efficiency. This creates a great opportunity for the growth and expansion of the market.

Market Challenges

What Are The Key Challenges That Limit The Growth Of The US Diamond Coating Market?

The market faces hurdles, including high manufacturing costs, difficulties in ensuring uniform coating thickness and quality, and limited awareness among potential users about the advantages of diamond coatings. There is also a need for skilled labor, significant capital investment, and competition from substitute materials. In particular, the scarcity of trained professionals in the country can impede production scaling and compromise coating quality. These factors limit the growth and hinder the expansion of the market.

Segmental Insights

Technology Insights

How Did The Chemical Vapor Deposition (CVD) Segment Dominate The U.S. Diamond Coatings Market In 2024?

The chemical vapor deposition (CVD) segment dominated the market in 2024. CVD is a process or technology that offers a product with high hardness, wear resistance, and thermal conductivity. The growth of the market is driven by the growing benefits offered, like enhanced properties, precision coating, and versatile applications in dental tools, micro-drills, and optical components, which increases the demand for the market. The key advantages, like high hardness and wear resistance, high thermal conductivity, chemical inertness, good adhesion, and tailored properties, support the growth and expansion of the market.

The electrochemical deposition segment expects significant growth in the U.S. diamond coatings market during the forecast period. It is a process or technology that uses an electric field for the deposition of materials and helps in creating wear-resistant and corrosion-resistant coatings, which enhance properties and attract consumers, helping in the growth of the market. The key properties and applications, like corrosion protection, wear resistance, and room temperature processing, fuel the growth of the market.

- For Instance, Ni-W/diamond composite coatings have shown improved hardness and wear resistance due to the incorporation of diamond particles in the nickel-tungsten matrix.

Substrate Material Insights

How Did Metal Segment Dominate The U.S. Diamond Coatings Market In 2024?

The metals segment dominated the market in 2024. It is achieved through CVD techniques, where a gaseous mixture that contains carbon is activated, which helps deposit a diamond layer on the substrate. Commonly used metals are reactive metals, non-reactive metals, and alloys. The key applications, like heat sinks, optical windows, and cutting tools which also helps in adhesion boosts the demand for the market and also contributes in the expansion of the market.

The polymers segment expects significant growth in the U.S. diamond coatings market during the forecast period. The growth of the market is driven by the growing demand for materials and procedures with enhanced properties like hardness, wear resistance, and biocompatibility, which improves the demand and growth of the market. The benefits offered, like wear resistance, and applications like surgical instruments or in microelectromechanical systems (MEMS), boost the growth and expansion of the market.

Product Type Insights

Which Product Segment Dominates The U.S. Diamond Coatings Market In 2024?

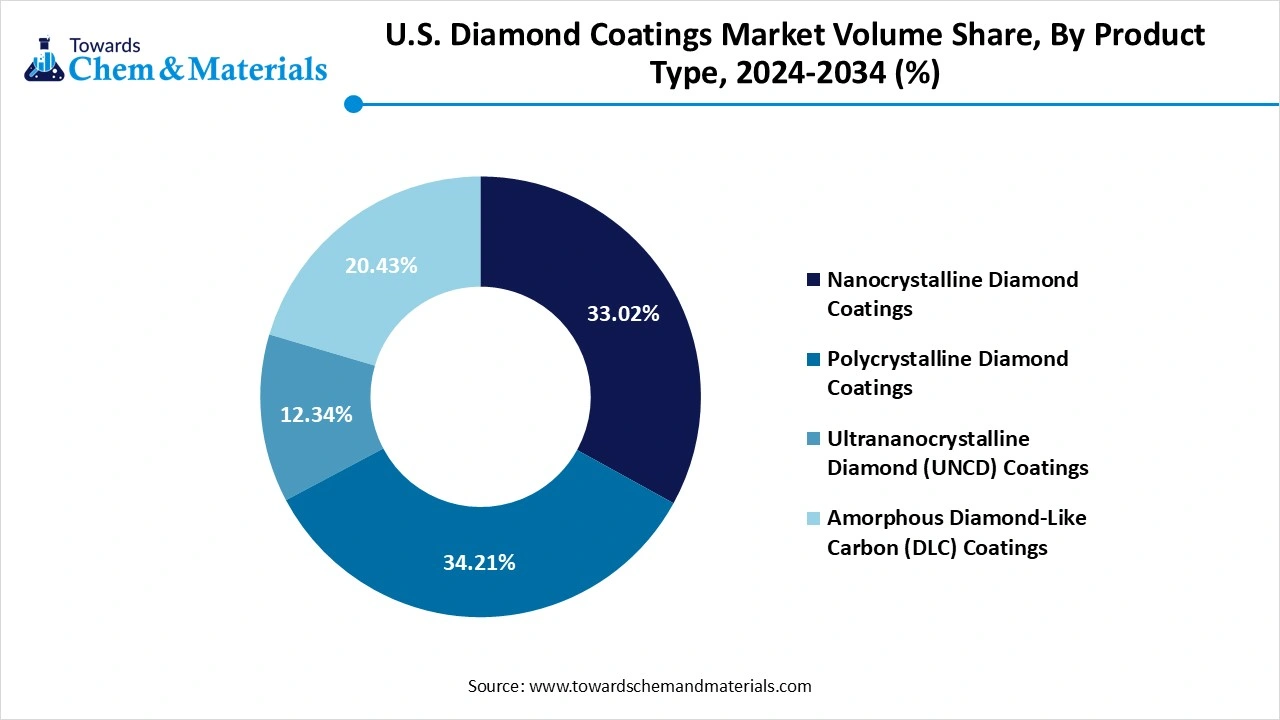

The polycrystalline diamond coatings segment dominated the market in 2024. This is made under high-pressure, high-temperature conditions, which makes them extremely hard and ideal cutting tools for manufacturing. The growth of the segment is driven by the growing and important key features and properties, like high hardness, wear resistance, chemical inertness, biocompatibility, and versatile deposition, making it an ideal choice for many, which is increasing the demand for the product. The growing applications, like cutting tools, medical implants, protective coatings, and optical components, such as x-ray lithography masks, boost the growth and expansion of the market.

The ultra-nanocrystalline diamond coatings segment expects significant growth in the U.S. diamond coatings market during the forecast period. The unique combination makes it a preferred choice by consumers and manufacturers due to its applications. The growing key benefits and properties like high hardness, wear resistance, low friction coefficient, chemical inertness, biocompatibility, electrical conductivity, and uniform coating influence the growth of the market. The growing applications in industries, medical, and electronics also support the expansion of the market.

U.S. Diamond Coatings Market Volume Share, By Product Type, 2024-2034 (%)

| By Product Type | Volume Share, 2024 (%) | Market Volume Tons - 2024 | Volume Share, 2034 (%) | Market Volume Tons - 2034 | CAGR (2025 - 2034) |

| Nanocrystalline Diamond Coatings | 33.02% | 167.78 | 23.53% | 222.43 | 3.18% |

| Polycrystalline Diamond Coatings | 34.21% | 173.83 | 32.12% | 303.63 | 6.39% |

| Ultrananocrystalline Diamond (UNCD) Coatings | 12.34% | 62.70 | 22.34% | 211.18 | 14.45% |

| Amorphous Diamond-Like Carbon (DLC) Coatings | 20.43% | 103.81 | 22.01% | 208.06 | 8.03% |

| Total | 100% | 508.12 | 100% | 945.31 | 6.40% |

End-Use Industry Insights

Which End Use Segment Dominates the U.S. Diamond Coatings Market In 2024?

The industrial tools & machinery segment dominated the market in 2024. The enhanced performance and durability due to the enhanced and improved hardness, wear resistance, and low friction make it an ideal product in the industry, which fuels the growth of the market. The increased applications in dies, mechanical components, precision machining, and cutting tools influence the growth of the market. The key benefits offered by the product, like chemical resistance, thermal stability, enhanced durability, and improved performance, boost the growth and expansion of the market in the U.S.

The medical & healthcare segment expects significant growth in the U.S. diamond coatings market during the forecast period. They are extensively used for implants, biosensors, surgical tools, drug delivery, and neural interfaces. The future directions, like advanced manufacturing, functionalization and targeted drug delivery increases the growth of the market. the advantages offered like biocompatibility, hardness, wear resistance, chemical inertness, surface modification and hemocompatibility makes it suitable for medical applications. These factors increase the demand and contribute to the growth and expansion of the market.

Coating Thickness Insights

Which Coating Thickness Segment Dominates the U.S. Diamond Coatings Market In 2024?

The 1-5 micron segment dominated the market in 2024. The 1–5 micron coating thickness segment in the US diamond coating market is witnessing steady growth due to rising demand in electronics, precision tools, and medical devices. These ultra-thin coatings offer superior hardness, wear resistance, and thermal conductivity while maintaining dimensional accuracy. The segment benefits from widespread adoption of CVD technology for high-precision applications. Increasing use in semiconductors and surgical instruments continues to fuel market expansion within this thickness category.

The <1 micron segment expects significant growth in the U.S. diamond coatings market during the forecast period. The <1 micron coating thickness segment in the US diamond coating market is gaining traction, particularly in microelectronics, optics, and MEMS devices. These ultra-thin coatings provide excellent surface hardness and thermal properties without altering component dimensions. Ideal for nanoscale applications, <1 micron coatings enhance durability and performance of delicate components. Advancements in nanotechnology and CVD processes are driving growth, making this segment essential for precision-driven industries demanding high-performance surface solutions.

Distribution Channel Insights

How Did Direct Sales (OEMs) Segment Dominate The U.S. Diamond Coatings Market In 2024?

The direct sales (OEMs) segment dominated the market in 2024. The growth of the market is driven by strong partnerships between coating service providers and original equipment manufacturers. OEMs in sectors like aerospace, electronics, and medical devices prefer direct sourcing to ensure quality control, customization, and timely delivery. This channel supports tailored coating solutions for precision components and fosters long-term contracts. The growing demand for high-performance, application-specific coatings continues to strengthen the OEM-focused distribution model.

The online sales segment expects significant growth in the U.S. diamond coatings market during the forecast period. The segment represents a small but emerging distribution channel, primarily focused on consumer and automotive applications. These platforms offer diamond-infused or nano-ceramic coating kits targeted at DIY users for surface protection, especially in vehicle detailing. The growing industrial use, growing e-commerce adoption, and awareness are gradually expanding the reach of diamond-based protective solutions online.

Recent Developments

- In February 2025, Gemini Industries, Inc., a producer of wood coating solutions, acquired Diamond Vogel’s Industrial Wood division. This milestone highlights Gemini’s dedication to enhancing quality, innovation, and service within the wood coatings sector.(Source: www.coatingsworld.com)

- In April 2025, Tesla (TSLA) launched a new premium paint called Diamond Black for the North American versions of the Model Y and Model 3. The company announced the new color through CEO Elon Musk on X (formerly Twitter). Tesla shared a teaser video featuring close-up shots of the shiny, metallic black paint, showcasing the new addition.(Source: www.teslaoracle.com)

Top Companies List

- Advanced Diamond Technologies, Inc.

- D-Coat GmbH (U.S. subsidiary)

- SP3 Diamond Technologies

- Blue Wave Semiconductors

- NeoCoat SA (U.S. operations)

- CemeCon Inc.

- Element Six (De Beers Group)

- Crystalline Mirror Solutions

- Dymatec USA

- J&M Diamond Tool

- Sandvik Hyperion (Hyperion Materials & Technologies)

- Morgan Advanced Materials

- Ionbond (U.S. division)

- United Protective Technologies, LLC

- NanoLab Inc.

- Startech Instruments Inc.

- Radiant Diamond Technology

- Duralar Technologies

- KISCO Ltd. (U.S. presence)

- Plasmatec USA

Segments Covered

By Technology

- Chemical Vapor Deposition (CVD)

- Microwave Plasma CVD

- Hot Filament CVD

- Pulsed Laser CVD

- Direct Current (DC) Arc CVD

- Physical Vapor Deposition (PVD)

- Thermal Spray

- Electrochemical Deposition

- Atomic Layer Deposition (ALD)

By Substrate Material

- Metals

- Tungsten Carbide

- Stainless Steel

- Aluminum

- Titanium

- Ceramics

- Silicon & Semiconductor Materials

- Polymers

- Glass & Optical Substrates

- Composites

By Product Type

- Nanocrystalline Diamond Coatings

- Polycrystalline Diamond Coatings

- Ultrananocrystalline Diamond (UNCD) Coatings

- Amorphous Diamond-Like Carbon (DLC) Coatings

By End-use Industry

- Electronics & Semiconductors

- Wafer Processing Equipment

- Heat Sinks & Packaging

- MEMS

- Aerospace & Defense

- Turbine Blades

- Optical Components

- Automotive

- Engine Components

- Fuel Injectors

- Medical & Healthcare

- Surgical Tools

- Implants

- Diagnostic Devices

- Industrial Tools & Machinery

- Cutting Tools (Drills, End Mills)

- Wear-resistant Components

- Bearings & Seals

- Optics & Photonics

- Infrared Windows

- Laser Optics

- Energy Sector

- Oil & Gas Drilling Equipment

- Nuclear Components

By Coating Thickness

- <1 Micron

- 1–5 Microns

- 5–20 Microns

- >20 Microns

By Distribution Channel

- Direct Sales (OEMs)

- Distributors

- Online Sales