Content

Transparent Plastics Market Size and Growth 2025 to 2034

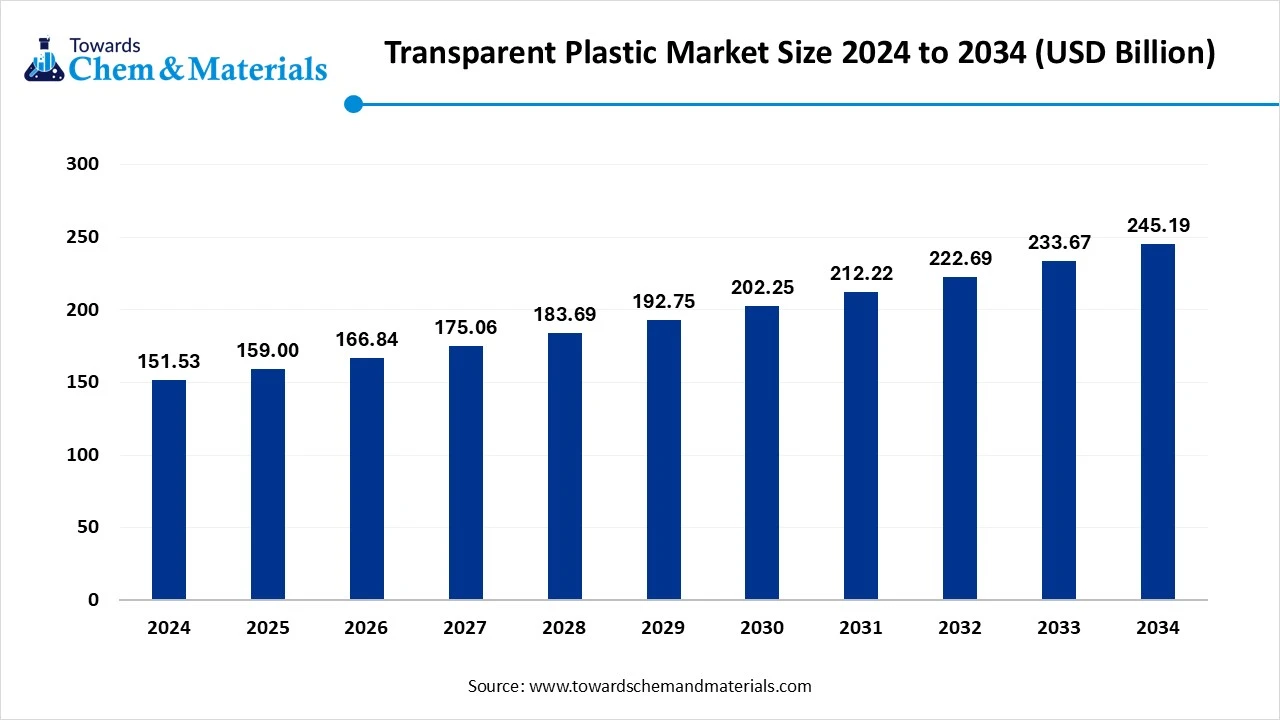

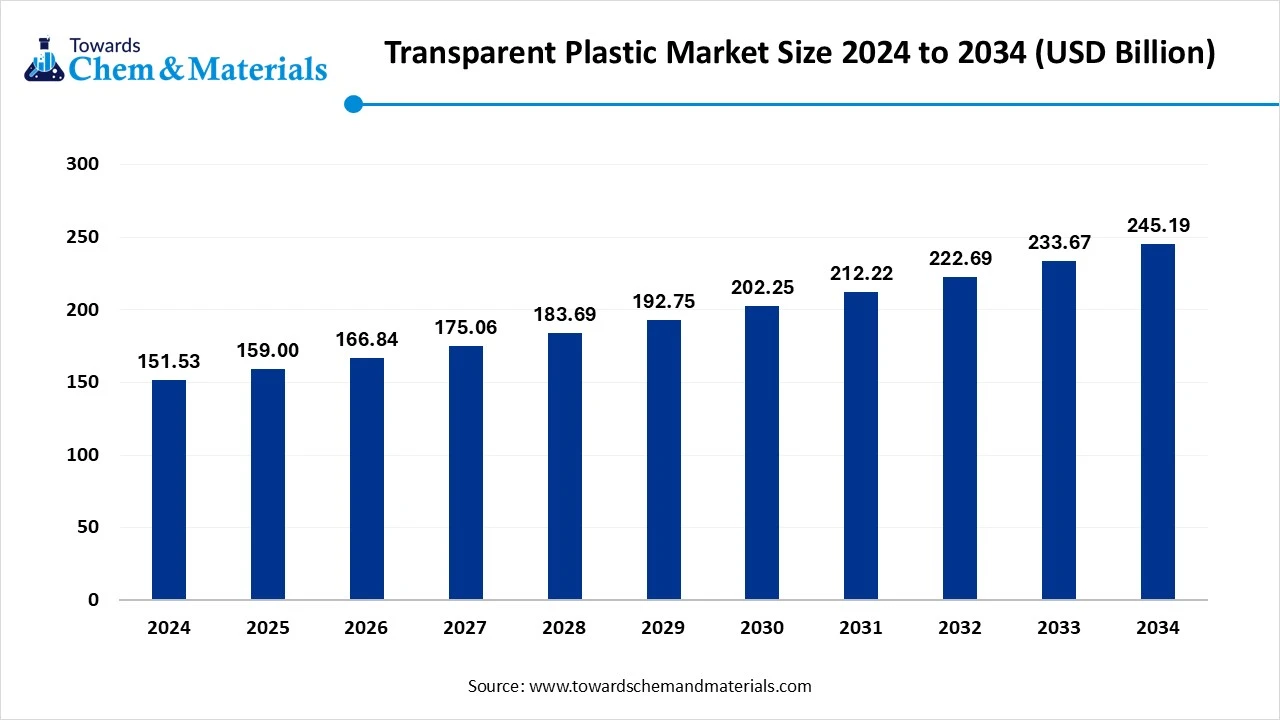

The global transparent plastics market size was reached at USD 151.53 billion in 2024 and is expected to be worth around USD 245.19 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.93% over the forecast period 2025 to 2034. The growth of the market is driven by the growing demand from various industries, particularly packaging, due to its properties and applications, which fuel the growth of the market.

Key Takeaways

- By region, Asia Pacific dominated the market in 2024. The Asia Pacific region held a 45% share in the market in 2024. The rapid industrialization and urbanization fuel the growth.

- By region, North America is expected to have significant growth in the market in the forecast period. The government initiatives and shift towards sustainability drive the growth.

- By polymer type, the polycarbonate (PC) segment dominated the market in 2024. The polycarbonate (PC) segment held a 30% share in the market in 2024. It is used in the automotive industry due to its durability, which fuels the growth.

- By polymer type, the polymethyl methacrylate (PMMA) segment is expected to grow significantly in the market during the forecast period. Used due to its excellent optical transparency and surface hardness, influencing growth.

- By form, the rigid transparent plastics segment dominated the market in 2024. The rigid transparent plastics segment held a 65% share in the market in 2024. The high strength and stability drive the growth of the market.

- By form, the flexible transparent plastics segment is expected to grow in the forecast period. The excellent bendability and lightweight properties make it a preferred choice.

- By manufacturing process, the injection molding segment dominated the market in 2024. The injection molding segment held a 40% share in the market in 2024. Extensive use in medical devices supports the growth.

- By manufacturing process, the thermoforming segment is expected to grow in the forecast period. Good optical clarity makes it an ideal choice for various industries.

- By application, the packaging segment dominated the market in 2024. The packaging segment held a 35% share in the market in 2024. High clarity, impact resistance, and barrier properties influence the growth.

- By application, the automotive & transportation segment is expected to grow in the forecast period. Flexible design and a growing industry fuel the growth of the market.

- By end-use industry, the healthcare segment is expected to grow in the forecast period. The key properties and benefits support the growth of the market.

- By distribution channel, the direct sales to the OEMs segment dominated the market in 2024. The direct sales to the OEMs segment held a 55% share in the market in 2024. The supply and quality of application fuels the growth.

- By distribution services, the online industrial platforms segment is expected to grow in the forecast period. The convenience and affordability drive the growth of the market.

Market Overview

Rising Demand For Durable Materials: Transparent Plastics Market To Expand

The transparent plastics market covers the production, processing, and sale of polymer materials that allow light to pass through with minimal scattering, offering optical clarity along with lightweight, shatter resistance, and design flexibility. These plastics include both amorphous and crystalline grades, manufactured via processes such as injection molding, extrusion, blow molding, and thermoforming.

Transparent plastics are used in packaging, construction, automotive, electronics, healthcare, and consumer goods due to their durability, chemical resistance, and cost-effectiveness compared to glass. Common transparent plastics include Polycarbonate (PC), Polymethyl Methacrylate (PMMA), Polystyrene (PS), Polyvinyl Chloride (PVC), and Transparent Polypropylene (PP).

What Are The Key Growth Drivers That Support The Growth Of The Transparent Plastics Market?

The growth of the market is driven by the increasing demand from the packaging industry to enhance product visibility, convenience, and aesthetics, growing demand from the food and beverage industry for packaging, and from the pharmaceutical industry for packaging medications and healthcare products, which fuels the growth of the market. The growing demand from various industries like the automotive industry, construction, and medical and healthcare further boosts the growth of the market. The growing demand for durable and lightweight properties for enhancing innovative and developed products boosts the growth of the market.

Market Trends

- The growing demand for recycled transparent plastics and the adoption of recycled plastics fuel the growth of the market.

- Increasing adoption of transparent plastics in healthcare for the packaging of medical devices and medications influences the growth.

- The rising adoption of eco-friendly packaging solutions due to growing awareness of increasing environmental concerns fuels the growth.

- The technological advancements, like innovation in materials science and manufacturing processes, further fuel the growth of the market.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 159.00 billion |

| Expected Size by 2034 | USD 245.19 billion |

| Growth Rate from 2025 to 2034 | CAGR 5.95% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Polymer Type, By Form, By Manufacturing Process, By Application, By End-Use Industry, By Distribution Channel, By Region |

| Key Companies Profiled | Dow, Inc., SABIC, BASF SE, Covestro AG, PPG Industries, Inc., LyondellBasell Industries N.V., DuPont de Nemours, Inc., INEOS Group Limited, LANXESS AG, Berry Global, Cosmo Films, Amcor plc |

Market Opportunity

What Are The Key Growth Opportunities That Support The Growth Of The Transparent Plastics Market?

The key growth opportunity that supports the growth of the market is the growing demand for bio-based transparent plastics due to growing environmental concerns and sustainability initiatives drive the growth of the market. The innovation in 3D printing and nanotechnology, like the creation of complex and intricate designs for application in various industries, fuels the growth of the market.

The expansion in emerging markets due to increasing disposable income resulting from increased population boosts the demand for transparent plastics in various applications, creating an opportunity for the growth and expansion of the market.

Market Challenge

What Are The Key Challenges That Hinder The Growth Of The Transparent Plastics Market?

The key challenge that hinders the growth of the market is the raw material price volatility, as the cost of raw materials like crude oil and natural gas is high and fluctuating, which impacts the profitability and also leads to price instability, hindering the growth of the market. The other key challenges are environmental concerns, regulatory compliance, competition from alternatives, and sustainability trends that hinder the growth and expansion of the market.

Regional Insights

How Did Asia Pacific Form The Transparent Plastics Market In 2024?

Asia Pacific dominated the transparent plastics market in 2024. The growth of the market is driven by the growing demand from various sectors due to rapid industrialization and urbanization, like packaging, automotive, construction, and electronics, which increases the growth. The increasing disposable income and increased consumption of packaged food in the region also influence the growth of the market in the region. The key players, Dow Chemical Company, DuPont, SABIC, LyondellBasell Industries N.V., BASF SE, Covestro, PPG Industries, Inc., INEOS, Evonik Industries AG, and LANXESS, also play a significant role in the market due to product innovation and to promotion of sustainable material use, which influences the growth and expansion of the market in the region.

China Is Experiencing Significant Growth Driven By the Increasing Demand From Various Sectors.

China is experiencing significant growth driven by increasing demand from various sectors, including electronics, construction, and especially packaging, due to increased consumption of packaged food, which increases the demand for transparent plastics from the food and beverages industries, which contributes to the growth of the market. The demand for cost-effective solutions and demand for transparent plastics due to their properties like lightweight and durability, which are applicable in various applications, is influencing the growth of the market in the country. The major and key driver is China's large and expanding manufacturing base, which aligns with the supportive government policies supporting the growth of the market.

North America Has Seen A Significant Growth, Driven By Government Initiatives.

North America is expected to have significant growth in the transparent plastics market in the forecast period. The growth of the market is driven by the growing government initiatives and policies for infrastructure development, and the shift towards sustainability fuels the growth of the market in the region. The growing healthcare and construction sectors increase the demand for high clarity and biocompatible plastics in pharmaceutical and medical devices, fueling the growth of the market further. The companies in North America are also investing in the chemical recycling infrastructure and adopting sustainable practices, like depolymerization, to meet circular economy goals, which boosts the growth and expansion of the market in the country.

The U.S. Has Seen Steady Growth, Driven By Growing Key Players In The Country.

The U.S. has seen steady growth, and the growth of the market is driven by the growing and expanding industrial sector and major contributions by the key players and strategic partnerships, like the collaboration between SMX and Aegis Packaging to improve recyclability and traceability of plastic packaging, which influences the growth of the market. The shift towards sustainable packaging and the development of biobased and recycled transparent plastics fuel the growth and expansion of the market in the country.

- The World shipped out 922 Transparent Plastic shipments from Aug 2023 to July 2024 (TTM). The exports made by 285 global exporters to 252 buyers, showing a growth rate of 14% over the previous 12 months.(Source: www.volza.com)

- Globally, China, Russia, and Germany are the major 3 exporters of Transparent Plastic. China is the global leader in Transparent Plastic exports with 634 shipments, Russia with 556 shipments, and Germany in 3rd place with 143 shipments.(Source: www.volza.com)

Segmental Insights

Polymer Type Insights

Which Polymer Type Segment Dominated The Transparent Plastics Market In 2024?

The polycarbonate (PC) segment dominated the market in 2024. Polycarbonate is a key segment in the market, valued for its exceptional impact resistance, high optical clarity, and thermal stability. It is extensively used in automotive glazing, electronic displays, medical devices, and construction applications like skylights and safety windows. Its lightweight yet durable properties make it a preferred alternative to glass, while its ease of molding supports complex designs for both functional and aesthetic product requirements.

The polymethyl methacrylate (PMMA) segment expects significant growth in the market during the forecast period. Polymethyl methacrylate, also known as acrylic, is valued for its excellent optical transparency, weather resistance, and surface hardness. It is widely used in signage, automotive lighting, aquariums, and architectural applications where aesthetics and durability are essential. PMMA offers superior UV stability compared to other transparent plastics, making it ideal for outdoor uses, while its lightweight and shatter-resistant nature provides a safer, more versatile alternative to glass.

Form Insights

How Did The Rigid Transparent Plastics Segment Dominate The Transparent Plastics Market In 2024?

The rigid transparent plastics segment dominated the market in 2024. Rigid transparent plastics are characterized by their high strength, dimensional stability, and resistance to impact, making them suitable for structural and protective applications. They are widely used in automotive components, construction glazing, eyewear lenses, and consumer electronics. These plastics, such as polycarbonate and PMMA, provide superior optical clarity while maintaining robustness, ensuring long service life and safety in demanding environments where both transparency and mechanical performance are critical.

The flexible transparent plastics segment expects significant growth in the transparent plastics market during the forecast period. Flexible transparent plastics offer high optical clarity combined with excellent bendability and lightweight properties, making them ideal for applications requiring both transparency and flexibility. Commonly used in packaging films, medical tubing, flexible displays, and protective coverings, these materials ensure durability, moisture resistance, and ease of processing. Their adaptability to complex shapes and compatibility with various manufacturing methods drive their use across consumer goods, healthcare, and electronics sectors.

Manufacturing Process Insights

Which Manufacturing Process Segment Dominated The Transparent Plastics Market In 2024?

The injection molding segment dominated the market in 2024. Injection molding is a widely used manufacturing process for transparent plastics, enabling high-volume production of precise and complex shapes with excellent optical clarity. This method ensures consistent quality, tight tolerances, and smooth surface finishes, making it suitable for automotive lenses, medical devices, consumer electronics casings, and lighting components. Its cost efficiency, material versatility, and ability to produce intricate designs drive significant demand in multiple high-performance end-use industries.

The thermoforming segment expects significant growth in the transparent plastics market during the forecast period.

Thermoforming involves heating transparent plastic sheets until pliable and shaping them into desired forms using molds, followed by cooling to retain the structure. This process is ideal for producing large, lightweight, and impact-resistant components with good optical clarity. Widely used in packaging, displays, signage, and automotive interior parts, thermoforming offers flexibility in design, lower tooling costs, and faster prototyping, making it a preferred choice for custom and medium-scale production.

Application Insights

How Did the Packaging Segment Dominate The Transparent Plastics Market In 2024?

The packaging segment dominated the market in 2024. Transparent plastics are extensively used in packaging to provide visibility of the product, enhance aesthetic appeal, and ensure durability. Materials like polycarbonate and polymethyl methacrylate offer high clarity, impact resistance, and barrier properties against moisture and contaminants. They are used in food containers, blister packs, bottles, and display packaging. The demand is driven by consumer preference for see-through packaging, branding needs, and lightweight alternatives to glass.

The automotive & transportation segment expects significant growth in the market during the forecast period. Transparent plastics are widely used in the automotive and transportation sector for windshields, windows, lighting covers, instrument panels, and interior glazing. Polycarbonate and PMMA offer high impact resistance, lightweight properties, and optical clarity, contributing to improved vehicle efficiency and safety. Their design flexibility enables complex shapes and integration of smart features. Rising adoption of lightweight materials to enhance fuel efficiency and electric vehicle design is boosting market demand.

End-Use Industry Insights

Which End-Use Industry Segment Dominated The Transparent Plastics Market In 2024?

The healthcare segment expects significant growth in the market during the forecast period. The growth of the market is driven by the growing application of transparent plastic in pharmaceutical packaging due to its properties. The high-performance plastic materials demanded for medical devices like polysulfone, PEI, PPSU, and PC increase the growth of the market. The key properties and benefits offered, like visibility, sterilizability, durability, lightweight, cost-effectiveness, and design flexibility, fuel the growth of the market.

Distribution Channel Insights

How Did Direct Sales To The OEMs segment Dominate The Transparent Plastics Market In 2024?

The direct sales to the OEMs segment dominated the market in 2024. In the market, direct sales to original equipment manufacturers (OEMs) ensure consistent supply, customization, and quality control for applications in automotive, electronics, aerospace, and construction. This channel allows manufacturers to collaborate closely with OEMs on product specifications, design integration, and performance testing. The model supports cost efficiency by eliminating intermediaries and is driven by long-term contracts, enabling steady demand and innovation in high-performance transparent plastic solutions.

The online industrial platforms segment expects significant growth in the market during the forecast period. Online industrial platforms are emerging as a key distribution channel in the transparent plastics market, offering buyers rapid access to diverse polymer grades and forms. These platforms enable bulk procurement, price comparison, and global supplier reach, catering to industries such as packaging, automotive, and electronics. Digital channels streamline transactions, reduce procurement lead times, and provide technical data sheets, making them increasingly popular for SMEs and large-scale buyers alike.

Recent Developments

- In July 2025, DataLase, a global leader in photonic printing solutions, announced the launch of new and advanced masterbatch pigment technology along with the launch of dual color masterbatch for clear plastics applications.(Source: www.fdiforum.net)

- In March 2025, the Philippines launched the National Plastic Action Partnership, which is to overcome and tackle plastic waste, supporting recyclability and sustainability, aligning with the circular economy. This is a step towards reducing plastic pollution, setting a pathway for inclusive sustainable development in the Philippines.(Source : www.undp.org)

Transparent Plastics Market Top Companies

- Dow, Inc.

- SABIC

- BASF SE

- Covestro AG

- PPG Industries, Inc.

- LyondellBasell Industries N.V.

- DuPont de Nemours, Inc.

- INEOS Group Limited

- LANXESS AG

- Berry Global

- Cosmo Films

- Amcor plc

Segments Covered

By Polymer Type

- Polycarbonate (PC)

- Polymethyl Methacrylate (PMMA)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Transparent Polypropylene (PP)

- Others (COP/COC, TPU, etc.)

By Form

- Rigid Transparent Plastics

- Flexible Transparent Plastics

By Manufacturing Process

- Injection Molding

- Extrusion

- Blow Molding

- Thermoforming

- Casting

By Application

- Packaging (food, beverage, cosmetics, pharmaceuticals)

- Building & Construction (windows, skylights, panels)

- Automotive & Transportation (windshields, lighting, interiors)

- Electrical & Electronics (screens, covers, lenses)

- Medical & Healthcare (syringes, diagnostic devices)

- Consumer Goods (furniture, eyewear, sports equipment)

By End-Use Industry

- Packaging

- Construction

- Automotive

- Electrical & Electronics

- Healthcare

- Consumer Products

By Distribution Channel

- Direct Sales to OEMs

- Plastic Resin Distributors

- Online Industrial Platforms

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait