Content

What is the Specialty Alumina Market Size?

The global specialty alumina market size was valued at USD 4.55 billion in 2024 and is expected to hit around USD 11.12 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.35% over the forecast period from 2025 to 2034. The global surge in the automotive and ceramic sectors has fostered industry resilience and long-term potential.

Key Takeaways

- By region, Asia Pacific dominated the market in 2024.

- By region, North America expects the fastest growth in the market during the forecast period.

- By type, the calcined alumina segment dominated the market in 2024.

- By type, the activated alumina segment is expected to grow at the fastest rate in the market during the forecast period.

- By particle size type, the fine segment dominated the market in 2024.

- By particle size type, the coarse segment is expected to grow at the fastest rate in the market during the forecast period.

- By application, the refractory materials segment dominated the market in 2024.

- By application type, the ceramics segment is expected to grow at the fastest rate in the market during the forecast period.

Precision-Engineered Purity: Why Specialty Alumina Matters More Than Ever

The specialty alumina is known as the specially processed, higher purity forms of the alumina oxide. Also, specialty alumina has gained major industry attention akin to its application in major industries like electronics, ceramics, and polishing materials, as per the latest observation. Furthermore, having the controlled particle size, purity, and surface is for the better performance; the specialty alumina is considered an essential element in the relevant procedure industries nowadays.

Specialty Alumina Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the increasing adoption of electronics, electric vehicles, and renewable energy systems is heavily supporting the demand-driven expansion in the sector in the current period. Also, the greater push for durable and lightweight materials in the aerospace and automotive sectors, the specialty alumina is reshaping market dynamics and increasing opportunity windows in the coming years.

- Sustainability Trends: The greater shift towards the low-carbon refining technologies from the alumina manufacturers is aligning with market trends to boost industry potential in the past few years. Moreover, some of the key players are recycling bauxite residues while reusing the alumina dust has boosted the overall capacity of the industry.

- Global Expansion: The developed regions have seen active investments in clean energy projects and advanced manufacturing in recent years. Furthermore, a specific region like the Asia Pacific is leading with higher production initiatives, while regions like Europe and North America are focusing on the development of high-end alumina for electric vehicles and EV batteries in recent years.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 5.44 Billion |

| Expected Size by 2034 | USD 11.12 Billion |

| Growth Rate from 2025 to 2034 | CAGR 9.35% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By Particle Size, By Application, By Region |

| Key Companies Profiled | Alteo Alumina, Traxys S.à.r.l, Huber Engineered Materials, Imerys Fused Minerals Villach GmbH, Nabaltec AG, Silkem d.o.o., MOTIM Electrocorundum Ltd., Sasol Germany GmbH, Hindalco, Resonac, NICHE Fused Alumina, Carborundum Universal Limited, Axens Group, Other Key Players |

From Heat to Efficiency: The Shift Toward Sustainable Alumina Systems

The developers are enormously shifting towards the green and smart refining methods, which are likely to lead to the emergence of high solutions in the industry in the upcoming years. Also, industry is witnessing another change for traditional high-temperature processes, which are increasingly replaced by hydrothermal systems and energy-efficient plasma systems.

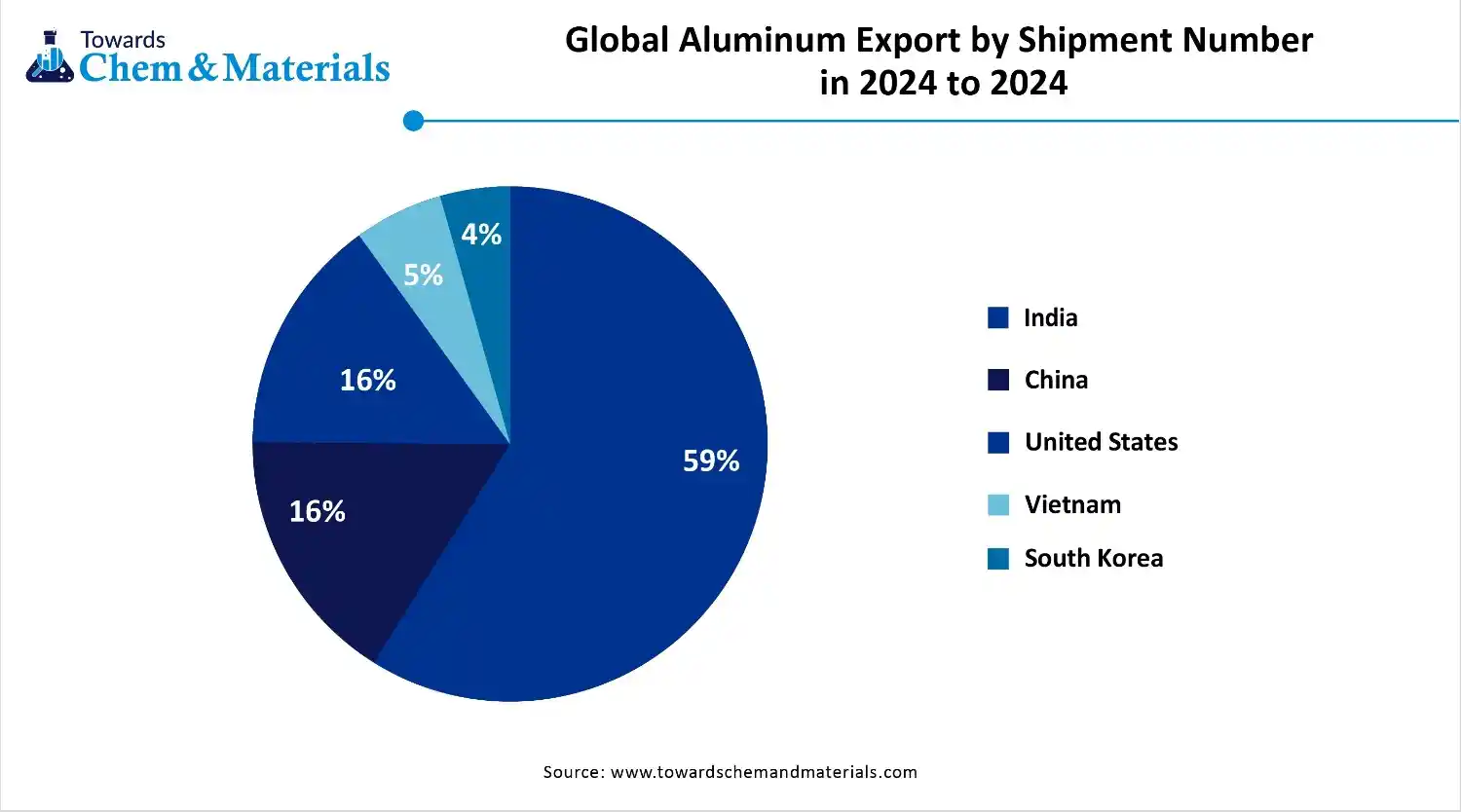

Trade Analysis of the Specialty Alumina Market:

Import, Export, Consumption, and Production Statistics

- The United States imported a heavy amount of aluminum in 2024, which is approximately worth $926 million from China, as per the published report.(Source: www.alcircle.com)

- India has seen in sophisticated export of alumina grain in 2024 to 2025, and 36 shipments have been recorded in the same year.(Source: www.volza.com )

Value Chain Analysis of the Specialty Alumina Market:

- Distribution to Industrial Users : The distribution of specialty alumina to industrial users involves direct sales from major producers, as well as sales through distributors and specialized suppliers.

- Chemical Synthesis and Processing : The chemical synthesis and processing of specialty alumina involve advanced methods to produce high-purity, engineered materials with specific physical properties, unlike the bulk production of metallurgical-grade alumina.

- Regulatory Compliance and Safety Monitoring : Regulatory compliance and safety monitoring in the market are guided by a complex framework of environmental, health, and product-specific standards at both international and national levels.

Specialty Alumina Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| China | Ministry of Industry and Information Technology (MIIT) | Action Plan for the High-Quality Development of the Aluminum Industry (2025–2027) | Tackling overcapacity | Responsible for providing guidance and oversight for the industry, ensuring stable market growth. |

| India | Bureau of Indian Standards (BIS) | The BIS Quality Control Order (QCO) | Ensuring product quality | Sets and enforces mandatory quality control orders (QCOs) for calcined alumina. |

| United States | Environmental Protection Agency (EPA) | Regulations under the Toxic Substances Control Act (TSCA) | Environmental compliance | Creates and enforces regulations to protect human health and the environment. |

| Europe | European Commission (EC) | REACH Regulation (EC No 1907/2006) | implementing strict chemical safety standards | The executive body of the EU that proposes legislation and enforces policies. |

Industry Opportunity Analysis Via Infographic:

Segmental Insights

Type Insights

How did the Calcined Alumina Segment Dominate the Specialty Alumina Market in 2024?

- The calcined alumina segment dominated the market in 2024 due to its excellent hardness, better thermal resistance, and stability. Moreover, by offering precision performance in industrial processes and consistence crystal structure, the calcinated alumina segment has gained major industry attention in recent years.

- The activated alumina segment is expected to grow at a significant rate owing to factors like stronger water absorption, eco-friendly filtration properties, and higher surface area. Also, the activated alumina has been seen in use in applications like gas drying, water treatment, and air purification systems, which is likely to create lucrative opportunities in the sector.

- The fused alumina segment is also notably growing, akin to its high melting point and hardness. Moreover, these factors make fused alumina perfect for applications such as polishing, abrasives, and cutting tools in the current period. Also, the greater need for advanced manufacturing in sectors such as aerospace and automotive is supporting the segment's growth in recent years.

Particle Size Insights

Why does the Fine Segment Dominate the Specialty Alumina Market by Particle Size?

- The fine segment dominated the market in 2024 because it provides superior smoothness, purity, and performance in ceramics, polishing compounds, and electronic components. Fine alumina particles enhance surface finish, improve strength, and ensure better dispersion in coatings and catalysts.

- The coarse segment is expected to grow at a rapid rate due to its growing use in heavy-duty refractories, foundries, and construction materials. Coarse particles provide better mechanical strength and resistance to thermal shock, making them ideal for furnaces, kilns, and insulation linings.

- The medium segment is also notably growing because it balances strength, texture, and processing flexibility. It is widely used in ceramics, polishing, and coatings, where neither extremely fine nor coarse textures are needed. Medium-sized particles help improve product performance without high costs, making them suitable for mid-range industrial applications.

Application Insights

How did the Refractory Materials Segment Dominate the Specialty Alumina Market in 2024?

- The refractory material segment dominated the market in 2024 because alumina's heat resistance and mechanical strength make it ideal for furnaces, kilns, and reactors. It can withstand temperatures over 1,700°C without deforming, protecting equipment from thermal and chemical damage.

- The ceramics segment is expected to grow at the fastest rate because of the surging demand for advanced ceramics in electronics, healthcare, and electric vehicles. Specialty alumina is key ín making technical ceramics that offer high strength, insulation, and wear resistance. As industries move toward lightweight and heat-resistant materials, alumina ceramics are replacing metals in many applications.

- The abrasives segment is notably growing because manufacturing and metalworking industries are increasingly using high-performance alumina abrasives for grinding, polishing, and cutting. Specialty alumina's extreme hardness ensures smooth finishes and extended tool life. The rise of precision machining, automotive repair, and electronics polishing boosts this demand.

Regional Analysis:

Asia Pacific Specialty Alumina Market Trends

Asia Pacific dominated the specialty alumina market in 2024, owing to the greater infrastructure for electronics, LED, and ceramics manufacturing in the region. Moreover, factors like the availability of the bauxite reserves, lower production cost, and sophisticated domestic refining capacity have actively supported the industry's growth in recent years.

China Dominates Specialty Alumina with High Purity Production for Tech Industries

China maintained its dominance in the specialty alumina market due to greater government support for advanced manufacturing and modern manufacturing infrastructure. Moreover, the manufacturers in China are seen under the heavy production of the purity aluminum for semiconductors, lithium-ion batteries, and LED lighting, which is driving the industry growth in the past few years.

North America Specialty Alumina Market Analysis

North America is expected to capture a major share of the specialty alumina market due to rapid innovation initiatives in different sectors, such as aerospace, battery technology, and electric vehicles, in recent years. The regional investment in high-purity alumina and focus on local manufacturing are immediately creating greater industry opportunities in the sector nowadays.

United States Research Investment: Fuel the Future of Sustainable Alumina

The United States is expected to emerge as a prominent country for the market in the coming years, owing to the country is known for its advanced manufacturing infrastructure. Also, several research institutes are seen under the heavy investment for the low-carbon refining processes while pursuing sustainability goals in recent years.

Europe Specialty Alumina Market Trends

Europe is a notably growing region because of factors like electric mobility, greater focus on energy efficiency, and sustainable materials. Also, the manufacturers in sectors like automotive, ceramics, and the electronics industry are heavily demanding high-purity aluminum in recent years, as per the latest survey. Furthermore, the hydrogen fuel sales demand has heavily supported the industry growth of specialty alumina in the past few years.

Germany Accelerates Toward High-Performance Alumina Solutions

Germany is expected to gain a major industry share due to the automotive sector. The automotive manufacturers are seen under a heavy need for precision-grade alumina, which can be used for EV batteries and LEDs. Moreover, in recent years, the country has observed that several research institutes are creating partnerships and collaborations for the innovation and study of nanostructured alumina.

Latin America Specialty Alumina Market Analysis

Latin America is expected to capture a major share of the market due to its abundant raw materials, rising industrialization, and foreign investments. Countries like Brazil and Chile are developing alumina refining capabilities to move beyond raw bauxite exports. The region is also seeing increasing demand from construction, ceramics, and renewable energy sectors.

Brazil Powers Ahead in Low-Emission Specialty Alumina Production

Brazil is expected to emerge as a prominent country for the market in the coming years, owing to its being the largest alumina producer in Latin America and is now shifting toward specialty-grade production. The country's vast bauxite reserves and renewable hydropower base make it ideal for low-emission alumina refining.

Expansion Of Specialty Alumina Market In The Middle East

The specialty alumina market in the Middle East is experiencing steady growth, driven by industrial diversification, rising demand for advanced materials, and investments in downstream manufacturing. Growth is supported by increasing use in electronics, ceramics, and energy applications, particularly in the Gulf Cooperation Council (GCC) countries. However, reliance on imports and limited local production capacity remain key challenges for sustained regional market expansion.

Saudi Arabia Specialty Alumina Market Trends

In Saudi Arabia, the market is growing steadily, supported by industrial diversification, expansion of advanced manufacturing, and rising demand in ceramics, electronics, and energy sectors. These trends indicate increasing domestic utilization of high-purity and specialty alumina, although local production remains limited and the market still depends significantly on imports.

Recent Developments

- In July 2025, Hindalco acquired the American specialty alumina producer for $125M and the newly acquired group name is AluChem, as per the published report by the company recently.(Source: projectblue.com)

Top Specialty Alumina Market Companies

Almatis

Corporate Information

- Almatis GmbH describes itself as a global leader in premium alumina and alumina based products, with over a century of expertise.

- Headquarters: Germany (Giulinistraße 2, 67065 Ludwigshafen am Rhein) according to one company profile.

- Global footprint: It operates approximately 14 sales, research and manufacturing hubs worldwide.

History and Background

- Beginnings: The business traces its roots back to the alumina activities of Alcoa in 1910 Alcoa sold its first specialty alumina for a non metals application.

Evolution: Over decades, the specialty alumina business expanded (tabular alumina developed around 1934 under Alcoa contract) and eventually became Almatis. - Independent company: In March 2004, the specialty chemicals business was spun out from Alcoa and became Almatis as a standalone company.

Key Developments and Strategic Initiatives

- Capacity & facility investments: For example, Almatis announced a multi million dollar investment into its Rotterdam (Netherlands) sintered aggregate operations, aimed at process improvement and supply chain flexibility.

- Global footprint localization: The fully integrated tabular alumina facility in Falta (West Bengal, India) inaugurated around November 2022 to serve Indian & Southeast Asian markets.

Mergers & Acquisitions

- Acquisition of the specialty hydrate business: In 2012, JM Huber Corporation (via its Huber Specialty Hydrates subsidiary) acquired Almatis’ specialty hydrate flame retardant business (Hydral® & SpaceRite® brands) located in Bauxite, Arkansas.

- Ownership transitions (detailed under history): major financial investors and strategic purchasers (Investcorp, DIC, OYAK).

Partnerships & Collaborations

- Strategic collaboration with Çimsa (Turkey) for Calcium Aluminate Cement (CAC) products: announced June 2025. The aim: joint product portfolio (CAC 40, 50, 70, 80), shared supply chain/warehousing, new product development.

- Customer/industry collaboration: Webinars and technical sessions with steelmakers, ceramics industry to co develop solutions such as ultra low soda alumina (XLS/ULS).

Product Launches / Innovations

- The company lists many product launches historically (since 1990) in its “Our Story” timeline: e.g., reactive aluminas 1975, Tabalox 1980, low soda aluminas 1987, polishing aluminas 2010, etc.

- Recent innovation: Introduction of XLS/ULS extra low and ultra low soda aluminas (for ceramics industry) via webinar in 2024.

Key Technology Focus Areas

- Specialty aluminas for demanding applications: refractories (high temperature), ceramics, polishing, glass, specialty industries.

- Material purity & soda content: Many innovations revolve around “ultra low soda” aluminas, fine particle sizes, high purity.

- Sustainability & circular economy: Use of recycled materials, closed circuit water cycles, zero waste approaches.

R&D Organisation & Investment

- R&D and application labs: Multiple global application and development labs (India, China, USA, Germany) support customer development, materials testing.

- Investment commitment: The company publicly states that it is “investing relentlessly in process and product breakthroughs” and emphasises its global investments (e.g., September 2024 investment announcements).

SWOT Analysis

Strengths

- Leading global market position in specialty alumina with over 100 years heritage.

- Broad product portfolio & global manufacturing/supply chain footprint (14 hubs).

- Strong customer collaboration and technical service orientation.

- Sustainability credentials (EcoVadis Gold, Mission NeutrAL roadmap).

- Vertical integration (own feedstock/refinery operations) and localized footprint (e.g., India plant).

Weaknesses

- High capital intensity: manufacturing large alumina facilities requires significant investment.

- Exposure to cyclical end markets (steel, refractories, ceramics) which may see demand fluctuations.

- Complexity of global operations: balancing multiple plants, geographies, regulations.

Opportunities

- Growth in emerging markets (India, Southeast Asia) with increasing demand for refractories, steel, ceramics Almatis is investing in these (Falta plant, etc).

- Sustainability & electric mobility: demand for high performance materials (e.g., polishing, abrasives, battery materials) may open new applications.

- Collaboration/partnerships (e.g., CAC with Çimsa) to expand product reach.

- Product innovations (ultra low soda aluminas, functional fillers) expanding into newer segments.

Threats

- Raw material input volatility (bauxite/alumina feedstock) and energy costs (calcination, sintering). For example, the Rotterdam site is flagged for high natural gas fuel use.

- Competition from other specialty alumina players and possible substitute materials (ceramic alternatives, recycled refractories).

- Regulation/environmental pressures (emissions, carbon footprint) may increase compliance cost.

- End market risks: slowdown in steel/ceramics industries could reduce demand for premium aluminas.

Recent News & Strategic Updates

- September 2025: The Iwakuni (Japan) plant achieved an “Excellence Award for Safety and Health” by the Yamaguchi Labour Bureau.

- June 2025: Strategic collaboration announced with Çimsa for Calcium Aluminate Cement products broadening the product line and leveraging joint supply chain/warehousing.

- Alteo Alumina: A French-based, global leader in specialty aluminas that develops high-value-added products for advanced ceramics.

- Traxys S.à.r.l: A physical commodity trader and merchant that provides supply chain management, logistics, and trading solutions.

- Huber Engineered Materials: Global producer of specialty minerals, chemicals, and biomaterials that manufactures engineered ingredients, including specialty aluminas.

- Imerys Fused Minerals Villach GmbH

- Nabaltec AG

- Silkem d.o.o.

- MOTIM Electrocorundum Ltd.

- Sasol Germany GmbH

- Hindalco

- Resonac

- NICHE Fused Alumina

- Carborundum Universal Limited

- Axens Group

- Other Key Players

Segments Covered in the Report

By Type

- Calcined Alumina

- Activated Alumina

- Aluminum Trihydroxide (ATH)

- Fused Alumina

- White

- Brown

- Boehmite

- Reactive Alumina

- Others

By Particle Size

- Coarse

- Fine

- Ultra-fine

- Medium

By Application

- Refractory Materials

- Ceramics

- Abrasives

- Polishing

- Catalyst

- Others

By Region

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe:

Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

Eastern Europe

Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA