Content

Small Caliber Ammunition Market Size and Growth 2025 to 2034

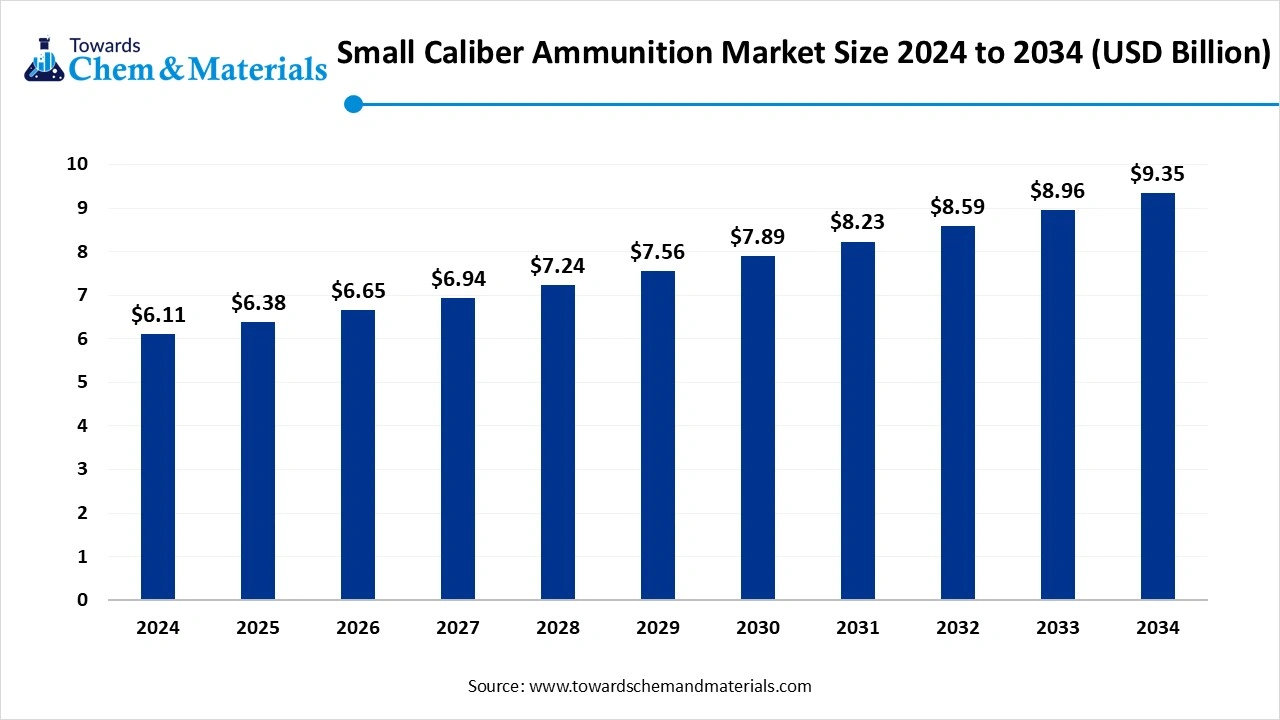

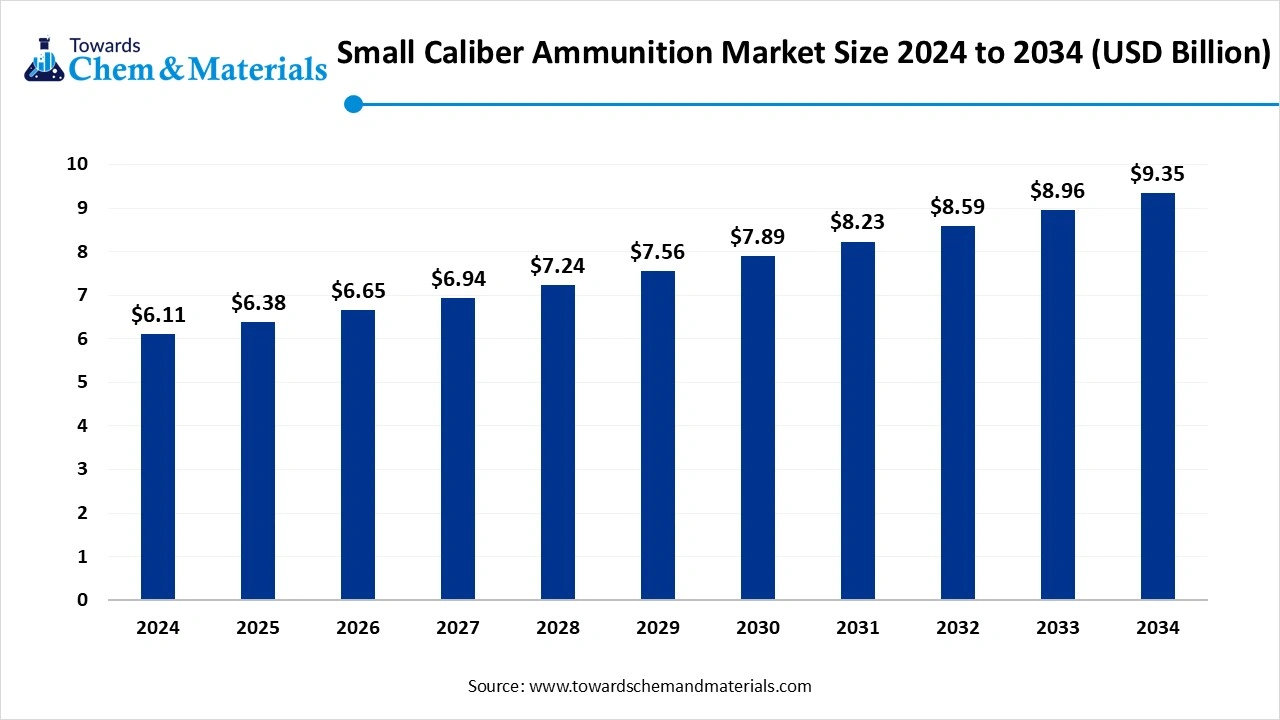

The global small caliber ammunition market size was reached at USD 6.11 billion in 2024 and is expected to be worth around USD 9.35 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.35% over the forecast period 2025 to 2034. The growth of the market is technological advancements with innovation in technologies, government spending, and regional variation influence the demand and growth of the market.

Key Takeaways

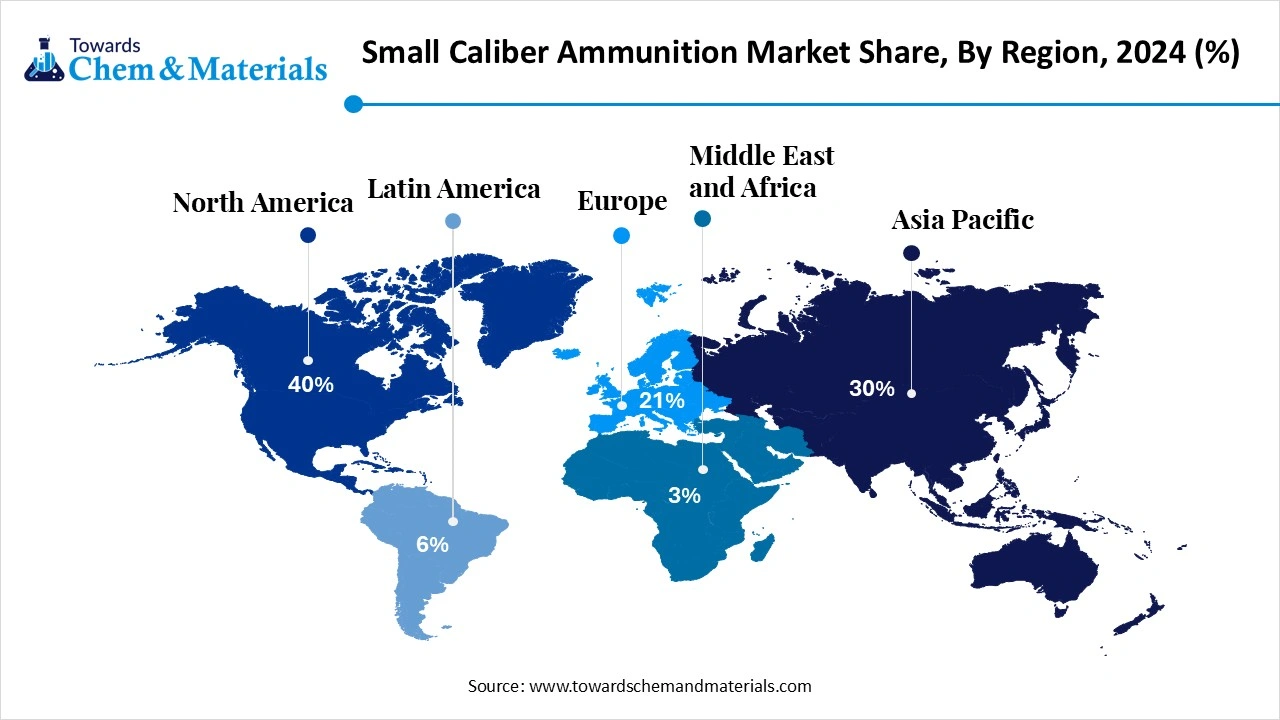

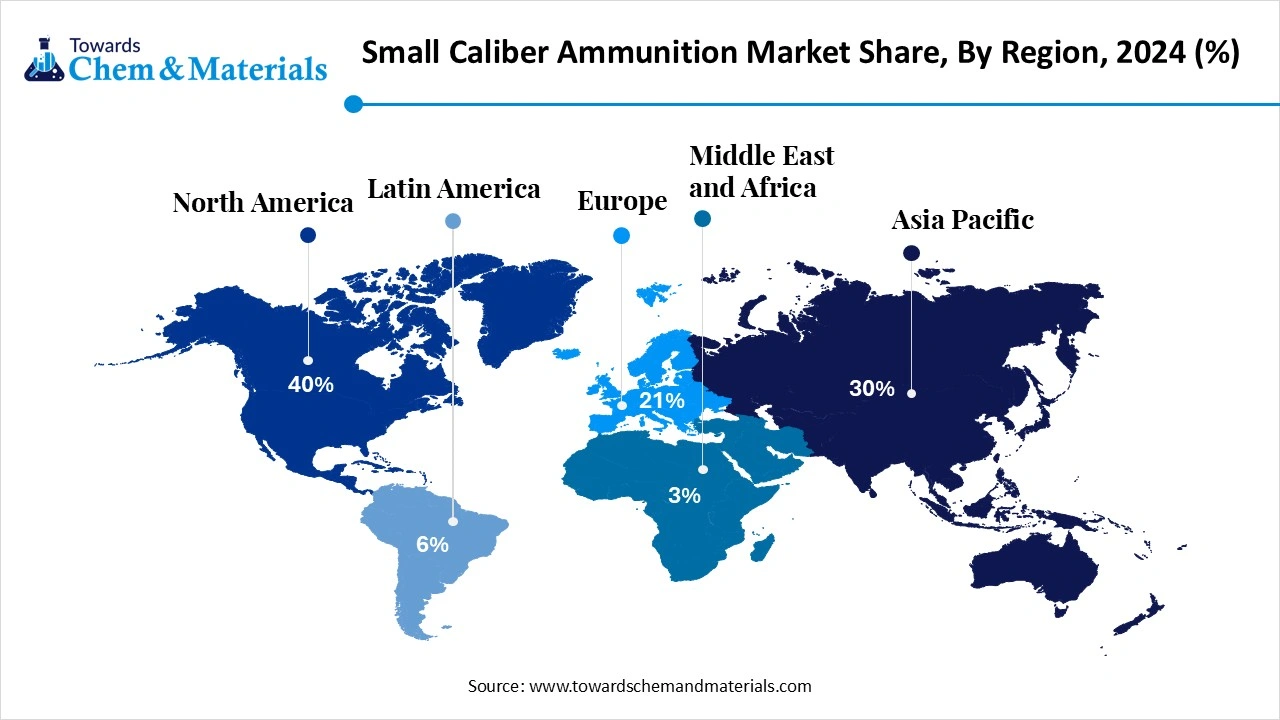

- By region, North America dominated the market in 2024. The North America region held a 40% share in the market in 2024. The technological advancements fuel the growth of the market.

- By region, the Asia Pacific is expected to have significant growth in the market in the forecast period. The growing demand for military and defence spending drives the growth.

- By caliber size, the 7.62mm segment dominated the market in 2024. The 7.62mm segment held a 30% share in the market in 2024. Military and defence applications fuel the growth of the market.

- By caliber size, the 9mm (handguns & law enforcement) segment is expected to grow significantly in the market during the forecast period. They are widely manufactured and form the backbone of global ammunition supply.

- By bullet type, the full metal jacket (FMJ) segment dominated the market in 2024. The full metal jacket (FMJ) segment held a 40% share in the market in 2024. The growing demand fuels the growth.

- By bullet type, the hollow point & non-lethal rounds segment is expected to grow in the forecast period. The growing demand for shooting increases the growth.

- By end use, the armed forces segment dominated the market in 2024. The armed forces segment held a 50% share in the market in 2024. Modernization programs drive the demand and growth.

- By end use, the civilian/sports shooters segment is expected to grow in the forecast period. Extensively used for shooting in competitions.

- By distribution channel, the direct procurement (govt. contracts) segment dominated the market in 2024. The high-strength segment held a 60% share in the market in 2024. Steady supply management increases growth.

- By distribution channel, the online sales segment is expected to grow in the forecast period. The convenience offered drives the growth of the market.

Market Overview

Rising Demand For Durable Materials: Small Caliber Ammunition Market To Expand

The small caliber ammunition market covers the production, distribution, and application of ammunition with a caliber size typically below 20mm. This includes cartridges used in military, law enforcement, civilian, and sporting activities. Small caliber ammunition consists of components such as a bullet, cartridge case, propellant, and primer, and is designed for use in pistols, rifles, shotguns, and light machine guns.

The market is driven by military modernization programs, rising civilian firearm ownership, hunting & sports shooting demand, and increasing homeland security needs. Ammunition is supplied in different calibers, types, and packaging formats for defense, training, and commercial use.

What Are The Key Growth Drivers That Support The Growth Of the Small Caliber Ammunition Market?

The growth of the market is driven by the military demand for military modernization, geopolitical tensions, terrorism, and conflict, which drives the growth of the market. The technological advancements, like the development of new ammunition types, including those with improved ballistics, reduced environmental impact, and compatibility with advanced weapons systems, fuel demand. The other key drivers are the increased firearm ownership, recreational shooting, personal protection, sport shooting, and hunting, which fuel the growth and expansion of the market.

Market Trends

- The increased defense spending to modernize their armed forces and address evolving security threats, which fuels the growth.

- Technological advancements like innovation in ammunition design contribute to the growth of the market.

- The growing civilian demand for sport shooting and self-defence fuels the growth of the market.

- Terrorist attacks, rising crime rates, and regional conflicts are fueling the need for increased security measures and stockpiling of ammunition.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 6.38 Billion |

| Expected Size by 2034 | USD 9.35 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.35% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Caliber Size, By Bullet Type, By End-User, By Distribution Channel, By Region |

| Key Companies Profiled | Aguila Ammunition (Mexico), BAE Systems (U.K.), Denel SOC Ltd (South Africa), General Dynamics Corporation (U.S.), Nammo AS (Norway), Northrop Grumman Corporation (U.S.), Olin Corporation (U.S.), RAUG Group (Switzerland), Remington Arms Company LLC (U.S.), Sellier & Ballot (Czech Republic), Vista Outdoor, Inc. (U.S.), Elbit Systems Ltd. (Israel), KNDS N.V. (France), Thales Group (France) |

Market Opportunity

What Are The Key Growth Opportunities That Support The Growth Of The Small Caliber Ammunition Market?

The key growth opportunity that supports the market growth is the growing demand for new and specialized product development, which is of enhanced Efficiency, accuracy, performance, and reliability, which fuels the growth of the market. The demand from developing countries for advanced and innovative materials and products further creates a great opportunity for growth and expansion of the market.

Market Challenge

What Are The Key Challenges That Hinder The Growth Of The Small Caliber Ammunition Market?

The key challenge that hinders the growth of the market is the stringent government regulations and export controls, supply chain disruptions, and dependency on imports. Rising raw material costs, competition, market access, and ethical concerns are some of the major and potential challenges that limit the growth and expansion of the market.

Regional Insights

How Did North America Dominate The Small Caliber Ammunition Market In 2024?

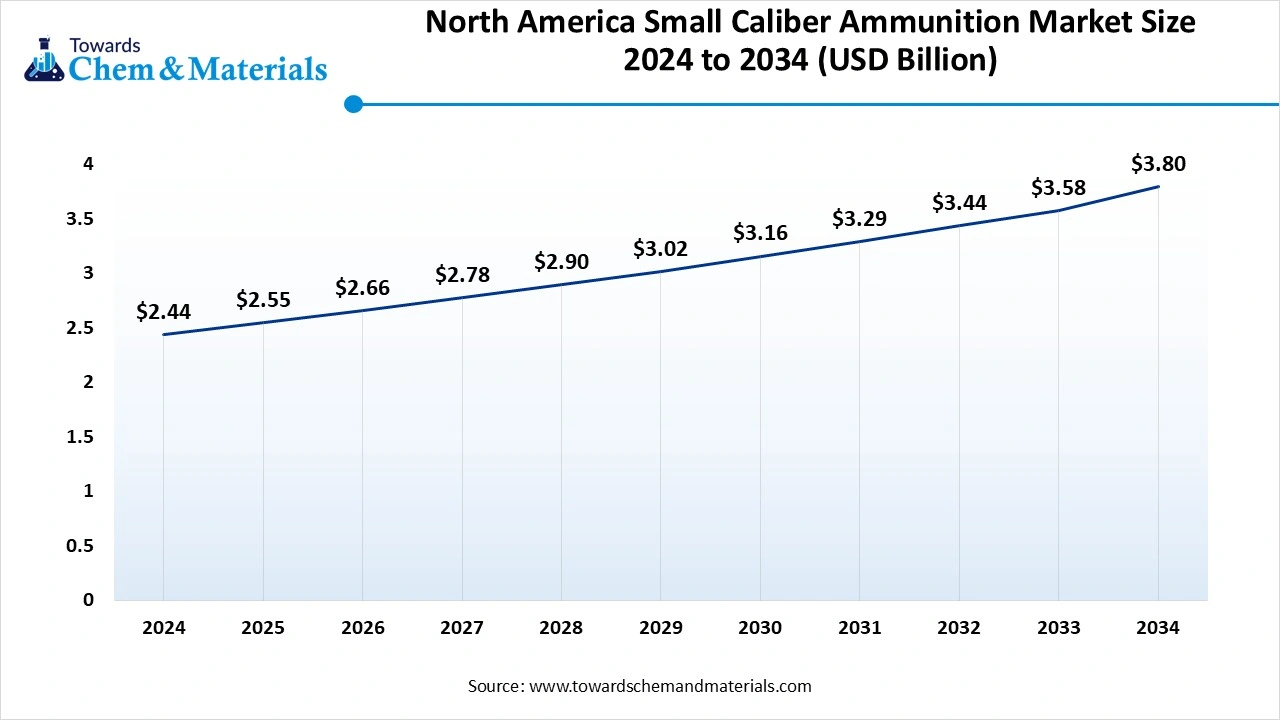

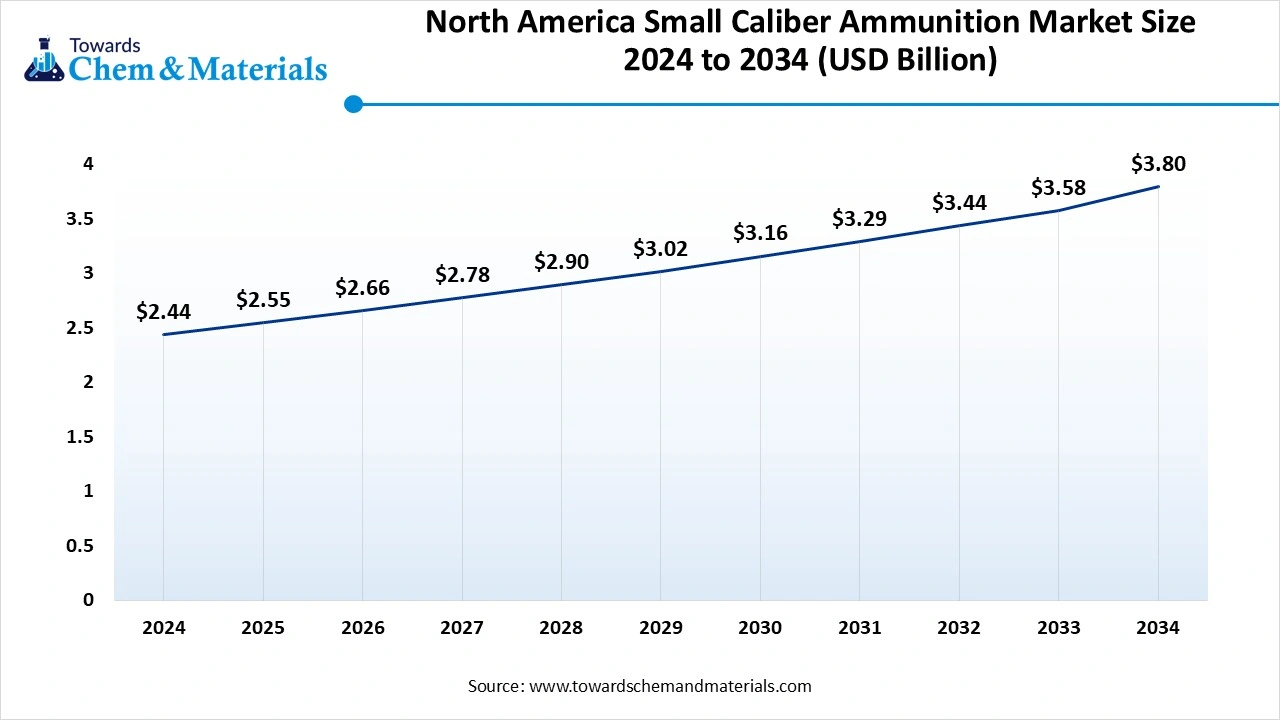

The North America small caliber ammunition market size was estimated at USD 2.44 billion in 2024 and is anticipated to reach USD 3.80 billion by 2034, growing at a CAGR of 4.53% from 2025 to 2034. North America dominated the small caliber ammunition market in 2024.

The growth of the market in the region is driven by the growing military spending and civilian gun ownership fuels the demand for the market. Participation in hunting and target shooting also contributes to the market's growth in the region.

There is a trend towards the adoption of more advanced and specialized ammunition, particularly in the US. Environmental regulations and health concerns are driving the development of lead-free ammunition and other environmentally friendly alternatives. Innovations include the development of smart ammunition, improved ballistics, and more efficient manufacturing processes. These factors fuel the growth and expansion of the market in the region.

The US Has Seen Significant Growth, Driven By Both Civilian And Military Demand

The growth of the market in the US is driven by the growing demand from both the military and civilians for sustained hunting and target shooting fuels the growth of the market. The US government is also spending on defense for modernization projects, which is a major contributor to the growth of the market. Growing interest in shooting sports, hunting, and personal safety fuels civilian purchases of small-caliber ammunition. These factors drive the growth of the market in the country.

Global Small Caliber Ammunition Market Revenue, By Regional, 2024-2034 (USD Billion)

| Regional | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| North America | 1.68 | 1.73 | 1.82 | 1.86 | 1.96 | 1.96 | 1.97 | 2.10 | 2.36 | 2.31 | 2.31 |

| Europe | 1.53 | 1.63 | 1.78 | 1.82 | 1.95 | 1.98 | 2.00 | 1.95 | 2.10 | 2.37 | 2.48 |

| Asia-Pacific | 1.60 | 1.71 | 1.75 | 1.90 | 2.00 | 2.10 | 2.15 | 2.22 | 2.29 | 2.54 | 2.74 |

| Latin America | 0.66 | 0.65 | 0.54 | 0.59 | 0.49 | 0.59 | 0.70 | 0.81 | 0.75 | 0.66 | 0.55 |

| Middle East & Africa | 0.65 | 0.65 | 0.75 | 0.77 | 0.84 | 0.93 | 1.07 | 1.15 | 1.09 | 1.08 | 1.28 |

The Growing Population And Military Demand Fuel The Growth Of The Market In The Asia Pacific Region

Asia Pacific is expected to see significant growth in the market in the forecast period. The growth of the market is driven by the growing demand of the market due to a large population and military spending, which drives demand for the market.

The defense spending for training and operational purposes across the region, the adoption of technologically advanced ammunition with enhanced effectiveness and precision, drives the growth of the market. Increased firearm ownership for personal safety and recreational activities like sport shooting is also contributing to market growth in the region, contributing to the expansion of the market.

Segmental Insights

Caliber Size Insights

Why Did 7.62mm Segment Dominated The Small Caliber Ammunition Market In 2024?

The 7.62mm segment dominated the small caliber ammunition market in 2024. The 7.62mm caliber ammunition segment plays a crucial role in military and defense applications, widely used in rifles, machine guns, and sniper platforms. Its reliability and performance in long-range shooting make it a preferred choice for armed forces worldwide.

The 9mm (handguns & law enforcement) segment expects significant growth in the small caliber ammunition market during the forecast period. The 9mm caliber ammunition segment dominates handguns and law enforcement applications. With its balanced recoil, affordability, and high availability, 9mm rounds remain the most popular choice for personal defense, police forces, and civilian shooters.

Bullet Type Insights

Why Did full Metal Jacket (FMJ) Segment Dominated The Small Caliber Ammunition Market In 2024?

The full metal jacket (FMJ) segment dominated the small caliber ammunition market in 2024. Full metal jacket (FMJ) bullets are extensively used for military training and field operations due to their penetration capabilities and cost-effectiveness. They are widely manufactured and form the backbone of global ammunition supply.

The hollow point & non-lethal rounds segment expects significant growth in the market during the forecast period. Hollow-point and non-lethal rounds are increasingly adopted in civilian defense and law enforcement, where controlled expansion and reduced collateral damage are critical. These types offer enhanced safety for defensive shooting scenarios.

Global Small Caliber Ammunition Market Revenue, By Bullet Type, 2024-2034 (USD Billion)

| By Bullet Type | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Full Metal Jacket (FMJ) | 2.47 | 2.69 | 2.89 | 3.05 | 3.09 | 3.31 | 3.45 | 3.57 | 3.93 | 4.20 | 4.46 |

| Hollow Point (HP) | 1.52 | 1.57 | 1.58 | 1.64 | 1.68 | 1.65 | 1.66 | 1.54 | 1.71 | 1.75 | 1.80 |

| Armor-Piercing (AP) | 0.93 | 0.85 | 0.87 | 0.95 | 1.05 | 1.19 | 1.22 | 1.31 | 1.25 | 1.20 | 1.17 |

| Tracer Rounds | 0.55 | 0.63 | 0.77 | 0.84 | 0.97 | 0.99 | 1.06 | 1.19 | 1.14 | 1.04 | 1.22 |

| Others (Frangible, Incendiary, Non-Lethal) | 0.64 | 0.63 | 0.55 | 0.46 | 0.46 | 0.42 | 0.49 | 0.61 | 0.57 | 0.77 | 0.70 |

End-User Insights

Why Did Armed Forces Segment Held The Largest Share Of The Small Caliber Ammunition Market In 2024?

The armed forces segment dominated the small caliber ammunition market in 2024. The armed forces segment represents a major consumer of small-caliber ammunition, driven by continuous defense modernization programs and operational training needs. This segment ensures a steady demand through government defense budgets.

The civilian/sports shooters segment expects significant growth in the market during the forecast period. Civilian and sports shooters constitute a rapidly expanding segment, with growing interest in hunting, competitive shooting, and personal defense. This group is strongly supported by rising ammunition availability and online retail platforms.

Global Small Caliber Ammunition Market Revenue, By End-User, 2024-2034 (USD Billion)

| By End-User | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Armed Forces | 3.36 | 3.43 | 3.79 | 4.00 | 4.15 | 4.28 | 4.34 | 4.36 | 4.42 | 4.59 | 4.84 |

| Police & Security Agencies | 1.19 | 1.26 | 1.25 | 1.24 | 1.28 | 1.36 | 1.46 | 1.60 | 1.73 | 1.79 | 1.83 |

| Civilian/Sports Shooters | 0.86 | 0.93 | 0.93 | 0.95 | 1.08 | 1.26 | 1.40 | 1.50 | 1.65 | 1.71 | 1.95 |

| Commercial Security Providers | 0.70 | 0.75 | 0.69 | 0.76 | 0.73 | 0.67 | 0.68 | 0.77 | 0.79 | 0.87 | 0.74 |

Distribution Channel Insights

Why Did Direct Procurement (Govt. Contracts) Segment Dominated The Small Caliber Ammunition Market In 2024?

The direct procurement (govt. contracts) segment dominated the small caliber ammunition market in 2024. Direct procurement through government contracts remains the largest channel for defense-grade ammunition, ensuring a steady supply to military organizations and law enforcement agencies.These contracts form long-term partnerships with manufacturers.

The online sales segment expects significant growth in the market during the forecast period. Online sales are emerging as a key distribution channel, particularly for civilian and sports shooters. Digital platforms provide convenience, accessibility, and product variety, making them increasingly popular for non-military ammunition purchases.

Small Caliber Ammunition Market Value Chain Analysis

- Chemical Synthesis and Processing : The small-caliber ammunition is manufactured through casting, swaging, cold forming, and jacketed bullets.

- Quality Testing and Certification : The small-caliber ammunition requires Standards like STANAG 4172 and the JOTP (Joint Ordnance Test Procedure).

- Distribution to Industrial Users : The small-caliber ammunition is distributed to the military, hunting, sport shooting, and law enforcement.

Recent Developments

- In January 2025, Belgium’s FN Herstal has launched the Small Arms Ammunition Technologies (SAAT) project. Over four years, this initiative will be coordinated by FN Herstal and carried out by a European consortium of defense companies, research organizations, and defense ministries from nine countries. The goal is to create a common standard for small arms ammunition in Europe, improving interoperability and boosting European strategic autonomy and sovereignty in defense.(Source: euro-sd.com)

Small Caliber Ammunition Market Top Companies

- Aguila Ammunition (Mexico)

- BAE Systems (U.K.)

- Denel SOC Ltd (South Africa)

- General Dynamics Corporation (U.S.)

- Nammo AS (Norway)

- Northrop Grumman Corporation (U.S.)

- Olin Corporation (U.S.)

- RAUG Group (Switzerland)

- Remington Arms Company LLC (U.S.)

- Sellier & Ballot (Czech Republic)

- Vista Outdoor, Inc. (U.S.)

- Elbit Systems Ltd. (Israel)

- KNDS N.V. (France)

- Thales Group (France)

Segments Covered

By Caliber Size

- 5.56mm

- 7.62mm

- 9mm

- 12.7mm (.50 Cal)

- Shotgun Shells

- Other Calibers (<20mm)

By Bullet Type

- Full Metal Jacket (FMJ)

- Hollow Point (HP)

- Armor-Piercing (AP)

- Tracer Rounds

- Others (Frangible, Incendiary, Non-Lethal)

By End-User

- Armed Forces

- Police & Security Agencies

- Civilian/Sports Shooters

- Commercial Security Providers

By Distribution Channel

- Direct Procurement (government, defense contracts)

- Commercial Retail (dealers, specialty stores)

- Online Sales

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait