Content

Recycled Polystyrene Market Size and Growth 2025 to 2034

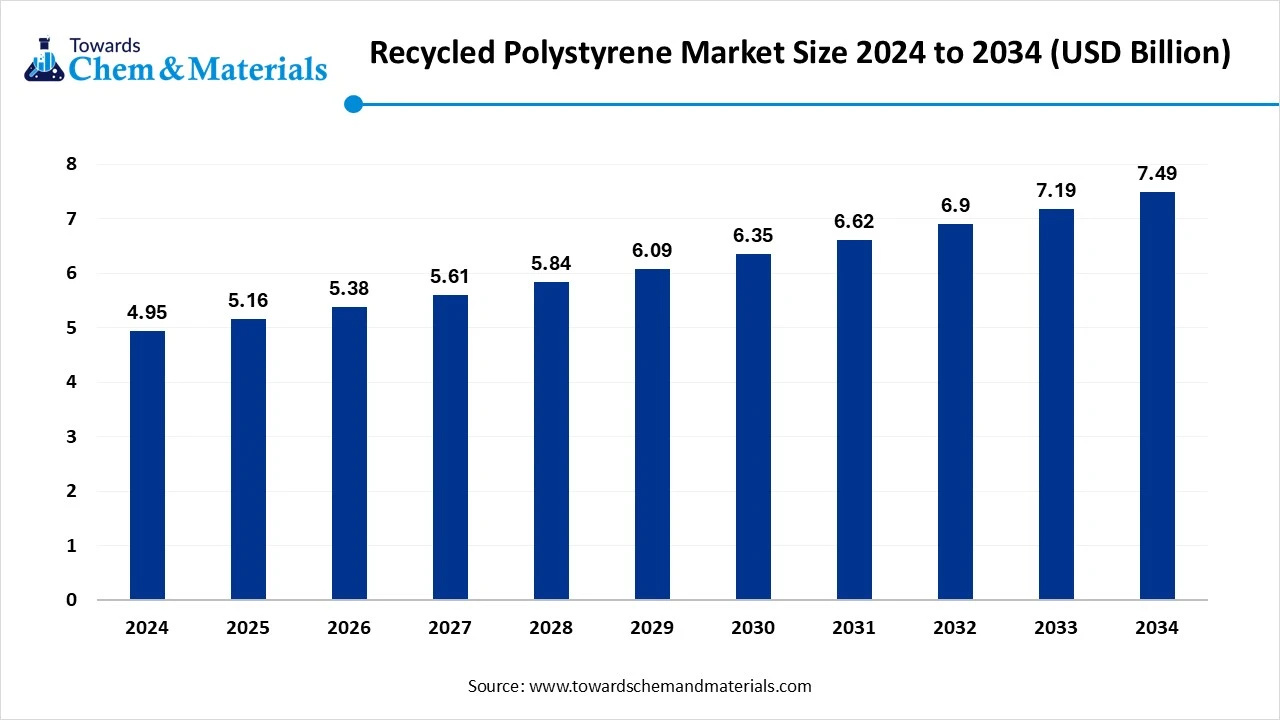

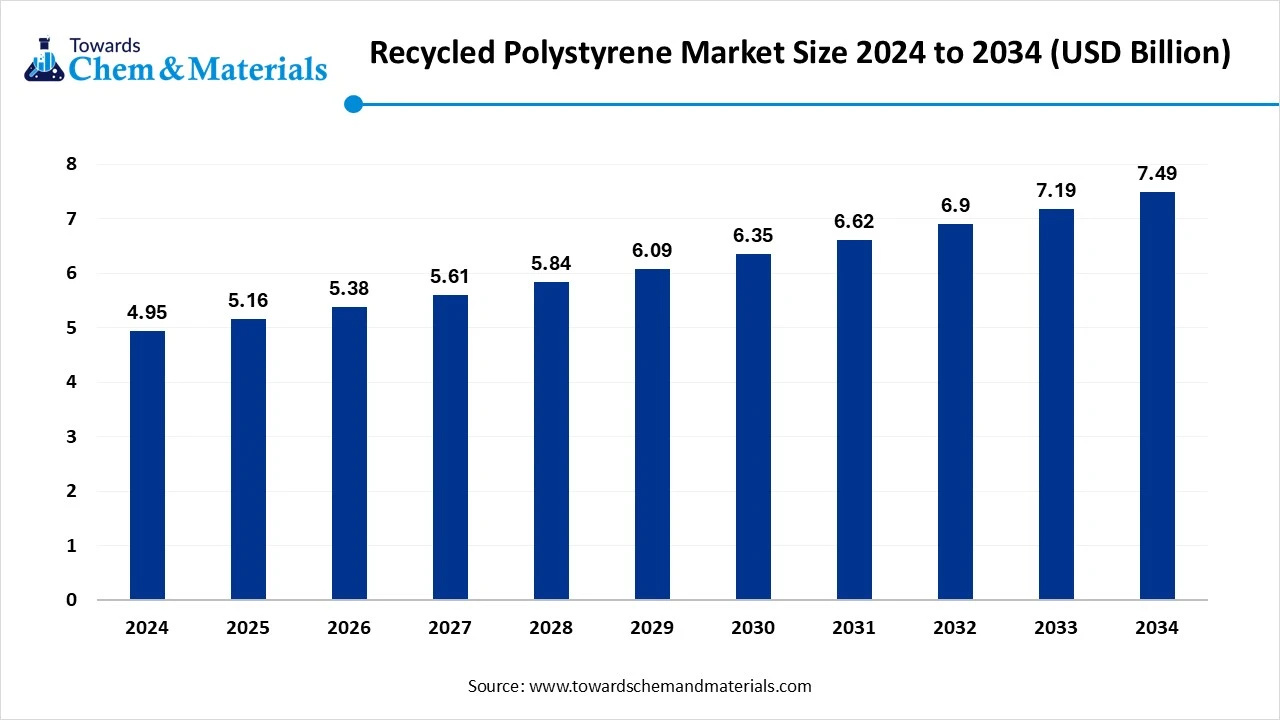

The global recycled polystyrene market size was reached at USD 4.95 billion in 2024 and is expected to be worth around USD 7.49 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.23% over the forecast period 2025 to 2034. The sudden global shift towards sustainability has accelerated industry potential in recent years.

Key Takeaways

- By region, Asia Pacific dominated the recycled polystyrene market in 2024 with 45% of the market share, akin to the presence of the enlarged recycled plastic manufacturing bases in the region.

- By region, Europe is expected to grow at a notable rate in the future, owing to factors such as the stricter regulations towards sustainability and advanced recycling infrastructure.

- By product type, the expanded polystyrene segment led the market in 2024 with 50% market share, due to its continuous consideration as a crucial element in industries such as packaging, food services, and insulation in the current period.

- By product type, the high-impact polystyrene segment is expected to grow at the fastest rate in the market during the forecast period, due to its continuous consideration as a crucial element in industries such as packaging, food services, and insulation in the current period.

- By the recycling process, the mechanical recycling segment emerged as the top-performing segment in the market in 2024 with 65% industry share, due to its characteristics and benefits, like a simple procedure, cost-effectiveness, and wide availability.

- By recycling process, chemical recycling is expected to lead the market in the coming years, due to as it can break down polystyrene into its original monomers.

- By form type, the recycled pellets segment led the market in 2024 with 55% market share because they are easy to store, transport, and process into new products.

- By form type, the styrene monomer segment is expected to capture the biggest portion of the market in the coming years, due to chemical recycling can recover polystyrene at the molecular level, producing high-purity styrene that is virtually identical to virgin material.

- By end-use industry, the packaging and food services segment led the market in 2024 with 50% market share, because polystyrene is lightweight, insulating, and cost-effective, making it ideal for protecting food and goods.

- By end-use industry, the electrical and electronics segment is expected to grow at the fastest rate in the market during the forecast period, because recycled high-impact polystyrene (HIPS) is ideal for making durable casings and components for appliances, TVs, computers, and other.

- By source type, the post-consumer waste segment led the market in 2024 with 60% market share, because most polystyrene products, such as food containers, packaging materials, and single-use items, come from consumer use.

- By source type, the post-industrial waste segment is expected to grow at the fastest rate in the market during the forecast period, because it is cleaner, more consistent, and easier to process than post-consumer waste.

- By distribution channel, the direct sales to manufacturers segment emerged as the top-performing segment in the recycled polystyrene market in 2024 with 55% industry share, because it provides a steady and reliable supply chain for recycled polystyrene.

By distribution channel, the online polymer trading platform segment are expected to lead the market in the coming years, as these platforms make it easier for buyers and sellers to connect globally, compare prices, and access a wider variety of recycled materials.

Market Overview

From Trash to Transformation: The Recycled Polystyrene Market

The recycled polystyrene market covers the collection, processing, and reuse of post-consumer and post-industrial polystyrene waste into usable raw materials for manufacturing new products. Polystyrene (PS) recycling can be mechanical or chemical (advanced recycling), producing materials such as recycled PS pellets, regrind, or styrene monomers. These are used in packaging, construction, consumer goods, electronics, and automotive components. Recycled polystyrene helps reduce landfill waste, lower greenhouse gas emissions, and meet circular economy and regulatory targets for plastic recycling. It can be expanded (EPS) or general-purpose (GPPS) polystyrene, processed into diverse products while reducing dependency on virgin resin.

What Factor is Driving the Recycled Polystyrene Market?

The global shift towards sustainability is spearheading industry growth in the current period. As several regions are actively seen under the reduction of plastic materials by using recycled plastic materials in their major manufacturing industries. Moreover, the global governments are heavily pushing the eco-friendly standards in their respective regions, where the recycled polystyrene has played a crucial role in the past few years.

Market Trends

- The major manufacturers are increasingly adopting advanced recycling technologies, which are contributing to market potential in recent years.

- The increased need for recycled polystyrene from the packaging industry has fueled the recycled polystyrene industry growth where food services and e-commerce are rapidly growing.

Market Report

| Report Attribute | Details |

| Market Size in 2025 | USD 5.16 billion |

| Expected Size by 2034 | USD 7.49 billion |

| Growth Rate from 2025 to 2034 | CAGR 4.23% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Recycling Process, By Form, By End-Use Industry, By Source, By Distribution Channel, By Region |

| Key Companies Profiled | FP Corporation, MBA Polymers, Intco, IBI, Gree, Chongqing Gengye New Material Technology, Zhaoqing Hongzhan Hardware Plastic, Changhong, Jiangxi Green Recycling, Rhino, Dongguan Guo Heng Plastic Technology |

Market Opportunity

Long-term Profit Margins Rise with High-End Application Integration

The expansion of recycled polystyrene in high-end applications is expected to create lucrative opportunities for manufacturers during the forecast period. Moreover, the manufacturers can create strategic collaborations with these high-end manufacturers, like electronics, automotive interiors, and insulation materials, which are likely to provide long-term profit margins with consumer trust in the upcoming years.

Market Opportunity

Weak Recycling Infrastructure May Disrupt Polystyrene Industry Outlook

The unstable supply of high-quality post-consumer polystyrene waste is anticipated to hinder the market growth in the upcoming years. Several global regions have poor recycling infrastructure, where the recycled polystyrene manufacturers can face industry hurdles, which can lead to an increase in product cost during the predicted times, as per the future industry observation.

Regional Insights

Asia Pacific Recycled Polystyrene Market Trends

Asia Pacific dominated the market in 2024, akin to the presence of the enlarged recycled plastic manufacturing bases in the region. Furthermore, the higher domestic packaging consumption of plastic material is contributing to the growth of the market. Also, the regional countries such as China, India, and Japan are actively seen under heavy polystyrene production for industries such as packaging, construction, and electronics in recent years.

Is China Turning Plastic Waste into Economic Power?

China maintained its dominance in the recycled polystyrene market, owing to the country being considered one of the largest plastic producers globally. Moreover, the country's heavy electronics and packaging sector is immensely contributing to the industry by developing high volumes of plastic recycling waste in the current period of the time.

Europe Recycled Polystyrene Market Trends

Europe is expected to capture a major share of the recycled polystyrene market during the forecast period, owing to factors such as the stricter regulations towards sustainability and advanced recycling infrastructure. Moreover, the regional governments are heavily pushing the eco-friendly infrastructure by giving attractive benefits to the sustainable plastic manufacturers in recent years. Furthermore, the increased need for high-purity polystyrene in the various industries is projected to contribute to the growth of the regional market during the forecast period.

How are Recycling Laws Fueling Germany’s Market Expansion?

Germany is expected to rise as a dominant country in the region in the coming years, owing to having the strongest manufacturing industries. Furthermore, the country has seen the implementation of strict waste packaging waste recycling laws, which are expected to lead to future growth of the market in the region, as per the recent survey. Also, industries such as automotive and packaging have been heavily contributing to the industry's potential in recent years.

Segmental Insights

Product Type Insights

How did the Expanded Polystyrene Segment Dominate the Recycled Polystyrene Market in 2024?

The expanded polystyrene segment held the largest share of the market in 2024, due to its continuous consideration as a crucial element in industries such as packaging, food services, and insulation in the current period. Also, having unique properties like lightweight, cost-effectiveness, and shock-absorbing properties has provided immense industry attention to the segment in recent years, making it an essential material in various industries.

The high-impact polystyrene segment is expected to grow at a notable rate during the predicted timeframe, akin to its superior durability and versatility. Industries such as electronics, automotive parts, and appliances are actively seen in seeking durable products where the high-impact polymer can gain immense industry attention in the upcoming years, as per the future industry expectations.

Recycling Process Insights

Why does the Mechanical Recycling Segment Dominate the Recycled Polystyrene Market in 2024?

The mechanical recycling segment held the largest share of the market in 2024, due to its characteristics and benefits, like a simple procedure, cost-effectiveness, and wide availability. Furthermore, by creating reusable pellets without any complex chemical treatment, the mechanical recycling segment has received huge industry attention in the current period. Furthermore, this method is globally considered for large-scale operations.

The chemical recycling segment is expected to grow at a notable rate during the forecast period, due to as it can break down polystyrene into its original monomers. Furthermore, the increased need for high-purity plastic is likely to drive the further growth potential of the segment in the upcoming years, as per the future industry expectations. Moreover, by handling the contaminated and mixed waste streams, chemical recycling is expected to gain major industry in the upcoming period.

Form Type Insights

Why does the Recycled Pellets Segment Dominate the Recycled Polystyrene Market in 2024?

The recycled pellets segment dominated the market with the largest share in 2024 because they are easy to store, transport, and process into new products. They can be fed directly into existing manufacturing equipment without major adjustments, making them convenient for manufacturers. Pellets are also versatile, suitable for applications in packaging, construction materials, and consumer products.

The styrene monomer segment is expected to grow at a significant rate due to the chemical recycling can recover polystyrene at the molecular level, producing high-purity styrene that is virtually identical to virgin material. This is crucial for industries like food packaging and medical devices, where strict safety standards apply. As more chemical recycling facilities come online, the production of recycled styrene monomer will increase.

End Use Industry Insights

Why does the packaging And Food Services Sector Segment Dominate the Recycled Polystyrene Market in 2024?

The packaging and food services sector segment held the largest share of the market in 2024, because polystyrene is lightweight, insulating, and cost-effective, making it ideal for protecting food and goods. Items like disposable cups, containers, trays, and protective packaging are produced in massive volumes, generating a large supply of recyclable material. The recycling infrastructure for food-service polystyrene is well-developed in many regions, supporting its re-entry into the production cycle.

The electrical and electronics segment is expected to grow at a notable rate during the predicted timeframe, because recycled high-impact polystyrene (HIPS) is ideal for making durable casings and components for appliances, TVs, computers, and other devices. As e-waste recycling programs expand, more polystyrene from discarded electronics will enter the recycling stream.

Source Type Insights

Why Does the post-Consumer Waste Segment Dominate the Recycled Polystyrene Market in 2024?

The post-consumer waste segment held the largest share of the recycled polystyrene market in 2024, because most polystyrene products, such as food containers, packaging materials, and single-use items, come from consumer use. This creates a large and steady supply of recyclable material. Many municipal recycling programs focus on collecting post-consumer plastics, ensuring a consistent feedstock.

The post-industrial waste segment is expected to grow at a notable rate because it is cleaner, more consistent, and easier to process than post-consumer waste. This type of waste comes from manufacturing offcuts, rejected parts, and excess material, which are typically uncontaminated. As manufacturers adopt more sustainable practices, they will recycle their own scrap polystyrene directly, ensuring better quality and cost savings.

Distribution Channel Insights

Why Does the Direct Sales To Manufacturers Segment Dominate the Recycled Polystyrene Market in 2024?

The direct sales to manufacturers segment dominated the market with the largest share in 2024 because it provides a steady and reliable supply chain for recycled polystyrene. Manufacturers prefer buying directly from recyclers to ensure consistent quality, bulk quantities, and lower costs by avoiding middlemen. This direct relationship also allows for customization of recycled material properties to match production needs.

The online polymer trading platform segment is expected to grow at a significant rate as these platforms make it easier for buyers and sellers to connect globally, compare prices, and access a wider variety of recycled materials. They also offer transparency in pricing and quality standards, which builds trust. Small and medium-sized manufacturers, in particular, benefit from the flexibility of ordering smaller quantities online without long-term contracts.

Recent Developments

- In February 2025, Trinseo launched its first recycled polystyrene. The newly introduced polystyrene is specifically designed for direct food contact applications, as per the report published by the company recently.(Source: www.trinseo.com)

- In June 2025, Sulzer introduced their latest technology for the chemical recycling of contaminated polystyrene. The newly launched technology is called the EcoStyreneTM, as per the company's claim.(Source : www.sulzer.com)

Recycled Polystyrene Market Top Companies

- FP Corporation

- MBA Polymers

- Intco

- IBI

- Gree

- Chongqing Gengye New Material Technology

- Zhaoqing Hongzhan Hardware Plastic

- Changhong

- Jiangxi Green Recycling

- Rhino

- Dongguan Guo Heng Plastic Technology

Segment Covered

By Product Type

- Expanded Polystyrene (EPS)

- High Impact Polystyrene (HIPS)

- General Purpose Polystyrene (GPPS)

By Recycling Process

- Mechanical Recycling

- Chemical Recycling (Depolymerization, Pyrolysis, Solvent-Based Recovery)

By Form

- Recycled Pellets

- Regrind/Flakes

- Styrene Monomer (from chemical recycling)

By End-Use Industry

- Packaging & Foodservice

- Construction

- Electrical & Electronics

- Automotive

- Consumer Goods

By Source

- Post-Consumer Waste

- Post-Industrial Waste

By Distribution Channel

- Direct Sales to Manufacturers

- Plastic Recyclers & Resin Distributors

- Online Polymer Trading Platforms

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE