Content

Propylene Glycol Market Size and Growth 2025 To 2034

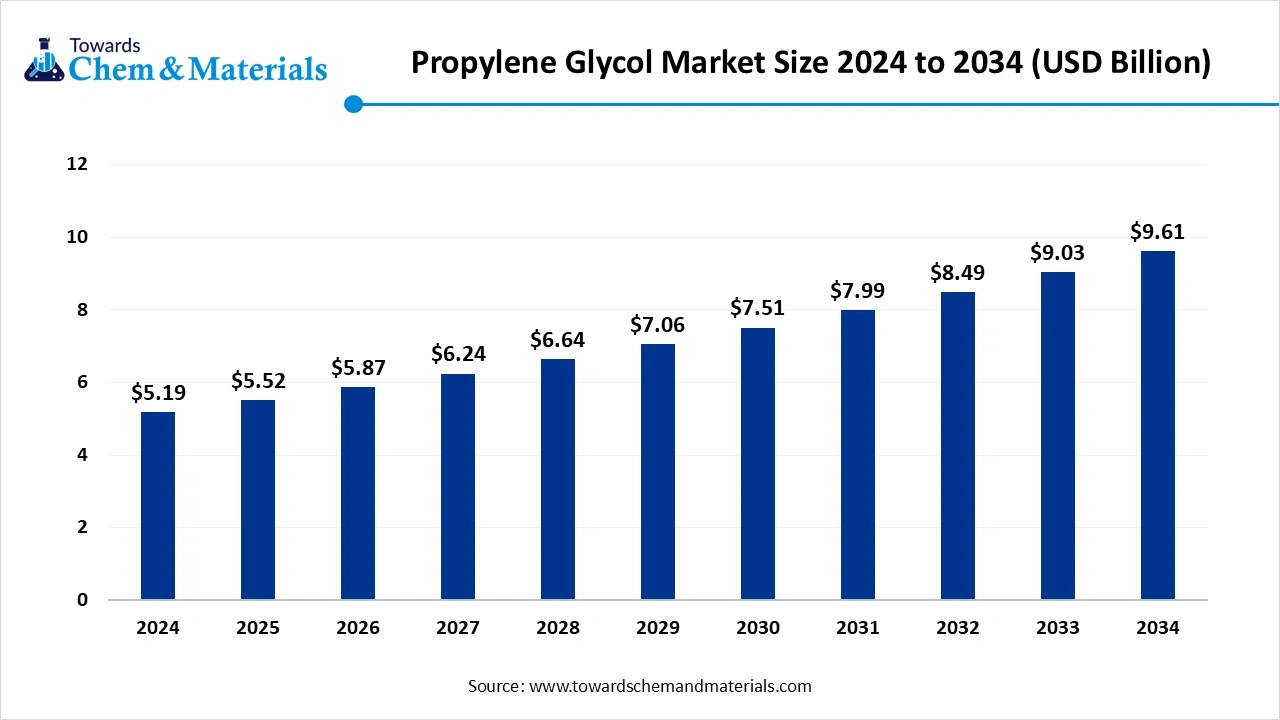

The global propylene glycol market size accounted for USD 5.52 billion in 2025 and is forecasted to hit around USD 9.61 billion by 2034, representing a CAGR of 6.35% from 2025 to 2034. The growing demand from diverse industries like automotive, food & beverage, personal care & cosmetics, and the construction industry drives the market growth.

Key Takeaways

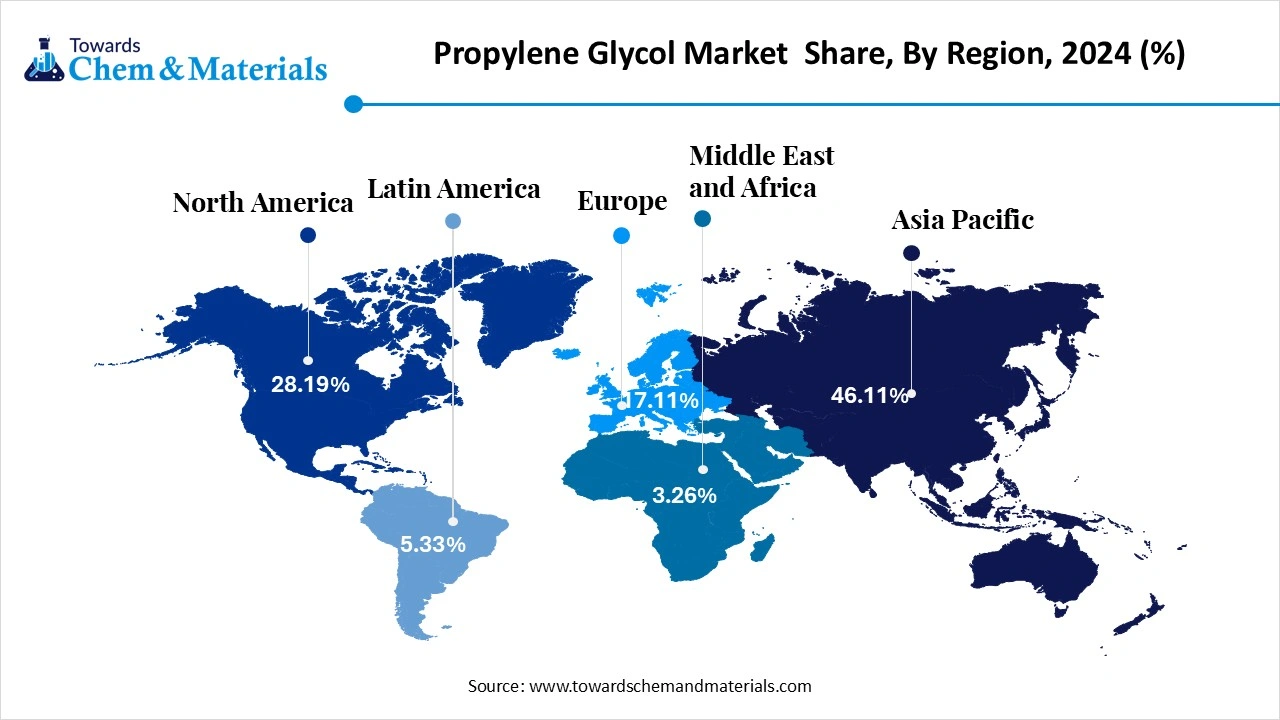

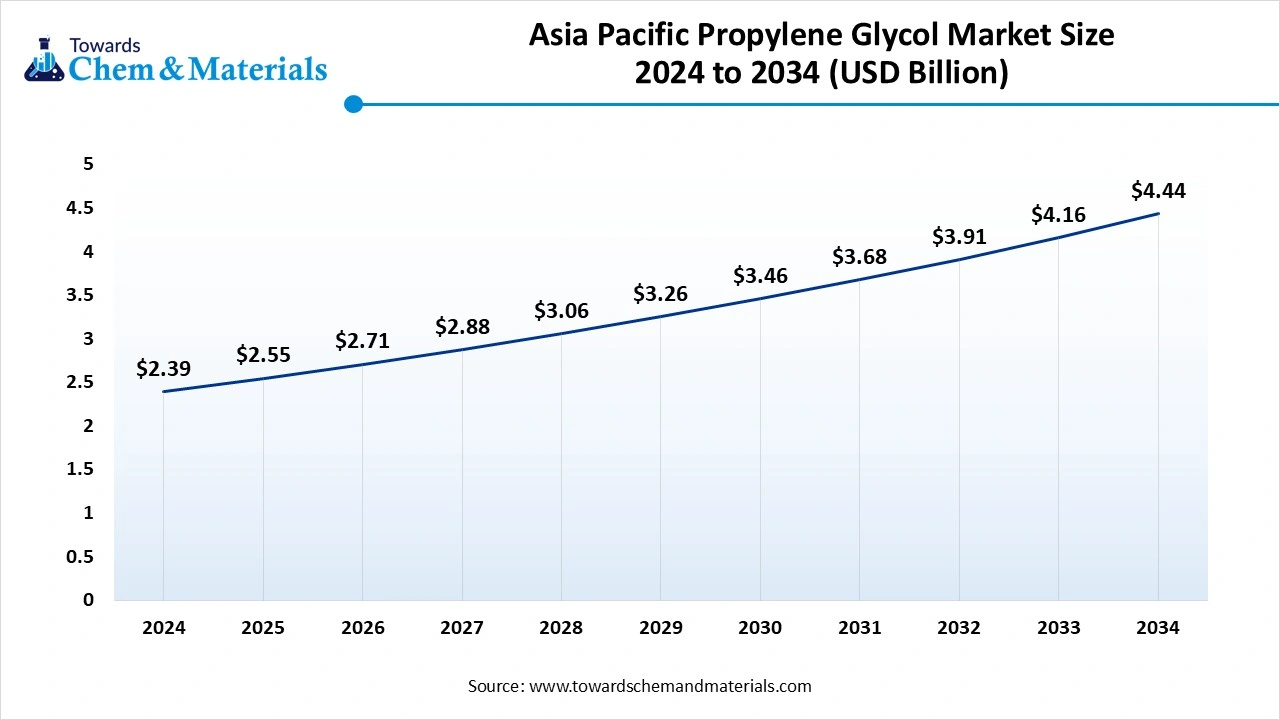

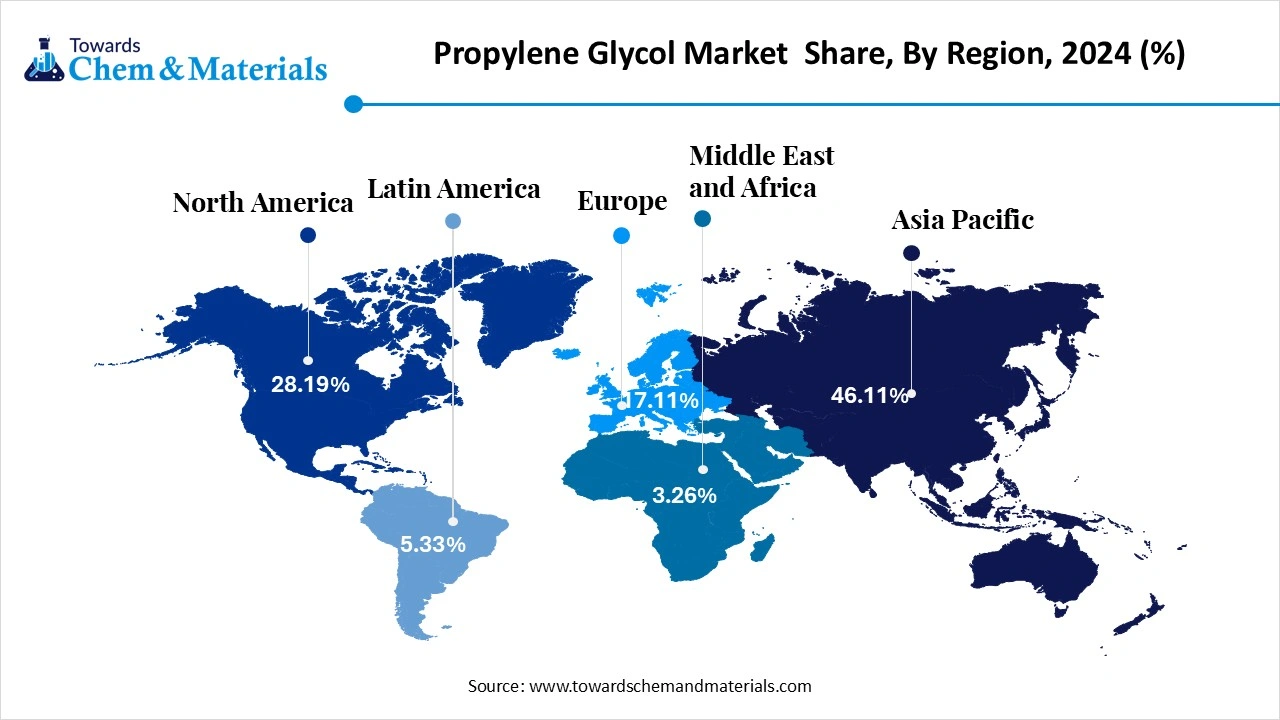

- Asia Pacific emerged as a dominating market, accounting for a revenue share of over 46.11% in 2024.

- By source, the petroleum-based segment dominated the market with a revenue share of over 72.25% in 2024.

- By source, the bio-based segment is predicted to expand at the highest CAGR of 6.65% in the forecast period.

- By grade, the industrial grade segment dominated the market with a revenue share of over 64.35% in 2024.

- By grade, the USP grade segment is anticipated to expand at a CAGR of 6.45% in the forecast period.

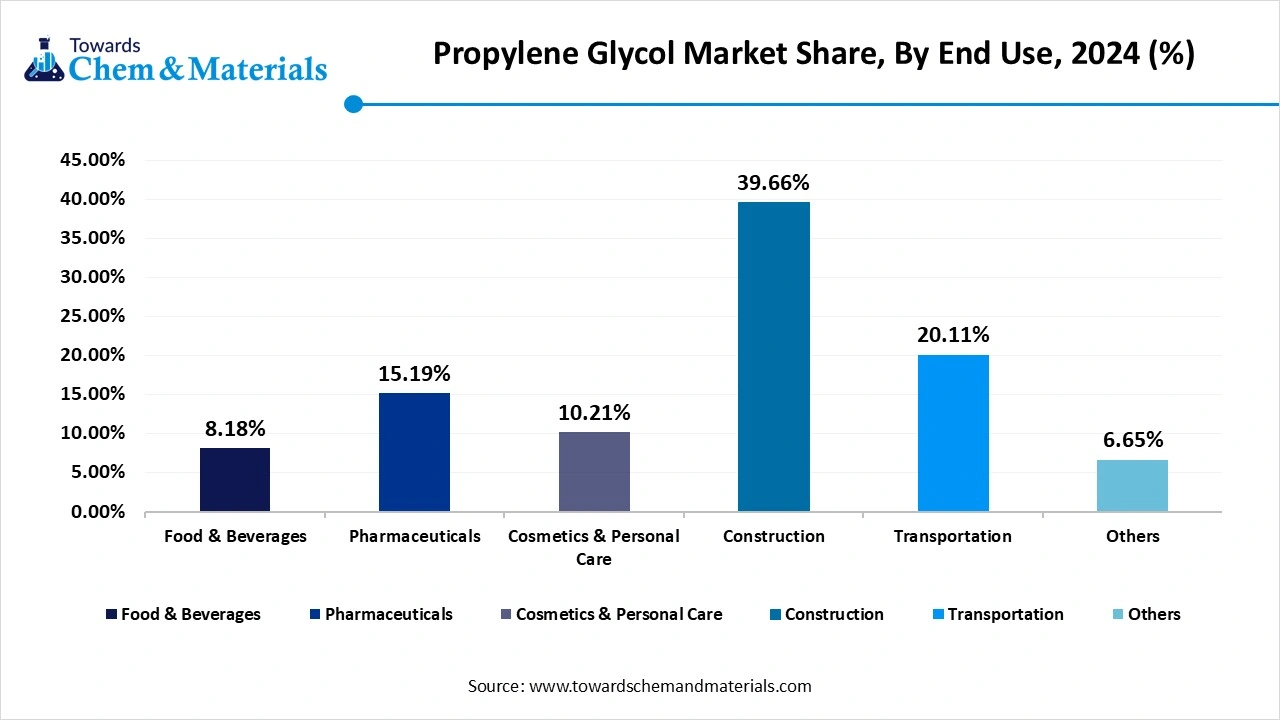

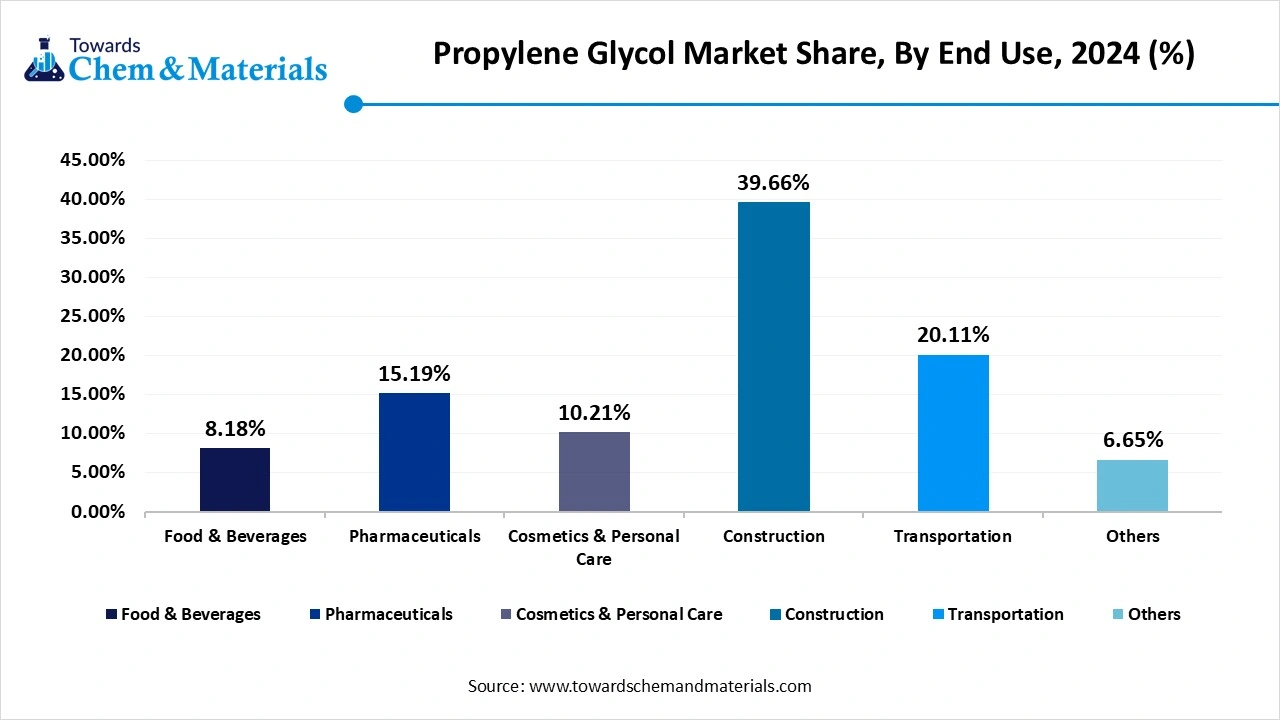

- By end use, the construction segment dominated the market with a revenue share of over 39.66% in 2024.

- By end use, the Transportation was the second-largest segment and is anticipated to expand at the highest CAGR of 6.95% in the coming years.

Versatility of Propylene Glycol in Consumer and Industrial Applications

Propylene glycol is a synthetic, colorless, viscous substance that absorbs water. The IUPAC name of propylene glycol is propane-1,2-diol, and its chemical formula is CH3CH(OH)CH2OH. It is faintly sweet in taste, and its molecular weight is 76.09 g/mol. Propylene glycol is used as a food additive in various food products and is approved by the U.S. Food & Drug Administration. It is widely used as an antifreeze agent in the pharmaceutical, chemical, and food industries. It helps to maintain moisture in certain food products, medicines, and cosmetics. The growing demand for beverages, ice creams, baked goods, and other products utilizes propylene glycol as a flavor enhancer, stabilizer, and humectant.

The growing adoption of various personal care products like creams, deodorants, moisturizers, shampoos, and lotions increases demand for propylene glycol to be used as a preservative, humectant, and emollient. The growing demand for topical medications and injectables helps in the market growth. The increasing demand for de-icing agents, antifreeze, and coolant in industrial processes fuels demand for propylene glycol. Factors like growing demand across various industries like personal care, cosmetics, pharmaceutical, transportation, food & beverage, and growing focus on sustainability contribute to the overall growth of the market.

- Germany exported $278M of propylene glycol in 2023.(Source: oec.world )

- South Korea exported 20371 shipments of propylene glycol.(Source: volza.com)

- World Propylene Glycol Export data, Dow Chemical International Pvt Ltd is the leading supplier of propylene glycol in the world.(Source: volza.com)

- Saudi Arabia exported $79.3 million of propylene glycol in 2023(Source:oec.world)

Growing Pharmaceutical Industry Propels Propylene Glycol Market Growth

The growing expansion of the pharmaceutical industry increases demand for propylene glycol for various purposes. The growing demand for various medications like topical preparations, oral liquids, and injectables utilizes propylene glycol as an excipient. It helps in the drug delivery system for the bioavailability of medications. The growing formulations of various drugs increase demand for propylene glycol to be used as an excipient & solvent. It offers good compatibility and low toxicity in the formulations of drugs.

The growing demand for medications like ointments and creams leads to a higher demand for propylene glycol. The rising production of specialized and generic drugs increases demand for propylene glycol. The growing production of drugs for pain management, respiratory ailments, and skin conditions leads to higher demand for propylene glycol. The growing pharmaceutical industry is a key driver of the propylene glycol market growth.

Source: India Brand Equity Foundation

https://www.ibef.org/industry/pharmaceutical-india

Market Trends

- The Growing Demand for Processed Food: The growing demand & consumption of processed food due to a busy lifestyle increases demand for propylene glycol. It is used as a food additive in processed food. The growing consumption of processed food & packaged food helps in the market growth.

- The Rapid Growth in Construction: The growing urbanization increases demand for residential, commercial, and infrastructural construction. The growing construction industry increases demand for propylene glycol for various construction purposes like coatings, components, and paints.

- The Growing Adoption of Sustainable Practices: The growing focus on sustainability in various industries increases the production of bio-based propylene glycol. The growing consumer preference for sustainability and environmental regulations fuels demand for propylene glycol. Companies' investment in bio-based propylene helps in the market growth.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 5.52 Billion |

| Expected Size by 2034 | USD 9.61 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.35% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Source, By End Use, By Region |

| Key Companies Profiled | BASF SE, INEOS, Adeka Corporation, LyondellBasell Industries Holdings B.V., Dow, ADM, Shell Plc, Huntsman International LLC. |

Market Opportunity

The Expansion of the Personal Care Industry

The growing consumer focus on personal care and increasing disposable incomes leads to higher spending on various personal care products. The growing demand for a wide range of personal care products increases demand for propylene glycol to be used as a solvent, preservative, humectant, and emollient. The growing demand for various moisturizing products like moisturizers, creams, and lotions, fuels demand for propylene glycol to retain moisture.

The growing development of various products, like a combination of water & oil-based products, increases demand for propylene glycol as an emulsifier & solvent. It is used to extend the shelf life of the products. The growing preference for personal grooming and skincare leads to a higher demand for propylene glycol for the preservation of products. The growing demand for various personal care products like skincare, cosmetics, and hair care helps in the market growth. The growing expansion of the personal care industry creates an opportunity for the growth of the propylene glycol market.

Market Challenge

Raw Material Price Fluctuations Limit the Adoption of the Propylene Glycol

Despite several benefits of propylene glycol in various industries, fluctuations in the raw materials prices restrict the market growth. Factors like seasonal demand, fluctuations in propylene oxide prices, and supply chain disruptions increase the cost of raw materials. Propylene glycol is made from propylene oxide, and fluctuations in propylene oxide prices restrain market growth. Propylene oxide, derived from crude oil prices and fluctuations in crude oil prices directly affects the market. The growing seasonal demand, like during colder months, increases the overall cost. Supply chain disruptions due to international shipping route disruptions and delays increase the cost. The growing fluctuations in raw material prices hamper the growth of the propylene glycol market.

Regional Insights

Which Region Dominated the Propylene Glycol Market in 2024?

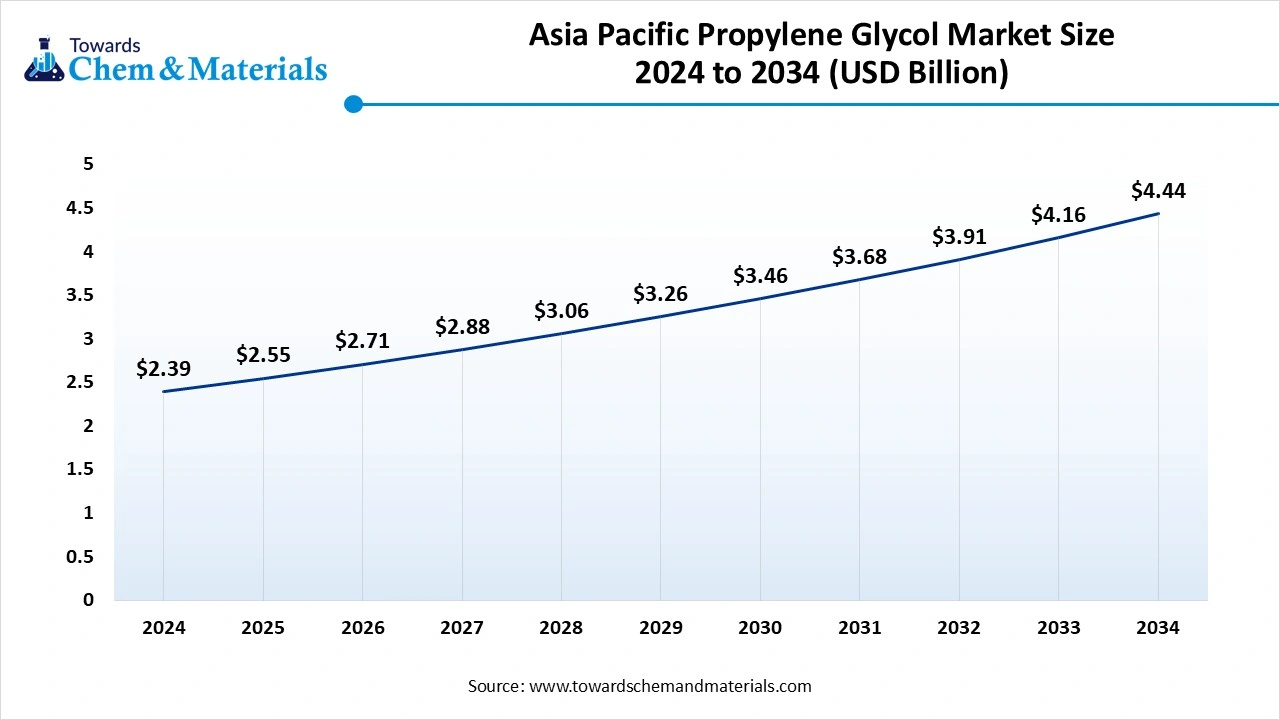

The Asia Pacific propylene glycol market is expected to increase from USD 2.55 billion in 2025 to USD 4.44 billion by 2034, growing at a CAGR of 6.39% throughout the forecast period from 2025 to 2034. Asia Pacific dominated the propylene glycol market in 2024. The growing industrialization and rapid growth in infrastructure development increase demand for propylene glycol for various applications. The growing expansion of the automotive industry is fueling demand for propylene glycol to be used as de-icing fluids or coolants, which helps the market growth. The growing boom of the construction industry increases demand for propylene glycol to be used as sealants & resin. The strong government support for bio-based chemical production, industrialization, and green building materials increases the adoption of propylene glycol. The growing disposable incomes and rising demand for personal care products and pharmaceuticals drive the overall growth of the market.

China Propylene Glycol Market Trends

China is a major contributor to the propylene glycol market. The well-established automotive industry and growing production of electric & traditional vehicles increase demand for propylene glycol for antifreeze & coolants. The growing population and the rising expansion of the food & beverage industry help in the market growth. The rapid growth in the cosmetics & pharmaceutical industry increases demand for propylene glycol for various applications. The growing focus on sustainable development increases the production of bio-based propylene glycol. The strong chemical manufacturing capabilities increase demand for propylene glycol. The strong investment in infrastructure projects like bridges, roads, & buildings, and the growing construction industry support the overall growth of the market.

- China exported $252M of propylene glycol in 2023.(Source: oec.world)

- China exported 27,132 shipments of propylene glycol.(Source: volza.com )

- China exported $260 million of propylene glycol in 2024.(Source: oec.world )

- China exported $32.7 million of propylene glycol in March 2025.(Source: oec.world)

India Propylene Glycol Market Trends

India is growing significantly in the market. The rapid urbanization and growing infrastructure development increase demand for propylene glycol. The growing expansion of the personal care & cosmetics industry helps in the market growth. The growing production of vehicles increases demand for propylene glycol. The growing disposable incomes and rising spending on personal care products like shampoos, creams, lotions, moisturizers, and other products drive the overall growth of the market.

- India exported $10,852.44K of propylene glycol in 2023.(Source: worldbank.org)

- India Export data, EMAMI LIMITED is the leading supplier of propylene glycol in India.(Source: volza.com)

Why Does North America Experience the Fastest Growth in the Propylene Glycol Market?

North America experiences the fastest growth in the market during the forecast period. The growing boom of residential construction in the region increases demand for propylene glycol for applications like coatings, coolants, and resins. The growing focus on sustainability increases demand for bio-based propylene glycol, which helps in the market growth. The growing demand for a wide range of personal care and cosmetics products like creams, moisturizers, and lotions increases demand for propylene glycol. The growing demand for food-grade coolant and stabilizer in the food & beverage industry fuels demand for propylene glycol. The growing expansion of the healthcare and pharmaceutical sector increases demand for propylene glycol for the formulation of drugs. The well-established chemical manufacturing infrastructure drives the overall growth of the market.

United States Propylene Glycol Market Trends

The United States is a key contributor to the market. The strong presence of the transportation sector, especially the automotive sector, increases demand for propylene glycol. The well-established cold-chain logistics networks and well-developed industrial infrastructure help in the market growth. The presence of a well-established chemical manufacturing base increases production of propylene glycol. The growing innovation in the development of propylene glycol helps in the market growth. The growing export of propylene glycol and the growing demand from the food, automotive, and pharmaceutical industries support the overall growth of the market.

- The United States exported $183M of propylene glycol in 2023.(Source: oec.world)

- The United States exported 16,379 shipments of propylene glycol.(Source: volza.com)

Segmental Insights

Source Insights

Which Source Segment Held the Largest Share of the Propylene Glycol Market in 2024?

The petroleum-based segment led the propylene glycol market in 2024. The growing demand from a wide range of industries, such as construction, personal care, automotive, and the aerospace industry, helps in the market growth. Petroleum-based propylene glycol is a cost-effective and readily available. It is derived from petroleum refining processes and has a lower production cost. The growing demand for coolants, production of unsaturated polyester resins, antifreeze, and solvents in various industries drives the overall growth of the market.

The bio-based segment is the fastest-growing in the market during the forecast period. The growing focus on sustainability and stringent environmental regulations increases demand for bio-based propylene glycol. The growing personal care and cosmetic industry increases demand for bio-based propylene glycol, helping in the market growth. The growing expansion of the food & beverage industry fuels demand for bio-based propylene glycol. The growing consumer preference for eco-friendly and sustainable products increases demand for bio-based propylene glycol. The growing demand from the pharmaceutical & automotive industries contributes to the overall growth of the market.

Grade Insights

Why did the Industrial Grade Segment Dominate the Propylene Glycol Market?

The industrial grade segment dominated the propylene glycol market in 2024. The growing production of low-toxicity antifreeze, aircraft deicers, unsaturated polyester resins, coolants, and cleaning agents increases demand for industrial-grade propylene glycol. The growing demand from the construction industry for manufacturing building materials like plastics & resins helps in the market growth. Industrial grade propylene glycol consists of high thermal stability, durability, and is widely used for various industrial applications. The growing demand across various industries like automotive, food, chemical, and pharmaceutical drives the overall growth of the market.

The USP grade segment is experiencing the fastest growth in the market during the forecast period. The growing need for food additives in the food & beverage industry increases demand for USP grade propylene glycol to be used as a humectant, solvent, and carrier. It consists of approximately 99.9% purity and has excellent oxidative stability & thermal stability. The growing production of topical, oral, and injectable medications fuels demand for USP grade propylene glycol. The increasing demand for food products like soft drinks, ice cream, and whipped cream increases demand for USP grade propylene glycol. The growing demand for various personal care products like creams, toothpaste, lotions, and shampoos supports the overall growth of the market.

End Use Insights

How Construction Segment Dominated the Propylene Glycol Market?

The construction segment led the propylene glycol market in 2024. The rapid urbanization and booming construction industry in various regions increase demand for propylene glycol. The growing various construction applications like composite materials, paints, and coatings increases demand for propylene glycol. The growing production of various building materials helps in the market growth. The growing development of various infrastructure projects increases demand for propylene glycol. The strong focus on the development of green buildings and eco-friendly buildings fuels demand for propylene glycol. The growing commercial and residential construction drives the overall growth of the market.

The transportation segment is the fastest growing in the market during the forecast period. The growing expansion of public transportation systems like trains & buses increases demand for propylene glycol. The growing demand from various transportation applications like brake fluids, hydraulic fluids, and many others helps in the market growth. The growth in air travel and the production of aircraft increases demand for propylene glycol. The growing demand for recreational vehicles and marine vessels in transportation applications contributes to the overall growth of the market.

Recent Developments

- In September 2023, Dow launched bio-based circular propylene glycol solutions in Europe. The solution is available for various industries like food, pharmaceutical, and agricultural. The solution is certified by ISCC, and the plant is located in Stade, Germany.(Source: indianchemicalnews.com)

- In May 2024, Dow expands propylene glycol capacity in Thailand. The capacity increases by 80000 tons per year, and the total production of propylene glycol is 250000 tons per year. The facility offers high-quality ingredients for pharmaceuticals, cosmetics, food, and other products and is the largest manufacturing facility in Asia Pacific. (Source: prnewswire)

- In December 2024, Castrol launched Direct-to-Chip Fluid for AI and HPC. The fluid is propylene glycol-based and named as Castrol ON Direct Liquid Cooling PG 25. The fluid is available for applications like high-performance computing, AI, and machine learning. The benefits of PG 25 fluid are enhanced safety in sensitive computing environments, provides protection against bacterial growth & metal corrosion, is globally available, compatible with common cooling system materials, and does not require dilution.(Source: insidehpc.com)

- In May 2023, the ORLEN Poludnie plant made propylene glycol production sustainable by using BASF technology. The BioPG plant converts glycerol into renewable propylene glycol. The BioPG is widely used to produce polyurethanes, de-icing solutions, polyester resin, paints, and solvents for the food industry. BioPG lowers the carbon dioxide footprint and focuses on meeting 75% of the country’s propylene glycol needs.(Source: indianchemicalnews )

Companies List

- BASF SE

- INEOS

- Adeka Corporation

- LyondellBasell Industries Holdings B.V.

- Dow

- ADM

- Shell Plc

- Huntsman International LLC.

Segments Covered

By Source

- Petroleum-based

- Bio-Based

By Grade

- Industrial Grade

- USP Grade

By End Use

- Construction

- Transportation

- Food & Beverages

- Cosmetics & Personal Care

- Pharmaceuticals

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait