Content

Ammonium Chloride Market Size and Competitive Analysis

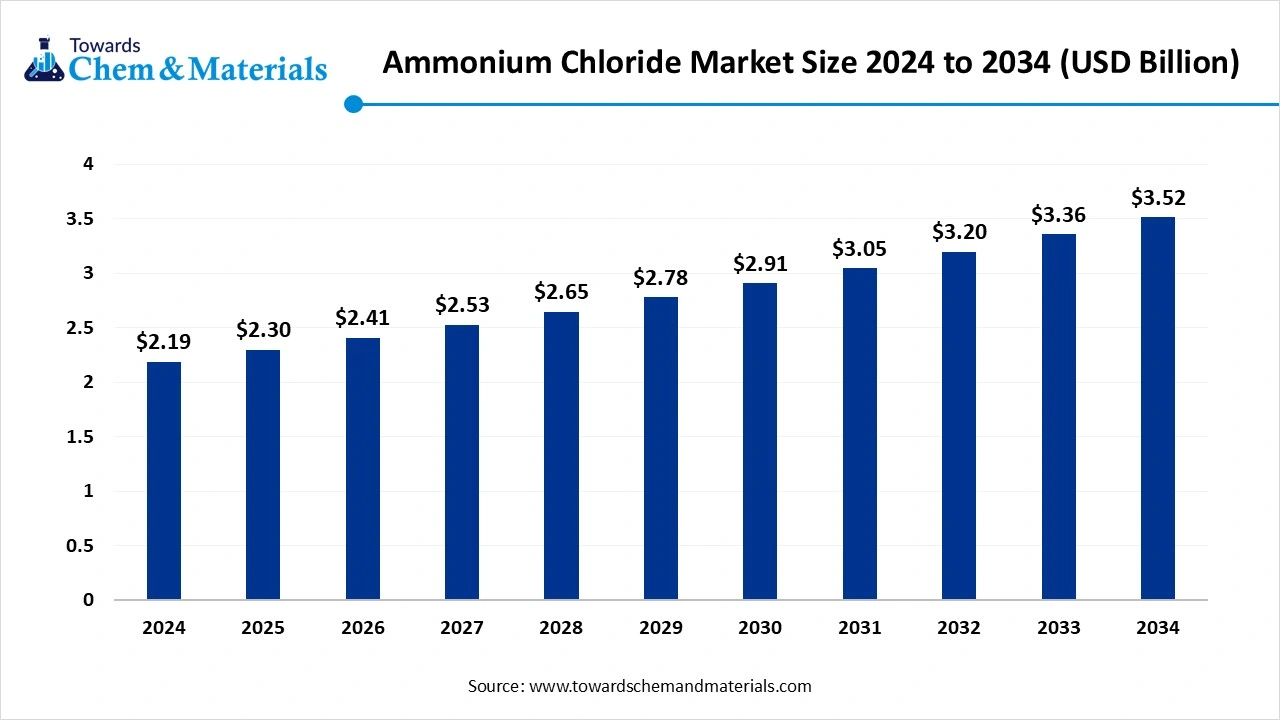

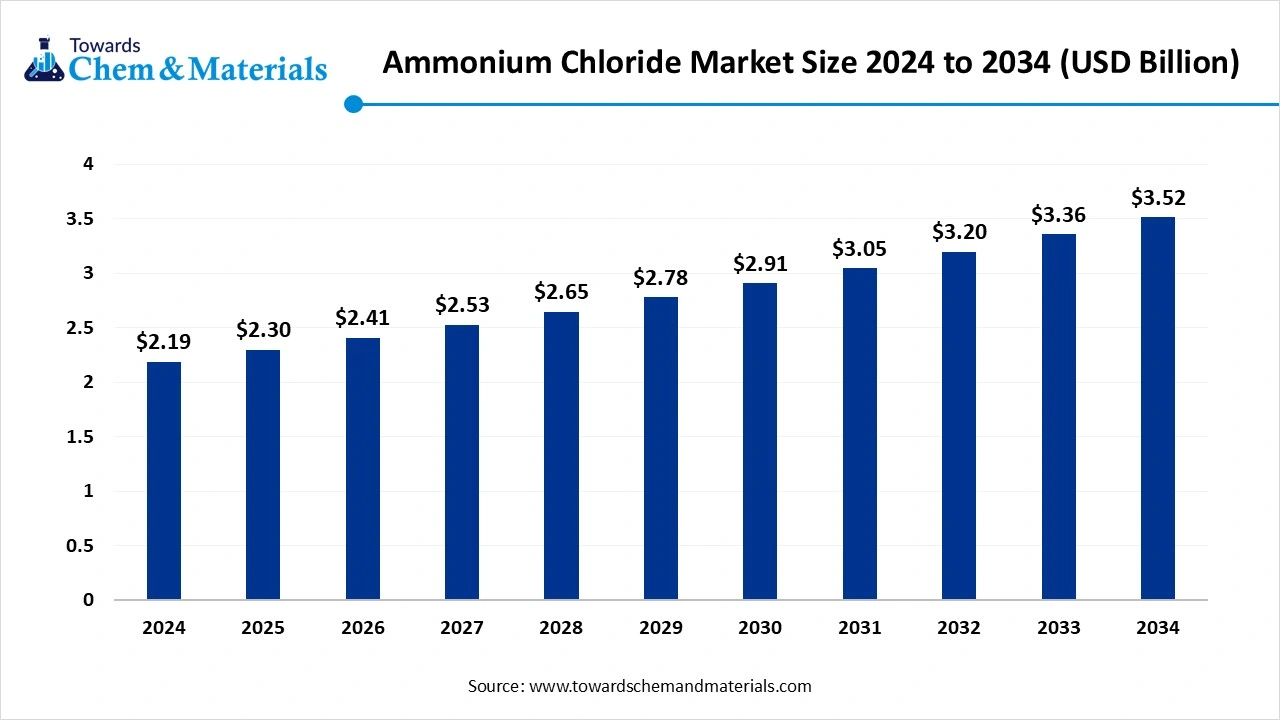

The global ammonium chloride market size is calculated at USD 2.30 billion in 2025 and is forecasted to reach around USD 3.52 billion by 2034, accelerating at a CAGR of 4.87% from 2025 to 2034. The growing demand for ammonium chloride from the fertilizer industry is the key factor driving market growth. Also, Innovations in production technologies coupled with the ongoing agricultural development and industrialization in developing countries can fuel market growth further.

Key Takeaways

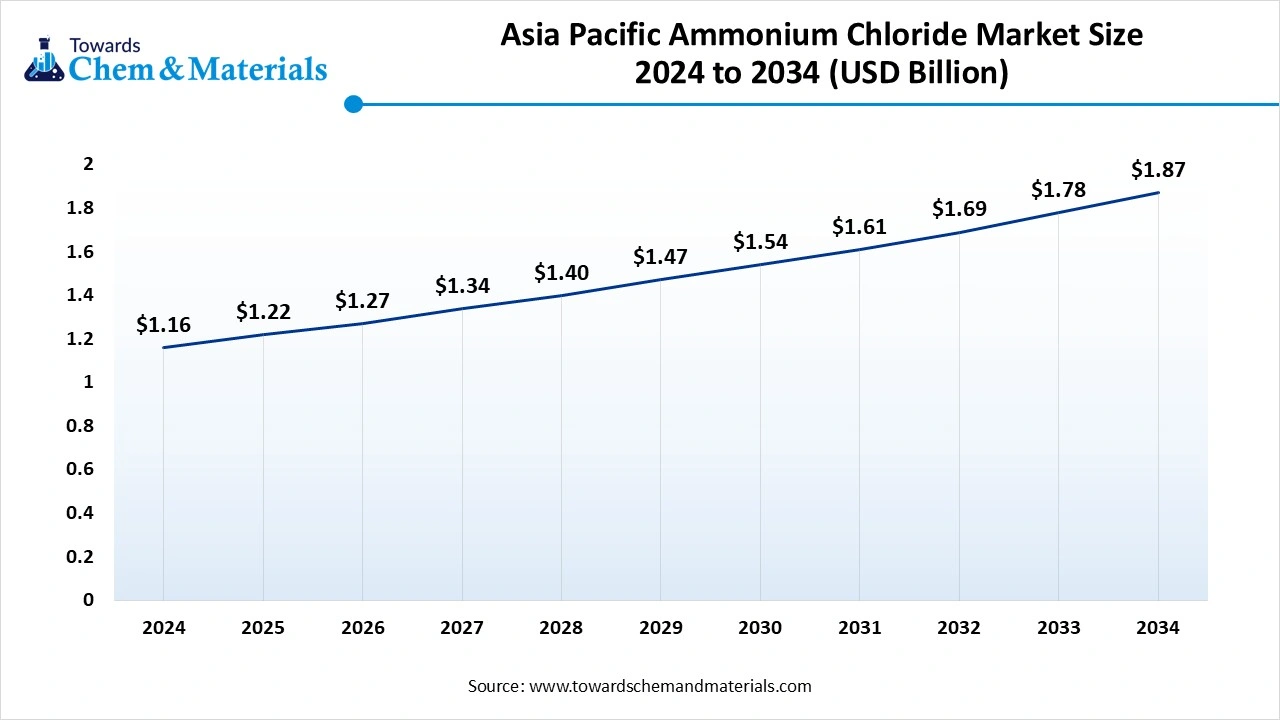

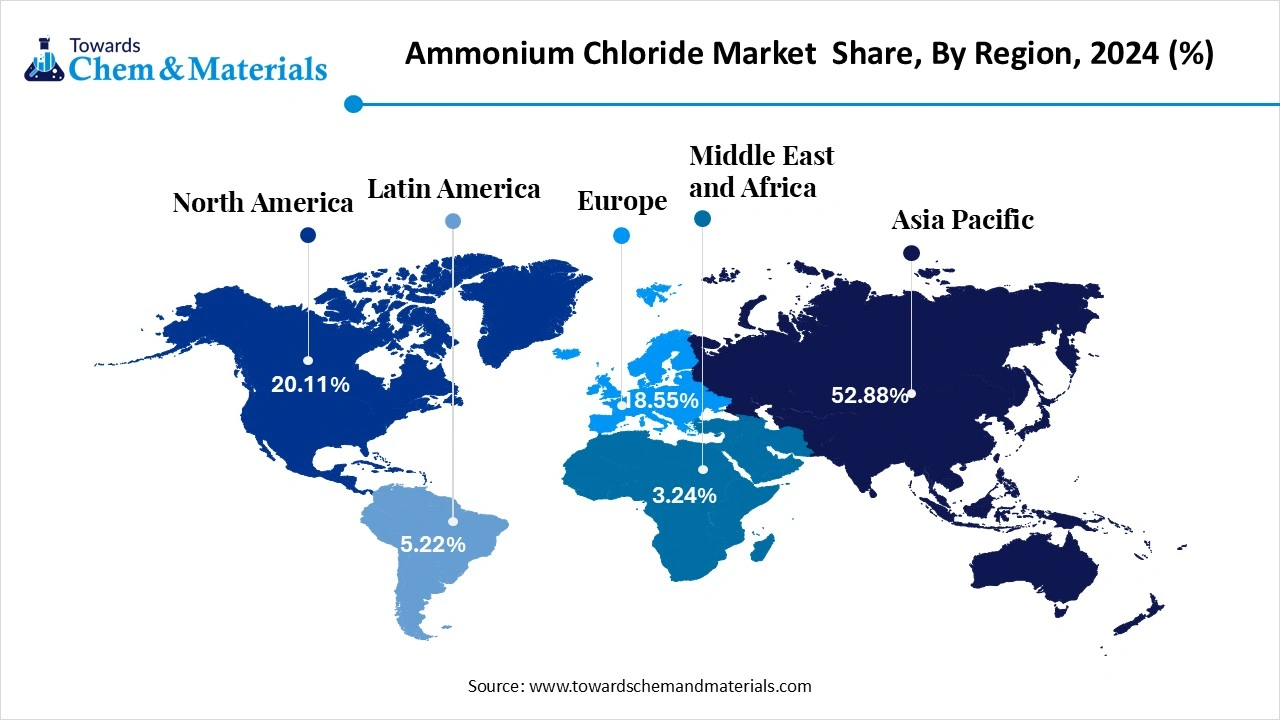

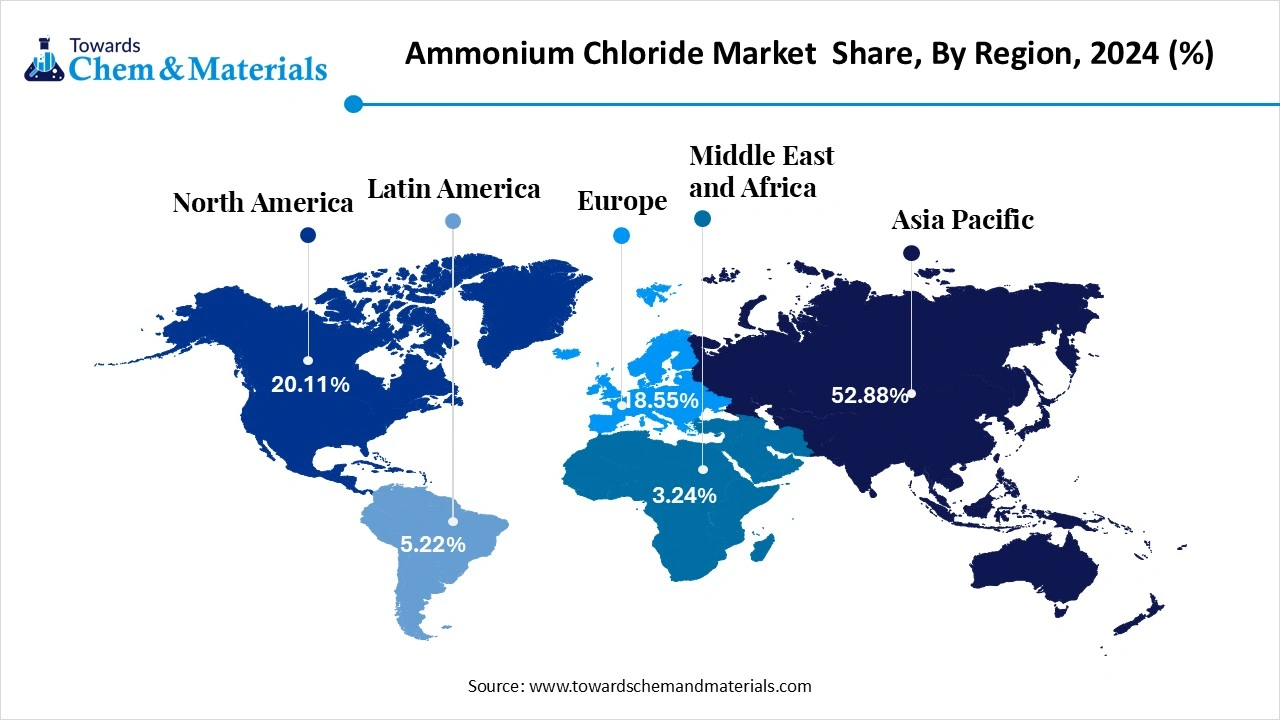

- Asia Pacific aseptic ammonium chloride industry dominated the global market in 2024, accounting for the largest share of 52.88% of the overall revenue.

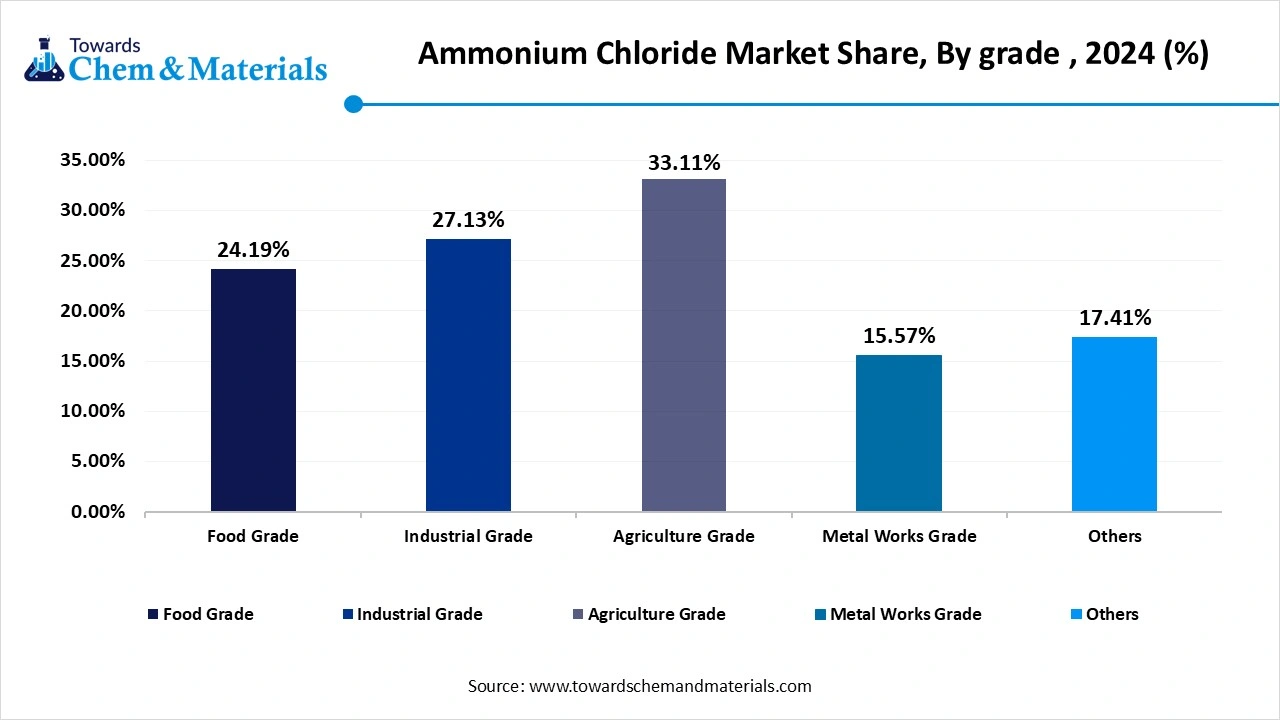

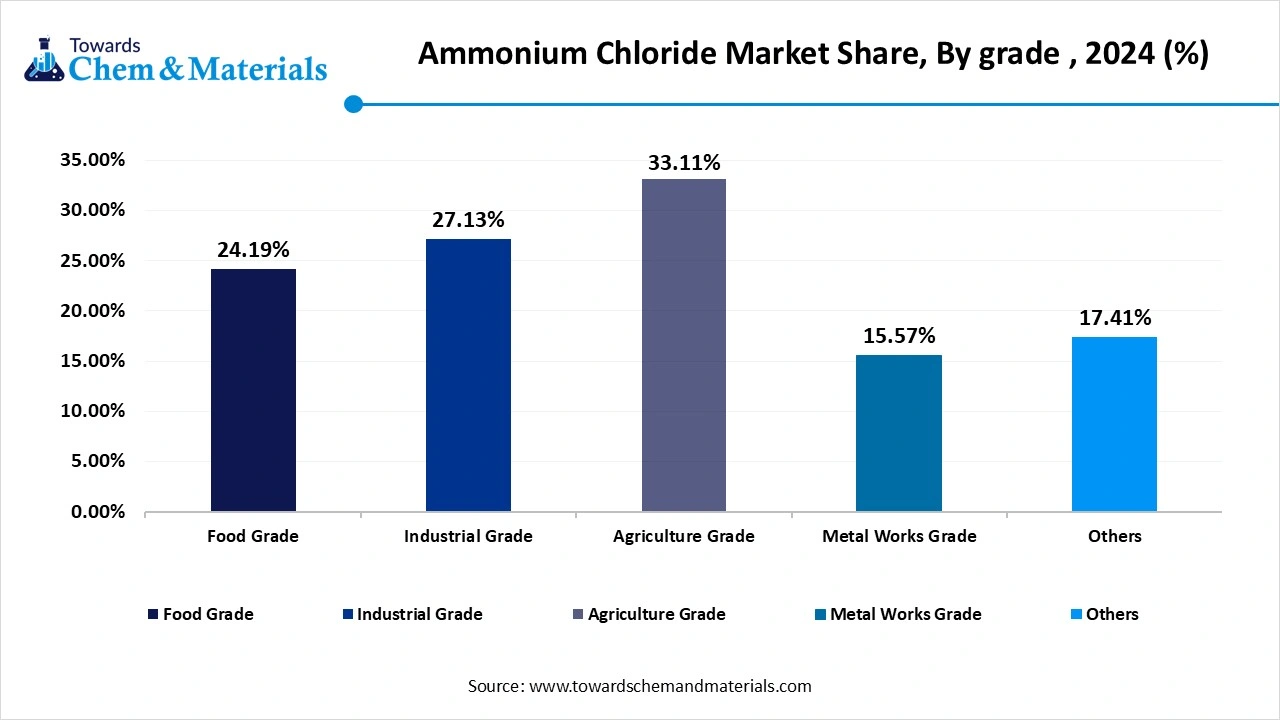

- By grade, the agriculture grade segment held the largest revenue share of 29.85% in 2024.

- By grade, the food grade segment is anticipated to witness a highest CAGR of 4.95% from 2025 to 2033.

- By application, the fertilizer segment dominated the market in 2024 with the largest revenue share of 26.88%.

- By application, the medical/pharmaceutical segment is expected to showcase the highest CAGR of 3.96% during the forecast period.

Rapid Urbanisation is Expanding the Market Growth

The market refers to the world trade and use of the chemical compound ammonium chloride (NH4Cl). It also covers different sectors and applications where ammonium chloride is utilized, such as pharmaceuticals, metalworking, and agriculture. The market is distinguished by its wide range of applications in different end-use industries. Many companies are focusing on capitalizing the new market opportunities that address the safety and environmental challenges related to its use and production, while also staying aware of regulatory developments and market trends. It is increasingly being used as a feed additive for livestock, offering key nutrients and supporting animal health.

What are the Key Trends Influencing the Ammonium Chloride Market?

- Growing demand for ammonium chloride from the agricultural industry is the latest trend propelling market growth. Ammonium chloride is widely utilized in the agricultural sector as a nitrogen fertilizer. The increasing food demand and growing population have led to the growth of agricultural activities, fuelling the product demand.

- Ammonium chloride has an extensive range of applications in different industries such as textiles, food and beverages, metal finishing, and pharmaceuticals. In the pharma sector, it is utilized as a diuretic and expectorant while in food and beverages, it acts as a yeast nutrient and food additive. The growing utilization of ammonium chloride in industrial sectors creates substantial opportunities for the market.

- Ongoing innovations in product development and production technologies are another trend impacting positive market growth. The development of new production processes like solvent extraction and membrane electrolysis can improve production yields and minimize costs.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 2.30 Billion |

| Expected Size by 2034 | USD 3.52 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.87% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Grade, By Application, By Region |

| Key Companies Profiled | BASF SE (Germany), The Dallas Group of America (U.S.), Central Glass Co., Ltd (Japan), Tuticorin Alkali Chemicals And Fertilizers Limited (India), Tinco Chemicals Private Limited (India), Hubei Yihua Chemical Industry Co Ltd (China), Jinshan Chemical (China), CNSG (China), HEBANG (China), Tianjin Bohua YongLi Chemical (China), Shannxi Xinghua (China), Shijiazhuang Shuanglian Chemical (China), Liuzhou Chemical (China), Hangzhou Longshan Chemical (China), Sichuan Guangzhou (China) |

How the Government is Supporting the Ammonium Chloride Market?

The Indian government is supporting the market through various initiatives and policies, mainly emphasizing the fertilizer sector. This includes incentives for green ammonia production, subsidies for fertilizer production, and strategic investments in research and development. The Ministry of New and Renewable Energy (MNRE) has recently launched Mode 2A of the SIGHT Programme impacting the fertilizer industry to produce green ammonia.

The US government is indirectly supporting the market through different initiatives and regulations that affect related industries. Regulations such as those implemented by the US FDA ensure the proper safety of food additives, such as ammonium chloride, earned consumer trust and adoption of the chemical in food processing.

Market Opportunity

Growing Focus on Quality and Standards

With the increasing demand, there is a growing focus on ensuring high-quality safety standards in the production of ammonium chloride and its usage. Establishing strong quality control standards is essential for maintaining consumer trust and market credibility. Furthermore, the market is experiencing a surge in strategic alliances among major players. These collaborations aim to use shared resources, combine expertise, and boost technological advancements.

- In December 2024, BASF expanded the manufacturing of ammonium chloride at its Ludwigshafen site, enhancing overall product quality. BASF is focusing on its long-term commitment to stay a trustworthy supplier of ammonium chloride.(Source: indianchemicalnews)

Market Challenge

Availability of Alternatives

The presence of alternative chemicals and fertilizers such as ammonium sulfate and urea can decrease the demand for ammonium chloride. These alternatives provide similar benefits and are easily available, potentially changing consumer preferences and hindering market growth. Moreover, the imposition of trade barriers like import restrictions and tariffs can substantially affect the global trade of ammonium chloride.

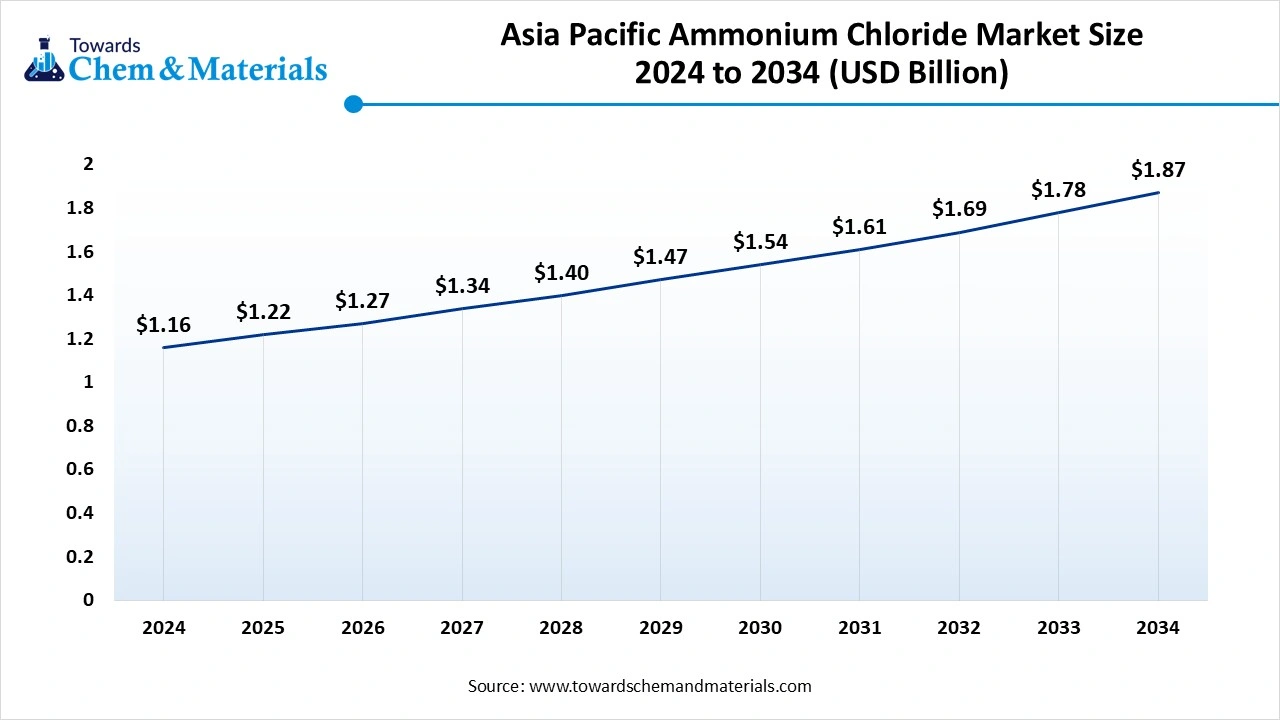

Regional Insight

Asia Pacific dominated the ammonium chloride market in 2024. The Asia Pacific ammonium chloride market is expected to increase from USD 1.22 billion in 2025 to USD 1.87 billion by 2034, growing at a CAGR of 4.89% throughout the forecast period from 2025 to 2034. The dominance of the region can be attributed to the ongoing investments in production infrastructure and capacity to fulfil the increasing product demand. The region is also witnessing innovations in manufacturing technologies and seeking new ways to enhance sustainability in manufacturing processes. In addition, the expansion of the agricultural sector in developing countries such as China and India is impacting positive regional growth soon.

- In January 2025, Adani Petrochemicals Ltd stepped into the petrochemical market via a 50:50 joint venture with Indorama Resources Ltd located in Thailand. The latest venture called Valor Petrochemicals Ltd (VPL) emphasized setting up petrochemical complexes, refineries, and chemical plants.(Source: manufacturingtodayindia)

Ammonium Chloride Market in China

In Asia Pacific, China led the market owing to the increasing emphasis on sustainable production practices along with heavy investments in advanced manufacturing processes and applications such as electronics and chemicals. Also, R&D efforts are intensifying to explore the latest applications and enhance existing processes. China is a major exporter of ammonium chloride, with destinations including Vietnam, Malaysia and Indonesia.

What is the Ammonia Product Export Data from China to Vietnam in 2024?

| Quantity | Price |

| 125 LTR | USD 556.25 |

| 640 KGM | USD 1,216 |

| 11190 KGM | USD 31,332 |

| 1 PCE | USD 100,106.55 |

| 11520 KGM | USD 23,040 |

(Source: Volza.com)

North America is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the growing focus on eco-friendly agricultural practices, which leads to the development of more environmentally friendly and efficient ammonium chloride formulations. Furthermore, countries in the region such as the US and Canada are investing heavily in enhancing production efficiencies and expanding the use of ammonium chloride, leading to market growth shortly.

Ammonium Chloride Market in the U.S.

In North America, the U.S. dominated the market by holding the largest market share, due to the increasing need for food-grade ammonium chloride, utilized as a yeast nutrient and pH regulator reflecting a trend towards natural and clean-label ingredients in food products. Major players in the U.S. market include ProChem, Inc., BASF SE, and Dallas Group of America.

Segmental Insight

Grade Insights

Which Grade Type Segment Dominated the Ammonium Chloride Market in 2024?

The agriculture grade segment dominated the market in 2024. The dominance of the segment can be attributed to the increasing use of agriculture grade as a nitrogen-rich fertilizer. It's a major component in improving crop yield and growth, while also contributing to disease and pest prevention. Additionally, the segment uses various forms of ammonium chloride such as prilled, granular, and crystalline, to suit various handling requirements and application methods.

- In November 2024, EuroChem Karatau announced a plan to introduce a fertilizer production ability in the Zhambyl region. According to a company's statement, the probable timeline for the project is 24 months. The construction is anticipated to begin in the first quarter of March.(Source: kz.kursiv.media)

The food grade segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the rising product demand from the food and beverage sector. It is utilized as a food additive, acting as a flavor enhancer, a leavening agent, and an acidity regulator. The market is further expected to grow due to the increasing consumption of ready-to-eat snacks, processed foods, and desserts.

Application Insights

Why Fertilizer Segment Dominated the Ammonium Chloride Market in 2024?

The fertilizer segment led the market in 2024. The dominance of the segment can be linked to the growing need for nitrogen-based fertilizers to improve crop yields and tackle food security needs. Major factors fuelling this growth include expanding arable land, rising global population, and ongoing government initiatives supporting agricultural productivity. Moreover, the rapid adoption of efficient farming practices, such as the use of efficient fertilizers can impact positive segment growth further.

The medical/pharmaceutical segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be driven by a surge in the use of ammonium chloride in different medications, especially expectorants and cough syrups, and as a treatment for metabolic alkalosis. In addition, the pharmaceutical sector is exploring innovative formulations and uses for ammonium chloride, contributing to market expansion through advanced drug development technologies.

Recent Developments

- In February 2025, Star Refrigeration introduced the advanced generation of their cutting-edge Azanechiller. The newly launched Azanechiller 3.0 is an innovative industrial air-cooled ammonia chiller built to reduce environmental impact and deliver superior performance.(Source: fdiforum.net)

- In December 2024, Netherlands-based energy firm VTTI unveiled an open season to gauge market interest in ammonia cracking and ammonia storage capacity at its terminals in Rotterdam and Antwerp. VTTI is also preparing to have further discussions with major stakeholders of the project.(Source: offshore-energy.bitz)

Top Companies List

- BASF SE (Germany)

- The Dallas Group of America (U.S.)

- Central Glass Co., Ltd (Japan)

- Tuticorin Alkali Chemicals And Fertilizers Limited (India)

- Tinco Chemicals Private Limited (India)

- Hubei Yihua Chemical Industry Co Ltd (China)

- Jinshan Chemical (China)

- CNSG (China)

- HEBANG (China)

- Tianjin Bohua YongLi Chemical (China)

- Shannxi Xinghua (China)

- Shijiazhuang Shuanglian Chemical (China)

- Liuzhou Chemical (China)

- Hangzhou Longshan Chemical (China)

- Sichuan Guangzhou (China)

Segments Covered

By Grade

- Food Grade

- Industrial Grade

- Agriculture Grade

- Metal Works Grade

By Application

- Agrochemical

- Medical/Pharmaceutical

- Food Additives

- Leather & Textiles

- Batteries

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait