Content

What is the Polyolefin Sheets in Industrial Market Size 2024 And Growth Rate?

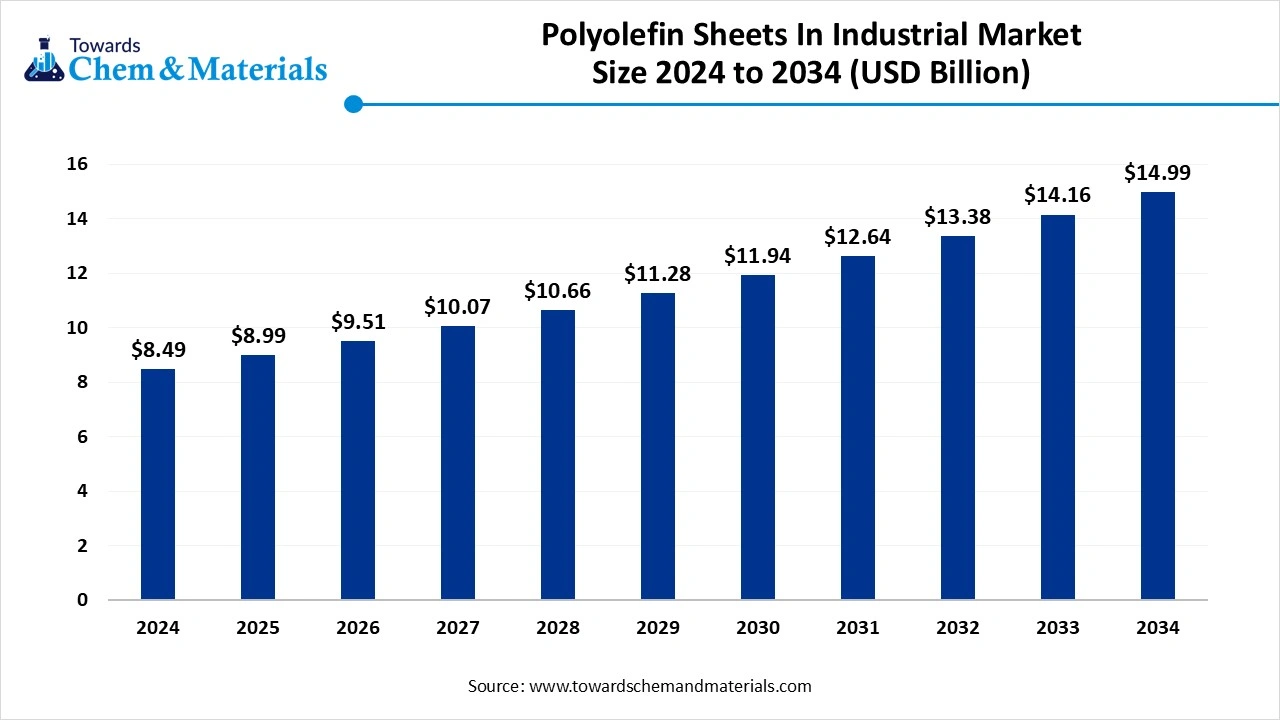

The global polyolefin sheets in industrial market size was valued at USD 8.49 billion in 2024 and is expected to reach around USD 14.99 billion by 2034, growing at a CAGR of 5.85% from 2025 to 2034. The increasing demand for lightweight, durable, and chemical-resistant materials in end-use applications is the key factor driving market growth. Also, technological innovations in polymer processing coupled with the rising demand for polyolefin sheets in construction and packaging are fuelling market growth further.

Key Takeaways

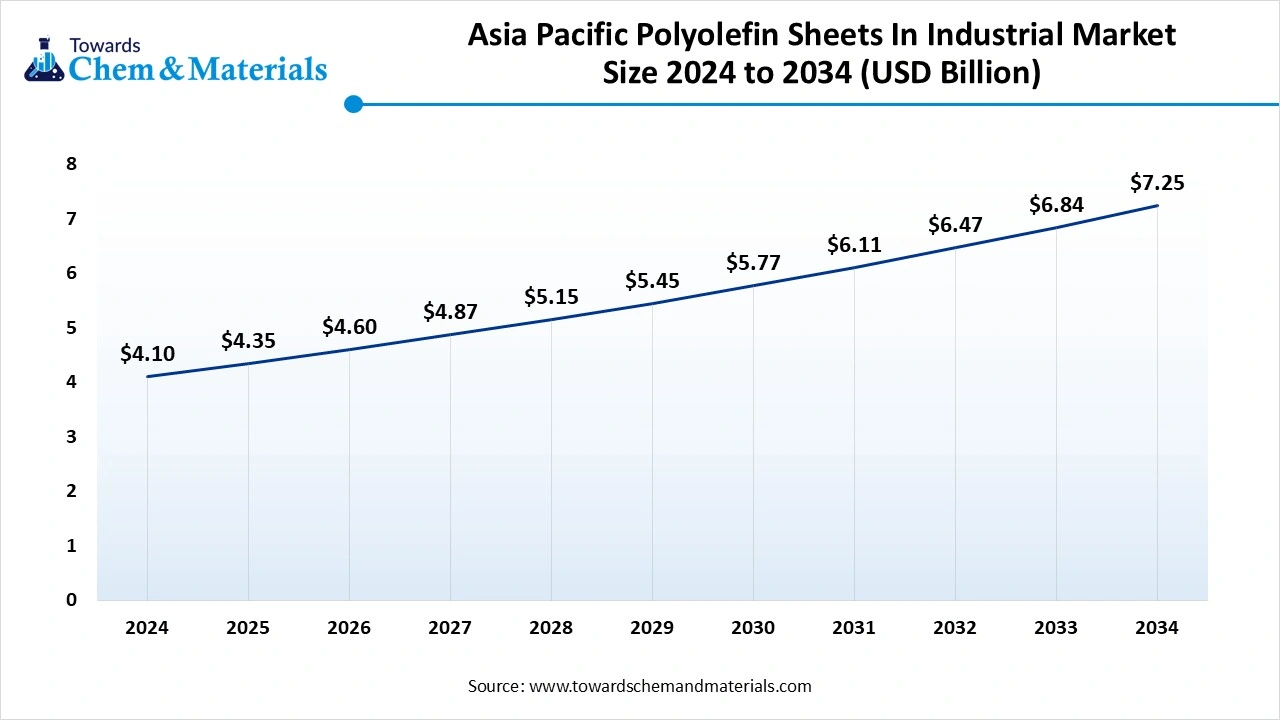

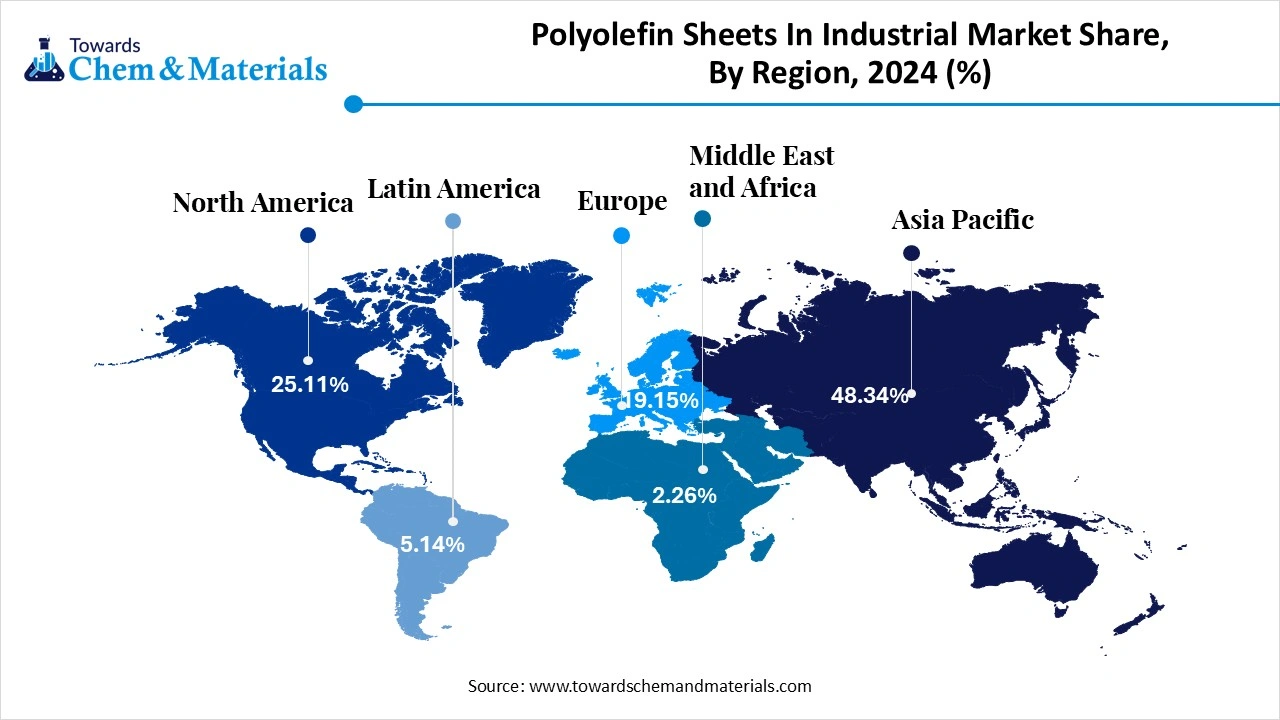

- The Asia Pacific polyolefin sheets in industrial market size was evaluated at USD 4.10 billion in 2024 and is expected to attain around USD 7.25 billion by 2034, growing at a CAGR of 5.87% from 2025 to 2034.

- Asia Pacific polyolefin sheets in industrial market held the largest global revenue share of over 48.34% in 2024 and is anticipated to grow at the fastest CAGR of 6.35% over the forecast period.

- By product, the polyethylene (PE) segment recorded the largest market revenue share, over 58.11%, in 2024.

- By product, the Polypropylene (PP) is projected to grow at the fastest CAGR of 6.11% during the forecast period.

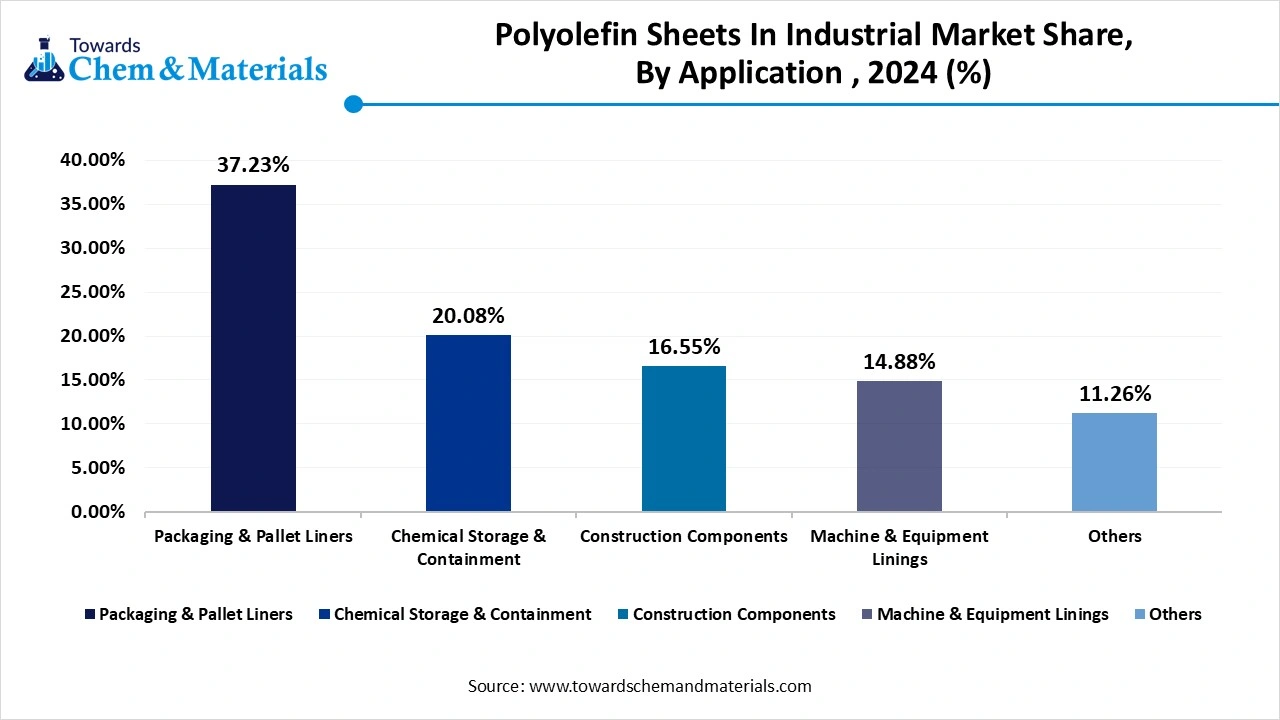

- By application, the packaging & pallet liners segment recorded the largest market share of over 37.23% in 2024.

- By application, the construction components segment is projected to grow at the fastest CAGR of 6.77% during the forecast period.

Increasing Use in Industrial Applications Expanding the Market

Polyolefin sheets are strong plastic sheets made from polyolefins such as polypropylene (PP) or polyethylene (PE) utilized in different applications including lining, insulation, packaging, and more. Polyolefins belong to a family of inexpensive, versatile, and environmentally friendly plastics, which makes them a crucial choice for different industrial applications. The market is growing because of the rising demand for recyclability, lightweight, sustainable, and chemical-resistant materials in industrial settings.

What Are the Key Trends Influencing the Polyolefin sheets in industrial market?

- The growing environmental concerns have impelled industries to shift towards more eco-friendly materials. Polyolefins are easily recyclable to substitutes like PVC. Many market players now producing polyolefin sheets utilizing recycled content, which aligns with the circular economy initiatives. Advancements in biodegradable polyolefins, like bio-PE extracted from sugarcane, are also gaining popularity.

- The versatility of these sheets fuels the adoption of polyolefin sheets in various industries. In healthcare, PP sheets are utilized for medical device components and sterile packaging because of their sterilization compatibility. The electronics industry highly depends on polyolefin sheets for the insulation of components in different devices.

- Innovations in polymer processing technologies, like thermoforming and extrusion, have further improved their customization and performance. The surge in additive manufacturing has optimized the use of polyolefin-based filaments for 3D-printed parts, minimizing overall production costs and reducing material waste.

How the Government is Supporting the Polyolefin Sheets in Industrial Market?

The Indian government is promoting the market through different initiatives such as supporting sustainable practices and the Plastic Parks scheme. These initiatives encourage innovation, strengthen the market's infrastructure, and optimize environmental sustainability. Government initiatives, like "Make in India", aim to offer import alternatives of plastic goods and promote the production of Indian-made products, including polyolefin sheets.

The US government is supporting the market through different initiatives including high expenditure investment for research and development, infrastructure development plans, and tax breaks for production facilities. This high funding can lead to innovations in polymerization technologies along with advancements in high-performance sheets specific to industrial applications. Initiatives such as Secretary's Order 3407, which meant to throw out single-use plastic products also optimize the adoption of polyolefin-based options.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 8.99 Billion |

| Market Size by 2034 | USD 14.99 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.85% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| High Impact Region | Asia Pacific |

| Segment Covered | By Product, By Application, By Region |

| Key Companies Profiled |

Grafix Plastics, Mapal, Trident Plastics, Inc., |

Market Opportunity

Increasing Demand from Automotive Industry

The automotive industry is witnessing a surge in demand for fuel-efficient and lightweight vehicles, which has facilitated crucial polyolefin sheets in industrial market opportunities. Carmakers are increasingly using polymers like polyolefin in different applications including interior & exterior components, electrical components, fuel systems, and under-the-hood parts. Furthermore, thermoplastic olefins, which are a mix of elastomers and polyolefins are utilized for roofing membranes, weather-stripping, and other applications necessity durability and flexibility.

- In April 2025, BASF and Hagihara Industries, Inc. collaborated to develop high-strength polyolefin yarns for artificial turf in sports arenas such as baseball fields, football stadiums, and tennis courts. After many years of research and development, the two organizations have created an innovative formulation with a series of Tinuvin. (Source: basf )

Market Challenge

Competition from Alternative Materials

The rising affordability and availability of alternative materials, such as biodegradable and sustainable plastic are creating a competitive concern to the market, which is the major factor hampering market growth. Moreover, polyolefins are extracted from petrochemical feedstocks such as propylene and ethylene which makes them prone to price fluctuations of natural gas and crude oil.

Regional Insights

Asia Pacific dominated the polyolefin sheets in industrial market in 2024.The Asia Pacific polyolefin sheets in industrial market is expected to increase from USD 4.35 billion in 2025 to USD 7.25 billion by 2034, growing at a CAGR of 5.87% throughout the forecast period from 2025 to 2034. The dominance of the region can be attributed to the ongoing advancements in the packaging and automotive industries. Additionally, expanding manufacturing, rapid industrialization and a surge in infrastructure development across emerging economies in the region such as China and India can impact positive market growth soon. The regional market also provides competitive pricing, which makes polyolefin sheets a crucial choice.

- In November 2024, Aerolam Group of Companies announced the expansion of its latest manufacturing facility in Bahrain worth USD 14 million. The initiative marks Aerolam's first international plant, in the Bahrain Investment Park, Salman Industrial Area, Hidd.(Source: bna.bh )

Polyolefin Sheets in Industrial Market in China

In Asia Pacific, China led the market owing to the increasing domestic demand for polyolefin, robust manufacturing ecosystem, and cost competitiveness in the country. Also, the Chinese market is placing more emphasis on sustainability and recycling, which leads to the adoption of sustainable polyolefin solutions such as POF shrink films.

North America is expected to grow at the fastest rate over the forecast period. The growth of the region can be credited to the rise in product demand in the pharmaceutical and packaging industry, which in turn can result in positive market expansion. Furthermore, growing awareness regarding plastic pollution is supporting the shift towards more eco-friendly polyolefin materials and practices.

Polyolefin Sheets in Industrial Market in the United States

In North America, the US dominated the market by holding the largest market share due to growing product demand across many industries like automotive, packaging, and construction along with technological innovations. The US benefits from extensive shale gas, offering cost-effective feedstock for polyolefin production. Companies such as Exxon Mobil Corporation, Dow, and LyondellBasell Industries are major market players in the country.

Who are Top Plastic Manufacturers in Terms of Market Capitalization in 2024?

| Manufacturer | Market Capitalization (Billion USD) |

| ExxonMobil Chemical | 300.0 |

| SABIC | 100.0 |

| BASF SE | 70.0 |

| LG Chem | 60.0 |

| Dow Inc. | 50.0 |

Segmental Insights

Product Insights

Which Product Segment Held the Largest Polyolefin Sheets in Industrial Market Share in 2024?

The polyethylene (PE) segment dominated the market in 2024. The dominance of the segment can be attributed to the unique properties of polyethylene (PE) which makes it a popular option for different industries. These benefits involved chemical resistance, high durability, cost-effectiveness, and recyclability, etc. In addition, PE is known for its strong ability to withstand stress and impact. Polyethylene sheets, particularly Low-Density Polyethylene (LDPE) and High-Density Polyethylene (HDPE) are extensively utilized in industrial applications.

- In July 2024, ExxonMobil launched its Enable™ 1617 performance polyethylene (PE) grade. The new product is designed to offer consistent extrusion and high tenacity that will allow the addition of high-loading levels of post-consumer recycled (PCR) content.(Source: packagingstrategies)

Polypropylene (PP) segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the low density, high chemical resistance, cost-effectiveness, and good mechanical strength. Moreover, PP is popular for its resistance to water, moisture, and fatigue along with its good electrical insulation properties. These sheets are utilized in applications like plating barrels, chemical tanks, and cleanroom walls, which require higher temperature resistance.

Application Insights

Why Packaging & Pallet Liners Segment Dominated the Polyolefin Sheets in Industrial Market in 2024?

The packaging & pallet liners segment held the largest market share in 2024. The dominance of the segment can be linked to the various advantages of polyolefin such as reduced costs, improved product protection, and optimized space use in transportation and warehouses in improving packaging & pallet liners. Also, their ease of fabrication and lightweight nature make them easy-to-go solutions in logistics-intensive industries.

The construction components segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment can be driven by the surge of commercial and infrastructure construction projects, especially in emerging economies. Furthermore, polyolefin sheets provide substantial benefits for construction components in the market, because of their lightweight nature, durability, and resistance to chemicals and moisture.

Recent Developments

Borouge Group

- Announcement: In March 2025, Borouge Group International announced the acquisition of Nova Chemicals, a major North America-based polyethylene manufacturer. The acquisition took place for US$ 13.4 billion expanding global reach to access market expansion. The Borouge 4 expansion project is anticipated to be recontributed at approximately US$7.5 billion.(Source: Zawya)

BASF and Oriental Yuhong

- Collaboration: In October 2023, BASF and Oriental Yuhong, a major Thermoplastic Polyolefin (TPO) roofing membrane manufacturer in China announced the collaboration to design solar roofing membranes utilized in buildings. The new advancements aim to fulfill China's rapidly increasing demand for rooftop solar panels.(Source:basf )

Hanwha TotalEnergies Petrochemical

- Expansion: In July 2023, Korea's Hanwha TotalEnergies Petrochemical finished the construction of a polyolefin elastomer plant, creating a substantial step in the growth of the value-added materials expansion. This is the firm's first collaborative project with Hanwha Solutions, TotalEnergies, a Hanwha affiliate of its shareholders.(Source: plasticstoday )

Top Companies List

- Grafix Plastics

- Mapal

- Trident Plastics, Inc.

- Farco Plastics Supply

- Duroplastic Technologies

- All Foam Products

- Ensinger, Inc.

- U.S. Packaging & Wrapping LLC

- Porex

- Dugar Polymers Limited

- Polycan Extrusion Pvt. Ltd

- Dutron

Segments Covered

By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Others

By Application

- Packaging & Pallet Liners

- Chemical Storage & Containment

- Construction Components

- Machine & Equipment Linings

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait