Content

Microplastic Recycling Market Size | Top Companies Analysis

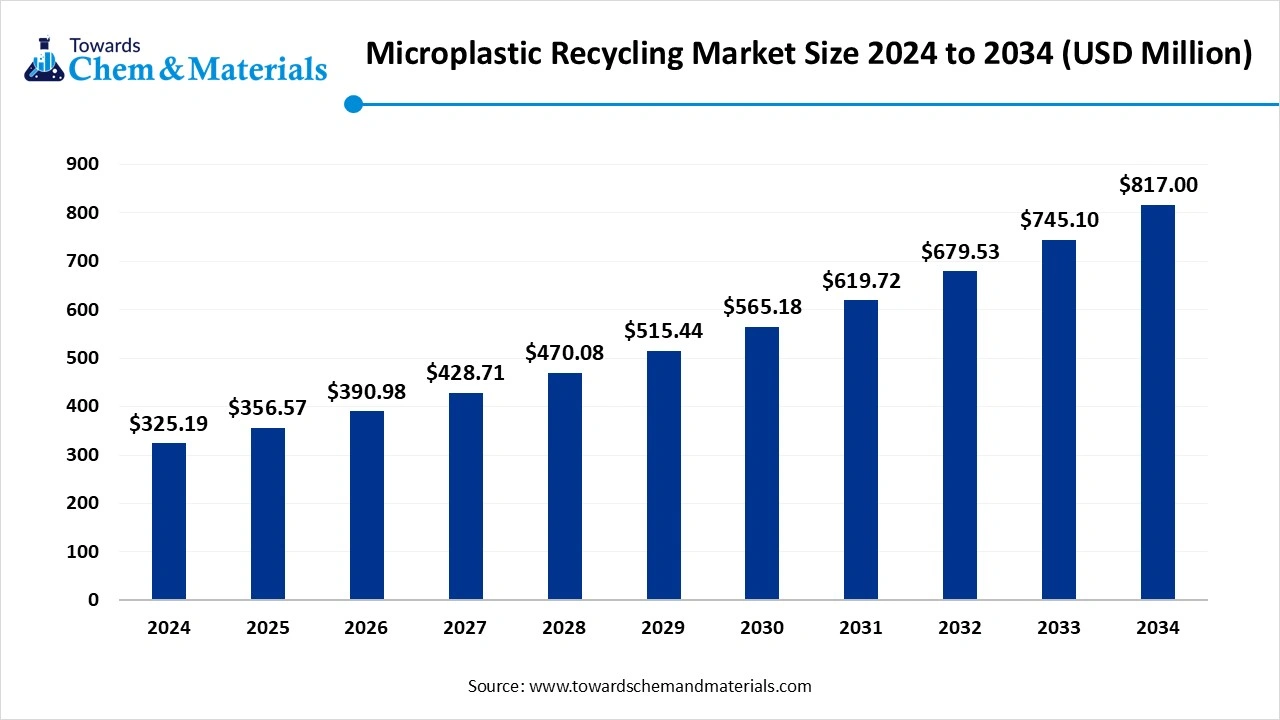

The global microplastic recycling market size was reached at USD 325.19 million in 2024 and is expected to be worth around USD 817.00 million by 2034, growing at a compound annual growth rate (CAGR) of 9.65% over the forecast period 2025 to 2034. The growth of the market is driven by the growing demand for sustainable and eco-friendly options for plastic recycling due to increasing environmental concerns.

Key Takeaways

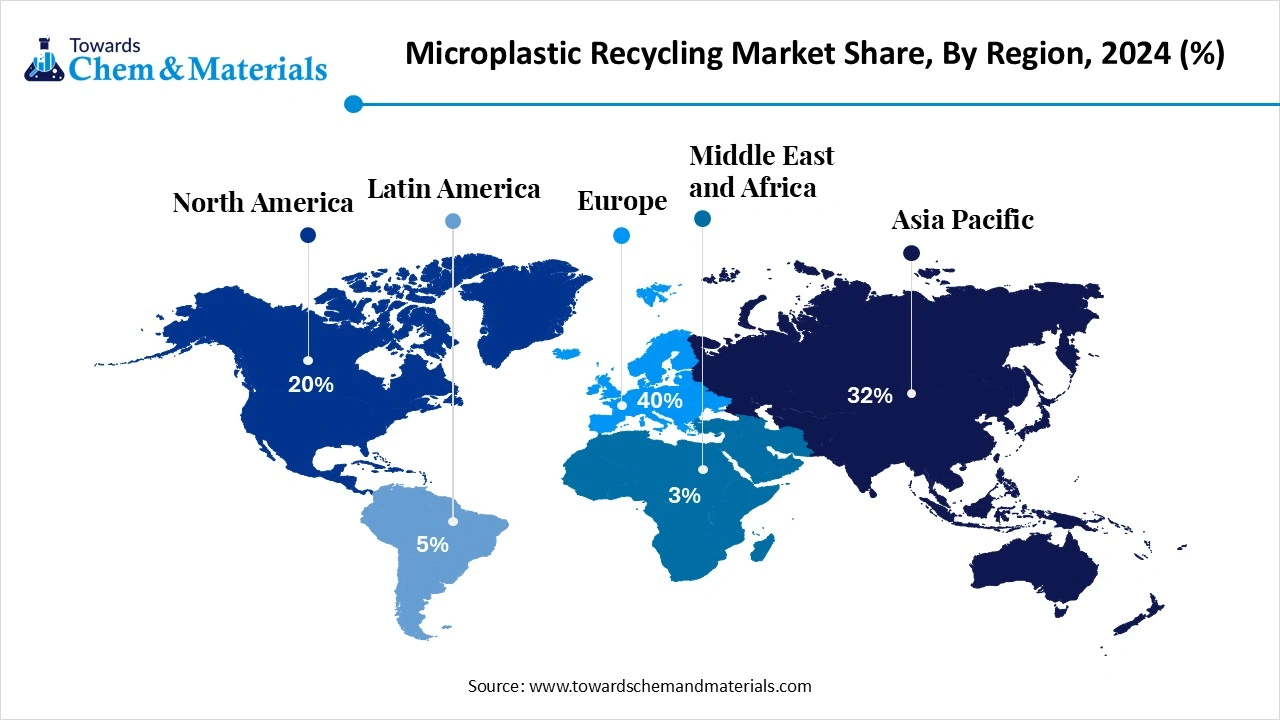

- By region, Europe dominated the market in 2024. The Europe region held approximately 40% share in the market in 2024. The growth is driven by strong regulatory support and initiatives.

- By region, Asia Pacific expected to have significant growth in the market in the forecast period. The growth is driven by the growing sectors due to rapid industrialization.

- By source, the municipal wastewater segment dominated the market in 2024. The municipal wastewater segment held approximately 40% share in the market in 2024. The growing focus on recycling and waste management fuels the growth.

- By source, the industrial waste segment is expected to grow significantly in the market during the forecast period. The rapid industrialization and demand for sustainable practices fuel the demand.

- By technology, the mechanical separation segment dominated the market in 2024. The mechanical separation segment held approximately 50% share in the market in 2024. The benefits offered by the technology with advancements fuel the growth of the market.

- By technology, the biological/enzymatic segment is expected to grow in the forecast period. Growing investment in bio-based solutions is expected to drive this segment.

- By application, the packaging segment dominated the market in 2024. The packaging segment held approximately 35% share in the market in 2024. The circular economy practices increase the adoption.

- By application, the textiles segment is expected to grow in the forecast period. The growing textile sector and demand for recycling due to awareness fuel the growth.

Market Overview

Rising Demand For Durable Materials: Microplastic Recycling Market To Expand

The global microplastic recycling market focuses on technologies and processes designed to capture, separate, and recycle microplastic particles from municipal wastewater, oceans, industrial effluents, and other waste streams. Still in its nascent stage, the market is driven by environmental regulations, circular economy initiatives, and rising corporate sustainability targets.

What Are The Key Growth Drivers That Support The Growth Of The Microplastic Recycling Market?

The growth of the market is driven by the growing environmental awareness due to the harmful effects of microplastics on ecosystems, marine life, and human health, which increases the adoption of recycling solutions, fueling the growth of the market. The stringent government policies for plastic waste management and the push of companies for the adoption of more environmentally responsible practices.

The most important and crucial driver for the growth is technological advancement and innovation in sorting, filtering, and innovation in recycling processes through integration of AI and machine learning, making the separation of microplastics efficient and easier, which increases the growth and expansion of the market.

Market Trends

- Government Regulations & Initiatives: Stringent government policies and regulations worldwide promote plastic waste reduction and encourage microplastic recycling technologies, increasing market demand.

- Growing Environmental Concerns: Rising consumer awareness about the harmful effects of microplastics on health and the environment is driving strong demand for recycling solutions.

- Expanding Industry Applications: Growing demand for recycled microplastics in sectors like packaging, agriculture, consumer goods, and textiles acts as a key driver for market growth.

- Focus on Circular Economy: Many regions, especially Europe, focus on circular economy goals, boosting investments and innovations in plastic recycling and waste management.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 356.57 Million |

| Expected Market Size by 2034 | USD 817.00 Million |

| Growth Rate from 2025 to 2034 | CAGR 9.65% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| High Impact Region | Asia Pacific |

| Segment Covered | By Polymer Type, By Source, By Processing Technology, By Application, By End-Use Industry, By Region |

| Key Companies Profiled | ExxonMobil Chemical, LyondellBasell Industries, SABIC: (Saudi Basic Industries Corporation), BASF SE, Dow Inc. (formerly Dow Chemical), INEOS, Reliance Industries , TotalEnergies, Chevron Phillips Chemical Co. LLC, Formosa Plastics Corporation, Covestro AG, DuPont, Evonik Industries AG, Celanese Corporation |

Market Opportunity

Increased Awareness And Integration Of AI

The microplastic recycling market offers a significant opportunity fueled by stricter environmental regulations, increasing awareness among consumers and industries about pollution, and advances in sorting and processing technologies. Governments globally are tightening rules to fight plastic pollution, boosting demand for efficient microplastic recycling solutions.

Innovations such as AI-based sorting, ultrasonic separation, and photocatalytic degradation are enhancing detection, separation, and breakdown of microplastics, lowering costs and improving recovery rates. Key growth areas include packaging, agriculture, and textiles, with expansion driven by rising demand for recycled materials and supportive government policies.

Market Challenge

The Standardization And Regulations

The key challenges in the microplastic recycling market involve difficulties in collecting and sorting tiny plastic particles, the absence of standardized testing and regulations, the high costs associated with advanced recycling technologies, contamination from toxins, limited public awareness, and the production of lower-quality recycled materials that compete less effectively with virgin plastics.

Addressing these issues calls for substantial investment in infrastructure, technological innovation, international cooperation, and public awareness efforts.

Regional Insights

How Did Europe Dominate The Microplastic Recycling Market In 2024

Europe dominated the market in 2024. Europe has a strong regulatory framework supporting microplastic recycling, with strict directives on water treatment and plastic waste management. The region’s focus on sustainability and innovation has spurred the development of biological and enzymatic recycling technologies. Textile and packaging sectors are key contributors, and recycling systems are increasingly supported by government incentives.

The UK Has Seen Growth Driven By the Presence Of Strong Players In The Country, Which Support Growth.

The UK is emerging as a strong player in microplastic recycling, driven by stringent environmental policies and public concern over marine pollution. The government’s bans on single-use plastics and support for sustainable packaging are fueling demand for advanced recycling technologies.

Universities and research centers are investing heavily in enzymatic and nano-filtration solutions. Additionally, the UK’s packaging and textile industries are adopting innovative recycling practices to align with the country’s net-zero targets.

Asia Pacific Is Experiencing Growth, Driven By The Strong Regulatory Support In The Region.

Asia Pacific is expected to experience significant growth in the microplastic recycling market in the forecast period. Asia Pacific leads in microplastic recycling efforts due to being the largest generator of plastic waste. Rapid industrialization, rising textile production, and urban wastewater challenges are driving investments in recycling infrastructure. Countries like China and Japan are pioneering advanced recycling technologies, while India is scaling up wastewater treatment integration.

India Is Experiencing Growth Driven By Policies And Investments From the Government.

India faces growing microplastic pollution from urban wastewater and expanding textile and packaging industries. While recycling is still in its early stages, policy reforms and investment in wastewater treatment are paving the way for adoption. Public-private partnerships and pilot projects in enzymatic recycling are gaining momentum, highlighting India’s potential as an emerging market.

Segmental Insights

Source Insights

Which Source Segment Dominated The Microplastic Recycling Market In 2024?

The municipal wastewater segment dominated the market in 2024. Municipal wastewater is one of the primary sources of microplastic accumulation, driven by urbanization and increased plastic consumption. Recycling from this stream focuses on capturing microplastics during sewage and water treatment processes. The growing emphasis on sustainable water management and stricter regulations on effluent discharge are pushing innovations in recycling technologies targeting wastewater streams.

The industrial waste segment expects significant growth in the market during the forecast period. Industrial waste, particularly from textiles, packaging, and manufacturing, contributes significantly to microplastic release. Recycling microplastics from industrial sources involves specialized separation and treatment systems that can handle large-scale discharge. With industries under increasing pressure to adopt green practices, demand for efficient recycling from industrial effluents is rising.

Technology Insights

How Did Mechanical Separation Dominate The Microplastic Recycling Market In 2024?

The mechanical separation segment dominated the market in 2024. Mechanical separation remains the most widely used method for microplastic recycling. This process involves filtration, sieving, and density separation to physically extract microplastics from wastewater and solid waste streams. It is preferred for its cost-effectiveness and adaptability in municipal treatment plants. Advances in membrane and nano-filtration technologies are enhancing recovery efficiency.

The biological/enzymatic segment expects significant growth in the market during the forecast period. Biological or enzymatic recycling of microplastics is an emerging approach that leverages microbes and engineered enzymes to degrade plastic particles. Though still in the research and pilot phase, this method is gaining traction due to its eco-friendly nature and potential to handle plastics that mechanical methods cannot. Growing investment in bio-based solutions is expected to drive this segment.

Application Insights

Which Application Segment Dominated The Microplastic Recycling Market In 2024?

The packaging segment dominated the microplastic recycling market in 2024. Packaging is a major contributor to microplastic pollution, with bottles, films, and wrappers being key sources. Recycling microplastics in this segment focuses on recovering particles from post-consumer packaging waste and reprocessing them into usable materials. The circular economy push and consumer demand for sustainable packaging are accelerating adoption in this segment.

The textiles segment expects significant growth in the market during the forecast period. Textiles, especially synthetic fibers like polyester and nylon, shed microplastics during washing and usage. Recycling efforts in this segment target wastewater from textile industries and laundries. With fast fashion generating substantial waste, textile microplastic recycling is becoming critical. Governments and industry players are collaborating to integrate fiber recovery technologies in textile value chains.

Microplastic Recycling Market Value Chain Analysis

- Chemical Synthesis and Processingn : The microplastic recycling is processed through chemical recycling processes by pyrolysis, gasification, and depolymerization.

Key players: Agilyx and Pyrowave, and CreaSolv by CreaCycle - Quality Testing and Certification: The microplastic recycling requires UNE-EN 15343 and the RecyClass Recycling Process scheme, ISO 14021, and ISO 14021 standards and schemes.

Key players: SGS, CIPET, and UL Solutions - Distribution to Industrial Users: The microplastic recycling is distributed to the wastewater treatment, construction, packaging, textile and consumer goods, and agriculture industries.

- Key players: PlanetCare and ECOFARIO.

Recent Development

- In September 2025, in Türkiye, the Ministry of Environment, Urbanization, and Climate Change has prepared a comprehensive plan to reduce the environmental impact of single-use plastics, marine litter, and microplastics.(Source : www.dailysabah.com)

Microplastic Recycling Market Top Companies

- Carbios

- PureCycle Technologies

- Ioniqa Technologies BV

- Loop Industries

- Veolia

- PlanetCare

- ECOFARIO

- Matter

- Polygonesystems

- The Ocean Cleanup

- Suez Recycling & Recovery

- Banyan Nation

- Republic Services

- Novoloop

- BluumBio

- DePoly

Segments Covered

By Source

- Municipal Wastewater

- Industrial Waste

- Oceanic/Environmental Microplastics

- Others

By Technology

- Mechanical Separation

- Chemical Recycling

- Biological/Enzymatic Degradation

- Advanced Filtration & Membranes

By Application

- Packaging

- Textiles

- Automotive

- Construction Materials

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait