Content

Hot Rolled Coil (HRC) Steel Market Size and Growth 2025 to 2034

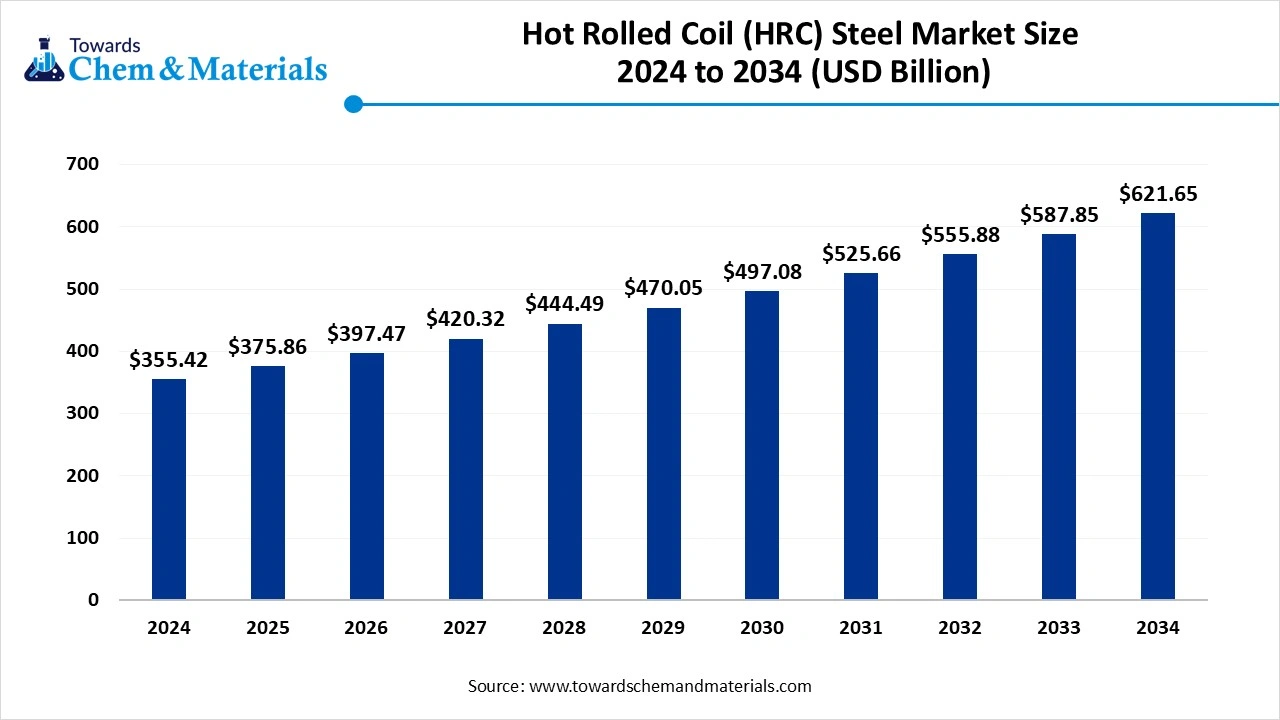

The global hot rolled coil (HRC) steel market size accounted for USD 355.42 billion in 2024, grew to USD 375.86 billion in 2025, and is expected to be worth around USD 621.65 billion by 2034, poised to grow at a CAGR of 5.75% between 2025 and 2034. The growth of the market is driven by the growing industries in the regions and increasing demand for the product from the industries, which fuels the growth.

Key Takeaways

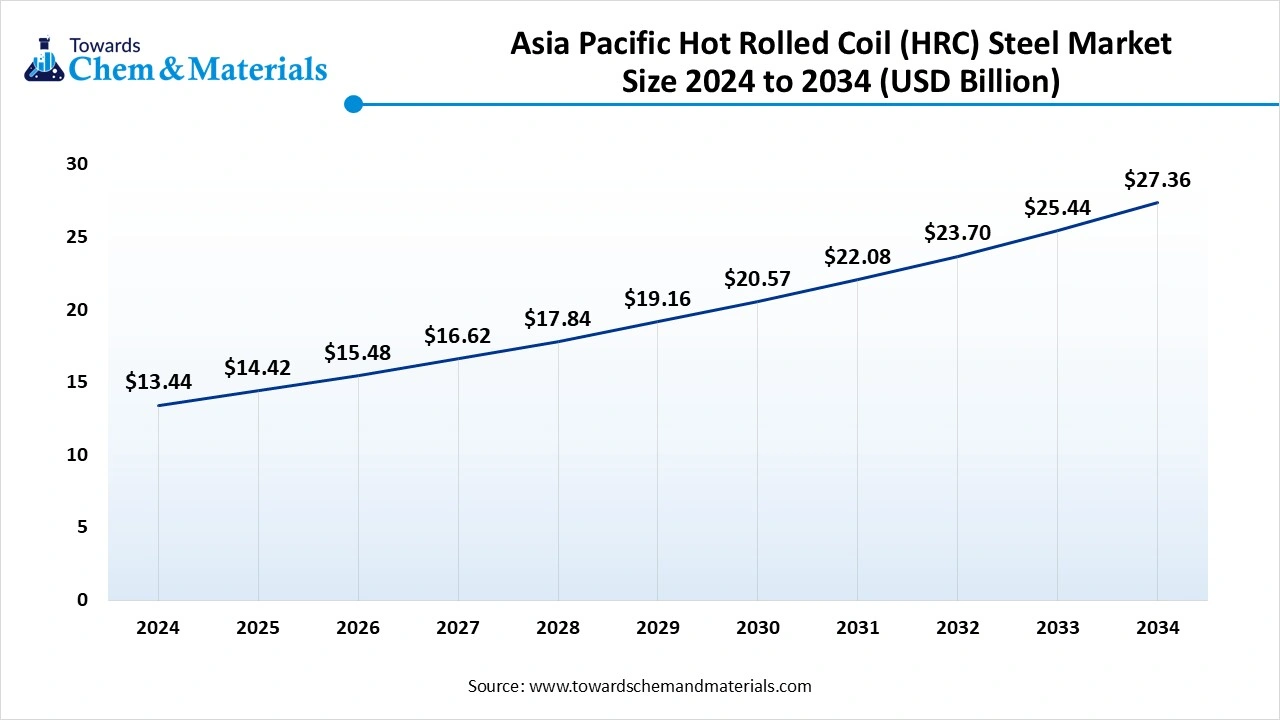

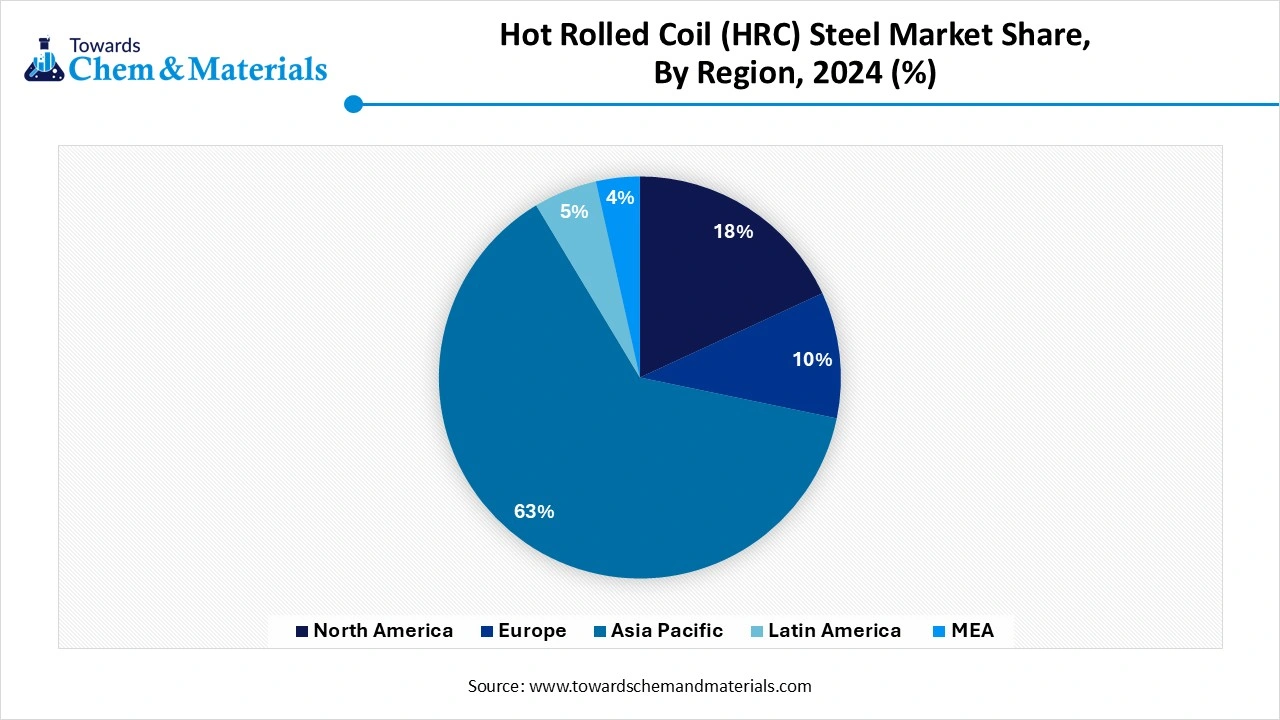

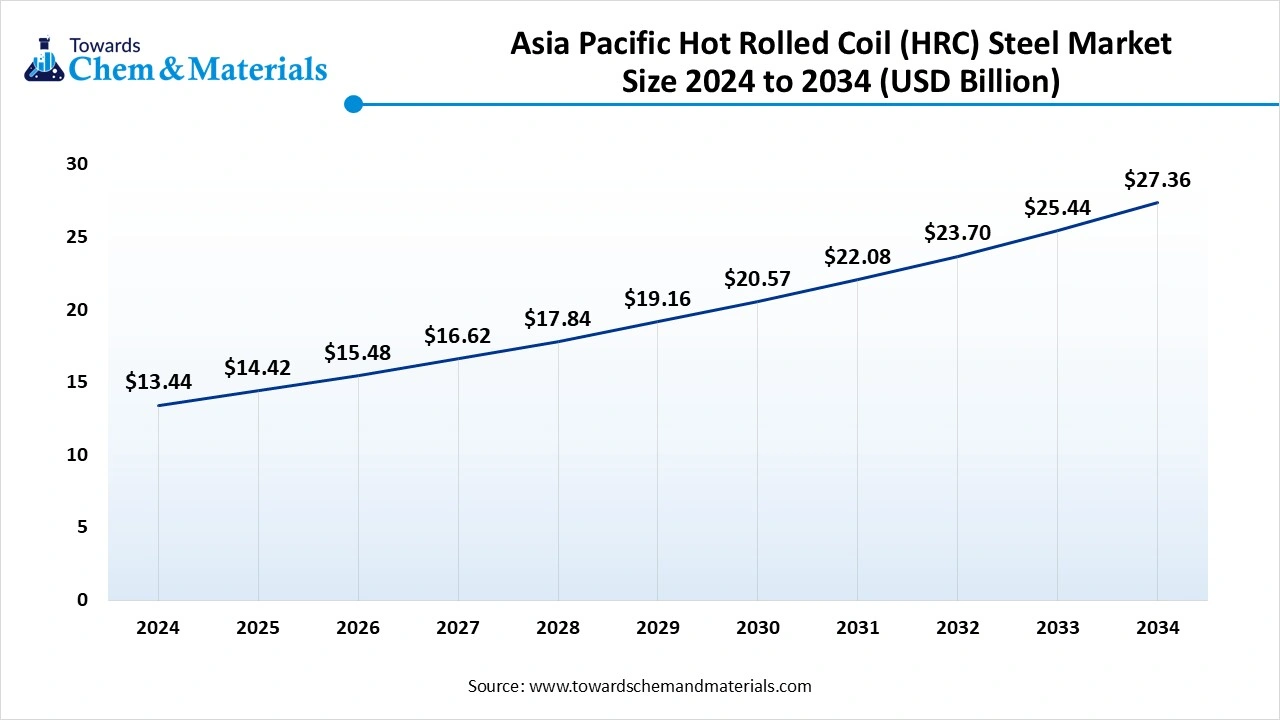

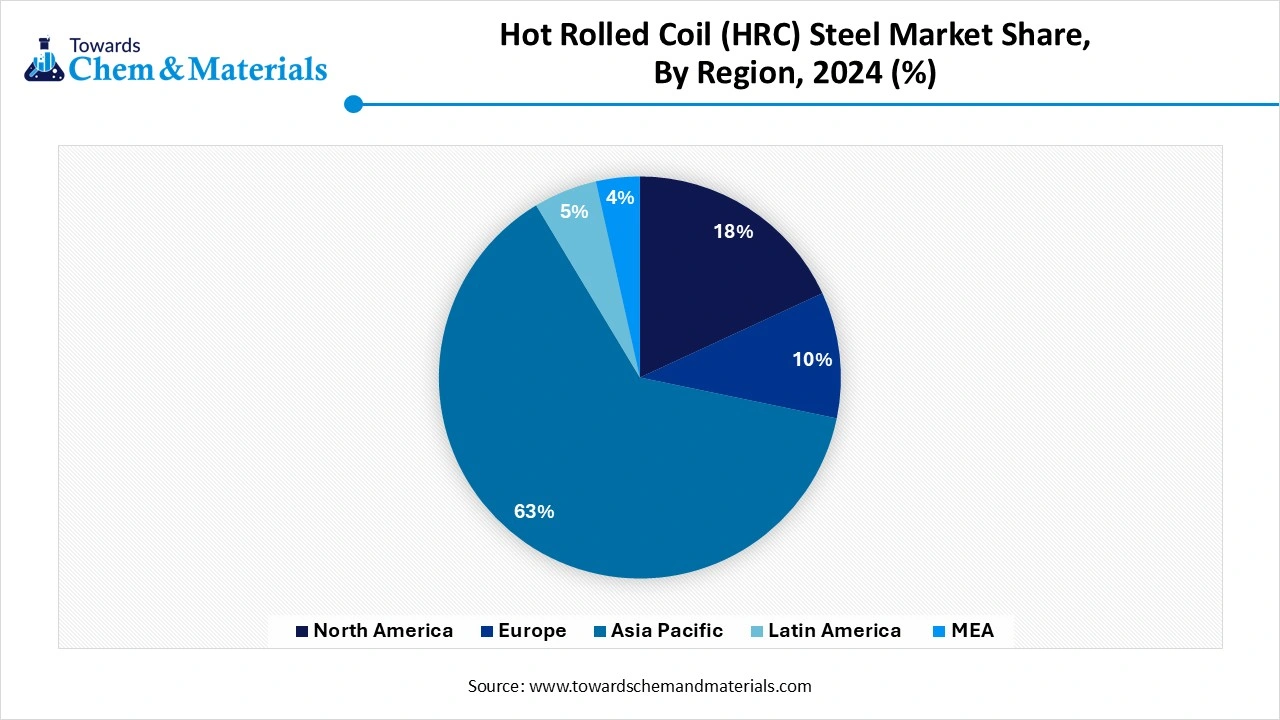

- By region, Asia Pacific dominated the market in 2024. The growth is driven by the increasing infrastructure development projects.

- By region, the Middle East & Africa are expected to have significant growth in the market in the forecast period. The growth of the market is driven by the rising adoption of domestic sources.

- By grade, the mild steel (low carbon) segment dominated the with the 45–50% market share in 2024 due to its wider use in the different industrial application.

- By grade, the stainless-steel segment is expected to grow significantly in the market during the forecast period. The growth is due to the demand for corrosion-resistant material.

- By thickness, the 2–6 mm segment dominated the market with the 40% share in 2024 due to its extensive use in the different industries.

- By thickness, the >6 mm segment is expected to grow in the forecast period. The growth is driven by to use and demand for heavy equipment and infrastructure development.

- By width, the 1000–1500 mm segment dominated the market with the 50% share in 2024 due to its efficient properties like strength and versatility.

- By width, the >1500 mm segment is expected to grow in the forecast period. The growth is due to increasing demand from industry.

By end use, the construction & infrastructure segment dominated the with 35–40% share market in 2024 due to its higher use in the construction industry. - By end use, the renewable energy segment is expected to grow in the forecast period. The growing demand for renewable sources of energy is due to rising awareness.

- By distribution channel, the direct sales segment dominated the market with 60% share in 2024 due to the higher preference.

- By distribution channel, the online portals segment is expected to grow in the forecast period. The ease and convenience offered drive the growth.

Market Overview

Rising Demand for Durable Materials: Hot Rolled Coil (HRC) Steel Market to Expand

Hot rolled coil (HRC) steel is made by heating a steel slab above its recrystallization temperature and then passing by rollers to reach the required shape and thickness. This process creates a flat, rolled steel strip that is coiled for easier handling, transportation, and storage.

The production involves heating steel slabs in a furnace, followed by continuous rolling into a strip using a series of rolling mills. The rolling takes place at temperatures around 1700°F (927°C) or higher, which makes the steel more malleable and easier to shape. However, this high-temperature process can lead to a rougher surface finish compared to cold-rolled steel. HRC is commonly used across different industries such as construction, automotive manufacturing, and the production of tubes, pipes, and other steel products.

What Are the Key Growth Drivers Responsible for The Growth of The Market?

The key growth drivers responsible for the growth of the market are the rising industrialization and increasing demand from the construction and infrastructure development projects drive the growth of the market. The rising government initiatives and investments for promoting industrial growth and infrastructure modernization, and the initiation of new development projects, drive the demand for the market.

The growth is also driven by the expanding automotive industry, and manufacturing activities increase the demand for hot-rolled coil steel due to the increasing use of steel in vehicle manufacturing along with technological advancements to improve steel production efficiency, cost-effectiveness and material performance making it more accessible and versatile driving the growth and expansion of the market.

Market Trends

- Technological advancements in product and production techniques for efficiency, cost-effectiveness, and material performance for versatility drive the growth.

- The rising preference for their properties, like durability and cost-effective material, is a growing trend fueling the growth of the market.

- The growing government policies for infrastructural development projects and announcements and import duties, and tariffs are a growing trend that drives the growth.

- The emerging economies are experiencing significant growth due to growing industrial activities and infrastructure development, which drives the growth.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 375.86 Billion |

| Market Size by 2034 | USD 621.65 Billion |

| Growth rate from 2024 to 2025 | CAGR 5.75% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Grade, By Thickness, By Width, By End-use Industry, By Distribution Channel, By Region |

| Key Profiled Companies | ArcelorMittal, Baosteel Group Corporation , POSCO , Nippon Steel Corporation , JFE Steel Corporation, Tata Steel , SSAB AB , thyssenkrupp AG , Hyundai Steel , JSW Steel , US Steel Corporation , Nucor Corporation, HBIS Group , Shougang Group , Ansteel Group Corporation , China Steel Corporation (CSC) , Voestalpine AG , Gerdau S.A. , Essar Steel (now part of ArcelorMittal Nippon Steel) |

Market Opportunity

What Are the Key Growth Opportunities Responsible for the Growth of the Market?

The key growth opportunity responsible for the growth of the steel market is the growing and expanding industries in growing economies like construction, automotive, shipbuilding, and heavy machinery, which demand steel due to increasing requirements from the industry, driving the demand, and supporting the growth of the market. The growth is also driven by demand for stainless steel materials from automotive and construction activities due to the fear of corrosion and damage, and demand from consumers for stainless steel further drives the growth and expansion of the market, which creates great opportunity for growth.

Market Challenge

What is The Key Challenge That Limits The Growth Of The Market?

The key challenge which hinders the growth of the market is the growing and fluctuating raw material price, like iron ore and coal, the cost of extraction and supply chain disruption due to political disputes or due to geopolitical tension hinders the supply chain which ultimately results in limited raw material supply which further results in high price of the final product which affects the profitability and hinders the growth of the market.

Regional Insights

How Did Asia Pacific Dominate The Hot Rolled Coil (HRC) Steel Market In 2024?

Asia Pacific dominated the hot rolled coil (HRC) steel market in 2024. The growth of the market is driven by the increasing infrastructural development in the region, rapid urbanization, and increasing industrial sectors like automotive and machinery, which demand steel for the manufacturing of vehicles and machines, which drives the growth of the market in the region. The government initiatives and support for the development of smart cities with increased transportation networks, along with infrastructure development projects, further boost the growth of the market and expansion in the region.

China Is Seeing Steady Growth, Driven By Infrastructure Development Projects.

The growth of the Chinese market is driven by the expanding industries and increasing construction activities in the country due to increasing population and economy, which demand increased activity, which fuels the growth of the market in the country. The government initiatives, like those made in China by the government, also increase the demand and growth of domestic manufacturing and products which resulting in a greater increase in growth and expansion of the market.

- China shipped out 6,671 Hot Rolled Coils shipments from October 2023 to September 2024 (TTM). These exports were handled by 496 China exporters to 664 buyers, showing a growth rate of 49% over the previous 1 year.(Source:www.volza.com )

- Globally China, Japan, and Vietnam are the top three exporters of Hot Rolled Coils. China is the global leader in Hot Rolled Coils exports with 102,013 shipments, followed closely by Japan with 75,588 shipments, and Vietnam in 3rd place with 55,482 shipments.(Source: www.volza.com)

The Large-Scale Construction Projects In The Middle East And Africa Drive The Growth Of The Market

The Middle East and Africa are expected to have significant growth in the forecasted period. The growth of the market is driven by the increasing and large-scale construction projects in the region, which increase the demand for the product, with quality fueling the market growth. The increasing oil and gas infrastructure and expanding energy sector, and use of renewable energy and infrastructure development further fuel the growth. Major initiatives like Saudi Vision 2030 and infrastructure development in the UAE increase the steel consumption and increase the growth of the market in the region, leading to the expansion of the market.

Saudi Arabia Is Experiencing Increasing Growth Driven By Rising Initiatives

The growth of the Saudi market is driven by the government initiatives like Vision 2030 to diversify the economy and reduce the dependency on oil revenue, which increases the demand for the market. The increasing construction activities and building of structural frames, energy infrastructure, and heavy machinery increase the demand for steel consumption, driving the growth of the market. The country's heavy investments in local steel manufacturing, with partnerships with major players in the country, further fuel the growth and expansion of the market in the country.

- The World shipped out 585,776 Hot Rolled Steel shipments from November 2023 to October 2024 (TTM). These exports were handled by 17,902 world exporters to 20,530 buyers, with the growth rate of 20% over the previous 1 year.(Source: www.volza.com)

- Globally China, Vietnam, and Japan are the top 3 exporters of hot-rolled steel. China is the global leader in Hot Rolled Steel exports with 537,743 shipments, followed closely by Vietnam with 422,911 shipments, and Japan in 3rd place with 392,839 shipments.(Source:www.volza.com )

Segmental Insights

Grade Insights

How Did the Mild Steel (Low Carbon) Segment Dominate the Hot Rolled Coil (HRC) Steel Market In 2024?

The mild steel (low carbon) segment dominated the hot rolled coil (HRC) steel market in 2024. The mild steel segment dominates the hot rolled coil market due to its properties like excellent weldability, ductility, and cost-effectiveness, which increases the demand. Widely used in construction, automotive frames, pipelines, and general fabrication, mild steel offers an ideal balance of strength and formability for diverse applications. Its lower carbon content makes it easier to shape and process, supporting mass production needs, fueling the growth of the market. Growing demand for affordable and versatile steel solutions continues to drive strong adoption of mild steel HRC globally.

The stainless-steel segment expects significant growth in the market during the forecast period. The stainless-steel segment of the hot rolled coil market serves industries such as food processing, chemical, oil and gas, and architectural applications requiring superior corrosion resistance, hygiene, and aesthetic appeal, which drive the growth of the market. With added chromium and nickel, stainless steel HRC offers excellent strength and durability even in harsh environments. Rising demand for long-lasting, low-maintenance structures and equipment, along with increased focus on sustainable and clean materials, fuels strong growth of the market and supports expansion.

Thickness Insights

Which Thickness Segment Dominates the Hot Rolled Coil (HRC) Steel Market In 2024?

The 2–6 mm segment dominated the hot rolled coil (HRC) steel market in 2024. The 2–6 mm thickness segment dominates the market due to its extensive use in automotive panels, construction frameworks, storage tanks, and heavy machinery components. This medium thickness offers an ideal balance between strength, flexibility, and ease of fabrication, making it suitable for forming and welding processes. Increasing demand for lightweight yet strong structural materials, particularly in vehicle manufacturing and modern buildings, continues to boost the adoption of this versatile segment.

The >6 mm segment expects significant growth in the market during the forecast period.

The >6 mm thickness segment serves critical applications requiring superior strength and load-bearing capacity, such as shipbuilding, heavy construction equipment, bridges, and large-diameter pipelines. These thicker coils provide excellent durability and structural stability, reducing the need for additional reinforcements. As global infrastructure projects expand and demand for robust, high-performance steel rises, this segment experiences steady growth, driven by industries prioritizing safety, longevity, and performance in harsh operating environments.

Width Insights

How Did The 1000-1500 Segment Dominate the Hot Rolled Coil (HRC) Steel Market In 2024?

The 1000–1500 mm segment dominated the market in 2024. The 1000–1500 mm width segment holds significant demand in the market, widely used across construction, automotive, and general engineering applications. This versatile width range offers an ideal balance between strength and workability, making it suitable for producing structural beams, automotive body parts, and heavy machinery components. Manufacturers prefer this segment for its adaptability in downstream processing, efficient material utilization, and compatibility with diverse fabrication techniques, supporting broad industrial growth.

The >1500 mm segment expects significant growth in the market during the forecast period. The >1500 mm width segment caters to specialized applications requiring large, heavy-duty steel sheets, particularly in shipbuilding, large-diameter pipes, heavy machinery, and infrastructure projects. This wider coil format reduces the need for additional welding and joining, enhancing structural integrity and lowering production costs. Growing investments in offshore wind farms, oil and gas pipelines, and mega infrastructure projects drive demand for these extra-wide coils, supporting robust growth in this premium and technically demanding market segment.

End Use Insights

Which End-Use Segment Dominates the Hot Rolled Coil (HRC) Steel Market In 2024?

The construction & infrastructure segment dominated the hot rolled coil (HRC) steel market in 2024. The construction and infrastructure sector is the largest consumer of hot rolled coil steel, driven by robust global urbanization and industrialization trends. HRC steel is widely used in building frameworks, bridges, tunnels, and structural sections due to its strength, durability, and cost-effectiveness. Massive investments in smart cities, transportation networks, and renewable energy facilities further fuel demand. Governments' focus on modernizing public infrastructure and the growth of residential and commercial projects ensures steady market expansion.

The renewable energy segment expects significant growth in the market during the forecast period. The renewable energy sector is emerging as a significant end user of hot rolled coil steel, propelled by the global transition toward cleaner energy sources. HRC steel is crucial in manufacturing wind turbine towers, solar panel mounting structures, and hydropower components due to its high strength and formability. Expanding investments in wind and solar farms worldwide, along with government incentives for green energy projects, continue to drive demand in this dynamic and rapidly growing segment.

Distribution Channel Insights

How Did the Direct Sales Segment Dominate the Hot Rolled Coil (HRC) Steel Market In 2024?

The direct sales segment dominated the hot rolled coil (HRC) steel market in 2024. Direct sales represent a prominent distribution channel in the market, favored by large-scale buyers such as automotive manufacturers, construction firms, and heavy machinery producers. This approach allows steelmakers to build long-term partnerships, ensure consistent supply, and offer customized solutions tailored to clients’ specific needs. Direct sales help reduce intermediary costs, improve margins, and provide better control over pricing and quality, strengthening relationships between producers and major end-use industries worldwide.

The online portals segment expects significant growth in the market during the forecast period. Online portals are an emerging distribution channel in the market, driven by the increasing digitization of industrial procurement. These platforms offer buyers easy access to a wide range of steel products, real-time pricing, and transparent transactions. Small and medium enterprises especially benefit from competitive rates and quick delivery options. The growth of e-commerce in the steel industry streamlines supply chains, enhances market reach, and supports flexible, on-demand purchasing decisions.

Recent Developments

- In August 2024, NMDC Steel Limited announced the achievement of its production capabilities. The company has achieved to produce 1 Million Ton (MnT) of Hot Rolled Coil (HRC), making them one of the fastest and most efficient plants in the industry.(Source: www.pib.gov.in)

Top Companies List

- ArcelorMittal

- Baosteel Group Corporation

- POSCO

- Nippon Steel Corporation

- JFE Steel Corporation

- Tata Steel

- SSAB AB

- thyssenkrupp AG

- Hyundai Steel

- JSW Steel

- US Steel Corporation

- Nucor Corporation

- HBIS Group

- Shougang Group

- Ansteel Group Corporation

- China Steel Corporation (CSC)

- Voestalpine AG

- Gerdau S.A.

- Essar Steel (now part of ArcelorMittal Nippon Steel)

Segments Covered

By Grade

- Mild Steel (Low Carbon Steel)

- High Carbon Steel

- Alloy Steel

- Stainless Steel

By Thickness

- 2–6 mm

- <2 mm

- 6 mm

By Width

- 1000–1500 mm

- <1000 mm

- 1500 mm

By End-use Industry

- Construction & Infrastructure

- Automotive

- Shipbuilding

- Industrial Equipment & Machinery

- Oil & Gas

- Renewable Energy (Wind Towers, Solar Mounts)

By Distribution Channel

- Direct Sales (to OEMs, large buyers)

- Distributors/Traders

- Online Portals

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait