Content

What is the Current Ferro Alloys Market Size and Share?

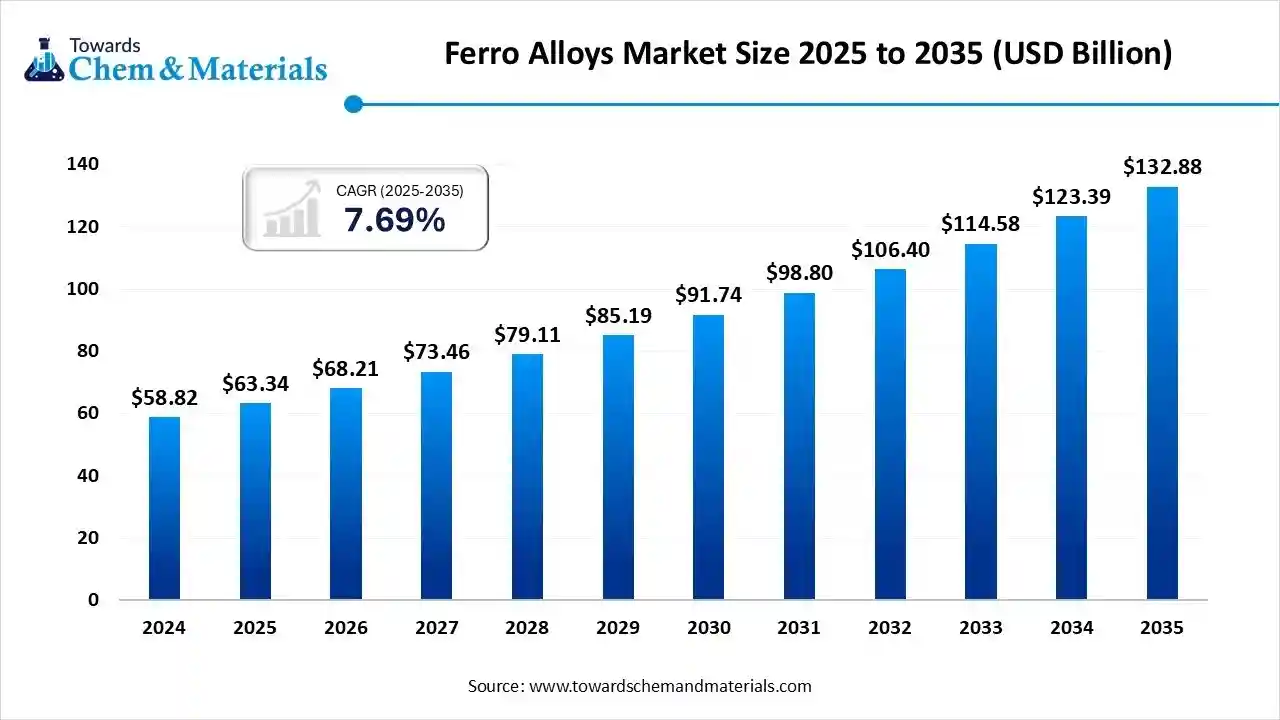

The global ferro alloys market size is calculated at USD 63.34 billion in 2025 and is predicted to increase from USD 68.21 billion in 2026 and is projected to reach around USD 132.88 billion by 2035, The market is expanding at a CAGR of 7.69% between 2025 and 2035. Asia Pacific dominated the ferro alloys market with a market share of 52.40% the global market in 2024. The growing steel manufacturing for the construction and automotive industries is the key factor driving market growth. Also, increasing demand for lightweight, high-strength steel, coupled with the rapid development of renewable energy sources, can further fuel market growth.

Key Takeaways

- By region, the Asia-Pacific dominated the market with a 52.4% share in 2024 and is expected to grow at the fastest CAGR of 8.0% over the forecast period.

- By region, North America is expected to grow at a notable CAGR over the forecast period.

- By type, the ferrochrome segment dominated the market with a 45.6% share in 2024.

- By type, the others (ferro-vanadium, ferro-tungsten, ferro-molybdenum, etc.) segment is expected to grow at the fastest CAGR of 7.4% over the forecast period.

- By production process, the blast furnace segment held a 69.5%market share in 2024.

- By production process, the electric arc furnace (EAF) process segment is expected to grow at the fastest CAGR of 7.3% over the forecast period.

- By application, the carbon & low alloy steel segment dominated the market with a 52.5% share in 2024.

- By application, the stainless-steel segment is expected to grow at the fastest CAGR of 7.1% during the projected period.

- By end user industry, the steel manufacturing segment dominated the market with a 42.4% share in 2024.

- By end user industry, the construction & infrastructure segment is expected to grow at the fastest CAGR of 7.2% during the study period.

What are Ferro Alloys?

The market is driven by infrastructure growth, new steelmaking technologies (e.g., EAF), and rising demand for high-performance alloys. The ferro alloys market encompasses iron-based alloys that contain substantial amounts of one or more elements such as chromium, manganese, silicon, vanadium, or molybdenum. These materials are added to molten steel or iron to impart properties like increased strength, hardness, corrosion resistance, or heat tolerance. Widely used in steelmaking, construction, automotive, aerospace, and foundry industries.

Ferro Alloys Market Outlook:

- Industry Growth Overview: The increasing demand for energy solutions, especially vanadium redox flow batteries, is fuelling the need for vanadium, a key ferroalloy. Ferroalloys are also important to create advanced steel grades.

- Sustainability Trends: Sustainability trends in the market include increasing emphasis on cleaner and energy-efficient production methods, with a rising role of economic practices like scrap recycling.

- Major Investors: Major investors and key companies in the market include multinational corporations like ArcelorMittal, Tata Steel, and Glencore. Their investments are mainly focused on technological upgrades for sustainability and capacity expansion.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 68.21 Billion |

| Expected Size by 2035 | USD 132.88 Billion |

| Growth Rate from 2025 to 2035 | CAGR 7.69% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2026 - 2035 |

| Leading Region | Asia Pacific |

| Fastest Growing Region | North America |

| Segment Covered | By Type, By Production Process, By Application, By End-User Industry, By Region |

| Key Companies Profiled | Glencore plc, Jindal Steel & Power Limited (JSPL), Samancor Chrome Limited, Tata Steel Limited, Eurasian Resources Group (ERG), OM Holdings Ltd, Afarak Group plc, Shanghai Shenjia Ferroalloys Co., Ltd., Eramet S.A., China Minmetals Corporation, ArcelorMittal S.A., Ferro Alloys Corporation Limited (FACOR), Steel Authority of India Limited (SAIL), Hernic Ferrochrome (Pty) Ltd. |

How Cutting Edge Technologies are revolutionizing the Ferro Alloys Market?

Advanced technologies are transforming the market by enhancing sustainability, improving operational efficiency, and enabling the production of high-quality, specialized alloys. Moreover, Artificial Intelligence tools and Machine Learning optimise processes by predicting maintenance needs by offering data-driven insights for quality control.

Trade Analysis of Ferro Alloys Market: Import & Export Statistics:

- In 2024, the United States exported $192M of Ferroalloys, being the 617th most exported product in the United States.

- In 2024, the main destinations of the United States' Ferroalloys exports were: Canada ($122M), Mexico ($29.8M), Malaysia ($11.2M), India ($10.5M), and Brazil ($4.83M).(Source:oec.world )

- In 2023, India exported $17.3M of Ferroalloys, nes, making it the 9th largest exporter of Ferroalloys, nes (out of 78) in the world.

- In 2023, India imported $79.1M of Ferroalloys, nes, becoming the 2nd largest importer of Ferroalloys, nes (out of 128) in the world.(Source: oec.world)

Ferro Alloys Market Value Chain Analysis

- Feedstock Procurement: It refers to the strategic sourcing, purchasing, and management of the raw materials necessary to produce various ferroalloys.

- Key Players: ArcelorMittal, OM Holdings LTD, Sakura Ferroalloys, Pertama Ferroalloys.

- Chemical Synthesis and Processing : It refers to the specific techniques used to produce high-quality or specialised alloys, which are crucial ingredients in the manufacturing of various chemical products.

- Key Players: Svenskt Stål AB, Indian Metals & Ferro Alloys (IMFA), Eurasian Resources Group (ERG).

- Packaging and Labelling : It refers to the crucial process of containing the material for storage and transport in compliance with international trade and safety regulations.

- Key Players: Glencore, Tata Steel, Ferroglobe PLC.

- Regulatory Compliance and Safety Monitoring: This stage includes adhering to national and international standards for product quality and safety.

- Key Players: Ferroglobe PLC, Elkem, and Tata Steel

Ferro Alloys Market's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| China | China faces numerous trade restrictions on its steel and ferroalloy products from other countries, often in response to state subsidies and alleged unfair pricing practices. |

| European Union (EU) | The EU is implementing the CBAM, which requires importers to report and pay a levy on the carbon emissions associated with imported goods, including ferroalloys. |

| United States | The U.S. has applied significant tariffs, such as a 25% "Section 232" tariff on steel imports, which affects the entire steel supply chain, including ferroalloys. |

Segment Insights

Type Insights

How Much Share Did the Ferrochrome Segment Hold in the Ferro Alloys Market During 2024?

- The ferrochrome segment dominated the market, accounting for 45.6% in 2024. The segment's dominance can be attributed to rising steel production, especially in emerging economies such as China and India, which further boosts demand for stainless steel.

- The others (ferro-vanadium, ferro-tungsten, ferro-molybdenum, etc.) segment is expected to grow at the fastest CAGR of 7.4% over the forecast period. The segment's growth can be attributed to the rising need for high-strength low-alloy (HSLA) steels in construction and transportation, as well as the growing demand for high-strength steel across various applications.

- The growth of the ferromanganese segment is driven by the rising need for robust materials, such as low-alloy steel and stainless steel, for projects like skyscrapers, bridges, and large-scale structures, which, in turn, drives demand for ferromanganese.

- The ferrosilicon segment held a significant market share in 2024. The segment's growth is driven by ongoing government investment in infrastructure such as airports, roads, and railways, which supports steel production and, in turn, higher demand for ferrosilicon.

Production Process Insights

Which Production Process Type Segment Dominated the Ferro Alloys Market in 2024?

- The blast furnace segment held a 69.5%market share in 2024. The segment's dominance can be linked to the growing trend toward electric arc furnaces (EAFs) driven by environmental regulations and a surge in scrap metal recycling. Blast furnaces can efficiently produce large quantities of hot metal.

- The electric arc furnace (EAF) process segment is expected to grow at the fastest CAGR of 7.3% over the forecast period. The segment's growth can be driven by superior operational efficiency and flexibility, as well as the growing demand for high-quality specialty steels. EAFs have faster production times than blast furnaces.

Application Insights

Which Application Segment Dominated the Ferro Alloys Market in 2024?

- The carbon & low alloy steel segment dominated the market with a 52.5% share in 2024. The segment's dominance is driven by the growing construction sector, fuelled by population growth, urbanisation, and government infrastructure initiatives. R&D efforts focused on lightweight steel grades create additional market opportunities.

- The stainless-steel segment is expected to grow at the fastest CAGR of 7.1% during the projected period. The segment's growth is driven by ongoing advancements in the steel industry and technological innovations in production processes.

- The growth of the alloy steel segment can be fuelled by the growing manufacturing of vehicles, such as electric vehicles, which necessitate highly durable steel. There is also an increasing demand for specialized, high-performance alloys utilized in niche applications.

- The cast iron segment held a significant market share in 2024. The segment's growth can be propelled by surging regional infrastructure projects, particularly in China and India. Cast iron is generally favoured for its low production costs and superior casting qualities, making it an attractive material for a wide range of applications.

End-User Industry Insights

Which End-User Industry Segment Dominated the Ferro Alloys Market in 2024?

- The steel manufacturing segment dominated the market, accounting for 42.4% in 2024. The dominance of the segment can be attributed to the growing production of lightweight, high-strength steel for vehicles, along with the development of new high-grade steel quality standards.

- The construction & infrastructure segment is expected to grow at the fastest CAGR of 7.2% during the study period. The segment's growth can be credited to advancements in steel manufacturing, driven by the development of high-strength alloys. Ferroalloys are important additives that improve the properties of steel.

- The growth of the automotive & transportation segment is fuelled by surging steel production for vehicle manufacturing, especially lightweight and high-strength grades required for modern cars and electric vehicles (EVs). Ferroalloys are crucial for the production of various cast iron and steel parts in vehicles.

- The electronics & others segment accounted for a major share of the market. Ferroalloys are crucial in the production of stainless steel, which is extensively used in the electronics industry for components such as connectors, casings, and circuits. Advancements in steelmaking technologies can boost the demand for ferroalloy formulations.

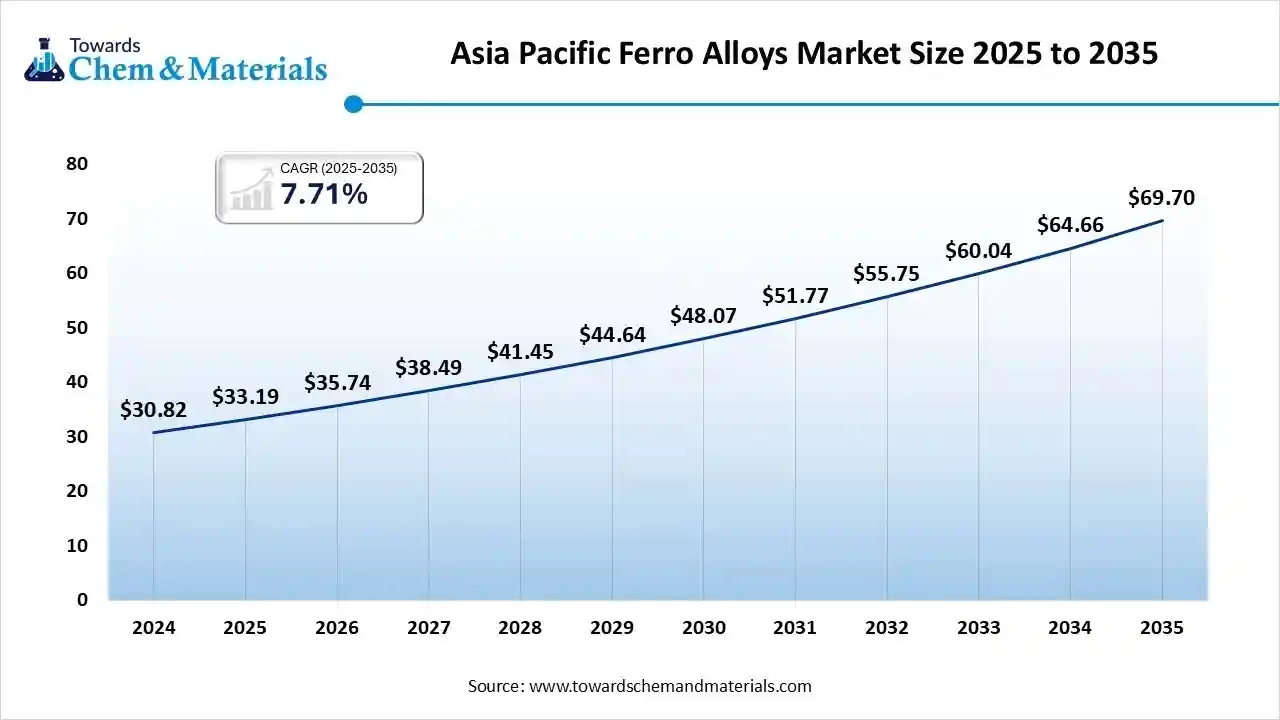

Regional Insights

The Asia Pacific ferro alloys market size was valued at USD 33.19 billion in 2025 and is expected to reach USD 69.70 billion by 2035, growing at a CAGR of 7.71% from 2025 to 2035. The Asia-Pacific dominated the market with a 52.4% share in 2024 and is expected to grow at the fastest CAGR of 8.0% over the forecast period.

The region's dominance and growth are driven by rapid urbanization and industrialization, which have increased demand for steel in automotive, construction, and infrastructure projects. The region is also a major producer of steel, particularly in countries such as China and India.

China Ferro Alloys Market Trends

In the Asia Pacific, China led the market owing to significant infrastructure investments and the increasing use of high-strength steel, particularly amid the surge in electric vehicles. Also, large-scale infrastructure projects in China boost demand for steel and ferroalloys, such as ferrochrome.

Why Is North America Showing Notable Growth in the Ferro Alloys Market?

North America is expected to grow at a notable CAGR over the forecast period. The region's growth can be credited to robust product demand from the construction and infrastructure sectors, along with growing investments in green steel production methods. The growing emphasis on electric vehicles (EVs) is also fuelling demand for lightweight and high-strength steel grades.

U.S. Ferro Alloys Market Trends

In North America, the U.S. dominated the market due to a rapid surge in construction spending, which directly translated into greater demand for steel and ferroalloys. The country also has a large and expanding construction industry, including both residential and commercial projects.

How is Europe Performing in the Ferro Alloys Market?

Europe held a significant market share in 2024. The region's growth is driven by strong product demand from the steel, construction, and automotive industries, along with an ongoing push towards sustainable production methods. Furthermore, demand for superalloys used in high-performance applications is increasing.

Germany Ferro Alloys Market Trends

In Europe, Germany dominated the market due to growing demand for stronger, more durable materials for machinery and vehicles, which directly boosts demand for ferroalloys, particularly those that improve steel's strength and overall performance, thereby driving market growth in the country.

How is Growth in the Latin American market for Ferro Alloys?

The growth of the Latin American market is driven by domestic steelmaking and the expanding construction sector, both of which are supported by infrastructure development. In addition, the growth in automobile manufacturing directly drives demand for steel to produce ferroalloys that improve its properties, leading to market expansion in the near term.

Ferro Alloys Market Share, By Region, 2024 (%)

| Regional | Revenue Share |

| North America | 22.19% |

| Europe | 17.33% |

| Asia Pacific | 52.40% |

| Latin America | 5.11% |

| Middle East and Africa | 2.97% |

Brazil Ferro Alloys Market Trends

Brazil is one of the major countries in Latin America. The growth of the county can be propelled by a rapid surge in general construction and infrastructure projects, both globally and domestically, which, in turn, fuels demand for steel and, consequently, ferroalloys.

Recent Developments

- In October 2025, A new ferroalloy manufacturing plant was unveiled in Ekibastuz, Kazakhstan. The new plant possesses two advanced electric furnaces that fulfill international technical and environmental safety standards.(Source: gmk.center)

- In September 2025, Beekay Steel Industries Ltd started commercial manufacturing at its new production facility in Cuttack, Odisha. This expansion boosts Beekay Steel's presence in eastern India and improves its manufacturing capabilities in the domestic steel sector.(Source: scanx.trade)

Ferro Alloys Market Companies

- Glencore plc: Glencore plc is a major global player in the ferroalloys market, primarily as one of the world's largest and lowest-cost producers of chrome ore and ferrochrome, and also a significant marketer of manganese ore and alloys, and a producer of ferrovanadium.

- Jindal Steel & Power Limited: Jindal Steel & Power Limited (JSPL) utilizes ferro alloys as crucial inputs in its integrated steel manufacturing process, primarily for captive consumption, rather than being a prominent external supplier in the merchant ferro alloys market.

Other Companies in the Ferro Alloys Market

- Glencore plc – Glencore is a leading global producer and marketer of ferroalloys, with operations spanning chrome ore, ferrochrome, and manganese production. The company is one of the world’s lowest-cost ferrochrome producers, leveraging vertically integrated operations in mining, smelting, and marketing. Glencore also produces ferrovanadium and other specialty alloys, serving key industries such as stainless steel, automotive, and construction. Its strategic global presence ensures a steady supply chain and strong market positioning in the ferroalloys sector.

- Jindal Steel & Power Limited (JSPL) – Jindal Steel & Power is a diversified steel and power producer that utilizes ferroalloys internally within its integrated steel manufacturing operations. The company’s ferroalloy production primarily supports captive consumption, enabling in-house production of high-quality steel products. Although not a major merchant supplier, JSPL’s ferroalloy facilities strengthen its cost efficiency and self-reliance in steel manufacturing.

- Samancor Chrome Limited – Samancor Chrome is one of the world’s largest integrated producers of chrome ore and ferrochrome, operating extensive mining and smelting assets in South Africa. The company’s ferrochrome is a critical input for global stainless-steel production, with a strong export presence in Asia and Europe.

- Tata Steel Limited – Tata Steel produces ferroalloys and minerals, primarily for its steelmaking operations, with facilities in India and abroad. The company also operates in the merchant ferroalloy market, offering manganese and chrome alloys to external customers. Its focus is on high-quality alloy steel manufacturing and sustainable sourcing of raw materials.

- Eurasian Resources Group (ERG) – ERG is a key global supplier of ferrochrome and manganese alloys, operating significant production facilities in Kazakhstan and Africa. The company emphasizes energy-efficient, sustainable smelting technologies and supplies high-grade alloys to the global stainless and specialty steel industries.

- OM Holdings Ltd – OM Holdings is a Singapore-based producer and trader of manganese ore, ferrosilicon, and silicomanganese alloys. With operations in Australia and Malaysia, the company supplies alloy products to major steelmakers worldwide, focusing on cost optimization and production flexibility.

- Afarak Group plc – Afarak Group, headquartered in Finland, operates across mining, processing, and trading of specialty ferroalloys such as low-carbon ferrochrome. The company serves high-value steel and foundry industries, emphasizing niche, high-purity alloy production with sustainability at its core.

- Shanghai Shenjia Ferroalloys Co., Ltd. – Shanghai Shenjia Ferroalloys specializes in the production of silicon-based and manganese-based ferroalloys. The company caters to the Asian steel and foundry industries, focusing on efficiency, product consistency, and technical innovation in alloy manufacturing.

- Eramet S.A. – Eramet is a French multinational mining and metallurgical company that produces manganese and nickel alloys, including silicomanganese and ferromanganese. The company’s ferroalloy operations, primarily based in Gabon and Norway, support global steel production with an emphasis on low-carbon metallurgical solutions.

- China Minmetals Corporation – China Minmetals is a state-owned enterprise engaged in the production and trading of ferroalloys and base metals. Its diversified portfolio includes manganese, chromium, and silicon alloys, supporting China’s vast steel industry and export markets.

- ArcelorMittal S.A. – ArcelorMittal, the world’s largest steel producer, maintains integrated ferroalloy operations to support its global steel manufacturing. The company produces key alloys, including ferrosilicon, ferrochrome, and ferromanganese, ensuring quality control and supply chain stability across its steel facilities.

- Ferro Alloys Corporation Limited (FACOR) – FACOR, one of India’s oldest ferroalloy producers, specializes in ferrochrome and ferromanganese production. The company supplies major stainless-steel producers domestically and internationally, leveraging vertically integrated mining and smelting operations.

- Steel Authority of India Limited (SAIL) – SAIL operates captive ferroalloy plants that produce manganese and silicon alloys to meet internal requirements for steel production. The company’s facilities ensure consistent alloy quality and cost efficiency across its integrated steel manufacturing operations.

- Hernic Ferrochrome (Pty) Ltd. – Hernic Ferrochrome, based in South Africa, produces high-carbon ferrochrome used in stainless steel production. The company, now part of the Glencore Group, utilizes modern smelting technology to enhance efficiency and environmental performance in ferroalloy manufacturing.

Segments Covered in the Report

By Type

- Ferrochrome

- Ferromanganese

- Ferrosilicon

- Silico-manganese

- Others (ferro-vanadium, ferro-tungsten, ferro-molybdenum, etc.)

By Production Process

- Blast Furnace

- Electric Arc Furnace (EAF)

By Application

- Carbon & Low Alloy Steel

- Stainless Steel

- Alloy Steel

- Cast Iron

By End-User Industry

- Steel manufacturing

- Construction & Infrastructure

- Automotive & Transportation

- Electronics & Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa