Content

Europe Specialty Chemicals Market Volume and Growth 2025 to 2034

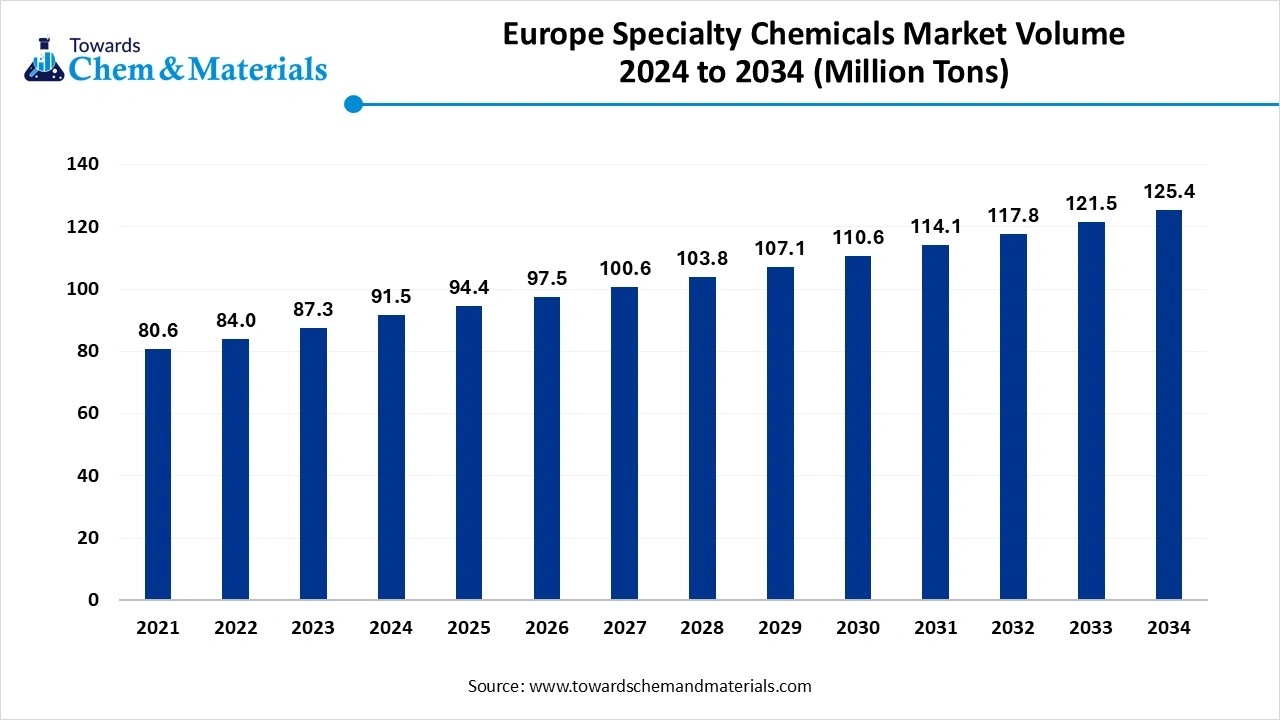

The Europe specialty chemicals market volume was reached at 91.51 million tons in 2024 and is expected to be worth around 125.43 million tons by 2034, growing at a compound annual growth rate (CAGR) of 3.20% over the forecast period 2025 to 2034. The strong focus on sustainability and growing demand across end-user industries like construction, healthcare, automotive, & electronics drives the market growth.

Key Takeaways

- Western Europe held approximately 48% share in the market in 2024 due to the well-developed industrial base.

- Eastern Europe is growing at the fastest CAGR in the market during the forecast period due to the rapid growth in construction.

- By product type, the agrochemicals segment held a 38% share in the market in 2024 due to the increasing demand for food.

- By product type, the personal care ingredients segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing demand for personal care products.

- By function, the surfactants segment held a 40% share in the market in 2024 due to the increasing demand for industrial cleaning products.

- By function, the antioxidants segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing demand for functional foods.

- By end-use industry, the agriculture segment held a 35% share in the market in 2024 due to the growing demand for agricultural yields.

- By end-use industry, the personal care & cosmetics segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing spending on personal care products.

Europe Specialty Chemicals: The Pillar of Modern Industries and Innovation

Europe specialty chemicals are a type of chemical product manufactured to provide high-value and specific functions in various industrial processes. They are used in small quantities and enhance the performance of products. Specialty chemicals include adhesives & sealants, cleaning materials, construction chemicals, agrochemicals, cosmetic additives, food additives, and many more. The stricter environmental regulation in the region increases demand for biodegradable specialty chemicals. The shift towards green chemistry focuses on the development of bio-based specialty chemicals. The growing demand for diagnostics, pharmaceuticals, and medical devices increases the adoption of specialty chemicals. The rising demand across end-user industries like automotive, electronics, construction, and food additives contributes to the overall growth of the Europe specialty chemicals market.

- The United Kingdom exported £259M of fungicides in 2024.(Source: oec.world )

- Germany exported 11,141 shipments of dye pigment.(Source: www.volza.com)

- Germany exported 39,024 shipments of food additives.(Source: www.volza.com )

- France exported $3.99B of pesticides in 2023.(Source: oec.world)

Growing Construction Industry Drives Market Growth

The increasing population and rapid urbanization increase demand for various construction that fuels demand for specialty chemicals. The growing development of infrastructure projects like tunnels, roads, and bridges increases demand for specialty chemicals for various purposes like coatings, concrete admixtures, and waterproofing materials. Europe’s increasing demand for commercial spaces and residential buildings fuels demand for specialty chemicals. The growing government investment in infrastructure development fuels demand for specialty chemicals. The shift towards green buildings and sustainability increases demand for specialty chemicals for applications like lighting systems, insulation, and thermal management. The increasing demand for high-performance materials in construction activities helps the market growth. The growing construction industry is a key driver for the growth of the specialty chemicals market.

Market Trends

- Growing Demand for Eco-Friendly Specialty Chemicals: Consumers focus on sustainability, and rising environmental regulations increase demand for eco-friendly specialty chemicals. The shift towards green chemistry and initiatives like the European Green Deal increases focus on the development of eco-friendly specialty chemicals.

- Growing Electronic Industry: The growing use of various electronic devices like computers, wearables, smartphones, and laptops increases demand for specialty materials for cleaning agents, soldering materials, and fluxes. The growing electronic industry increases the adoption of specialty chemicals for various manufacturing processes.

- Increasing Demand for Personalised Medicines: The shift towards personalised medicine increases demand for specialty chemicals for the development of customized drugs. The focus on sustainable drug development increases the adoption of eco-friendly specialty chemicals.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 94.44 Million Tons |

| Expected Volume by 2034 | 125.43 Million Tons |

| Growth Rate from 2025 to 2034 | CAGR 3.20% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type, By Function, By End-use Industry, By Region |

| Key Companies Profiled | BASF SE, Clariant AG, Evonik Industries AG, Croda International Plc – UK, Solvay SA , LANXESS AG, Akzo Nobel N.V., Albemarle Europe, Symrise AG , DSM Firmenich , Wacker Chemie AG , Brenntag SE , INEOS Group Holdings S.A. , Arkema SA , Perstorp Group , Henkel AG & Co. KGaA , Givaudan SA , Johnson Matthey Plc , Kemira Oyj , MÜNZING Chemie GmbH |

Market Opportunity

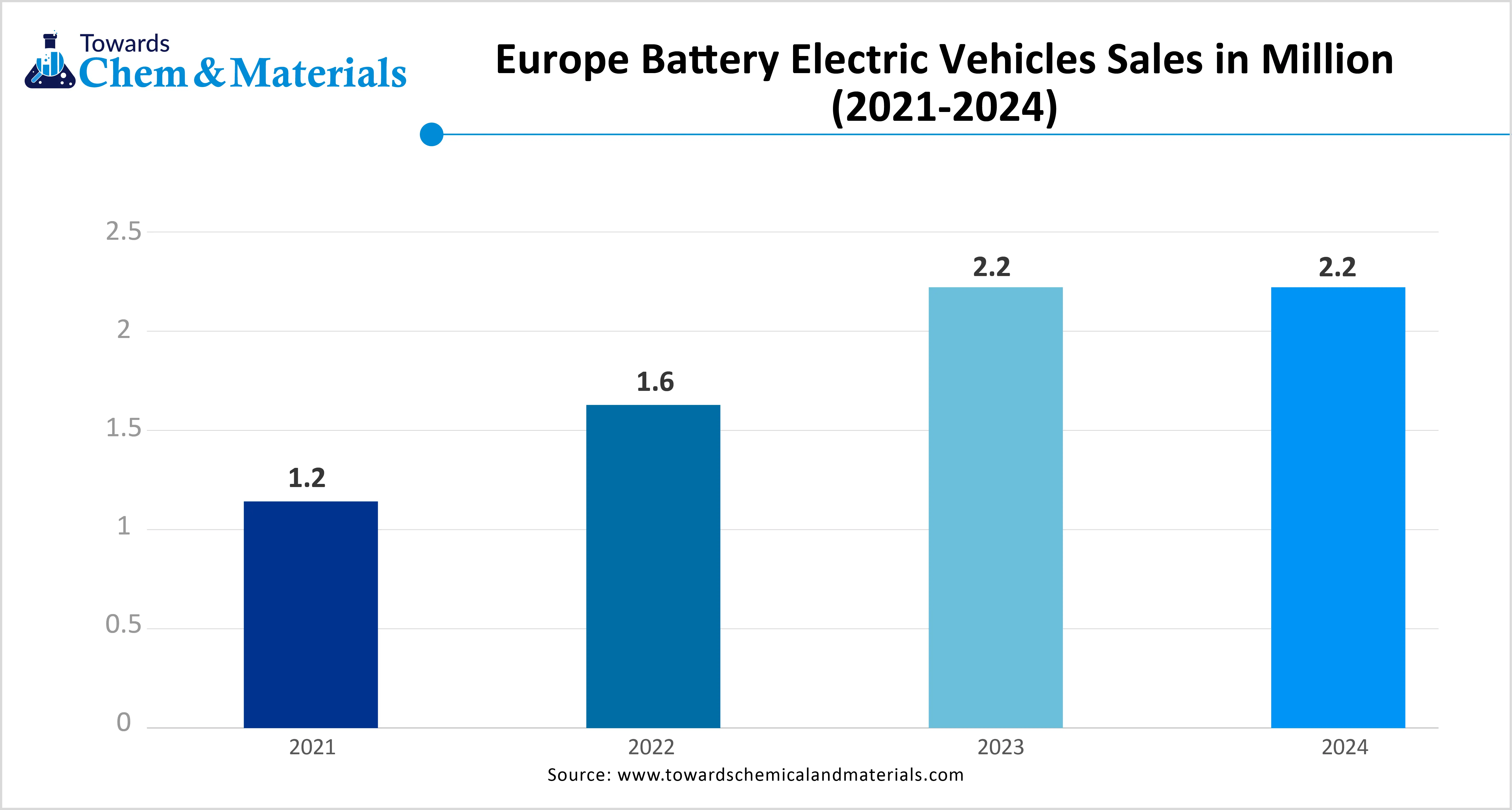

Expansion of the Automotive Industry Surge Demand for Specialty Chemicals

The growing expansion of the automotive industry increases demand for specialty chemicals for various automotive applications. The growing production of electric and traditional vehicles increases demand for specialty chemicals for applications like adhesives, fluids, coatings, and elastomers. The increasing production volume of vehicles creates higher demand for specialty chemicals. The strong presence of the automotive industry increases demand for high-performance materials that require specialty chemicals to enhance the performance of vehicles. The increasing adoption of electric vehicles is fueling demand for specialized chemicals for thermal management, battery technology, and lightweight materials.

The increasing advancements in automotive technology, like smart technologies & digitalization, increase demand for specialty chemicals. The growing automakers' focus on improving fuel efficiency and stringent emissions regulations increases the adoption of specialty chemicals. The growing expansion of the automotive industry creates an opportunity for the specialty chemicals market.

Market Challenge

Raw Material Price Fluctuations Limit Expansion of Specialty Chemicals

Despite several benefits of Europe specialty chemicals, the raw material price fluctuations restrict the market growth. Factors like geopolitical instability, fluctuating oil prices, supply chain disruptions, and changing demand are responsible for fluctuating raw material prices. Crude oil is essential for the production of specialty chemicals, but the fluctuating cost of crude oil can affect the market. Supply chain disruptions, like logistical inefficiencies, geopolitical events, and natural disasters, increase the cost of raw materials. The geopolitical instability, like political conflicts, trade restrictions, and tariffs, fuels the cost of raw materials. The fluctuation in demand for specialty chemicals directly affects the raw material prices. Raw material cost fluctuations hamper the growth of the European specialty chemicals market.

Regional Insights

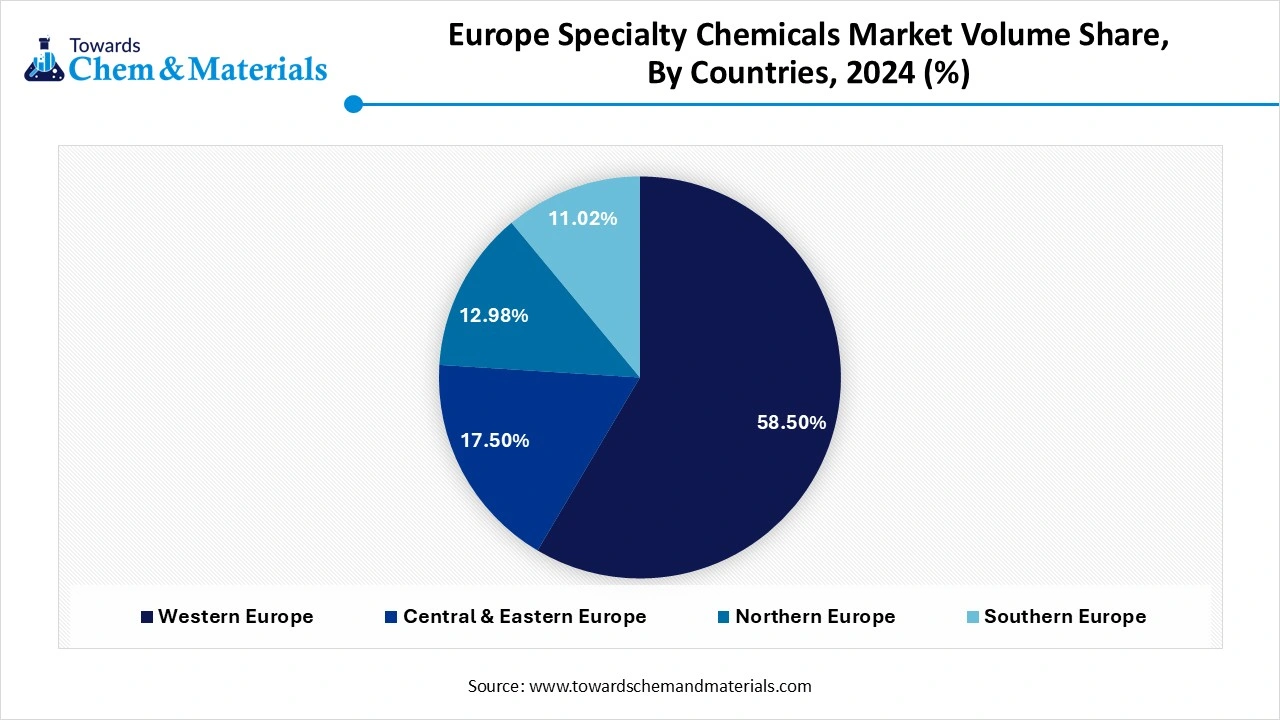

How Western Europe Dominated the Europe Specialty Chemicals Market?

Western Europe dominated the Europe specialty chemicals market in 2024. The well-established industrial infrastructure in countries like France, the UK, and Germany increases the production of specialty chemicals. The increasing consumption of flavors, nutraceuticals, and fragrances increases demand for specialty chemicals. The growing demand for eco-friendly solutions helps the market growth. The increasing adoption of advanced technology supports the production of specialty chemicals. The growing demand across end-user industries like pharmaceuticals, electronics, and cosmetics drives the overall growth of the market.

Europe Specialty Chemicals Market Volume Share, By region, 2024 (%)

| By Region | Volume Share, 2024(%) | Market Volume Million Tons - 2024 | Volume Share, 2034 (%) | Market Volume Million Tons - 2034 | CAGR (2025 - 2034) |

| Western Europe | 58.50% | 53.53 | 53.01% | 66.49 | 2.44% |

| Central & Eastern Europe | 17.50% | 16.01 | 22.32% | 28.00 | 6.40% |

| Northern Europe | 12.98% | 11.88 | 14.03% | 17.60 | 4.46% |

| Southern Europe | 11.02% | 10.08 | 10.51% | 13.18 | 3.02% |

| Total | 100.00% | 91.51 | 100.00% | 125.43 | 3.20% |

Europe Specialty Chemicals Market Trends in Germany

Germany is a major contributor to the Europe specialty chemicals market. The growing investment in environmentally friendly technologies increases the adoption of Europe specialty chemicals. The focus on the development of advanced specialty chemicals helps the market growth. The strong presence of industries like construction, automotive, and pharmaceuticals helps the market growth. The presence of key players like Evonik Industries, Lanxess AG, Symrise AG, Wacker Chemie AG, and Brenntag SE supports the overall growth of the market.

- Kiana Fze is the leading supplier of specialty chemicals in Germany. (Source: www.volza.com)

- From August 2023 to July 2024, Germany exported 14 shipments of protective coating with a growth rate of 40% from the previous 12 months.(Source: www.volza.com)

- From October 2023 to September 2024, Germany exported 229 shipments of thermoplastic elastomer.(Source: www.volza.com)

Why Eastern Europe is Growing in the Europe Specialty Chemicals Market?

Eastern Europe is experiencing the fastest growth in the market during the forecast period. The rapid urbanization and growing construction activities fuel demand for specialty chemicals. The growth in infrastructure development and increased manufacturing activities helps the market growth. The increasing demand for household goods, personal care products, food additives, and other products increases demand for specialty chemicals. The strong focus on eco-friendly manufacturing processes increases the adoption of specialty chemicals. The growing demand across end-user industries like aerospace, automotive, and electronics drives the overall growth of the market.

Segmental Insights

Product Type Insights

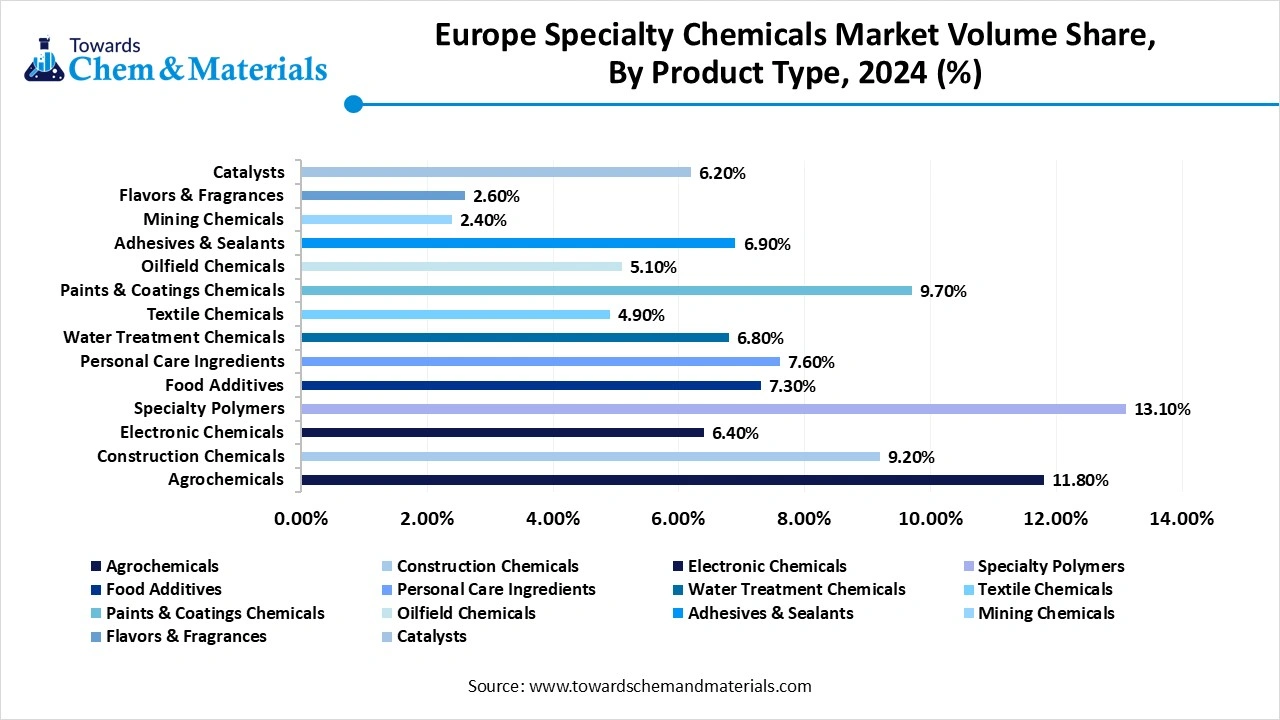

Why Agrochemicals Segment Dominated the Europe Specialty Chemicals Market?

The agrochemicals segment dominated the Europe specialty chemicals market in 2024. The growing food demand and changing dietary choices increase demand for agrochemicals. The strong focus on sustainable agriculture and increasing adoption of precision farming helps in the market growth. The well-developed agriculture sector increases demand for various agrochemicals like fungicides, herbicides, pesticides, and insecticides. The increasing demand for higher crop yields and growing investment in research & development of agrochemicals help the market growth. The growing demand for environmentally friendly chemicals and the focus on organic farming drive the overall growth of the market.

Europe Specialty Chemicals Market Volume Share, By Product Type, 2024 (%)

| By Product Type | Volume Share, 2024 (%) | Market Volume Million Tons - 2024 | Volume Share, 2034 (%) | Market Volume Million Tons- 2034 | CAGR (2025 - 2034) |

| Agrochemicals | 11.80% | 10.80 | 10.41% | 13.06 | 2.13% |

| Construction Chemicals | 9.20% | 8.42 | 8.50% | 10.66 | 2.66% |

| Electronic Chemicals | 6.40% | 5.86 | 7.80% | 9.78 | 5.87% |

| Specialty Polymers | 13.10% | 11.99 | 14.70% | 18.44 | 4.90% |

| Food Additives | 7.30% | 6.68 | 7.04% | 8.83 | 3.15% |

| Personal Care Ingredients | 7.60% | 6.95 | 9.20% | 11.54 | 5.79% |

| Water Treatment Chemicals | 6.80% | 6.22 | 7.40% | 9.28 | 4.54% |

| Textile Chemicals | 4.90% | 4.48 | 4.40% | 5.52 | 2.33% |

| Paints & Coatings Chemicals | 9.70% | 8.88 | 8.90% | 11.16 | 2.58% |

| Oilfield Chemicals | 5.10% | 4.67 | 3.80% | 4.77 | 0.23% |

| Adhesives & Sealants | 6.90% | 6.31 | 7.30% | 9.16 | 4.22% |

| Mining Chemicals | 2.40% | 2.20 | 2.70% | 3.39 | 4.93% |

| Flavors & Fragrances | 2.60% | 2.38 | 2.90% | 3.64 | 4.83% |

| Catalysts | 6.20% | 5.67 | 4.95% | 6.21 | 1.01% |

| Total | 100% | 91.51 | 100% | 125.43 | 3.20% |

The personal care ingredients segment is the fastest growing in the market during the forecast period. The growing consumer preference for plant-based ingredients like fermented ingredients, botanical extracts, & essential oils, and organic ingredients in personal care products helps the market growth. The increasing trend for clean beauty fuels demand for personal care ingredients. The increasing focus on personalised beauty and skincare increases demand for personal care ingredients. The key manufacturers of personal care ingredients like Evonik Industries, BASF SE, and Croda International Plc support the overall growth of the market.

Function Insights

How Surfactants Segment Held the Largest Share of the Europe Specialty Chemicals Market?

The surfactants segment held the largest revenue share of the Europe specialty chemicals market in 2024. The growing demand for personal care products like lotions, shampoos, conditioners, and other products increases demand for surfactants. The increasing demand for home and industrial cleaning products helps the market growth. The growth in textile processing applications like adhesives, smoothing agents, and antistatic increases demand for surfactants. The growing focus on sustainability increases demand for bio-based surfactants. The rising demand across industries like textiles, industrial processes, personal care products, and agriculture increases demand for surfactants. The presence of key players like BASF, Nouryon, and Evonik Industries drives the market growth.

The antioxidants segment is experiencing the fastest growth in the market during the forecast period. The increasing consumer demand for clean-label products increases demand for antioxidants. The increasing health awareness and rising demand for functional foods fuel the demand for antioxidants. The increasing demand for clean-label and natural products increases the adoption of antioxidants. The stringent regulations for cosmetics and food products increase demand for antioxidants, supporting the overall growth of the market.

End-use Industry Insights

Which End-User Industry Dominated the Europe Specialty Chemicals Market?

The agriculture segment dominated the Europe specialty chemicals market in 2024. The growing demand for agricultural and food products increases demand for specialty chemicals like agrochemicals. The increasing demand for optimizing crop yields and a focus on intensive farming methods help the market growth. The shift towards sustainable agricultural practices and focus on precision farming increases demand for specialty chemicals like bio-herbicides, micronutrient fertilizers, and bio-based fertilizers. The growing demand for various agricultural products like vegetables, cereals, and fruits drives the overall growth of the market.

The personal care & cosmetics segment is the fastest growing in the market during the forecast period. The growing disposable incomes and rising spending on personal care products help the market growth. The increasing exposure to pollution fuels demand for personal care products. The strong presence of the cosmetic industry and increasing demand for sustainable & organic products increases the adoption of specialty chemicals. The rapid growth in online shopping increases demand for various personal care products and cosmetics. The growing demand for vitamin E, Hyaluronic Acid, Moisturizer, Sunscreen, and Vitamin E supports the overall growth of the market.

Recent Developments

- In April 2024, Vantage Specialty Chemicals expanded taurate capacity in Leuna, Germany. The facility increases the production of mild surfactants and helps in various sectors like laundry, industrial, personal care, household, and institutional.(Source: www.indianchemicalnews.com)

- In March 2025, OQ Chemicals launched heptanoic acid production in Germany. The production helps various sectors like energy solutions, aviation, performance materials, and consumer products. The focus is on maintaining a stable supply and ensuring reliability & consistency to support customers.(Source: www.indianchemicalnews.com)

- In October 2024, Arkema launched bio-based ethyl acrylate in Carling, France. It is derived from sustainably produced bioethanol and reduces the carbon footprint up to 30%. (Source: www.alchempro.com)

Top Companies List

- BASF SE

- Clariant AG

- Evonik Industries AG

- Croda International Plc – UK

- Solvay SA

- LANXESS AG

- Akzo Nobel N.V.

- Albemarle Europe

- Symrise AG

- DSM-Firmenich

- Wacker Chemie AG

- Brenntag SE

- INEOS Group Holdings S.A.

- Arkema SA

- Perstorp Group

- Henkel AG & Co. KGaA

- Givaudan SA

- Johnson Matthey Plc

- Kemira Oyj

- MÜNZING Chemie GmbH

Segments Covered

By Product Type (Volume, Kilotons; Revenue, USD Million, 2021 - 2034)

- Agrochemicals

- Herbicides

- Insecticides

- Fungicides

- Bio-pesticides

- Construction Chemicals

- Concrete Admixtures

- Waterproofing Chemicals

- Adhesives & Sealants

- Protective Coatings

- Electronic Chemicals

- Semiconductor Chemicals

- PCB Chemicals

- Photoresists

- Wet Process Chemicals

- Specialty Polymers

- Engineering Plastics

- Thermoplastic Elastomers (TPE)

- Functional Polymers

- Food Additives

- Preservatives

- Emulsifiers

- Flavor Enhancers

- Enzymes

- Personal Care Ingredients

- Emollients

- Surfactants

- Active Ingredients

- Preservatives

- Water Treatment Chemicals

- Coagulants & Flocculants

- Biocides & Disinfectants

- Scale Inhibitors

- Textile Chemicals

- Finishing Agents

- Colorants & Dyes

- Sizing Agents

- Paints & Coatings Chemicals

- Binders

- Pigments

- Additives

- Oilfield Chemicals

- Drilling Fluids

- Cementing Chemicals

- Enhanced Oil Recovery Chemicals

- Adhesives & Sealants

- Reactive

- Hot-melt

- Pressure-sensitive

- Mining Chemicals

- Flotation Chemicals

- Extractants

- Flavors & Fragrances

- Aroma Chemicals

- Natural Flavors

- Catalysts

- Zeolites

- Organometallic Catalysts

By Function (Volume, Kilotons; Revenue, USD Million, 2021 - 2034)

- Surfactants

- Binders

- Dispersants

- Antioxidants

- Rheology Modifiers

- Stabilizers

- Biocides

- Chelating Agents

- Lubricants

By End-use Industry (Volume, Kilotons; Revenue, USD Million, 2021 - 2034)

- Agriculture

- Construction

- Automotive

- Electronics & Semiconductors

- Food & Beverages

- Personal Care & Cosmetics

- Water & Wastewater Treatment

- Textile

- Mining

- Oil & Gas

- Packaging

- Pharmaceuticals

By Region

- Western Europe

- Central Europe

- Eastern Europe

- Northern Europe

- Southern Europe