Content

Caustic Soda Market Size and Growth 2025 to 2034

According to an exclusive report, the global caustic soda market size is estimated at USD 50.12 billion in 2025 and is expected to hit around USD 76.11 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.75% over the forecast period from 2025 to 2034. The growing industrial activities, the rise in demand for alumina, and the increasing manufacturing of chemicals drive the market growth.

Key Takeaways

- By region, Asia Pacific held a 50% share in the caustic soda market in 2024 due to the rise in industrial activities.

- By region, Latin America is growing at the fastest CAGR in the market during the forecast period due to a well-established pulp industry.

- By application, the inorganic chemicals production segment held a 40% share in the market in 2024 due to the increasing manufacturing of sodium salts.

- By application, the organic chemicals production segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing need for neutralization of acidic waste.

- By production process, the membrane cell process segment held a 60% share in the market in 2024 due to its ability to produce high-purity caustic soda.

- By production process, the diaphragm cell process segment is expected to grow at the fastest CAGR in the market during the forecast period due to the lower electricity consumption.

- By form, the liquid segment held a 70% share in the market in 2024 due to the ease of handling.

- By form, the solid segment is expected to grow at the fastest CAGR in the market during the forecast period due to the longer shelf life.

- By end-use industry, the chemical manufacturing segment held a 35% share in the caustic soda market in 2024 due to the increasing production of organic chemicals.

- By end-use industry, the electronics segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing manufacturing of semiconductors.

Market Overview

Caustic soda is an extremely corrosive, alkaline chemical compound and is also called sodium hydroxide (NaOH). The caustic soda is available in white color and is easily dissolved in water. It is manufactured using methods like Loewig’s process, Castner-Kellner process, and Nelson Diaphragm cell. It has a melting point of 591K and has a soapy feel. Caustic soda is a stable compound and is moderately soluble in alcohol.

Caustic soda is widely used as a reagent in laboratories, for the extraction of aluminum, as a cleansing agent, and for the preparation of soda lime. Factors like increasing production of paper, rise in manufacturing of soaps, need for wastewater treatment, growing food processing industry, increasing awareness about hygiene, and rising manufacturing of chemicals contribute to the growth of the caustic soda market.

Caustic Soda Export

- India exported $157M of caustic soda (sodium hydroxide) solid in 2023.(Source: oec.world)

- The United States exported $1.73B of caustic soda (sodium hydroxide) in aqueous solution in 2023. (Source: oec.world)

- Germany exported $686M of caustic soda (sodium hydroxide) in aqueous solution in 2023.(Source: oec.world)

- South Korea exported $195M of caustic soda (sodium hydroxide) in aqueous solution in 2024. (Source: oec.world)

Growing Textile Industry Drives Market Growth

The increasing production of textiles and changing trends of fashion increase demand for caustic soda. The increasing production of higher-quality fabrics and the focus on appealing textiles increase demand for caustic soda. The need for removing impurities like oils & waxes, and the high demand for bleaching agent in fibers, fabrics, & yarns, increases demand for caustic soda.

The increasing utilization of the mercerization process in treating fibers and the focus on enhancing the texture of fibers increase demand for caustic soda. The growing preference for sustainable textiles and the focus on maintaining long-lasting colors on various fabrics increase demand for caustic soda. The increasing spending on clothing and high manufacturing of viscose rayon increases the adoption of caustic soda. The growing textile industry is a key driver for the growth of the caustic soda market.

Market Trends

- Growing Demand for Cleaning Products: The growing awareness about hygiene and increasing demand for cleaning products like detergents & soaps increases demand for caustic soda.

- Increasing Need for Water Treatment: The stringent quality of water and increasing problems of water scarcity increase demand for caustic soda. The increasing expansion of wastewater treatment facilities increases demand for caustic soda.

- The Growing Pulp Industry: The rise in e-commerce and the growing packaging sector increases demand for pulp. The increasing production of paper products requires caustic soda to separate wood fibers.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 50.12 Billion |

| Expected Size by 2034 | USD 76.11 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.75% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Application, By Production Process, By Form, By End-Use Industry, By Region |

| Key Companies Profiled | Dow Chemical Company, Occidental Petroleum Corporation (OxyChem), Formosa Plastics Corporation, SABIC, Shin-Etsu Chemical Co., Ltd., INEOS Group, Westlake Chemical Corporation, Covestro AG, PPG Industries, Inc., BASF SE, Solvay S.A., Tata Chemicals Limited, Aditya Birla Chemicals, Tosoh Corporation, LG Chem Ltd., Hanwha Solutions Corporation, Shintech Inc., Asahi Glass Co., Ltd., Kemira Oyj, Olin Corporation |

Market Opportunity

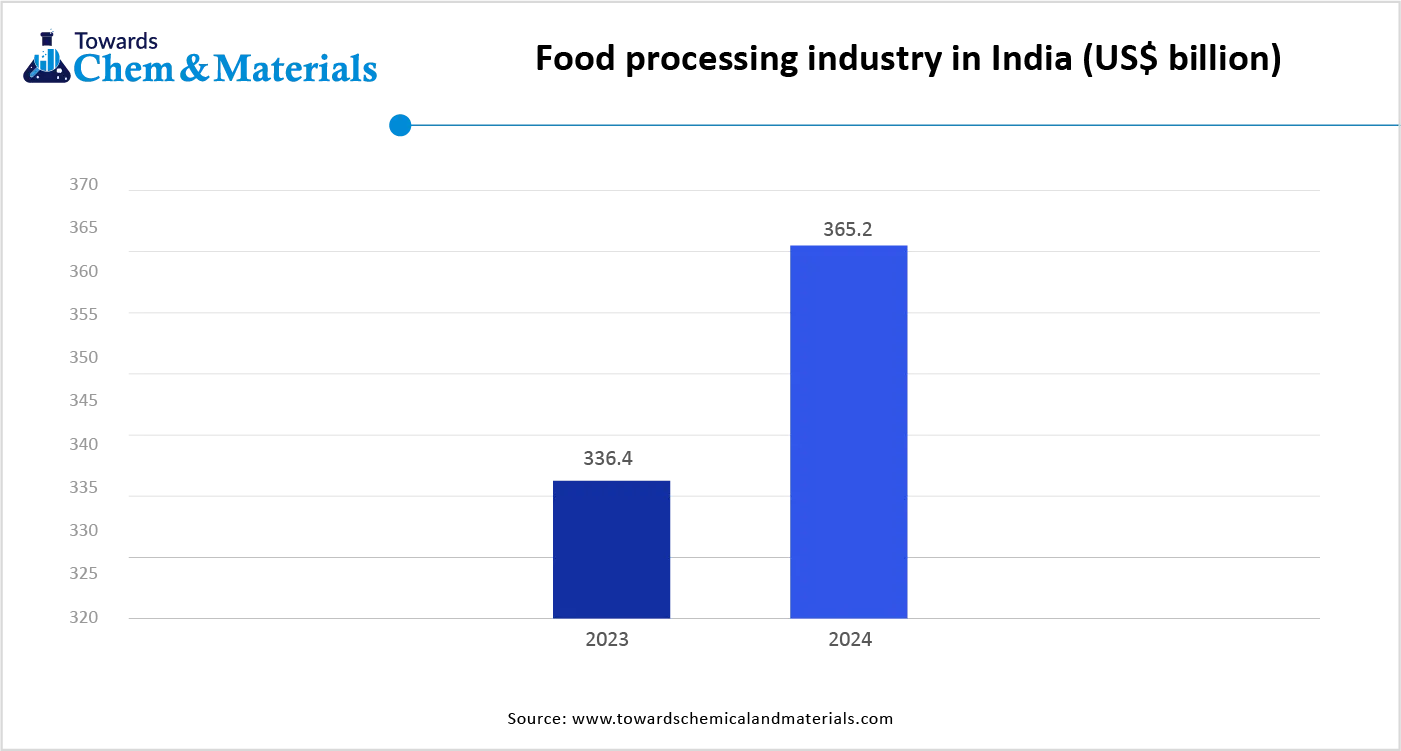

Growing Food & Beverage Sector Unlocks Market Opportunity

The growing expansion of the food & beverage industry and the growing food processing industry increases demand for caustic soda. The increasing production of beverages and the increasing processing of meat & plants increases demand for caustic soda. The growing manufacturing of seafood and the need for peeling the skin of fruit & vegetables increase demand for caustic soda. The growing preservation of packaged & processed food and the development of flavor increase demand for caustic soda.

The focus on maintaining hygiene in food processing and increasing the consumption of foods increases demand for caustic soda. The growing processing of corn, olive, and cocoa, and increasing consumption of packaged food, increases demand for caustic soda. The growing food & beverage sector creates an opportunity for the growth of the caustic soda market.

Market Challenge

Fluctuating Raw Material Prices Shut Down Market Growth

Despite several benefits of the caustic soda across various industries, the fluctuating cost of raw materials restricts the market growth. The volatility in raw material prices like energy and sodium chloride, increases the cost. The supply chain disruptions due to factors like logistics complications, high freight costs, and transportation interruptions increase the cost. The volatility in electricity prices and natural disasters requires a high cost. The trade policies, like trade agreements, tariffs, & export restrictions, and geopolitical events like natural disasters, disruption in energy, and other factors, increase the cost. The fluctuating raw material prices hamper the growth of the market.

Regional Insights

Asia Pacific Caustic Soda Market Size, Industry Report 2034

The asia pacific caustic soda market size was estimated at USD 23.93 billion in 2024 and is projected to reach USD 38.10 billion by 2034, growing at a CAGR of 4.76% from 2025 to 2034. Asia Pacific dominated the market with a 50% share in 2024.

The growth in industrial activities and rapid urbanization increases demand for caustic soda. The growing expansion of the textile industry and the strong presence of chemical manufacturing increase demand for caustic soda.

The strong government support for infrastructure development and the increasing need for water treatment increase the adoption of caustic soda. The high production of paper & pulp and increasing demand for aluminum increase the adoption of caustic soda. The presence of key players like GACL and Aditya Birla Chemicals drives the overall market growth.

China Caustic Soda Market Trends

China is a major contributor to the caustic soda market. The growing infrastructure development and high production of alumina increase demand for caustic soda. The vast production of paper & pulp and growing consumer demand for various textiles increase the adoption of caustic soda. The strong manufacturing facility and extensive government support increase demand for caustic soda. The rapid growth in water treatment facilities and growing chemical processing increases the adoption of caustic soda, supporting the overall market growth.

- China exported $340M of caustic soda (sodium hydroxide) solid in 2023.(Source: oec.world)

- China exported $827M of caustic soda (sodium hydroxide) in aqueous solution in 2023.(Source: oec.world)

Latin America Caustic Soda Market Trends

Latin America is experiencing the fastest growth in the market during the forecast period. The strong presence of the pulp industry and the increasing production of aluminum increase demand for caustic soda. The strong presence of the mining sector and the expansion of chemical manufacturing increase demand for caustic soda. The strong government focus on water quality and growing demand for personal care products increase demand for caustic soda. The growing textile industry and rapid industrial development increase the adoption of caustic soda, supporting the overall market growth.

Brazil Caustic Soda Market Trends

Brazil is a key contributor to the caustic soda market. The growing export of paper goods and increasing production of aluminum increase demand for caustic soda. The presence of a large paper industry and growing production of alumina increases demand for caustic soda. The increasing manufacturing of minerals and the strong presence of the agriculture sector increase the adoption of caustic soda. The increasing need for industrial and municipal wastewater increases demand for caustic soda, supporting the overall market growth.

- Brazil exported $381K of caustic soda (sodium hydroxide) solid in 2024.(Source: oec.world)

- Brazil exported $2.57M of caustic soda (sodium hydroxide) in aqueous solution in 2024.(Source: oec.world)

- Brazil exported $103K of caustic soda (sodium hydroxide) in aqueous solution in July 2025.(Source: oec.world )

Segmental Insights

Application Insights

Why did the Inorganic Chemicals Production Segment Dominate the Caustic Soda Market?

The inorganic chemicals production segment dominated the market with a 40% share in 2024. The growing production of sodium hypochlorite and sodium carbonate increases demand for caustic soda. The increasing manufacturing of sodium salts and the growing need for alumina increase demand for inorganic chemicals production. The growing demand for water treatment, soaps & detergents, and textiles increases demand for inorganic chemical production, driving the overall growth of the market.

The organic chemicals production segment is the fastest-growing in the market during the forecast period. The focus on acid gas scrubbing and neutralization of acidic waste increases the use of caustic soda in organic chemical production. The increasing manufacturing of plastics and production of agrochemicals increases demand for organic chemicals. The growing manufacturing of inks, coatings, detergents, dyes, soaps, and solvents increases demand for organic chemicals, driving the overall growth of the market.

Production Process Insights

How Membrane Cell Process Segment Held the Largest Share in the Caustic Soda Market?

The membrane cell process segment held the largest revenue share of 60% in the market in 2024. The growing demand for high-purity caustic soda and focus on lower operation cost increases demand for the membrane cell process. The need to lower carbon emissions and stringent environmental regulations increases the adoption of the membrane cell process. The growing large-scale production of caustic soda and focus on lowering consumption of power increases demand for caustic soda, driving the overall market growth.

The diaphragm cell process segment is the fastest-growing in the market during the forecast period. The strong ability to operate impure brine and focus on lower consumption of electricity increases the adoption of the diaphragm cell process. The increasing production of high-purity salts and lower operating costs increase demand for the diaphragm cell process. The growing industrialization and technological advancements in the diaphragm cell process support the overall market growth.

Form Insights

What made Liquid Segment Dominate the Caustic Soda Market?

The liquid segment dominated the market with a 70% in 2024. The ease of handling and availability of bulk shipping by rail, pipelines, & truck increases demand for liquid caustic soda. The high solubility and focus on increasing efficiency in chemical processes increase demand for liquid caustic soda. The growth in applications like chemicals, soaps, water treatment, pulp & paper, textiles, and detergents increases demand for liquid caustic soda. The rapid growth in industrial activities and increasing need for continuous dosing of caustic soda increases the adoption of the liquid form, driving the overall market growth.

The solid segment is experiencing the fastest growth in the market during the forecast period. The strong focus on easy-to-store and longer shelf life increases the adoption of solid caustic soda. The growing industrialization and cost-effectiveness help the market growth. The well-established water treatment infrastructure and growing production of pharmaceuticals increase demand for solid caustic soda. The availability of various solid forms of caustic soda, like peals and flakes, supports the overall market growth.

End-Use Industry Insights

Which End-Use Industry Held the Largest Share in the Caustic Soda Market?

The chemical manufacturing segment held the largest revenue share of 35% in the market in 2024. The increasing production of inorganic and organic chemical compounds increases demand for caustic soda. The focus on controlling pH in chemical reactions and increasing the manufacturing of chemicals like acetic acid, epichlorohydrin, formaldehyde, and acetic acid increases demand for caustic soda. The growing demand for chemicals across various industries like agrochemicals, cosmetics, pharmaceuticals, and plastics increases the adoption of caustic soda, driving the overall market growth.

The electronics segment is experiencing the fastest growth in the market during the forecast period. The increasing production of semiconductors and the rise in high-performance batteries increase demand for caustic soda. The increasing manufacturing of circuit boards, electronic components, and connectors increases demand for caustic soda. The growth in the adoption of electronic devices and focus on electronic component preparation increases demand for caustic soda, supporting the overall market growth.

Caustic Soda Market Value Chain Analysis

- Feedstock Procurement: The feedstock procurement for caustic soda involves the chlor-alkali process by using raw materials like water & sodium chloride.

- Chemical Synthesis and Processing: The chemical synthesis and processing involve steps like brine preparation, electrolysis using cathode & anode reactions, and formation of caustic soda.

- Key Players:- OxyChem, Shin-Etsu Chemical, Dow Chemical, BASF SE, Westlake Chemical

- Quality Testing and Certification: The quality testing involves testing of the visual appearance, sodium hydroxide content, concentration of chlorides, & determining moisture content, and certification like ISCC Plus, BIS, and ISO.

Recent Developments

- In April 2025, DCM Shriram launched a new 300 TPD caustic soda flakes plant in Gujarat. The facility is located in Jhagadia, and the total capacity of the unit is 900TPD. The facility enhances operational efficiency and supports sustainability.(Source: www.indianchemicalnews.com)

- In June 2025, thyssenkrupp nucera is expanding TGV SRAACL’s caustic soda plant in Andhra Pradesh. The plant is expanding up to 1500 TPD and includes the installation of an additional 3 electrolyzers. The project focuses on setting up Waste Air Dichlorination and a new Chlorine system.(Source: www.indianchemicalnews.com)

- In December 2023, Dow launched a reduced carbon caustic soda product range. The range includes TRACELIGHT DEC and Caustic DEC and supports sustainability by using renewable energy. TRACELIGHT DEC is widely used for food & sensitive applications, and Caustic DEC is used for industrial applications.(Source: corporate.dow.com)

Caustic Soda Market Top Companies

- Dow Chemical Company

- Occidental Petroleum Corporation (OxyChem)

- Formosa Plastics Corporation

- SABIC

- Shin-Etsu Chemical Co., Ltd.

- INEOS Group

- Westlake Chemical Corporation

- Covestro AG

- PPG Industries, Inc.

- BASF SE

- Solvay S.A.

- Tata Chemicals Limited

- Aditya Birla Chemicals

- Tosoh Corporation

- LG Chem Ltd.

- Hanwha Solutions Corporation

- Shintech Inc.

- Asahi Glass Co., Ltd.

- Kemira Oyj

- Olin Corporation

Segments Covered

By Application

- Alumina Production

- Bayer Process

- Inorganic Chemicals Production

- Sodium Carbonate (Soda Ash)

- Sodium Bicarbonate

- Sodium Silicate

- Phosphoric Acid

- Organic Chemicals Production

- Acetone

- Phenol

- Epichlorohydrin

- Butyl Acrylate

- Soaps & Detergents

- Household Soaps

- Industrial Detergents

- Personal Care Products

- Textile Processing

- Fabric Bleaching

- Dyeing

- Mercerization

- Water Treatment

- pH Adjustment

- Heavy Metal Removal

- Pulp & Paper

- Pulping

- Bleaching

- Deinking

- Food Processing

- Additive Production

- pH Regulation

- Steel & Metallurgy

- Metal Surface Cleaning

- Sintering Process

- Other Industrial Applications

- Oil & Gas

- Pharmaceuticals

- Battery Manufacturing

By Production Process

- Membrane Cell Process

- Diaphragm Cell Process

- Mercury Cell Process

By Form

- Solid

- Flakes

- Pearls

- Liquid

- 50% Solution

- 25% Solution

By End-Use Industry

- Chemical Manufacturing

- Aluminum Production

- Water Treatment

- Pulp & Paper

- Textile Industry

- Food & Beverages

- Pharmaceuticals

- Oil & Gas

- Electronics

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait

List of Figures

- Global Caustic Soda Market Size & Growth Forecast (2025-2034) – Market Overview (100%)

- Regional Market Share of Caustic Soda in 2024 – Asia Pacific (50%), Latin America, North America, Europe, Middle East & Africa (100%)

- Caustic Soda Market by Application (2024) – Inorganic Chemicals Production (40%), Organic Chemicals Production, Water Treatment, Textile Processing, Other Applications (100%)

- Caustic Soda Market by Production Process (2024) – Membrane Cell Process (60%), Diaphragm Cell Process, Mercury Cell Process (100%)

- Caustic Soda Market by Form (2024) – Liquid (70%), Solid (100%)

- End-Use Industry Share in Caustic Soda Market (2024) – Chemical Manufacturing (35%), Aluminum Production, Water Treatment, Pulp & Paper, Textile Industry, Food & Beverages, Pharmaceuticals, Electronics (100%)

- Growth of Caustic Soda Market by Region (2025-2034) – CAGR by Region: Asia Pacific, Latin America, North America, Europe, Middle East & Africa (100%)

- Growth in Caustic Soda by Application (2025-2034) – CAGR by Application: Inorganic Chemicals Production, Organic Chemicals Production, Water Treatment, Textile Processing, Other Applications (100%)

- Growth of Caustic Soda by Production Process (2025-2034) – CAGR by Production Process: Membrane Cell Process, Diaphragm Cell Process, Mercury Cell Process (100%)

- Growth of Caustic Soda by End-Use Industry (2025-2034) – CAGR by End-Use Industry: Chemical Manufacturing, Aluminum Production, Water Treatment, Pulp & Paper, Textile Industry, Food & Beverages, Pharmaceuticals, Electronics (100%)

- Caustic Soda Market by Form (2025-2034) – Growth in Liquid & Solid Forms (100%)

- Top Exporting Countries of Caustic Soda in 2023 – India, United States, Germany, South Korea (100%)

- Caustic Soda Market Competitive Landscape (2024) – Market Share by Key Players: Dow Chemical, OxyChem, Formosa Plastics, BASF, Shin-Etsu Chemical, INEOS (100%)

List of Tables

- Caustic Soda Market Size & Forecast (2025-2034) – USD Value (100%)

- Regional Share of Caustic Soda Market in 2024 – Asia Pacific (50%), Latin America, North America, Europe, Middle East & Africa (100%)

- Caustic Soda Market by Application in 2024 – Inorganic Chemicals Production (40%), Organic Chemicals Production, Water Treatment, Textile Processing, Other Applications (100%)

- Caustic Soda Market by Production Process in 2024 – Membrane Cell Process (60%), Diaphragm Cell Process, Mercury Cell Process (100%)

- Caustic Soda Market by Form in 2024 – Liquid (70%), Solid (100%)

- End-Use Industry Share in Caustic Soda Market in 2024 – Chemical Manufacturing (35%), Aluminum Production, Water Treatment, Pulp & Paper, Textile Industry, Food & Beverages, Pharmaceuticals, Electronics (100%)

- Growth Rate (CAGR) of Caustic Soda Market by Region (2025-2034) – Asia Pacific, Latin America, North America, Europe, Middle East & Africa (100%)

- Growth Rate (CAGR) of Caustic Soda Market by Application (2025-2034) – Inorganic Chemicals Production, Organic Chemicals Production, Water Treatment, Textile Processing, Other Applications (100%)

- Growth Rate (CAGR) of Caustic Soda Market by Production Process (2025-2034) – Membrane Cell Process, Diaphragm Cell Process, Mercury Cell Process (100%)

- Growth Rate (CAGR) of Caustic Soda Market by End-Use Industry (2025-2034) – Chemical Manufacturing, Aluminum Production, Water Treatment, Pulp & Paper, Textile Industry, Food & Beverages, Pharmaceuticals, Electronics (100%)

- Caustic Soda Export Values by Country (2023) – India, United States, Germany, South Korea (100%)

- Market Share of Key Companies in the Caustic Soda Industry (2024) – Dow Chemical, OxyChem, Formosa Plastics, BASF, Shin-Etsu Chemical, INEOS (100%)