Content

Biopharma Plastic Market Size and Growth 2025 to 2034

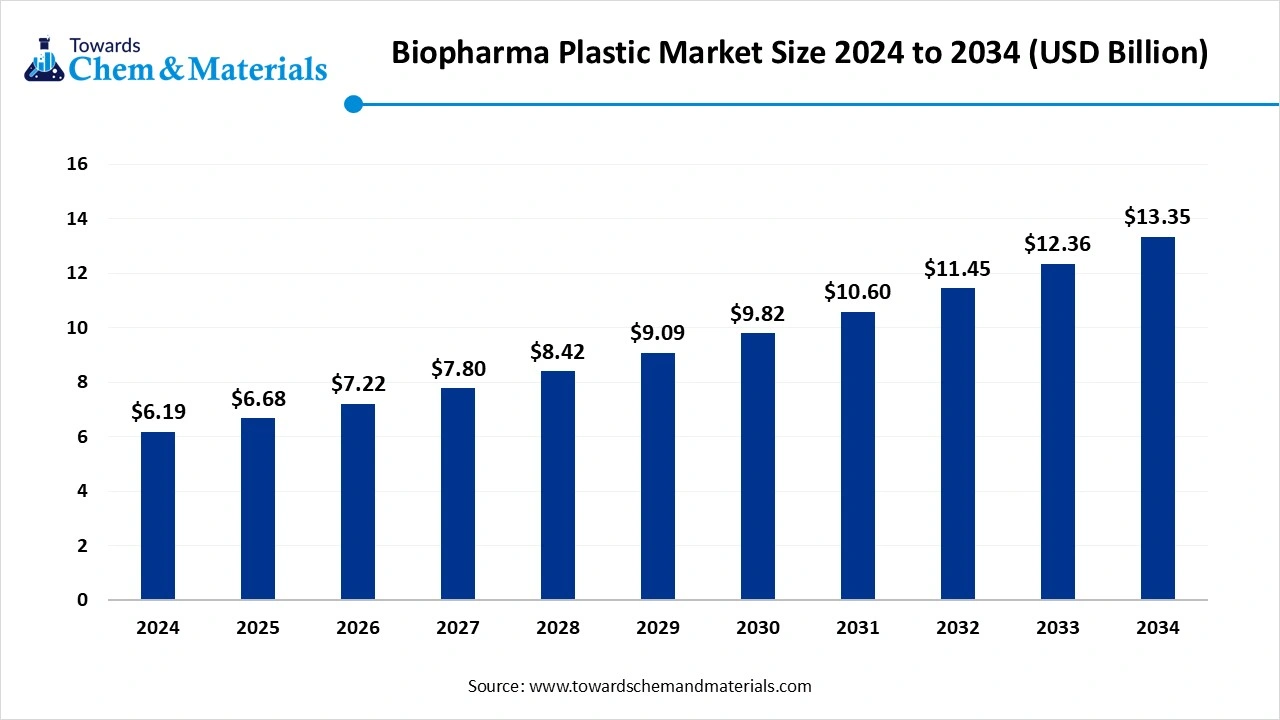

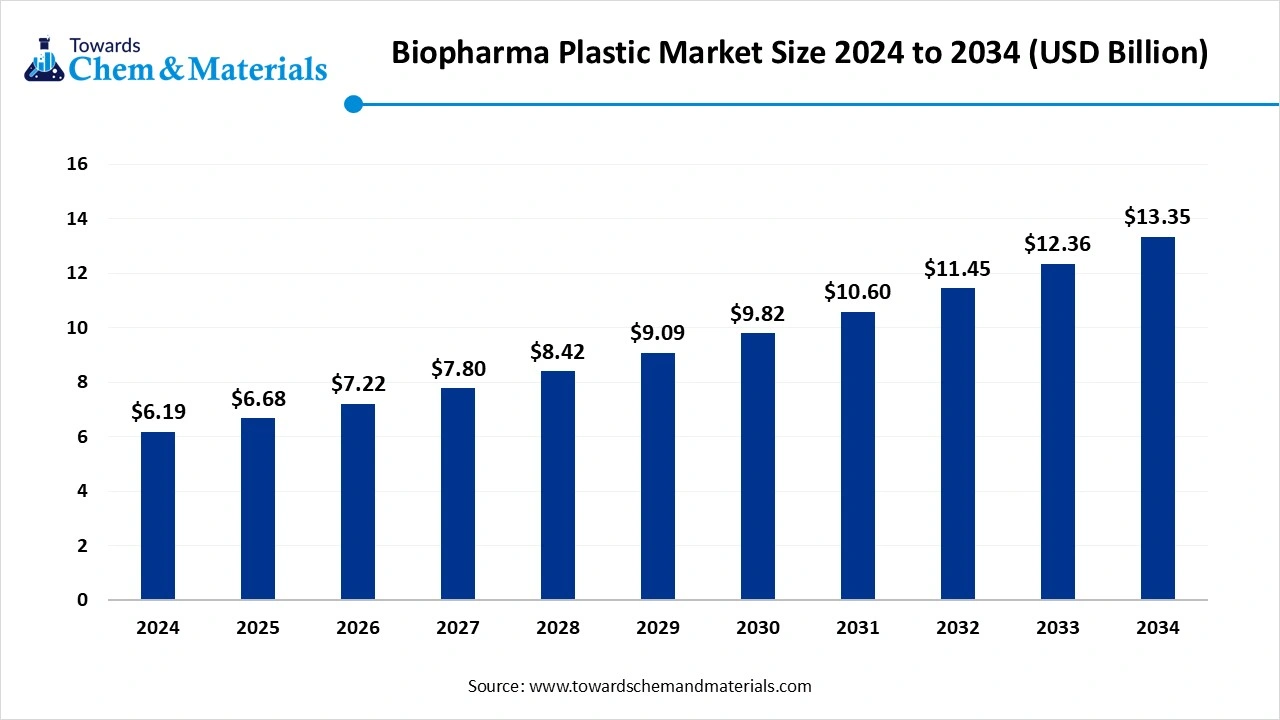

The global biopharma plastic market size is calculated at USD 6.19 billion in 2024, grew to USD 6.68 billion in 2025 and is predicted to hit around USD 13.35 billion by 2034, expanding at healthy CAGR of 7.99% between 2025 and 2034. The growing demand across the biopharmaceutical industry, increasing medical packaging, and rising demand for drug delivery devices drive the market growth.

Key Takeaways

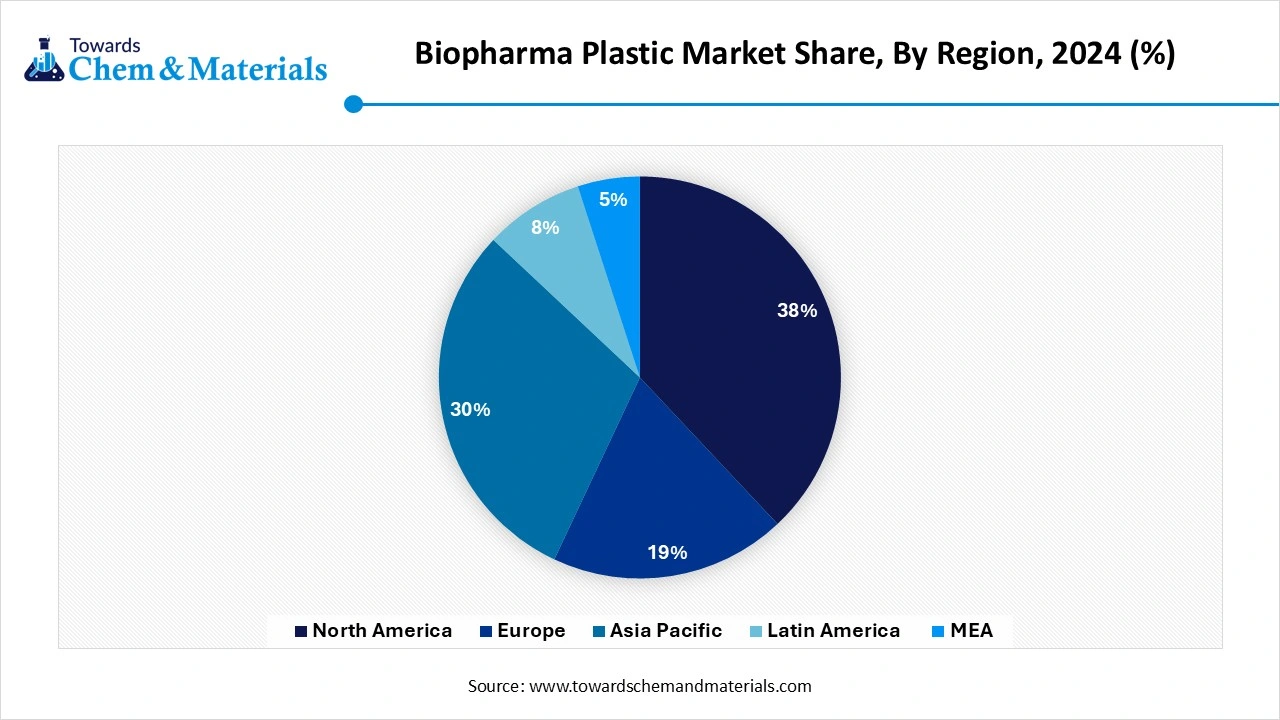

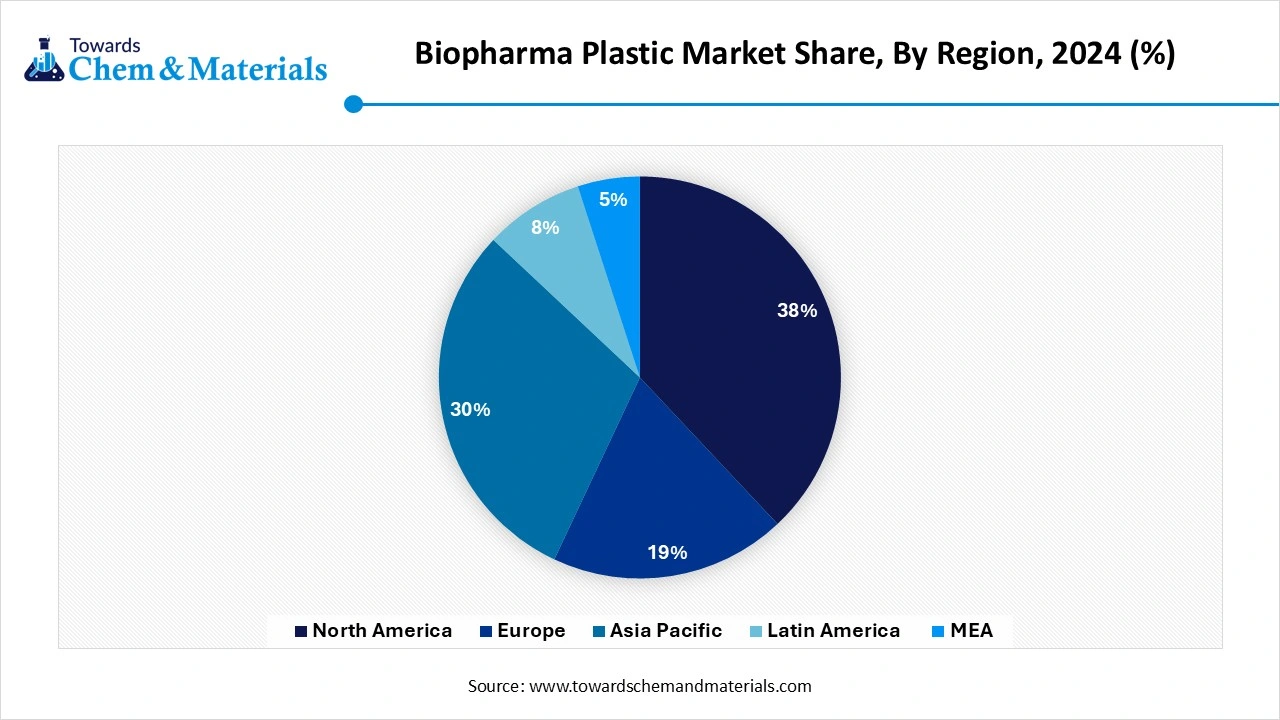

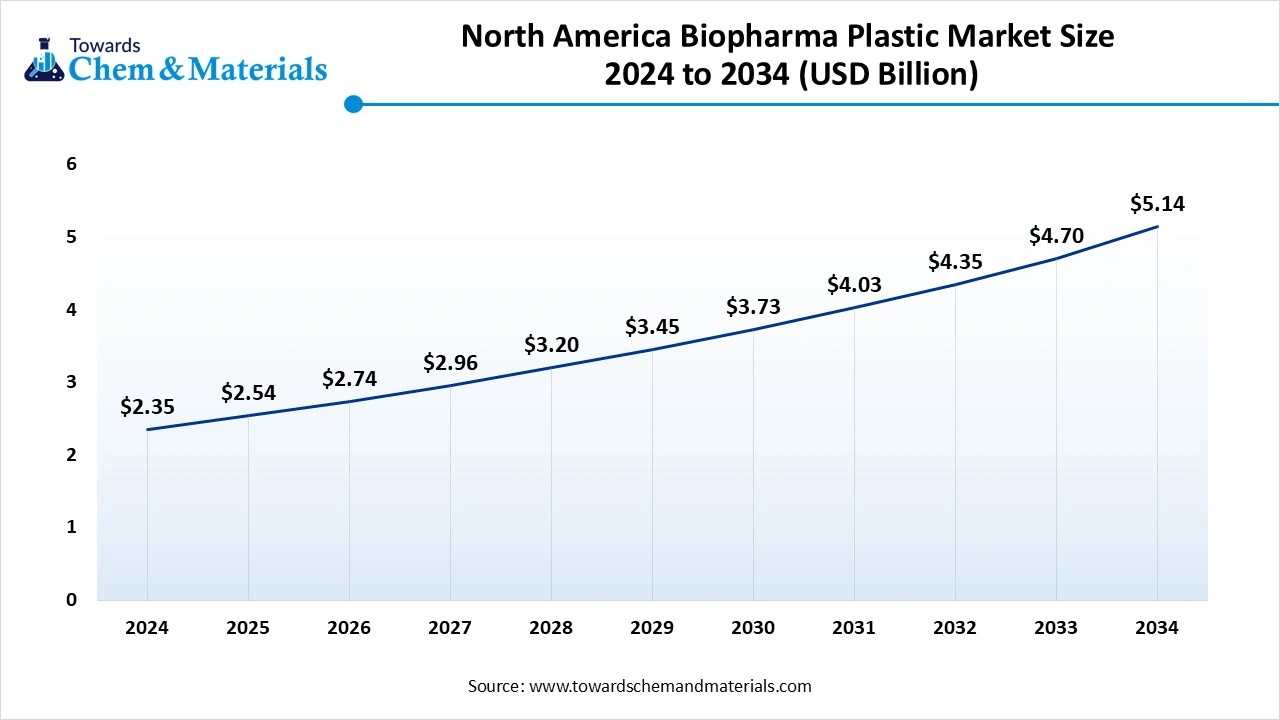

- North America biopharma plastic market dominated the global market and accounted for largest revenue share of 38% in 2024.

- Asia Pacific is growing at the fastest CAGR in the market during the forecast period due to the growing healthcare spending.

- By product type, the polypropylene segment held a 24% share in the biopharma plastic market in 2024 due to the growing use of medical devices.

- By product type, the COC/COP segment is expected to grow at the fastest CAGR in the market during the forecast period due to the rising demand for advanced drug delivery systems.

- By application, the bioprocessing equipment segment held a 35% share in the biopharma plastic market in 2024 due to the increasing demand for cell & gene therapy.

- By application, the drug delivery segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing prevalence of chronic disease.

- By Usage Mode, the single-use systems (SUS) segment held a 62% share in the biopharma plastic market in 2024 due to the increasing demand for biologics.

- By Usage Mode, the multi-use/ reusable systems segment is significantly growing in the market due to a growing focus on sustainability.

- By end user, the biopharmaceutical manufacturers segment held a 48% share in the biopharma plastic market in 2024 due to the growing manufacturing of biopharmaceutical products.

- By end user, the CMOs segment is expected to grow at the fastest CAGR in the market during the forecast period due to the rising research & development in biopharmaceuticals.

- By distribution channel, the direct sales segment held a 55% share in the biopharma plastic market in 2024 due to the growing focus on customization.

- By distribution channel, the online/e-commerce segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing demand for medication refills.

Market Overview+ Market Drivers+ Growth Factors

Biopharma Plastic: Unsung Hero of Modern Medicine and Drug Discovery

The biopharma plastic is a type of plastic developed for use in the biopharmaceutical and pharmaceutical industry. They are made up of bio-based polymers and used in the storage, delivery, production, and processing of vaccines and biologics. The biopharma plastic consists of sterilizability, low chemical reactivity, biocompatibility, durability, and high purity. They possess high chemical resistance and are used in various biopharmaceutical applications. Biopharma plastic is widely used in medical devices like tubing, syringes, and IV bags.

The growing demand for the packaging of blister packs, bottles, and vials increases demand for biopharma plastic. The increasing advancements in gene therapy, biologics, and personalised medicines increase demand for biopharma plastic. The growing advancements in single-use technologies increase demand for biopharma plastics to reduce contamination risk and enhance efficiency. Factors like growing focus on sustainability, increasing prevalence of chronic disease, high healthcare spending, and rising medical packaging contribute to the growth of the biopharma plastics market.

- According to Volza’s Export data, India exported 346874 shipments of polypropylene.

- According to OEC World, Germany exported $176M of polytetrafluoroethylene in 2023.

- According to OEC World, South Korea exported $797M of polyethylene terephthalate in 2023.

- According to OEC World, South Korea exported $1.46B of polycarbonates in 2023.

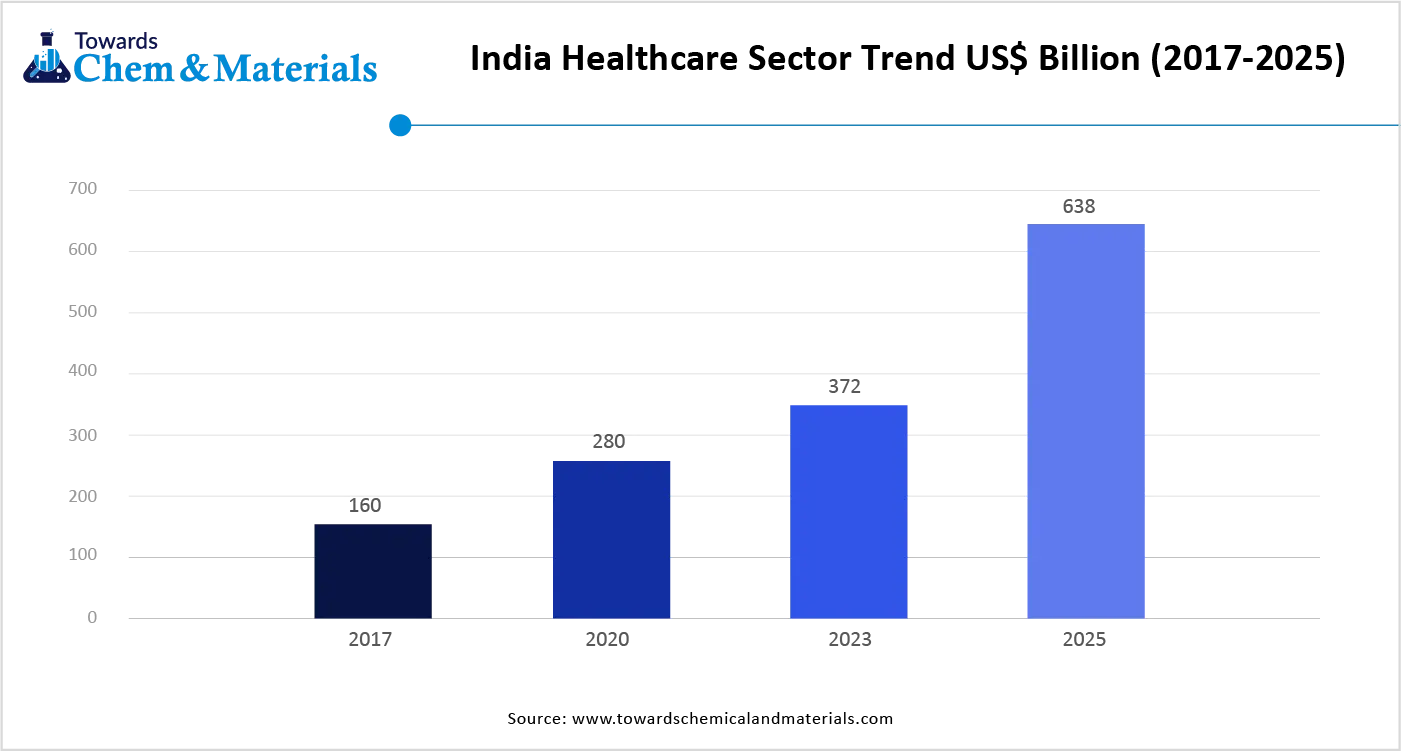

The Growing Healthcare Sector Propels Demand for Biopharma Plastic

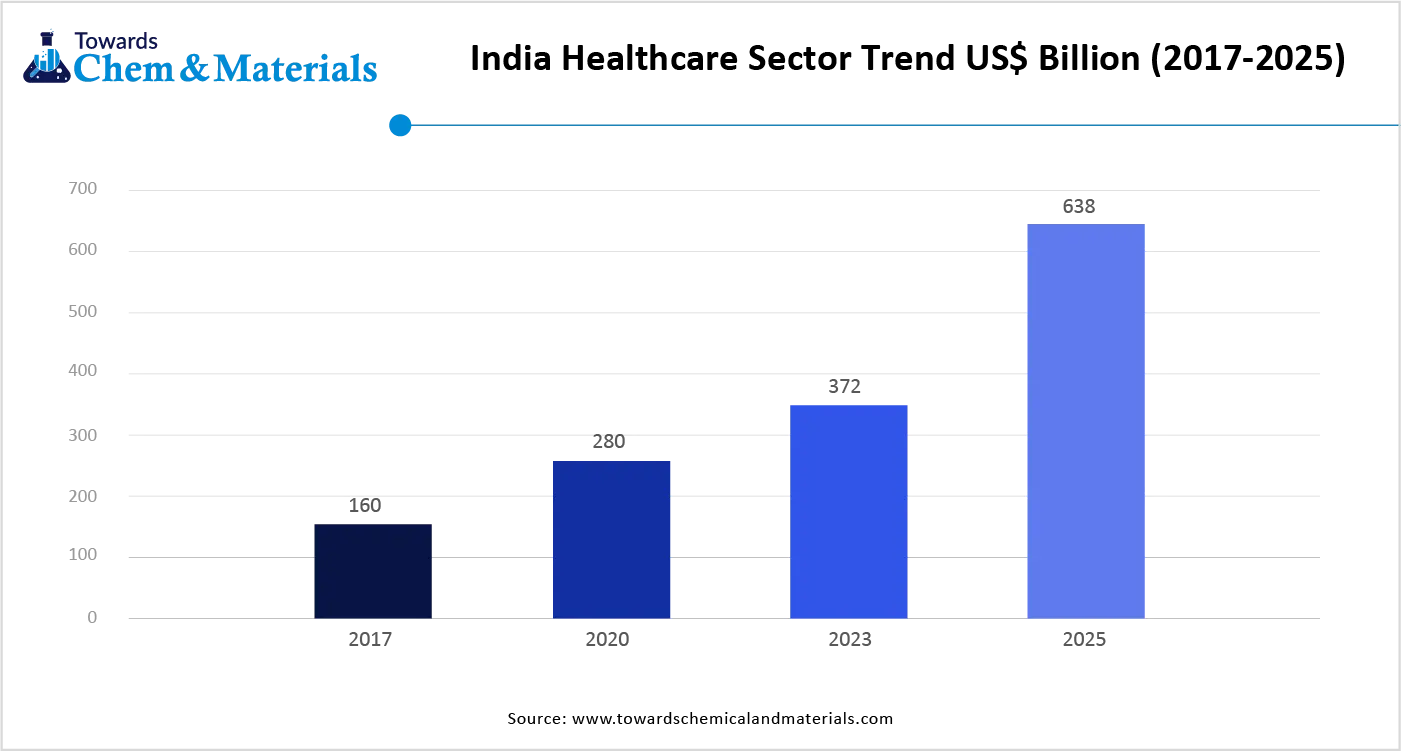

The growing healthcare sector increases demand for biopharma plastic for various applications. The growing healthcare sector increases demand for various medical devices like catheters, diagnostic equipment, implants, and surgical instruments increases demand for biopharma plastic. The growing demand for drug delivery systems in the healthcare industry increases demand for IV bags, prefilled syringes, and other systems, fueling demand for biopharma plastics.

The increasing demand for various medications like biologics increases demand for biopharma plastics. The growing demand for personalized medicine, regenerative medicine, and cell & gene therapy increases demand for efficient and advanced biopharma plastics. The rising demand for healthcare services like medications, surgeries, and medical devices fuels demand for biopharma plastic. The growing healthcare sector is a key driver for the biopharma plastic market.

- According to the India Brand Equity Foundation, India has the largest healthcare sector and healthcare delivery system, categorised into private and public components.

Market Trends

- The Growing Adoption of Single-Use Systems:- The growing adoption of single-use systems in biopharmaceutical applications like laboratory equipment and drug delivery increases demand for biopharma plastic.

- The Rise in Personalised Medicine:- The growing popularity of personalised medicine increases demand for biopharma plastics for maintaining the integrity and safety of advanced therapeutics.

- Expansion of Biopharma Industry:- The growing expansion of the biopharma industry fuels demand for biopharma plastic for safe transportation and storage of pharmaceutical products.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 6.68 Billion |

| Market Size by 2034 | USD 13.35 Billion |

| Growth rate from 2024 to 2025 | CAGR 7.99% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Product Type, By Application, By Usage Mode, By End User, By Distribution Channel, By Region |

| Key Profiled Companies | BASF SE, SABIC, Dow Inc., DuPont de Nemours, Inc., Celanese Corporation, Solvay SA, Evonik Industries AG, Röchling Group, Ensinger GmbH, Saint-Gobain Performance Plastics, 3M Company, Covestro AG, W. L. Gore & Associates, Inc., Daikyo Seiko Ltd., West Pharmaceutical Services, Inc., Thermo Fisher Scientific Inc., Freudenberg Group, Entegris, Inc., Nordson Corporation, Moldex3D (CoreTech System Co., Ltd.) |

Market Opportunity

Growing Demand for Biologics Unlocks Opportunity for Biopharma Plastic

The growing demand for biologics increases the demand for biopharma plastics for delivery, production, and storage. The increasing production of biologics increases demand for single-use systems like bioreactors, bags, and tubing. Biologics require high-purity requirements to maintain integrity during drug production. The increasing demand for biologics like complex therapies, vaccines, and monoclonal antibodies leads to higher demand for biopharma plastic for delivery, production, and storage. The growing prevalence of chronic diseases like autoimmune disorders, heart disease, and cancer increases demand for biologic therapies is fueling the adoption of biopharma plastic. The growing use of auto-injectors, personalised medicines, and pre-filled syringes increases the utilization of biologics, fueling demand for biopharma plastic. The growing demand for biologics creates an opportunity for the biopharma plastic market.

Market Challenge

High Production Cost Limits the Expansion of Biopharma Plastic

Despite several benefits of the biopharma plastic, the high production cost restricts the market growth. Factors like stringent regulatory environments, the need for premium materials, the need for high purity, and specialized manufacturing processes increase the production cost. The need for high-purity raw materials for single-use systems and packaging increases the cost.

The requirement of extensive documentation, testing, and validation requires stringent regulations increases the overall cost. The need for specialized processes like controlled environment production, aseptic manufacturing, and sterilization leads to higher costs. The increasing complexity of manufacturing is leading to higher costs. The high production cost hampers the growth of the biopharma plastic market.

Regional Insights

How North America Dominated the Biopharma Plastic Market?

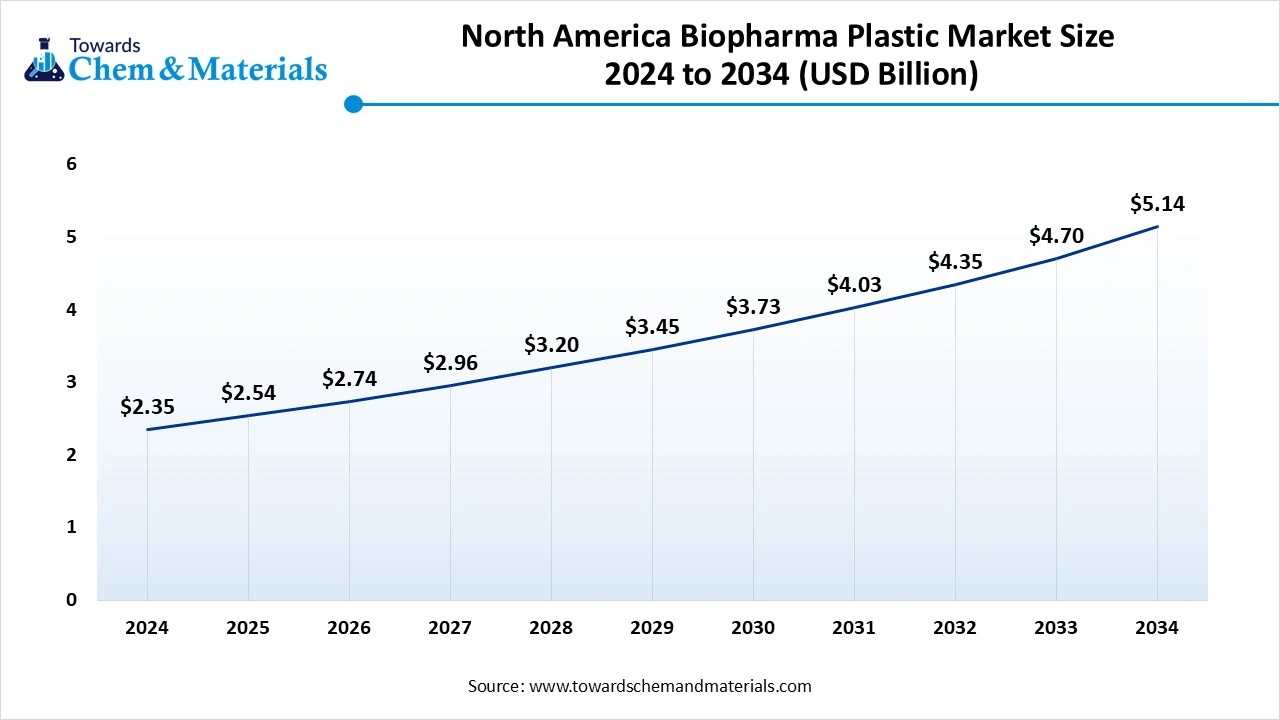

The North America biopharma plastic market size accounted for USD 2.54 billion in 2025 and is forecasted to hit around USD 5.14 billion by 2034, representing a CAGR of 8.14% from 2025 to 2034. North America dominated the biopharma plastic market in 2024. The presence of a well-developed pharmaceutical industry increases demand for biopharma plastic. The growing biopharmaceutical manufacturing and production of gene therapies & biologics help in the market growth. The increasing healthcare spending and growing demand for medical devices & pharmaceuticals increase the adoption of biopharma plastic. The growing advancements in packaging technology fuel the adoption of biopharma plastic. The presence of major players like DuPont, Eastman Chemical Co., and Celanese Corporation drives the market growth.

What are the Biopharma Plastic Trends in the United States?

The United States is a major contributor to the biopharma plastic market. The well-developed pharmaceutical industry and the presence of an advanced healthcare system increase demand for biopharma plastic. The extensive investment in research & development of specialty drugs and biologics increases the adoption of biopharma plastics. The strong government support for healthcare access and pharmaceutical manufacturing increases demand for biopharma plastic. The rising prevalence of chronic disease and increasing healthcare spending drive the overall growth of the market.

- According to Volza’s Export data, the United States exported 222367 shipments of polypropylene.(Source: www.volza.com )

- According to OEC World, the United States exported $2.6B of polyvinyl chloride in 2023. (Source: oec.world)

- According to OEC World, the United States exported $143M of polytetrafluoroethylene in 2023.(Source: oec.world )

Why is Asia Pacific the Fastest-Growing in the Biopharma Plastic Market?

Asia Pacific is experiencing the fastest growth in the market during the forecast period. The growing expansion of the pharmaceutical industry, especially in biologics and generic drugs, increases demand for biopharma plastic. The growing prevalence of chronic disease and rising healthcare spending help in the market growth. The focus on advancements in healthcare infrastructure increases the adoption of biopharma plastic.

The growing drug processing and manufacturing industry increases demand for single-use biopharma plastic. The high availability of raw materials for the production of biopharma plastic helps the market growth. The strong government support for the pharmaceutical industry drives the overall growth of the market.

China Biopharma Plastic Market Trends

China is a key contributor to the biopharma plastic market. The growing prevalence of chronic disease and the increasing expansion of the pharmaceutical industry increase demand for biopharma plastic. The robust manufacturing of PE, PET, and PP biopharma packaging helps in the market growth. The extensive government support for the pharmaceutical and healthcare industry increases the adoption of biopharma plastic. The growing private and public healthcare spending increases demand for biopharma plastic, supporting the overall growth of the market.

- According to Volza’s Export data, China exported 525061 shipments of polypropylene.(Source: www.volza.com )

- According to OEC World, China exported $2B of polyvinyl chloride in 2023.(Source: oec.world)

- According to OEC World, China exported $254M of polytetrafluoroethylene in 2023. (Source: oec.world)

Segmental Insights

By Product Type

How Polypropylene Segment Held the Largest Share of the Biopharma Plastic Market?

The polypropylene (PP) segment led the biopharma plastic market in 2024. The growing demand across various applications like vials, closures, syringes, and bottles increases demand for polypropylene, helping in the market growth. Polypropylene is highly chemically resistant, and its flexibility creates complex designs & shapes. It sustains in a diverse range of temperatures and avoids the buildup of contaminants and bacteria. PP is cost-effective, compatible with sterilization, and biocompatible. The growing utilization of medical devices and increasing biopharma manufacturing increases demand for polypropylene, driving the overall growth of the market.

The COC/COP segment is the fastest-growing in the market during the forecast period. The increasing demand for advanced drug delivery systems and the growing prevalence of chronic disease increase the demand for COC/COP. The growing focus on sustainability helps in the market growth. COC/COP materials have high purity and provide excellent moisture barrier properties. They have a very low level of extractables and are highly transparent.

COC/COP is lightweight, shatter-resistant, and compatible with various sterilization methods. The growing focus on lowering drug contamination and enhancing patient safety increases the adoption of COC/COP. The growing demand from applications like diagnostic, medical devices, and prefilled syringes supports the market growth.

By Application

Why did Bioprocessing Equipment Segment Dominate the Biopharma Plastic Market?

The bioprocessing equipment segment dominated the biopharma plastic market in 2024. The growing development of new therapies like mRNA vaccines, monoclonal antibodies, and cell & gene therapy increases demand for bioprocessing equipment. The increasing production of biologics increases demand for bioprocessing equipment for the production of filtration systems, bioreactors, and chromatography systems. The expansion of biopharmaceutical manufacturing and focus on personalised medicines drive the market growth.

The drug delivery segment is experiencing the fastest growth in the market during the forecast period. The increasing demand for biosimilars and biologics increases demand for efficient drug delivery systems. The growing prevalence of chronic diseases like cardiovascular conditions, diabetes, and cancer fuels demand for drug delivery systems, helping the market growth. The increasing expansion of healthcare and the growing popularity of personalised medicine support the overall growth of the market.

By Usage Mode

How Single-Use Systems Dominated the Biopharma Plastic Market?

The single-use systems (SUS) segment dominated the biopharma plastic market in 2024, and the segment is observed to sustain the position during the forecast period. The growing demand for cell & gene therapies, biologics, and personalised medicine increases the demand for single-use systems. The increasing manufacturing of biopharmaceuticals helps in the market growth. Single-use systems readily adapt to various process steps and are highly flexible. This system reduces operational cost and minimizes contamination risk. The growing advancements in single-use systems and the increasing focus on improving productivity for biopharmaceuticals drive the market growth.

The multi-use/ reusable systems segment is significantly growing in the market. The growing environmental concerns and focus on sustainability increase demand for multi-use/ reusable systems. The growing focus on minimizing materials needs and reducing waste increases the adoption of multi-use/ reusable systems, helping the market growth. The increasing demand for child resistance, sterility, and tamper-evidence in pharmaceutical applications increases the adoption of multi-use and reusable systems. The growing various pharmaceutical applications supports the overall growth of the market.

By End User

Which End-User Segment Dominated the Biopharma Plastic Market in 2024?

The biopharmaceutical manufacturers segment dominated the biopharma plastic market in 2024. The growing demand for specialized plastic in production and the development of drugs increases demand for biopharmaceutical manufacturers. The growing demand for disposable connectors and bioreactor bags helps in the market growth. The rising demand for biologics increases demand for biopharmaceutical manufacturers. The growing production of biopharmaceuticals like complex therapies and monoclonal antibodies, drives the market growth.

The CMOs segment is experiencing the fastest growth in the market during the forecast period. The growing various diseases increases demand for gene therapies, monoclonal antibodies, and vaccines is fueling demand for CMOs. The increasing production of complex biologics increases demand for CMOs, helping the market growth. The increasing companies' focus on research and development increases the adoption of CMOs. The growing technological advancements, like advanced purification technologies and single-use systems, increase the adoption of CMOs, supporting the overall growth of the market.

By Distribution Channel

Why Direct Sales Segment Held the Largest Share in the Biopharma Plastic Market?

The direct sales segment led the biopharma plastic market in 2024. The growing demand for biopharma-tailored and customized manufacturing needs increases the demand for direct sales. The growing focus on faster communication between end-users and suppliers increases the adoption of direct sales, helping the market growth. The growing biopharma companies focus on control over quality and supply chains, increasing demand for direct sales, driving the overall market growth.

The online/e-commerce segment is the fastest-growing in the market during the forecast period. The growing consumer preference for conveniently ordering biopharmaceutical products increases the adoption of online/e-commerce services. The increasing demand for chronic condition management increases the demand for refills of medications is fueling demand for e-commerce services. The focus on personalized medicine and demand for improving access to medications increases demand for e-commerce services, supporting the overall growth of the market.

Recent Developments

- In July 2024, Thermo Fisher Scientific launched biobased films. The film is approved by the ISCC and developed for biopharma manufacturers. Biobased films lower environmental impact and are used in the production of biologics & vaccines.

(Source:www.recyclingtoday.com) - In April 2025, DuPont launched Liveo Pharma TPE ultra-low temperature tubing. The TPE is used in biopharmaceutical applications and sustains in low temperatures. The tubing is sealable, sterilizable, & weldable and offers excellent burst pressure resistance. The tube is available for single-use bioprocessing and fluid transport applications.

(Source:www.dupont.com) - In October 2023, Raumedic extended its biopharma tubing line. The range includes TPE, PVC, silicon, and FEP tubes. The custom-specific dimensions are available for tubing and used for biopharmaceutical fluid-processing applications.

(Source:www.plasticstoday.com)

Top Companies List

- BASF SE

- SABIC

- Dow Inc.

- DuPont de Nemours, Inc.

- Celanese Corporation

- Solvay SA

- Evonik Industries AG

- Röchling Group

- Ensinger GmbH

- Saint-Gobain Performance Plastics

- 3M Company

- Covestro AG

- W. L. Gore & Associates, Inc.

- Daikyo Seiko Ltd.

- West Pharmaceutical Services, Inc.

- Thermo Fisher Scientific Inc.

- Freudenberg Group

- Entegris, Inc.

- Nordson Corporation

- Moldex3D (CoreTech System Co., Ltd.)

Segments Covered

By Product Type

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polytetrafluoroethylene (PTFE)

- Polyethylene Terephthalate (PET/PETG)

- Polycarbonate (PC)

- Polysulfone (PSU)

- Cyclic Olefin Copolymer (COC) / Cyclic Olefin Polymer (COP)

- Fluoropolymers (FEP, PVDF)

- Others (PA, PEEK, PPSU, etc.)

By Application

- Bioprocessing Equipment

- Single-use bags & bioreactors

- Tubing and connectors

- Filters & membranes

- Packaging

- Bottles & containers

- Vials & ampoules

- Closures

- Drug Delivery

- Syringes

- IV Bags & Systems

- Inhalers & injectors

- Diagnostic Equipment & Consumables

- Cartridges & cassettes

- Microfluidic chips

- Medical Devices (Biopharma Use)

By Usage Mode

- Single-use Systems (SUS)

- Multi-use / Reusable Systems

By End User

- Biopharmaceutical Manufacturers

- CMOs (Contract Manufacturing Organizations)

- Research Laboratories

- Diagnostic Labs

- Hospitals & Clinics (for injectable biologics)

By Distribution Channel

- Direct Sales

- Distributors / Wholesalers

- Online / E-Commerce Platforms

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait