Content

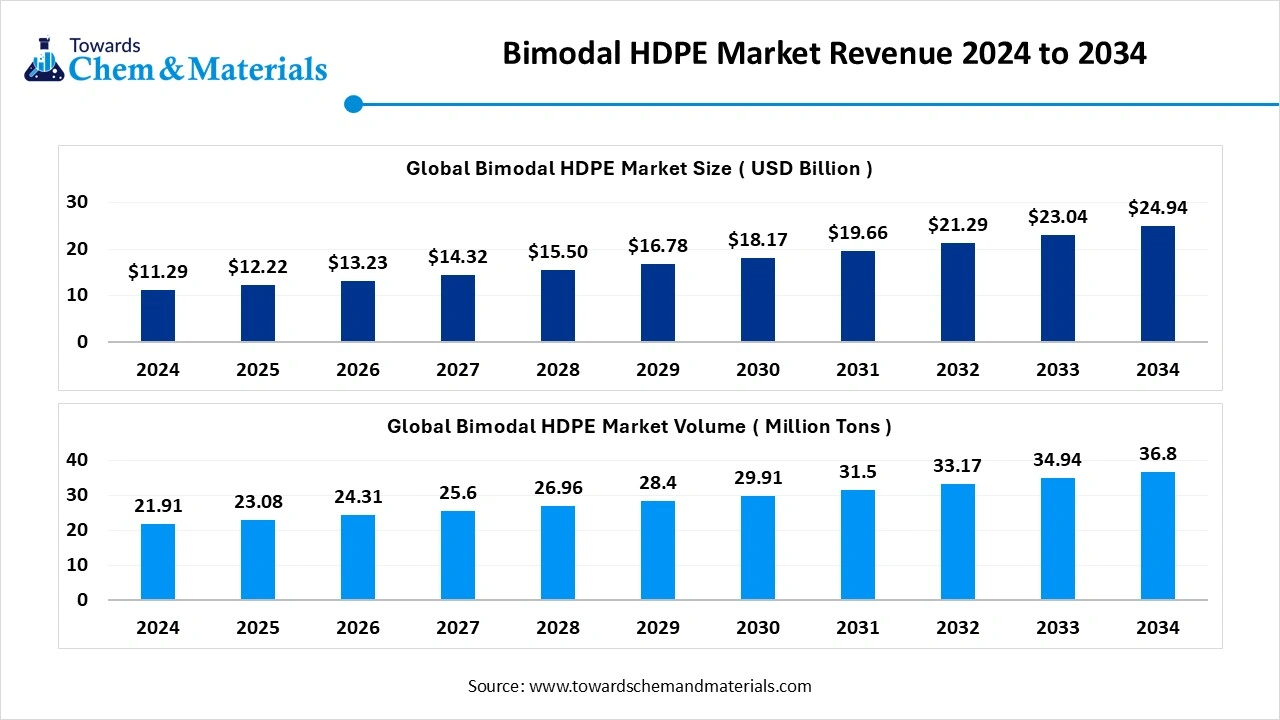

Bimodal HDPE Market Volume to Reach 36.80 Million Tons by 2034

The global bimodal HDPE Market volume is estimated at 23.08 million tons in 2025, and is expected to reach 36.80 million tons by 2034, at a CAGR of 5.32% during the forecast period 2025-2034.

The global bimodal HDPE market size was reached at USD 11.29 billion in 2024 and is expected to be worth around USD 24.94 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.25% over the forecast period 2025 to 2034. The growing expansion of the packaging industry, increasing construction activities, and the development of lightweight automotive components drive the market growth.

Key Takeaways

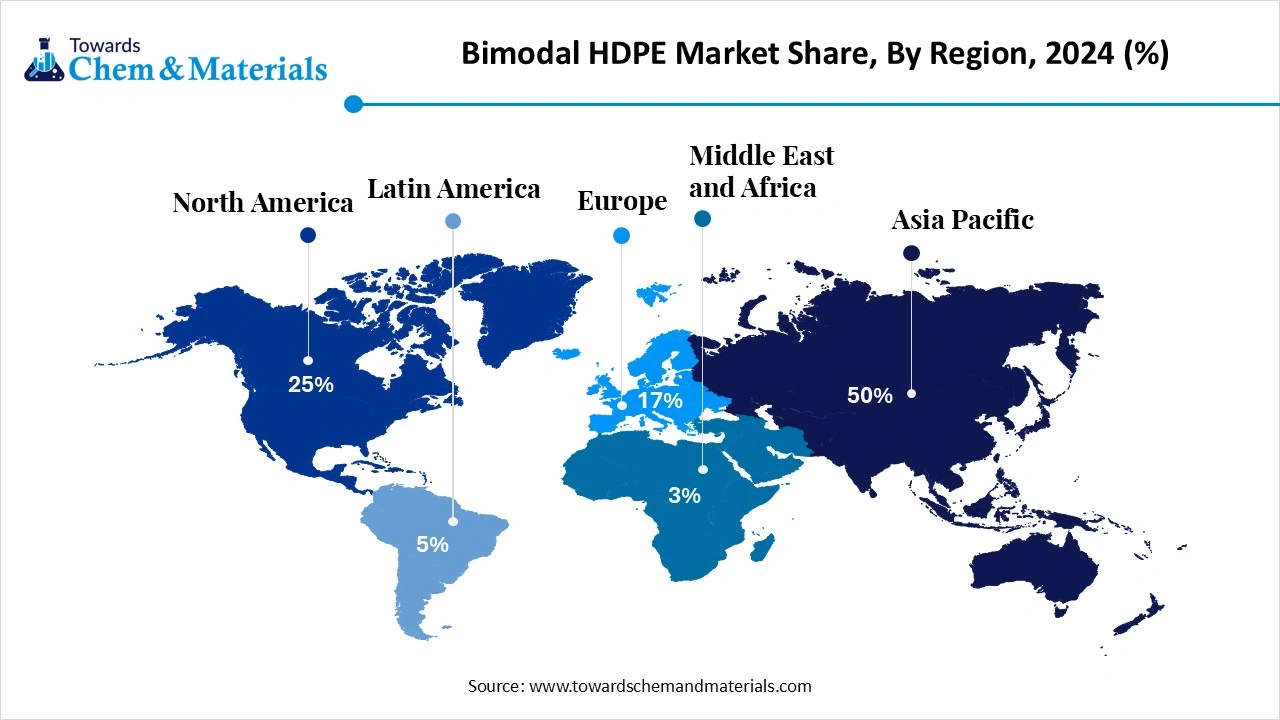

- By region, Asia Pacific held approximately a 50% share in the bimodal HDPE market in 2024 due to the growing infrastructure development.

- By region, Middle East & Africa is growing at the fastest CAGR in the market during the forecast period due to the growing packaging industry.

- By type, the pipe-grade segment held approximately a 40% share in the market in 2024 due to the growing upgradation of infrastructure projects.

- By type, the blow-molding grade segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing demand for blow-molded products.

- By application, the pipes & fittings segment held approximately a 45% share in the market in 2024 due to the increasing development of long-distance energy pipelines.

- By application, the packaging segment is expected to grow at the fastest CAGR in the market during the forecast period due to the rise in e-commerce.

- By end-use industry, the construction segment held approximately a 40% share in the market in 2024 due to the increasing residential construction activities.

- By end-use industry, the automotive segment is expected to grow at the fastest CAGR in the market during the forecast period due to the focus on enhancing the fuel efficiency of vehicles.

Bimodal HDPE: A Star Behind Modern Infrastructure and Industries

Bimodal HDPE is a type of HDPE that consists of a high molecular weight (HMW) component and a low molecular weight (LMW) component. The HMW offers toughness & enhanced stress crack, and the LMW offers strength & stiffness. The bimodal HDPE offers benefits like high stress crack resistance, excellent mechanical properties, improved durability, high strength, and better processability.

Bimodal HDPE is used in the production of pipes, detergent bottles, cable jacketing, food storage containers, and other products. Factors like the expansion of infrastructure projects, increasing demand for sustainable packaging, the growing automotive sector, increasing construction applications, and the expansion of the packaging industry contribute to the growth of the bimodal HDPE market.

- The United States exported 1876 shipments of the HDPE pipes.(Source: www.volza.com)

- India exported 9714 shipments of HDPE bottles.(Source: www.volza.com)

- The United States exported 2759 shipments of the HDPE film.(Source: www.volza.com)

Growing Packaging Industry Surges Demand for Bimodal HDPE

The growing expansion of the packaging industry and the surge in packaging increases demand for bimodal HDPE. The strong focus on sustainability and the trend of sustainable packaging increase demand for bimodal HDPE. The growing consumption of packaged foods increases demand for packaging. The increasing production of various packaging forms like films, bottles, bags, and containers increases demand for bimodal HDPE.

The ongoing customization of packaging applications requires bimodal HDPE. The increasing manufacturing of jerry cans, heavy-duty sacks, and industrial drums increases the adoption of bimodal HDPE. The rise in e-commerce and increased purchasing of packaged consumer goods increases demand for bimodal HDPE. The growing demand for packaging in industries like personal care, food & beverage, and chemicals increases the adoption of bimodal HDPE. The growing packaging industry is a key driver for the growth of the bimodal HDPE market.

Market Trends

- Growing Infrastructure Development: The growing development of infrastructure projects like energy pipelines, sewage systems, and water supply systems increases demand for bimodal HDPE due to long service life and stress-crack resistance.

- Increasing Consumption of Packaged Foods: The growing consumption of packaged foods and ready-to-eat foods increases demand for bimodal HDPE to extend shelf life and enhance product protection.

- Rise in Electric Vehicles: The growth in the adoption of electric vehicles increases demand for bimodal HDPE for the development of battery casing and under-the-hood automotive components.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 12.22 Billion |

| Expected Market Size by 2034 | USD 24.94 Billion |

| Growth Rate from 2025 to 2034 | CAGR 8.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| High Impact Region | Asia Pacific |

| Segment Covered | By Type, By Application, By End-Use Industry, By Region |

| Key Companies Profiled | Dow Inc., Chevron Phillips Chemical Company, SABIC, Exxon Mobil Corporation, Dynalab Corp., LyondellBasell Industries N.V., INEOS AG, SINOPEC Beijing Yanshan Company, PetroChina Company Ltd., Braskem S.A., Formosa Plastics Corporation, Daelim Industrial Co., Ltd., Mitsui Che |

Market Opportunity

Growing Automotive Sector Unlocks Market Opportunity

The rapid urbanization and growing automotive sector in various regions increase demand for bimodal HDPE for various automotive applications. The focus on reducing the weight of vehicles and enhancing the fuel efficiency of vehicles increases demand for bimodal HDPE. The growth in electric vehicles and the development of heavy battery packs lead to higher demand for bimodal HDPE.

The increasing manufacturing of intricate parts and focus on the safety of automotive components increases demand for bimodal HDPE. The manufacturing of the under-the-hood components increases the demand for bimodal HDPE. The growing electric vehicle and production of interior & exterior parts of vehicles require bimodal HDPE. The complexity in the production of automotive parts like fluid systems and air ducts increases demand for bimodal HDPE. The growing automotive sector creates an opportunity for the growth of the bimodal HDPE market.

Image Title : Number of Automobiles Produced in India in Million ( FY21 to FY24)

Market Challenge

High Production Cost Shuts Down Expansion of Bimodal HDPE Market

Despite several benefits of the bimodal HDPE in various applications, the high production cost restricts the market growth. Factors like fluctuations in prices of raw materials, need for new equipment, advanced manufacturing processes, and need for specialized catalysts contribute to the high production cost. The fluctuation in prices of raw materials like ethylene and complex manufacturing processes like dual-reactor technology & multi-step polymerization increases the production cost.

The utilization of high-performance platforms like Unipol, Hostalen, & Borstar technologies and high investment in new equipment increases the cost. The need for specialized catalysts requires a high cost. The high production cost hampers the market growth.

Regional Insights

Asia Pacific Bimodal HDPE Market Trends

Asia Pacific dominated the market in 2024. The growing development of infrastructure projects like logistics, water management, and power transmission increases demand for bimodal HDPE. The increasing expansion of construction activities and a strong focus on efficient water supply in the agriculture industry increase demand for bimodal HDPE.

The growth in plastic packaging and the rise in e-commerce increase demand for bimodal HDPE. The strong government support for the domestic manufacturing of bimodal HDPE drives the overall growth of the market.

China Bimodal HDPE Market Trends

China is a major contributor to the bimodal HDPE market. The growing development of infrastructure projects like drainage systems, scale water systems, and gas systems increases demand for bimodal HDPE. The rapid industrial growth and the growing expansion of the packaging sector increase demand for bimodal HDPE. The increasing construction activities and government support for smart infrastructure development increase demand for bimodal HDPE, supporting the overall growth of the market.

- China exported 1767 shipments of HDPE bottles.(Source: www.volza.com)

- China exported 693 shipments of the HDPE sheets.(Source: www.volza.com)

Middle East & Africa Bimodal HDPE Market Trends

Middle East & Africa are experiencing the fastest growth in the market during the forecast period. The growing packaging demand and rapid growth in the e-commerce sector increase demand for bimodal HDPE. The increasing investment in infrastructure development and growing consumption of packaged food increase demand for bimodal HDPE. The increasing awareness about hygiene and the presence of abundant feedstocks increase the production of bimodal HDPE. The well-established petrochemical industry and growth in food delivery services increase demand for bimodal HDPE, driving overall growth of the market.

Saudi Arabia Bimodal HDPE Market Trends

Saudi Arabia is a key contributor to the market. The strong focus on durable packaging and extensive development of infrastructure projects increases demand for bimodal HDPE. The strong government support for domestic manufacturing and the presence of the oil & gas industry increase demand for bimodal HDPE. The growing expansion of petrochemical capacity and booming construction activities increase the adoption of bimodal HDPE, supporting the overall growth of the market.

Segmental Insights

Type Insights

Why did Pipe-Grade Segment Dominate the Bimodal HDPE Market?

The pipe-grade segment dominated the market in 2024. The growing upgrading of gas infrastructure and the modernization of infrastructure projects increase demand for pipe-grade. The increasing development of long energy pipelines and the expansion of natural gas infrastructure increase demand for pipe-grade. The increasing investment in wastewater management and water supply increases the adoption of pipe-grade. The growing demand for pipe-grade in applications like agriculture irrigation, hydrocarbons transportation, municipal water systems, and agricultural irrigation drives the overall market growth.

The blow-molding grade segment is the fastest-growing in the market during the forecast period. The growing production of blow-molded products like detergents, personal care, chemicals, and beverages increases demand for blow-molding grade. The increasing manufacturing of industrial and chemical packaging increases demand for blow-molding grade. The strong focus on sustainable packaging and the growing production of lightweight containers increases demand for blow-molding grade. The growing expansion of industries like personal care, food & beverage, and chemicals increases the adoption of blow-molding grade, supporting the overall growth of the market.

Application Insights

How the Pipes & Fittings Segment Held the Largest Share in the Bimodal HDPE Market?

The pipes & fittings segment held the largest revenue share in the market in 2024. The growing modernization of infrastructure projects like stormwater management, water supply, and the sanitation system increases demand for pipes & fittings. The development of long energy pipelines and a strong focus on sustainability increases the adoption of pipes & fittings. The growing advancements in waste management, plumbing, and drainage in industries increase demand for pipes & fittings. The growth in sectors like agricultural irrigation systems, municipal water, and gas distribution drives the overall growth of the market.

The packaging segment is experiencing the fastest growth in the market during the forecast period. The strong focus on sustainability and shift towards eco-friendly packaging increases the adoption of bimodal HDPE. The growing consumption of packaged food and the growth in the food & beverage industry increase demand for packaging. The increased purchasing of personal care and consumer goods increases demand for packaging. The booming e-commerce and expansion of the FMCG sectors increase demand for packaging, supporting the overall growth of the market.

End-Use Industry Insights

Which End-Use Industry Dominated the Bimodal HDPE Market?

The construction segment dominated the market in 2024. The rapid urbanization and growing infrastructure development increase demand for geomembranes, pipes, & fittings that require bimodal HDPE. The aging pipeline and focus on the modernization of pipeline infrastructure increase demand for bimodal HDPE. The growing commercial and residential construction activities increase the adoption of bimodal HDPE. The strong focus on the development of green buildings and the need for replacement of traditional building materials increases demand for bimodal HDPE, driving the overall growth of the market.

The automotive segment is the fastest-growing in the market during the forecast period. The focus on improving the fuel efficiency of vehicles and the development of lightweight vehicle components increases demand for bimodal HDPE. The rise in electric vehicles and the focus on the development of thermal shielding in EVs increase demand for bimodal HDPE. The stringent emission regulations and growing production of complex vehicle designs increase the adoption of bimodal HDPE. The growing manufacturing of various exterior and interior vehicle parts increases demand for bimodal HDPE, supporting the overall growth of the market.

Bimodal HDPE Market Value Chain Analysis

- Feedstock Procurement: The feedstock procurement for bimodal HDPE includes ethylene and alpha-olefin comonomers like 1-Octene, 1-Hexene, and 1-Butene derived from crude oil.

- Chemical Synthesis and Processing: The chemical synthesis and processing include a two-stage polymerization using the first & second reactors, like loop reactors & stirred tank reactors.

- Regulatory Compliance and Safety Monitoring: The regulatory compliance involves EU regulation, FDA regulation, REACH, & RoHS, and safety monitoring like material integrity, thermal stability, contaminant & leaching monitoring, and fire safety.

Recent Developments

- In June 2024, BPCL selected Univation’s PE process for the two Bina Refinery sites in Madhya Pradesh. The polyethylene production capacity of the units is 1150000 tons per annum, and the sites produce HDPE & LLDPE. The HDPE is widely used in applications like LPBM, high-pressure PE100 & PE80 pipe, and SPBM.(Source:www.indianchemicalnews.com)

- In March 2023, Dow launched bimodal polyethylene resin, FINGERPRINT DFDA-7555 NT, for the microirrigation market. The technology used for the production of bimodal polyethylene resin is the Unipol process, and the resin helps to conserve resources, increase water productivity, & enhance crop yields.(Source: www.specialchem.com)

- In May 2025, Univation Technologies launched the UNIPOL PE process technology for an 800000-tonne-per-year design. The facility produces bimodal HDPE, metallocene PE, unimodal HDPE, and LLDPE resin products. This offers benefits like a flexible production platform, PE process technology, advanced process control, cost-effective operations, and compatibility with Univation’s PE catalysts. (Source: www.prnewswire.com)

Bimodal HDPE Market Top Companies

- Dow Inc.

- Chevron Phillips Chemical Company

- SABIC

- Exxon Mobil Corporation

- Dynalab Corp.

- LyondellBasell Industries N.V.

- INEOS AG

- SINOPEC Beijing Yanshan Company

- PetroChina Company Ltd.

- Braskem S.A.

- Formosa Plastics Corporation

- Daelim Industrial Co., Ltd.

- Mitsui Chemicals Inc.

Segments Covered

By Type

- Film-Grade

- Blow-Molding Grade

- Pipe-Grade

- Injection Molding Grade

- Others

By Application

- Pipes & Fittings

- Packaging (bottles, containers)

- Films & Sheets

- Industrial Containers

- Wire & Cable Insulation

- Others

By End-Use Industry

- Construction

- Packaging

- Automotive

- Agriculture

- Utilities

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait