Content

Aquaculture Market Size and Forecast 2025 to 2034

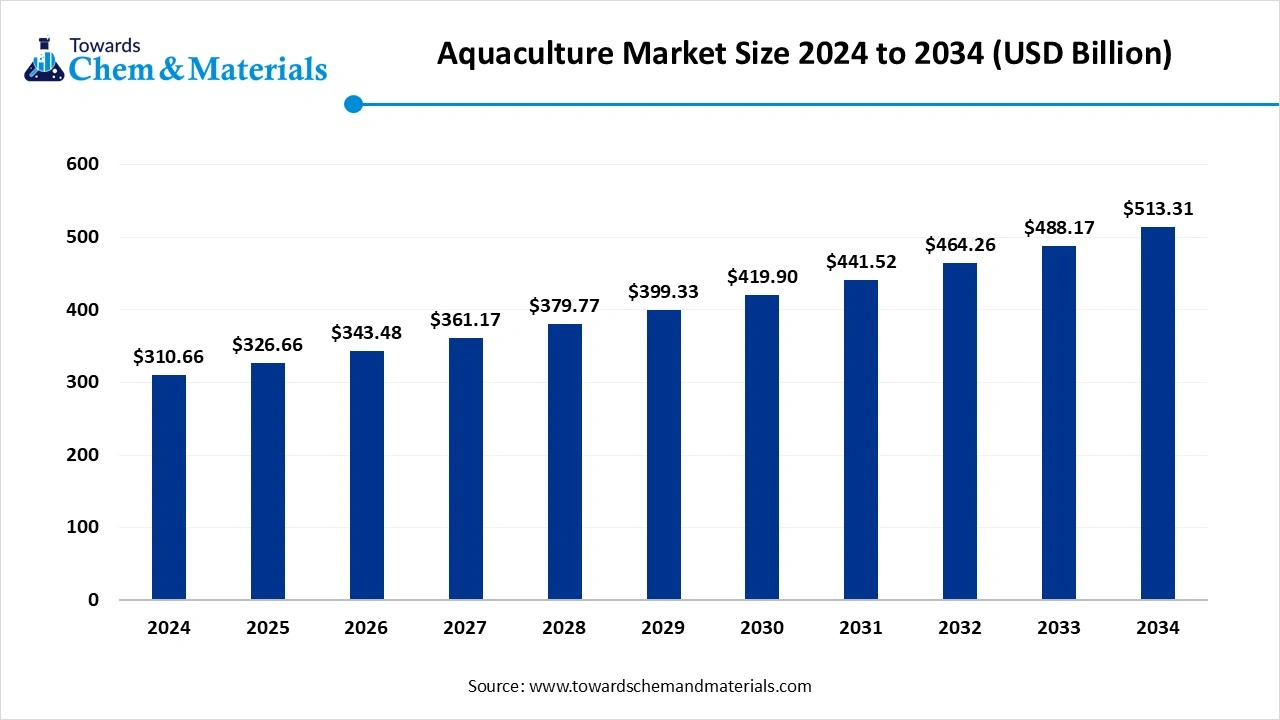

The global aquaculture market size is calculated at USD 310.66 billion in 2024, grew to USD 326.66 billion in 2025, and is projected to reach around USD 513.31 billion by 2034. The market is expanding at a CAGR of 5.15% between 2025 and 2034. The growing consumer demand for seafood, increasing cultivation of aquatic species, and high demand for protein drive the market growth.

Key Takeaways

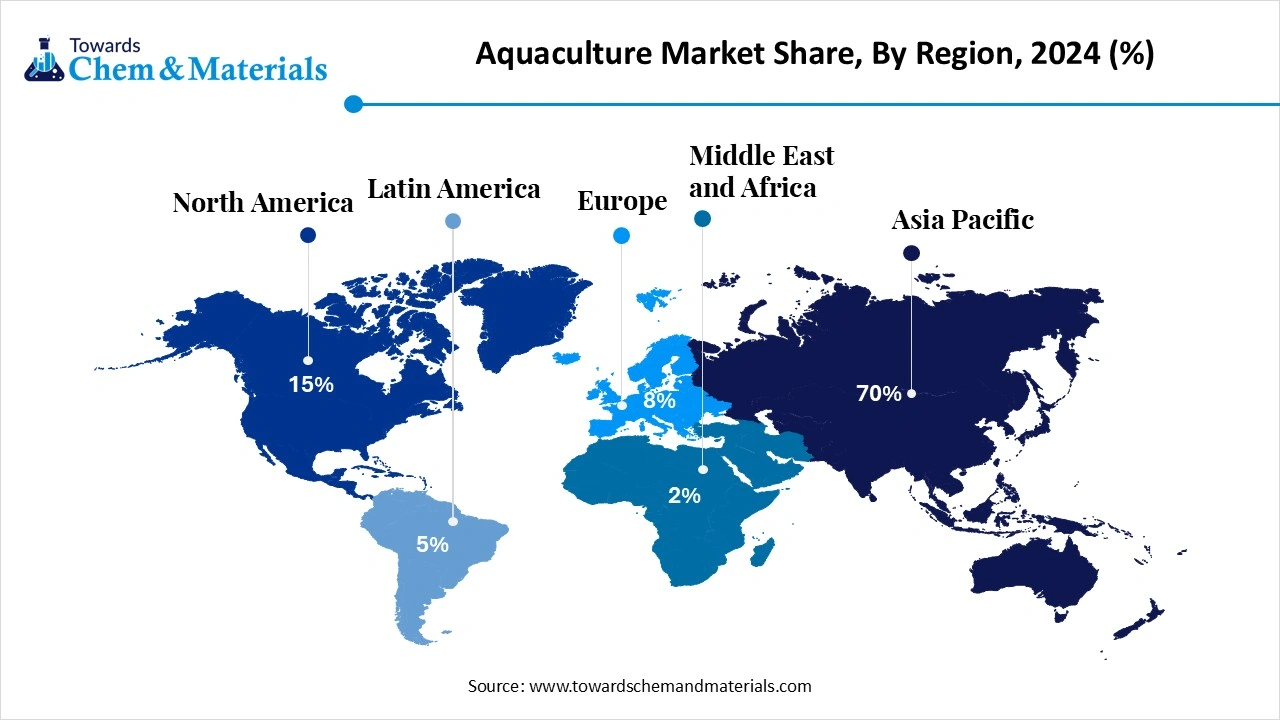

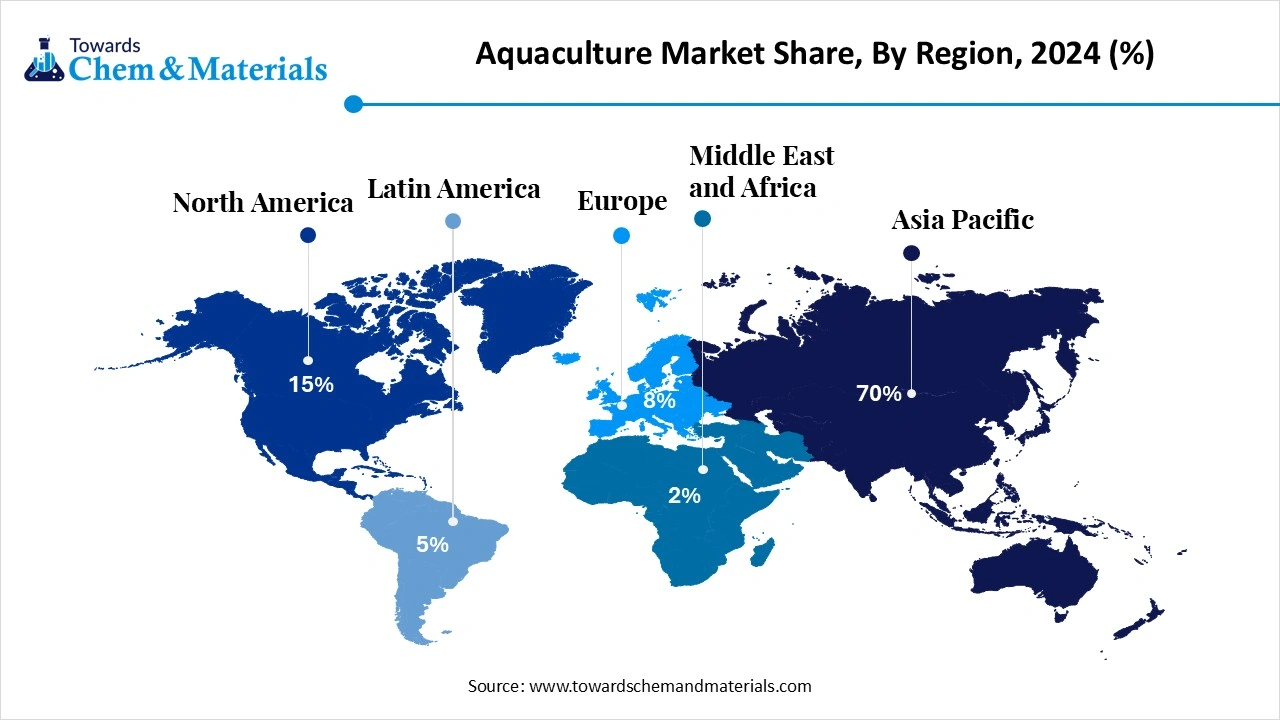

- By region, Asia Pacific held approximately a 70% share in the market in 2024.

- By region, North America is growing at the fastest CAGR in the market during the forecast period.

- By species, the finfish segment held approximately a 58% share in the market in 2024.

- By species, the crustaceans segment is expected to grow at the fastest CAGR in the market during the

- By culture environment, the marine segment held approximately a 50% share in the market in 2024.

- By culture environment, the brackish water segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By farming system, the ponds segment held approximately a 40% share in the aquaculture market in 2024.

- By farming system, the RAS segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By feed & nutrition, the compound aquafeeds segment held approximately a 65% share in the market in 2024.

- By feed & nutrition, the alternative proteins segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end-use application, the human food consumption segment held approximately an 85% share in the market in 2024.

- By end-use application, the nutraceuticals & pharma segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By processing & product form, the chilled/frozen fillets segment held approximately a 60% share in the aquaculture market in 2024.

- By processing & product form, the value-added processed segment is expected to grow at the fastest CAGR in the market during the forecast period.

What is Aquaculture?

Aquaculture market growth is driven by the increasing consumption of seafood, the high need for highly nutritious food, and the development of precision aquaculture. Aquaculture is the farming of aquatic organisms like plants, fish, and shellfish and involves processes like harvesting, breeding, & rearing. It consists of diverse species like shrimp, seaweeds, salmon, and oysters. The environments for aquaculture are recirculation systems, ponds, ocean enclosures, and tanks. The benefits of aquaculture are environmental sustainability, food security, and habitat restoration.

Aquaculture Market Outlook:

- Industry Growth Overview: Between 2025 and 2030, the industry is expected to see accelerated growth in tilapia, shrimp, sea bream, pangasius, sea bass, and Atlantic salmon. The growing focus on food security and sustainability in regions like the Asia Pacific, South America, and Africa helps industrial growth.

- Sustainability Trends: Sustainability focuses on improving food security and minimizing environmental footprint by using advanced closed-loop systems like IMTA and RAS. For instance, Danish company FREA A/S utilizes land-based RAS for farming rainbow trout.

- Global Expansion: Leading players are expanding geographically due to high consumption of seafood and favorable subtropical & tropical climates in the Asia Pacific, North America, Africa, and South America. For instance, Shrimpl company is expanding aquaculture management operations in regions like Southeast Asia and Latin America.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 326.66 Billion |

| Expected Size by 2034 | USD 513.31 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.15% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Species Cultured, By Culture Environment, By Farming System, By Feed & Nutrition, By End-Use Application, By Processing & Product Form, By Region |

| Key Companies Profiled | Pentair Aquatic Eco-Systems, Bakkafrost, CP Foods (Charoen Pokphand Foods), Alltech Coppens, SalMar, Grieg Seafood, Cermaq, Regal Springs, AquaBounty Technologies, De Heus Animal Nutrition, Lerøy Seafood Group, Tassal Group, Zeigler Bros., AquaGen, Benchmark Holdings |

Key Technological Shifts in the Aquaculture Market

The market is undergoing key technological shifts driven by the demand for sustainability, optimizing resource use, and enhancing fish growth. One of the most significant transformations is the adoption of artificial intelligence (AI) to enhance profitability, efficiency, and minimize environmental impact. AI algorithms help in water quality monitoring, automated health monitoring, the reduction of labor, precision feeding, and the early detection of diseases.

- For instance, TidalX AI, a California-based underwater crop monitoring company, uses an AI-enabled feeding control system to reduce waste and enhance fish health.

Trade Analysis of Aquaculture Market: Import & Export Statistics:

- Chile exported $459M of fish oil in 2023.(Source: oec.world)

- India exported $4.56B of crustaceans in 2023.(Source: oec.world)

- China exported $1.85B of molluscs in 2023.(Source: oec.world)

- The United States exported $270K of seaweeds & other algae in 2023.(Source: oec.world)

- Thailand exported $2.97B of processed fish in 2023.(Source: oec.world)

- China exported $3.57B of fish fillets in 2023.(Source: oec.world)

Aquaculture Types Overview:

| Types | Description | Farmed Species | Method of Farming |

| Freshwater Aquaculture | The process of aquatic species cultivation in freshwater environments |

|

|

| Brackishwater Aquaculture | The cultivation of aquatic species or organisms in a mixture of seawater & freshwater |

|

|

| Marine Aquaculture | The cultivation of marine organisms in saltwater environments |

|

|

Market Opportunity

Growing Seafood Consumption Opens Door for Aquaculture Market

The growing demand for micronutrients and macronutrients, and increasing awareness about the consumption of omega-3 fatty acids, increases demand for seafood. The rise in population and growing awareness about the health benefits of seafood increase demand for controlled production of aquaculture. The strong focus on food security and changing dietary preferences increases demand for seafood.

The preference for tasty meals and the rise in ready-to-eat options increase the purchase of packaged seafood. The strong focus on hair, brain, and skin health, and high consumption of shrimp, tuna, freshwater species, salmon, and other species, increases the development of aquaculture. The growing seafood consumption creates an opportunity for the growth of the market.

Market Challenge

Environmental Issues

Aquaculture causes the environmental issues like hampering the ecosystem by excessive use of antibiotics and chemicals that may limits the expansion of the aquaculture market.

Regional Insights

Asia Pacific Aquaculture Market Size, Industry Report 2034

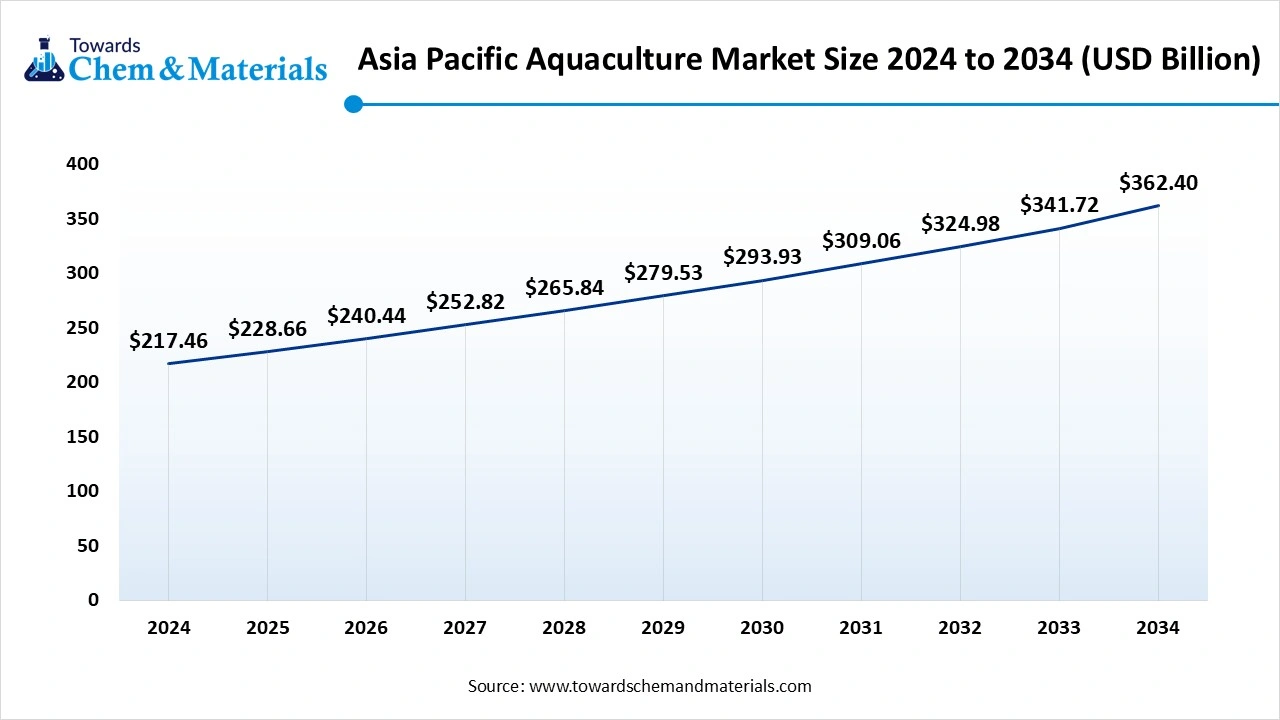

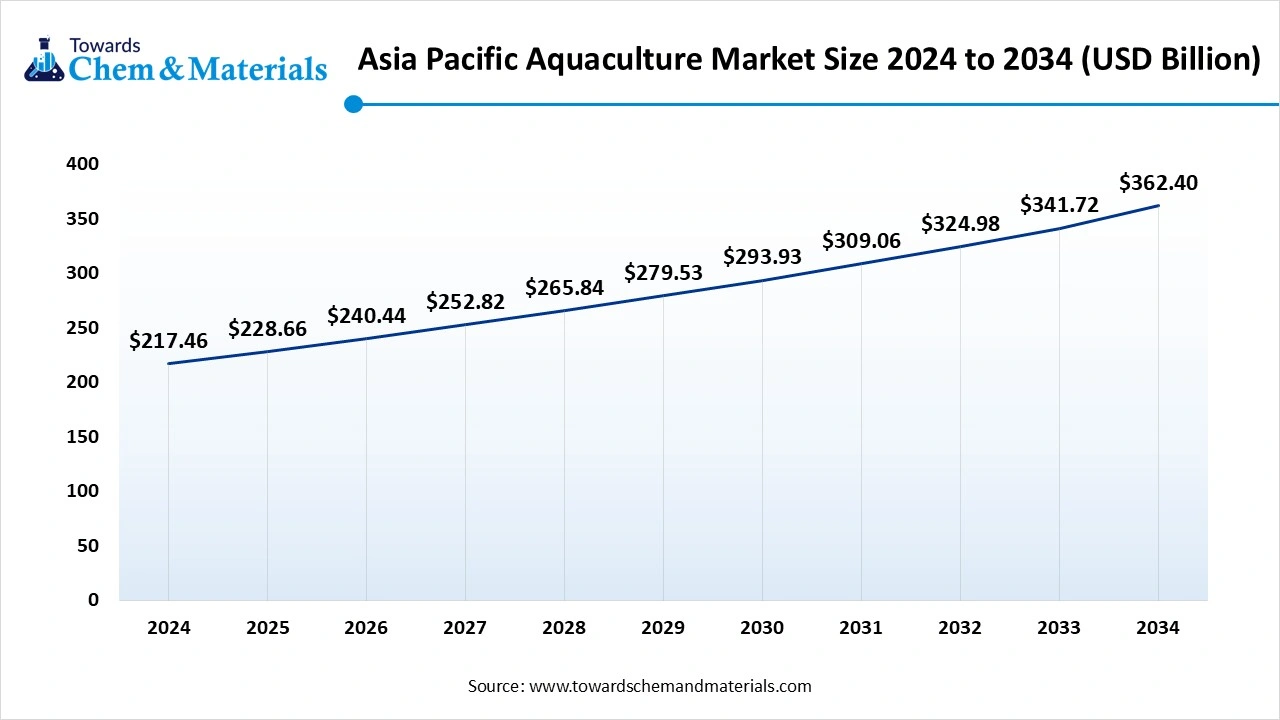

The Asia Pacific aquaculture market size was estimated at USD 217.46 billion in 2024 and is projected to reach USD 362.40 billion by 2034, growing at a CAGR of 5.24% from 2025 to 2034. Asia Pacific dominated the market with approximately 70% share in 2024.

The vast reserves of water resources, like lakes & rivers, and a favorable climate increase the development of aquaculture. The high demand for protein-rich seafood and the focus on food security increase demand for aquaculture. The increasing consumption of farmed fish and favorable government policies increase the development of aquaculture. The strong presence of advanced aquaculture infrastructure and high production of seafood drives the market growth.

China Aquaculture Market Trends

China is a major contributor to the market. The increasing consumption of fish and a strong focus on food security increase demand for aquaculture. The availability of various species, such as mollusks, fish, and crustaceans, helps the market growth. The growing investment in the aquaculture industry and increasing awareness about healthy food consumption support the overall market growth.

- China exported $562M of fish oil in 2024.(Source: oec.world)

- China exported $17.2M of frozen catfish in 2024.(Source: oec.world)

North America Aquaculture Market Trends

North America is experiencing the fastest growth in the market during the forecast period. The increasing sourcing of seafood options and the shift towards sustainable feed ingredients increase the development of aquaculture. The high production of trout, catfish, salmon, and shellfish helps market growth. The strong government support through agencies like NOAA and technological innovations like RAS increases the development of aquaculture. The increasing health benefits of seafood and high consumption of seafood support the market growth.

United States Aquaculture Market Trends

The United States is a key contributor to the market. The increasing consumption of seafood and strong government support for aquaculture through initiatives like NOAA’s help the market growth. The strong focus on sustainability and ongoing technological advancements like RAS increases the development of aquaculture. The presence of high-value species like shrimp and salmon drives the overall market growth.

- The United States exported $961M of crustaceans in 2024.(Source: oec.world)

- The United States exported $403M of molluscs in 2024. (Source: oec.world)

Segmental Insights

Species Cultured Insights

Why Finfish Segment Dominates the Aquaculture Market?

The finfish segment dominated the market with approximately 58% share in 2024. The growing demand for high-quality protein and the increasing need for omega-3 fatty acids increase demand for finfish. The growing consumption of catfish, tilapia, and freshwater carp helps market growth. The increasing advancements in fishing equipment and the high importance of traditional food sources increase demand for finfish. The simple cultivation process and cost-effectiveness drive the market growth.

The crustaceans segment is the fastest-growing in the market during the forecast period. The high preference for ready-to-eat foods and increasing consumption of seafood products increases demand for crustaceans. The increasing consumption of high-protein content food and the increasing need for omega-3 fatty acids increase demand for crustaceans. The strong focus on the consumption of nutritious food options and increasing health consciousness supports the market growth.

Culture Environment Insights

How Marine Segment Held the Largest Share in the Aquaculture Market?

The marine segment held the largest revenue share of approximately 50% in the aquaculture market. The increasing consumption of freshwater aquaculture and the growing benefits of seafood increase demand for marine species. The strong presence of vast water bodies, long coastlines, and vast oceans increases the development of marine farming. The growing availability of marine species like oysters, salmon, and shrimp, and increasing awareness about nutritional benefits, drive the market growth.

The brackish water segment is experiencing the fastest growth in the market during the forecast period. The favorable environmental conditions and the presence of vast untapped resources increase demand for brackish water. The increasing scarcity of freshwater and growing climate change problems increase demand for brackish water. The high profitability of seafood species and large areas of coastal land support the market growth.

Farming System Insights

Why did Ponds Segment Dominate the Aquaculture Market?

The ponds segment dominated the market with approximately 40% share in 2024. The need for less initial investment and the presence of simple infrastructure increase the development of ponds. The presence of medium and small-scale farmers and the increasing demand for fresh water increase the development of ponds. The ease of management and integration of freshwater with aquaculture drives the market growth.

The RAS (recirculating aquaculture systems) segment is the fastest-growing in the market during the forecast period. The focus on lowering environmental effects and the need to lower disease transmission increases the adoption of RAS. The focus on lowering water consumption and precise control over the environment helps market growth. The increasing consumption of proteins and the growing practices of urban farming support the overall market growth.

Feed & Nutrition Insights

How the Compound Aquafeeds Segment Held the Largest Share in the Aquaculture Market?

The compound aquafeeds segment held the largest revenue share of approximately 65% in the market in 2024. The growing demand for micronutrients like vitamins & minerals, and macronutrients like protein & fats, increases demand for compound aquafeeds. The focus on improving overall well-being and the need for optimal digestion increases demand for compound aquafeeds. The increasing consumption of immune boosters, probiotics, & prebiotics, and the adaptation of intensive farming systems, drive the market growth.

The alternative proteins segment is experiencing the fastest growth in the market during the forecast period. The growing scarcity of protein sources and focus on lowering carbon footprint increases demand for alternative proteins. The strong focus on nutritional values and increasing need for feed security increases demand for alternative proteins. The cheap prices and focus on improving the immunity of individuals increase the adoption of alternative proteins, supporting the overall market growth.

End-Use Application Insights

Which End-Use Application Segment Dominated the Aquaculture Market?

The human food consumption segment dominated the aquaculture market with approximately 85% share in 2024. The growing food demand and focus on food security increase demand for aquatic food. The increasing need for high-quality protein and the high consumption of convenient foods help the market growth. The increasing availability of food sources and the presence of diverse species like seaweed, fish, & shellfish drive the market growth.

The nutraceuticals & pharma segment is the fastest-growing in the market during the forecast period. The increasing demand for minerals, amino acids, and vitamins, and the growing need for protein, increases demand for nutraceuticals. The focus on improving animal health and the need to lower reliance on antibiotics increases demand for aquatic pharmaceutical products. The focus on enhancing immunity and sustainable aquaculture practices increases demand for nutraceuticals, supporting the overall market growth.

Processing & Product Form Insights

How the Chilled or Frozen Fillets Segment Held the Largest Share in the Aquaculture Market?

The chilled or frozen fillets segment held the largest revenue share of approximately 60% in the market in 2024. The focus on lowering spoilage and preventing the growth of microorganisms increases demand for chilled fillets. The need for longer-term storage of food products and the rise in easy-to-prepare meals increase demand for frozen fillets. The growing adoption of an urban lifestyle and focus on lowering meal preparation time increases demand for chilled fillets, supporting the overall market growth.

The value-added processed segment is experiencing the fastest growth in the market during the forecast period. The increasing consumption of ready-to-eat seafood and growing health consciousness increase demand for value-added processed food. The growing availability of ready-to-cook options and the focus on extending the life of food products increase demand for value-added processed food. The need to lower post-harvest losses and maintain the quality of food drives the overall market growth.

Aquaculture Market Value Chain Analysis

- Feedstock Procurement: The feedstock procurement for aquaculture includes fish oil, microalgae, fish meal, microbial biomass, and plant-based protein.

- Quality Testing and Certification: Quality testing involves testing of chemical properties, feed analysis, physical properties, & soil testing, and certification includes ASC & BAP.

- Regulatory Compliance and Safety Monitoring: The regulatory compliance & safety monitoring includes guidelines for food safety, worker safety, environmental protection, and aquatic animal welfare & health.

Recent Developments

- In May 2025, Guoxin launched an improved & new deep-sea aquaculture vessel. The water holding capacity of the vessel is increased by 16000 cubic meters. The vessel is 45 meters wide & 245 meters long and consists of a solar photovoltaic system.(Source: www.seafoodsource.com)

- In May 2025, ADB collaborated with Thai Union to launch a blue loan for sustainable aquaculture in Thailand. The company signed $150 million financial agreement and support in the management of aquatic resources. The project aims to lower its environmental footprint and increase the proportion of sustainable shrimp.(Source: fasi.eu)

- In March 2025, Dajin Heavy Industries and Zhanjiang Bay Laboratory launched a new DP-capable aquaculture vessel in China. The vessel has 20 20 meters depth, 154 meters LOA, and 44 meters beam. The total production capacity of assorted fish species in 2000 tonnes yearly, and the total capacity of the vessel is 80000 cubic meters.(Source: www.bairdmaritime.com)

Top Companies in Aquaculture Market & Their Offerings

- Mowi: The world’s largest producer of seafood and leader in the production of Atlantic salmon. Its extensive profile includes food products like steaks, smoked salmon, fresh fish, loins, kebabs, and ready-to-eat dishes.

- Skretting (Nutreco): The company is a global leader in supplying and manufacturing high-quality animal nutrition and develops sustainable nutritional solutions. The product line offers feeds like VITALIS 2.5, Kuroline, & LORICA.

- Cargill Aqua Nutrition: It offers high-quality aquafeeds to enhance the immune system of species. The company supports local Fisheries Improvement Projects and research about innovative ingredients.

- BioMar: The international company is the leading supplier of sustainable feed solutions and is present across Asia, North America, Europe, and South America.

- AKVA Group: The company is Norwegian-based and offers land-based and & sea-based aquaculture solutions. They offer fish farming services like manufacturing, installation, design, technology rental, and sales.

Other Top Companies

- Pentair Aquatic Eco-Systems

- Bakkafrost

- CP Foods (Charoen Pokphand Foods)

- Alltech Coppens

- SalMar

- Grieg Seafood

- Cermaq

- Regal Springs

- AquaBounty Technologies

- De Heus Animal Nutrition

- Lerøy Seafood Group

- Tassal Group

- Zeigler Bros.

- AquaGen

- Benchmark Holdings

Segments Covered

By Species Cultured

- Finfish

- Salmonids (salmon, trout)

- Carp species (common, grass, silver, bighead)

- Tilapia

- Catfish (channel, pangasius)

- Marine finfish (sea bass, sea bream, cobia, grouper, yellowtail)

- Other specialty cultured finfish (barramundi, basa)

- Crustaceans

- Shrimp (vannamei, black tiger)

- Prawns

- Crabs

- Lobsters

- Molluscs & Bivalves

- Oysters

- Mussels

- Clams

- Scallops

- Aquatic Plants & Algae

- Macroalgae/seaweed (nori, kelp, wakame, eucheuma)

- Microalgae (nutraceuticals, feed, industrial use)

- Other Aquatic Animals

- Sea cucumbers

- Ornamental fish & aquarium species

By Culture Environment

- Freshwater aquaculture

- Brackish water aquaculture

- Marine aquaculture

By Farming System

- Ponds (extensive, semi-intensive, intensive)

- Cages (nearshore, offshore)

- Tanks (flow-through, recirculating aquaculture systems – RAS)

- Biofloc systems

- Aquaponics systems

- Hatcheries & nurseries (broodstock, larval, juvenile)

By Feed & Nutrition

- Compound aquafeeds (extruded/pelletized)

- Hatchery & starter feeds (microdiets)

- Specialty functional feeds (medicated, probiotic, immune-boosting)

- Feed additives & supplements (enzymes, probiotics, amino acids, omega-3)

- Alternative proteins (insect meal, plant proteins, single-cell proteins, algae-based)

By End-Use Application

- Human food consumption (fresh, frozen, processed)

- Nutraceuticals & pharmaceuticals (algae bioactives, omega-3)

- Ornamental/aquarium trade

- Stock enhancement & restocking

- Industrial (fishmeal, fish oil, collagen, fertilizers)

By Processing & Product Form

- Live/fresh whole

- Chilled/refrigerated whole & fillets

- Frozen (IQF, block)

- Value-added processed (smoked, canned, ready-to-eat)

- By-products (fishmeal, fish oil, gelatin, collagen)

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait