Content

What is the Current Alloy Steel Market Size and Share?

The global alloy steel market size was estimated at USD 84.75 billion in 2025 and is predicted to increase from USD 90.91 billion in 2026 and is projected to reach around USD 170.97 billion by 2035, The market is expanding at a CAGR of 7.27% between 2026 and 2035. Asia Pacific dominated the alloy steel market with a market share of 52.11% the global market in 2025.The growing product demand from key sectors such as construction, lightweight, and energy is the key factor driving market growth. Also, rapid urbanization and industrialization in emerging economies, coupled with the advancements in steelmaking, can fuel market growth further.

Key Takeaways

- By region, Asia Pacific led the alloy steel market with the largest revenue share of over 52.11% in 2025. The dominance of the region can be attributed to the ongoing industrialization & urbanization.

- By region, Middle East & Africa held a 3.92% market share in 2025 and is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the surge in local manufacturing and demand for fuel-efficient, lightweight vehicles.

- By region, Europe held a 15.45% market share in 2025 and is expected to grow at a notable CAGR over the forecast period. The growth of the region can be driven by an ongoing push towards sustainability.

- By type, the low alloy steel segment dominated the market with nearly 58% share in 2025. The dominance of the segment can be attributed to the growing demand for long-lasting, durable materials.

- By type, the high alloy steel segment held a nearly 42% market share in 2025 and is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the rising demand for materials providing superior performance.

- By alloying element, the chromium alloy steel segment held an approximately 32% market share in 2025. The dominance of the segment can be linked to its superior hardness, strength, and corrosion resistance.

- By alloying element, the boron alloy steel segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by growing product demand from safer, lighter, and fuel-efficient vehicles.

- By product form, the flat products segment dominated the market with nearly 54% share in 2025. The dominance of the segment is owed to the growing emphasis on general power infrastructure.

- By product form, the tubular products segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to a surge in industrial machinery needs.

- By application, the automotive segment held approximately 28% market share in 2025. The dominance of the segment can be attributed to the growing demand for lightweighting.

- By application, the aerospace & defense segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the rapid surge in global defense spending.

- By end user industry, the construction & infrastructure segment held a nearly 35% market share in 2025. The dominance of the segment can be linked to the extensive government spending on public projects.

- By end user industry, the energy segment is expected to grow at the fastest CAGR over the study period. The growth of the segment can be driven by increasing demand for strong, corrosion-resistant alloy steels.

What is Alloy Steel?

The alloy steel market refers to the global industry involved in the production, processing, and distribution of steel that is alloyed with elements such as chromium, nickel, molybdenum, manganese, vanadium, and tungsten to enhance mechanical properties. Alloy steels exhibit superior hardness, strength, corrosion resistance, toughness, and wear resistance compared to carbon steels, making them essential across construction, automotive, energy, machinery, aerospace, shipbuilding, and heavy engineering industries. Increasing demand for high-performance materials, industrial expansion, and infrastructure development are key growth drivers.

Alloy Steel Market Trends

- The growth in renewable energy projects is the latest trend in the market. Solar and Wind installations need strong materials that can bear harsh climatic conditions, impacting positive market growth further.

There is a growing emphasis on "green steel" initiatives, such as the use of carbon capture technologies and hydrogen as a reducing agent, with growing reliance on recycled steel scrap to fulfil strict environmental regulations, leading to market growth soon. - The ongoing growth of solar power, wind turbines, and other clean energy structures necessitates materials that can bear extreme environmental conditions, fuelling the demand for specialized alloy steels.

- Rapid investments in alloy research have led to enhanced metallurgical compositions, improving performance in extreme atmospheric conditions. Also, the transition towards green materials for fuel efficiency has boosted the adoption of specialized alloys in industrial and transportation machinery.

- Major market players in the industry are focusing on developing cutting-edge products like high-strength alloy steel grades to improve their performance and durability and fulfill the increasing industry demand.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 90.91 Billion |

| Revenue Forecast in 2035 | USD 170.97 Billion |

| Growth Rate | CAGR 7.27% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | Middle East & Africa |

| Segment Covered | By Type, By Alloying Element, By Product Form, By Application, By End User Industry, By Region |

| Key companies profiled | ArcelorMittal, Nippon Steel CorporationBaosteel (China Baowu Group), POSCO, Tata Steel, JFE Steel Corporation, Thyssenkrupp AG, Voestalpine AG, United States Steel Corporation, HBIS Group, Nucor Corporation, Allegheny Technologies (ATI), Sandvik Materials Technology, Carpenter Technology Corporation, SAIL (Steel Authority of India Ltd.), JSW Steel, Outokumpu, Vallourec, Schaeffler Group, SSAB AB |

How Cutting Edge Technologies are revolutionizing the Alloy Steel Market?

Advanced technologies are transforming the market by propelling production efficiency and designing advanced materials by enabling sustainable extraction techniques. Furthermore, Artificial Intelligence (AI) and automation are being combined into production processes to optimize manufacturing parameters and thus improve efficiency.

Trade Analysis of Alloy Steel Market Import & Export Statistics:

- In 2024, the U.S. steel trade deficit expanded by 4.8% with 18.2 million metric tons, while U.S. steel exports reached $4.25 billion in the first quarter of 2025, indicating both a growing deficit in volume and a significant value of exports early in the year.

- In 2024, China set a record with 110.72 million tons of steel exports, boosted by attractive pricing amid weak domestic demand, with December seeing 9.72 million tons, exceeding previous monthly averages.

Alloy Steel Market Value Chain Analysis

- Feedstock Procurement : It involves the sourcing, purchasing, and management of different raw materials crucial for producing the extensive range of high-performance alloy steels required by many industries.

- Major Players: BHP Billiton, Rio Tinto.

- Chemical Synthesis and Processing: It refers to the important stages of converting raw materials into refined metal, then to the final product with specific properties by using a chemical process.

- Major Players: ArcelorMittal, Nippon Steel Corporation.

- Packaging and Labelling : It involves the mandatory standards that ensure product safety, integrity, identification, and compliance over the supply chain. It is driven by the unique physical properties of steel.

- Major Players: Tata Steel, Nippon Steel Corporation

- Regulatory Compliance and Safety Monitoring: It encompasses adherence to a wide range of national, local, and international laws and standards created to ensure worker safety and environmental protection.

- Major Players: JFE Steel Corporation, HBIS Group.

Alloy Steel Market 's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| United States | The US has implemented protective trade measures under Section 232 of the Trade Expansion Act, which included a 25% tariff on most steel imports and was raised to 50% for all countries except the UK as of June 4, 2025. |

| European Union | The EU's regulatory landscape is heavily influenced by its commitment to the European Climate Law, which mandates climate neutrality by 2050. |

| India | The primary regulatory tool is the enforcement of Quality Control Orders (QCOs), which require all steel products to be BIS-certified to prevent the import of non-compliant steel and counter cheap imports |

Segmental Insights

Type Insights

How Much Share Did the Low Alloy Steel Segment Held in 2025?

The low alloy steel segment dominated the market with nearly 58% share in 2025. The dominance of the segment can be attributed to the growing demand for long-lasting, durable materials in buildings, bridges, and infrastructure. Low alloy steels offer a good strength-to-weight ratio, which makes them a cost-effective alternative for vehicle frames.

The high alloy steel segment held a nearly 42% market share in 2025 and is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the rising demand for materials providing superior performance characteristics such as durability and high strength. Also, high alloy steels offer improved properties through enriched content.

Alloying Element Insights

Which Alloying Element Type Segment Dominated Alloy Steel Market in 2025?

The chromium alloy steel segment held an approximately 32% market share in 2025. The dominance of the segment can be linked to its superior hardness, strength, and corrosion resistance, which are necessary for the infrastructure and automotive sectors. Moreover, stringent emission norms push automakers towards adopting lighter and advanced steels.

The boron alloy steel segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by growing product demand from safer, lighter, and fuel-efficient vehicles. Boron steels allow for lighter, thinner components without compromising strength, essential for modern vehicle design.

Product Form Insights

How Much Share Did the Flat Products Segment Held in 2025?

The flat products segment dominated the market with nearly 54% share in 2025. The dominance of the segment is owed to the growing emphasis on general power infrastructure and renewable energy projects, which created demand for high-quality products. Advancements in metallurgical technologies further lead to enhancing product properties.

The tubular products segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to a surge in industrial machinery needs coupled with the ongoing industrialization and economic growth in emerging regions. Market players are increasingly focusing on developing sustainable manufacturing methods, leading to market growth soon.

Application Insights

How Much Share Did the Automotive Segment Held in 2025?

The automotive segment held approximately 28% market share in 2025. The dominance of the segment can be attributed to the growing demand for lightweighting, stringent emissions regulations, and expansion of the EV market. Increasing disposable incomes, especially in emerging economies, fuel demand for personal automobiles.The aerospace & defense segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the rapid surge in global defense spending and increased commercial aviation activities. Aircraft manufacturers are seeking lighter materials to enhance fuel economy and reduce overall emissions.

End User Industry Insights

Which End User Type Segment Dominated the Alloy Steel Market in 2025?

The construction & infrastructure segment held a nearly 35% market share in 2025. The dominance of the segment can be linked to the extensive government spending on public projects coupled with the growing emphasis on high-performance, corrosion-resistant steels. Furthermore, supportive policies for green transitions and infrastructure further drive segment growth.

The energy segment is expected to grow at the fastest CAGR over the study period. The growth of the segment can be driven by increasing demand for strong, corrosion-resistant alloy steels for offshore platforms and pipelines. rising research and developments in materials science has enhanced the creation of cutting-edge alloys for applications.

Regional Insights

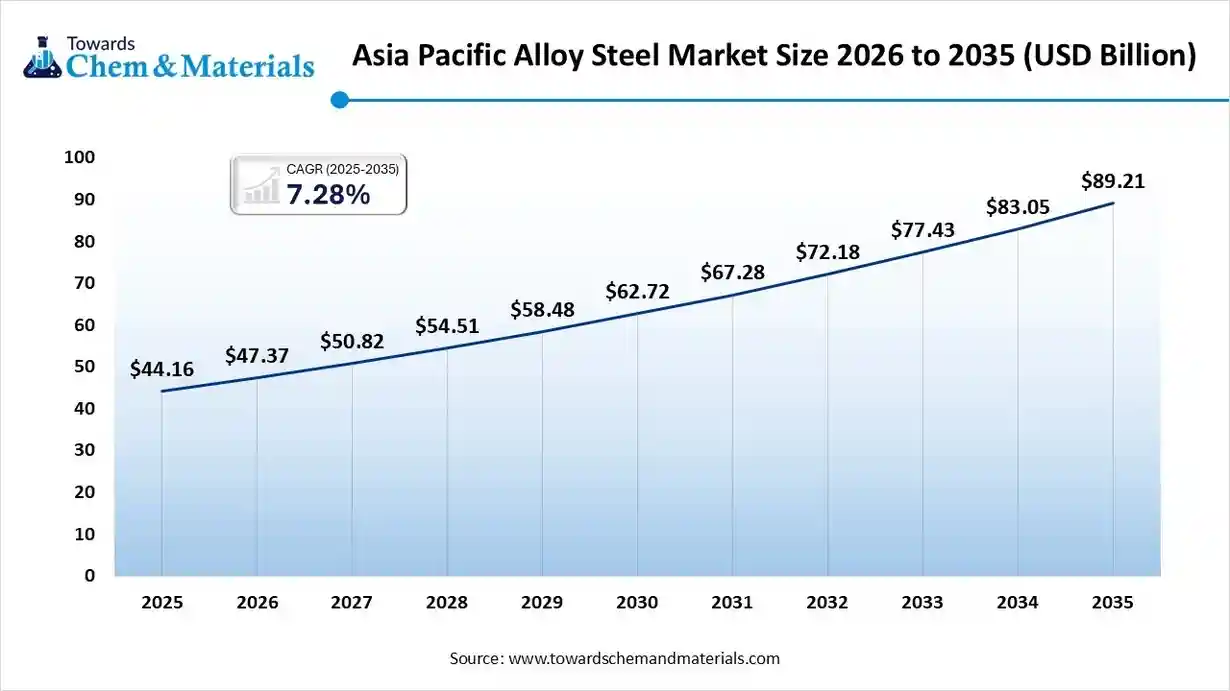

The Asia Pacific alloy steel market size was valued at USD 84.75 billion in 2025 and is expected to reach USD 170.97 billion by 2035, growing at a CAGR of 7.27% from 2026 to 2035. Asia Pacific dominated the market with a 52.11% share in 2025. The dominance of the region can be attributed to the ongoing industrialization & urbanization, along with the expanding automotive production sectors in the emerging economies. In addition, advancements in steel production, like the use of advanced heat treatment processes and electric arc furnaces, are driving the adoption of steel alloys in the market further.

China Alloy Steel Market Trends

In the Asia Pacific, China dominated the market owing to ongoing government support for industrial upgrade and a surge in the need for high-performance materials in defense/energy. Growth in vehicle manufacturing, particularly with an emphasis on new energy vehicles and efficiency, is leading to positive market growth soon.

The Middle East & Africa held a 5.92% market share in 2025 and is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the surge in local manufacturing and demand for fuel-efficient, lightweight vehicles, which boosts the use of high-strength steel. The region also holds the world's largest oil and gas deposits, which leads to continuous investments in refineries, storage tanks, and pipes.

Saudi Arabia Alloy Steel Market Trends

The growth of the market in the country can be driven by ongoing urbanization and major investments in commercial complexes, housing, and logistics infrastructure, which are further creating a continuous demand for fabricated and structural steel.

Europe held a 15.45% market share in 2025 and is expected to grow at a notable CAGR over the forecast period. The growth of the region can be driven by an ongoing push towards sustainability with a high demand from the construction and automotive sectors. A wide range of government policies, like financial incentives and funding for research & development, are playing a key role in creating a better environment for new technology adoption.

Germany Alloy Steel Market Trends

The growth of the market in the country can be fuelled by rapid technological advancements in high-strength steels and government emphasis on resource efficiency. Strict EU and German standards push for higher-quality and reliable materials, driving market growth soon in the country.

North America Alloy Steel Market Trends

North America held a 22.19% market share in 2025. The growth of the region can be linked to the surge in energy demand and growing emphasis on cutting-edge automation, manufacturing, and sustainable production. Also, advanced alloys are necessary for high-performance components in defence and aircraft systems, requiring better strength and extreme condition resistance.

U.S. Alloy Steel Market Trends

In North America, the U.S. led the market due to growing demand for efficient and sustainable products with convenient industrial states such as OH, MI, and PA. Rapid EV adoption in the region creates lucrative demand for stronger, lighter alloy steel for better range and safety.

South America held a notable market share in 2025. The growth of the region can be attributed to the ongoing development of huge infrastructure projects and growth in the mining/energy industries. General industrial expansion and economic growth across the region increase overall demand for different steel grades.

Brazil Alloy Steel Market Trends

The growth of the market in the country can be driven by the ongoing shift towards more sustainable manufacturing methods, coupled with the increasing global focus on ESG (Environmental, Social, and Governance) standards. The government in the country has also implemented policies to boost industrial activity.

Recent Developments

- In September 2025, Beekay Steel Industries Ltd has started manufacturing at its new production facility in Cuttack, Odisha. This expansion will boost Beekay Steel's presence in eastern India and improve its manufacturing capabilities in the domestic steel sector.(Source: scanx.trade)

Alloy Steel Market Companies

- ArcelorMittal: ArcelorMittal is a global steel giant, a leader in most steel markets, including high strength/advanced steels crucial for the evolving alloy steel sector, especially automotive, construction, and energy.

- Nippon Steel Corporation: Nippon Steel Corporation is a prominent global steel manufacturer that holds a significant position in the market, primarily through its leadership in developing and supplying high-grade, specialized alloy steel products for demanding sectors like automotive, energy, and construction.

Other Companies in the Market

- ArcelorMittal

- Nippon Steel CorporationBaosteel (China Baowu Group)

- POSCO

- Tata Steel

- JFE Steel Corporation

- Thyssenkrupp AG

- Voestalpine AG

- United States Steel Corporation

- HBIS Group

- Nucor Corporation

- Allegheny Technologies (ATI)

- Sandvik Materials Technology

- Carpenter Technology Corporation

- SAIL (Steel Authority of India Ltd.)

- JSW Steel

- Outokumpu

- Vallourec

- Schaeffler Group

- SSAB AB

Segments Covered in the Report

By Type

- Low Alloy Steel

- High Alloy Steel

By Alloying Element

- Chromium Alloy Steel

- Nickel Alloy Steel

- Manganese Alloy Steel

- Molybdenum Alloy Steel

- Vanadium Alloy Steel

- Tungsten Alloy Steel

- Silicon Alloy Steel

- Boron Alloy Steel

By Product Form

- Flat Products

- Long Products

- Forged Products

- Tubular Products

By Application

- Automotive

- Construction & Infrastructure

- Machinery & Heavy Equipment

- Oil & Gas

- Power Generation

- Aerospace & Defense

- Shipbuilding

- Railways

By End User Industry

- Construction & Infrastructure

- Automotive

- Energy (Oil & Gas, Power, Renewables)

- Mechanical & Heavy Engineering

- Aerospace

- Defense

- Others (Railways, Mining)

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa