Content

Agricultural Fumigants Market Volume and Forecast 2025 to 2034

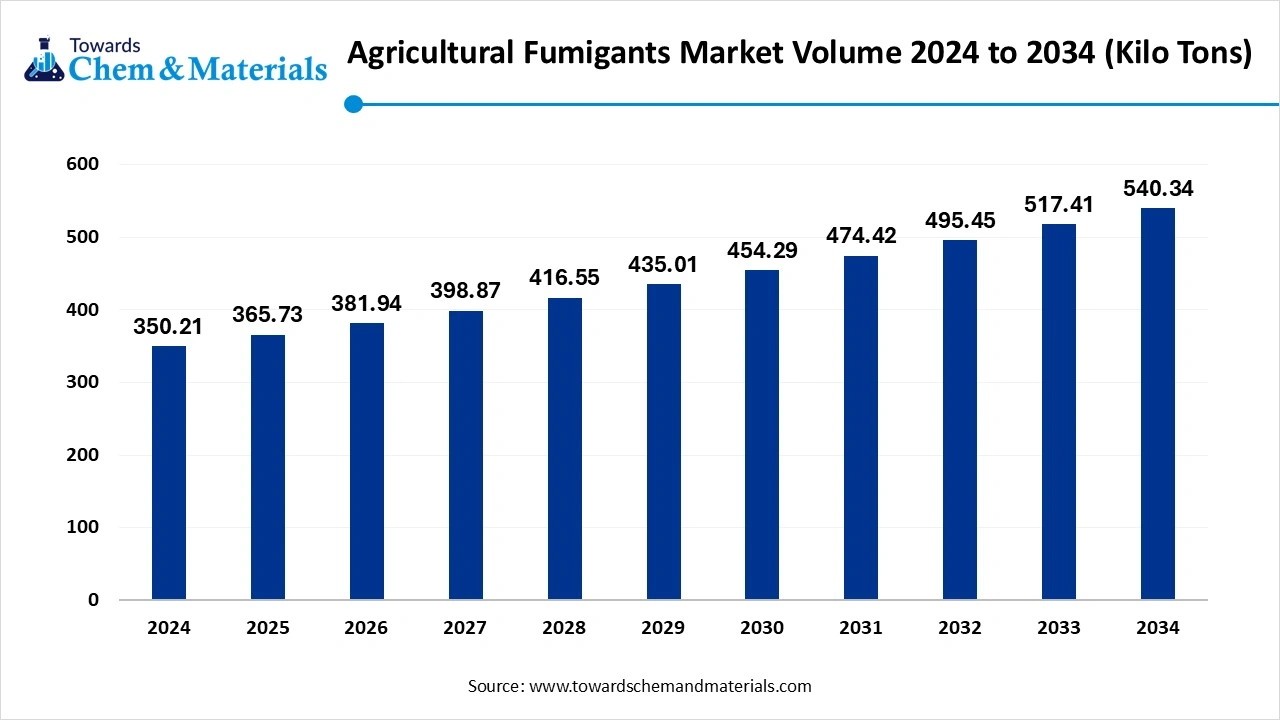

The global agricultural fumigants market volume was accounted for 350.21 Kilo Tons in 2024 and is expected to be worth around 540.34 Kilo Tons by 2034, growing at a compound annual growth rate (CAGR) of 4.43% during the forecast period 2025 to 2034. The rising focus on sustainable and eco-friendly alternatives due to the rising demand from farmers to protect crops from pests and diseases drives the growth of the market.

Key Takeaway

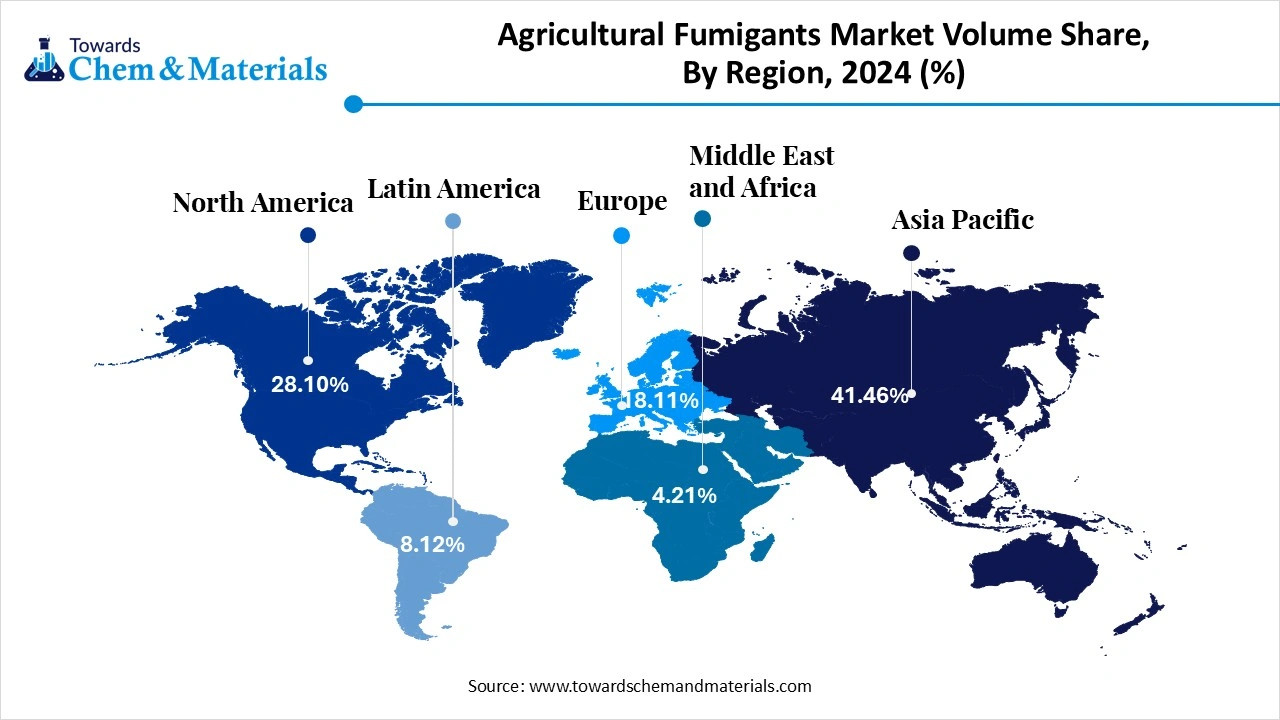

- The Asia Pacific agricultural fumigants market size reached a volume of 145.20 Kilo Tons in 2025, the market is further projected to grow at a CAGR of 5.01% between 2025 and 2034, reaching a volume of 236.83 Kilo Tons by 2034.

- Asia Pacific agricultural fumigants market dominated the global market, with the largest volume share of 41.46% in 2024.

- North America agricultural fumigants market accounted for a substantial market volume share of 28.10% in 2024.

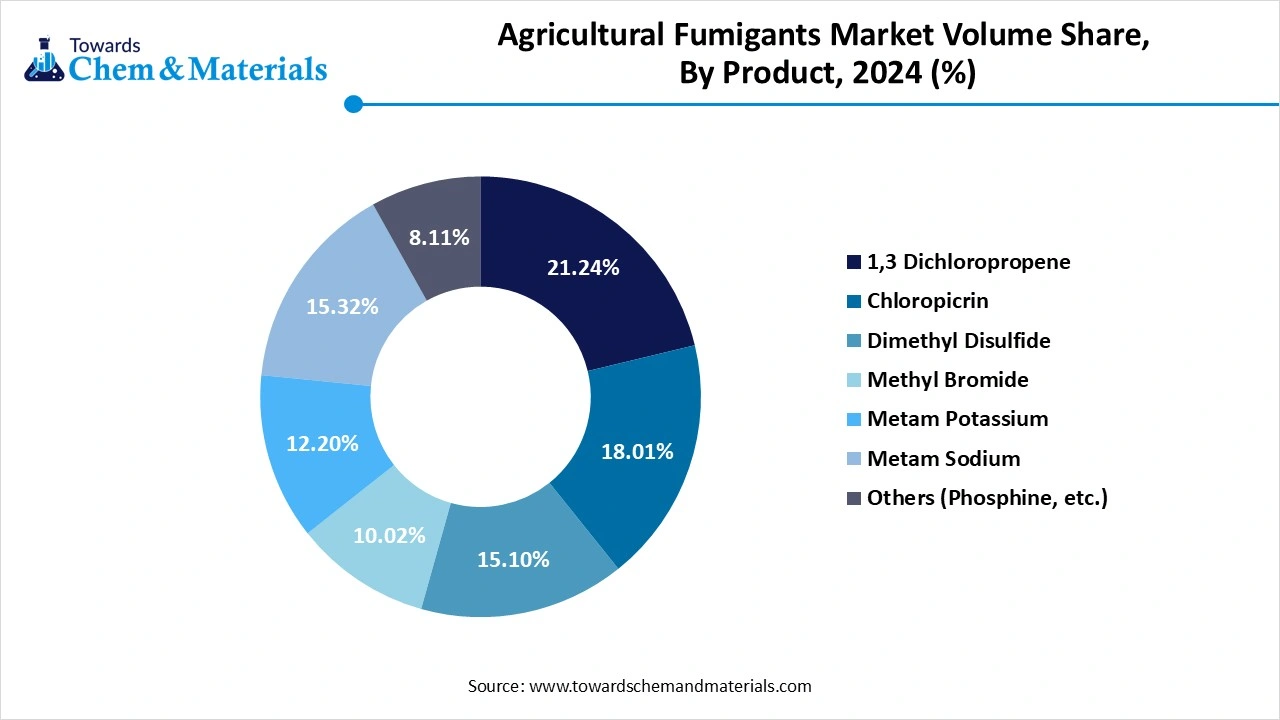

- By Product the, 1,3 Dichloropropene segment dominated the agricultural fumigants market and accounted for the largest volume share of 21.24% in 2024.

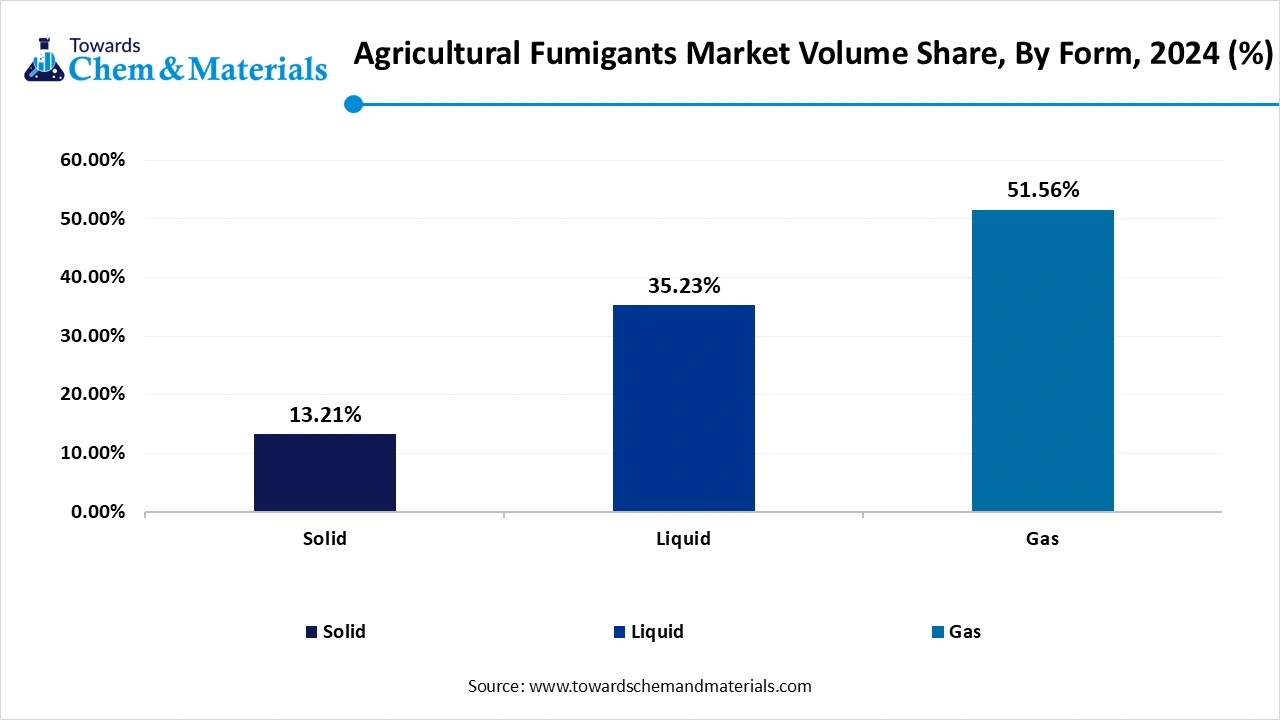

- By form, the Gas segment dominated the market and accounted for the largest volume share of 51.56% in 2024.

Market Overview

Rising Demand for Durable Materials: Agricultural Fumigants Market to Expand

Fumigation is a process that involves pest control, which helps remove harmful pests and microorganisms. Fumigants are gaseous vapours and materials which is used to control insects and rodents, also sterilize stored grains, food, and other agricultural commodities. Fumigants are highly volatile liquids which does not leave any residue on the product after fumigation. It involves filling an area with a fumigant gas, which is then allowed to penetrate and kill pests.

This method is effective because fumigants can reach pests within the commodities and in enclosed spaces, unlike some other insecticides. Benefits of fumigation involve effective pest control, prevention of damage and losses, and protection of commodities. Sustainable agricultural fumigants adoption aligns with rising environmental concerns, driving the growth of the market.

What are the Key Drivers for the Growth of the Agricultural Fumigants Market?

The agricultural fumigants market growth is driven by a shift towards rising adoption of sustainable alternatives to the toxic fumigants drives the demand for the market, with rising environmental concerns driving the growth. The rising population demand for an increase in crop production due to higher demand helps grow. Storing grain and crops safely also requires and demands pest control, which ensures crop quality, which supports the growth of the market. Advancement and new and modern storage facilities for effective fumigation drive the demand and help in the expansion of the market. Government initiatives that support food security and also promote less harvest loss attract the farmers to practice sustainable farming practices and also help grow the market. Climate change and rising pest incidence contribute to higher demand for the use of effective agricultural fumigation solutions, which supports the growth of the market.

Market Trends

- Rising demand for pest control due to the increasing demand by farmers to protect crops and stored grains from diseases and pests drives the market.

- Increasing focus on food security due to rising population and urbanization demands for fumigation to reduce harvest losses.

- Advancement in fumigation techniques and advancement in storage facilities to enhance efficiency and fumigation practices are a growing trend in the market.

- Rising demand and shift towards sustainable alternatives to traditional toxic fumigants, which align with the environment, fuel the growth of the market.

- Rising demand for high-quality and high-value crops raises the demand for the market due to a rise in consumer demand.

- Stringent regulation promotes the development and adoption of sustainable alternatives and drives growth.

Report Scope

| Report Attributes | Details |

| Market Volume in 2025 | 365.73 Kilo Tons |

| Market Volume by 2034 | 540.34 Kilo Tons |

| Growth Rate from 2025 to 2034 | CAGR 4.43% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| High Impact Region | North America |

| Segment Covered | By Product,By Application, By Region |

| Key Companies Profiled | Dow, Bayer AG, Arkema, AMVAC Chemical Corporation, LANXESS, BASF, Trinity Manufacturing, Inc., Arysta LifeScience Corporation, Novozymes A/S, part of Novonesis Group, Syngenta International AG, Corteva Agriscience, Detia Degesch GmbH, UPL Limited, SGS SA, MustGrow Biologics Corp., |

Market Opportunity

What is the Key Opportunity Responsible of the Growth of the Agricultural Fumigants Market?

The key opportunity responsible for the growth of the agricultural fumigants market is the development of new fumigant technology, which mainly focuses on innovation and advancement in technology for developing environmentally friendly fumigants, which supports the growth of the market. The government initiatives to support and offer farmers with fumigation practices and solutions, and storage facilities support the growth of the market. The agricultural fumigants also offer increasing agricultural production and support food safety concerns, resulting in minimizing and reducing post-harvest losses, which creates a great opportunity for the growth of the market by increasing adoption by the farmers due to the benefits associated with it.

Market Challenge

The Rise in Environmental Concerns and Strict Regulatory Restrictions Hinders the Growth of the Market

The rising environmental concerns are due to the rise in ozone layer depletion, due to the release of harmful toxic chemical fumes, and it also leads to health risks due to constant exposure, like respiratory diseases, skin irritation, and also affects soil and water quality as it leads to contamination. Extensive and repeated use of fumigants also develops resistance in pests, which then leads to crop failure this resulting in hindrance of the growth of the market. The raw material price and labor cost also add to the challenge for the growth of the market. The adoption of new technology and adoption of sustainable practices affects the growth. These factors and challenges hinder the growth of the market. The region is also focusing on the development of bio-based alternatives to traditional fumigants to safer alternatives that support the market growth.

Regional Insights

How Did North America Dominate the Agricultural Fumigants Market in 2024?

North America dominated the agricultural fumigants market in 2024. The regions' rising focus on food safety regulation and stringent regulations, and ensuring protection of crops for storage and transportation, drives the growth of the market. Rising demand for agricultural products in the region due to increasing consumption of the products aligns with the shift towards green and sustainable use of products. Consumers' demand for green and safe products due to a shift towards healthy product use and green products fuels the growth of the market. The region well well-developed infrastructure and well-developed storage facilities like warehouses, also undergo effective pest control, driving the demand for the market. Advances in fumigation equipment to enhance efficiency, safety, and precision drive the growth and expansion of the market in the region.

The USA Has Seen a Steady Growth in the Agricultural Fumigants Market Due to Increasing Demand

The USA agricultural fumigants market has seen steady growth with rising demand for pest control in crops to protect them from insects and diseases, which demands sustainable and eco-friendly fumigants in the country. The fumigants are used in pre-plant soil treatment and post-harvest treatment, which increases the demand for the fumigants in the country. The country’s increased demand for food security to ensure food production, and also advances and innovations in technology, with evolving crop protection techniques, which are becoming more adoptable by the farmers. These factors support the growth and expansion of the market in the country.

Asia Pacific is Experiencing Steady Growth in the Agricultural Fumigants Market Due to Large Agricultural Practices in the Region.

Asia Pacific held the significant share of the market in 2024 and is expected to grow notably during the forecast period. Asia Pacific has seen significant growth as it holds the largest consumer of agricultural fumigants due to large agricultural practices in the region. The increasing demand from farmers for green and eco-friendly fumigants, with changing climate conditions and a rise in the need for pest control, drives the market in the region. The humid and rigorous changing climate in the region results in high outbreaks of pests and insects in the warehouses and storage areas in the region, which increases the demand for pest control and effective fumigants, which drives the growth of the market.

China is the Largest Market in the Region for the Agricultural Fumigants Market

China has seen steady growth in the agricultural fumigants market, which is a large farming practice in the country due to increasing demand because of the rising population in the country. The demand for organic products is rising, and China is the leading producer of vegetables due to high demand. The government policies of domestic and local use of products increase the large adoption of local products, which contributes to the growth of the market. Key companies are investing in formulating innovative and advanced fumigants for the protection of crops from failure, and also stored grains. These factors and applications drive the growth and expansion of the market in the country.

- The World exported 63,805 shipments of Fumigant from Nov 2023 to Oct 2024 (TTM). These exports were made by 7,903 Exporters to 6,602 Buyers. (Source : Volza )

- Globally, the top three exporters of fumigants are China, the United States, and South Korea. China led in Fumigant exports with 153,185 shipments, the United States with 74,945 shipments, and South Korea taking with the 33,200 shipments. (Source : Volza)

Agricultural Fumigants MarketVolume Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Volume Kilo Tons - 2024 | Volume Share, 2034 (%) | Volume Kilo Tons - 2034 | CAGR (2025 - 2034) |

| North America | 28.10% | 98.41 | 25.67% | 138.71 | 3.49% |

| Europe | 18.11% | 63.42 | 17.23% | 93.10 | 3.91% |

| Asia Pacific | 41.46% | 145.20 | 43.83% | 236.83 | 5.01% |

| Latin America | 8.12% | 28.44 | 9.03% | 48.79 | 5.55% |

| Middle East & Africa | 4.21% | 14.74 | 4.24% | 22.91 | 4.51% |

| Total | 100% | 350.21 | 100% | 540.34 | 4.43% |

Segmental Insights

Product Insights

The phosphine segment dominated the agricultural fumigants market in 2024. The growth of the market is driven by the growing need for effective, efficient, and cost-effective alternatives to the traditional fumigants. Phosphine is highly effective at low concentrations in controlling a large range of pests, which drives the demand for the market. Phosphine can penetrate deeply and ensures effective pest control, and it also does not leave harmful residues on the product, which also attracts the consumers, driving the demand for the market. It is an easy-to-apply fumigant and is a popular choice by farmers and storage facilities.

The low cost, ease of application, and compliance are the factors that drive the growth and expansion of the market. The 1,3-dichloropropene segment expects significant growth in the market during the forecast period. The segment is favoured for its effectiveness, short soil residence time, and compatibility with pest management, which helps grow the market. They are commonly used to control nematodes, soil-borne pathogens, and certain weeds in high-value crops. It is considered to be the most viable alternative to methyl bromide, which is toxic, commonly used for vegetables and fruits. The rising groundwater and environmental contamination the adoption of the segment has increased which resulting in a rise in growth and expansion of the market.

Agricultural Fumigants Market Volume Share, By Product, 2024-2034 (%)

| By Product | Volume Share, 2024 (%) | Volume Kilo Tons - 2024 | Volume Share, 2034 (%) | Volume Kilo Tons - 2034 | CAGR (2025 - 2034) |

| 1,3 Dichloropropene | 21.24% | 74.38 | 17.10% | 92.40 | 2.19% |

| Chloropicrin | 18.01% | 63.07 | 17.10% | 92.40 | 3.89% |

| Dimethyl Disulfide | 15.10% | 52.88 | 18.12% | 97.91 | 7.08% |

| Methyl Bromide | 10.02% | 35.09 | 7.34% | 39.66 | 1.37% |

| Metam Potassium | 12.20% | 42.73 | 15.12% | 81.70 | 7.47% |

| Metam Sodium | 15.32% | 53.65 | 18.11% | 97.86 | 6.91% |

| Others (Phosphine, etc.) | 8.11% | 28.40 | 7.11% | 38.42 | 3.41% |

| Total | 100% | 350.21 | 100% | 540.34 | 4.43% |

Application Insights

The soil segment dominated the agricultural fumigants market in 2024. Soil fumigation is a pre-plant pest control method that is used to sterilize soil by eliminating harmful organisms such as nematodes, bacteria, fungi, insects, and weed seeds, raising the demand for the market. This is useful in improving crop health and productivity of the crop by implementing and creating a pest-free environment by managing and complying with environmental and safety regulations. These factors drive the growth of the market and also help in expansion.

Form Insights

The liquid segment dominated the agricultural fumigants market in 2024. The fumigants are applied in the liquid form to the soil to control pests such as nematodes, bacteria, fungi, insects, and weed seeds before planting, which helps yield a good crop. Liquid fumigants are extensively used in high-value crop cultivation due to their efficiency and ease of application. This is done by drip irrigation and by injecting them directly into the soil. It also helps minimise the environmental impact and ensures safety; these factors and applications drive the growth of the market.

The gas segment expects significant growth in the market during the forecast period. These are applied in vapour form to control pests on both soil and storage. They are extensively used in pre-plant soil treatment to prepare the soil and are also used in fumigating the stored grains. These gases deeply penetrate and kill the pests and insects, by offering rapid action and high efficacy. These properties attract the farmers for large adoption, which results in the growth and expansion of the market.

Agricultural Fumigants Market Volume Share, By Form, 2024-2034 (%)

| By Form | Volume Share, 2024 (%) | Volume Kilo Tons - 2024 | Volume Share, 2034 (%) | Volume Kilo Tons - 2034 | CAGR (2025 - 2034) |

| Solid | 13.21% | 46.26 | 14.33% | 77.43 | 5.29% |

| Liquid | 35.23% | 123.38 | 37.34% | 201.76 | 5.04% |

| Gas | 51.56% | 180.57 | 48.33% | 261.15 | 3.76% |

| Total | 100% | 350.21 | 100% | 540.34 | 4.43% |

Recent Developments

- In October 2024, Alaa Farouk, Egypt’s Minister of Agriculture and Land Reclamation, launched the project titled "Sustainable Pesticide Management Framework," which was launched by CropLife. Group in coordination with the Agricultural Pesticides Committee. (Source : dailynewsegypt)

- In March 2025, the California Department of Pesticide Regulation (DPR) introduced the SprayDays California, a latest online notification system designed to enhance transparency regarding pesticide use. This system offers alerts before the application of restricted pesticides in their vicinity. (Source : agnetwest.com)

Top Companies List

- Dow

- Bayer AG

- Arkema

- AMVAC Chemical Corporation

- LANXESS

- BASF

- Trinity Manufacturing, Inc.

- Arysta LifeScience Corporation

- Novozymes A/S, part of Novonesis Group

- Syngenta International AG

- Corteva Agriscience

- Detia Degesch GmbH

- UPL Limited

- SGS SA

- MustGrow Biologics Corp.

Segments Covered in the Report

By Product

- 1,3 Dichloropropene

- Chloropicrin

- Dimethyl Disulfide

- Methyl Bromide

- Metam Potassium

- Metam Sodium

- Phosphine

- Others

By Application

- Soil

- Others

By Form

- Solid

- Liquid

- Gas

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait