Content

What is the Wood Coatings Market Size 2024 And Growth Rate?

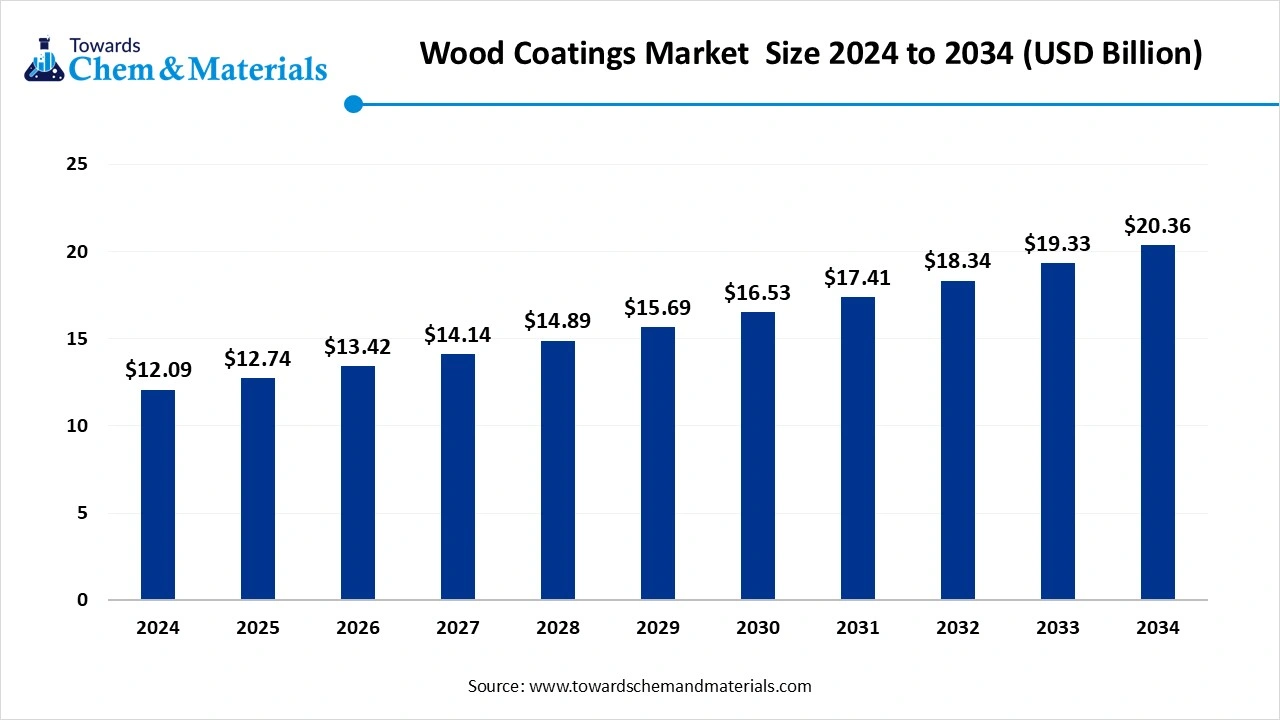

The global wood coatings market size was valued at USD 12.09 billion in 2024 and is expected to reach around USD 20.36 billion by 2034, growing at a CAGR of 5.35% from 2025 to 2034. The rapid urbanization, growing demand for furniture, and strong focus on aesthetics drive the growth of the market.

Key Takeaways

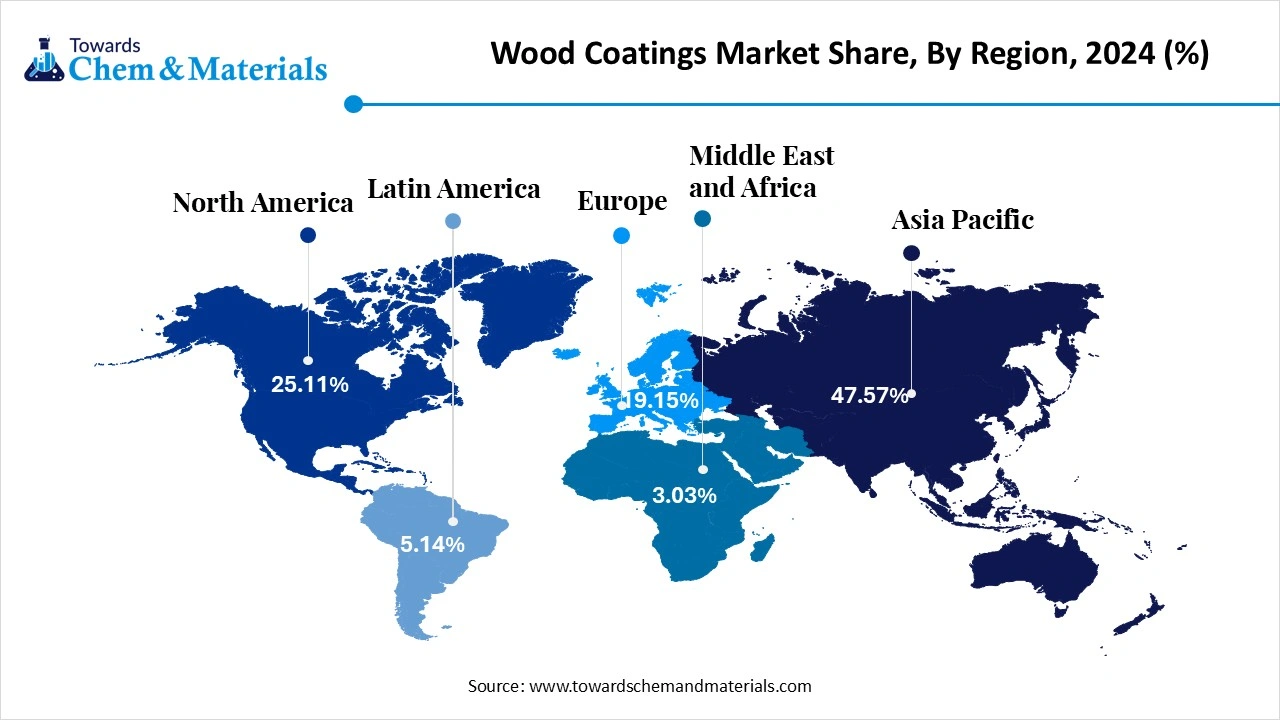

- The Asia Pacific wood coatings market size was evaluated at USD 5.75 billion in 2024 and is expected to attain around USD 9.70 billion by 2034, growing at a CAGR of 5.37% from 2025 to 2034.

- Asia Pacific wood coatings market dominated the global market and accounted for a revenue share of 47.57% in 2024.

- By resin type, the Polyurethane emerged as the leading resin type segment and accounted for the maximum revenue share of over 41.37% of the overall revenue in 2024.

- By resin type, the nitrocellulose segment is expected to grow at a CAGR of 5.55% over the forecast period.

- By application, the Furniture emerged as the leading Application segment and accounted for the maximum revenue share of over 59.15% in 2024.

- By application, the flooring and decking segment is expected to grow at a CAGR of 4.55% over the forecast period.

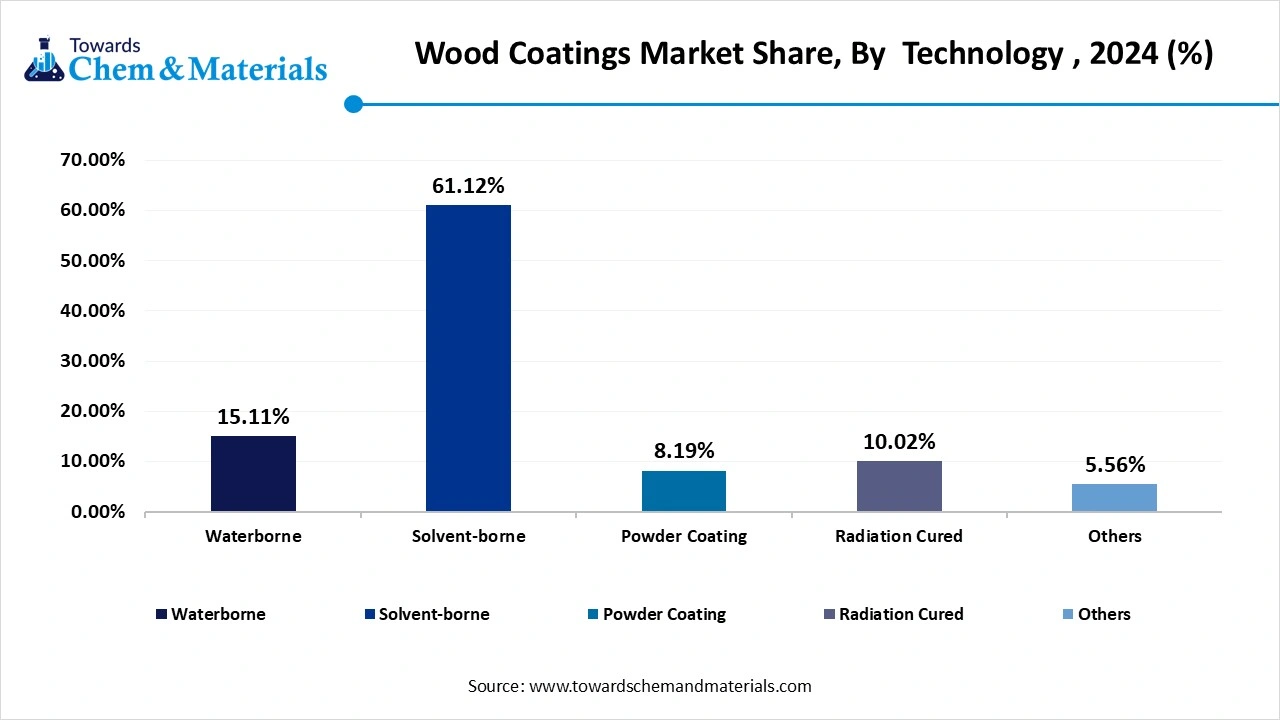

- By technology, the Solvent-borne emerged as the leading technology segment and accounted for the maximum revenue share of over 61.12% in 2024.

- By technology, the waterborne segment is expected to grow at the fastest CAGR of 5.54% over the forecast period.

Wood Coating: The Magic Behind the Shield and Shine

Wood coating is a kind of protective material applied to the wooden surface. It protects wood from sunlight, wear & tear, water, and chemicals. The gives a decorative appearance to wood and enhances its natural grain. It extends the lifespan of wood surfaces and adds a glossy appearance. Wood coating is applied to garden furniture, kitchens, furnishing floors, street furniture, and doors. Wood coatings consist of various types, like paints, varnishes, stains, sealers, and topcoats. It has different textures, colors, & sheens and offers exceptional UV resistance. It is very easy to maintain and offers matte, gloss, & semi-gloss finishes.

The growing demand for various wood products like decking, furniture, and flooring increases the demand for wood coatings. The increasing technological advancements in wood coatings help in the market growth. Factors like rapid urbanization, growing construction, increasing renovations, growing furniture demand, and increasing production of eco-friendly coatings contribute to the growth of the market.

- TIMBERLAND COMPANY LIMITED held the maximum market share of the wood coatings market with 42749 shipments.(Source: volza )

- Spain exported 1.2K wood coatings. (Source:volza )

- Vietnam exported 192984 shipments of polyurethane resins. (Source: volza )

- Japan exported 197250 shipments of powder coating.(Source: volza )

- South Korea exported 26355 shipments of acrylic resin.(Source: volza )

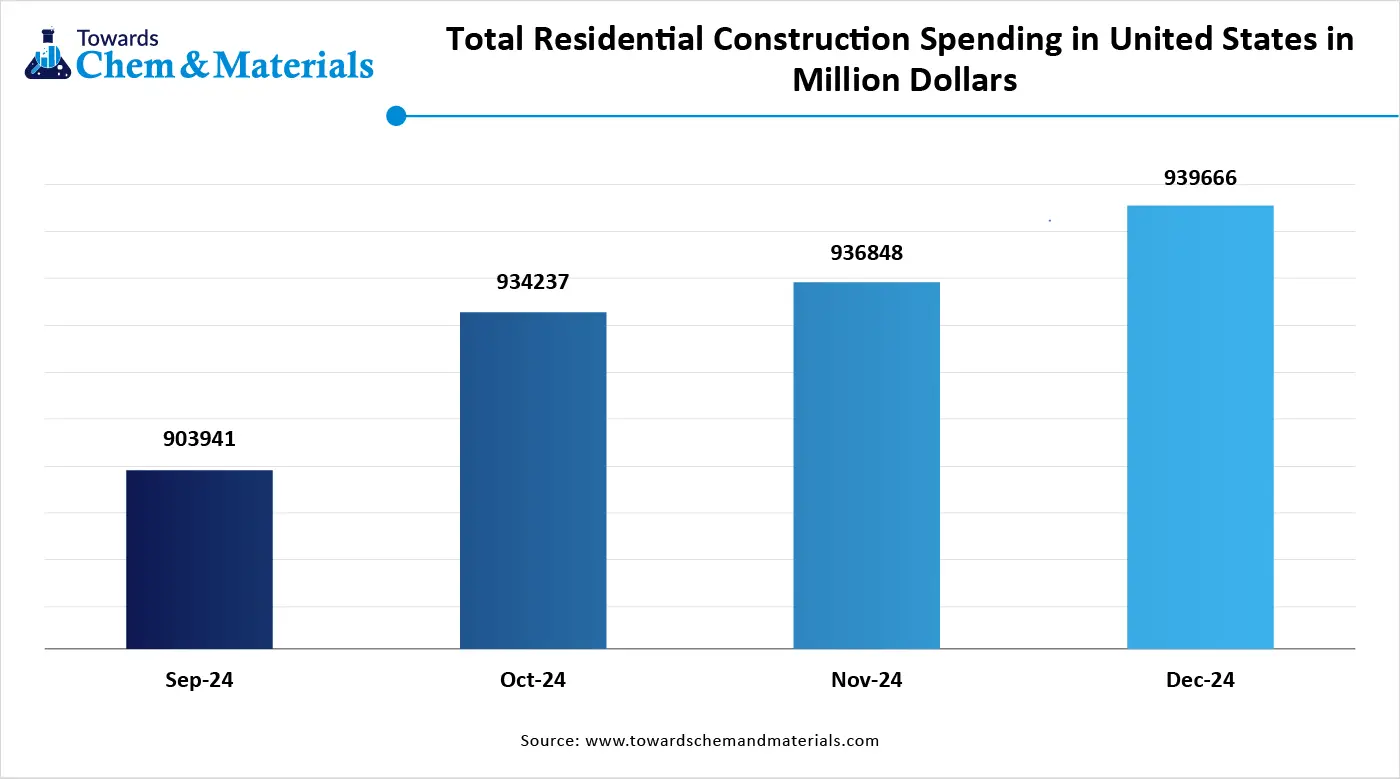

Growing Construction Activities are Driving Demand for Wood Coating

The growing construction activities in the commercial and residential sectors increase demand for wood coatings for various applications. The rapid urbanization and growing population increase demand for various construction projects. The growing residential construction, like farmhouses, apartments, and bungalows, increases demand for flooring, furniture, frames, and cabinetry, fueling demand for wood coatings. The growing demand for commercial construction, like office spaces, hotels, and resorts in various regions, increases demand for wood-based products like furniture & decking, fueling the adoption of wood coatings.

The growing disposable incomes of consumers increase spending on construction activities, which fuel demand for wood coating for various applications. The growing demand for an aesthetically pleasing look in commercial & residential construction drives demand for wood coating for a glossy finish. The growing construction activities are a key driver for the growth of the wood coatings market.

Market Trends

- Strong focus on sustainability: The growing focus on sustainability helps in the development of low-volatile compound emissions and HAPs-free wood coatings formulations. The growing focus on sustainability increases the adoption of water-based wood coatings.

- Technological advancements: The ongoing technological advancements, like the development of low-VOC, high-performance, and bio-based coatings, help in the market growth. Advancements like waterborne UV technologies, smart coating, self-healing coating, and nanotechnology drive market growth.

- Rise in DIY trends: The strong focus on home improvement by using DIY trends increases demand for wood coatings to improve the aesthetic appeal of the home. The wide range of DIY projects, like flooring, furniture, and decks, increases demand for wood coatings to enhance the look.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 12.74 Billion |

| Market Size by 2034 | USD 20.36 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.35% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| High Impact Region | Asia Pacific |

| Segment Covered | By Resin Type, By Technology, By Application, By Region |

| Key Companies Profiled | PPG Industries, Nippon Paint Holdings Co., Ltd., Diamond Paints, The Sherwin-Williams Company, Akzo Nobel N.V., RPM International Inc., KANSAI HELIOS, Axalta Coating Systems, LLC, Eastman Chemical Company, BASF SE, Asian Paints |

Market Opportunity

The Growing Demand for Premium Furniture

The growing consumer demand for premium furniture fuels the adoption of wood coatings. The rising disposable incomes increase demand for luxury goods like high-quality furniture to enhance aesthetics. The growing home décor trend and rapid urbanization increase demand for premium furniture. Wood coating like polyurethane provides a smooth & glossy finish to furniture. Premium furniture is widely used in high-traffic areas, which increases demand for solvent-borne coatings to withstand conditions like moisture, scratches, and heat.

The growing customization demand and the rising demand for high-quality furniture fuel demand for wood coatings to create aesthetic appeal. The growing expansion of the real estate industry increases demand for premium furniture to decorate apartments and homes, driving demand for high-quality wood coatings. The increasing demand for premium furniture in commercial and residential sectors increases the adoption of wood coatings. The growing demand for premium furniture creates an opportunity for the wood coatings market.

Market Challenge

Fluctuating Raw Material Prices Limit the Adoption of Wood Coatings

Despite several benefits of wood coatings in various industries, fluctuations in the prices of raw materials limit the expansion of the market. Factors like supply chain disruptions, environmental regulations, crude oil prices, and geopolitical tensions are responsible for fluctuations in prices. Wood coating requires raw materials that originate from petrochemicals like crude oil. Fluctuations in crude oil prices affect the wood coatings market.

The supply chain disruption problems are due to various reasons like geopolitical conflicts, natural disasters, and trade wars affect raw materials prices. The stricter environmental regulations increase the prices of raw materials. The fluctuations of prices like additives, resins, and solvents affect the prices of raw materials. The fluctuating raw materials prices hamper the growth of the market.

Regional Insights

Which Region Dominated the Wood Coatings Market in 2024?

The Asia Pacific wood coatings market is expected to increase from USD 6.06 billion in 2025 to USD 9.70 billion by 2034, growing at a CAGR of 55.37% throughout the forecast period from 2025 to 2034. Asia Pacific dominated the wood coatings market in 2024. The growing development of infrastructure projects and rapid urbanization increases demand for furniture, fueling demand for wood coatings. The growing consumption and production of furniture in the region help in the market growth. The strong manufacturing base and availability of raw materials help in the expansion of wood coatings. The growing construction activities in countries like India and China fuel demand for wood coatings.

The strong government investment in infrastructure development and construction increases demand for wood coatings for various applications. The growing demand for high-quality goods and rising disposable incomes increases demand for various wood products, fueling demand for high-performance wood coating. The growing shift towards sustainability increases demand for water-based and low-VOC coatings. Additionally, the presence of major players like Nippon Paint and AkzoNobel contributes to the overall growth of the market.

What are the Wood Coatings Market Trends in China?

China is a major contributor to the wood coatings market. The thriving construction sector and growing demand for building materials increase the demand for wood coatings. The growing expansion of the furniture industry helps in the growth of the market. The growing expansion of metropolitan areas and rapid urbanization increases demand for home decoration & furniture, fueling demand for wood coatings. The growing population and rising demand for furniture drive the market growth. The rising middle-class people and growing disposable incomes increase demand for home renovations and furniture, fueling demand for wood coatings. Additionally, growing furniture production and demand drive the overall growth of the market.

- China exported 37911 shipments of polyurethane resins. (Source: volza)

- China exported 199846 shipments of polyurethane coatings.(Source: volza)

- China exported 220153 shipments of powder coating.(Source: volza)

- China exported 48850 shipments of acrylic resin.(Source: volza)

The Furniture Industry Driving Force Behind the Wood Coatings Market in India

India is significantly growing in the market. The growing expansion of the woodworking and furniture industries helps in the market growth. The growing disposable incomes increase spending on home renovations and furnishing, fueling demand for wood coatings.

The growing demand for stylish interiors demand for sustainable & eco-friendly wood coatings help in the market growth. Additionally, the growing population, rapid urbanization, and growing demand for housing drive the overall growth of the market.

- From October 2023 to September 2024, India exported 3630 shipments of polyurethane resins with a growth rate of 11% compared to the previous 12 months. (Source: volza)

- From November 2023 to October 2024, India exported 41308 shipments of powder coating with a growth rate of 61% compared to the previous twelve months.(Source: volza )

Why North America Growing In The Wood Coatings Market?

North America experiences the fastest growth in the market during the forecast period. The construction activities in the commercial & residential sectors increase demand for wood coatings. The growing renovation activities and rising spending on construction help in the market growth. The growing demand for high-performance wood coatings in applications like decking & flooring drives market growth. The growing customization and DIY trends to personalize homes and other projects increase the adoption of wood coatings.

The strong focus on sustainability increases demand for sustainable & renewable raw materials, fueling demand for wood coatings. Additionally, growing wood-based applications like siding, flooring & decking, and the expansion of the furniture industry support the overall growth of the market.

The United States Wood Coatings Market Trends

The United States is a key contributor to the wood coatings market. The thriving construction industry in the commercial and residential segments increases demand for wood coatings for various applications, like decking, cabinetry, siding, and fencing. The strong focus on sustainability and growing preference for low-volatile organic compound emissions increases the adoption of waterborne wood coatings.

The growing advancements in wood coating technologies like UV-curable systems & waterborne help in the market growth. Furthermore, the well-established distribution channels and strong furniture & cabinetry industry drive the overall growth of the market.

- The United States exported 18.4K polyurethane resin.(Source: volza )

- MONARCH COLOR CORPORATION is the leading supplier of polyurethane resin in the United States. (Source: volza )

Segmental Insights

Resin Type Insights

Which Resin Type Dominated The Wood Coatings Market In 2024?

The polyurethane segment dominated the market in 2024. The growing demand from construction activities for various applications helps in the market growth. Polyurethane protects against fading, scratches, and stains, and it is applicable for wear & tear surfaces. It offers excellent chemical resistance to wood surfaces. The growing demand from various applications like cabinetry, furniture, and flooring increases the adoption of polyurethane coatings. It consists of better moisture resistance and UV resistance properties. It is available in a variety of formulations, like oil-based and water-based. The growing focus on aesthetic appeal increases demand for polyurethane coatings for glossy & smooth finishes. Additionally, growing demand from the furniture and construction sectors drives the overall growth of the market.

The nitrocellulose segment is the fastest growing in the market during the predicted period. The growing demand for high-quality finishes & coatings in various industries like furniture & construction increases the adoption of nitrocellulose coatings. It provides a faster drying time and is widely used in furniture renovation processes. Nitrocellulose offers a glossy appearance and smooth finish. It is widely used for aesthetic applications and is also used in various wood coatings like replica coating, furniture, and flooring. Additionally, the growing demand from the Asia Pacific region due to urbanization and industrialization supports the overall market growth.

Technology Insights

Why Did the Solvent-Borne Segment Dominated The Wood Coatings Market?

The solvent-borne segment held the largest market share in the wood coatings market in 2024. The growing demand for long-lasting protection in various applications increases the adoption of solvent-borne coatings. These coatings consist of a wide range of finishes, colors, and textures. Solvent-borne coatings offer rapid drying and uniform finishes. The growing demand from the furniture industry helps in the market growth. Solvent-borne coatings offer superior resistance to chemicals, high durability, and excellent adhesion. Additionally, growing demand from various applications like kitchen cabinets, flooring & decking, and architectural joinery supports the overall growth of the market.

The waterborne segment experiences the fastest growth in the market during the forecast period. The growing environmental regulations fuel demand for lower volatile organic compound emissions, increasing the adoption of wood coatings. The growing consumer awareness about environmental problems helps in the market growth. The waterborne coatings offer low toxicity, excellent adhesion, and high flexibility. It has a faster drying time and is easy to apply. The growing adoption of sustainability in the construction industry increases demand for waterborne coatings. Furthermore, growing demand for high-quality wood products and rapid urbanization drive the overall growth of the market.

Application Insights

How Furniture Segment Dominated the Wood Coatings Market in 2024?

The furniture segment dominated the market in 2024. The growing demand for custom and premium furniture helps in the market growth. The growing consumer preference for aesthetically appealing and durable furniture increases demand for wood coatings to protect against UV damage, scratches, and moisture. The growing popularity of interior design and demand for a personalised look fuel demand for wood coatings. The growing demand for furniture in the institutional, residential, and commercial sectors drives market growth. Rapid growth in construction activities and home remodelling increases demand for furniture. Additionally, rapid urbanization, growing disposable incomes, and rising demand for office furniture support the overall growth of the market.

The flooring & decking segment is the fastest growing in the market during the forecast period. The growing consumer preference for hardwood flooring and decking for homes helps in the market growth. The growing trend of personalizing spaces increases demand for high-quality flooring. The increasing consumer demand for eco-friendly options is fueling demand for wood flooring and decking applications. The growing demand from commercial & industrial spaces helps the market growth. Additionally, growing outdoor living popularity and rising home renovation activity contribute to the overall growth of the market.

Recent Developments

- In February 2025, AkzoNobel launched wood coating with 20% bio-based content. The RUBBOL WF 3350 wood coating is waterborne and utilizes renewable raw materials. It is a sprayable opaque coating and suitable for exterior & interior use. (Source: akzonobel)

- In July 2024, Axalta launched Cerulean waterborne wood coatings. The coating has excellent flow & levelling properties, is easy to apply, and is ready to spray. The product range includes premium waterborne topcoat, premium pigmented waterborne, and waterborne undercoat. It is applicable for furniture, kitchen cabinets, bathroom cabinets, store fixtures, and architectural millwork. (Source: coatingsworld )

- In April 2024, EPS launched a new bio-based polymer, PC-Mull 815, for wood coating. The polymer provides exceptional levelling, chemical resistance, transparency, block resistance, and hardness. It is used as a self-sealing resin and a topcoat in wood applications.(Source: coatingsworld )

- In January 2025, AkzoNobel launched a polyurethane and acrylic coatings system. The Selva Pro range consists of three systems: Selva Pro Chairo, Selva Pro Acrilico, and Selva Pro Bianco. The system is applicable for residential projects like kitchens & bathrooms, architectural millwork, and retail store fit-outs. It is available on the Chemcraft network and is compatible with standard paint shakers.(Source:woodworkingnetwork)

Top Companies List

- PPG Industries

- Nippon Paint Holdings Co., Ltd.

- Diamond Paints

- The Sherwin-Williams Company

- Akzo Nobel N.V.

- RPM International Inc.

- KANSAI HELIOS

- Axalta Coating Systems, LLC

- Eastman Chemical Company

- BASF SE

- Asian Paints

Segments Covered in the Report

By Resin Type

- Polyurethane

- Nitrocellulose

- Acrylic

- Unsaturated Polyester

- Others

By Technology

- Solvent-Borne

- Waterborne

- Powder Coating

- Radiation Cured

- Others

By Application

- Furniture

- Flooring & Decking

- Joinery

- Siding

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait