Content

VAE Emulsion Market Size and Share 2034

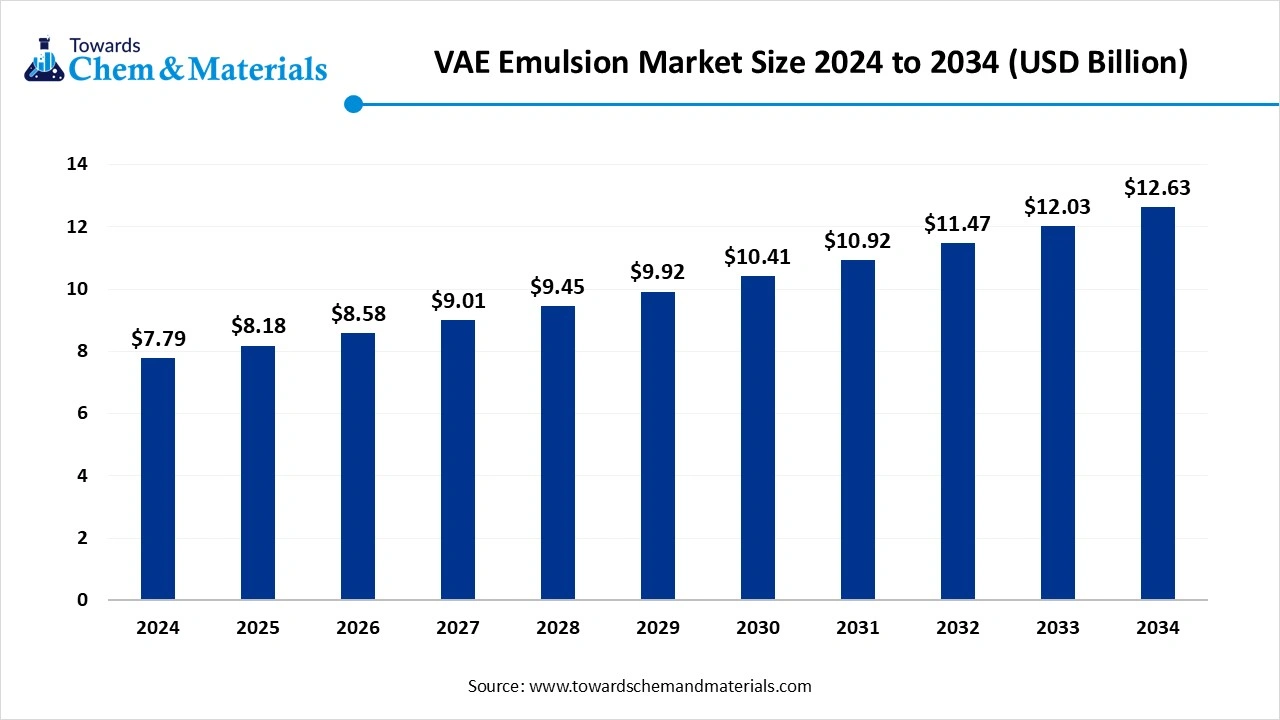

The global VAE emulsion market size is calculated at USD 7.79 billion in 2024, grew to USD 8.18 billion in 2025, and is projected to reach around USD 12.63 billion by 2034. The market is expanding at a CAGR of 4.95% between 2025 and 2034. The ongoing adoption of low VOC products and the implementation of sustainability standards have fueled the market potential in recent years.

Key Takeaways

- By region, Asia Pacific dominated the VAE emulsion market in 2024, akin to the presence of a heavy manufacturing industry and domestic demand.

- By region, Latin America is expected to grow at a notable rate in the future, owing to a sudden increase in investment in the packaging and housing sectors.

- By product, ordinary VAE emulsions segment captured the biggest portion of the market in 2024, owing to their unique offerings, such as affordability and versatility, which can make it ideal for many daily applications

- By product, the waterproof VAE emulsion segment is anticipated to expand at the highest rate in the coming years, owing to its moisture resistance and durability.

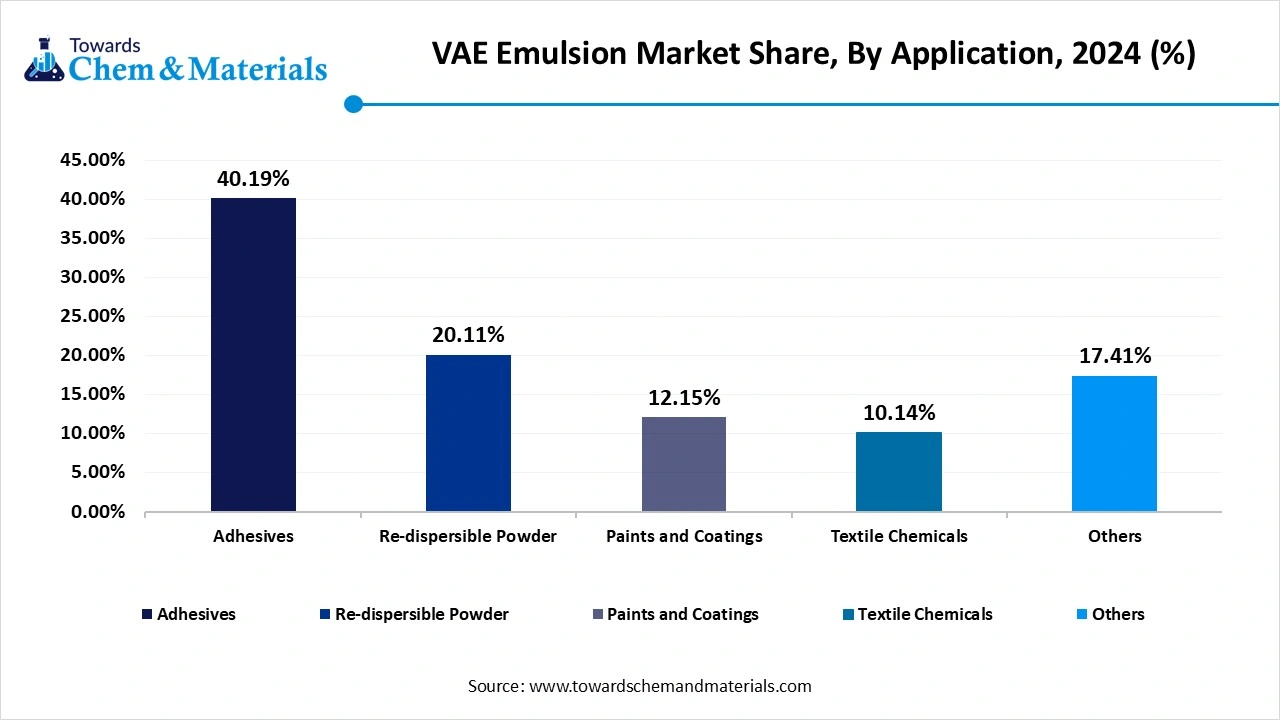

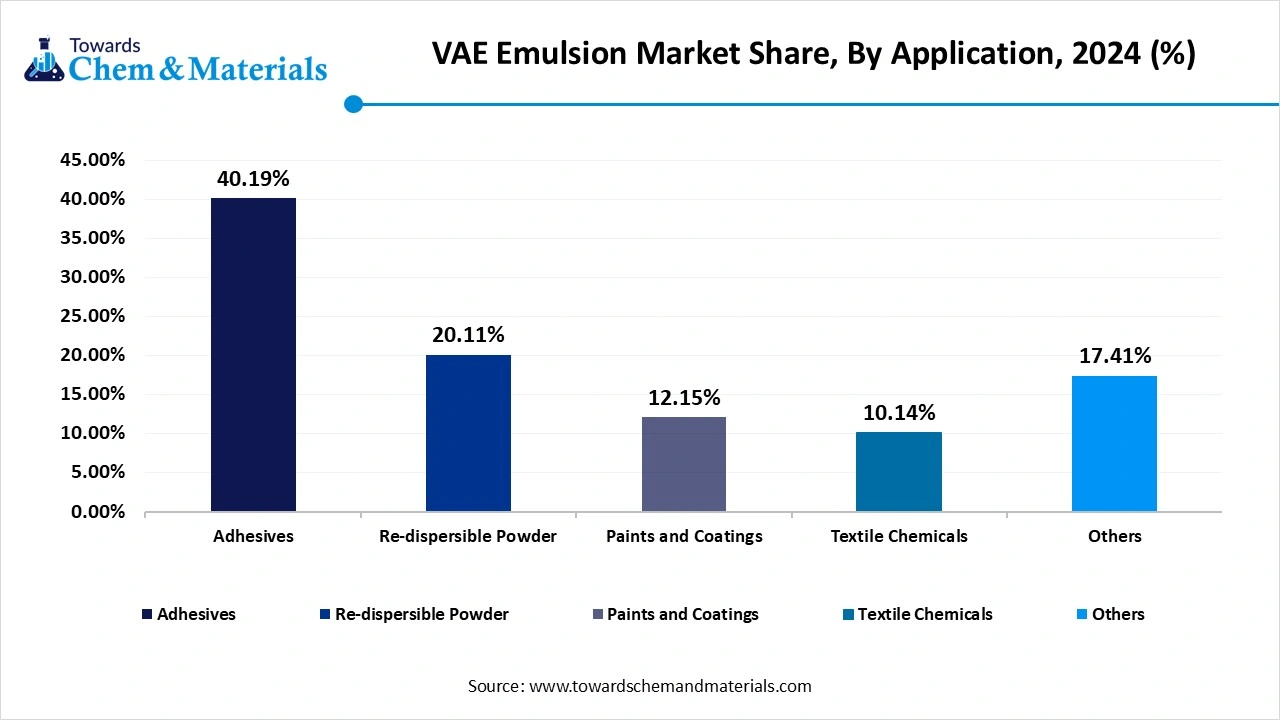

- By application, the adhesive segment emerged as the top consumer of VAE emulsion market share of 40.19% in 2024, because of its strong initial tack.

- By application, the re-dispersible segment is likely to witness the most rapid growth in the market in the years ahead, owing to its flexibility and longer shelf life.

Market Overview

Flexibility Meets Sustainability: VAE Emulsions Redefine Industry Norms

The VAE emulsion market is expected to see steady growth owing to increasing use in major industries such as textiles, paints, adhesives, and construction in recent years. Also, several industries are seen using VAE emulsion as an alternative to solvent-based products by having unique properties, like flexibility, sustainability due to the water-based nature, and strong bonding properties. Moreover, the ongoing implementation of eco-friendly initiatives by regional governments has provided a sophisticated consumer base to the industry in recent years, as per the observation. Furthermore, several construction developers are increasingly preferring the VAE emulsion akin to its high performance and flexibility while mixing with cement. This can create substantial opportunities for manufacturers in the coming years.

Which Factor Is Driving the Growth of the VAE Emulsion Market?

The increasing global demand for low-VOC products is spearheading industry growth in the current period. The VAE emulsion emerged as an eco-friendlier material than other materials available in the market due to water-based manufacturing. The major brands and developers are increasingly preferring the sustainable product line where eco-friendly raw materials are used directly. Moreover, the regional governments are heavily seen in supporting the eco-friendly initiatives by providing attractive benefits like tax reduction and attractive subsidies in the current industrial environment to the major producers who implement the sustainability standards.

Market Trends

- The ongoing expansion of the construction industry has spearheaded the market potential in recent years. VAE emulsion is increasingly seen in mixing with cement modifications in order to improve their durability and flexibility. Also, the rapid infrastructure development and ongoing urbanization can lead to the industry's potential in the coming years.

- The increasing adoption of water-based paints is driving industry growth in the current period. As the global green shift is pushing the growth for these types of paints, as per the recent market environment report.

- The packaging industry has increasingly provided a sophisticated consumer base to the VAE emulsion market in the past few years. Also, the packaging manufacturers are seen as under the heavy usage of the application, such as cartons, paper, and laminates.

Market Report

| Report Attributes | Details |

| Market Size in 2025 | USD 8.18 Billion |

| Expected Size by 2034 | USD 12.63 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.95% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product, By Application, By Region |

| Key Companies Profiled | Wacher Chemie AG, Celanese, CC, Vinavil, The Beijing Eastern Petrochemical, Wanwei, BouLing Chemical Co., Limited, Sinopec Sichuan Vinylon Works, Sumika Chemtex Company, Limited, Shaanxi XuTai Technology Co., Ltd, Yunnan Zhengbang Technology |

Market Opportunity

VAE Emerges as a Key Ingredient in Green Coating Innovations

The expansion of water-based paints and coatings is expected to create significant market opportunities for the VAE manufacturers in the coming years. Also, the VAE offers the perfect solution owing to its flexibility, durability, and lower environmental impact. These several governments are increasingly seeing the implementation of sustainability initiatives, which is anticipated to push the industry's potential during the forecast period. Also, the major brands and consumers have been increasingly demanding eco-friendly coatings and paints in recent years. Also, several manufacturers are increasingly investing in R&D activities for the specialized innovation sectors, which is projected to provide the first mover advantage for these manufacturers in the future period, as per the industry expectations

Market Challenge

Expensive Raw Materials Slow VAE Emulsion Expansion

The fluctuations in the raw material cost are expected to hamper the industry's growth during the forecast period. As the required raw materials for VAE emulsion are generally derived from the petrochemical industry, which is considered a highly volatile industry for pricing. Moreover, these price fluctuations can increase the chances of product price hikes and product delays sometimes. However, manufacturers can escape from this price fluctuations traps while maintain log term contracts and good global relations, ass per the future industry observations.

Regional Insights

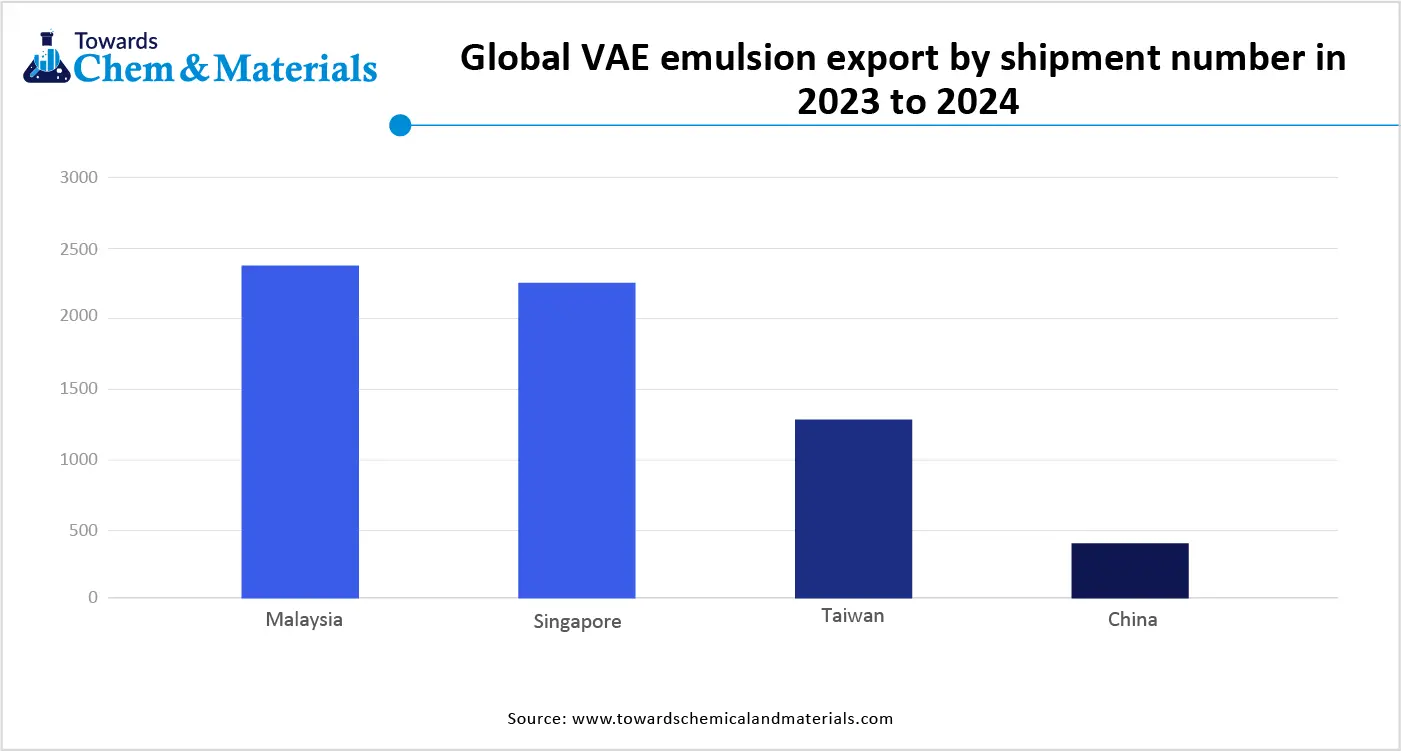

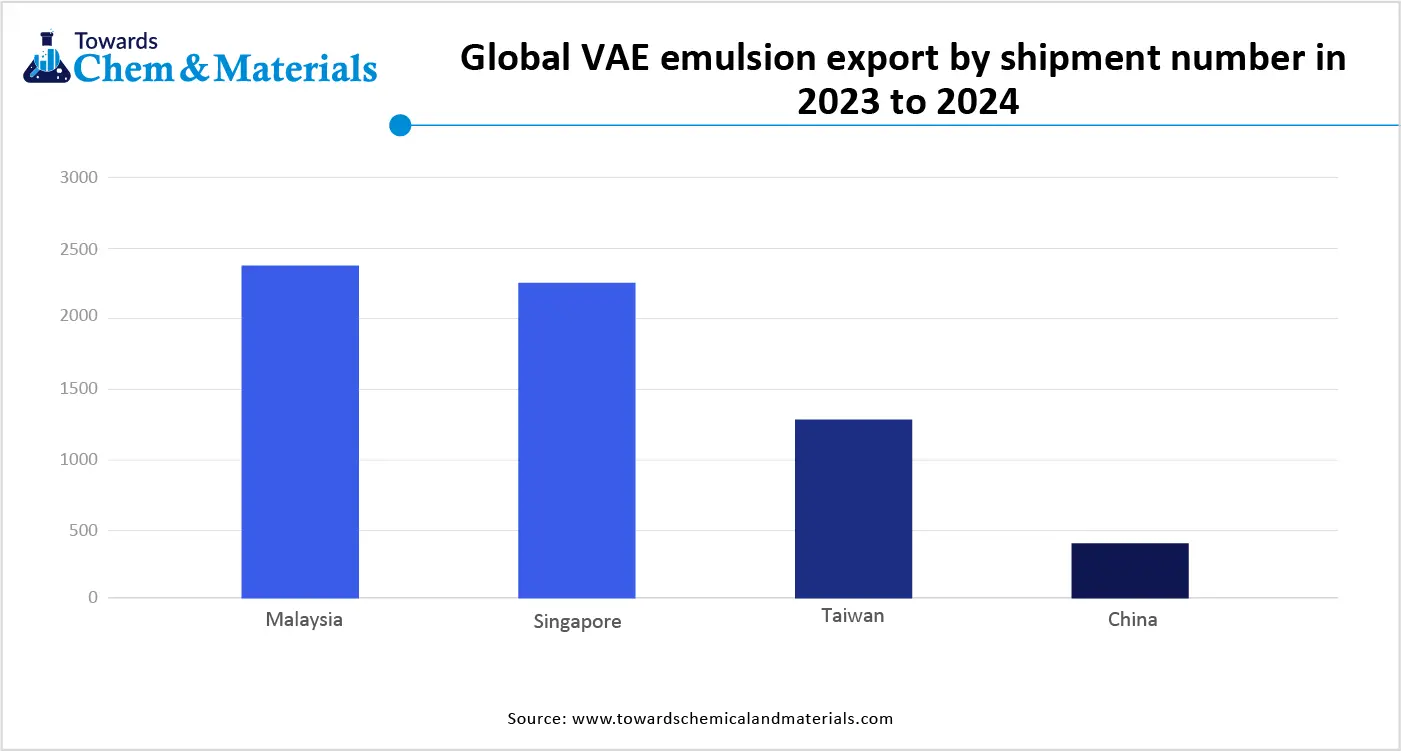

Asia Pacific accounted for the heavy revenue in the market in 2024, akin to the huge demand from the major industries such as textiles, paints, and construction. Moreover, the regional countries such as China, India, and Southeast Asian countries are seen under the heavy infrastructure development and urbanization, whereas VAE-based adhesives and coatings can play an ideal role in these developments. Also, by having benefits like low labor cost and favorable government initiatives, the region has gained major industry share in recent years, as per the recent industry observation.

Can China’s Expanding Construction Sector Sustain Market Leadership?

China maintained its dominance in the VAE emulsion market owing to the presence of heavy manufacturing brands and domestic needs. Moreover, the country has a sophisticated chemical industry, which is leading the industry to growth over time. The enlarged construction industry in the country is expected to contribute heavily to future market growth, akin to the rapid infrastructure development needs in recent years. Furthermore, the government's implementation of stricter regulations for the low-VOC products can drive the industry demand further, as per the recent observation.

Latin America is expected to capture a major share of the market during the forecast period, owing to a sudden increase in investment in the packaging and housing sectors. As the region is heavily preferring the eco-friendly alternatives in the current period, this is providing a heavy consumer base to the water-based VAE emulsion industry in recent years. As technology has advanced played the ideal role in the development of more sustainable VAE emulsions, the industry is expected to create significant opportunities for manufacturers in the coming years.

How is Brazil’s Industrial Strength Driving VAE Demand?

Brazil is expected to rise as a dominant country in the Latin American region in the coming years, owing to the country being considered the largest economy with a heavy industrial base. Also, the sectors such as construction and packaging are seen under the heavy requirement for the VAE emulsions, which can further accelerate industry growth as per the current market statistics. Also, countries' push for green building initiatives and low VOC material preference is expected to contribute to the industry's potential in the coming years.

Segmental Insights

Product Insights

How Ordinary VAE Segment Dominated the VAE Emulsion Market in 2024?

The ordinary VAE segment held the largest share of the market in 2024, due to its unique offerings, such as affordability and versatility, which can make it ideal for many daily applications. Also, these missions are seen in heavy usage in the coatings, construction, and paints, which have provided significant industry attention in recent years. Moreover, its easy-to-use and strong binding characteristics made it a preferable solution for the mass manufacturing industries over the period, as per the past years' observations.

The waterproof emulsion segment is seen to grow at a notable rate during the predicted timeframe, owing to increasing demand for the eco-friendly alternative in major manufacturing industries. By having moisture resistance and durability, many manufacturers are increasingly adopting waterproof emulsions instead of ordinary emulsions in the current period. The modern instant weather changes and heavy pollution hurdles are expected to contribute to the growth of the segment in the coming years, as per the recent industry observations.

Application Type Insights

What Made the Adhesives Segment the Dominant Segment in the VAE Emulsion Market in 2024?

The adhesive segment held the dominant share of the market in 2024, due to adhesives made with VAE are widely used in packaging, woodworking, textiles, paper, and construction. VAE emulsions are known for their strong initial tack, fast drying, and flexibility, which are important properties for making reliable adhesives.

In industries like packaging, especially for food and consumer goods, these adhesives help ensure safe, clean, and quick bonding of materials. VAE-based adhesives are also more eco-friendly than solvent-based options, making them increasingly popular as industries move toward greener solutions. Their easy application, cost-effectiveness, and performance make them suitable for mass production.

The re-dispersible powders segment is seen to grow at a notable rate during the predicted timeframe, owing to its high flexibility, long shelf life, and convenience in transportation and storage. Re-dispersible powders are created by drying VAE emulsions into a powder form, which can be reactivated by adding water. This makes them especially useful in dry mix construction products like tile adhesives, plasters, and wall putties. These powders are easier to handle in remote locations or for export, where liquid-based emulsions may not be practical. As construction companies seek better performance and longer-lasting materials, redispersible powders are becoming more favored. They also improve water resistance, adhesion, and flexibility of end products, which is important in modern infrastructure projects.

Recent Developments

- In March 2025, Asian Paints plans to establish the manufacturing plant of the VAE and Vam manufacturing in India. The plant can also be established in the Dahej, Gujarat, as per the company's claim. Also, the company considered a budget of 3,250 Cr for this program. (Source: indianchemicalnews)

- In January 2023, Asian Paints established a wholly owned subsidiary. The latest launched subsidiary is mainly focused on the production of VAE and VAM, as per the report published by the company recently.(Source: indianchemicalnews)

Top Companies List

- Wacher Chemie AG

- Celanese

- DCC

- Vinavil

- The Beijing Eastern Petrochemical

- Wanwei

- BouLing Chemical Co., Limited

- Sinopec Sichuan Vinylon Works

- Sumika Chemtex Company, Limited

- Shaanxi XuTai Technology Co., Ltd

- Yunnan Zhengbang Technology

Segment Covered

By Product

- Waterproof VAE Emulsions

- Ordinary VAE Emulsions

By Application

- Adhesives

- Re-dispersible Powder

- Paints and Coatings

- Textile Chemicals

- Others

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE