Content

U.S. Smart Plastics In Precision Agriculture Market- Size, Share & Industry Analysis

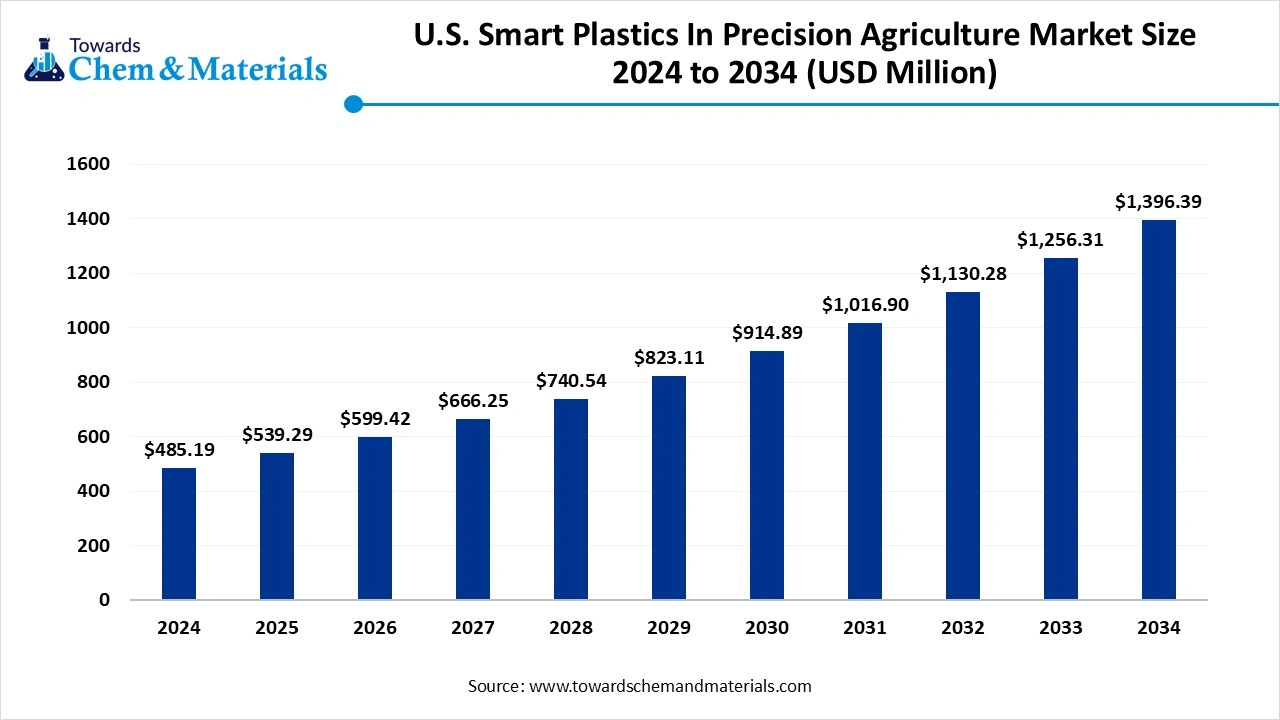

The U.S. smart plastics in precision agriculture-market size was valued at USD 485.19 million in 2024, grew to USD 539.29 million in 2025, and is expected to hit around USD 1,396.39 million by 2034, growing at a compound annual growth rate (CAGR) of 11.15% over the forecast period from 2025 to 2034. A shift towards advanced agriculture practices has been a key enabler of industry development.

Key Takeaways

- By product type, the biodegradable mulch films& biodegradable agriculture films segment led the U.S. smart plastics in precision agriculture market in 2024, due to their being considered as the ideal, akin to their dual benefits, such as providing crop protection while maintaining environmental waste.

- By product type, the sensor-embedded films & sensor strips segment is expected to grow at the fastest rate in the market during the forecast period, owing to having specialized characteristics and abilities, like its ability to transform passive plastic into decision-making tools, which has led to the segment's growth in recent years

- By functional capability, the UV/thermal/light management segment emerged as the top-performing segment in the U.S. smart plastics in precision agriculture market in 2024, owing to its ability to address crop quality and yield optimization.

- By functional capability, the controlled nutrient/pesticide release segment is expected to lead the market in the coming years, because it reduces input waste while ensuring healthier crop growth.

- By application, the open field raw crops segment led the U.S. smart plastics in the precision agriculture market in 2024, because they represent the largest cultivated area in the United States.

- By application, the controlled-environment agriculture / vertical farms segment is expected to capture the biggest portion of the market in the coming years, because they rely on precision materials for sustainability and profitability.

- By material type, the conventional polyolefins (LDPE/LLDPE/HDPE) segment led the U.S. smart plastics in the precision agriculture market in 2024, because they are cheap, durable, and widely available.

- By material type, the biopolymers & PLA/PHAs segment is expected to capture the biggest portion of the market in the coming years, because they combine eco-friendliness with smart functionality.

- By technology, the RFID / NFC / passive sensor tags segment emerged as the top-performing segment in the U.S. smart plastics in precision agriculture market in 2024, because they offered low-cost entry points for digitizing agriculture.

- By technology, the controlled nutrient/pesticide release segment is expected to lead the market in the coming years, because it enables ultra-thin, flexible, and multifunctional smart plastics.

- By deployment model, the single-use disposable films segment led the U.S. smart plastics in the precision agriculture market in 2024, because they fit traditional United States farming practices.

- By material type, the compostable / in-soil biodegrading films segment is expected to capture the biggest portion of the market in the coming years, because they solve the waste problem without disrupting farming practices.

Market Overview

Next Gen Farming Tools: Smart Plastic Films, Coatings, and IoT Solutions

Smart plastics in precision agriculture are polymer-based films, coatings, seed/soil treatments, and componentized plastics that add sensing, controlled-release, biodegradable, or active functionalities to cropping systems, enabling precise water/nutrient delivery, pest suppression, microclimate control, and traceability.

Products include biodegradable mulch films, sensor-embedded films and tapes, controlled-release polymer coatings (fertilizer/pesticide), photo-selective/light-management films, conductive/printed-trace plastics for IoT integration, RFID/NFC-tagged plastic components, and recovery/recycling services. The market spans raw resin & additive suppliers, film converters/coaters, sensor/IoT integrators, packagers & farm-technology integrators, and aftermarket services (collection, composting, analytics).

- For Instance, according to the research report, the agriculture sector in the United States uses 2.7% of plastic of total domestic plastic use, which is approximately 1.56 million tons each year.(Source: www.sciencedirect.com)

Efficiency Meets Innovation in Modern Farming

The shift towards resource-efficient farming has allowed stakeholders to capitalize on growth opportunities. Moreover, the farmers in the United States are actively trying to get better crop yields by using fewer inputs, which is driving the industry trend in recent years. Also, these smart plastics are reducing excessive inputs while providing precision in nutrient release and minimizing waste with boosting crop yield in the current period.

Market Trends

- The integration of smart plastic with farm data platforms is increasingly positioning the industry for long-term expansion. As the AI-driven farm systems have gained major industry attention in recent years.

- The greater push for sustainability from the regional government is enhancing market readiness and future industry capabilities.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 539.29 Million |

| Expected Size by 2034 | USD 1,396.39 Million |

| Growth Rate from 2025 to 2034 | CAGR 11.15% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type / Offering, By Functional Capability, By Application / Use-Case, By Material / Resin Type, By Technology Integration / Enablers, By Deployment Model / Product Life-cycle |

| Key Companies Profiled | Arable Labs , Berry Global, Inc. , BASF SE , Coveris / agricultural films divisions , Dow / Corteva-related film & polymer solutions , DuPont de Nemours , Ginegar , Invengo / RFID hardware partners , John Deere, Metalcraft , NatureWorks LLC , Novamont , Netafim , Taghleef Industries , Walki / specialty film divisions |

AI Integrated Plastics Set to Transform Agriculture Productivity

The development of the multifunctional smart plastic, which is customized for the suitability of the major United States crops like corn, leafy greens, and soybeans, is likely to elevate earnings potential for manufacturers in the coming years. Also, with technology integration, the producers can integrate their smart plastics with AI, which can provide excessive crop yield and real-time insights. Furthermore, this technological integration may lead to robust revenue growth across the sector during the forecast period.

High Cost and Tech Hurdles Slow Smart Farming Expansion

The adoption barriers and higher initial cost are forecasted to limit industry entry and scalability in the coming years. Moreover, the integration of smart plastic requires expensive materials like sensors, farm automation, and data systems, which can create growth barriers for the new entrants and mid-sized businesses which has limited budgets.

Segmental Insights

By Product Type

How did the Biodegradable Mulch Films& Biodegradable Agriculture Films Segment Dominate the U.S. Smart Plastics in Precision Agriculture Market in 2024?

The biodegradable mulch films& biodegradable agriculture films segment held the largest share of the market in 2024, due to they considered as the ideal akin to their dual benefits, such as providing crop protection while maintaining environmental waste. Furthermore, by improving the soil temperature and moisture retention, the biodegradable films have gained major industry attention in recent years. also, several farmers in the United States have seen under the heavy adoption of these films while resulting in labor savings and sustainability.

The sensor-embedded films & sensor strips segment is expected to grow at a notable rate during the predicted timeframe, owing to having specialized characteristics and abilities, like it can transform the passive plastic into decision-making tools, which has led to the segment growth in recent years. Also, by providing helpful insights such as the real-time soil conditions, pest threats, and nutrient levels, the sensor-embedded films are expected to gain a major industry advantage in the coming years.

By Functional Capability

Why does the UV/Thermal/Light Management Segment dominate the U.S. Smart Plastics in the Precision Agriculture Market by Functional Capability?

The UV/thermal/light management segment held the largest share of the U.S. smart plastics in the precision agriculture market in 2024, owing to their ability to address crop quality and yield optimization. Also, this management is seen as very successful in the US regions like the Midwest and California, where the climate instability is very high. Moreover, by preventing crop damage with consistent growth of crop yield, several farmers in the US supported the segment growth in recent years.

On the other hand, the controlled nutrient/pesticide release segment is expected to grow at a notable rate because it reduces input waste while ensuring healthier crop growth. Instead of spraying or applying fertilizers multiple times, smart plastics embedded with micro-reservoirs release nutrients gradually into the soil. This precision lowers chemical runoff with U.S. environmental regulations and saves farmers money on inputs.

By Application

How did the Open-Field Row Crops Segment Dominate the U.S. Smart Plastics in Precision Agriculture Market in 2024?

The open-field row crops segment dominated the market with the largest share in 2024 because they represent the largest cultivated area in the U.S. Crops like corn, soybeans, and wheat cover millions of acres, and smart plastics are already used here for weed control, water retention, and soil temperature stabilization. Farmers adopted biodegradable mulch films in row crops because they significantly reduce input and labor costs at scale.

The controlled-environment agriculture / vertical farms segment is expected to grow at a significant rate because it relies on precision materials for sustainability and profitability. Unlike open fields, these systems depend on constant monitoring of light, temperature, and humidity. Smart plastics with embedded sensors, UV filters, or water-retention properties are critical to maintaining stable microclimates.

By Material/Resin Type

Why Do Polyolefins Still Rule the Mulch Film Market in 2024?

The conventional polyolefins (LDPE/LLDPE/HDPE) segment dominated the market with the largest share in 2024 because they are cheap, durable, and widely available. For decades, U.S. farmers relied on polyethylene-based mulch films due to their strength and affordability. Even with environmental drawbacks, polyolefins remained the standard because of cost advantages and compatibility with existing farming practices.

The biopolymers & PLA/PHAs segment is expected to grow at a significant rate because they combine eco-friendliness with smart functionality. Unlike conventional plastics, these materials are compostable and biodegradable, addressing rising U.S. concerns about agricultural plastic waste. Manufacturers are also engineering PLA and PHA with added features like UV filtering and moisture control, giving them dual value.

By Technology

Can Low-Cost RFID Solutions Truly Transform Farming Practices?

The RFID / NFC / passive sensor tags segment dominated the market with the largest share in 2024 because they offered low-cost entry points for digitizing agriculture. U.S. farmers started with passive tags to track environmental conditions like soil temperature and moisture without large infrastructure changes. These technologies integrate easily with existing farm equipment and require minimal training

The printed electronics / conductive ink traces segment is expected to grow at a significant rate because they enable ultra-thin, flexible, and multifunctional smart plastics. Unlike passive RFID, printed electronics integrate advanced sensing, wireless communication, and even energy-harvesting capabilities directly into films. For U.S. vertical farms and high-value crops, these materials offer superior precision and data collection.

By Deployment Model

Is Traditional Driving the Continued Use of Disposable Agriculture Plastics?

The single-use disposable films segment dominated the market with the largest share in 2024 because they fit traditional U.S. farming practices. Farmers were used to applying mulch films at planting and discarding them after harvest. The simplicity and low cost of single-use plastics kept adoption high, especially for large-scale row crops.

The compostable / in-soil biodegrading films segment is expected to grow at a significant rate because they solve the waste problem without disrupting farming practices. Farmers won't need to collect or dispose of plastics, as these films naturally break down into the soil. They align with U.S. sustainability policies and help farms meet organic certification requirements.

Recent Developments

- For instance, in 2024, the report published by Hansen Plastics, which the company is actively transforming its custom plastic manufacturing, will provide a solution according to the customer's needs in the United States.(Source : www.hansenplastics.com)

Top Companies list

- Arable Labs

- Berry Global, Inc.

- BASF SE

- Coveris / agricultural films divisions

- Dow / Corteva-related film & polymer solutions

- DuPont de Nemours

- Ginegar

- Invengo / RFID hardware partners

- John Deere

- Metalcraft

- NatureWorks LLC

- Novamont

- Netafim

- Taghleef Industries

- Walki / specialty film divisions

Segment Covered

By Product Type / Offering

- Biodegradable mulch films & biodegradable agricultural films

- Conventional (PE/LDPE/LLDPE) mulch & greenhouse films (UV-stabilized/photo-selective)

- Sensor-embedded films & sensor strips (moisture/temperature/CO₂ proxies)

- Controlled-release polymer coatings (fertilizer, bioactive, pheromone dispensers)

- Seed/soil polymer coatings (water-retentive, inoculant carriers)

- Conductive/printed-trace plastics & flexible substrates for IoT attachment

By Functional Capability

- Moisture-sensing / soil-temperature sensing (embedded probes, passive tags)

- Controlled nutrient/pesticide release (time- or stimulus-triggered polymers)

- UV/thermal/light management (photo-selective, IR-reflective films)

- Biodegradability / compostable performance (certified degradable films)

- Traceability & identification (RFID/NFC-tagged plastic markers)

- Conductive pathways for distributed sensing/actuation (printed electronics)

By Application / Use-Case

- Open-field row crops (vegetables, melons, berries) — mulch & sensor strips

- High-value horticulture & specialty crops (greenhouse/hoophouse films)

- Orchards & vineyards (protective films, tree wraps, traceable tags)

- Controlled-environment agriculture / vertical farms (specialty films, sensor substrates)

- Nurseries & transplant production (plug-tray films, germination coatings)

By Material / Resin Type

- Conventional polyolefins (LDPE/LLDPE/HDPE) with additives (UV stabilizers, slip agents)

- Biopolymers & PLA/PHAs (commercial compostable agricultural films)

- Biodegradable PBAT blends and Mater-Bi type formulations

- Composite films (multi-layer coextruded for barrier and strength)

- Conductive/printable polymer substrates (PET, flexible laminates)

By Technology Integration / Enablers

- Embedded low-power sensors (passive/active moisture or temperature sensing)

- RFID / NFC / passive sensor tags laminated into plastics for traceability

- Printed electronics / conductive ink traces on films for distributed sensing

- Controlled-release chemistries (microencapsulation, polymer matrices)

- Cloud/edge integration & analytics (platforms receiving film/sensor telemetry)

By Deployment Model / Product Life-cycle

- Single-use disposable films (traditional mulch) with recovery or landfill disposal

- Compostable / in-soil biodegrading films (no-collection lifecycle)

- Reusable / multi-season modular plastic components (tunnel covers, frames)

- Service models (film-as-a-service, sensor-and-analytics subscriptions)