Content

U.S. Plastics Market Size | Top Companies Analysis

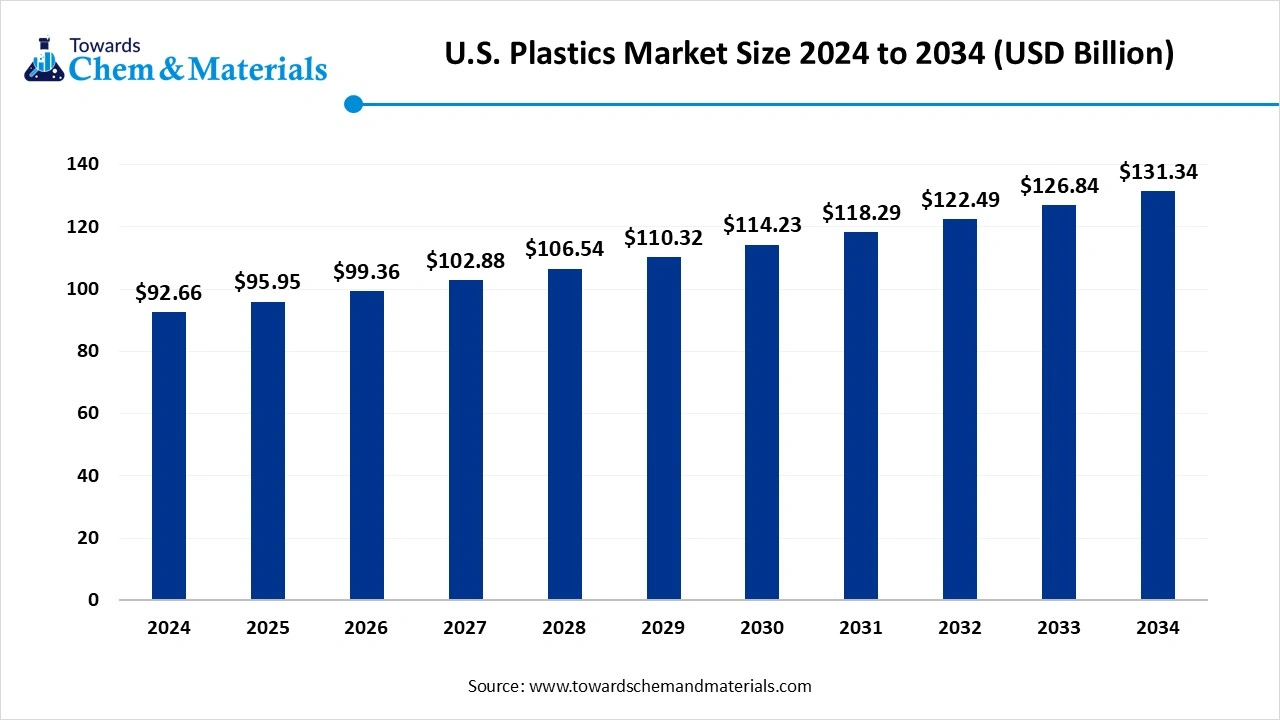

The U.S. plastics market size was reached at USD 92.66 billion in 2024 and is expected to be worth around USD 131.34 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.55% over the forecast period 2025 to 2034. The growing expansion of the packaging industry, rising construction activities, and the rise in electric vehicles drive the market growth.

Key Takeaways

- By polymer type, the polyethylene segment held approximately a 30% share in the U.S. plastics market in 2024 due to the ease of processing.

- By polymer type, the polypropylene segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing manufacturing of components.

- By source, the petrochemical-based plastics segment held approximately 85% share in the market in 2024 due to the high availability of feedstocks.

- By source, the bio-based & bio-degradable plastics segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing environmental concerns.

- By processing technology, the injection molding segment held approximately 35% share in the market in 2024 due to the growing mass production.

- By processing technology, the 3D printing/additive manufacturing segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing customization of products.

- By end-use industry, the packaging & consumer goods segment held approximately 42% share in the market in 2024 due to the rise in online shopping.

- By end-use industry, the automotive & transportation segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growth in electric vehicles.

Role of Plastics in Technology, Medicine, and Beyond in the U.S.

U.S. Plastics is a polymer of long carbon chains, a manmade, versatile material. The plastic is made up of petrochemical-derived polymers like polypropylene, polystyrene, polyethylene, & PVC as well as bio-based & biodegradable polymers. Plastics possess characteristics like lightweight, malleability, and durability. The different types of plastics are thermosetting plastics and thermoplastics. Plastics moulded into various shapes and resistant to many chemicals.

The growing industries like construction, healthcare, textiles, consumer goods, packaging, automotive, electrical & electronics, and agriculture increase demand for plastics. Factors like technological innovations in polymer recycling & chemistry, regulatory pressure on single-use plastics, development of sustainable plastic solutions, strong demand for durable & lightweight materials, rising applications in healthcare applications, and advancements in recycling technologies contribute to the growth of the U.S. plastics market.

- The United States exported 2,505,540 shipments of plastic.(Source: www.volza.com)

- The United States exported $3.65B of self-adhesive plastics in 2023.(Source:oec.world)

- The United States exported 9,519 shipments of medical plastics. (Source: www.volza.com)

- Amazon.com Services Inc. is the leading supplier of plastic in the United States.(Source: www.volza.com)

Growing Construction Activities Drive Plastics Market in the U.S.

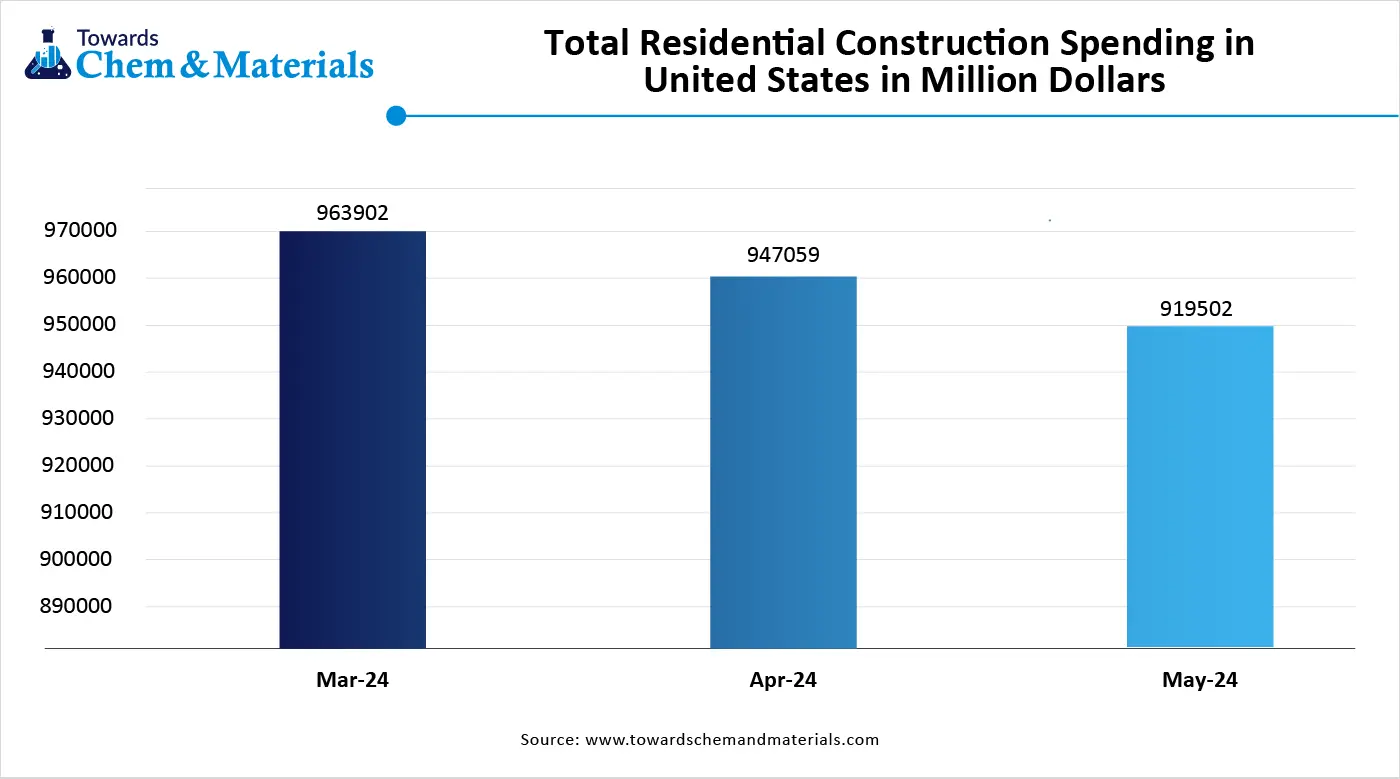

The rapid urbanization and growing construction activities in the United States increase demand for plastic for the production of various construction materials. The growing government investment in infrastructure development, like transportation systems, roads, and others, increases demand for plastics. The growing residential and commercial construction activities increase demand for plastics.

The manufacturing of lightweight construction materials and the focus on reducing labor costs increase demand for plastics. The increasing production of various products like sheets, architectural components, pipes, and cables increases demand for plastics. The focus on extending the lifespan of buildings and lowering energy consumption increases demand for plastics. The growing construction activities are a key driver for the growth of the U.S. plastics market.

Market Trends

- Growth in E-Commerce: The growing online shopping and expansion of e-commerce in the United States increases demand for packaging that requires plastics.

- Growing Electronics Industry: The growing adoption of electronic devices like smartphones, wearables, computers, and laptops, and increasing miniaturization of electronics, increases demand for plastics.

- Rise in Electric Vehicles: The growth in electric vehicles increases demand for plastics for manufacturing electrical components, interior trims, battery systems, dashboards, and body panels, which helps to reduce vehicle weight.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 95.95 Billion |

| Expected Size by 2034 | USD 131.34 Billion |

| Growth Rate from 2025 to 2034 | CAGR 3.55% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Polymer Type, By Source, By Processing Technology, By End-Use Industry |

| Key Companies Profiled | ExxonMobil Chemical, Dow, Inc., Chevron Phillips Chemical Co., LLC, Westlake Chemical, DuPont, Celanese Corporation, Eastman Chemical Company, Huntsman International LLC, RTP Company |

Market Opportunity

Growing Expansion of Healthcare in Surge Demand for Plastics

The growing expansion of healthcare and advancements in healthcare applications in the United States increase demand for plastics. The increasing prevalence of chronic diseases increases demand for plastics for the development of drug delivery systems, medical devices, and implants. The increasing manufacturing of diagnostic kits, gloves, and masks increases the adoption of plastics.

The ongoing advancements in healthcare, like personalised implants and 3D-printed medical devices, increase demand for plastics. The increasing utilization of surgical tools and the development of medical devices like respirators, catheters, & others increases demand for plastics.

The rising awareness about hygiene and increasing demand for single-use medical items increases the demand for plastics. The growing expansion of healthcare creates an opportunity for the growth of the U.S. plastics market.

Market Challenge

Growing Environmental & Health Concerns Limit the Expansion of the Market

Despite several applications of plastic in various industries, the growing environmental concerns restrict the market growth. The growing climate change issues and increased greenhouse gas emissions increase plastic pollution. Plastic increases air, water, & soil pollution, and plastic production processes release harmful chemicals like Bisphenol & phthalates into the environment. Plastic creates harm to terrestrial and marine ecosystems.

The growing utilization of plastics causes health concerns like neurotoxicity, reproductive issues, and obesity. Plastic causes chronic inflammation and spreads waterborne diseases. The growing environmental & health concerns hamper the growth of the U.S. plastics market.

Country Insights

South U.S. Plastics Market Trends

The South region dominated the U.S. plastics market in 2024. The strong industrial base and favorable regulatory environment increase demand for plastics. The high rate of exporting finished plastic products and a port for importing raw materials help the market growth. The growing access to raw materials increases the production of plastics. The growing sectors like healthcare, e-commerce, automotive, construction, and packaging increase the adoption of plastics, driving the overall growth of the market.

West U.S. Plastics Market Trends

The West region is experiencing the fastest growth in the market during the forecast period. The rapid urbanization and growing construction activities increase demand for plastics for the production of insulation, piping, and many other products. The rise in e-commerce and the growing expansion of packaging increases demand for plastics.

The focus on reducing carbon emissions and enhancing the fuel efficiency of vehicles increases the adoption of plastics. The strong government support for recycling and the growing electronic industry increases demand for plastic, supporting the overall growth of the market.

Segmental Insights

Polymer Type Insights

Why did the Polyethylene Segment Dominate the U.S. Plastics Market?

The polyethylene (PE) segment dominated the U.S. plastics market in 2024. The ease of processing and strong focus on recyclability increase the adoption of polyethylene. The growing production of bags, pipes, films, and containers increases demand for polyethylene. The growing consumption of packaged beverages and food increases demand for PE. The increasing manufacturing of lightweight vehicle components and the rise in e-commerce increase demand for PE, driving the overall growth of the market.

The polypropylene (PP) segment is the fastest-growing in the market during the forecast period. The increasing production of various food & beverage packaging, like wraps and films, increases demand for PP. The rise in online shopping and a strong focus on reducing vehicle weight increases demand for PP. The increasing manufacturing of components like door assemblies, interior trims, and others increases demand for PP. The growing industries like medical, automotive, construction, and packaging increase the adoption of PP, supporting the overall growth of the market.

Source Insights

How the Petrochemical-Based Plastics Segment Held the Largest Share in the U.S. Plastics Market?

The petrochemical-based plastics segment held the largest revenue share in the U.S. plastics market in 2024. The increasing production of lightweight construction material and packaging material increases demand for petrochemical-based plastics. The growing automotive sector and increasing infrastructure development increase demand for petrochemical-based plastics. The high availability of feedstocks and the growing production of household appliances increase demand for petrochemical-based plastics, driving the overall growth of the market.

The bio-based & biodegradable plastics segment is experiencing the fastest growth in the market during the forecast period. The growing environmental concerns and stringent regulations, like a ban on single-use plastics, increase the adoption of bio-based or biodegradable plastics. The increasing demand for sustainable packaging solutions increases the development of bioplastics. The focus on improving the fuel efficiency of vehicles and the development of lightweight components increases demand for biodegradable plastics. The growing demand for bio-based plastics across applications like household appliances and electronic casing supports the overall growth of the market.

Processing Technology Insights

What Made the Injection Molding Segment Dominate the U.S. Plastics Market?

The injection molding segment dominated the U.S. plastics market in 2024. The growing mass production of plastic and the low cost of production increase demand for injection molding. The complex part of manufacturing and modernization in product design increases demand for injection molding. The growing production of lightweight plastic material for industrial and consumer use increases the adoption of injection molding. The focus on minimizing waste and increasing the manufacturing of medical devices, consumer goods, and other products increases the adoption of injection molding, driving the overall growth of the market.

The 3D printing/additive manufacturing segment is the fastest-growing in the market during the forecast period. The strong focus on customization of products and creating unique designs of products increases demand for 3D printing. The need for rapid prototyping and focus on reducing the need for traditional tooling increases demand for 3D printing. The growing manufacturing of consumer products, medical devices, automotive components, and prosthetics increases demand for additive manufacturing, supporting the overall growth of the market.

End-Use Industry Insights

Which End-Use Industry Held the Largest Share in the U.S. Plastics Market?

The packaging & consumer goods segment held the largest revenue share in the U.S. plastics market in 2024. The rise in online shopping and the growing expansion of e-commerce increase demand for packaging. The growth in the ready-to-eat meals and the growing consumption of packaged foods increases demand for plastics. The growing demand for consumer goods like household goods, personal care, toys, outdoor furniture, hygiene, and other products increases the adoption of plastics. The growing demand for packaging across applications like medicines, cosmetics, personal care, and hygiene products drives the overall growth of the market.

The automotive & transportation segment is experiencing the fastest growth in the market during the forecast period. The focus on reducing vehicle weight and enhancing the fuel efficiency of vehicles increases demand for plastics.

The growing need for lightweight vehicle materials and the rise in electric vehicles increases demand for plastics. The growing manufacturing of automotive components like dashboards, grilles, and spoilers increases the adoption of plastics. The stringent emission regulations and increasing complexity in vehicle parts increase demand for plastics, supporting the overall growth of the market.

U.S. Plastics Market Value Chain Analysis

- Feedstock Procurement: The feedstock procurement for plastics includes the sourcing of raw materials like coal, crude oil, bio-based materials, and natural gas to produce new plastics.

- Chemical Synthesis and Processing: The chemical synthesis and processing involve the processing of plastic, monomer production, polymerization, and pelletization.

- Quality Testing and Certification: The quality testing involves the evaluation of the durability, safety, strength, and thermal properties of plastics, and certification includes NSF/ANSI Standards, GRS & RCS, BIS, ISCC PLUS, and ISO.

Recent Developments

- In May 2025, Plastic recycling startup, Green Recycle USA LLC, launched in Pittsylvania. The company aims to lower industrial plastic waste and develop a sustainable plastic solution. The startup focuses on recycling annually 2000 tons of plastic waste and supports sustainability.(Source:www.vedp.org)

- In May 2025, Oroville Flexible Packaging launched Oroflex recycling and plastic packaging solution in the U.S. The solution is available for foodservice and retail applications. The solution offers features like customization, recycling, comprehensiveness, and domestic manufacturing.(Source: www.businesswire.com)

- In February 2024, BASF launched its recycled plastics initiative ChemCycling in the United States. The recycling supports the circular economy and focuses on utilizing more plastic waste. The recycled plastic is used in applications like construction, packaging, and automotive.(Source: www.indianchemicalnews.com)

U.S. Plastics Market Top Companies

- ExxonMobil Chemical

- Dow, Inc.

- Chevron Phillips Chemical Co., LLC

- Westlake Chemical

- DuPont

- Celanese Corporation

- Eastman Chemical Company

- Huntsman International LLC

- RTP Company

Segments Covered

By Polymer Type

- Polyethylene (PE – LDPE, LLDPE, HDPE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS) & Expanded Polystyrene (EPS)

- Polyethylene Terephthalate (PET)

- Polycarbonate (PC)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyurethane (PU)

- Others (Nylon, PMMA, etc.)

By Source

- Petrochemical-Based Plastics

- Bio-Based & Biodegradable Plastics

By Processing Technology

- Injection Molding

- Extrusion

- Blow Molding

- Rotational Molding

- Compression Molding

- Thermoforming

- 3D Printing / Additive Manufacturing

By End-Use Industry

- Packaging & Consumer Goods

- Building & Construction

- Automotive & Transportation

- Electrical & Electronics

- Healthcare & Medical

- Textiles & Fashion

- Agriculture

- Industrial & Machinery