Content

What is the U.S. Copper Market Size?

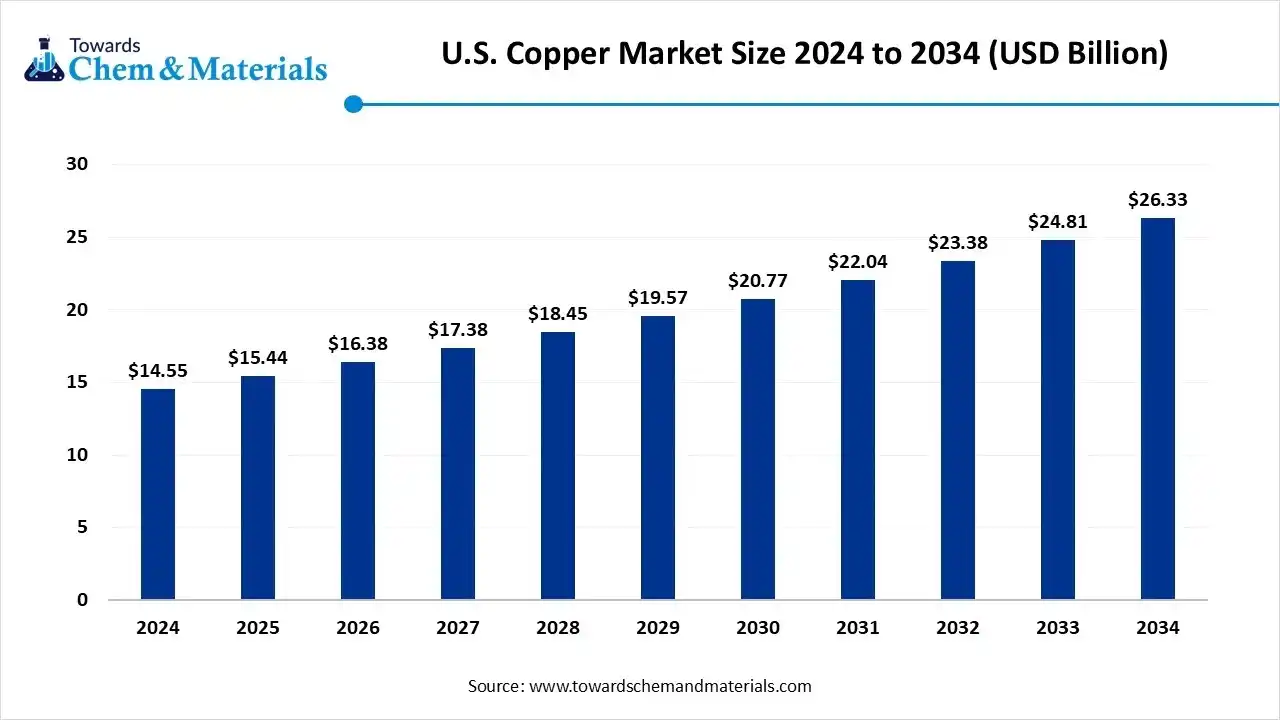

The U.S. copper market size was approximately USD 14.55 billion in 2024 and is projected to reach around USD 26.33 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 6.11% between 2025 and 2034. The market is experiencing notable growth, driven by increasing demand across various industries. As key sectors continue to rely on copper for applications ranging from electrical wiring to construction, the market is poised for sustained expansion. This trend reflects a robust interest in copper's properties and its essential role in technological advancements.

Key Takeaways

- By product type, the primary copper segment held the largest share of the market at approximately 62% in 2024.

- By product type, the secondary copper segment is expected to grow at the fastest rate during the forecast period.

- By product form, the wire segment held the largest market share of approximately 61.7% in 2024.

- By product form, the flat rolled products segment is expected to grow at the fastest rate during the forecast period.

- By application, the electrical segment held the largest share at approximately 60% in 2024.

- By application, the building & construction segment is expected to grow at the fastest rate during the forecast period.

- By end user industry, the construction segment held the largest share at approximately 32% in 2024.

- By end user industry, the industrial equipment segment is expected to grow at the fastest rate during the forecast period.

Market Overview

The U.S. copper market refers to the production, processing, and consumption of copper and copper-based products across various forms, applications, and industries within the United States. The market encompasses both primary (mined) and secondary (recycled) copper, serving sectors such as electrical, construction, transportation, industrial machinery, and consumer goods.

Growth in the U.S. copper market is being impelled by accelerating electrification, grid modernization, and surge demand for electric vehicles and renewable energy infrastructure. Copper’s unrivalled electrical and thermal conductivity makes it an indispensable material for power transmission, EV motors, and charging infrastructure, thereby elevating its strategic importance in decarbonization agendas.

Domestic production, recycling streams, and import dynamics interact to supply a market that is simultaneously critical and geopolitically sensitive. Price volatility and inventory cycles influence capital allocation across mining, smelting, and fabrication tiers. Policy incentives for clean energy and infrastructure spending act as demand multipliers, while environmental and permitting hurdles shape supply-side responsiveness. Consequently, the market occupies a judicious balance between industrial necessity and strategic supply-chain stewardship.

- In September 2025, US Copper, referred to as the Company, has announced a planned non-brokered private placement intended to raise up to $750,000 through the issuance of up to 7,500,000 units priced at $0.10 each (with each unit consisting of one common share and one warrant) (the "Offering"). Holders of each full warrant will have the right to buy one common share for $0.15 anytime within a two-year period following closing. All securities issued under this private placement will be subject to a hold period of four (4) months. The completion of the Offering depends on obtaining all necessary regulatory approvals as well as the consent of the TSX Venture Exchange.(source: investingnews.com )

Market Outlook

- Industry Growth Overview: Industry growth is being driven by three interlocking vectors structural demand from electrification, investment in grid upgrades and EV charging networks, and expanding downstream fabrication for high value coppe components. Fabricators and wire-rod suppliers are scaling capacity to service electric motor and transformer demand, while recyclers invest in sophisticated sorting and refining. Nevertheless, growth is uneven; capital-intensive mining projects take long lead times, whereas recycling and smelting can scale more rapidly. The sectors expansion therefore, blends near-term substitution with long-term supply side projects.

- Sustainability Trends: Sustainability is central: low-carbon copper production, energy-efficient smelting, and expanded recycling are now board-level priorities. Firms increasingly report lifecycle carbon footprints and pursue renewable-powered smelting to reduce Scope 1 emissions. Circular-economy practices urban mining of end-of-life cables and electronics are gaining traction as a lower-carbon source of refined copper. Simultaneously, stricter environmental permitting and community consent processes are shaping project viability and timelines.

- Major Investors: Capital flows into the sector from diversified sources: strategic miners, private equity funds seeking industrial plays, infrastructure investors targeting long-duration cash flows, and corporate offtake partners securing future supply. Public investment vehicles and green infrastructure funds also back downstream processing and recycling assets.

- Startup Economy: A modest but innovative startup cohort focuses on urban mining, advanced sorting, solvent-extraction-electrowinning (SX-EW) process optimisation, and alloy innovation for lighter-weight copper applications. These ventures often partner with incumbent smelters or automakers for pilots and scale-up.

Key Technological Shifts in the U.S. Copper Market

The U.S. copper market is witnessing a major technological transformation driven by automation, digitization, and sustainability-focused mining practices. The adoption of advanced extraction technologies such as solvent extraction-electrowinning (SX-EW) has improved recovery efficiency and reduced waste generation. Artificial intelligence (AI) and predictive analytics are now used in smelting and refining plants to optimize energy consumption and detect equipment anomalies early.

Furthermore, the integration of Internet of Things (IoT) systems in mining operations enhances real-time monitoring of ore grades and safety conditions. Electrification of mining machinery and the introduction of renewable-powered smelting units are reducing carbon footprints. These advancements are aligning the U.S. copper sector with the broader green economy transition while maintaining high productivity and global competitiveness.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 16.38 Billion |

| Expected Size by 2034 | USD 26.33 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.11%% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type, By Product Form, By Application, By End-Use Industry |

| Key Companies Profiled | Lundin Mining Corporation , First Quantum Minerals Ltd. , Antofagasta PLC , Anglo American plc , BHP , Glencore , Aurubis AG , Mueller Industries , Cambridge-Lee Industries LLC , KME Group SpA , Luvata , Cerro Flow Products LLC , American Elements |

Trade Analysis Of the U.S. Copper Market: Import & Export Statistics

- The major export destinations United States' Refined Copper are Mexico ($1.55B), Canada ($120M), Germany ($45.7M), Netherlands ($44.4M), and Malaysia ($43.1M) in 2024.(Source : oec.world)

- The major export destinations United States' raw copper are Canada ($436M), South Korea ($9.95M), Malaysia ($2.86M), Italy ($1.26M), and France ($1.03M) in 2024.

- The United States majorly exports raw copper from Malaysia ($191k), South Korea ($54k), China ($16.2k), and Germany ($5.54k) in 2025. (source: oec.world )

U.S. Copper Market: Value Chain Analysis

Chemical Synthesis and Processing: In copper refining, chemical processes are vital for achieving high purity and performance standards. The SX-EW process involves dissolving copper ore in an acid solution, extracting it with an organic solvent, and then plating it onto cathodes through electrolysis. This method is energy-efficient and environmentally safer than traditional pyrometallurgy.

In smelting, fluxing agents and reducing chemicals help separate impurities from molten copper. Advanced chemical additives are also used to enhance cathode smoothness and conductivity. Continuous research focuses on reducing reagent consumption and improving recovery from low-grade ores. As a result, chemical synthesis remains a core technological pillar of copper processing in the U.S.

Raw Material Sourcing: The U.S. sources its primary copper ore from major mining regions in states like Arizona, Utah, New Mexico, and Nevada. These regions provide large-scale deposits of chalcopyrite and bornite, which are processed into concentrates before smelting.

Secondary sourcing through scrap recycling is becoming increasingly important, as it supports circular economy goals and reduces dependence on mining. Recycled copper retains full conductivity and quality, making it a valuable supplement to primary supply. The country also imports limited quantities of copper concentrates from South America to balance domestic demand. Sustainable sourcing practices now emphasize responsible mining, efficient water use, and reduced environmental impact throughout the supply chain.

Landscape And Companies Where Raw Copper Is Used After Export

| Country | Company | Aim | Main Origin |

| U.S. | Tesla | Equipment for electrical lighting and signaling | Mexico |

| China | General Motors | Parts and accessories | China |

Tesla Exports and Imports | The Observatory of Economic Complexity

General Motors Exports and Imports | The Observatory of Economic Complexity

Market Dynamics

Market Opportunity

Circular Copper: Value from Waste

The most compelling opportunity lies in scaling recycling and urban-mining infrastructures to recover high-value copper from end-of-life electronics, cables, and vehicles. Circular approaches reduce dependence on virgin ore, lower lifecycle emissions, and create localised supply resilience. Innovations in hydrometallurgy and automated sorting can unlock previously uneconomical scrap streams. Downstream, alloy innovation and component redesign for recyclability amplify value capture. Finance models that blend private capital with public incentives for recycling facilities could accelerate deployment. Thus, circularity offers both environmental returns and stable commercial margins.

Market Restraint

Permitting and Upstream Lead-Time Drag

A salient restraint is the protracted lead times and regulatory bottlenecks associated with new mine development and capacity expansion. Environmental assessments, community consultation, and lengthy permitting processes delay primary supply responses to demand surges. Capital intensity and commodity-price cyclicality deter rapid greenfield investments, leaving the market reliant on incremental recycling and marginal production increases. Logistics and concentrate supply also create chokepoints, particularly for domestic smelters that depend on imported concentrates. Thus, while demand pressures intensify, supply-side agility is constrained by structural and regulatory frictions.

Segmental Insights

Product Type Insights

Why Primary Copper Segment Is Dominating The U.S. Copper Market?

The primary copper segment dominate the market holding a share of 62% in 2024, driven by the increasing demand for high-quality copper products. As industries expand their electrification and electrical infrastructure, the need for mined copper remains critical. Primary copper, acquired through mining operations, provides the foundation for various applications, including construction, electrical wiring, and renewable energy technologies. With advancements in mining techniques and a heightened focus on sustainability, the production of primary copper is becoming more efficient, reducing environmental impact.

Moreover, the geopolitical landscape influences the sourcing and supply chains associated with primary copper, making it crucial for the U.S. to secure reliable domestic production. In this context, primary copper not only meets current industry demands but also positions itself as a strategic asset for future technological developments.

The secondary copper segment expects the fastest growth in the U.S. copper market during the forecast period, as it currently complements rather than competes with primary copper. The recycling sector is essential for sustainability but faces challenges, including the need for sophisticated sorting technologies and efficient processing methods. As the market evolves, enhancing the supply chain for recycled copper is becoming increasingly important. The interplay between primary and secondary copper production will likely shape future market dynamics, with both sectors needing to innovate to meet environmental goals. This balance is vital as the global push toward decarbonization intensifies and demands higher copper usage in green technologies. Ultimately, the continued dominance of primary copper will depend on its ability to adapt to market trends while supporting emerging initiatives in sustainability.

Product Form Insights

Why Wire Segment Dominating The U.S. Copper Market?

The wire segment is dominating the market with share of 61.7% in 2024, as it serves as the lifeblood of electrical and electronic applications. Its ubiquity is anchored in its unmatched conductivity, ductility, and reliability across a spectrum of uses from grid transmission lines to EV motors. Copper wire underpins the modern electrification narrative, enabling both energy efficiency and functional resilience. Demand from residential and commercial construction, coupled with infrastructure upgrades, continues to underpin robust volumes. Wire’s commanding share reflects not only utility but also an enduring alignment with the megatrends of urbanization and digitalization. Quite literally, it is the silent conduit of modern progress.

Yet the segment’s strength also conceals challenges. Rising copper prices inflate input costs for cable and transformer manufacturers, who in turn seek efficiency gains through lightweighting and alloy innovations. Recycling plays a key role in sustaining wire production, as end-of-life cables provide a ready secondary feedstock. The rise of high-voltage EV charging networks, data centers, and renewable installations further amplifies demand for copper wire. In the years ahead, this segment is set to grow not just in volume but also in technical sophistication, with insulated and high-temperature wires gaining traction. Copper wire, therefore, epitomises both continuity and innovation.

Flat rolled products segment expects the fastest growth in the U.S. copper market during the forecast period, These products, encompassing sheets, strips, and plates, are essential in industries ranging from electronics to architectural applications. Their increasing adoption is driven by the miniaturization of electronic devices and the demand for lightweight yet durable materials. Solar panels, electric vehicles, and advanced machinery all require flat rolled copper for precision components. Growth is further catalyzed by downstream innovations that enhance strength, corrosion resistance, and fabrication versatility. As such, flat rolled products represent the cutting edge of copper’s industrial evolution.

The appeal of flat rolled copper lies not only in functionality but also in versatility across end-user domains. Architectural uses such as roofing, cladding, and decorative panels benefit from copper’s aesthetic longevity, while electronics demand ultra-thin foils with impeccable conductivity. Manufacturers are investing in modern rolling mills and digital quality control to meet rising precision requirements.

Additionally, flat rolled copper plays a pivotal role in emerging applications such as printed circuit boards and thermal management in electric vehicles. The confluence of utility, design adaptability, and technological relevance positions this sub-segment as a robust growth driver. Its ascent underscores copper’s expanding role in both functional and aesthetic spheres.

Application Insights

Why Electrical Segment Dominating The U.S. Copper Market?

Electrical segment account for 60% of the market in 2024, underscoring the metal’s unrivalled role as the conductor of electrification. Copper is indispensable in power transmission cables, transformers, switchgear, and motors, making it the backbone of modern energy systems. The surge in EV adoption and renewable integration only amplifies copper’s indispensability in high-voltage and high-efficiency applications. this segment represents the most technologically sensitive use of copper. Demand is non-sustainable at scale, given copper’s unique conductivity and reliability. Thus, electrical applications stand as the defining pillar of copper consumption.

Yet, electricity engineering plays a crucial role in developing and maintaining modern technology. It encompasses the design and application of electrical systems, ranging from power generation to communication networks. The demand for skilled professionals in this field continues to grow as industries increasingly rely on electricity and electronic devices. Innovations such as renewable energy sources and smart grid technology are reshaping the landscape of electrical engineering. Additionally, electrical engineers focus on improving energy efficiency and reducing emissions, contributing to sustainability efforts. Overall, this dynamic field offers exciting opportunities for those interested in shaping the future of technology and infrastructure.

The building and construction segment expects the fastest growth in the U.S. copper market during the forecast period, followed by both infrastructure upgrades and urban expansion. Copper’s strength, corrosion resistance, and antimicrobial properties make it ideal for plumbing, HVAC, roofing, and cladding systems. The boom in sustainable building practices also favors copper, given its recyclability and durability. Demand is further supported by government-backed infrastructure modernization programs that embed copper into public utilities and smart cities. This position constructed as not just a consumer of copper but also a driver of long-term demand resilience. Its trajectory reflects the broader evolution of urban living.

Moreover, construction applications highlight copper’s dual role as both functional and aesthetic. Decorative uses in modern architecture underscore the mental ability to blend durability with design, while functional uses in water systems and wiring remain indispensable. Growth in this segment also derives from residential retrofits and green building certifications that prioritize durable, recyclable materials. With rising populations and urbanization, demand for copper-intensive construction elements is poised to escalate further. Thus, while the electrical segment dominates in share, construction represents the sector with most dynamic momentum. Copper’s indispensability in the built environment ensures its centrality in shaping tomorrow’s cities.

End User Industry Insights

Why Construction Segment Dominating The U.S. Copper Market?

The construction segment is dominating by holding the share of 32% in the market in 2024, industries, consuming nearly one-third of total copper demand. From wiring to plumbing to architectural features, copper is woven into the fabric of residential, commercial, and civic infrastructure. Its durability, recyclability, and antimicrobial properties enhance its desirability in modern sustainable building practices. Infrastructure revitalization programmes in urban centers further amplify copper’s demand trajectory. This segment also benefits from demographic and economic trends, including housing demand and smart city development. In sum, construction is copper’s must consistent and structural anchor.

Nonetheless, the construction sector’s demand for copper is not static but evolving. Increasingly stringent environmental standards compel builders to prefer materials with long lifecycles and recyclability, amplifying Cooper’s appeal. Beyond functional uses, architects are re-embracing copper for aesthetic facades and design longevity. This creates a dual demand profile, commodity volume for functional use and premium demand for design-driven applications. As construction pivots toward greener paradigms, copper’s role will only deepen. It remains a material of both necessity and distinction in this sector.

Industrial equipment segment expects the fastest growth in the U.S. copper market during the forecast period, driven by automation, robotics, and the electrification of manufacturing processes. Motors, turbines, heat exchangers, and machine wiring all rely on copper’s conductivity and resilience. The shift toward energy-efficient equipment amplifies copper intensity, as industries demand high-performance components. Furthermore, advanced manufacturing technologies such as 3D printing and robotics require precision-engineered copper alloys. Growth is particularly strong in high-tech and heavy industrial clusters, where performance and reliability are paramount. Thus, industrial equipment exemplifies copper’s industrial versatility.

The dynamism of this segment is reinforced by macroeconomic imperatives. As industries pursue productivity gains, electrified systems replace older, inefficient mechanical ones, thereby boosting copper demand. Add to this the electrification of logistics and industrial vehicles, and the trajectory becomes even steeper. Companies are also experimenting with copper-based composites for thermal management in high-performance machinery. In this context, copper is no longer a background material but a central enabler of industrial progress. This sub-segment, though smaller today, is fast ascending as a transformative force in copper demand.

Country Insights

How West is Dominating the U.S. Copper Market?

West dominates the regional narrative for market holding a share of 45%, driven by advanced fabrication, and policy emphasis on supply-chain resilience. The United States, as the primary market, combines heavy industrial demand utilities, construction, and EV manufacturing with formidable technological capability in processing and recycling. Domestic firms and integrators are investing in low-emission refining and urban-mining capabilities to meet corporate and regulatory decarbonization targets. Ports, logistics networks, and a mature financial sector also facilitate large-scale commodity flows and project financing. Consequently, North America exerts outsized influence over product specifications, standards, and green premium pricing.

Why is South America the Fastest Growing for the U.S. Copper Market?

South America is witnessing fastest growth in market, primarily due to its rich mineral reserves and increasing production capabilities. Countries like Chile and Peru are enhancing their mining operations, leveraging advanced technologies to boost efficiency and output. The region’s strategic focus on sustainability and environmental regulations aligns well with global demand for responsibly sourced copper. Furthermore, strong investments in infrastructure and electric vehicle (EV) initiatives are driving a surge in copper consumption. As international markets seek reliable supply sources, South America's geopolitical positioning makes it a key player in the global copper industry. Ultimately, the combination of abundant resources and progressive industry practices positions South America at the forefront of the copper market boom.

| United States | Investment is increasingly channeled towards sustainable practices, including renewable-energy-powered smelting processes aimed at reducing Scope 1 emissions. | Companies are prioritizing energy-efficient production methods and transparency in lifecycle carbon footprints, reflecting a shift toward environmentally responsible operations. |

Recent Developments

- In July 2025, the U.S. is set to launch its first significant copper mine in over ten years by 2028; Ivanhoe Electric’s Santa Cruz project in Arizona will focus on producing copper cathodes for the domestic market.(Source: globalflowcontrol.com)

- In October 2025, The U.S. International Development Finance Corp. has formed the Critical Mineral Consortium (CMC) with Orion Resource Partners and Abu Dhabi’s ADQ to boost investment and cooperation in essential minerals and materials.(Source: www.eenews.net)

Market Top Companies

- Freeport-McMoRan (Provide capital for expansion and innovation in copper-related ventures to enhance market growth.)

- Southern Copper Corporation (Target long-term cash flows by funding copper-related infrastructure, fostering sustainable energy solutions.)

- Hudbay Minerals (Secure future copper supply to ensure reliable inputs for manufacturing and production.)

- Kennecott Utah Copper (Rio Tinto) (Support recycling and processing facilities to promote sustainability and circular economy principles.)

- Grupo México (Invest in projects aimed at improving environmental outcomes and enhancing the copper supply chain.)

- Teck Resources (Develop advanced processes for efficiently recovering copper from end-of-life products and electronics.)

- Sumitomo Metal Mining Co., Ltd. (Innovate in urban mining and new technologies to improve copper recovery and processing efficiency.)

Other Top Companies

- Lundin Mining Corporation

- First Quantum Minerals Ltd.

- Antofagasta PLC

- Anglo American plc

- BHP

- Glencore

- Aurubis AG

- Mueller Industries

- Cambridge-Lee Industries LLC

- KME Group SpA

- Luvata

- Cerro Flow Products LLC

- American Elements

- Market Segmentation

By Product Type

- Primary Copper

- Secondary Copper

By Product Form

- Wire

- Rods, Bars & Sections

- Flat Rolled Products

- Tube

- Foil

By Application

- Electrical

- Transportation

- Industrial Machinery

- Consumer & General Products

- Building & Construction

- Infrastructure

By End-Use Industry

- Construction

- Appliances & Electronics

- Power Generation

- Distribution & Transmission

- Industrial Equipment