Content

U.S. Chillers Market Size and Growth 2025 to 2034

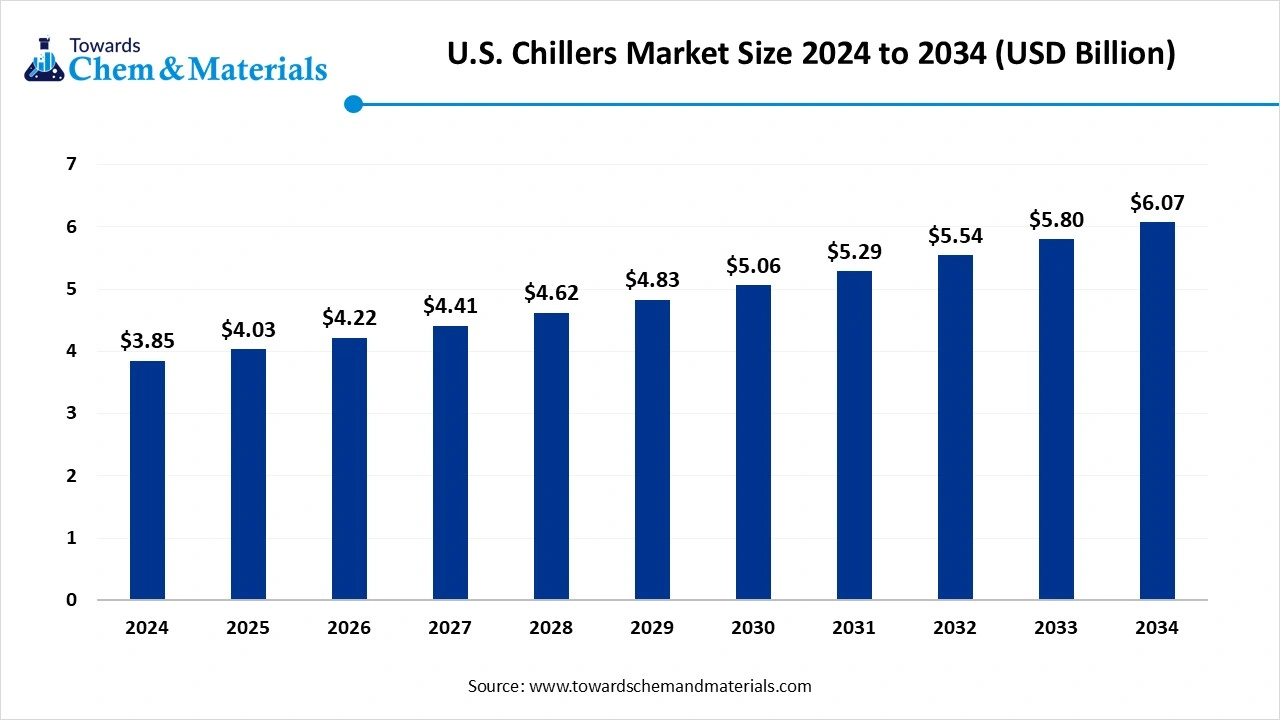

The U.S. chillers market was valued at approximately USD 3.85 billion in 2024 and is projected to grow at a CAGR of 6.25% from 2025 to 2034, reaching a value of USD 6.07 billion by 2034. The increasing need for energy-efficient cooling systems in several spaces has fueled industrial growth in recent years.

Key Takeaways

- By type, the water-cooled segment emerged as top top-performing segment in 2024 due to better efficiency.

- By type, the air-cooled segment is likely to experience notable growth during the forecast period, akin to easy installation with less maintenance.

- By application, the commercial application segment led the market in 2024, owing to high demand from offices, hotels, shopping malls, and hospitals.

- By application, the industrial application segment is projected to grow significantly over the forecast period due to the increased need for heavy-duty cooling systems.

- By compressor, screw chillers segment emerged as leading segment in the U.S. chillers market in 2024 owing its strength and reliability.

- By compressor, scroll chillers are likely to register the fastest growth among all segments during the coming years, akin to energy efficiency and affordability.

U.S. Chillers Market Gains Momentum Amid Rising Tech Facilities Demands

The United States chillers market is expected to see steady growth owing to its wide application in modern infrastructure in the current period. Moreover, several industries are actively seeking efficient cooling systems in the country nowadays, which is contributing to the growth of the market as per the earlier observation. Also, the country's commercial spaces and tech facilities are increasingly demanding advanced temperature control systems in the current period. In this process, technology advances are projected to play a major role in the upcoming period and lead the global consumer base, as expected in the United States.

What is Driving the Growth of the Chillers Industry in the United States?

The increased need for energy-efficient cooling systems is spearheading the U.S. chillers market growth in the current period. Several sectors, such as data centers, factories, buildings, and other commercial sectors, are actively looking for the cost of their electricity bills in the United States, as per the recent observation. By launching smart chillers, the manufacturers are expected to gain a first mover advantage in the country for the future period. Moreover, the United States government is increasingly seen as backing up the green environment initiatives, which is likely to provide substantial advantages for the chillers manufacturers in

Market Trends

- The increasing preferences for eco-friendly and green building development are spearheading the industry growth in the current period. These developers are increasingly observed as installing this type of chiller or the low-emission refrigerants to save energy and water. The modern standards like LEED and others heavily recommending these types energy energy-efficient chillers and green initiatives.

- The sudden surge in internet service and cloud computing has led to an increasing number of data centers in the United States recently, which provides a heavy consumer base to the chiller manufacturers in the current period. These data centers have been observed as generating a lot of heat and requiring powerful cooling systems in recent years.

- The growing adoption of modular and smart chillers is expected to create beneficial opportunities for manufacturers in the coming years, as the smaller units of modular chillers are seen as providing flexibility and being easily upgradable. Moreover, smart chillers are mainly seen in heavy adoption in the enlarged business infrastructure.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 4.03 Billion |

| Expected Size by 2034 | USD 6.07 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product, By Application, By Compressor |

| Key Companies Profiled | Thermal Care, Inc., Advantage Engineering, Inc., Compressed Air Systems, Inc., Thermal Care, Inc.,Delta Industries, Universal Air & Gas Products (aka Universal Air Products Corp.),Dimplex Thermal Solutions,Ecochillers, Inc., G&D Chillers, Baltimore Aircoil Company, Custom Control Sensors, LLC, Drake Refrigeration, Inc.,Cold Shot Chillers, Thermo Fisher Scientific Inc., American Chillers, Legacy Chillers, Inc.,Chillermen, FLUID CHILLERS, INC., Carrier Global Corporation, TRANE Technologies Plc., Polyscience Inc. |

Market Opportunity

Upgrading Cooling Infrastructure Creates New Opportunities for Manufacturers

The ongoing replacement of old systems in several spaces, such as industrial and commercial, is expected to create lucrative opportunities for U.S. chillers market. Moreover, several industry and commercial spaces are increasingly seen replacing or actively looking for modern cooling systems that are suitable for their modern infrastructure in the current period. Also, several governments in the regions are observed as backing and implementing sustainable and green building initiatives, which are likely to contribute to the chillers market growth during the forecast period.

Market Challenge

High-Tech Cooling Systems Face Resistance from Cost-Conscious Buyers

The high cost of technologically advanced chillers is expected to hamper the U.S. chillers market growth in the upcoming years. In today’s modern era, several small businesses and mid-size commercial places can struggle to afford this chiller or initial investment in the future. Also, government-released regulations are continuously increasing the cost of technology, which can create further barriers for industry growth in the future. Also, new entrants are likely to face these challenges during the projected period.

Is Energy Efficiency the Key Factor Behind Water–Cooled Chillers?

The water-cooled segment held the largest share of the market in 2024, akin to its efficiency for better working in steady end-use environments and large buildings. Also, in large offices, hospitals, factories, and malls are installing water-cooled chillers in the current period. Having unique properties like lower operating costs and strength has actively contributed to the segment's growth in recent years. Also, nations' commercial and institutional spaces are expected to provide a higher number of consumers to the segment in the future.

The air-cooled segment is seen to grow at a notable rate during the predicted timeframe, owing to unique advantages such as easy installation and less maintenance. This chiller does not require any type of water supply is making it ideal for small institutions and areas where water supply or access is very limited, which is anticipated to contribute to the segmental growth during the incoming years. Moreover, air-cooled chillers have gained immense popularity in mid-size and small business firms, as per the recent observation.

What Makes Commercial Applications the Top Contributor to U.S. Chillers Market?

The commercial application segment held the dominant share of the U.S. chillers market in 2024 due to high demand from offices, hotels, shopping malls, hospitals, and schools. These places need constant cooling to keep people comfortable and equipment running properly. Commercial buildings also focus more on energy savings and system reliability, and chillers are key to managing large-scale cooling. Many buildings are also replacing older systems with modern, energy-efficient chillers. Since the commercial construction industry is large and growing in the U.S., the need for reliable cooling solutions remains strong. This has kept commercial applications as the top contributor to chiller demand in recent years.

The industrial application segment is seen to grow at a notable rate during the predicted timeframe. Factories, food processing plants, chemical facilities, and data centers all need heavy-duty cooling systems. As industries expand and upgrade their equipment, they need chillers to control temperature and protect machinery. Also, strict rules for process cooling and safety will drive demand. The rise in U.S. manufacturing and warehousing will push the need for more chillers in production and storage areas. Industrial applications will likely grow faster than commercial ones as industries adopt smart and energy-saving cooling systems to improve productivity and meet new efficiency standards.

Can Screw Chillers Handle Fluctuating Cooling Loads Better Than Others?

The screw chillers segment held the largest share of the market in 2024 owing to screw chillers are strong, reliable, and work well in medium to large cooling systems. They are often used in hotels, hospitals, and manufacturing plants where the cooling load changes throughout the day. Screw compressors can handle these changes without losing efficiency. They also run more quietly and have fewer moving parts, which means fewer breakdowns. For many years, screw chillers have been the go-to choice for dependable and steady cooling. Their long life and ability to handle larger buildings have helped make screw chillers the most used type in the market.

The scroll chillers segment is expected to grow at the fastest rate in the market during the forecast period. Scroll chillers are compact, energy-efficient, and affordable. They are perfect for small to medium-sized buildings like offices, retail stores, and clinics. Scroll compressors are quieter and easier to maintain than other types. As more businesses and building owners look for low-cost, high-efficiency cooling systems, scroll chillers will become a preferred option. They are also ideal for modular systems where extra units can be added when needed. With new building projects and retrofits focusing on efficiency and cost, scroll chillers are set to play a bigger role in the future U.S. chillers market.

Recent Developments

- In May 2025, Modine increased their production capacity of chillers recently. Also, the reason for this expansion is to serve data centre customers, as per the report published by the company. Also, the company is expected to invest $38 million in this initiative, as per the company's claim. (Source: investors.modine.com )

- In October 2024, Pro Refrigeration introduced its latest cooling solution. Moreover, the newly launched chiller is named the PRO Chiller PRO4 Series, as per the report published by the company. Also, this launch is held at the World Dairy Expo in Madison, Wisconsin. (Source : businesswire.com )

- In April 2024, the G&D Chillers unveiled their latest propane technology in the United States industrial and commercial refrigeration industry environment. Also, the newly launched product line is trialing Elite 290 propane chillers, according to a report published by the company. Moreover, the chillers have unique properties like zero global warming potential and cost-effectiveness. (Source: gdchillers.com)

Top Companies List

- Thermal Care, Inc.

- Advantage Engineering, Inc.

- Compressed Air Systems, Inc.

- Thermal Care, Inc.

- Delta Industries

- Universal Air & Gas Products (aka Universal Air Products Corp.)

- Dimplex Thermal Solutions

- Ecochillers, Inc.

- G&D Chillers

- Baltimore Aircoil Company

- Custom Control Sensors, LLC

- Drake Refrigeration, Inc.

- Cold Shot Chillers

- Thermo Fisher Scientific Inc.

- American Chillers

- Legacy Chillers, Inc.

- Chillermen

- FLUID CHILLERS, INC.

- Carrier Global Corporation

- TRANE Technologies Plc.

- Polyscience Inc.

Segment Covered in the Report

By Product Type

- Water-Cooled

- <50kW

- 51-100kW

- 101-500kW

- 501-1000kW

- 1001-1500kW

- >1501kW

- Air-Cooled

- <50kW

- 51-100kW

- 101-500kW

- 501-1000kW

- 1001-1500kW

- >1501kW

By Application

- Commercial

- Corporate Offices

- Data Centers

- Public Buildings

- Mercantile & Service

- Healthcare

- Others

- Industrial

- Chemicals & Petrochemicals

- Food & Beverage

- Metal Manufacturing & Machining

- Medical & Pharmaceutical

- Plastics

- Others

- Residential

By Compressor

- Screw Chillers

- Centrifugal Chillers

- Absorption Chillers

- Scroll Chillers

- Reciprocating Chillers