Content

Polyolefin Compounds Market Size and Growth 2025 to 2034

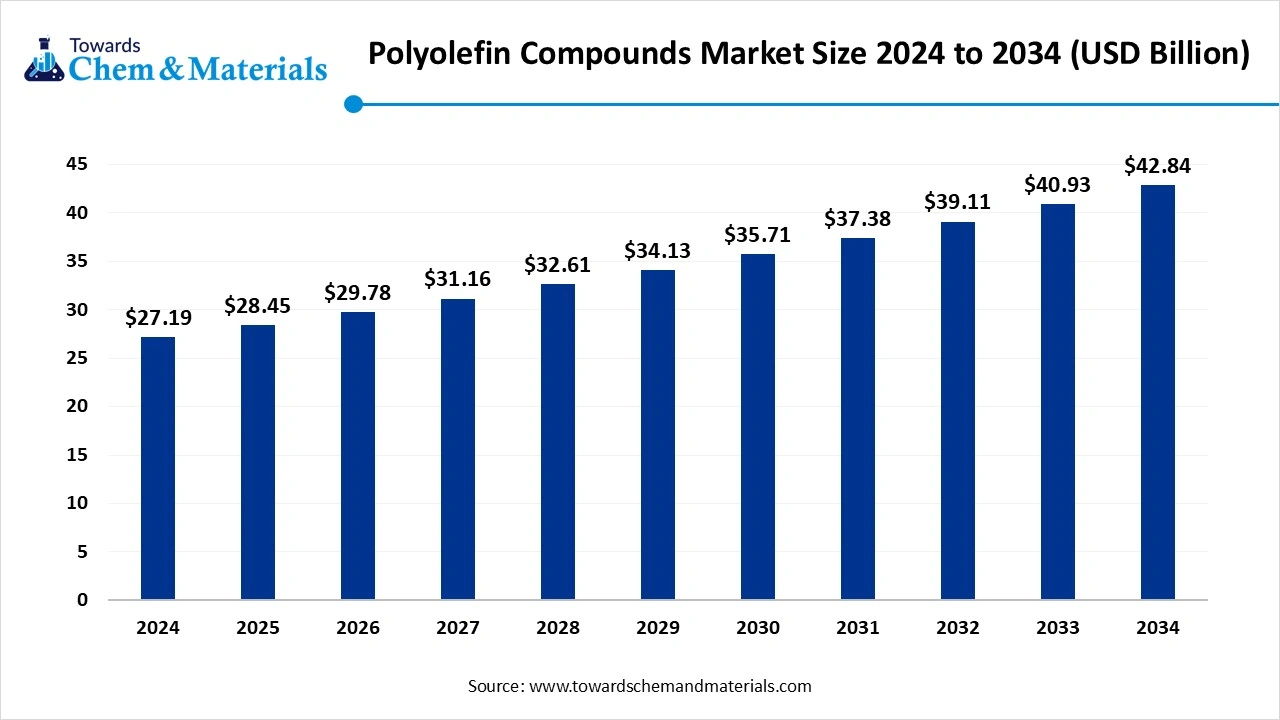

The global polyolefin compounds market size was reached at USD 27.19 billion in 2024 and is expected to be worth around USD 42.84 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.65% over the forecast period 2025 to 2034. Market growth is driven by increasing demand for lightweight and high-performance materials in automotive and transportation, rising use of sustainable and recyclable compounds, and innovations in bio-based and specialty polyolefin compounds.

Key Takeaways

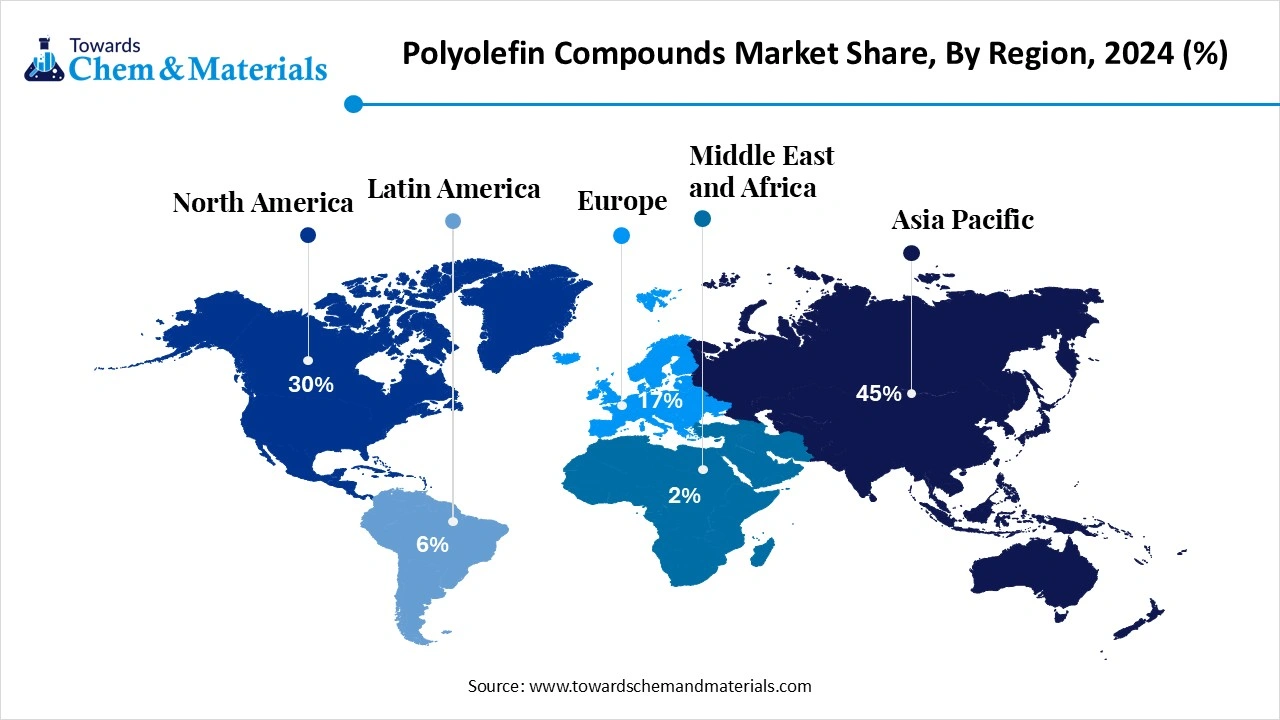

- By region, Asia Pacific dominated the market in 2024. The Asia Pacific region held approximately 45% share in the market in 2024. The growing demand for lightweight materials due to growing industries fuels the growth.

- By region, Europe is expected to have significant growth in the market in the forecast period. The rapid industrialization and urbanization fuel the growth of the market.

- By resin type, the polypropylene compounds segment dominated the market in 2024. The polypropylene compounds segment held approximately 45% share in the market in 2024. The wide use in automotive and the cost effectiveness of the fuel the growth.

- By resin type, the polyolefin elastomers and plastomers segment is expected to grow significantly in the market during the forecast period. The flexibility and softness drive the demand for the market.

- By filler type, the mineral-filled compounds segment dominated the market in 2024. The mineral-filled compounds segment held approximately 35% share in the market in 2024. Thermal resistance and high performance drive the growth of the market.

- By filler type, the glass-fiber reinforced & flame-retardant compounds segment is expected to grow in the forecast period. Increased industrial adoption of advanced lightweight materials fuels the growth of the market.

- By application, the automotive and transportation segment dominated the market in 2024. The automotive and transportation segment held approximately 40% share in the market in 2024. The growing and expanding automotive industry and demand for lightweight materials fuel the growth.

- By application, the healthcare and electricals segment is expected to grow in the forecast period. Durability and flame resistance, and safety regulation drives the growth of the market.

Market Overview

Rising Demand For Durable Materials: Polyolefin Compounds Market To Expand

The polyolefin compounds market refers to the production and application of compounded materials based on polyolefins such as polypropylene (PP), polyethylene (PE), and their blends, often modified with fillers, reinforcements, stabilizers, and additives to enhance performance. These compounds offer versatility, durability, chemical resistance, and lightweight properties, making them suitable for a wide range of industries, including automotive, packaging, construction, electricals, and healthcare.

What Are The Key Growth Drivers That Support The Growth Of the Polyolefin Compounds Market?

Key factors driving the market include the rising demand from the packaging industry for their lightweight, cost-effective, and barrier properties, as well as the automotive sector's focus on lightweighting to enhance fuel efficiency. Additionally, increased consumer need for goods, expansion into healthcare applications driven by non-toxicity and sterilization capabilities, and a surge in infrastructure and construction activities contribute to growth. The growing need for packaging in the food, beverage, pharmaceutical, and personal care sectors is particularly significant.

Polyolefins are popular for their lightweight nature, affordability, and excellent qualities suited for making films, containers, and bags. Moreover, expanding construction and infrastructure projects, especially in emerging markets, boost the demand for polyolefins used in building materials, pipes, and insulation.

Market Trends

- Sustainability and Circular Economy: There is a significant industry emphasis on sustainability, recycling, and eco-friendly solutions.

- Technological Advancements: progress in creating customized compounds and material innovations, especially for 3D printing, is are prominent trend.

- Lightweight Materials: The need for lightweight materials in diverse industries to improve fuel efficiency and cut transportation expenses acts as a major growth driver.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 28.45 Billion |

| Expected Market Size by 2034 | USD 42.84 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.65% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| High Impact Region | Asia Pacific |

| Segment Covered | By Resin Type, By Filler Type, By Application, By Region |

| Key Companies Profiled | ExxonMobil Corporation: (U.S.), LyondellBasell Industries N.V.: (Netherlands), The Dow Chemical Company: (U.S.), Saudi Basic Industries Corporation (SABIC): (Saudi Arabia), Borealis AG: (Austria), INEOS GROUP AG: (U.K.), TotalEnergies SE: (France), Sinopec Corp. (China), Reliance Industries Limited: (India), Formosa Plastics Corporation: (Taiwan), Repsol SA: (Spain), Mitsui Chemicals, Inc. (Japan), Braskem S.A.: (Brazil), RTP Company: (U.S.) |

Market Opportunity

The Growing Application In Various Sectors Creates

The polyolefin compound market is expanding, driven by opportunities in packaging, automotive, and healthcare sectors, thanks to its lightweight, durable, and affordable qualities. The automotive industry’s push for lightweight materials to boost fuel efficiency and lower vehicle weight opens up opportunities for polyolefin compounds in both interior and exterior parts.

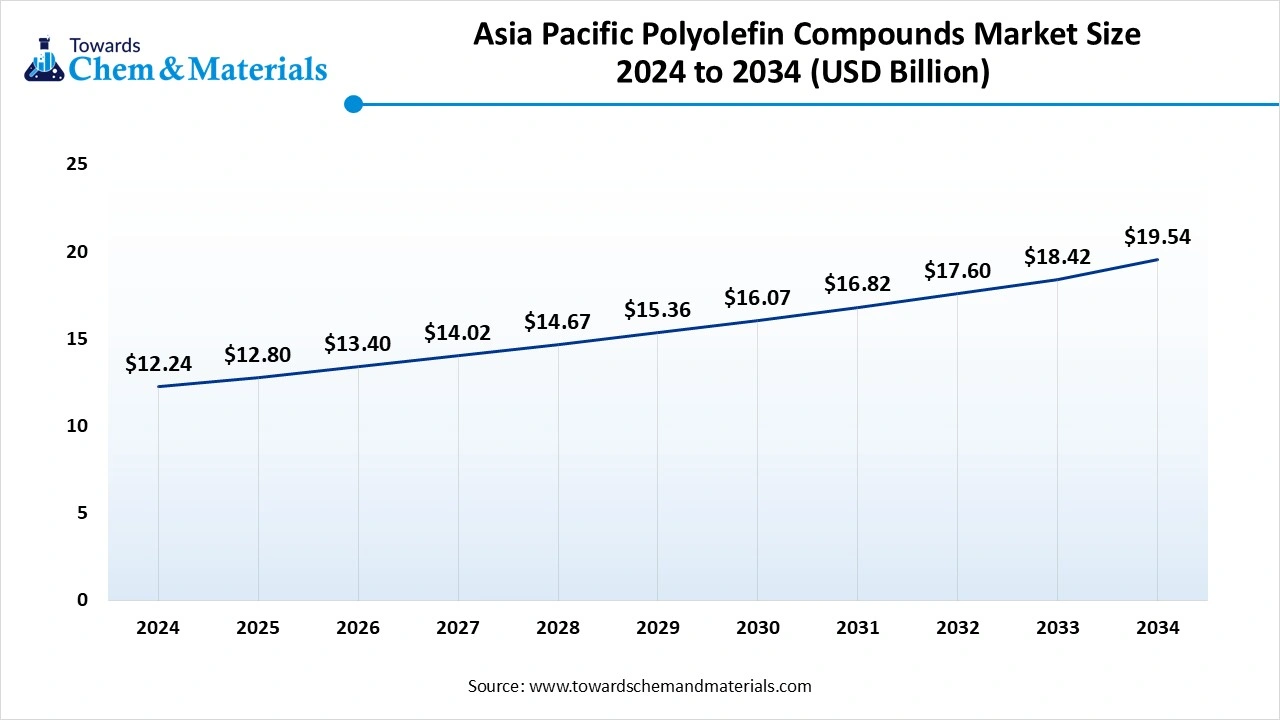

Growing emphasis on hygiene and infection control is increasing demand for polyolefins in medical devices, packaging, and drug delivery systems because of their sterilizability, biocompatibility, and chemical resistance. Major trends include a rising demand for custom compounds, greater use of recycled materials, the growth of e-commerce, and technological innovations that lead to new applications. Geographically, the Asia Pacific, especially China, is expected to experience significant growth due to its robust manufacturing sector and strong domestic demand.

Market Challenge

Cost And Supply Chain Disruption

The market encounters several challenges, including unpredictable raw material prices, especially volatile crude oil and natural gas, which influence costs. Additionally, stricter environmental regulations and concerns over plastic waste complicate operations. Supply chain disruptions further add to these difficulties, while competition from alternative materials such as bioplastics and recycled polymers intensifies the market landscape.

Continuous innovation in production and formulation is essential to meet evolving performance standards and sustainability targets. Since polyolefins originate from crude oil and natural gas, their prices are directly impacted by fluctuations in these resources. Such price volatility affects manufacturers' production costs, profitability, and overall market stability.

Regional Insights

How Did Asia Pacific Dominate The Polyolefin Compounds Market In 2024?

The Asia Pacific polyolefin compounds market size was estimated at USD 12.24 billion in 2024 and is anticipated to reach USD 19.54 billion by 2034, growing at a CAGR of 4.79% from 2025 to 2034. Asia Pacific dominated the market in 2024.

The region has seen significant growth, and the growth is driven by the growing industrial base and large-scale industrial increases the growth of the market. The expanding end-use industries like automotive, construction, and other sectors drive the demand for polyolefin. The growing demand for lightweight materials demands for the market. The key players like China Petrochemical Corporation, ExxonMobil Corporation, LyondellBasell Industries, and Dow play a significant role in the growth and expansion of the market through innovation and development.

India Has Seen Growth Driven By the Growing Manufacturing Sector.

Inia has seen significant growth, driven by the direct investment in its manufacturing sectors, which contributes to the growth of the market. Policies supporting infrastructure modernization, industrial automation, and the use of recyclable and eco-friendly materials are accelerating demand. Growing focus on circular due to growing focus on sustainable and eco-friendly polyolefin solutions further boosts the growth and expansion of the market in the country.

- The World shipped out 55 polyolefin shipments from October 2023 to September 2024 (TTM). These exports were made by 27 Indian exporters to 35 buyers, showing a growth rate of 10% over the previous year.(Source: www.volza.com)

- Globally, Germany, the United States, and Russia are the top three exporters of Polyolefin. Germany is the global leader in Polyolefin exports with 50 shipments, followed by the United States with 35 shipments, and Russia in 3rd with 29 shipments.(Source: www.volza.com)

Europe Is Expected To Experience Growth, Driven By Growing Industries

Europe is expected to experience significant growth in the polyolefin compound market in the forecast period. The region is experiencing growth in the market, driven by the government initiatives in the region for the promotion and use of recycled and bio-based polyolefins, which increases the demand for the market.

The transformation of the automotive sector also increased the use of EVs, also demand for lightweight materials for vehicles to increase fuel efficiency and performance, driving the growth of the market. The key growth areas in the region are automotive, construction, packaging, and the healthcare sector, which fuel the growth and expansion of the market.

Segmental Insights

Resin Type Insights

Which Resin Type Segment Dominated The Polyolefin Compounds Market In 2024?

The polypropylene compounds segment dominated the market in 2024. Polypropylene compounds dominate the market due to their versatility, cost efficiency, and balance of mechanical and thermal properties. Widely used in automotive, packaging, and consumer goods, these compounds offer lightweighting benefits and durability. Continuous innovations, such as impact-modified and glass fiber–reinforced grades, further enhance performance, making polypropylene a preferred choice across industries where strength, recyclability, and processability are key requirements.

The polyolefin elastomers & plastomers segment expects significant growth in the market during the forecast period. Polyolefin elastomers and plastomers are increasingly used in applications demanding flexibility, resilience, and softness. They serve as alternatives to traditional elastomers in packaging, automotive interiors, and healthcare products, offering excellent sealing, impact resistance, and processing ease. Their role in sustainable and lightweight material solutions is growing, with advancements in catalyst technologies enabling superior performance in demanding sectors such as electrical insulation and medical devices.

Filler Type Insights

How Did The Mineral-Filled Compounds Segment Dominate The Polyolefin Compounds Market In 2024?

The mineral-filled compounds segment dominated the market in 2024. Mineral-filled polyolefin compounds enhance stiffness, dimensional stability, and thermal resistance. These are widely applied in packaging, household goods, and automotive parts where durability and cost efficiency are essential. Talc, calcium carbonate, and mica are common fillers, providing improved surface finish and processing benefits. The segment is gaining traction in industries prioritizing lightweight yet high-performance solutions without compromising recyclability.

The glass-fiber reinforced & flame-retardant compounds segment expects significant growth in the polyolefin compounds market during the forecast period. Glass fiber reinforced and flame-retardant compounds are critical in high-performance applications like automotive, aerospace, and electrical.

They deliver superior strength, dimensional stability, and resistance to heat and fire, making them indispensable in structural parts and safety-critical components. This segment is witnessing increasing demand as industries adopt stricter fire safety and performance standards while focusing on advanced lightweight materials.

Application Insights

Which Application Segment Dominated The Polyolefin Compounds Market In 2024?

The automotive and transportation segment dominated the market in 2024. Automotive and transportation is one of the largest application areas for polyolefin compounds, driven by the demand for lightweighting and fuel efficiency. These compounds are used in bumpers, dashboards, door panels, and under-the-hood components. With the rise of electric vehicles, demand for flame-retardant and glass-fiber-reinforced compounds is growing, enabling manufacturers to meet safety regulations while ensuring performance, cost-effectiveness, and sustainability.

The healthcare and electricals segment expects significant growth in the market during the forecast period. Healthcare and electrical applications are steadily expanding in the market. In healthcare, these materials are valued for their biocompatibility, sterilization compatibility, and safety in medical devices and packaging. In electricals, compounds provide excellent insulation, durability, and flame resistance, supporting their use in wires, cables, and connectors. Their adaptability to stringent safety and regulatory standards makes them highly relevant for these critical industries.

Polyolefin Compounds Market Value Chain Analysis

- Chemical Synthesis and Processing: The Polyolefin Compounds are synthesised and processed through extraction and molding.

- Key players: ExxonMobil, LyondellBasell, Dow Inc., SABIC, Borealis, and Braskem

- Quality Testing and Certification: The polyolefin compounds require IS 17609:2021, IS 10951:2020, IS 7328:2020, and ASTM Standards certification.

Key players: SGS, NSF International, UL, SGS PSI - Distribution to Industrial Users: The polyolefin compounds are distributed to the packaging, automotive, electronics, textile, and construction industries.

- Key players: SABIC, LyondellBasell, Dow Inc., and ExxonMobil Chemical.

Recent Developments

- In January 2024, LyondellBasell Industries N.V. introduced Petrothene T3XL7420, a cross-linkable, flame-retardant polymer blend designed to boost manufacturing efficiency, cut costs, and improve end-product quality in the wire and cable sector, especially for automotive and appliance uses. This versatile compound offers improved cure kinetics, greater stiffness for easier handling during small-gauge wire assembly, and enhanced barrier properties.(Source: www.lyondellbasell.com)

- In April 2024, Dow Inc., in collaboration with HIUV Materials Technology, launched an innovative polyolefin elastomer (POE)-based artificial leather for the global automotive seating market. This animal-free material provides an ultra-soft texture, excellent durability, and color stability, while being free of hazardous chemicals.(Source: www.specialchem.com)

Polyolefin Compounds Market Top Companies

- ExxonMobil Corporation: (U.S.)

- LyondellBasell Industries N.V.: (Netherlands)

- The Dow Chemical Company: (U.S.)

- Saudi Basic Industries Corporation (SABIC): (Saudi Arabia)

- Borealis AG: (Austria)

- INEOS GROUP AG: (U.K.)

- TotalEnergies SE: (France)

- Sinopec Corp. (China)

- Reliance Industries Limited: (India)

- Formosa Plastics Corporation: (Taiwan)

- Repsol SA: (Spain)

- Mitsui Chemicals, Inc. (Japan)

- Braskem S.A.: (Brazil)

- RTP Company: (U.S.)

Segments Covered

By Resin Type

- Polypropylene (PP) Compounds

- Polyethylene (PE) Compounds (HDPE, LDPE, LLDPE)

- Polyolefin Elastomers (POE) & Plastomers

- Others (blends, specialty grades)

By Filler Type

- Mineral-Filled Compounds (talc, calcium carbonate)

- Glass-Fiber Reinforced Compounds

- Flame-Retardant Compounds

- UV-Stabilized Compounds

- Others (antistatic, impact-modified)

By Application

- Automotive & Transportation (interior, exterior, under-the-hood)

- Packaging (rigid & flexible)

- Construction (pipes, profiles, sheets, insulation)

- Electrical & Electronics (cables, connectors, housings)

- Healthcare (devices, packaging, disposables)

- Consumer Goods & Appliances

- Others (industrial uses)

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait