Content

Plastic Antioxidants Market Size and Growth 2025 to 2034

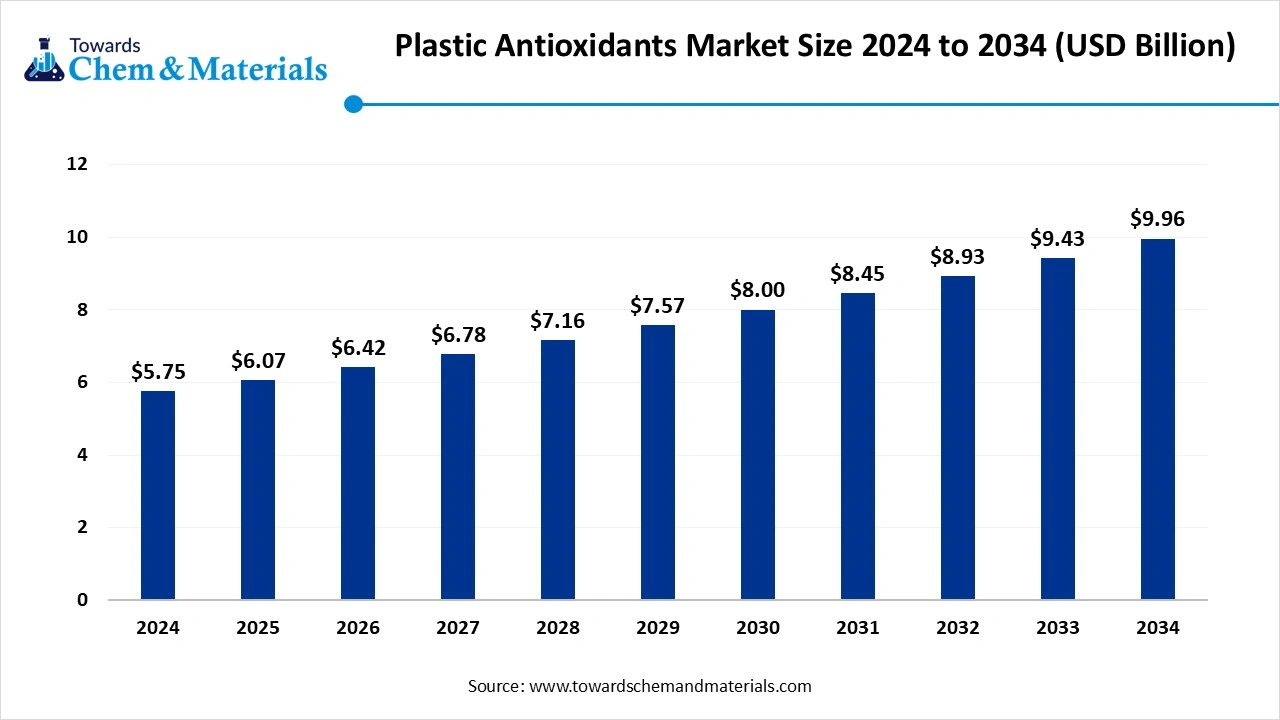

The global plastic antioxidants market size was valued at USD 5.75 billion in 2024. The market is projected to grow from USD 6.07 billion in 2025 to USD 9.96 billion by 2034, exhibiting a CAGR of 5.65% during the forecast period. The growing demand for plastics, rising consumer goods demand, and growing focus on bio-based plastic antioxidants drive the growth of the market.

Key Takeaways

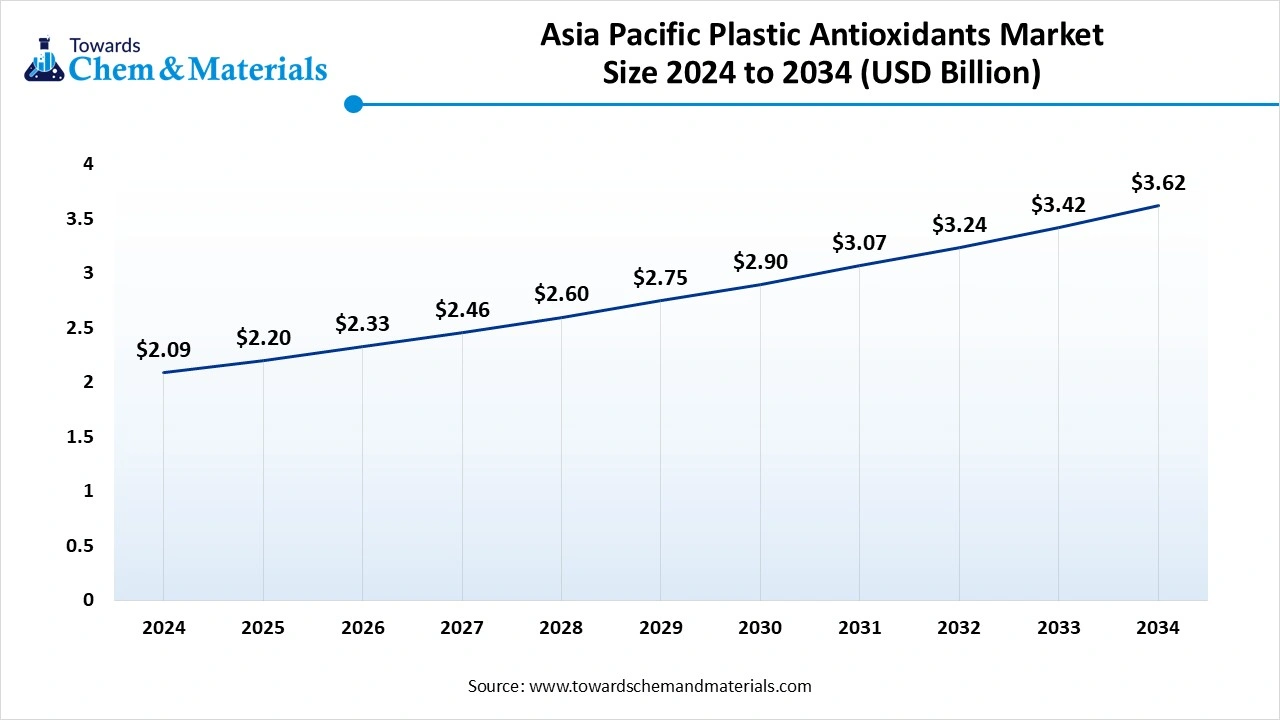

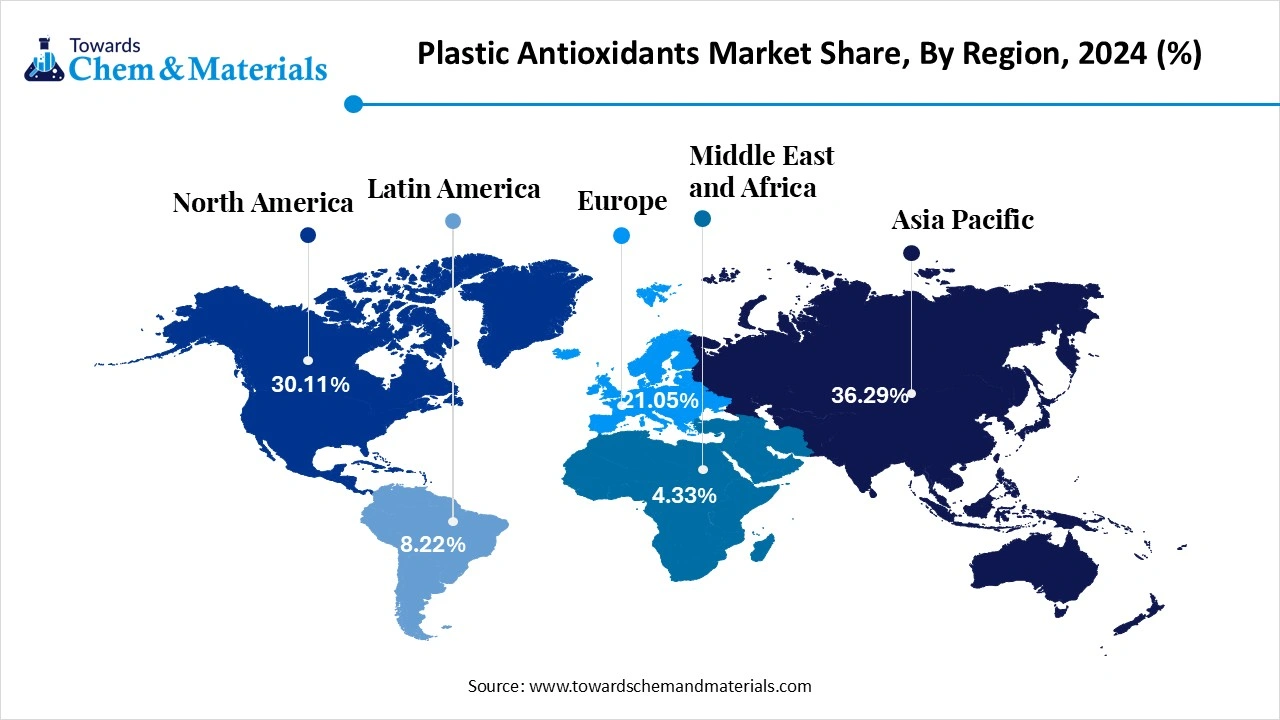

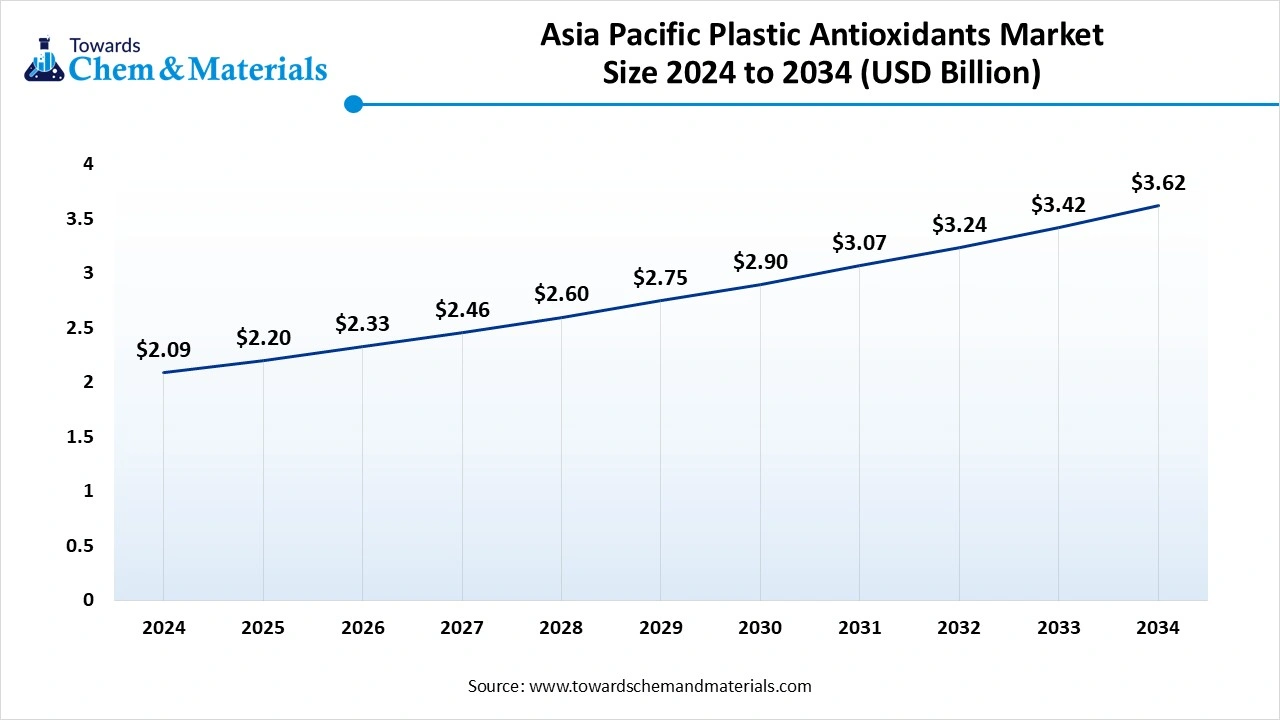

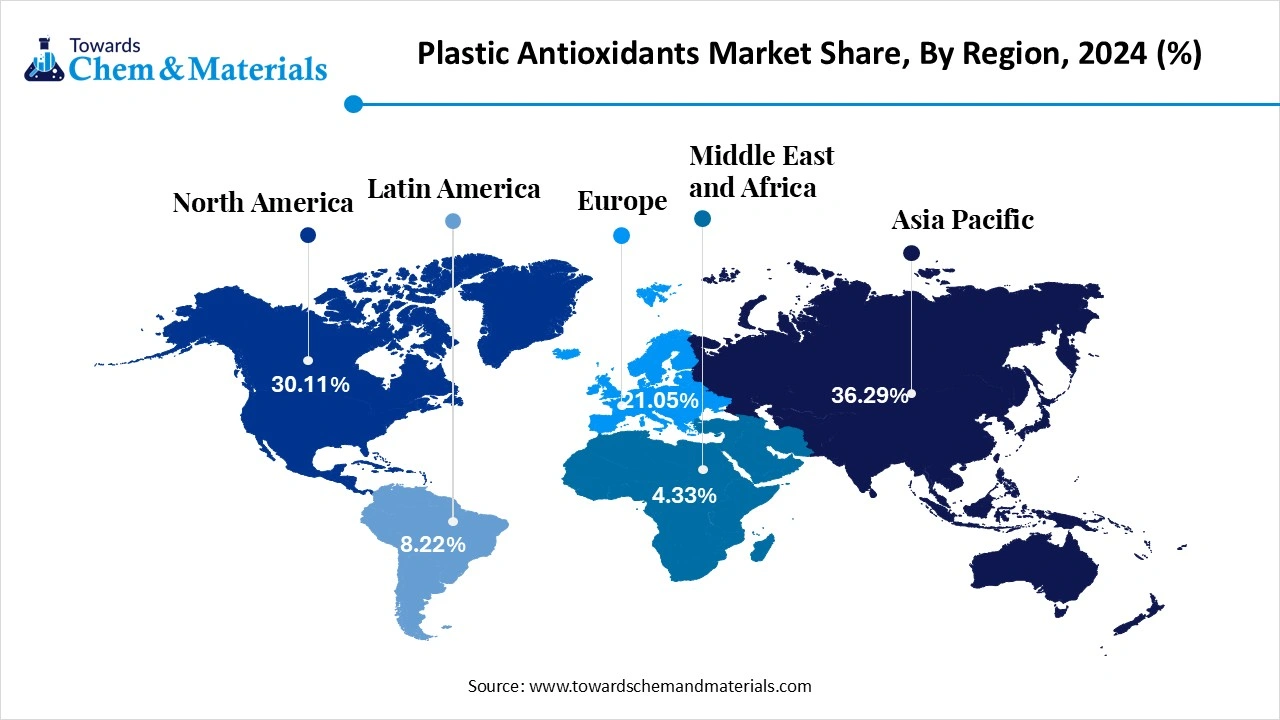

- The Asia Pacific region led the market and accounted for over 36.29% of global revenue in 2024., due to the growing plastic production and consumption in the region.

- The European market is expected to grow at a moderate pace of 5.46% during the forecast period.

- By antioxidant type, the phenolic segment dominated the market with the largest share of 41.19% in 2024 due to the growing demand from the construction, automotive, and packaging industries.

- By antioxidant type, the antioxidant blend segment is expected to grow at the fastest CAGR in the market during the forecast period due to the strong focus on sustainability.

- By resin type, the polyethylene segment dominated the market share of 35.19% in 2024 due to the rising demand from agricultural films, bottles, and containers.

- By resin type, the polyvinyl chloride segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing demand from healthcare applications.

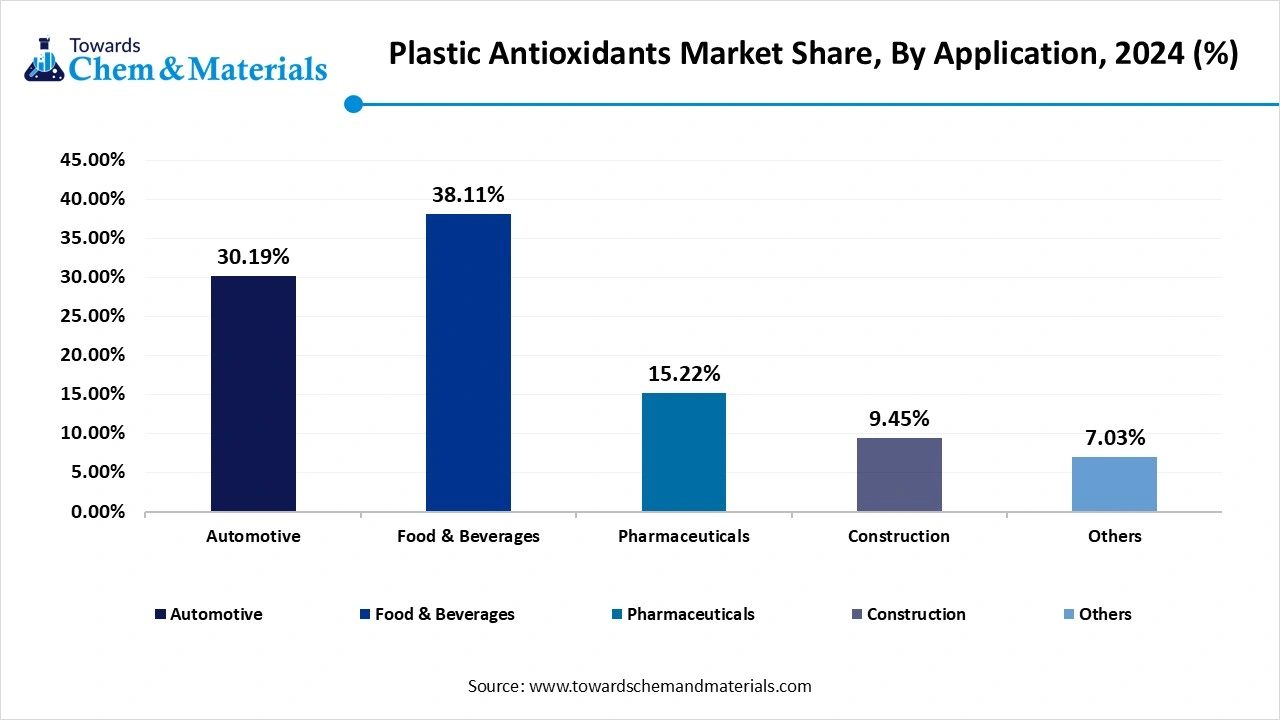

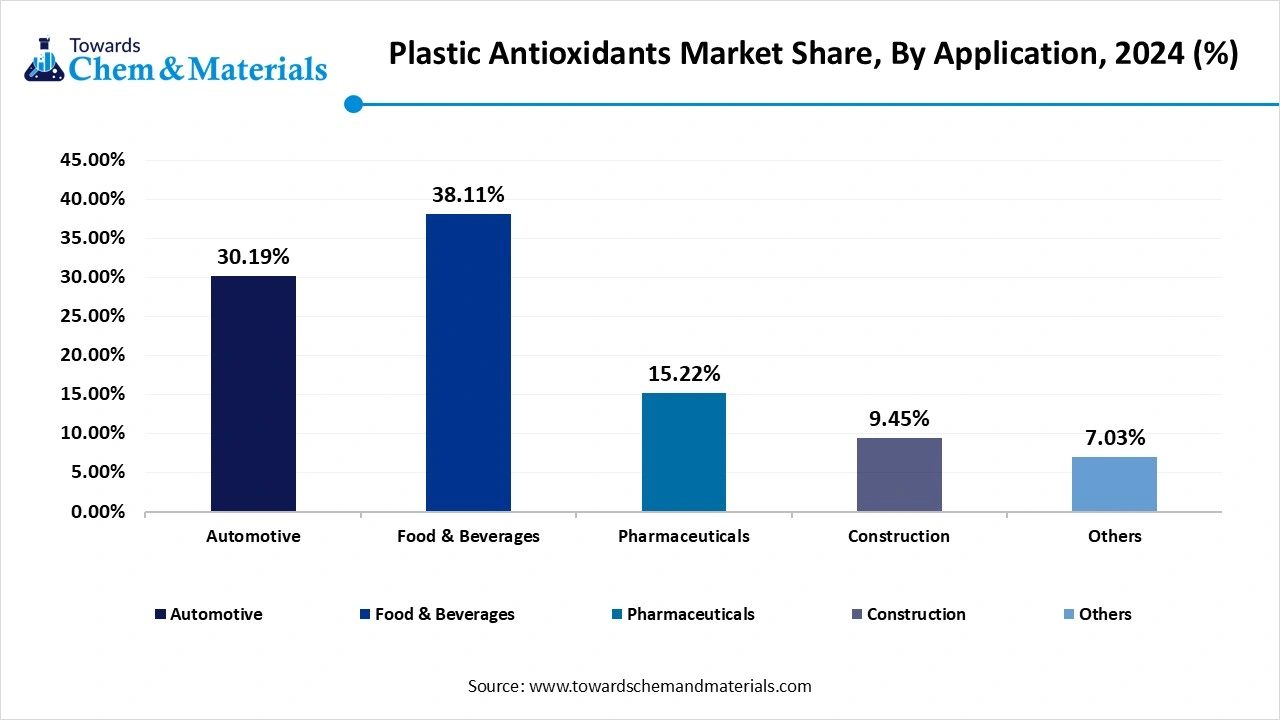

- By application, the food & beverages segment dominated the market share of over 38.11% in 2024 due to the growing demand for packaged food & beverages.

- By application, the automotive segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing demand for lightweight vehicles.

The Power of Plastic Antioxidants in Enhancing the Shelf Life of Plastic

Plastic antioxidants are additives commonly used to prevent oxidation of plastics and plastics products. The antioxidants enhance performance, extend the lifespan of products, and minimize frequent replacement needs. Plastic antioxidants are categorized as primary, secondary, and antioxidant blends. Primary antioxidants defend against free radicals, which include hindered phenols and amines. Secondary antioxidants remove byproducts of the initial oxidation process and initiate new radical reactions, which include thioethers and phosphites.

Antioxidant blends are a combination of primary and secondary antioxidants like Veenox B215 & Veenox B225. Plastic antioxidants improve temperature stability, flow rate, and viscosity of plastic. They enhance durability, reduce flammability, and improve the aesthetics of plastic products. The growing demand for durable & long-lasting plastic in various industries increases demand for plastic antioxidants to protect against UV damage, oxidation, and heat. The growing advancements in antioxidant technology help in the market growth.

The growing demand for plastics in various industries like electronics, automotive, construction, and many more drives the market growth. Factors like growing demand for plastic, development of environment-friendly antioxidants, increasing awareness of plastic degradation, and growing packaging demand contribute to the plastic antioxidants market growth.

- A total of 21569 suppliers of plastic additives are present in the world. (Source:Volza)

- European Plastic Joint-Stock is the leading supplier of plastic additives in the world. (Source: Volza)

- India Export data, Germany exported 369 shipments of phenolic antioxidants. (Source:Volza)

- South Korea exported 289 shipments of phosphite antioxidant.(Source: Volza)

- BASF MEXICANA S A DE C V is the leading supplier of hindered amine light stabilizer and HSN code 3911 in the world.(Source:Volza)

Growing Demand From the Construction Industry Propels Market Growth

The growing urbanization and increasing infrastructure, residential, and commercial development increase demand for various plastic materials like roofing, pipes, and wiring, which fuels demand for plastic antioxidants. The growing demand for construction materials that can sustain in harsh conditions like moisture exposure, direct sunlight, and temperature fluctuations increases demand for plastic antioxidants to prevent weakening, cracking, and discoloration.

The growing demand for polypropylene and polyethylene wiring, siding, pipes, and roofing increases the demand for antioxidants to prevent thermal degradation and oxidation. The growing demand for high-performance plastic materials in construction fuels demand for antioxidants. The increasing demand for lightweight and cost-effective construction materials fuels demand for plastic materials. Plastic antioxidants are widely used in pipes, films, laminates, fittings, adhesives, window frames, floor covering, door frames, and many other construction projects. The growing construction activities in various regions are a key driver for the plastic antioxidants market.

Market Trends

- The Growing Demand from the Automotive Sector: The growing automotive sector is a key consumer of plastic antioxidants. The growing shift of the automotive industry towards plastic components for various vehicle parts, like under-the-hood components, dashboards, and bumpers, increases demand for plastic antioxidants to prevent degradation and maintain integrity. The growing adoption of electric vehicles increases demand for lightweight materials, fueling demand for plastic antioxidants.

- Increasing Demand for Plastics: The growing demand and consumption of plastic in various industries increases demand for plastic antioxidants to enhance the stability and performance of plastic products. The growing demand for plastics in various industries like packaging, electronics, automotive, and construction helps in the market growth.

- The Growing Demand from the Packaging Industry: The growing demand for packaging various products like food & beverages, consumer goods, and many other products increases demand for plastic antioxidants to maintain the integrity of the product and extend the shelf life of products.

- Technological Advancement: The rising technological advancements like nanotechnology based antioxidants, eco-friendly antioxidants, and multifunctional antioxidants increase adoption in various sectors and improve durability, and lower the environmental impact.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 6.07 Billion |

| Expected Size by 2034 | USD 9.96 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.65% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Antioxidant Type, By Resin Type, By Application, By Region |

| Key Companies Profiled | Lanxess AG, Clariant AG, Astra Polymers, BASF SE, Syensqo, SONGWON. SI Group, Dover Chemical Corporation, 3V Sigma USA, Eastman Chemical Company, Tosaf Compounds Ltd., Avient Corporation |

Market Opportunity

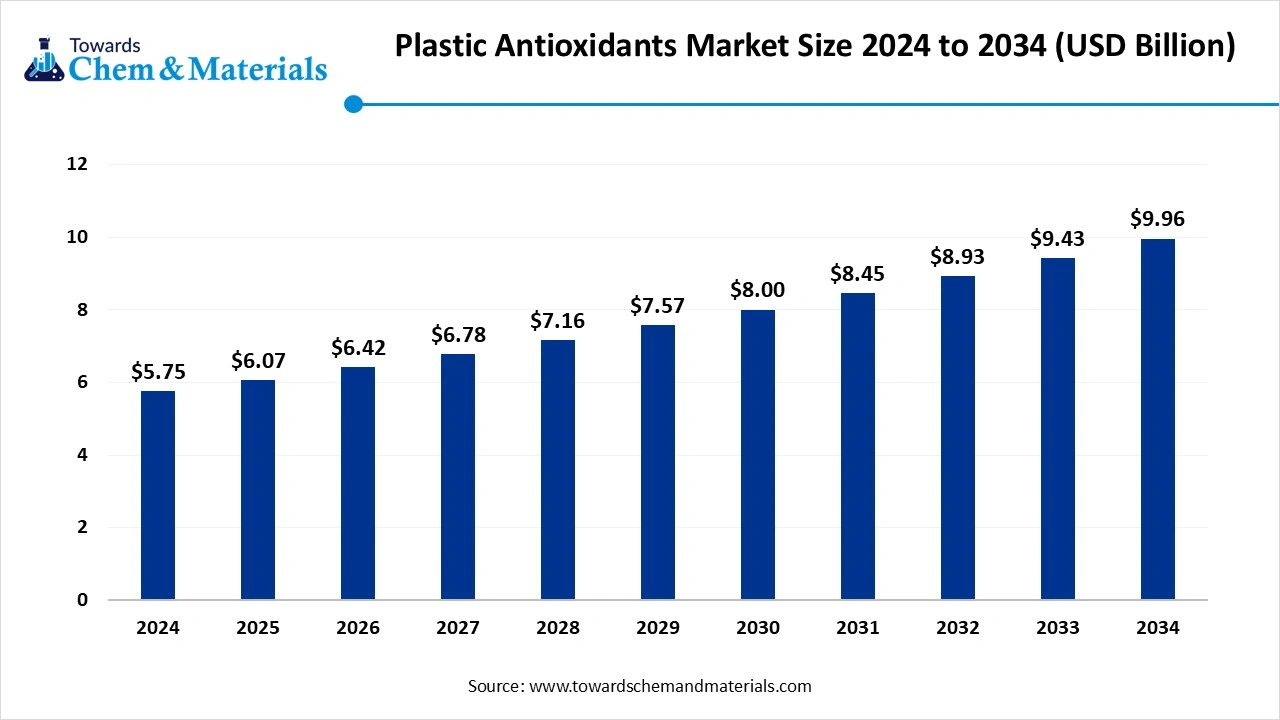

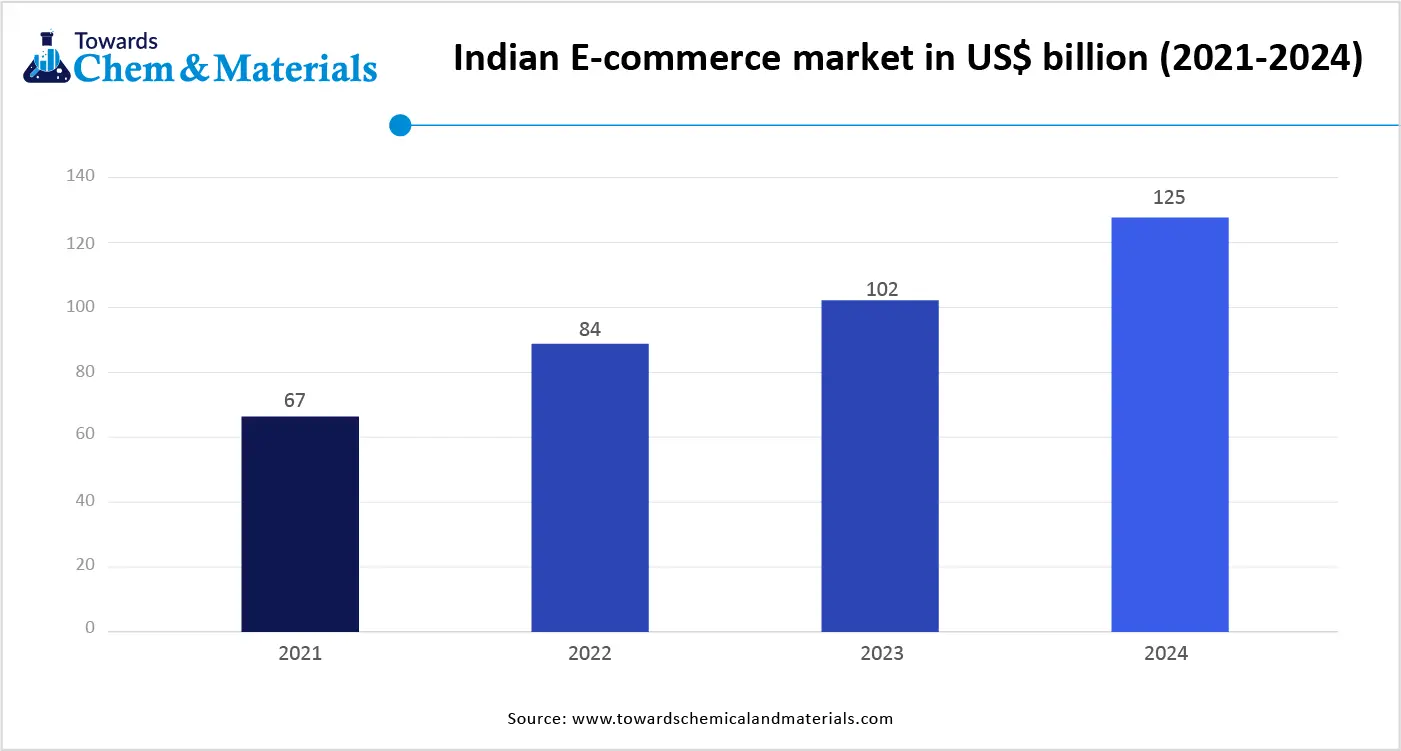

The Growing Expansion of E-Commerce Demands Plastic Antioxidants

The growing expansion of e-commerce is due to factors like increased consumer spending, 24/7 shopping, rising smartphone adoption, and increasing internet penetration, which increases demand for plastic packaging. The growing demand for plastic packaging in the e-commerce sector increases demand for plastic antioxidants for extending product shelf life. The growing demand for longer shelf life of products and reliable packaging increases the adoption of plastic antioxidants. The growing online shipping volume fuels demand for plastic antioxidants to prevent degradation during transit and storage.

The packaging during transit is exposed to various conditions like sunlight exposure & temperature fluctuations, fueling demand for antioxidants to keep packaging intact and protect plastic from various stressors. The growing e-commerce sector increases demand for sustainable packaging, which fuels demand for sustainable plastic antioxidants. The packaging of delicate & perishable items needs robust plastic materials, driving demand for antioxidants. The growing expansion of the e-commerce sector creates opportunities for market growth.

Market Challenge

Fluctuations in Raw Material Prices Restrict Plastic Antioxidants Growth

Despite several benefits of plastic antioxidants, the fluctuations in raw materials limit the adoption of plastic in various industries. Factors like geopolitical events and supply & demand dynamics are responsible for fluctuating raw material prices. The fluctuations in petrochemical prices directly affect the plastic antioxidants. Fluctuation in oil prices due to factors like geopolitical tension and growing production increases the cost of antioxidants. The various geopolitical events, like political instability, geopolitical tensions, and trade wars, are responsible for fluctuations in raw materials prices. The growing demand for plastic antioxidants increases the cost. The factors, like natural disasters, affect the raw materials prices. The fluctuations in raw material prices hamper the growth of the plastic antioxidants market.

Regional Insights

Which Region Dominated the Plastic Antioxidants Market in 2024?

The Asia Pacific plastic antioxidants market is expected to increase from USD 2.20 billion in 2025 to USD 3.62 billion by 2034, growing at a CAGR of 5.68% throughout the forecast period from 2025 to 2034. Asia Pacific dominated the plastic antioxidants market in 2024. The rapid urbanization increases demand for plastic products in housing, consumer goods, infrastructure development, and transportation, fueling demand for plastic antioxidants. The growing plastic production in countries like Japan, China, and India helps in the market growth. The well-established manufacturing base in the electronics and automotive industries increases the adoption of plastics, fueling demand for plastic antioxidants. The growing demand for plastics from various end-user industries like automotive, electronics, packaging, and construction drives the market growth. The presence of key market players like Songwon and BASF contributes to the market growth.

Plastic Antioxidants Market Trends in China

China is a major contributor to the plastic antioxidants market. The presence of a large plastic production industry in the nation increases demand for plastic antioxidants. The growing demand from industries like electronics, automotive, packaging, and construction helps in the market growth. The strong investment in the construction and automotive sectors increases demand for plastic antioxidants. Additionally, rapid urbanization and rising demand for consumer goods drive the overall growth of the market.

- India Export data, China exported 876 shipments of phenolic antioxidants. (Source:Volza)

- China exported 671 shipments of phosphite antioxidant.(Source: Volza)

How is India Growing in the Plastic Antioxidants Market?

India is significantly growing in the plastic antioxidants market. The growing disposable incomes and rising demand for consumer products increase demand for plastic antioxidants. The growing expansion of the manufacturing sector in various sectors like automotive, healthcare, packaging, and agriculture helps in the market growth. The growing urbanization and rapid industrialization increase demand for plastics for various applications like electronics, construction, and packaging, driving the overall growth of the market.

- From September 2023 to August 2024, India exported 13 shipments of phenolic antioxidants with a growth rate of 86% from the previous 12 months. (Source:Volza)

Why Middle East & Africa the Fastest Growing in the Plastic Antioxidants Market?

The Middle East & Africa are experiencing the fastest growth in the market during the forecast period. The growing consumption of plastic in various industries like automotive, electronics, packaging, and construction increases demand for plastic antioxidants. The growing urbanization and rapid industrialization increase demand for infrastructure development, and plastic products help in the market growth. The favorable government policies for industrial expansion fuel demand for plastic antioxidants. The growing expansion of the manufacturing sector in the region increases demand for plastic antioxidants. Furthermore, growing construction projects, the automotive sector, consumer goods, and industrial machinery support the overall growth of the market.

United Arab Emirates Plastic Antioxidants Market Trends

The United Arab Emirates is growing in the plastic antioxidants market. The boom of the retail and e-commerce sector increases demand for plastic antioxidants for flexible packaging. The growing infrastructure projects development helps in the market growth. The growing demand from various industries like construction, packaging, and automotive drives the overall growth of the market.

Segmental Insights

Antioxidant Type Insights

Why did the Phenolic Segment Hold the Largest Share of the Plastic Antioxidants Market in 2024?

The phenolic segment led the plastic antioxidants market in 2024. The growing demand from key industries like construction, automotive, and packaging helps in the market growth. Phenolic antioxidants have excellent thermal stability and prevent degradation. They prevent the oxidation of plastic materials and protect against thermal degradation. The helps to preserve color and maintain the mechanical strength of plastics. The growing innovation in phenolic antioxidants increases adoption in modern plastic formulations. The growing demand from polypropylene and polyethylene applications drives the overall market growth.

The antioxidant blend segment is the fastest growing in the market during the forecast period. The growing focus on sustainability increases demand for an antioxidant blend for extending the lifespan of plastics. Antioxidant blend is a mixture of different types of antioxidants, like phosphite and phenolic. They protect against oxidation, heat, and light. They extend lifespan and enhance the durability of plastics. Antioxidant blends prevent loss of mechanical strength, discoloration, and brittleness. The growing demand for high-performance plastics in various applications like medical devices, automotive, and aerospace drives the overall growth of the market.

Resin Type Insights

Which Resin Type Dominated the Plastic Antioxidants Market in 2024?

The polyethylene segment dominated the plastic antioxidants market in 2024. The growing demand from diverse applications like bottles, agricultural films, packaging films, and containers helps in the market growth. Polyethylene lowers the environmental impact of packaging and improves the recyclability of plastic materials. It helps to prevent degradation caused due to UV radiation, oxidation, and heat. The growing demand for lightweight materials in the automotive sector and the expansion of the automotive sector are increasing the demand for polyethylene. Additionally, the growing demand for flexible packaging in the pharmaceuticals and food & beverage industry supports the market growth.

The polyvinyl chloride is experiencing the fastest growth in the market during the forecast period. The growing demand from infrastructure projects and healthcare applications helps in the market growth. Polyvinyl chloride maintains the chemical and physical properties of plastics and extends their lifespan. Additionally, growing demand from various industries like electrical wiring, consumer goods, construction, and medical devices drives the overall growth of the market.

Application Insights

How Food & Beverage Segment Dominating the Plastic Antioxidants Market?

The food & beverages segment led the plastic antioxidants market in 2024. The growing demand for packaged food and processed snacks increases demand for plastic antioxidants to extend shelf life. The growing demand for the preservation of food & beverages and preventing oxidation fuels demand for plastic antioxidants. The growing demand for various food & beverages like fats, bakery items, snacks, oils, processed meats, and beverages helps in the market growth. The growing demand for maintaining the integrity of food packaging fuels demand for plastic antioxidants. The growing consumer demand for a wide range of food & beverage items drives the overall growth of the market.

The automotive segment is the fastest growing in the market during the forecast period. The growing demand for lightweight vehicles increases the adoption of plastic antioxidants for various plastic components, like under-the-hood components. The rise of electric vehicles in various regions increases demand for lightweight plastic materials, helping in the market growth. The rising utilization of plastic in vehicles improves fuel efficiency and minimizes weight, which increases demand for plastic antioxidants to enhance performance and extend longevity. Plastic antioxidants are widely used in automotive parts like dashboards, interior trim, bumpers, and steering wheels. The growing demand for high-performance antioxidants in the automotive industry supports the overall market growth.

Recent Developments

- In May 2024, Clariant introduces AddWorks® PPA, a perfluoralkyl substances (PFAS) a new solution to minimize the environmental impact of plastics at NPE 2024. The new PPA polymer additive range features stable & smooth processability and has high thermal stability and low migration. The products do not contain silicone components and inorganic content. The company introduces PKG 158 antioxidant solution that offers excellent color protection. This increases the overall performance and reduces environmental impact.(Source: clariant)

- In September 2023, BASF launched biomass balance plastic additives, Irganox 1010 BMBcert and Irganox 1076 FD BMBcert. The additives use renewable feedstocks and support the sustainability target. Both additives were initially produced at Kaisten, Switzerland, at BASF’s site, and they lower greenhouse gas emissions.(Source: worldbiomarketinsights)

- In December 2024, BASF increases prices for hindered amine light stabilizer and standard antioxidants for plastics. The prices increased by 10 percent globally.(Source: coatingsworld)

- In April 2024, Milliken showcased sustainable plastic additive and colorant solutions, Milliken UltraGuard 2.0 and Hyperform HPN 58ei at NPE’24 Florida. The new solution aims to enhance the efficiency and recyclability of polyethylene and polypropylene plastics. The UltraGuard 2.0 is made for PE and improves barrier performance in LLDPE and HDPE. The Hyperform HPN 58ei improves PP performance and is approved for food packaging. The solution enhances health & well-being and minimizes resource consumption.(Source: fibre2fashion)

Top Companies List

- Lanxess AG

- Clariant AG

- Astra Polymers

- BASF SE

- Syensqo

- SONGWON. SI Group

- Dover Chemical Corporation

- 3V Sigma USA

- Eastman Chemical Company

- Tosaf Compounds Ltd.

- Avient Corporation

Segments Covered

By Antioxidant Type

- Phenolic

- Antioxidant Blends

- Phosphite & Phosphonite

- Amines

- Others

By Resin Type

- Polyethylene

- Polyvinyl Chloride

- Polypropylene

- Polystyrene

- Acrylonitrile Butadiene Styrene

- Others

By Application

- Food & Beverages

- Automotive

- Pharmaceuticals

- Construction

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait