Content

Phosphate Fertilizers Market Size and Share 2034

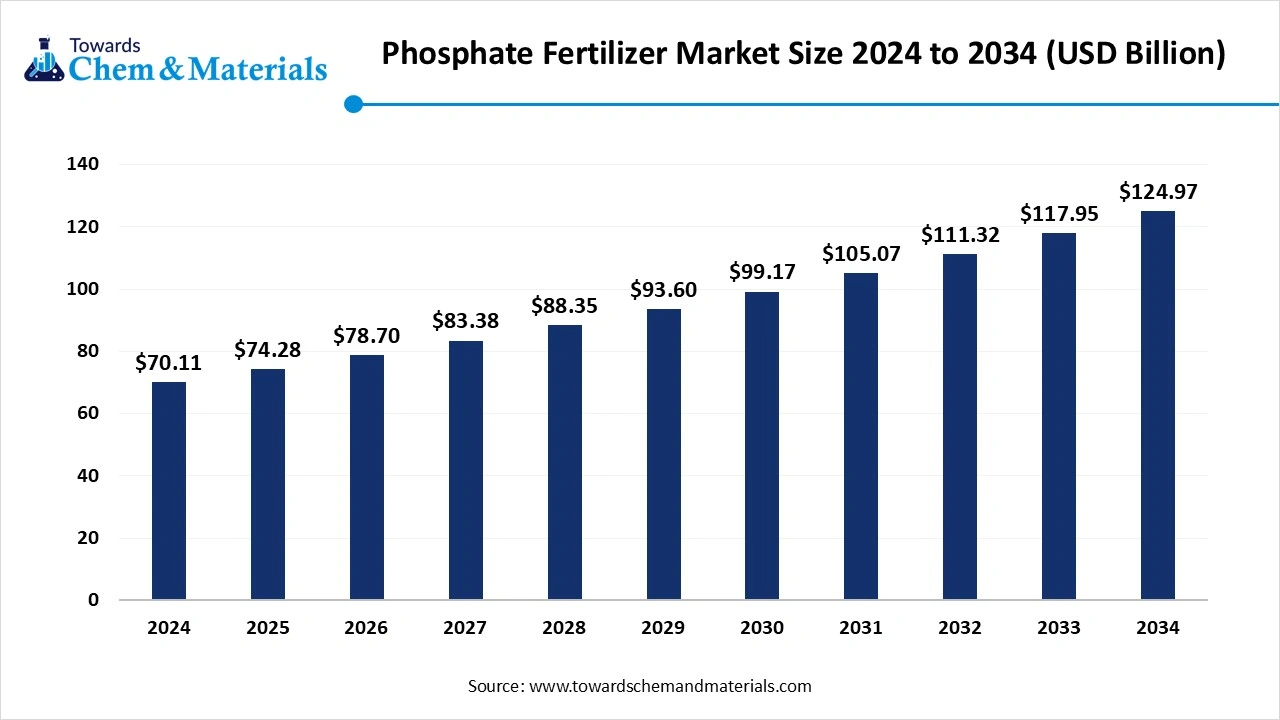

The global phosphate fertilizers market size is calculated at USD 70.11 billion in 2024, grew to USD 74.28 billion in 2025, and is projected to reach around USD 124.97 billion by 2034. The market is expanding at a CAGR of 5.95% between 2025 and 2034.The demand for greater crop yield and the application of modern agriculture practices is driving industry growth in the current market environment.

Phosphate Fertilizers Market Key Takeaways

- The Asia Pacific phosphate fertilizers market is projected to grow from USD 48.36 billion in 2025 to USD 81.44 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 5.96% during the forecast period (2025 - 2034)

- Asia Pacific dominated the phosphate fertilizers market with a share of 65.11% in 2024.

- Europe was the second-largest regional segment in terms of revenue in 2024 and is anticipated to expand at a CAGR of 6.15% in the coming years.

- By product type, the monoammonium phosphate segment dominated the market in 2024 and accounted for the largest revenue share of 40.87%.

- By product type, the triple superphosphate segment is expected to register the fastest CAGR from 2025 to 2034.

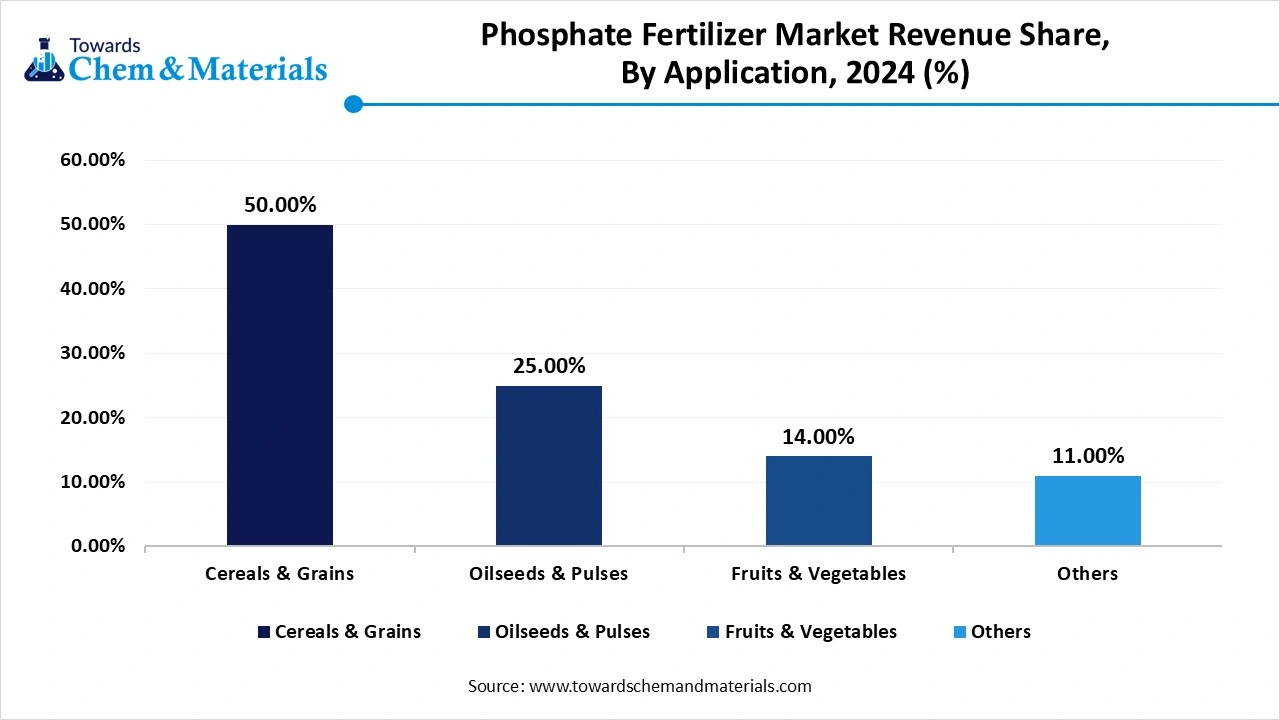

- By application, the cereal & grains segment dominated the global industry in 2024 and accounted for the highest share of 50% of the overall revenue.

- By application, the oilseeds & pulse segment is projected to grow at the fastest CAGR of 20.98% over the forecast period.

Smart Farming, Stronger Yield: The Global Momentum Behind Phosphate Fertilizers

The phosphate fertilizers market is witnessing steady growth due to its critical role in enhancing soil fertility and agricultural productivity. Phosphate fertilizers are essential for plant development, especially in root formation and energy transfer, making them vital for global food security. As the global population grows and arable land becomes limited, the need for efficient crop yields is driving demand in the current period.

Moreover, emerging economies are increasing their agricultural output through mechanization and improved farming practices, further boosting consumption in recent years. With governments supporting sustainable agriculture and food production, the market is anticipated to experience consistent expansion across both developed and developing regions in the coming years, as per the observation.

The rising global demand for greater crop yield is spearheading industry growth, which is pushing farmers to maximize crop output on limited land. Phosphorus, a core nutrient in phosphate fertilizers, plays an important role in improving crop quality and resistance to disease. This demand is further encouraged by climate change challenges and soil degradation, leading to increased dependency on nutrient-rich fertilizers. Moreover, government subsidies and support programs in countries with growing populations are encouraging large-scale fertilizer use, accelerating phosphate fertilizers market growth.

Phosphate Fertilizers Market Trends

- The market is expanding rapidly due to increasing global food demand, especially in developing regions. As agricultural production intensifies to meet population needs, phosphate fertilizers play a crucial role in enhancing crop yield and soil fertility. Governments and the private sector are investing in modern farming practices to ensure food security.

- Manufacturers are seen in the heavy adoption of advanced technologies such as precision nutrient delivery and controlled-release fertilizers. These innovations aim to improve nutrient uptake efficiency and reduce environmental impact. Automation in fertilizer production enhances consistency and scalability.

- Developing countries across Asia, Africa, and Latin America are significantly driving phosphate fertilizer consumption. These regions are experiencing increased investment in agricultural infrastructure and rural development.

- With growing environmental concerns, the phosphate fertilizer industry is moving toward sustainable production methods. Manufacturers are increasingly reducing emissions and waste in the production process while also exploring alternative raw materials.

Market Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 74.28 Billion |

| Expected Size By 2034 | USD 124.97 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.95% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Application, By Region |

| Key Companies Profiled | Eurochem Group AG, Agrium Inc., Potash Corp. of Saskatchewan Inc., Yara International ASA, CF Industries Holdings Inc., Israel Chemicals Ltd., Coromandel International Ltd., The Mosaic Co., S.A. OCP, PJSC PhosAgro. |

Phosphate Fertilizers Market Opportunity

Beyond Basics: High-Tech Phosphate Fertilizers for Modern Agriculture

Manufacturers are increasingly adopting advanced processing technologies to enhance the efficiency and effectiveness of phosphate fertilizers, which is expected to create lucrative opportunities in the phosphate fertilizers market in coming years. Also, innovations such as slow-release formulations and precision application are enabling better nutrient uptake and reduced environmental impact in the current period. These advancements are helping to meet the evolving needs of modern, sustainable agriculture. As farmers seeking higher productivity with minimal resource wastage, high performance phosphate solutions are gaining traction.

Phosphate Fertilizers Market Challenge

Market Under Pressure: Resource Scarcity Challenges the Future of Phosphate Fertilizers

The phosphate fertilizers market is seen under pressure due to the limited supply of high-quality phosphate rock, which is the primary raw material is expected to hamper the phosphate fertilizers market growth during the forecast period.

Moreover, as easily accessible reserves decline, extraction becomes more expensive and resource-intensive in future periods. Also, this challenges cost control and consistent supply for manufacturers. Moreover, geopolitical issues in major producing regions can disrupt supply chains, which further create growth barriers for the market, as per observation.

Market Regional Insights

Asia Pacific dominated the phosphate fertilizers market in 2024, due to its large agricultural base, rapid population growth, and rising food security concerns in the current period. Countries such as India, Indonesia, and Vietnam rely heavily on phosphate-based fertilizers to enhance crop yield and soil productivity is driving the industry growth in the region. Moreover, government support, expanding rural infrastructure, and increasing demand for crops further fuel this growth. Moreover, the presence of local manufacturers and cost-effective labor has contributed to high production and consumption rates in the region recently. As the region continues to modernize farming practices and adopt advanced agriculture practices, the

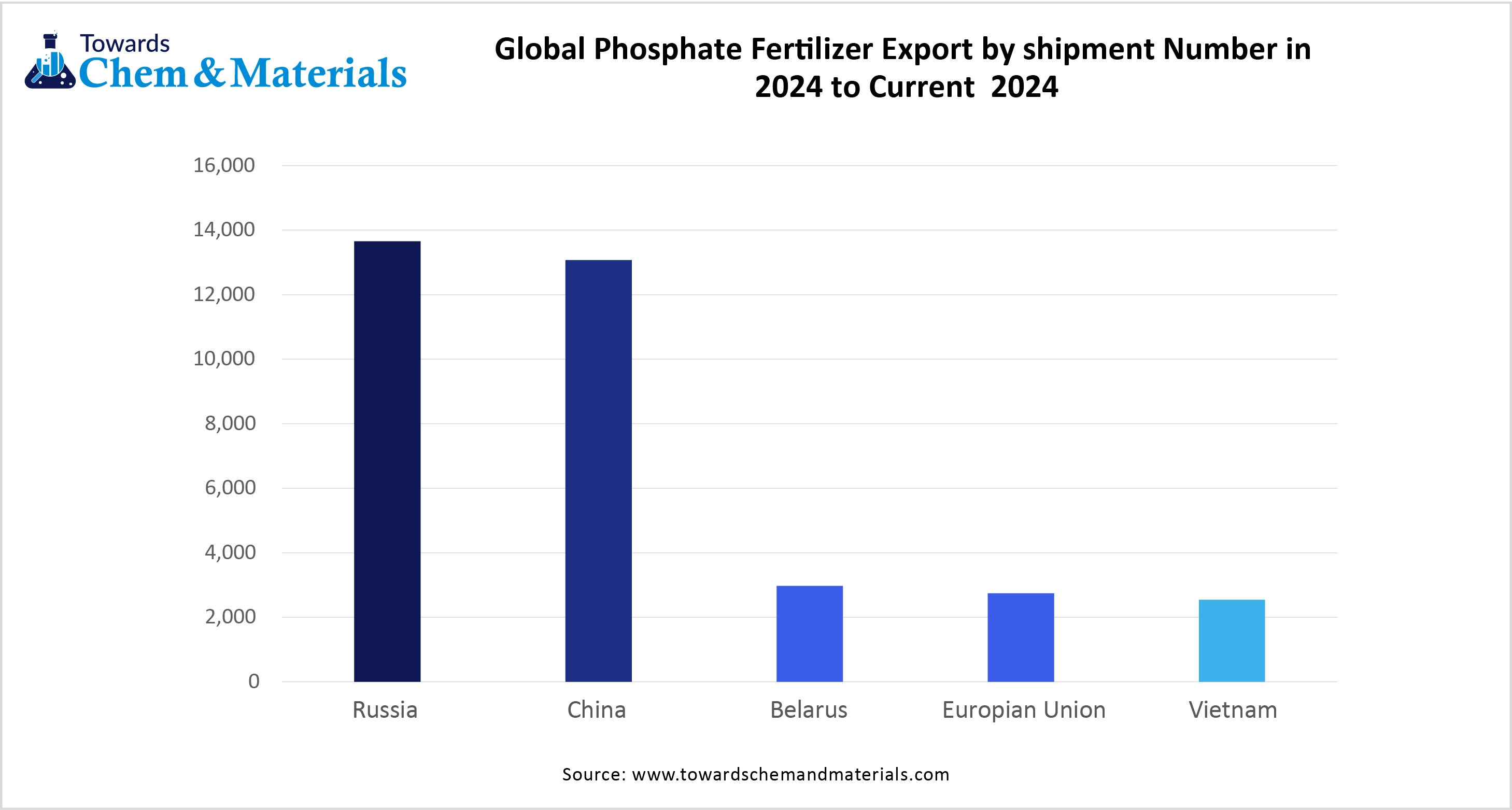

Controlling the Flow: China’s Influence on Phosphate Trade and Policy , As both a leading producer and consumer, China maintains a strong domestic supply chain supported by heavy phosphate rock reserves. The country’s large-scale industrial capacity allows it to influence global prices and trade flows in the current period, as per the observation. Moreover, in recent years, China has shifted its focus toward sustainable agriculture, as seen in the heavy promotion of controlled fertilizer use and cleaner production methods, which gives further advantages to the country in the coming years.

Product Trade –China exported a phosphate fertilizer worth $453 million in the year of 2023.

Europe is expected to grow at the fastest pace in the phosphate fertilizers market during coming period, akin to its strong dependency on sustainable agriculture, modern farming practices, and stringent environmental regulations. The region can gain market momentum from advanced research and development, which supports efficient nutrient management and precision farming in the future. Moreover, Europe’s robust agrochemical industry and growing demand for high-yield crops are driving the need for effective phosphate-based fertilizers.

Also, the governments and the European Union are seen as actively promoting food security through subsidies and innovation in fertilizer application methods, which is expected to drive industry growth in the region for the future. As climate-conscious policies gain traction, Europe’s focus on optimizing fertilizer use will further

Next-Gen Fertilizers: Germany’s Sustainable Path to Agriculture Efficiency, Germany has its strategic focus on technological innovation, and sustainability is likely to drive the country's growth in the coming years. From other countries, Germany invests heavily in bio-based fertilizers and recycling phosphorus from waste and wastewater in the current period. Moreover, this circular approach reduces dependency on imported phosphate rock with the country’s environmental goals in the projected period. Germany has also been practicing digital agriculture and automation in fertilizer application, enhancing efficiency and minimizing runoff in recent years. With strong government initiatives and industrial partnerships, Germany is likely to shape next-generation fertilizer solutions in the future.

Product Type Insights

The monoammonium phosphate segment held the dominating share of the phosphate fertilizers market in 2024, owing to its high nutrient content and efficiency in crop production. The monoammonium phosphate offers a balanced supply of nitrogen and phosphorus, essential for early root development and plant growth, which is driving the segment growth in the current period. Moreover, its water-soluble nature allows for easy absorption, making it suitable for various soil types and crops. Also, monoammonium is widely preferred in precision agriculture and fertigation systems, enhancing its demand in modern farming practices, which has heavily contributed to the segment's growth in recent years.

The triple superphosphate segment is expected to experience notable phosphate fertilizers market growth in the future, owing to its high phosphorus concentration and cost-effectiveness for large-scale farming. Triple superphosphate delivers concentrated phosphorus directly to the root zone, promoting strong root systems and improved crop maturity is likely to drive the segment growth in the future also. Moreover, its low nitrogen content makes it ideal for phosphorus-deficient soils and for crops that require specific nutrient ratios. With increasing global dependency on crop productivity and targeted fertilization, TSP can offer a customized solution for enhancing yield without nutrient imbalance, which is anticipated to create

Application Type Insights

The cereal & grains segment dominated the phosphate fertilizers market with the largest share in 2024, owing to its critical role in global food security and large-scale cultivation. Crops such as wheat, rice, and maize require substantial phosphorus for root development and yield enhancement. With increasing population and consumption, the demand for staple grains remains consistently high, especially in regions such as Asia-Pacific and Africa are heavily contributing to the segment growth in the current period. Moreover, phosphate fertilizers improve grain quality and crop resilience, making them essential for intensive farming. Governments and agricultural agencies will continue to support grain production with subsidies and research in the future.

The oilseeds & pulse segment is expected to grow at the fastest rate in the phosphate fertilizers market during the forecast period due to the growing demand for plant-based protein and edible oils. Also, crops like soybeans, sunflowers, and lentils require phosphorus to enhance seed formation and increase oil or protein content. With rising health awareness and the global shift toward sustainable food sources, these crops are gaining economic and nutritional importance, which is expected to drive the segment's growth in the future. Moreover, in developing markets, pulse cultivation is seen as expanding through supportive government policies and improved farming practices. As dietary trends evolve and export demand rises, phosphate fertilizers will play an ideal role in optimizing oilseed and pulse yields, driving future market growth.

Phosphate Fertilizers Market Recent Developments

EUROCHEM

Plant Establishment: In March 2024, EUROCHEM unveiled its latest plant opening of phosphate fertilizers in Brazil. Also, this plant has the capacity to produce 1 million tons of advanced phosphate fertilizers annually.

Paradeep Phosphate Limited

New Launch: In June 2024, The Paradeep Phosphate introduced their latest product line of urea and DAP products. Also, the product is called biogenic nano urea and nano DAP.

KRIBHCO and NOVONESIS

Collaboration: In September 2024, The Novonesis and KRIBHCO created a partnership with the signing MOU for the development of biofertilizers in India recently. Also, the Indian farmers will get access to the advanced technology of these companies accordingly.

Top Companies List in Phosphate Fertilizers Market

- Eurochem Group AG

- Agrium Inc.

- Potash Corp. of Saskatchewan Inc.

- Yara International ASA

- CF Industries Holdings Inc.

- Israel Chemicals Ltd.

- Coromandel International Ltd.

- The Mosaic Co.

- S.A. OCP

- PJSC PhosAgro.

Segment Covered in the Report

By Product Type

- Monoammonium Phosphate (MAP)

- Diammonium Phosphate (DAP)

- Single Superphosphate (SSP)

- Triple Superphosphate (TSP)

- Others

By Application

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Argentina

- The Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait