Content

What is the Current Oleochemicals Market Size and Volume?

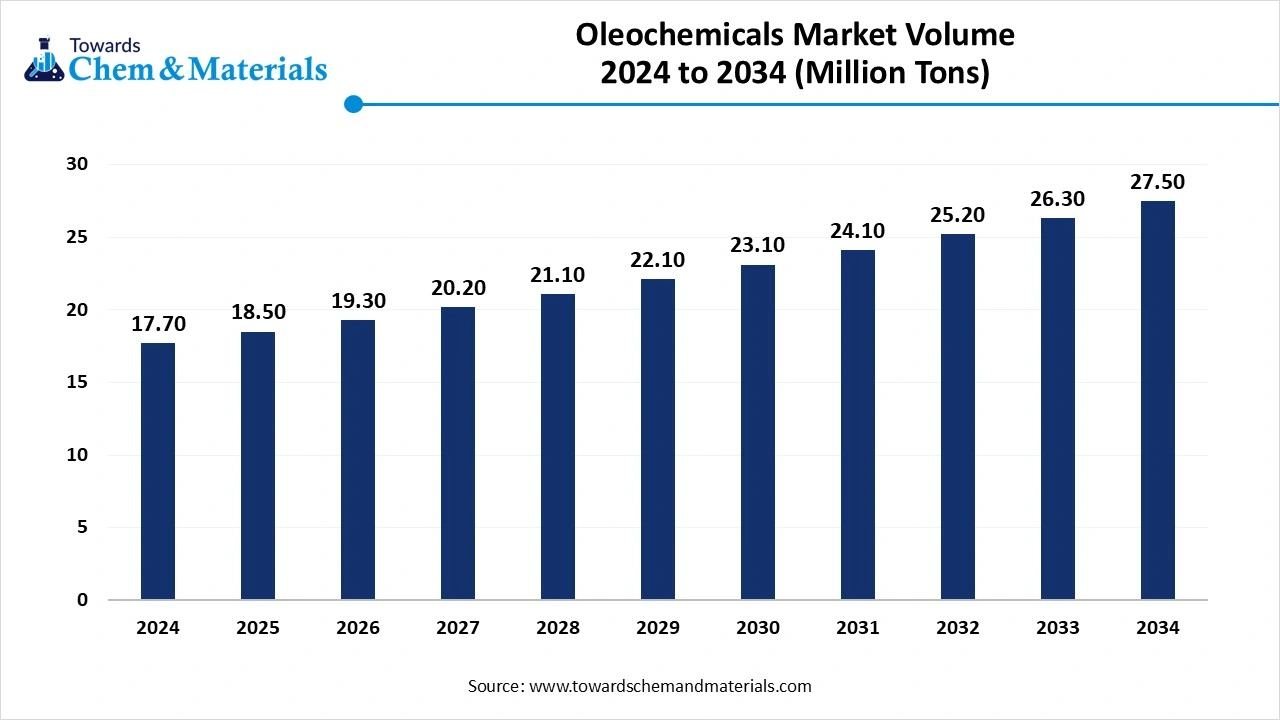

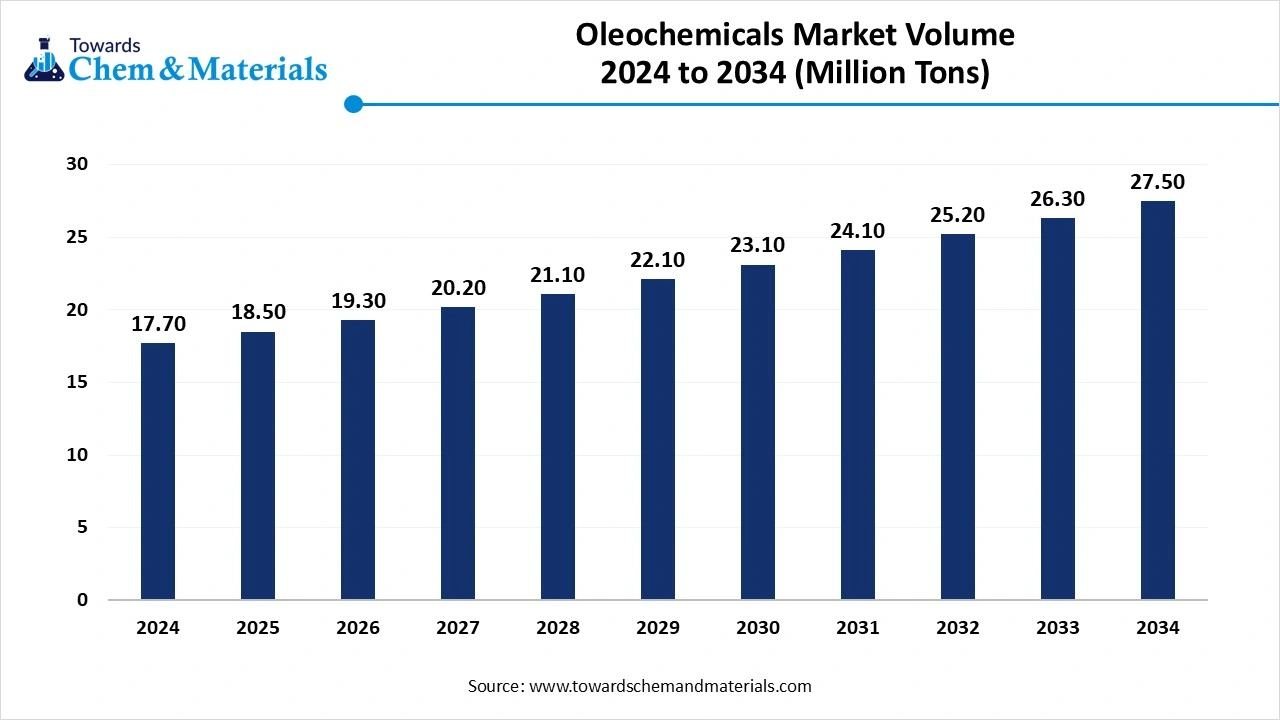

The global oleochemicals market size was estimated at USD 28.11 billion in 2025 and is expected to increase from USD 30.20 billion in 2026 to USD 57.51 billion by 2035, growing at a CAGR of 7.42% from 2026 to 2035. In terms of volume, the market is projected to grow from 18.97 million tons in 2025 to 31.23 million tons by 2035. growing at a CAGR of 5.11% from 2026 to 2035. Asia Pacific dominated the oleochemicals market with the largest volume share of 41.95% in 2025. The expansion of the personnel and cosmetic industry and rising sustainability initiatives have fueled the industry’s growth potential in recent years.

Oleochemicals Market Key Takeaways

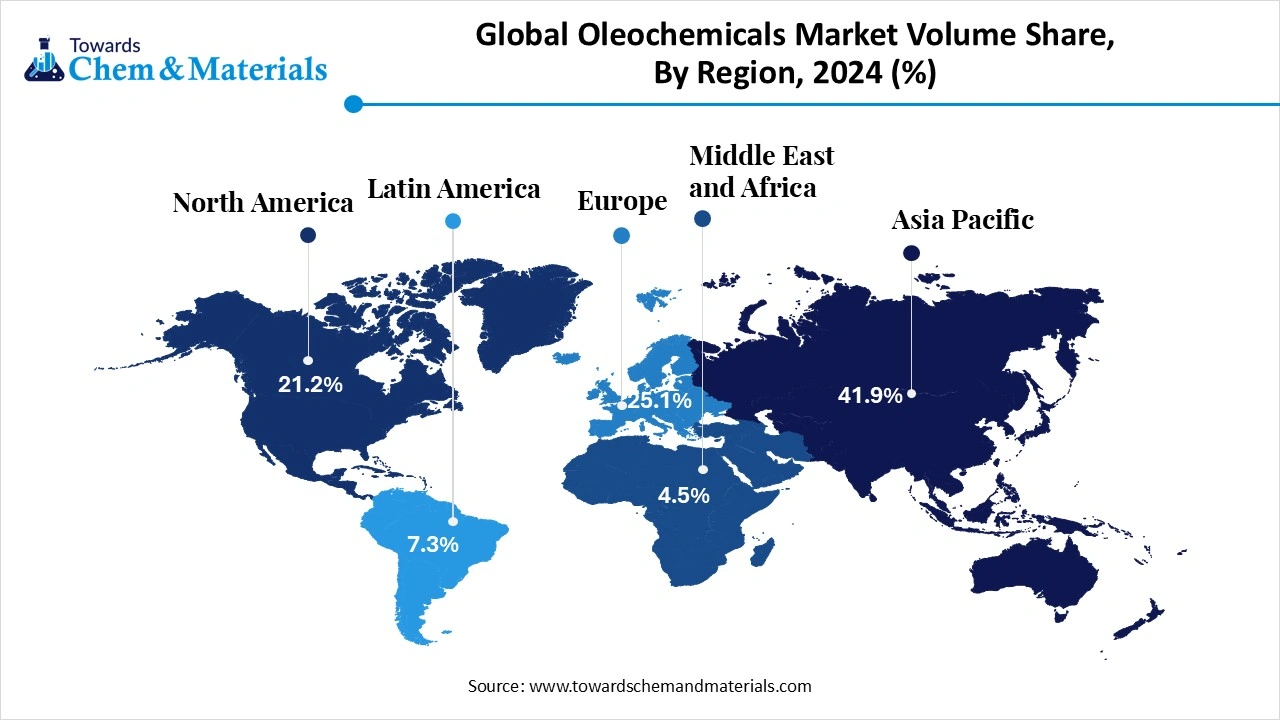

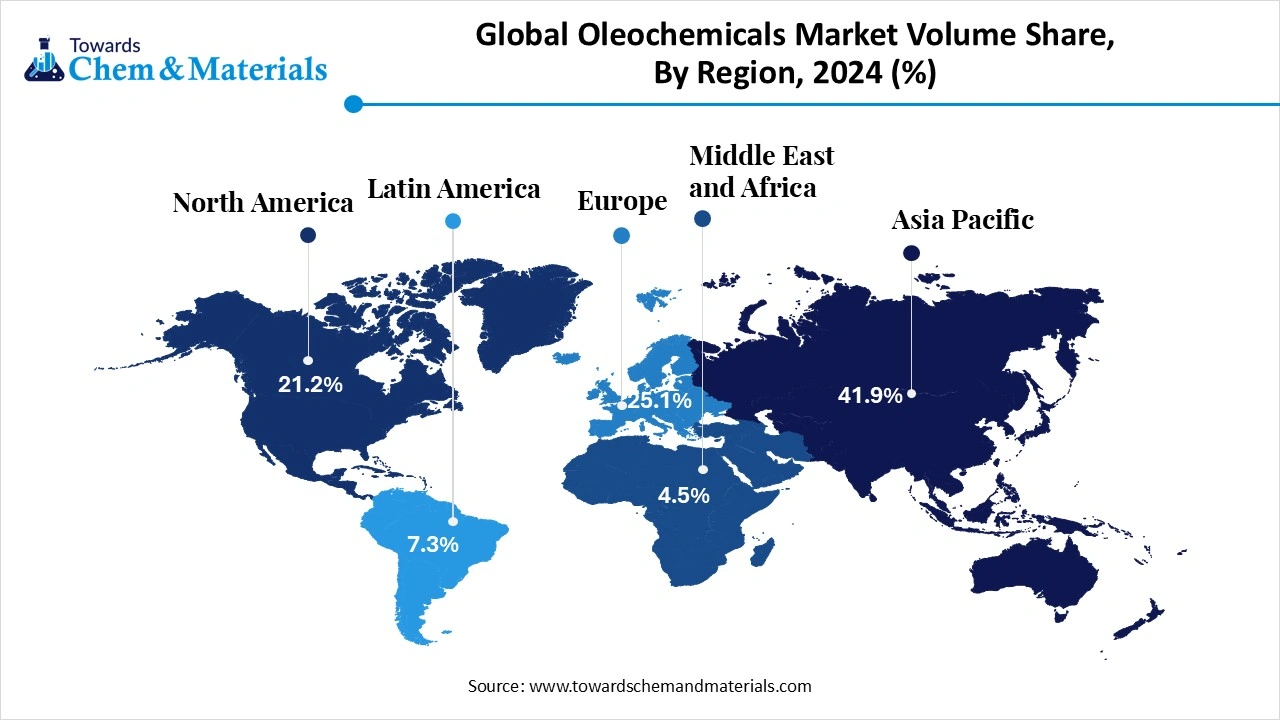

- The Asia Pacific led the oleochemicals market with the largest volume share of over 41.95% in 2025.

- The North America is anticipated to experience the fastest growth rate during the forecast period, akin to sudden shift toward sustainable alternatives.

- The Europe led the ammonia market held the volume share of around 26.10% in 2025.

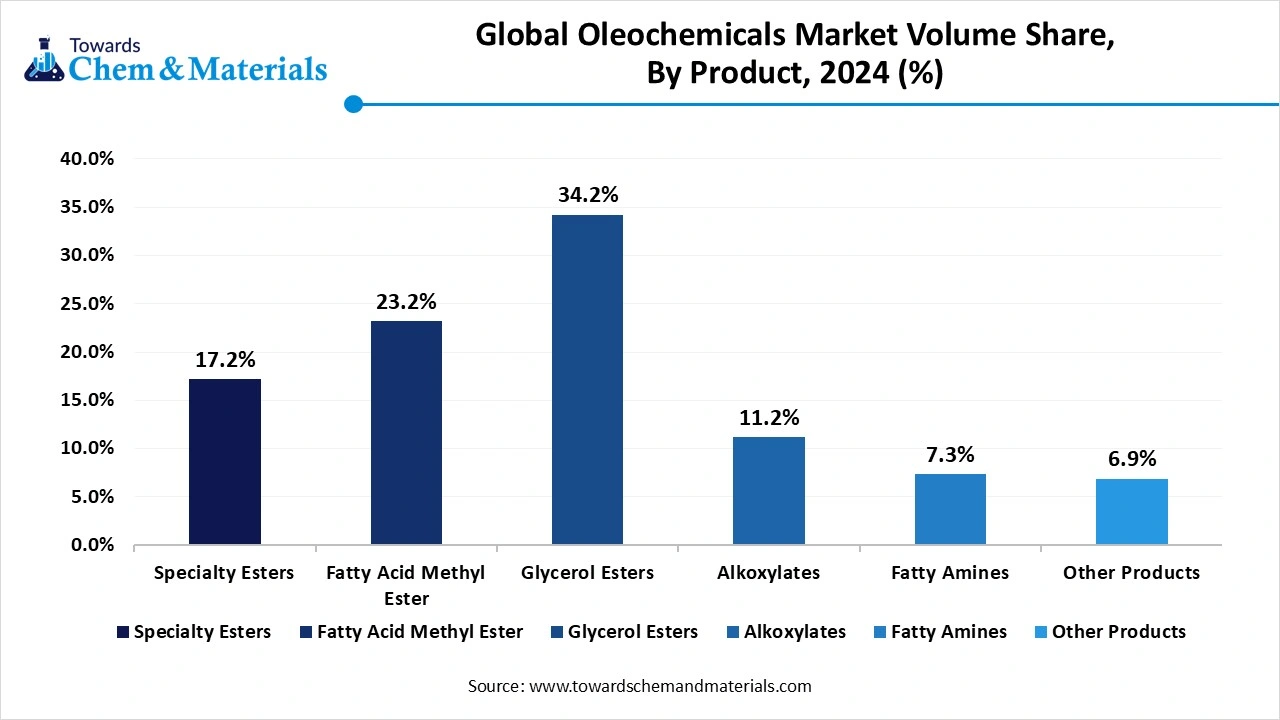

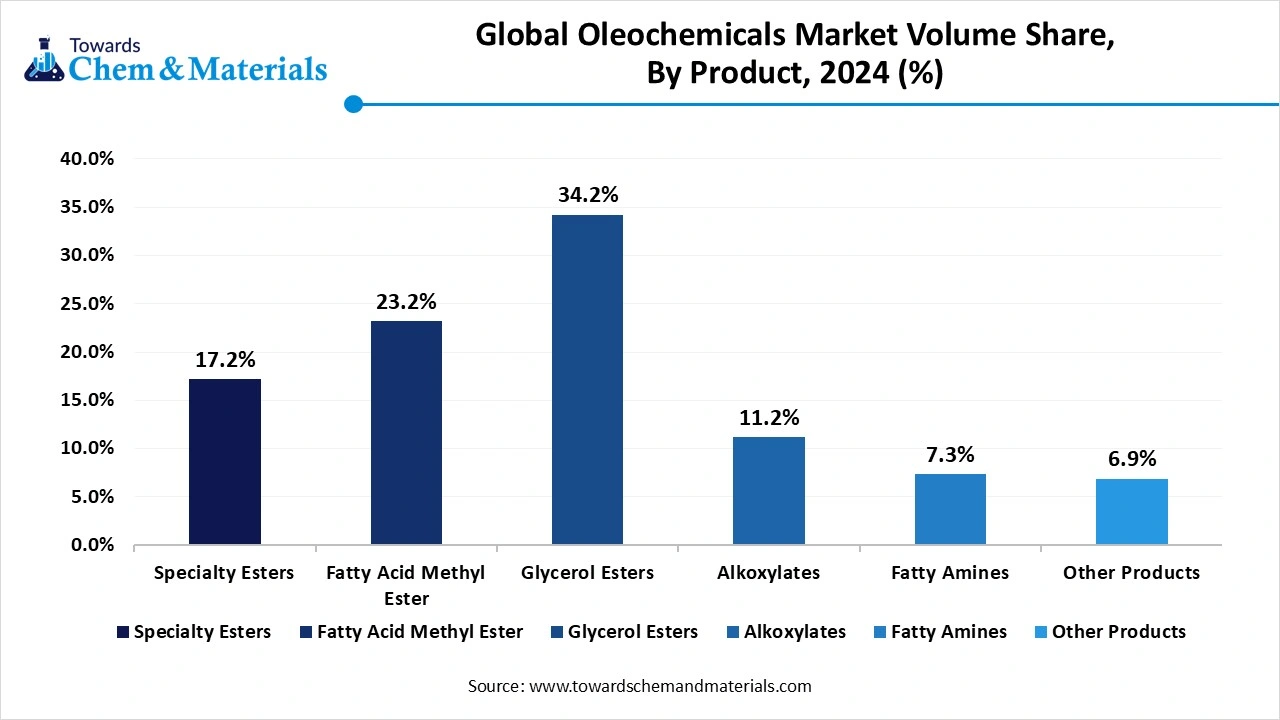

- By Product, the glycerol esters segment led the market with the largest volume share of 35.12% in 2025.

- By Product, the specialty esters segment is expected to experience significant market growth in the future, owing to its biodegradability and performance excellence.

- By application, the personal care & cosmetics segment led the market with the largest volume share of 31.56% in 2025.

- By application, the industrial segment is expected to grow at the fastest rate in the market during the forecast period, owing to factors such as rapid commercialization and others.

Beauty, Health, and Sustainability: Oleochemicals Power a Cleaner Future

The oleochemicals market has witnessed fast-paced growth in earlier periods. Having a wide industrial application, oleochemicals have gained major market attraction in recent years. Moreover, the global initiatives toward green chemicals and sustainable alternatives are gaining major market share in the oleochemicals industry in the current period.

Several manufacturers are seeking the replacement of the petrochemical-based product, which is toxic and can be expensive sometimes. Also, the expansion and advancements in the pharmaceutical industry are heavily contributing to the growth of the oleochemical market as the need for ointments, capsules, and drug delivery systems is increasing these days.

The wide application of oleochemicals in the personal and cosmetics industry is driving the growth of the market in the current period. Several products, such as lotions, creams, deodorants, and others, have contained oleo-based essential ingredients such as esters, glycerides, and others in recent years.

Also, the personal and cosmetic industry consumers' shift towards sustainable and eco-friendly products will be a greater advantage for the oleochemical manufacturers in the coming period, as oleochemicals are made up of sustainable raw materials like palm, soybean, and coconut oil and fats. Also, several personal care product manufacturers are observed in heavy promotion of their sustainable, eco-friendly products and packaging in the current market scenario.

Oleochemicals Market Trends

- The growing demand for eco-friendly alternatives is significantly driving the oleochemicals industry in the current period. As individuals are increasingly using sustainable products, such as personal care and household products. This trend apparently can be pushing the oleochemicals industry growth as oleochemicals contain biodegradable raw materials in their production.

- The expansion of the food and beverage industry is crucially contributing to the growth of the oleochemicals market. The food and beverage manufacturers are seen in heavy usage of food-grade emulsifiers, release agents, and stabilizers, in which oleo chemicals play an essential role in the production of these products.

- The rising volatility of crude oil prices has spread the oleochemical industry's potential in recent years. These price volatilities encourage the heavy manufacturers to move their dependence on petrochemical-based products, which are essential in manufacturing, and shift towards sustainable alternatives like oleochemicals, which are widely available in several regions across the globe.

Oleochemicals Market Report Scope

| Report Attributes | Details |

| Market Volume in 2026 | USD 30.20 Billion / 19.94 Million Tons |

| Expected Volume by 2035 | USD 57.51 Billion/ 31.23 Million Tons |

| Growth Rate | CAGR of 7.42% |

| Base Year of Estimation | 2025 |

| Forecast Period | 2026-2035 |

| High Impact Region | Asia Pacific |

| Segment Covered | By Product, By Application, By Region |

| Key Companies Profiled | Vantage Specialty Chemicals, Inc.,Emery Oleochemicals,Evonik Industries AG,Wilmar International Ltd.,Kao Chemicals Global,Ecogreen Oleochemicals,Corbion N.V,Cargill, Incorporated,Oleon NV,Godrej Industries,IOI Corporation Berhad,KLK OLEO,Evyap,JNJ Oleochemicals, Incorporated,, Sakamoto Yakuhin Kogyo Co., Ltd.,Stepan Company,Pepmaco Manufacturing Corporation,Philippine International Dev. |

Oleochemicals Market Opportunity

First Mover Advantage: Tech-Driven Oleochemicals Firms Lead the Charge

The integration of advanced processing technology is expected to create substantial growth opportunities for the oleochemicals market during the forecast period. Advanced technologies like fractionation and enzymatic transesterification are seen in heavy usage for oleochemicals manufacturers, akin to providing better products while reducing energy consumption.

Also, the adoption of the latest technology and R&D activities can provide better opportunities for the oleochemical producers. Also, several manufacturers are putting in heavy investment in digitalization as per industry observation, which is expected to take the first mover advantage in the coming years.

Oleochemicals Market Challenge

Supply Delays and Price Shocks Challenge Stability in the Oleochemicals Industry

The unstable price of raw materials is expected to hamper the industry's growth during the forecast period, as the oleo chemicals needed raw materials like palm oil, soybean oil, and animal fats, which are reliant on the weather conditions. Also, many more factors, such as harvest cycle disruption, geopolitical issues, and others, are likely to create delay issues in supply for some regions, which is anticipated to create growth barriers for the oleochemicals production in the coming years.

However, technological advancement can efficiently contribute to the production of oleochemicals while encouraging manufacturers to produce oleochemicals without any disruptions.

Value Chain Analysis

- Raw Material Sourcing: Focuses on cultivating and extracting natural fats and oils from plant and animal sources, with increasing scrutiny on sustainability.

- Key Players: IOI Corporation Berhad, Incorporated, and Cargill.

- Processing and Manufacturing: Raw fats and oils are processed into basic oleochemicals like fatty acids, alcohols, and glycerin.

- Key Players: Oleon NV, Ecogreen Oleochemicals, and P&G Chemicals.

- Specialty Chemical Production: Basic oleochemicals are refined into specialty derivatives like surfactants and esters with specific functional properties.

- Key Players: Croda International Plc, Evonik Industries AG, Kao Corporation, and Stepan Company.

- Distribution and Supply Chain Management: Ensures efficient and traceable delivery of oleochemicals globally through integrated networks and distributors.

- Key Players: Tricon Energy, Ravago S.A., IMCD N.V., Helm AG, and KLK OLEO.

- Sustainability and Waste Management: This involves adopting circular economy principles, using certified sustainable materials, and recycling byproducts into new materials or biofuels.

- Key Players: Waste Management, Inc., Republic Services, Inc., SUEZ S.A., and Agilyx Corporation

Oleochemicals Market Segmental Insights

By Product Insights

The glycerol esters segment held the dominating share of the oleochemicals market largest volume share of 35.12% in 2025. Having properties such as versatility, wide applications, and eco-friendly nature has provided popularity to the glycerol esters segment in recent years. Moreover, high adoption of glycerol esters in industries like pharmaceuticals, cosmetics, personal care, and food has gained major market share in the current period. as the glycerol provides the essential properties to this industry, such as stabilizing, emulsifying, and lubricating. Furthermore, the demand for packaged and ready-to-eat meals due to the fast-paced life has majorly contributed to the growth of the segment.

The specialty esters segment is expected to experience significant oleochemicals market growth during the forecast period. The multifunctional benefits of specialty esters are expected to provide a mature consumer base to segment in the coming years. Also, specialty ester allows customizations for specific performance needs, which is likely to gain significant industry attention during the forecast period, as the specific chemical need is increased in the future. Moreover, increasing need for biodegradability, performance excellence, and lower toxicity, specialty esters are expected to become an essential solution for consumer products in the coming period.

By Applications Insights

The personal care & cosmetics segment dominated the oleochemicals market with the largest volume share of 31.56% in 2025. The rising need for safe, sustainable, and natural personal care products is heavily contributing to the segment's growth in the current period. As oleo chemicals are derived from natural oils and fats like soybean, coconut, and others, which are generally safer. Also, the sudden consumer shift towards synthetic chemical-free and preservative-free products is actively providing the market attraction to oleochemicals nowadays.

- Furthermore, several manufacturers are seen in heavy promotion of their biobased products in the current period, which is leading to greater sales for oleo chemicals in recent years.

The industrial segment is expected to grow at the fastest rate in the oleochemicals market during the forecast period. The expansion of heavy-duty industries and rapid commercialization is likely to increase segment growth in the coming years. Additionally, increasing use of solvents, lubricants, surfactants, and plastic additives in several industries like processing and manufacturing is anticipated to expand segment growth during the projected period. Moreover, the increasing use of oleochemicals in the plastic and rubber industries can give a huge consumer base to the market in the coming years.

Regional Insights

The Asia Pacific oleochemicals market size was valued at USD 11.99 billion in 2025 and is expected to be worth around USD 24.58 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 7.44% over the forecast period from 2026 to 2035.

The Asia Pacific oleochemicals market volume was estimated at 8.14 million tons in 2025 and is projected to reach 13.42 million tons by 2035, growing at a CAGR of 5.13% from 2026 to 2035. The Asia Pacific led the ammonia market with the largest volume share of over 45.38% in 2025. Having a strong raw material supply has maintained the dominance of the region in recent years, as countries such as China, India, Indonesia, and Malaysia have huge natural resources in the current period. Also, the enlarged palm oil industry is heavily contributing to the market growth in the region recently. Palm oil is considered an essential raw material in the production of glycerin and other oleochemicals. Moreover, regional industries such as textile, plastics, food processing, and personal care are seen in heavy usage of oleochemicals in the current period.

From Imports to Innovation: China’s Oleochemicals Sector Gains Global Attention

China is considered one of the world's heaviest oleochemical consumers in the current period. The downstream oleochemicals consumption and innovative product development are providing major market attention to China recently. Also, advanced manufacturing infrastructure is fueling industry growth in the country. Also, manufacturing hubs like textiles, electronics, and plastics are expected to expand oleochemicals usage in the country during the upcoming period. Also, having reliance on imports of oleochemicals from neighboring countries is propelling the oleochemical industry in the whole Asia Pacific region.

- For Instance, In 2024, Kuala Lumpur Kepong Berhad (KLK) extended the expansion of its oleochemical processing capabilities in China recently. This expansion aims to fulfill the over-increased demand for sustainable oleochemical products in China.

How will Europe contribute to the Oleochemicals Market?

The Europe led the ammonia market held the volume share of around 25.1% in 2025. Europe is a sophisticated and mature player in the global oleochemicals market, characterized by strong demand for sustainable and bio-based products. The region is driven by strict environmental regulations and high consumer awareness, which encourage industries to adopt renewable raw materials in place of petrochemical alternatives. Key applications driving the market include personal care, cosmetics, and industrial lubricants, with a focus on advanced oleochemical derivatives and on improving production efficiency to meet consumer demand for green chemistry.

Germany Oleochemicals Market Trends

Germany is a key contributor to the global market, defined by a strong emphasis on innovation, high-value specialized products, and a deep commitment to sustainability within its industrial landscape. The country integrates a powerful chemical industry base with strict environmental considerations. Consumption is largely driven by applications in high-end cosmetics, pharmaceuticals, and specialized industrial fluids, promoting bio-economy principles and a circular economy.

Emergence of Latin America in the Oleochemicals Market

Latin America is emerging as a significant growth region in the global oleochemicals market, as it harnesses its vast natural resources and experiences increasing industrialization. The market is primarily supported by the region's strong agricultural base, which supplies essential raw materials, including soybeans and palm oil derivatives. Rising demand in the food and beverage, personal care, and detergent sectors is boosting consumption. Countries like Brazil are rapidly expanding their production capacities, focusing on both domestic needs driven by urbanization and export opportunities amid global industries' pursuit of sustainable supply chains.

Brazil Oleochemicals Market Trends

Brazil is the main growth driver in the Latin American oleochemicals market, capitalizing on its abundant agricultural feedstocks and burgeoning domestic industry. The country is experiencing strong demand in the cosmetics, cleaning products, and food sectors. Brazil is increasingly implementing advanced production technologies, with local companies leading efforts in sustainable sourcing and processing of agricultural derivatives to enhance both domestic consumption and export capabilities for oleochemical products.

How will the Middle East and Africa surge in the Oleochemicals Market?

The surge of the Middle East and Africa in the oleochemicals market is rooted in strategic economic diversification efforts and expanding domestic consumer bases. The region is benefiting from increasing investments in processing facilities and a shift toward developing non-oil-based manufacturing sectors. Key drivers include rising demand for personal care products, soaps, and detergents, fueled by population growth and improving living standards. Investments in advanced manufacturing and a growing emphasis on hygiene and health standards are further stimulating market growth across the region.

UAE Oleochemicals Market Trends

The UAE plays a significant role in the oleochemicals market and aligns closely with its national strategy to reduce reliance on petrochemicals and become a hub for sustainable industries. The country plays a crucial role in the MEA region, leveraging strategic investments in infrastructure and technology to develop sophisticated downstream chemical processing capabilities. There is significant demand for oleochemical derivatives across the expanding hospitality sector, construction chemicals, and personal care markets.

Oleochemicals Market Volume Share, By Region, 2025 (%)

| Regional | Revenue Share |

| North America | 21.33% |

| Europe | 25.15% |

| Asia Pacific | 41.95% |

| Latin America | 7.35% |

| Middle East and Africa | 4.22% |

North America is expected to grow at the fastest pace in the oleochemicals market during the coming period. The sudden shift toward sustainable, eco-friendly product lines in the region will help regional growth during the coming years. Several major brands of personal care, food processing, and plastics manufacturers are seen in seeking sustainable alternatives nowadays.

Thus, oleo chemicals are expected to rise as the ideal solution for these industries during the projected period. Moreover, the increasing investments in advanced processing technologies can provide a heavy consumer base to the oleo manufacturers in the coming years, as per observation.

From Soyabeans to Sustainability: United States Drives Oleochemicals Growth with Purpose

The United States is expected to play a crucial role in the development of the oleochemicals market during the forecast period, akin to its diverse industrial demand for oleochemicals. Initiatives like bioeconomy and others are expected to increase the market share during the forecast period.

According to these enhancements, the state of the United States is seen as providing several benefits for the sustainable production industries with tax incentives, funding, and some subsidies to encourage them. Furthermore, well well-developed agriculture sector is likely to push the oleo chemical industry forward in the country. As the high volumes of soybean and oil crops are considered essential raw materials in the production of oleochemicals.

Oleochemicals Market Recent Developments

Emery Oleochemicals

- Lab Establishment: In 2024, Emery Oleochemicals established a laboratory unit in Rayong, Thailand. Also, the company created a partnership with PTT Global Chemical Public Company Limited (PTTGC). This strategic move aims to expand the global production capabilities of the company, as the company claimed.

Oleon and A.Azevedo Oleos

- Acquisition: In 2024, Oleon completes the acquisition of A.Azevedo Oleos which is Brazilian company. With this acquisition, the company is trying to strengthen its position in the South American market

- Investments: In 2024, Godrej Industries signed an MOU with the government of Gujarat recently. As per the signed agreement, the company is planning to invest 600 crores to enhance the production capabilities of oleo chemicals in the next four years.

Oleochemicals Market Top Companies list

- Vantage Specialty Chemicals, Inc.

- Emery Oleochemicals

- Evonik Industries AG

- Wilmar International Ltd.

- Kao Chemicals Global

- Ecogreen Oleochemicals

- Corbion N.V

- Cargill, Incorporated

- Oleon NV

- Godrej Industries

- IOI Corporation Berhad

- KLK OLEO

- Evyap

- JNJ Oleochemicals, Incorporated

- Sakamoto Yakuhin Kogyo Co., Ltd.

- Stepan Company

- Pepmaco Manufacturing Corporation

- Philippine International Dev.

Segment Covered in the Report

By Product

- Specialty Esters

- Fatty Acid Methyl Ester

- Glycerol Esters

- Alkoxylates

- Fatty Amines

- Other Products

By Application

- Personal Care & Cosmetics

- Consumer Goods

- Food Processing

- Textiles

- Paints & Inks

- Industrial

- Healthcare & Pharmaceuticals

- Polymer & Plastic Additives

- Other Applications

By Regional

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Argentina

- The Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait