Content

What is the Current Nafion Market Size and Share?

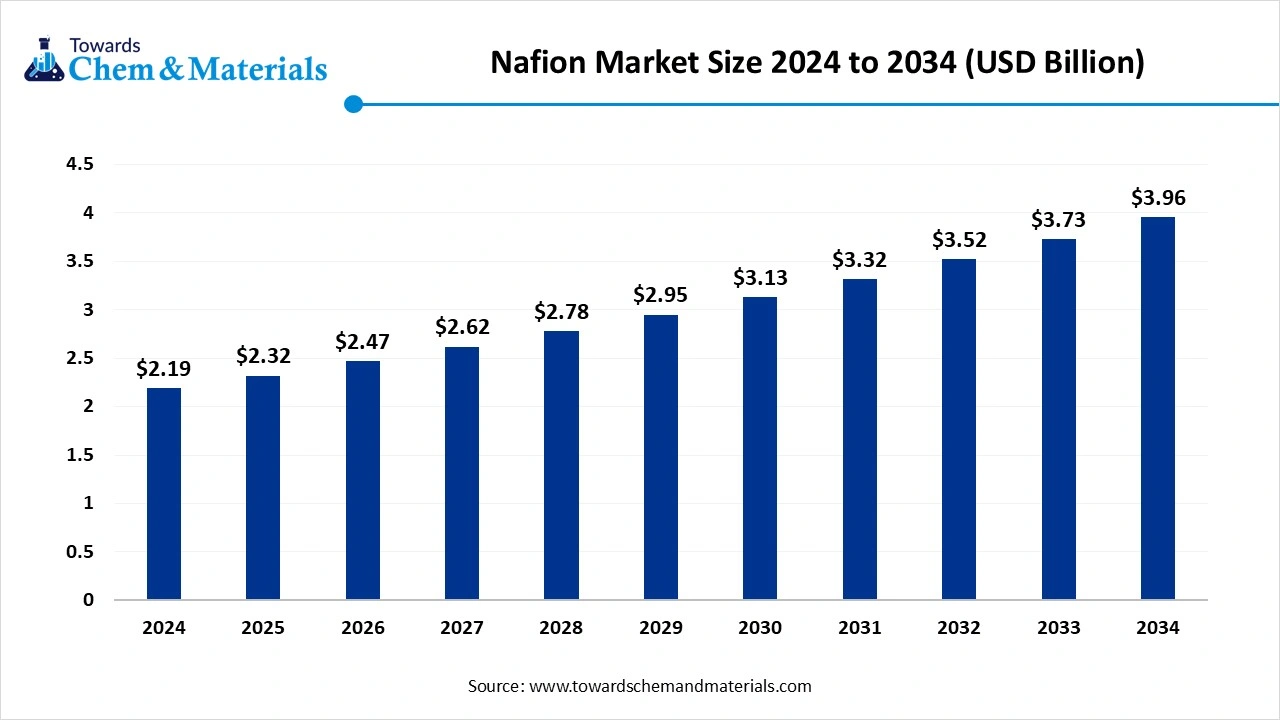

The global nafion market size was USD 2.32 billion in 2025 and is predicted to increase from USD 2.46 billion in 2026 and is expected to be worth around USD 4.20 billion by 2035, growing at a CAGR of 6.11% from 2026 to 2035.The growing adoption of fuel cells, increasing focus on sustainability, and rising demand for clean energy sources drive the growth of the market.

Key Takeaways

- The North America dominated the nafion market with the largest revenue share in 2025.

- By region, Asia Pacific is growing at the fastest CAGR in the market during the forecast period due to the growing demand from various industries.

- By application, the fuel cell segment dominated the market with the largest share in 2025 due to the increasing demand for cleaner energy sources.

- By application, the chlor-alkali process segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing wastewater generation.

- By product type, the membrane segment led the market in 2025 due to the growing demand from electrochemical applications.

- By end use, the energy segment dominated the market with the largest share in 2025 due to the growing demand for renewable energy sources.

- By form factor, the sheet segment led the nafion market in 2025 due to the growing demand from the chlor-alkali industry.

Nafion: A Shining Star Behind Sustainable Energy & Green Industries

Nafion is a polymer type used in proton exchange membrane and electrochemical applications. It is a perfluorosulfonic acid ionomer and consists of high ion conductivity and chemical stability. Nafion is widely used in fuel cells, electrochemical devices, the chlor-alkali process, and gas drying. It is manufactured as a copolymer & powder resin, and its molecular weight is variable. Nafion is a translucent plastic and operates at temperatures up to 190°C.

The growing technological advancements in fuel cells increase demand for Nafion membranes for proton exchange membranes. The growing investment and strong government support for renewable energy increase demand for Nafion. Technological advancements in Nafion-based membranes to enhance performance help in the market growth. The growing demand from energy, automotive, transportation, and electronics drives the market growth. Factors like growing demand for fuel cells, increasing production of chlor-alkali, advancements in chemical processing, growing demand for clean energy, and the rise of electric vehicles contribute to the market growth.

- The European Union exported $188620.81K of polytetrafluoroethylene in 2023.(Source: worldbank)

- Germany exported $181883.13K of polytetrafluoroethylene in 2023.(Source: wits.worldbank)

- W8 SHIPPING is the leading supplier of fuel cells in the world.(Source: volza)

- Japan exported 306 shipments of the Ion Exchange Membranes.(Source: Volza)

The Growing Demand from the Semiconductor Industry

The growing expansion of the semiconductor industry increases demand for Nafion for various applications. The growing chip fabrication increases demand for Nafion for various applications like coating, etching, and cleaning. The growing semiconductor industry fuels demand for applications like proton exchange membranes, which use Nafion for storage & power generation applications. The growing demand & adoption of consumer electronics like wearables, smartphones, laptops, smart home devices, and others increases demand for Nafion.

The growing demand for advanced semiconductors for processing capabilities & data storage in AI and cloud computing increases demand for Nafion-based membranes. The growing demand for semiconductors in advanced technologies like IoT & AI increases demand for Nafion. The growing demand for semiconductors in the automotive sector for autonomous vehicles' driving features, engine management, and infotainment is driving the adoption of Nafion. The growing demand from the semiconductor industry is a key driver for the growth of the nafion market.

![]()

Market Trends

- Growing Demand for Fuel Cells: The growing demand for fuel cells in various applications like electric vehicles, stationary power generation, transportation, portable power, and space missions increases demand for Nafion membranes. The growing demand for fuel cells helps in the market growth.

- Growing Green Hydrogen Production: The growing green hydrogen production increases demand for electrolyzers, where Nafion is a key material. Nafion membranes separate hydrogen & oxygen efficiently through water electrolysis.

- Increasing Adoption of Electric Vehicles: The growing demand for electric vehicles increases demand for fuel cells for additional range and power, fueling demand for Nafion.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 2.46 Billion |

| Expected Size by 2035 | USD 4.20 Billion |

| Growth Rate from 2026 to 2035 | CAGR 6.11% |

| Base Year of Estimation | 2025 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Application, By End Use, By Form Factor, By Region |

Key Companies Profiled |

Dow Chemical, Triton Consulting, FuelCell Energy, AgfaGevaert, GreenTech Energy Solutions, Xincotec, Gem Fuel Cells, Asahi Kasei, Ballard Power Systems, Nafion, DuPont, L. Gore and Associates, Fumatech BWT, Ion Power, Membrane Solutions |

Market Dynamics

Market Drivers

The Nafion market is driven by rising demand for high-performance ion exchange membranes across fuel cells, electrolyzers, and advanced electrochemical systems. Increasing adoption of proton exchange membrane fuel cells in transportation, stationary power generation, and backup power applications is a major growth driver. Expansion of green hydrogen production using proton exchange membrane electrolyzers is further accelerating Nafion demand due to its high proton conductivity, chemical stability, and durability under harsh operating conditions. Growing investment in clean energy infrastructure and decarbonization initiatives is reinforcing long-term adoption. In addition, Nafion’s established use in chlor-alkali processing, batteries, and industrial electrolysis continues to support baseline market demand.

Market Restraints

The Nafion market faces restraints related to its high material cost compared to alternative ion exchange membranes, which limits adoption in cost-sensitive applications. Dependence on fluorinated raw materials and complex manufacturing processes increases production costs and exposes the supply chain to pricing volatility.

Environmental concerns associated with perfluorinated materials are also increasing regulatory scrutiny, particularly in regions tightening restrictions on fluorinated compounds. In some emerging applications, alternative membrane chemistries with lower cost or reduced fluorine content are gaining attention. These factors can slow broader market penetration despite Nafion’s strong technical performance.

Market Opportunities

Significant opportunities exist in the expanding hydrogen economy, where large-scale deployment of PEM electrolyzers and fuel cells requires reliable, high-efficiency membranes. Advances in membrane engineering, including thinner films and reinforced structures, are improving performance while reducing material usage. Growth in energy storage systems, redox flow batteries, and electrochemical carbon capture technologies is creating new application pathways for Nafion membranes. Increasing research into sustainable manufacturing and recycling approaches for fluoropolymer membranes may also improve long-term acceptance. Emerging demand from Asia Pacific and the Middle East for clean energy and industrial electrolysis presents additional growth opportunities.

Market Challenges

The Nafion market faces challenges in balancing performance advantages with cost reduction and environmental sustainability. Scaling production to meet growing clean energy demand requires capital-intensive manufacturing expansion and secure access to specialized raw materials. Regulatory uncertainty around per- and polyfluoroalkyl substances may impact long-term material acceptance and compliance requirements. Competition from alternative membrane technologies is intensifying as researchers seek lower-cost or partially fluorine-free solutions. Maintaining consistent membrane performance across diverse operating environments remains critical to sustaining Nafion’s position in high-growth electrochemical applications.

Value Chain Analysis

- Research & Development (R&D): This focuses on the fundamental chemistry and development of Nafion and related fluoropolymers and other chemical inputs.

- Key Players: Solvay S.A., AGC Inc., DuPont de Nemours, Dongyue Group Ltd., and 3M Company.

- Manufacturing and Processing: This involves the complex chemical synthesis and processing of raw materials into various Nafion forms such as membranes, dispersions, and resins.

- Key Players: The Chemours Company, Solvay S.A., Dongyue Group Ltd., AGC Inc., and FUJIFILM Wako Pure Chemical Corporation.

- Distribution and Logistics:This involves standard and potentially specialized packaging and freight forwarding.

- Key Players: Thermo Fisher Scientific Inc., BeanTown Chemical Inc., DHL, and FedEx.

- Application and Integration: This mainly involves customization and engineering to meet specific application requirements.

- Key Players: Hyundai Motor Company, Ballard Power Systems, Asahi Kasei Corporation, and Umicore.

Segmental Insights

Application Insights

How Fuel Cell Dominated the Nafion Market?

The fuel cell segment led the nafion market in 2025. The growing focus on sustainability and demand for cleaner energy increases the adoption of fuel cells. The growing trend of electric vehicles helps in the growth of the market. The growing automotive sector increases demand for fuel cells to be used in vehicles like trucks, cars, buses, and many more. The growing demand for energy storage, transportation, and power generation increases the adoption of fuel cells.The growing demand for renewable energy sources like wind & solar increases demand for fuel cells, driving overall growth of the market.

The chlor-alkali process segment is the fastest-growing in the market during the forecast period. The growing demand for the chlor-alkali process in industries like plastic production, water treatment, and chemical manufacturing increases demand for Nafion. The growing focus on eco-friendly production and sustainability helps in the market growth. The rapid industrialization & growing urbanization increase wastewater generation, fueling demand for the chlor-alkali process. The growing demand from the construction and automotive industries drives the overall growth of the market.

Product Type Insights

Why Did the Membrane Segment Dominate the Nafion Market?

The membrane segment dominated the nafion market in 2025. The growing fuel cells and electrochemical applications increase demand for Nafion membranes. The growing demand from the chlor-alkali industry for the production of sodium & chlorine, hydroxide & membrane-based electrolysis helps in the growth of the market. Nafion membranes have high degradation resistance, proton conductivity, and chemical stability. The growing demand from various industries like chemical processing, automotive, and electronics drives the market growth. Furthermore, stricter environmental regulations and driving demand for clean energy solutions contribute to the overall growth of the market.

The dispersion segment is significantly growing in the market during the forecast period. The growing adoption of fuel cells in various industries increases demand for Nafion dispersions for catalyst and membrane coating. The dispersion is widely used in catalyst coating, thin films, and coatings. The dispersion technology enhances Nafion properties and allows flexibility in the formulation of Nafion-based materials. The rise of electric vehicles increases demand for Nafion dispersion. The shift towards clean energy sources helps in the market growth. The growing demand from electrochemical applications, sensor technology, chemical processing, and fuel cell components supports the overall growth of the market.

End Use Insights

Which End-Use Segment Held the Largest Share of the Nafion Market?

The energy segment led the market in 2025. The growing focus on renewable energy sources and sustainable energy increases demand for Nafion. The growing government investment in green energy technologies helps in the market growth. The growing demand for energy conversion in fuel cells increases the demand for Nafion. The growing demand for clean energy sources like solar energy and wind energy drives the overall growth of the market.

The automotive segment is experiencing the fastest growth in the market during the forecast period. The rise of electric vehicles in various countries increases demand for fuel cells, fueling demand for Nafion. The growing shift towards sustainable transportation helps in the market growth. The strong focus of automakers on the development of fuel cells increases demand for Nafion. The growing focus on minimizing emissions increases adoption of fuel cells is driving demand for Nafion. Fuel cells provide cleaner emissions, longer range, and faster refuelling. Furthermore, growing demand from various automotive applications like the development of new fuel cell technology, stationary power generation, and backup power systems drives the overall growth of the market.

Form Factor Insights

What Made the Sheet Segment Dominate the Nafion Market?

The sheet segment dominated the market in 2025. The growing demand for fuel cells for easy integration in fuel cell stacks helps in the market growth. The sheets are easily produced in a diverse thickness range and consist of different strengths. They sustain in harsh conditions and conduct protons efficiently due to which is widely used in sheets. The sheet form is cost-effective and easy to fabricate. Sheets can be easily shaped according to specific applications and offer high mechanical strength. The growing demand from the chlor-alkali industry for the production of caustic soda and chlorine contributes to the overall market growth.

The film segment is the fastest growing in the market during the forecast period. The growing demand for fuel cells in the energy & automotive sectors increases demand for Nafion films. The films consist of high mechanical durability and chemical durability. They lower performance degradation and offer extended operating life. They are widely used in electrode performance enhancement by offering mechanical and physical endurance. The growing demand from electrochemical devices like batteries and sensors helps the market growth. The film offers precise control over surface properties and thickness. Additionally, growing demand from various applications like chlor-alkali electrolysis, membrane separation technology, electrode coating, biomedical applications, and sensors drives the overall growth of the market.

Regional Insights

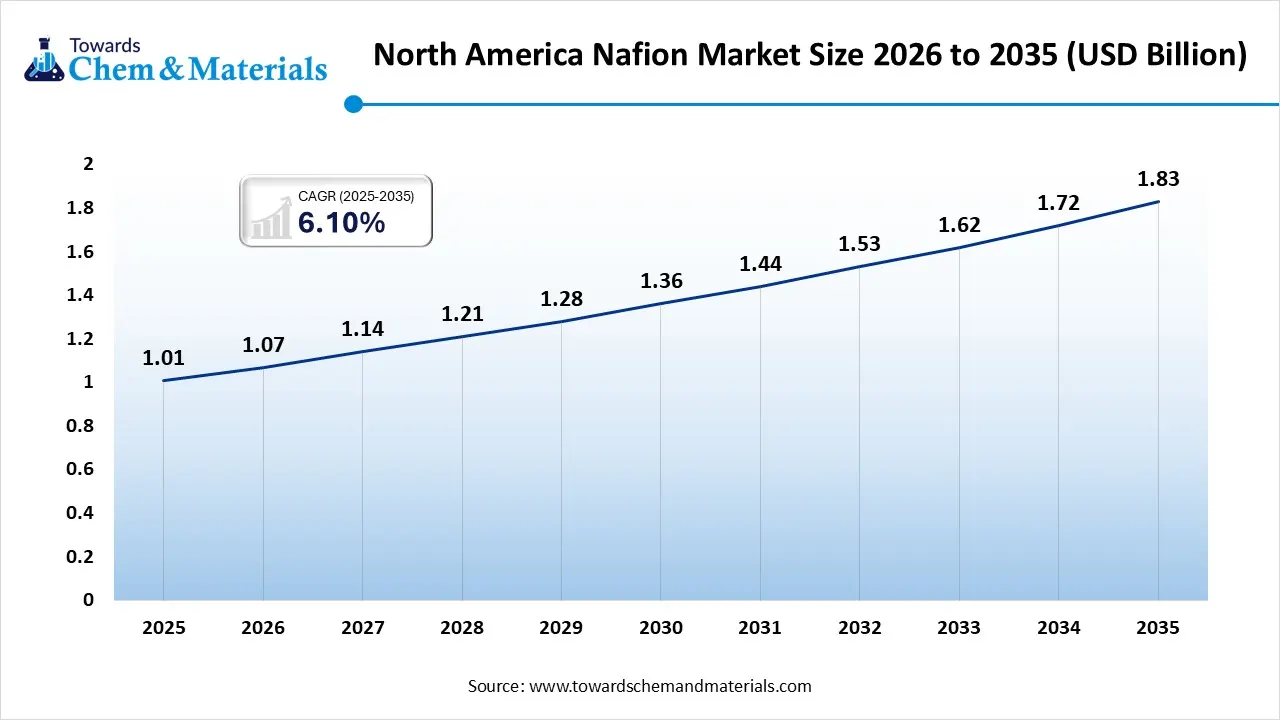

The North America nafion market size was valued at USD 1.01 billion in 2025 and is expected to be worth around USD 1.83 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 6.10% over the forecast period from 2026 to 2035. North America dominated the nafion market in 2025.

The strong presence of fuel cell technology and growing demand for fuel cells in stationery and transportation applications help in the market growth. The well-established chlor-alkali industry in the region increases demand for Nafion. The growing infrastructure development fuels demand for Nafion-based paints. The government support for lowering emissions and clean energy increases demand for Nafion. The growing research & development in fuel cell technologies help in the market growth. The growing investments in clean energy projects and rising demand for green hydrogen drive the overall growth of the market.

The United States Nafion Market Trends

The United States is a major contributor to the Market. The growing commercialization of fuel cell technologies increases demand for Nafion. The strong focus on research & development of fuel cells and increasing development of fuel cells helps the market growth. The supportive government policies for clean energy increase the adoption of Nafion. The growing investment in the green hydrogen initiative and growing infrastructure development help market growth. Additionally, the presence of key players like Solvay and Chemours supports the overall growth of the market.

- The United States exported 7738 shipments of Fuel Cell. (Source: volza)

- The United States exported 135 shipments of the Ion Exchange Membranes. (Source: Volza)

Which Region is Fastest Growing in the Nafion Market?

Asia Pacific experiences the fastest growth in the market during the forecast period. The growing production of electric vehicles in the region increases demand for Nafion. The strong government support from East Asia for the adoption of clean energy and the growing demand for fuel cells help in the market growth. The growing investment in the development of Nafion applications increases demand for Nafion. The rapid urbanization and industrialization in the region fuel demand for Nafion for various services and products. The strong government support for renewable energy sources increases demand for Nafion. The growing demand in various industries like healthcare, electronics, & automotive, and the increasing expansion of Nafion production facilities, drives the overall growth of the market.

China’s Nafion Market Trends

China is a key contributor to the nafion Market. The rapid industrialization increases demand for Nafion for various applications like fuel cell technology & chlor-alkali production. The growing development of renewable energy technology helps the market growth. The strong government support for clean energy and a well-established manufacturing base increases demand for Nafion. The growing urbanization and development of various industrial projects fuel demand for Nafion-based technologies. The growing expansion of the automotive sector increases demand for fuel cells, fueling demand for Nafion. The growing demand for electrolyzers and fuel cells contributes to the overall market growth.

- China exported $251010.52K of polytetrafluoroethylene in 2023.(Source: worldbank.org)

- The China exported 2825 shipments of Fuel Cell.(Source: volza)

- China exported 135 shipments of the Ion Exchange Membranes. (Source: Volza)

How is India Growing in the Nafion Market?

India is growing in the market. The growing demand for electric vehicles in the nation increases demand for Nafion for the production of fuel cells. The rising production of green hydrogen is driving demand for Nafion. The strong government support for green technologies, manufacturing, and renewable energy helps in the market growth. The growing expansion of the semiconductor industry increases demand for Nafion for chip fabrication. The growing adoption of clean energy and a strong commitment to lower carbon emission drives the overall growth of the market.

- India exported $125894.99K of polytetrafluoroethylene in 2023.(Source: wits.worldbank.org)

How will Europe be considered a Notable Region in the Nafion Market?

Europe is a notable region in the global market, largely due to its ambitious decarbonization targets, robust policy support for the hydrogen economy, and substantial investments in green hydrogen production technologies and fuel cells. The European Union has introduced supportive regulatory frameworks and initiatives, such as the EU Green Deal and the Hydrogen Strategy, to accelerate the transition to clean energy. Europe is at the forefront of the hydrogen economy, with a growing demand for proton exchange membrane electrolyzers, which utilize Nafion membranes to produce green hydrogen from renewable sources.

Germany Nafion Market Trends

Germany represents a mature market within the global landscape, characterized by its ambitious decarbonization goals and a strong industrial foundation, along with Energiewende policy, alongside the EU's hydrogen strategy, and expedited the deployment of electrolysis projects, increasing the need for Nafion in efficient hydrogen production and usage. Germany has become a hub for advanced battery and clean energy research, which includes leveraging it in applications like redox flow batteries and energy storage systems.

How will Latin America emerge in the Nafion Market?

Latin America is an emerging region in the global market, primarily driven by a strong push toward clean energy adoption, abundant mineral resources crucial for energy technologies, and supportive government initiatives for green hydrogen projects. Countries in this region are focusing on diversifying their energy mix and reducing dependence on fossil fuels to meet climate goals and lower emissions. This shift encourages the adoption of technologies that use Nafion, enabling some of the world's lowest levelized costs for electrolysis-based hydrogen production, thanks to excellent solar and wind resources.

Brazil Nafion Market Trends

Brazil is an emerging market in Latin America, characterized by its vast renewable energy resources and the development of a domestic hydrogen strategy. The country's high reliance on renewable sources for electricity generation positions it as a potential major player in the global trade of renewable hydrogen. This is particularly relevant in the industrial sector, where hydrogen is utilized in processes such as petrochemicals, fertilizers, and general process heating.

How will the Middle East and Africa Surge in the Nafion Market?

The Middle East and Africa are crucial regions in the global market, driven by vast energy resources, strategic trade routes, and massive infrastructure demands from rapid urbanization and economic diversification. The region holds over half of the world's proven oil reserves and significant natural gas, making it vital for global energy security. Key waterways, such as the Suez Canal and the Strait of Hormuz, along with its role as a tricontinental trade hub, enhance its importance. Additionally, untapped potential in healthcare, agriculture, and green energy presents substantial growth opportunities.

The UAE Nafion Market Trends

The UAE is a rapidly developing market within this region, marked by significant national investments and a strategic shift towards a low-carbon and hydrogen-based economy. The UAE has established bilateral partnerships and trade collaborations with countries like Germany to supply low-carbon ammonia, further integrating itself into the global hydrogen supply chain and increasing the demand for related technologies, such as Nafion membranes.

Recent Developments

- In September 2025, Professor Xiangfeng Duan and graduate student Boxuan Zhou (Materials Science and Engineering) lead a research team that has developed a durable, low-cost, printable light-emitting membrane from ultrathin molybdenum disulfide and Nafion, with strong potential for chip-integrated photonic devices.(Source: www.chemistry.ucla.edu)

- In November 2025, Columbia Engineering chemical engineer Dan Esposito and his team are developing an alternative to Nafion. Their work, supported by the U.S. Department of Energy and in collaboration with industrial partners Nel Hydrogen and Forge Nano, aims to replace the Nafion membranes used in conventional electrolyzers with ultra-thin, PFAS-free oxide membranes. Replacing this component eliminates upwards of 99% of the PFAS contained in an electrolyzer.(Source: www.eurekalert.org)

Top Companies List

- Dow Chemical

- Triton Consulting

- FuelCell Energy

- AgfaGevaert

- GreenTech Energy Solutions

- Xincotec

- Gem Fuel Cells

- Asahi Kasei

- Ballard Power Systems

- Nafion

- DuPont

- L. Gore and Associates

- Fumatech BWT

- Ion Power

- Membrane Solutions

Segments Covered

By Application

- Fuel Cells

- Chlor-Alkali Process

- Electrolyzers

- PVD Processes

By Product Type

- Membrane

- Dispersion

- Resin

By End Use

- Energy

- Automotive

- Chemical Processing

- Electronics

By Form Factor

- Sheet

- Film

- Coating

- Powder

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait