Content

Metal Casting Market Size and Growth 2025 to 2034

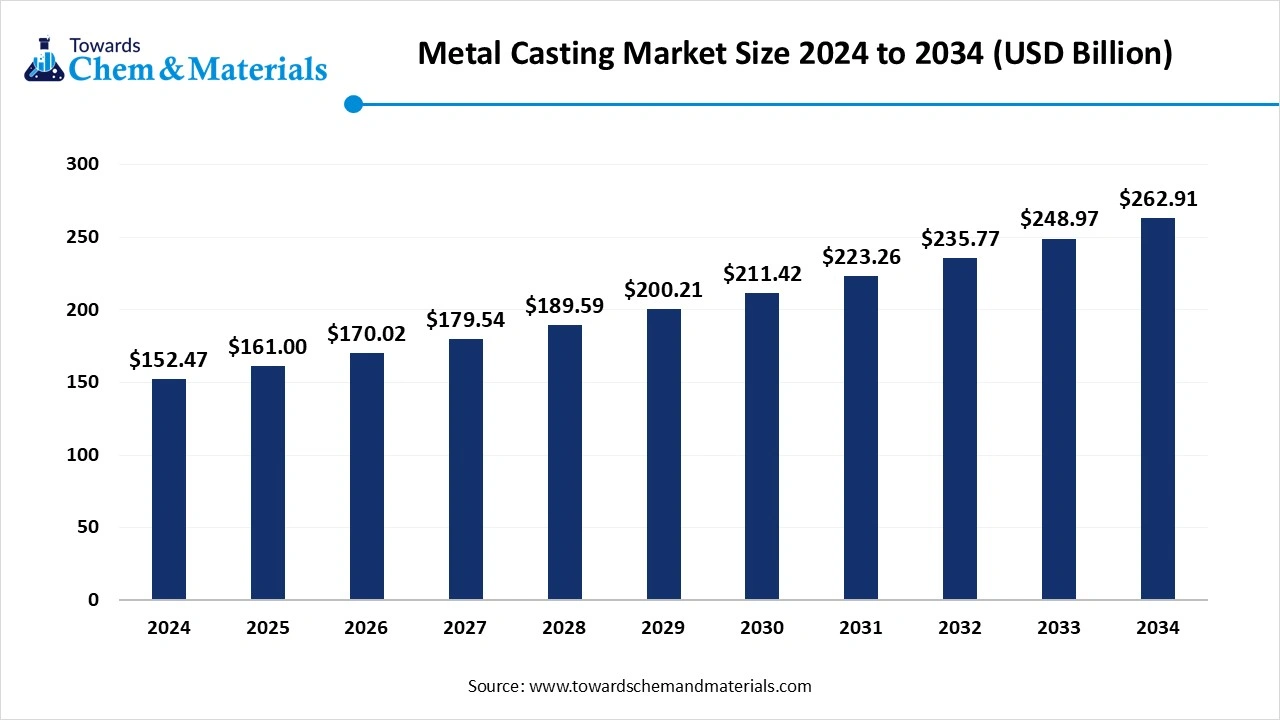

The global metal casting market size was reached at USD 152.47 billion in 2024 and is estimated to surpass around USD 262.91 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.60% during the forecast period 2025 to 2034. The increasingly enlarged industrialization and expanding automotive industry have accelerated the market growth in recent years.

Metal Casting Market Key Takeaways

- By region, Asia Pacific dominated the metal casting market in 2024, akin to its strong industrial base, cost-effective labor, and rising demand across the automotive, construction, and manufacturing sectors.

- By region, Europe is expected to experience the fastest growth rate during the forecast period, owing to its strong industrial base, advanced manufacturing technologies, and sustainability practices.

- By material, the aluminum segment held the dominating share of the metal casting market in 2024 its lightweight properties, corrosion resistance, and high strength-to-weight ratio.

- By material, the steel segment is expected to experience notable market growth in the future, as infrastructure, construction, and heavy machinery sectors witness steady global expansion

- By application, the automotive manufacturing segment dominated the market with the largest share in 2024, owing to high demand for lightweight, durable, and cost-effective components.

- By application, the industrial segment is expected to grow at the fastest rate in the market during the forecast period due to expanding infrastructure projects,

The Backbone of Modern Manufacturing: Metal Casting’s Expanding Footprints

The metal casting market is experiencing rapid growth, akin to its essential role in numerous industrial applications, including automotive, aerospace, machinery, and construction. Moreover, metal casting is a vital process that allows for the creation of complex metal components with high strength and durability, making it indispensable for modern manufacturing.

As global industries continue to automate and scale up production, the demand for high-performance cast products is increasing. Furthermore, the developing countries are also contributing to this upward trend through rising investments in industrial development and infrastructure projects. Also, manufacturers are seen in expanding their capabilities, adopting advanced casting technologies, and streamlining production to meet the quality and volume demands of various end-use sectors.

The rising demand from the automotive industry is spearheading the industry's growth nowadays. Automakers across the globe depend heavily on cast metal parts for engines, chassis, and structural components due to their strength, reliability, and cost-effectiveness.

As automotive manufacturers move towards lightweight vehicle designs to enhance fuel efficiency and meet emissions regulations, the need for precision metal casting is growing. Furthermore, the sudden shift toward electric vehicles is pushing the demand for new types of cast components customized to EV designs. The continuous growth of vehicle production, particularly in regions such as Asia-Pacific and Latin America, is significantly contributing to the metal casting market growth.

Metal Casting Market Trends

- Manufacturers are increasingly using lightweight alloys such as aluminum and magnesium to reduce component weight in the current period. Also, this trend is driven by demand from the automotive and aerospace sectors, focusing on improving fuel efficiency. Moreover, it is reshaping material selection in casting operations across the world. Companies are applying different production strategies to meet sustainability and performance goals.

- The metal casting industry is heavily dependent upon automation and digital technologies to boost efficiency and precision. Smart foundries with real-time monitoring and data analytics are becoming mainstream nowadays.

- Rising industrialization and infrastructure development in different regions are fueling demand. Local manufacturers are seen in increasing their operations to fulfill the demand of the growing automotive and construction sectors. Regional demand patterns are influencing global supply chain strategies. Also, several brands are observed in increasing investment for the production plant expansion in the current period.

Metal Casting Market Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 161 Billion |

| Expected Size in 2034 | USD 262.91 Billion |

| Growth Rate | CAGR of 5.60% 2025 to 2034 |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| High Impact Region | Asia Pacific |

| Segment Covered | By Material, By Application, By Region |

| Key Companies Profiled | POSCO,Dynacast,Arconic,Ryobi Limited,Endurance Technologies Limited,Alcast Technologies,UNI Abex,MES, Inc.,CALMET,Hitachi Ltd. |

Casting Locally, Competing Globally: The Rise of Regional Manufacturing Hub

Manufacturers can invest in regional production facilities, which are expected to create significant growth opportunities for the metal casting market. This strategy is likely to help meet rising demand efficiently while lowering transportation costs and ensuring faster delivery in the specific regions.

Also, it supports adaptability to regional regulations and material availability in the future. As infrastructure and manufacturing expand, localized hubs become an ideal solution for industry growth.

Metal Casting Market Challenge

Rising Costs, Shrinking Margins: The Challenge of Unstable Raw Material Prices

Fluctuating prices of ingredients like metals and alloys are anticipated to hamper metal casting market growth during the forecast period. also, which is impacting cost stability for manufacturers. This uncertainty makes long-term planning difficult. Inconsistent supply chains can further create several challenges in the future. As a result, many producers face margin challenges in a competitive industry environment.

Metal Casting Market Regional Insights

Asia Pacific dominated the metal casting market in 2024, owing to its strong industrial base, cost-effective labor, and rising demand across the automotive, construction, and manufacturing sectors. Countries such as India, China, Japan, and South Korea are seen in investing heavily in infrastructure and industrial expansion, driving the need for metal components.

Moreover, favorable government policies and growing foreign investments have contributed to regional production capabilities in recent years. The region’s dense manufacturing network and expanding end-use industries continue to push demand for metal casting, which is expected to create beneficial opportunities for producers in the future.

India has become the second-largest producer of casting. Also, its annual production has crossed 12 million tons recently. Moreover, this production limit is supported by government initiatives such as the Made in India and others.

From Scale to Skill: China’s Evolving Role in Global Metal Casting

China has maintained its dominance in the Asia Pacific region for the past period due to its massive production capacity and integrated supply chains. Moreover, as the country is considered as world's largest producer and consumer of cast metal products, while receives benefits from its advanced manufacturing infrastructure and strong domestic demand, especially in the sectors such as automotive and machinery sectors. From other regional players, China focuses heavily on automation and technological upgrades to enhance casting precision and energy efficiency in the current period.

Europe is expected to grow at the fastest pace in the metal casting market during the coming period, akin to its strong industrial base, advanced manufacturing technologies, and sustainability practices. The region has well-established automotive, machinery, and aerospace sectors, all of which heavily depend on the precision cast components, which are expected to create enlarged opportunities for the manufacturer in the region.

Additionally, stringent environmental regulations in Europe are driving the adoption of cleaner casting processes with enlarged innovation and investment. Also, European manufacturers are seen in increasing production capacity to meet both domestic demand and global export requirements, which is expected to change the industry environment in the coming years.

From Tradition to Innovation: Germany’s Automotive Industry Fuels Casting Demands

The industry growth of Germany is mainly attributed to its leadership in engineering excellence and its position as a manufacturing hub. The country’s automotive sector is considered home to global OEMs, which generates strong demand for high-performance cast parts, which is anticipated to drive the growth of country in the future. Also, Germany is seen as heavily investing in automation and digital factory solutions to boost efficiency and precision compared to its neighboring countries. Moreover, German companies are prioritizing research in lightweight alloys and sustainable materials to align with green production goals, which is expected to give them a market advantage in the coming years.

Metal Casting Market Segmental Insights

Material Insights

The aluminum segment held the dominating share of the metal casting market in 2024 its lightweight properties, corrosion resistance, and high strength-to-weight ratio. These characteristics make aluminum ideal for automotive, aerospace, and electronics applications, where reducing weight without compromising performance is essential. Moreover, rising demand for fuel-efficient vehicles and sustainable materials has accelerated the shift toward aluminum-based components in the current period.

With strong demand from developed and emerging countries, aluminum remains the ideal choice across industries prioritizing efficiency, durability, and environmental compliance.

The steel segment is expected to experience notable metal casting market growth in the future, as infrastructure, construction, and heavy machinery sectors witness steady global expansion. Steel’s superior strength, durability, and resistance are expected to drive the segment's growth in the coming year.

Moreover, growing investments in renewable energy, transport networks, and industrial machinery are boosting demand for high-performance cast steel products. Furthermore, technological advances in casting methods are improving the efficiency and precision of steel production. As industries focus on robust, long-lasting materials, steel is anticipated to lead future market growth driven by evolving structural and industrial needs.

Application Insights

The automotive manufacturing segment dominated the metal casting market with the largest share in 2024, owing to high demand for lightweight, durable, and cost-effective components. In the current period, automakers are increasingly depending on metal casting to produce engine blocks, transmission parts, and structural components with high precision and performance.

Growing vehicle production, especially in developing markets, has further increased this demand. Furthermore, the sudden shift towards electric vehicles (EVs) has created the need for complex cast parts used in motors and batteries. Also, this trend, supported by continuous innovation in casting technologies, has made the automotive sector a major consumer of metal casting solutions across global manufacturing bases in recent years.

The industrial segment is expected to grow at the fastest rate in the metal casting market during the forecast period due to expanding infrastructure projects, machinery upgrades, and energy sector investments across the world. Moreover, industries are increasingly adopting advanced casting solutions for turbines, pumps, valves, and heavy equipment, driven by efficiency and durability requirements.

With the push for sustainable and localized manufacturing, many industrial operations are reshaping supply chains to meet specific material and design needs, which is expected to lead the segment growth in the coming years. Additionally, global decarbonization efforts are accelerating the demand for precision-engineered parts in renewable energy and smart grid systems is likely to drive the potential of the segment during the forecast period.

Metal Casting Market Recent Developments

Foundry Lab and NJJI

- Collaboration: In 2024, Foundry Lab created a partnership with the NJJI to develop superior metal parts. Moreover, the NJJI is the first commercial customer of the company, as per company claimed.

3D Lab

- Launch: In 2025, 3D Lab introduced their latest ultra-frequency system with ATO cast and ATO sieve recently. Also, for this development, the 3d lab made a collaboration with Additive Plus. Moreover, this is the fourth generation of the ultrasonic system, which is specifically designed for fine powder production.

Stratasys

- Launch: In 2024, Stratasys unveiled its latest processor, which is Neo SLA built for investment casting. Also, for the development of the processor, Stratasys made a partnership with Materialize.

Handtmann

- New Launch: In 2025, Handtmann introduced its latest components for the light metal casting recently. Moreover, this component will be used in vehicle manufacturing as per the company's claim, and it will pass through the aluminum die casting process.

Metal Casting Market Top Companies list

- POSCO

- Dynacast

- Arconic

- Ryobi Limited

- Endurance Technologies Limited

- Alcast Technologies

- UNI Abex

- MES, Inc.

- CALMET

- Hitachi Ltd.

Segment Covered in the Report

By Material

- Iron

- Steel

- Aluminum

- Others

By Application

- Automotive & Transportation

- Industrial

- Building & Construction

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Argentina

- The Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Report Covered: [Revenue + Volume]

- Historical Year: 2021-2023

- Base Year: 2024

- Estimated Years: 2025-2034