Content

Lubricant Additives Market Size and Growth 2025 to 2034

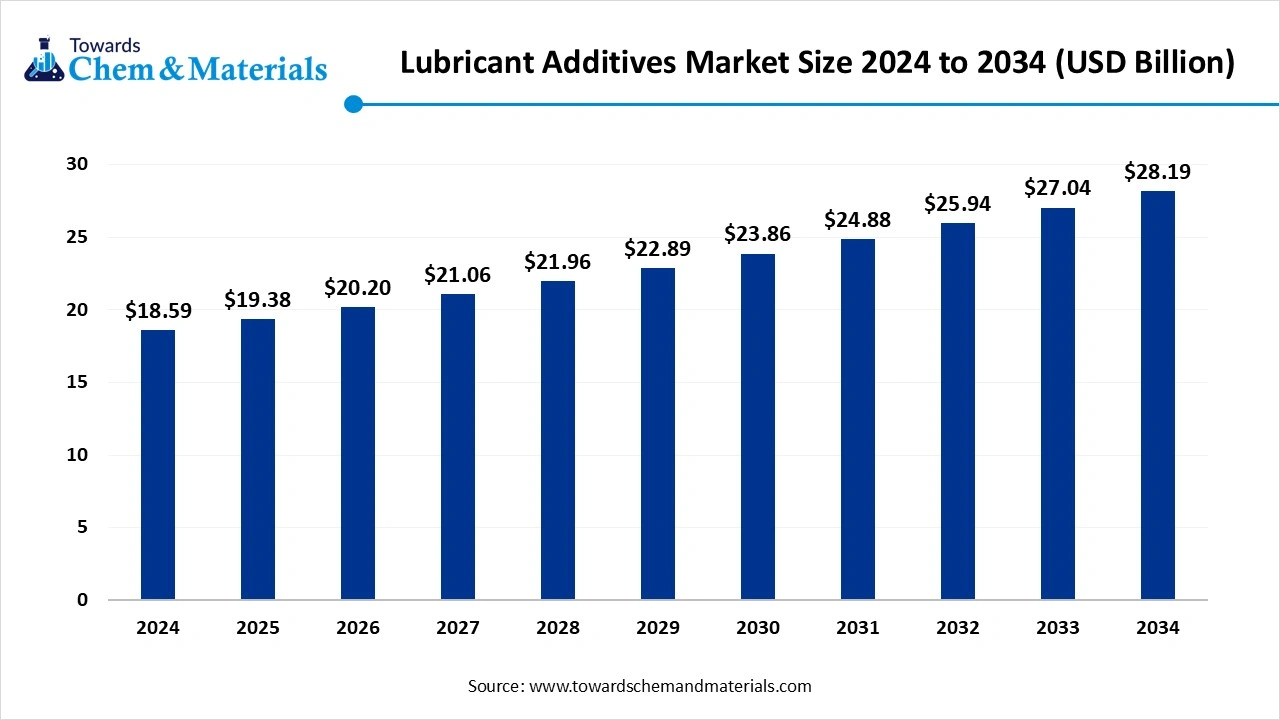

The global lubricant additives market size is calculated at USD 18.59 billion in 2024, grew to USD 19.38 billion in 2025 and is predicted to hit around USD 28.19 billion by 2034, expanding at healthy CAGR of 4.25% between 2025 and 2034.The growing vehicle production, rapid industrialization, and advancements in additive technology drive the growth of the market.

Key Takeaways

- The Asia Pacific led the lubricant additives market due to the increasing development of infrastructure projects.

- The North America is growing at the fastest CAGR in the market during the forecast period due to the growing expansion of the automotive industry.

- The Europe is growing at a notable rate in the market due to the rapid industrial growth.

- By application, the automotive lubricants segment dominated the market with the largest share of 64.36% in 2024 due to the rise of electric vehicles.

- By application, the industrial lubricants segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing demand from various industrial applications.

- By product, the viscosity index improvers segment led the market share of 25.19% in 2024 due to the growing demand from various machinery.

- By product, the dispersants segment is expected to grow at a significant CAGR in the market during the forecast period due to the increasing demand for maintaining engine cleanliness.

Lubricant Additive: A Science Behind Smooth Operations and Power Efficiency

Lubricant additives are inorganic and organic compounds added to base oils to improve properties and performance. They enhance the ability of lubricants to sustain in various conditions. Lubricant additives consist of 0.1% to 30% of the total lubricant volume. They enhance properties like anti-foaming, oxidation resistance, and viscosity. The various types of lubricant additives are antioxidants, anti-wear additives, detergents, viscosity modifiers, dispersants, corrosion inhibitors, extreme pressure additives, pour point depressants, anti-foaming agents, and friction modifiers. Lubricant additives enhance existing base oil properties, suppress undesirable base oil properties, and impart new properties to the base oil. The growing demand for vehicles and increased automotive production fuel demand for lubricant additives. The stringent emission standards and growing fuel efficiency requirements help in the market growth. Factors like growing advancements in additive technology, rising industrial sector, bio-based lubricant additives, manufacturing growth, and growing adoption of renewable energy contribute to the lubricant additives market growth.

- Singapore exported 1,147 shipments of lubricant additives. (Source: Volza)

As per the India Export data, India exported 11.4K shipments of lubricant additives.(Source: volza) - BP LUBRICANTS USA INC is the leading supplier of lubricant additives.(Source: volza)

- Germany exported 2,156 shipments of lubricant additives. (Source: volza)

- Japan exported 1,164 shipments of viscosity index improver.(Source: volza)

Growing Industrialization Drives Lubricant Additives Market Growth

The growing industrialization worldwide increases demand for lubricant additives to extend the lifespan of equipment and ensure smooth operations. The growing industrialization increases demand for machinery in various industries like construction, transportation, manufacturing, and mining. The growing machinery demand increases the adoption of lubricant additives to lower heat generation, friction, and wear. The increasing demand from industries to improve the operational efficiency of equipment is driving demand for lubricant additives.

The growing operations of industrial processes in extreme conditions like corrosive environments, high temperatures, and heavy loads increase demand for lubricant additives to enhance anti-wear properties, viscosity, and oxidation stability. The growing industries focus on sustainability, fueling the adoption of sustainable practices increases demand for lubricant additives to lower harmful emissions. The growing industrialization is a key driver for the lubricant additives market.

Market Trends

- The Strong Focus on Reducing Emissions: The stringent regulations to lower emissions of carbon increase demand for manufacturing fuel-efficient vehicles. The growing focus on the development of fuel-efficient vehicles increases demand for lubricant additives to improve fuel economy.

- Technological Advancements: The ongoing technological advancements focus on addressing the demand for modern machinery, enhancing performance, and improving sustainability. Advancements like nano-lubricants, eco-friendly additives, bio-based lubricants, and green additives help in the market growth.

- The Rapid Growth in Manufacturing: The growing expansion of manufacturing activities increases demand for lubricant additives. The growing manufacturing in various sectors like construction and automotive leads to higher demand for lubricant additives.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 19.38 Billion |

| Expected Size by 2034 | USD 28.19 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Application, By Product, By Region |

| Key Companies Profiled | BASF SE, Chevron Oronite Company LLC, Deutsche Oelfabrik Gesellschaft Fur Chemische Erzeugnisse M.B.H. & Co. Kg, Afton Chemical Corp., BRB International B.V., Daelim Co. Ltd., Dorf-Ketal Chemicals India Pvt. Ltd., The Elco Corp. (Italmatch Chemicals S.p.A), Evonik Industries AG, Dover Chemical Corp, Eni S.p.A., Infineum International Ltd., King Industries, Inc., Lehmann & Voss & Co. KG., Metall-Chemie GmbH & Co. KG, RT Vanderbilt Holding Company, Inc., Jinzhou Kangtai Lubricant Additives Co., Ltd., LANXESS AG, Lubrizol Corp., Xinxiang Richful Lube Additive Co., Ltd. |

Market Opportunity

The Growing Automotive Industry Surges Demand for Lubricant Additives

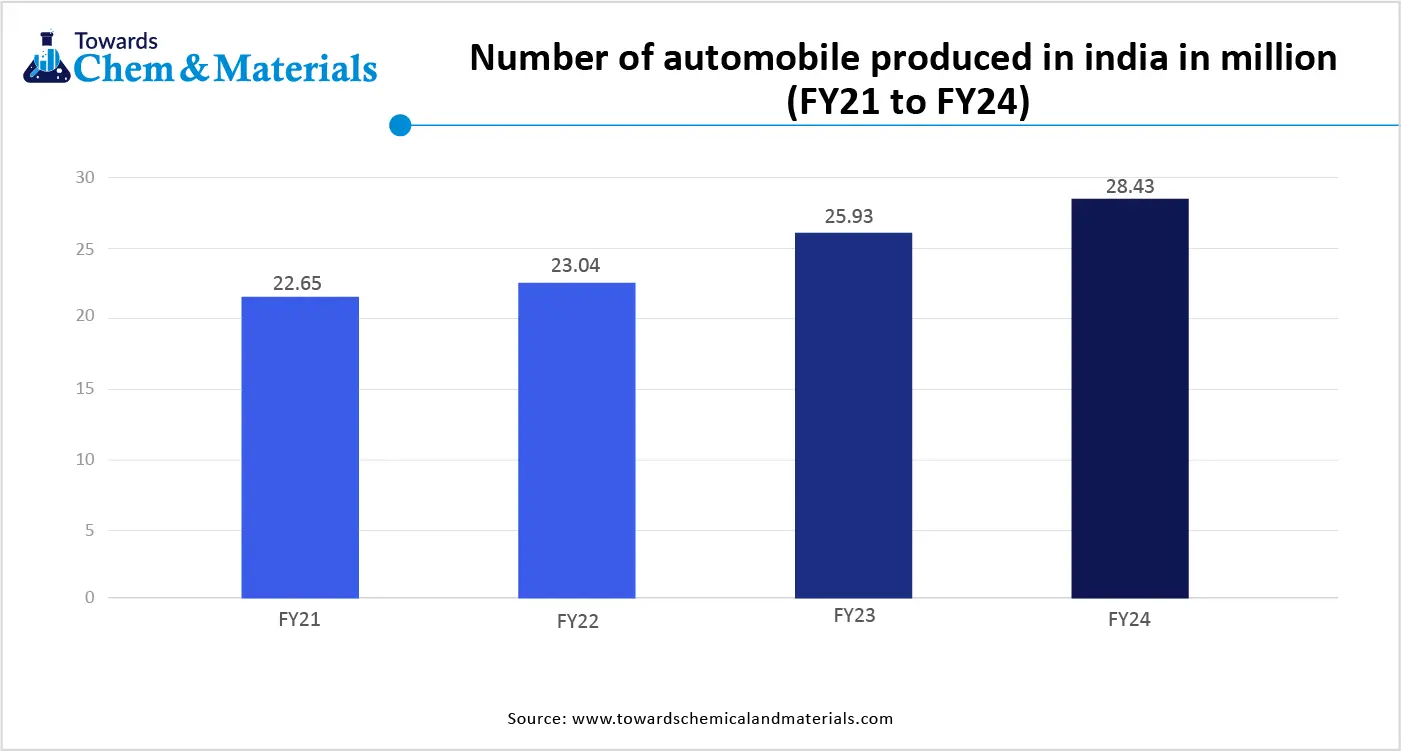

The growing expansion of the automotive industry and the rising demand for various vehicles increases the demand for lubricant additives for enhancing performance, fuel efficiency, and durability. The growing production of vehicles worldwide leads to higher demand for lubricant additives to improve the performance of engines. The stringent fuel efficiency standards for vehicles fuel demand for lubricant additives. The growing advancements of engine technology, like direct injection and turbocharging, increase demand for lubricant additives.

The growing production of vehicles increases the demand for vehicle maintenance of vehicles. The growing demand for the maintenance of vehicles is driving the adoption of high-performance lubricant additives. The growing shift towards hybrid and electric vehicles increases demand for lubricant additives to enhance efficiency. The growing demand for motorcycles, passenger cars, and commercial vehicles helps in the market growth. The growing automotive industry creates an opportunity for the lubricant additives market.

(Source: India Brand Equity Foundation)

Market Challenge

Raw Material Price Fluctuations Restrict the Adoption of Lubricant Additives

Despite several benefits of the lubricant additives in various sectors, raw material price fluctuations restrict the market growth. Factors like fluctuating chemical additives & base oils cost, fluctuating crude oil prices, and supply chain disruption are responsible for fluctuating raw material prices. Base oil is an important component for the formulation of lubricants. Base oil originates from crude oil, and the fluctuating price of crude oil restricts the market growth. Supply chain disruptions due to logistical challenges, natural disasters, and pandemics increase the cost of raw materials. The volatility in chemical additives prices restricts the market growth. Raw material price fluctuations hamper the growth of the market.

Regional Insights

Why did Asia Pacific Dominate the Lubricant Additives Market?

Asia Pacific dominated the market in 2024. The growing demand for vehicles and machinery for various industrial activities increases the demand for lubricant additives. The growing automotive manufacturing and rapid growth in vehicle production help in the market growth. The strong investment in infrastructure projects, development such as construction, roads, and railways, is fueling demand for lubricant additives. The stringent emission regulations and focus on fuel efficiency increase demand for advanced lubricant additives. The growing adoption of renewable energy and increasing construction activities fuel demand for lubricant additives. Additionally, the growing production of automobiles in various countries like India, South Korea, China, and Japan drives the overall growth of the market.

China Lubricant Additives Market Trends

China is a major contributor to the market. The growing automotive manufacturing industry and rapid growth in the industrial base in various sectors, like steel production, increase demand for lubricant additives. The growing development of various infrastructure projects, like construction and renewable energy, helps in the market growth. The growing expansion of the steel industry is fueling demand for lubricant additives. The growing popularity of electric vehicles increases the adoption of lubricant additives. The growing export of lubricant additives and the expansion of power generation capacity drive the overall growth of the market.

- According to China’s Pressure Additive Export data, Yihai Kerry (Guangzhou) is the leading supplier of pressure additives.(Source: volza)

What are the Growth Factors for the Lubricant Additives Market in North America?

North America experiences the fastest growth in the market during the forecast period. The growing demand from various industries like marine, mining, and cement increases the demand for lubricant additives to improve equipment longevity. The growing expansion of the manufacturing sector in the region helps in the market growth. The growing expansion of the automotive sector, including commercial vehicles and passenger vehicles, is driving demand for lubricant additives.

The ongoing technological advancements in lubricant additives like dispersants, anti-wear agents, and others help the market growth. The stricter environmental regulations, like focusing on improving fuel efficiency and reducing carbon emissions, increase demand for lubricant additives. The growing adoption of electric vehicles increases demand for lubricant additives to manage electrical conductivity & thermal management, supporting the overall growth of the market.

United States Lubricant Additives Market Trends

The United States is a key contributor to the lubricant additives market. The presence of a large automotive manufacturing industry increases demand for lubricant additives. The growing industrial base in various sectors like power generation, steel production, and metalworking helps in the market growth. The strong investment in research & development of lubricant additives and the presence of advanced infrastructure drive the market growth. The presence of major automotive manufacturing players like Chrysler, General Motors, and Ford increases demand for lubricant additives. The increasing demand for high-performance lubricant additives in industrial sectors and the automotive industry helps in the market growth. The presence of key market players like Lubrizol & Afton Chemical drives the overall growth of the market.

- The United States exported 48,308 shipments of lubricant additives.(Source: Volza)

- The United States exported 112,372 shipments of lubricating oil additive.(Source: Volza)

- The United States exported 11,191 shipments of corrosion inhibitor.(Source: Volza)

Why is Europe Growing at a Notable Rate in the Lubricant Additives Market?

Europe experiences notable growth in the market. The strong presence of the automotive industry and the growing high-volume production of vehicles increases demand for lubricant additives. The stricter environmental regulations increase demand for environment-friendly lubricant additives. The growing technological advancements in lubricant additives help in the market growth. The growing demand for synthetic lubricants drives demand for lubricant additives. The rapid industrial growth and rising demand from various industries like construction, manufacturing, and power generation drive the overall growth of the market.

Segmental Insights

Application Insights

Which Application Segment Dominated the Lubricant Additives Market in 2024?

The automotive lubricants segment led the market in 2024. The growing production of commercial and passenger vehicles increases demand for automotive lubricants. The growing demand for low-emission and fuel-efficient vehicles helps in the market growth. The growing advancements in engine technologies like direct injection and turbocharging increase demand for lubricant additives. The rapid growth in various types of vehicles, like buses, heavy trucks, and many others, is fueling demand for lubricant additives.

The growing trend of electric vehicles increases demand for lubricant additives for electric transmissions and motors. Additionally, the growing expansion of the automotive industry drives the overall growth of the market.

The industrial lubricants segment is the fastest growing in the market during the forecast period. The growing various industrial applications like the construction sector, steel industry, and power generation increase demand for various lubricant additives. The increasing industrial manufacturing fuel demand for equipment and machinery, helping in the market growth. The growing demand for high-quality lubricant additives in industrial applications helps the market growth. The rapid growth in various industries like construction, renewable energy, mining, automation, and the marine industries increases demand for lubricant additives, driving overall growth of the market.

Product Insights

How Viscosity Index Improvers Dominated the Lubricant Additives Market?

The viscosity index improvers segment dominated the market in 2024. The growing production of electric and traditional vehicles increases demand for viscosity index improvers. It is widely used for operating conditions and various applications. It lowers wear and friction of machinery and extends lifespan. The growing demand from modern vehicles & engines helps in the market growth. The stringent environmental regulations increase demand for viscosity index improvers. The growing demand for a variety of lubricants like hydraulic fluids, engine oils, and gear oils fuels the adoption of viscosity index improvers. The rapid industrialization and growing demand for high-performance lubricant additives drive the overall growth of the market.

The dispersants segment is the fastest growing in the market during the forecast period. The growing manufacturing of diesel and gasoline vehicles increases demand for dispersants. The growing demand from various applications like natural gas engine oils, automatic transmission fluids, heavy-duty diesel engine oils, aviation piston engine oils, and gear lubricants helps in the market growth. Dispersants prevent deposits & sludge formation and maintain engine cleanliness. It enhances the performance of machinery & engines and extends the lifespan. Technological advancements in dispersant formulations and stringent emission regulations support the overall growth of the market.

Recent Developments

- In November 2024, GAT GmbH and EnerG Lubricants launched ‘GAT X EnerG’ product line, in India. The new range includes engine care, body care, car detailing products, fuel system cleaners, and body care. The products are GAT EnerG G1 Diesel Engine Cleaner, GAT EnerG G1 Engine Flush, GAT EnerG G1 Octane Boosters, and GAT EnerG G1 Engine Oil Booster. The products have MB 229.52 and MB 229.51 certifications.(Source: autocarpro)

- In May 2023, Lumax Auto Technologies Limited launched Lumax lubricants and coolants. The product is available for two-wheelers, commercial vehicles, passenger vehicles, three-wheelers, and farm equipment. The lubricants and coolants are packed in 100% recycled plastic. The product offers protection in various climatic conditions and improves the performance of the engine. The range of lubricants consists of 4W gear oil, greases, 2W & 4W engine oil, and transmission oil. (Source: carindia)

- In June 2024, BRB launched a new additive package, Petraload 750, for power steering fluids and automotive transmission. The product boosts the endurance, performance, and efficiency of engine lubricants and gear systems.(Source: brb-international)

- In August 2024, Energizer and Assurance Intl launched a new STP product line in the Middle East & Africa and the Asia Pacific regions. The STP lubricants offer enhanced protection against deposits, wear, and corrosion and are made up of advanced additives. It sets new standards, offers high durability, performance, and reliability.(Source: mobilityoutlook.)

Top Companies List

- BASF SE

- Chevron Oronite Company LLC

- Deutsche Oelfabrik Gesellschaft Fur Chemische Erzeugnisse M.B.H. & Co. Kg

- Afton Chemical Corp.

- BRB International B.V.

- Daelim Co. Ltd.

- Dorf-Ketal Chemicals India Pvt. Ltd.

- The Elco Corp. (Italmatch Chemicals S.p.A)

- Evonik Industries AG

- Dover Chemical Corp

- Eni S.p.A.

- Infineum International Ltd.

- King Industries, Inc.

- Lehmann & Voss & Co. KG.

- Metall-Chemie GmbH & Co. KG

- RT Vanderbilt Holding Company, Inc.

- Jinzhou Kangtai Lubricant Additives Co., Ltd.

- LANXESS AG

- Lubrizol Corp.

- Xinxiang Richful Lube Additive Co., Ltd.

Segments Covered

By Application

- Automotive Lubricants

- Passenger Car Motor Oil

- Heavy Duty Motor Oil

- Others

- Industrial Lubricants

- Metalworking Fluids

- General Industrial Oil

- Industrial Engine Oil

- Others

By Product

- Viscosity Index Improvers

- Dispersants

- Anti-Wear Additives

- Friction Modifiers

- Detergents

- Antioxidants

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait