Content

Ductile Iron Pipes Market Size and Growth 2025 to 2034

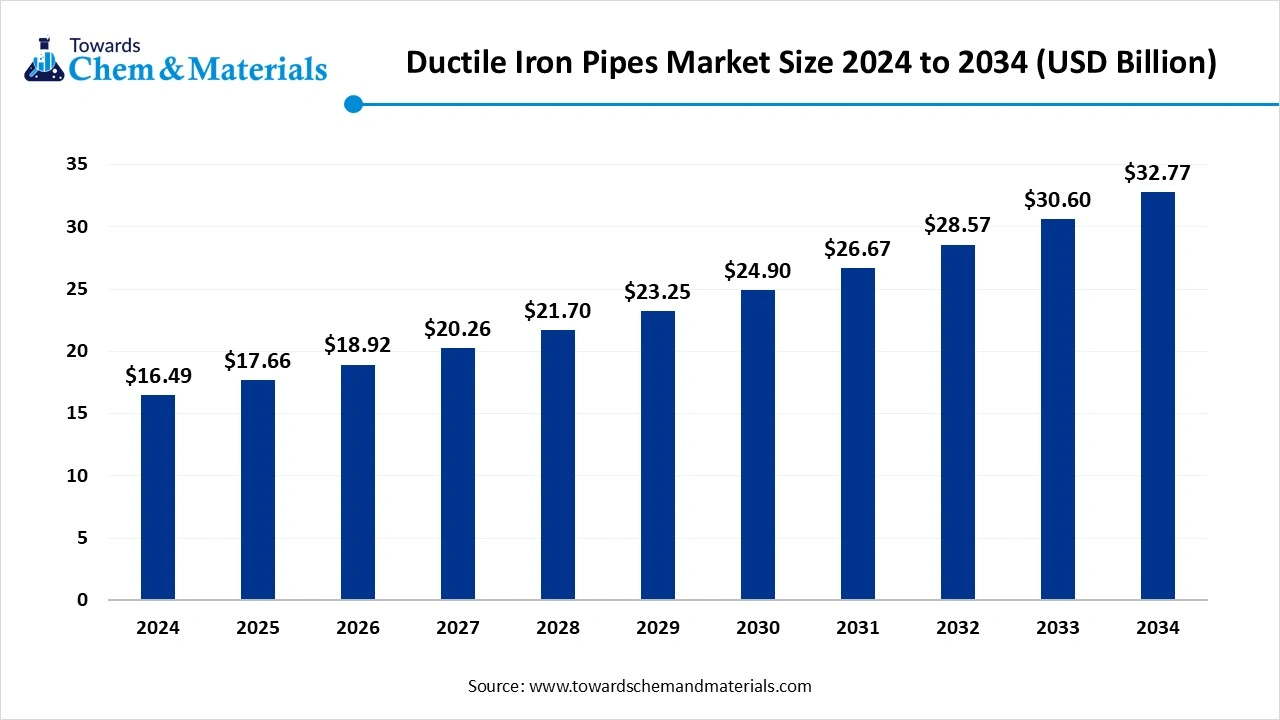

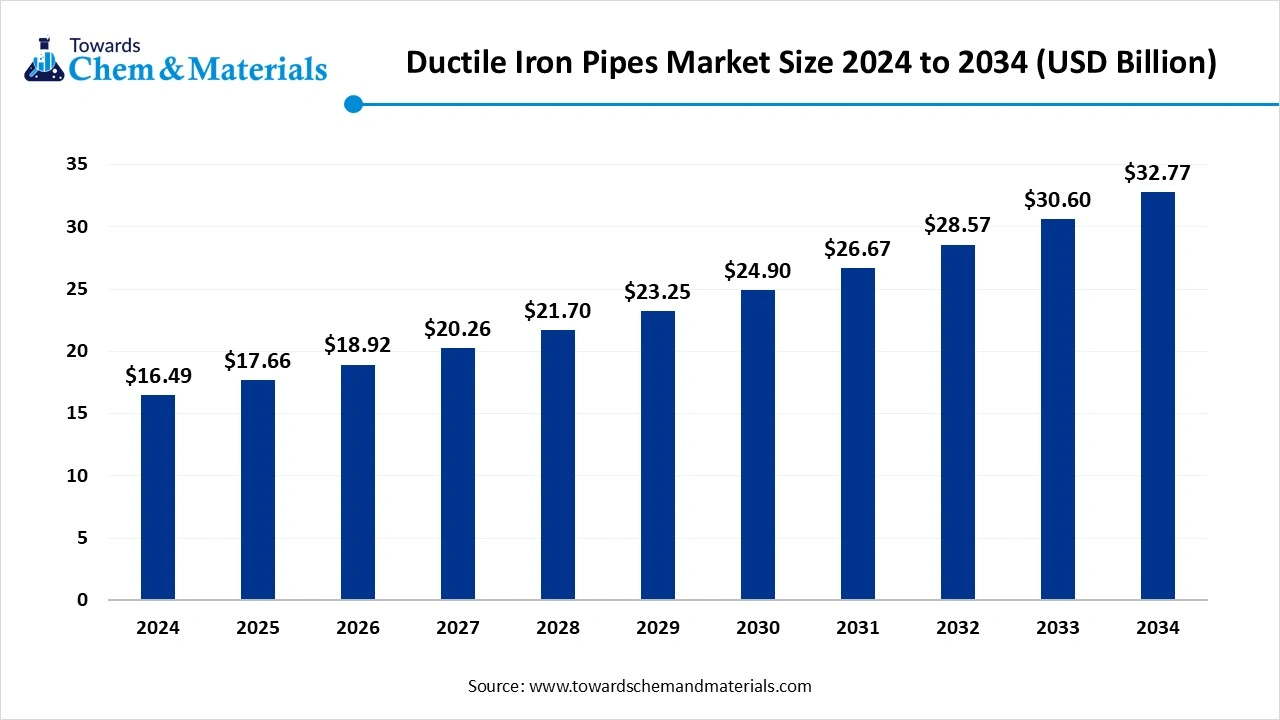

The global ductile iron pipes market size is calculated at USD 16.49 billion in 2024, grew to USD 17.66 billion in 2025 and is predicted to hit around USD 32.77 billion by 2034, expanding at healthy CAGR of 7.11% between 2025 and 2034. Increasing investments in water infrastructure are the key factor driving market growth. Also, rapid industrialization in emerging economies, coupled with the surge in environmental awareness, can fuel market growth further.

Key Takeaways

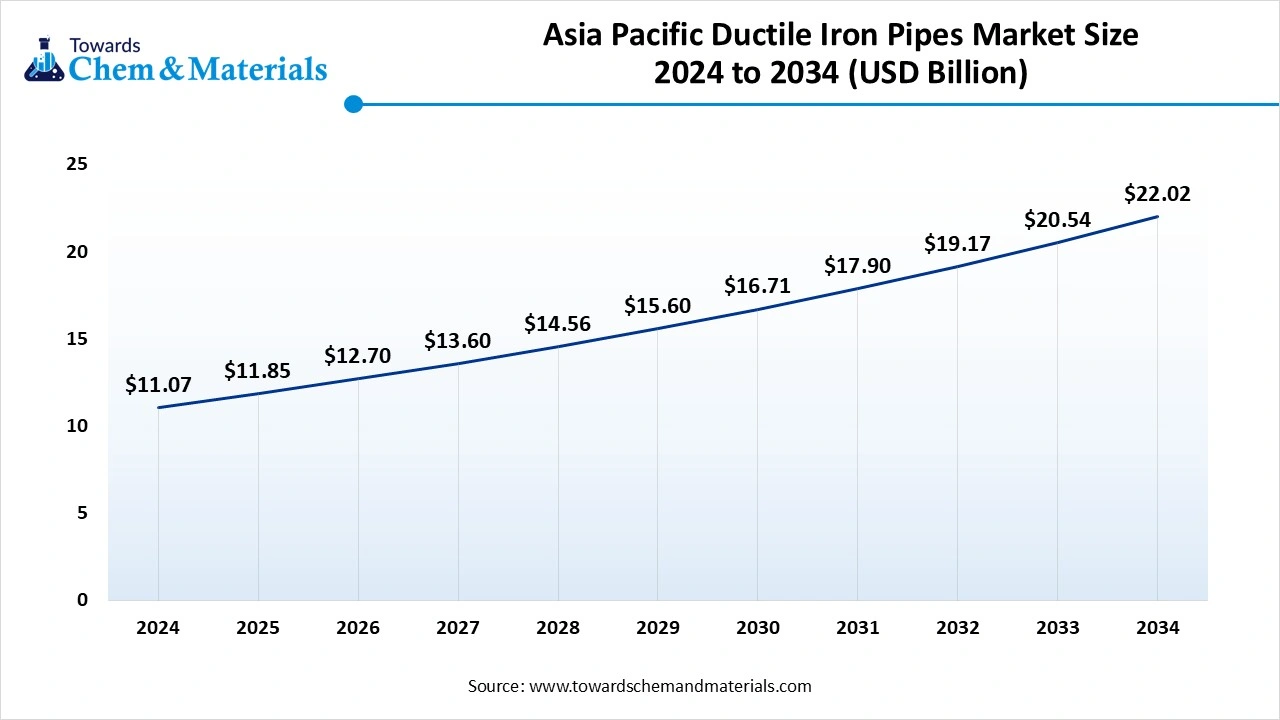

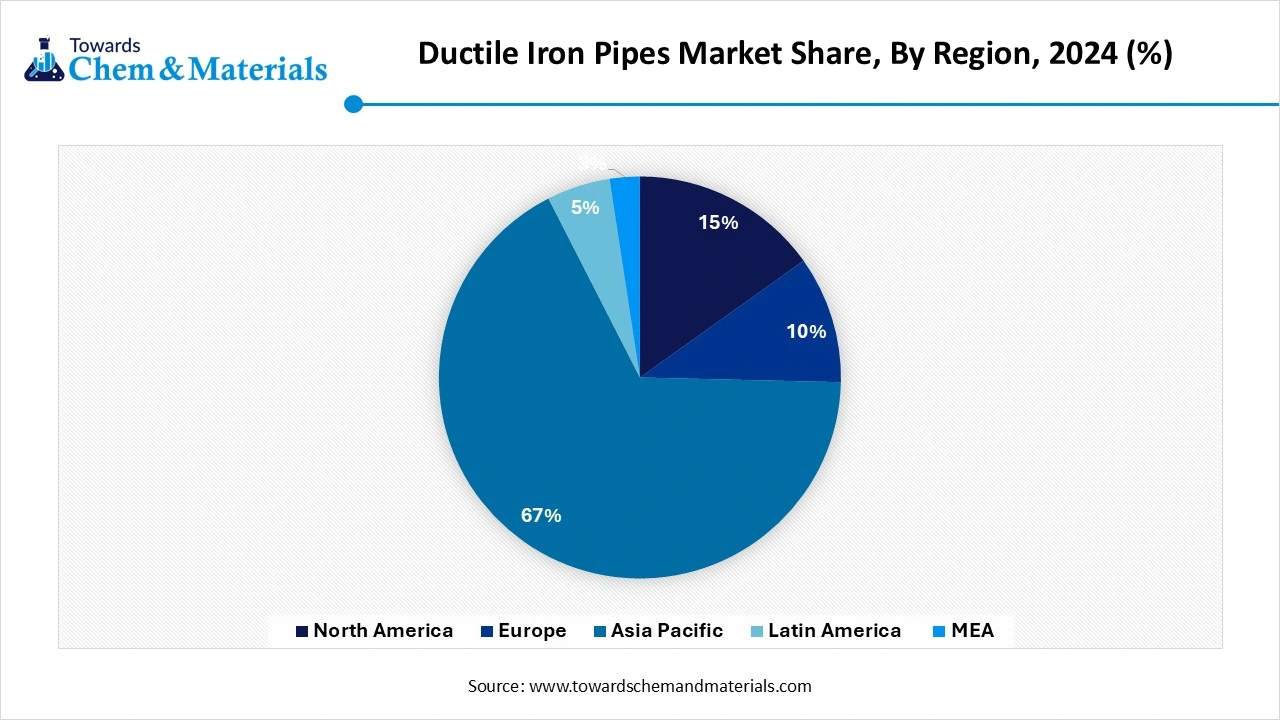

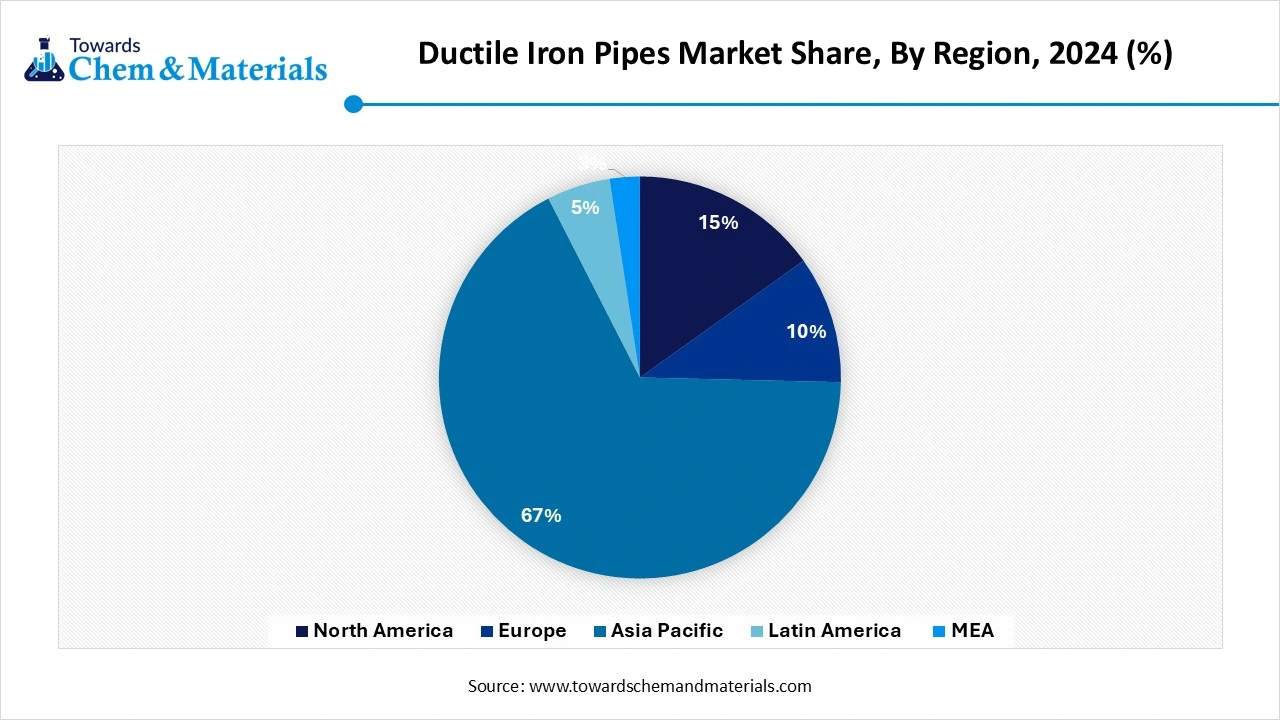

- By region, Asia Pacific dominated the global ductile iron pipes market with the largest share 67.11% in 2024. The dominance of the region can be attributed to the increasing population growth, along with the investment from the private and government sectors in infrastructure projects.

- By region, the Middle East & Africa are expected to grow at a significant CAGR over the forecast period. The growth of the region can be credited to the substantial investments in wastewater and water infrastructure.

- By diameter insight, the DN 80–300 mm (Small Diameter) segment dominated the market in 2024. The growth of the segment can be attributed to the surge in infrastructure development, especially for wastewater.

- By diameter insight, the DN 1100 mm segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to their superior corrosion resistance properties, durability, and long-term cost-effectiveness.

- By application, the portable water segment held the largest market share in 2024. The dominance of the segment can be linked to the ongoing industrialization and urbanization, along with the demand to change the current water infrastructure.

- By application, the fire protection system segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be driven by the growing need for durable and reliable water infrastructure.

- By installation technique, the open trench installation segment dominated the ductile iron pipes market in 2024. The dominance of the segment is owed to the rising demand for durable and reliable wastewater infrastructure.

- By installation technique, the trenchless installation segment is expected to grow at a significant CAGR over the projected period. The growth of the segment is due to the growing demand for less disruptive construction methods in rural and urban areas.

- By lining type, the cement-mortar lining segment led the market in 2024. The dominance of the segment can be credited to the surge in water quality standards.

- By lining type, the polyurethane lining segment is expected to grow the fastest CAGR during the project period. The growth of the segment can be linked to the growing demand for corrosion-resistant and durable pipes, along with polyurethane's ability to withstand various environmental conditions.

- By coating type, the zinc coating segment dominated the market in 2024. The dominance of the segment can be driven by a surge in urbanization, growing demand for wastewater infrastructure.

- By coating type, the ceramic epoxy polymer segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to ongoing government initiatives emphasizing water infrastructure.

- By end-use sector, the municipal infrastructure projects segment held the largest market share in 2024. The growth of the segment is credited to the innovations in ductile iron pipe manufacturing technology

- By end-use sector, the commercial/residential construction segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be attributed to the increasing awareness regarding the benefits of effective wastewater treatment.

- By pressure rating, the PN 10–16 (Standard Pressure) segment dominated the ductile iron pipes market in 2024. The dominance of the segment is owed to the growing investments in water infrastructure, especially in emerging economies.

- By pressure rating, the PN 20 and above (high pressure) segment is expected to grow at a significant CAGR over the projected period. The growth of the segment can be linked to the rising adoption of modern installation methods.

- By sales channel, the direct Sales (to governments & EPCs) segment led the market in 2024. The dominance of the segment can be linked to the growing awareness among EPCs and governments regarding the advantages of ductile iron pipes.

- By sales channel, the distributors/stockist's segment is expected to grow the fastest CAGR during the project period. The growth of the segment is owed to the increasing use of ductile iron pipes by SMEs, along with the rural procurement.

Ongoing Technological Innovations Expanding Market Growth

Ductile Iron Pipes are centrifugally cast-iron pipes manufactured using ductile cast iron, a type of iron known for its high strength, elasticity, and impact resistance. These pipes are extensively used in water and wastewater transportation systems due to their durability, corrosion resistance (often enhanced by linings/coatings), and long service life. Ductile iron offers better performance compared to traditional gray cast iron due to its nodular graphite inclusions. There is an increasing focus on eco-friendly water management practices; hence, these iron pipes are preferred for their long service life and durability, which makes them a crucial choice among manufacturers.

What Are the Key Trends Influencing the Ductile Iron Pipes Market?

- The surge in demand for infrastructure development projects across the globe is the key trend in the market. This demand is fuelled by heavy investments in urbanization, wastewater management, and enhancements in the water infrastructure. Due to its resilience to corrosion and affordability, ductile iron is highly preferred by major players.

- Major players in the market are emphasising increasing awareness regarding the benefits of using sustainable ductile iron pipes. To meet customers' demand, major players are creating advanced sustainable ductile iron pipe techniques to stick to the latest trend in the market. This is the major factor impacting positive market growth.

- The use of materials such as zinc-aluminium, epoxy, zinc, electro steel and PE, PU, and ceramic allows vendors to reach greater levels of protection due to innovations in ductile iron pipe coating technology. Governments across the world are emphasizing improving their nations' abilities for water and sanitation, leading to market expansion shortly.

How is the Government Supporting the Ductile Iron Pipes Market?

The government is increasingly promoting the market through various initiatives and infrastructure projects focusing on water, sanitation, and management. The efforts, such as Smart Cities Mission and Al Jeevan Mission, directly fuel the demand for ductile iron pipes because of their reliability and durability in wastewater management and water distribution.

The Indian government is rapidly investing in water infrastructure projects such as the Smart Cities Mission and Jal Jeevan Mission (JJM), both of which depend on ductile iron pipes for water supply and sanitation. Emerging economies with increasing populations and infrastructure demand are also witnessing growing demand for ductile iron pipes.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 17.66 Billion |

| Market Size by 2034 | USD 32.77 Billion |

| Growth rate from 2024 to 2025 | CAGR 7.11% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Diameter, By Application, By Installation Technique, By Lining Type, By Coating Type, By End-Use Sector, By Pressure Rating, By Sales Channel, By Region |

| Key Profiled Companies | Saint-Gobain PAM (France), Jindal SAW Ltd. (India), Kubota Corporation (Japan), American Cast Iron Pipe Company (USA), U.S. Pipe (USA), Electrosteel Castings Ltd. (India), McWane Inc. (USA), Tata Metaliks (India), Benxi Beiying Iron and Steel (China), Xinxing Ductile Iron Pipes Co., Ltd. (China), AMSTED Industries (USA), Svobodny Sokol (Russia), Angang Group Yongtong Ductile Cast Iron Pipe Co., Ltd. (China), Duktus Rohrsysteme Wetzlar GmbH (Germany), Atlantic States Cast Iron Pipe Company (USA), Zhejiang Weifeng Pipe Industry Co., Ltd. (China), Shanxi Ductile Iron Pipes Co., Ltd. (China), Saint-Gobain PAM España (Spain), United Gulf Pipe Manufacturing Co. (Oman), Binhai New Area Tianjin Pipe Co. Ltd. (China) |

Market Opportunity

Stringent Government Standards

Regulatory bodies globally are mandating the use of nontoxic, safe, and anti-corrosion materials to ensure good water quality for public health. Their ability to bear high external loads and internal pressures enables them to comply with the strict performance standards fixed for industrial and municipal water systems. Furthermore, this regulatory environment propels the demand for long-lasting and long-lasting pipe materials in retrofitted water networks, creating future opportunities in the market.

- In January 2025, Rungta Steel announced its expansion into the manufacturing of Ductile Iron (DI) Pipes. The launches of Ductile Iron Pipes complement the firm's flagship product, TMT Bars, with Fly Ash Bricks and Wire Rods.(Source: www.ptinews.com)

Market Challenge

Competition from Substitute Materials

Substitutes such as HDPE, PVC, and steel are the major alternatives to the ductile iron pipes in the market. These materials offer crucial benefits such as lower installation costs and corrosion resistance, hindering market growth further. Moreover, poor port and road infrastructure can delay the supply of raw materials and hence the distribution of end products, affecting the market expansion negatively.

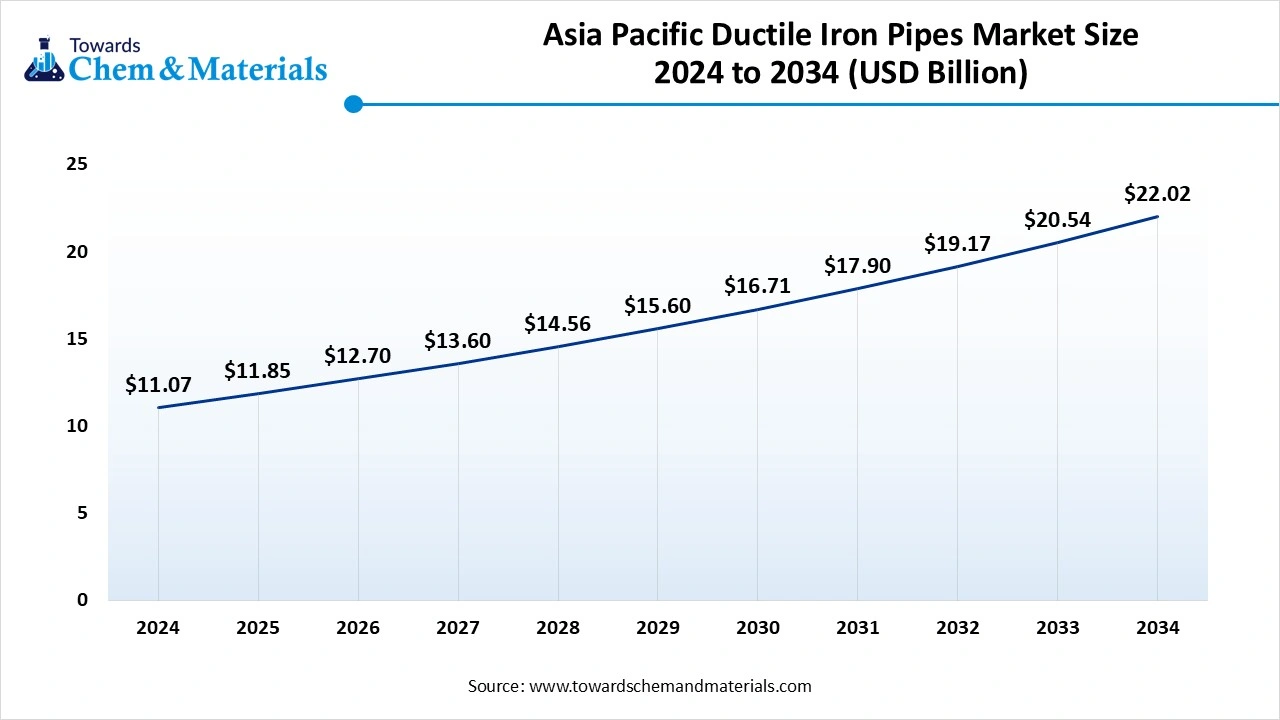

Regional Insights

Asia Pacific dominated the ductile iron pipes market by holding 38% of the market share in 2024. The Asia Pacific ductile iron pipes market is expected to increase from USD 11.85 billion in 2025 to USD 22.02 billion by 2034, growing at a CAGR of 7.12% throughout the forecast period from 2025 to 2034. The dominance of the region can be attributed to the increasing population growth, along with the investment from the private and government sectors in infrastructure projects among developing economies such as China and India. In addition, a surge in regulations and awareness regarding water access and quality, particularly in underdeveloped and rural areas, is boosting the adoption of ductile iron pipes.

Ductile Iron Pipes Market in China

In the Asia Pacific, China led the market owing to the ongoing infrastructure development and urbanization, especially in wastewater and water management. Also, China is the largest manufacturer and consumer of ductile iron pipes, having strong government support and domestic demand within the country. Ductile iron pipes are extensively used in industrial, municipal, and mining sectors for gas, oil, and water supply.

The Middle East & Africa are expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the substantial investments in wastewater and water infrastructure. This growth is further propelled by the region's increasing population and demand to address sanitation and water scarcity challenges. Additionally, major players in the region are involved in mergers and acquisitions to optimize production and expand distribution networks.

- In May 2025, China's Xinxing invests $150mln in a ductile iron pipe plant in Egypt. The plant is anticipated to create 700 direct jobs and an additional 220 indirect employment opportunities. It has an annual production capacity of 250,000 tonnes.(Source: www.zawya.com)

Who is the Top Steel-Producing Companies in 2024?

| Company | Tonnage (million tonnes) |

| China Baowu Group | 130.09 |

| ArcelorMittal (1) | 65.00 |

| Ansteel Group | 59.55 |

| Nippon Steel Corporation (2) | 43.64 |

| HBIS Group | 42.28 |

Segmental Insight

Diameter Insight

Which Diameter Segment Dominated the Ductile Iron Pipes Market in 2024?

The DN 80–300 mm (Small Diameter) segment dominated the market by holding 40 % market share in 2024. The growth of the segment can be attributed to the surge in infrastructure development, especially for wastewater and water management in developing as well as developed nations. This includes rehabilitation of aging pipelines and new construction projects.

The DN 1100 mm and Above (Extra-large Diameter) is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to their superior corrosion resistance properties, durability, and long-term cost-effectiveness. The long lifespans for this size of pies are also positively impacting their cost-effectiveness over time.

Application Insight

How Potable Water Distribution Segment Dominated the Ductile Iron Pipes Market in 2024?

The Potable water distribution segment held the 40% market share in 2024. The dominance of the segment can be linked to the ongoing industrialization and urbanization, along with the demand to change the current water infrastructure. Moreover, governments across the globe are investing heavily in expanding and upgrading water distribution networks.

The fire protection systems segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the growing need for durable and reliable water infrastructure. Stringent fire safety regulations and emphasis on eco-friendly water management practices are also impacting positive market growth soon.

Installation Technique Insight

How Much Ductile Iron Pipes Market Share Was Held By Open Trench Installation Segment in 2024?

Open trench installation segment led the market by holding 60% market share in 2024. The dominance of the segment is owed to the rising demand for durable and reliable wastewater infrastructure, propelled by industrialization and urbanization, coupled with the government initiatives supporting sanitation projects. Also, the expansion of sewage systems and water distribution networks is driving segments' growth shortly.

The trenchless installation segment, such as HDD and pipe Bursting, is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to the growing demand for less disruptive construction methods in rural and urban areas. Trenchless methods, including pipe bursting and horizontal directional drilling (HDD), are especially beneficial in populated areas where open-cut trenching can lead to inconvenience.

Lining Type Insight

Why the Cement-Mortar Lining Segment Dominated the Ductile Iron Pipes Market in 2024?

The cement-mortar lining segment held the 70% market share in 2024. The dominance of the segment can be credited to the surge in water quality standards, increasing urbanization, and aging infrastructure, which contribute to the increasing demand for CML-lined ductile iron pipes in the market.

The polyurethane lining segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be linked to the growing demand for corrosion-resistant and durable pipes, along with polyurethane's ability to withstand various environmental conditions. PU linings provide significant resistance to corrosion as compared to conventional traditional cement mortar linings.

Coating Type Insight

Which Coating Type Segment Dominated the Ductile Iron Pipes Market in 2024?

The zinc coating with bitumen or epoxy segment dominated the market with 60% market share in 2024. The dominance of the segment can be driven by a surge in urbanization, growing demand for wastewater infrastructure and reliable water, coupled with the increasing preference for corrosion-resistant and durable materials.

The ceramic epoxy coating segment is expected to grow at the fastest CAGR over the study period. The growth of the segment is due to ongoing government initiatives emphasizing water infrastructure and the benefits of ceramic epoxy coatings in longevity and corrosion protection. Ceramic coatings minimize the need for frequent replacement and maintenance.

End-Use Sector Insight

How did the Municipal Infrastructure Projects Segment Dominate the Ductile Iron Pipes Market in 2024?

The municipal infrastructure projects segment led the market by holding 60% market share in 2024. The growth of the segment is credited to the innovations in ductile iron pipe manufacturing technology, which are improving their performance by making them more attractive to infrastructure developers and utilities, such as municipal construction projects.

The commercial/residential construction segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be attributed to the increasing awareness regarding the benefits of effective wastewater treatment and clean water that requires the use of robust piping solutions, further fuelling the demand for ductile iron pipes.

Pressure Rating Insight

Which Pressure Rating Segment Dominated the Ductile Iron Pipes Market in 2024?

The PN 10–16 (Standard Pressure) segment dominated the market by holding 65% market share in 2024. The dominance of the segment is owed to the growing investments in water infrastructure, especially in emerging economies, along with the need for long-lasting and reliable pipelines. Furthermore, many countries are increasingly adopting upgrades and expansions of their water supply, which will impact positive segment growth soon.

The PN 20 and Above (High Pressure) segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be linked to the rising adoption of modern installation methods, such as trenchless technology, which are making it faster and easier to install ductile iron pipes, contributing to segment expansion further.

Sales Channel Insight

How Much Share Did the Direct Sales Segment Held in 2024?

The Direct Sales (to governments & EPCs) segment held 60% market share in 2024. The dominance of the segment can be linked to the growing awareness among EPCs and governments regarding the advantages of ductile iron pipes over materials such as PVC and concrete. Direct sales to governments and EPCs are a convenient approach for ductile iron pipe producers.

The distributors/stockist's segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is owed to the increasing use of ductile iron pipes by the SMEs, along with the rural procurement. Distributors and stockists play a significant role in ensuring a constant supply of ductile iron pipes.

Recent Developments

- In February 2025, Sarytogan Graphite created a ductile cast iron utilising its Micro80C graphite, manufactured through its Kazakhstan graphite project. The firm also announced that it has a plan to place as many carbon units into as many markets soon.(Source:www.foundry-planet.com)

- In June 2025, Jindal Saw approved the addition of a step-down facility in the UAE and entered into joint venture agreements to establish major companies in Saudi Arabia. The new facility will emphasize setting up a pipe production facility with a capacity of 300,000 tons per annum (TPA) in Abu Dhabi.(Source: economictimes.indiatimes.com)

Top Companies List

- Saint-Gobain PAM (France)

- Jindal SAW Ltd. (India)

- Kubota Corporation (Japan)

- American Cast Iron Pipe Company (USA)

- U.S. Pipe (USA)

- Electrosteel Castings Ltd. (India)

- McWane Inc. (USA)

- Tata Metaliks (India)

- Benxi Beiying Iron and Steel (China)

- Xinxing Ductile Iron Pipes Co., Ltd. (China)

- AMSTED Industries (USA)

- Svobodny Sokol (Russia)

- Angang Group Yongtong Ductile Cast Iron Pipe Co., Ltd. (China)

- Duktus Rohrsysteme Wetzlar GmbH (Germany)

- Atlantic States Cast Iron Pipe Company (USA)

- Zhejiang Weifeng Pipe Industry Co., Ltd. (China)

- Shanxi Ductile Iron Pipes Co., Ltd. (China)

- Saint-Gobain PAM España (Spain)

- United Gulf Pipe Manufacturing Co. (Oman)

- Binhai New Area Tianjin Pipe Co. Ltd. (China)

Segments Covered

By Diameter

- DN 80–300 mm (Small Diameter)

- DN 350–600 mm (Medium Diameter)

- DN 700–1000 mm (Large Diameter)

- DN 1100 mm and Above (Extra-large Diameter)

By Application

- Potable Water Distribution

- Sewage & Wastewater

- Irrigation

- Industrial Use

- Mining

- Fire Protection Systems

By Installation Technique

- Open Trench Installation

- Trenchless Installation (e.g., HDD, Pipe Bursting)

By Lining Type

- Cement-Mortar Lining

- Polyethylene Lining

- Polyurethane Lining

- Epoxy Lining

By Coating Type

- Zinc Coating with Bitumen or Epoxy

- Polyethylene Coating

- Ceramic Epoxy Coating

By End-Use Sector

- Municipal Infrastructure Projects

- Industrial Facilities

- Agricultural Sector

- Commercial/Residential Construction

By Pressure Rating

- PN 10–16 (Standard Pressure)

- PN 20 and Above (High Pressure)

By Sales Channel

- Direct Sales (to governments & EPCs)

- Distributors/Stockists

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait