Content

Industrial Ovens Market Size and Growth 2025 to 2034

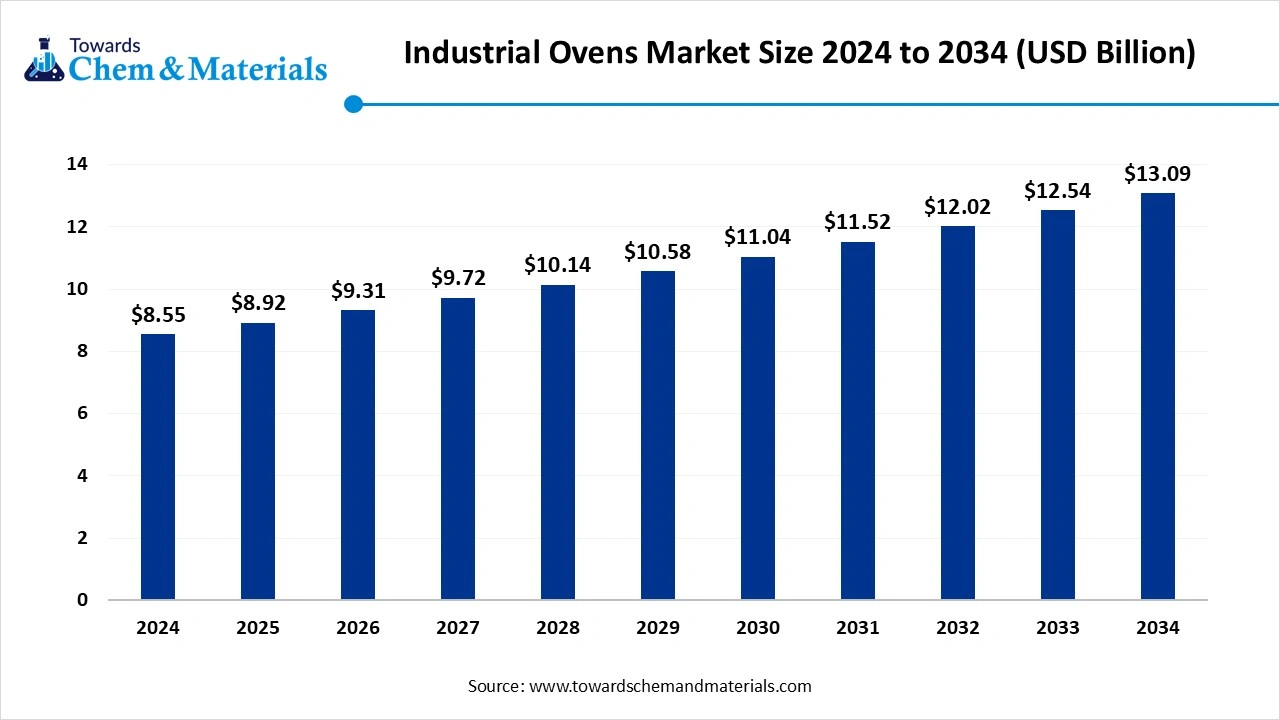

The global industrial ovens market size accounted for USD 8.55 billion in 2024 and is predicted to increase from USD 8.92 billion in 2025 to approximately USD 13.09 billion by 2034, expanding at a CAGR of 4.35% from 2025 to 2034. A surge in the manufacturing sector globally is the key factor driving market growth. Also, ongoing urbanisation and industrialization, particularly in emerging economies, coupled with the growing need for innovative industrial ovens, can fuel market growth further.

Key Takeaways

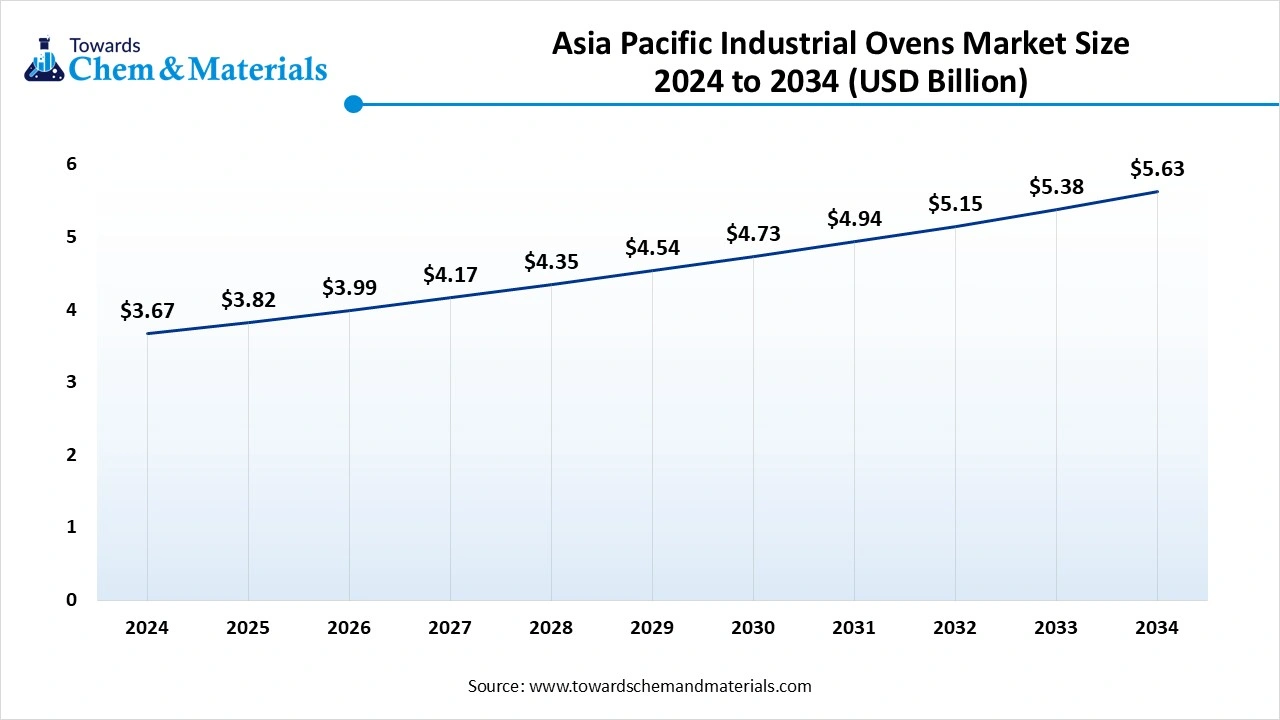

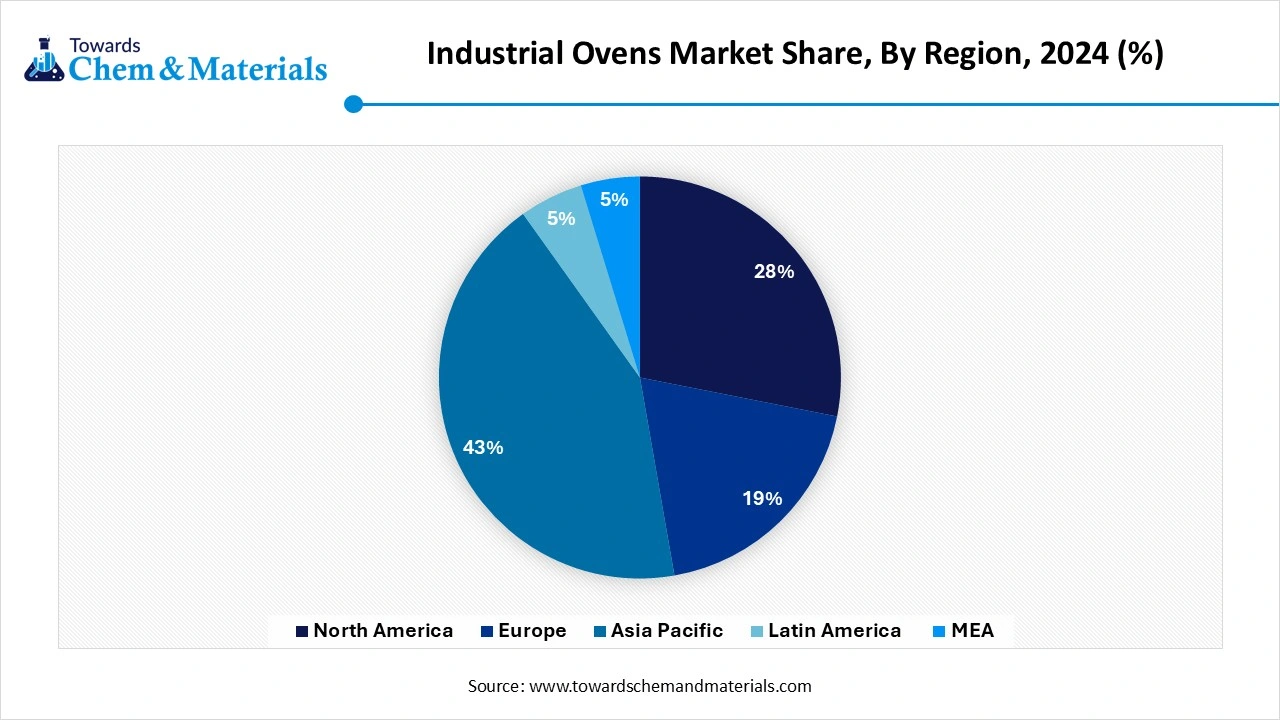

- Asia Pacific dominated the industrial ovens market with the largest revenue share of 42.88% in 2024.

- By region, North America is expected to grow at a significant CAGR over the forecast period. The growth of the region can be credited to the presence of strong production hubs in the U.S., Canada, and Mexico.

- By product type, the curing ovens segment dominated the market with 28% market share in 2024. The dominance of the segment can be attributed to its wide range of applications in various industries.

- By product type, the reflow ovens segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing demand for powerful and smaller electronic devices.

- By heating technology, the electric heat segment led the industrial ovens market by holding 52% market share in 2024. The dominance of the segment can be linked to the innovations in energy efficiency and its suitability for low-temperature applications and smaller batch processes.

- By heating technology, the hybrid segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is driven by the rising need for energy-efficient solutions.

- By configuration, the conveyor/continuous ovens segment held the 37% market share in 2024. The dominance of the segment is due to the increasing need for high-volume production, raised automation, and the rising need for energy-efficient solutions.

- By configuration, the batch/walk-in ovens segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is owed to the growing demand from sectors such as aerospace and automotive.

- By operating temperature, the 500°F–1,000°F segment led the market with 44% market share in 2024. The dominance of the segment can be credited to the rising demand for reliable and efficient thermal processing alternatives in various sectors.

- By operating temperature, the above 1,000°F segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is linked to the developments in material science.

- By application, the food processing segment led the market with 30% market share in 2024. The dominance of the segment can be attributed to the rising demand for drying, baking, and curing processes necessary in food production.

- By application, the electronics segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment can be credited to the innovations in energy efficiency and its suitability.

- By end use industry, the manufacturing segment dominated the market with a 34% market share in 2024. The dominance of the segment can be driven by the growing demand for innovative thermal processing alternatives across different industries.

- By end use industry, the pharmaceuticals segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment is because of innovations in manufacturing technology.

Increasing Sustainability is Expanding Market Growth

The Industrial Ovens Market refers to the global industry involved in the manufacturing and supply of thermally insulated chambers used in a wide range of industrial applications to cure, bake, dry, or heat materials or components. These ovens operate at varied temperature ranges and are essential across sectors such as food processing, automotive, aerospace, chemicals, pharmaceuticals, and electronics. Sectors such as food processing are witnessing significant demand for ovens because of the expansion processed food industry.

What Are the Key Trends Influencing the Industrial Ovens Market?

- Major players are transitioning towards energy-efficient ovens and furnaces to reduce operating costs and fulfil sustainability objectives, which is the key trend driving market growth. Automotive, metal processing, and ceramics sectors are embracing the trending insulation technologies to minimize energy usage, leading to market growth soon.

- Industrial ovens are widely used in the food industry for roasting, baking, and drying purposes. Market players are increasingly being pressured by regulations to utilise temperature-controlled furnaces that ensure persistent sterilizing and cooking because of a focus on food safety.

- Technological innovations in the capabilities and design of industrial overv is another major factor fuelling market growth. Modern ovens come with the latest features like improved energy efficiency, advanced control systems, and IoT integration, which enable manufacturers to control and monitor processes efficiently from remote locations.

How is the Government Supporting the Industrial Ovens Market?

Governments across the globe are increasingly promoting the market through several initiatives aimed at boosting energy efficiency, manufacturing, and strengthening technological advancements. These efforts include infrastructure investments, financial incentives, and regulatory frameworks that optimise the adoption of energy efficient, modern, and industrial norms.

Governments provide tax breaks and subsidies to companies investing in energy-efficient industrial ovens, allowing market players to innovate their sustainable practices and equipment. Governments may offer grants to research companies and institutions to innovate energy-sufficient technologies.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 8.92 Billion |

| Market Size by 2034 | USD 13.09 Billion |

| Growth rate from 2024 to 2025 | CAGR 4.35% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Heating Technology, By Configuration, By Operating Temperature, By Application, By End-Use Industry, By Region |

| Key Profiled Companies | Despatch Industries, Grieve Corporation, Wisconsin Oven Corporation, ASC Process Systems, LEWCO Inc., JLS Ovens, France Etuves, Davron Technologies, HORN Glass Industries AG, Thermcraft Inc., Blue M (Thermo Fisher Scientific), International Thermal Systems (ITS), Epcon Industrial Systems, ACE Equipment Company, Steelman Industries, Inc., HEATTEK, Sistem Teknik, Oshikiri Machinery Ltd., Grupel S.A. |

Market Opportunity

Sustainability Trend Can Drive Market Expansion

Increasing sustainability trend and environmental concern can create future market opportunities. The main benefit of industrial ovens is their significant effectiveness, which enables market players to revolutionize their electrical power into radiant heat. Moreover, as compared to system that depends on fossil fuels, these ovens have almost zero environmental impact as they employ an electric heat source that emits nothing.

- In August 2024, Bühler India introduced two options that will allow biscuit producers to offer a wide range of products to their consumers, to meet the increasing demand in the region. This market launch is a testament to Bühler’s “Make in India” policy that stand upon company's strong expertise in production grain solutions. (Source: nuffoodsspectrum.in)

Market Challenges

Maintenance and Repair Complexity

Modern ovens with innovative features can be challenging to maintain, and specialized knowledge is often needed for repairs and troubleshooting, raising overall operational costs. Moreover, sectors such as pharmaceuticals and food processing face stringent regulations, necessitating ovens to fulfil quality and safety standards, which can add to operational delays and costs in adopting new technologies.

Regional Insights

The Asia Pacific industrial ovens market is expected to increase from USD 3.82 billion in 2025 to USD 5.63 billion by 2034, growing at a CAGR of 4.37% throughout the forecast period from 2025 to 2034. Asia Pacific dominated the industrial ovens market in 2024, and the region is expected to sustain this position during the forecast period. The dominance of the region can be attributed to the rapid urbanisation, industrialization, and the expanding electronics and automotive manufacturing sectors in countries such as China and India. Furthermore, Strategic partnerships between local manufacturers and multinational corporations are boosting technology transfer by enabling more cost-effective production.

Industrial Ovens Market in China

In the Asia Pacific, China led the market owing to the technological innovations, rapid industrialization, and growing demand across different sectors in the country. Also, China has a substantial trade balance in industrial ovens and their parts, with substantial exports to different countries. The Chinese government is promoting industry consolidation to enhance competitiveness in the market.

What is the Microwave Ovens Exports by Country in 2023?

| Reporter | Trade Value 1000USD |

| China | 3,333,954.19 |

| Malaysia | 456,216.23 |

| Thailand | 200,478.72 |

| Germany | 122,431.36 |

| United Kingdom | 100,447.04 |

North America is expected to grow at a significant CAGR over the forecast period. The growth of the region can be credited to the presence of strong production hubs in the U.S., Canada, and Mexico, especially in the aerospace, automotive, and metal fabrication sectors. In addition, there is a growing trend towards smart production and IoT integration, which leads to more connected and sophisticated oven systems.

Segmental Insight

Product Type Insight

Which Product Type Segment Dominated the Industrial Ovens Market in 2024?

The curing ovens segment dominated the market with 28% market share in 2024. The dominance of the segment can be attributed to its wide range of applications in various industries, including aerospace, automotive, and healthcare. In addition, these ovens are important for processes such as coating, adhesive curing, and composite material hardening, which require perfect temperature control.

The reflow ovens segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing demand for powerful and smaller electronic devices. These are specialized industrial ovens used in electronics production, especially for surface mount technology (SMT), to connect components onto printed circuit boards (PCBs).

Heating Technology Insight

Why Electric Heat Segment Held the Largest Industrial Ovens Market Share in 2024?

The electric heat segment led the market by holding 52% market share in 2024. The dominance of the segment can be linked to the innovations in energy efficiency and its suitability for low-temperature applications and smaller batch processes. Electric ovens offer persistent heat distribution and temperature control without combustion emissions, which makes them convenient for sectors with strict contamination.

The hybrid segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is driven by the rising need for energy-efficient solutions, the growth of different industries, along innovations in technology.

Configuration Insight

How did Conveyor /Continuous Ovens Segment Dominated the Industrial Ovens Market in 2024?

The conveyor /continuous ovens segment held the 37% market share in 2024. The dominance of the segment is due to the increasing need for high-volume production, raised automation, and the rising need for energy-efficient solutions. These ovens combine smoothly into automated production lines, minimizing dependence on manual labour and optimizing the production process.

The batch/walk-in ovens segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is owed to the growing demand from sectors such as aerospace, automotive, and food processing, coupled with the innovations in energy efficiency and automation.

Operating Temperature Insight

How Did the 500°F–1,000°F Segment Dominated the Industrial Ovens Market in 2024?

The 500°F–1,000°F segment led the market with 44% market share in 2024. The dominance of the segment can be credited to the rising demand for reliable and efficient thermal processing alternatives in various sectors and technological innovations, which lead to more versatile and efficient operations. In production plants where heat treatment needs temperatures below 1,000°F, these ovens are required.

The above 1,000°F segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is linked to the developments in material science, like the creation of new alloys and innovative ceramics, which often necessitate high-temperature processing for their manufacturing and treatment.

Application Insight

Which Application Segment Held the Largest Industrial Ovens Market Share in 2024?

The food processing segment dominated the market with 30% market share in 2024. The dominance of the segment can be attributed to the rising demand for drying, baking, and curing processes necessary in food production. The growth of processed and packaged food sectors, particularly in the U.S. and Europe, boosts the need for energy-efficient and reliable ovens, driving segment growth further.

The electronics segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment can be credited to the innovations in energy efficiency and its suitability. The growing adoption of smart factory and automation concepts, along with stringent regulatory and quality standards, is also contributing to market expansion soon.

End-Use Industry Insights

Which End-Use Industry Segment Dominated the Industrial Ovens Market in 2024?

The manufacturing segment dominated the market with a 34% market share in 2024. The dominance of the segment can be driven by growing demand for innovative thermal processing alternatives across different industries and rapid urbanisation in emerging economies such as China and India. Government initiatives to support production hubs and export-oriented sectors are also expected to impact positive market growth soon.

The pharmaceuticals segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment is because of innovations in manufacturing technology, the growing need for drug production, and the demand for reliable and efficient thermal processing solutions.

Recent Developments

- In January 2025, Tata Steel issued an advisory regarding the decommissioning process of its coke oven battery to safeguard from the misinterpretation of the flaring that takes place over the process of retiring the battery.

(Source: www.business-standard.com) - In September 2024, Valoriani supplier, introduced a 10-year service proposition for ovens. The scheme titled Revisione will see an oven owner's benefits through finding areas of enhancement and regular health checks, and examinations.(Source: www.cateringinsight.com)

Top Companies List

- Despatch Industries

- Grieve Corporation

- Wisconsin Oven Corporation

- ASC Process Systems

- LEWCO Inc.

- JLS Ovens

- France Etuves

- Davron Technologies

- HORN Glass Industries AG

- Thermcraft Inc.

- Blue M (Thermo Fisher Scientific)

- International Thermal Systems (ITS)

- Epcon Industrial Systems

- ACE Equipment Company

- Steelman Industries, Inc.

- HEATTEK

- Sistem Teknik

- Oshikiri Machinery Ltd.

- Grupel S.A.

Segments Covered

By Product Type

- Curing Ovens

- Drying Ovens

- Baking Ovens

- Reflow Ovens

- Batch Ovens

- Continuous Ovens

- Clean Room Ovens

- Others (e.g., laboratory ovens, tunnel ovens)

By Heating Technology

- Electric Heat

- Gas-Fired

- Infrared Heaters

- Microwave

- Hybrid

By Configuration

- Batch/Walk-in Ovens

- Conveyor/Continuous Ovens

- Top Load

- Bottom Load

- Cabinet Ovens

By Operating Temperature

- Up to 500°F

- 500°F–1,000°F

- Above 1,000°F

By Application

- Food Processing

- Automotive & Aerospace

- Electronics

- Pharmaceuticals

- Chemical Processing

- Metallurgy & Foundry

- Textile

- Others (plastics, composites)

By End-Use Industry

- Manufacturing

- Healthcare & Pharmaceuticals

- Food & Beverage

- Electrical & Electronics

- Metallurgy

- Aerospace & Defense

- Automotive

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait