Content

Hydrazine Hydrate Market Size and Growth 2025 to 2034

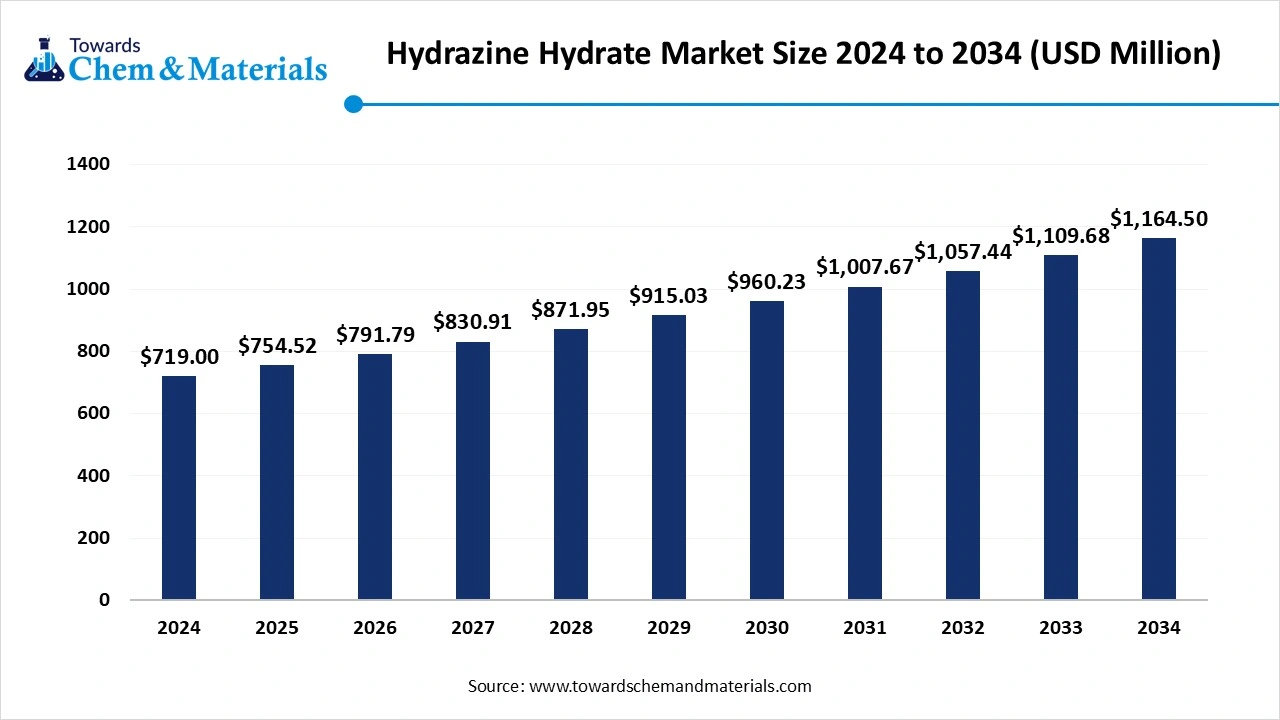

The global hydrazine hydrate market size reached USD 719 million in 2024 and is projected to hit around USD 1,164.50 million by 2034, expanding at a CAGR of 2.45% during the forecast period from 2025 to 2034. The growing demand for polymer foams and the increasing demand from various industries like agrochemicals, pharmaceuticals, and water treatment drive the growth of the market.

Hydrazine Hydrate Market Key Takeaways

- By region, Asia Pacific dominated the hydrazine hydrate market in 2024 due to the well-established industrial sector and the growing agrochemical industry.

- By region, North America is growing at the fastest rate in the market during the forecast period due to growing innovation and the strong presence of the chemical industry.

- By region, Europe is growing at a notable rate in the market due to the presence of major key players in the region.

- By concentration level, the 60-85% segment held a significant share in the hydrazine hydrate market in 2024 due to growing demand from veterinary drugs and the aerospace industry.

- By application, the polymerization & blowing agent segment dominated the market with the largest share in 2024 due to the growing demand for polymer foams.

- By application, the pharmaceuticals segment is expected to grow at the fastest rate in the market during the forecast period due to growing health issues and increasing need for certain pharmaceutical products.

Hydrazine Hydrate: Unknown Power Behind Industrial Applications

Hydrazine hydrate is the solution of hydrazine included in water, and it is utilized as a solvent & reducing agent in various industrial processes. The molecular formula of hydrazine hydrate is N₂H₄ · H₂O, and the molecular weight is 50.061g/mol. It is an oily & colorless liquid, and is a very powerful reducing agent. Azine hydrate is formed using a process like the ketazine process, and this includes ketazine formation, hydrolysis, and a purification & concentration process. The process includes the oxidation of ammonia in the presence of an aliphatic ketone.

Hydrazine hydrate is used as a reducing agent in various chemical reactions, like the reduction of nitro groups, the reduction of metal ions, and organic synthesis. It is used as a solvent in various processes like coatings & paints, leather processing, water treatment, and textile processing. It is widely used in the process of production of agrochemicals, pharmaceuticals, and other chemical processing. Hydrazine hydrate is used as an oxygen scavenger in boilers in water treatment to prevent corrosion. It is used in rockets and some satellites as a fuel.

Hydrazine hydrate can dissolve in water and alcohol, but chloroform and ethyl ether are insoluble. The application of hydrazine hydrate in agriculture is used as herbicides and fungicides. The growing demand from the pharmaceutical and agrochemical sectors helps in the growth of the market. The growing production of plastic chemicals, polymer foams, and rubber increases demand for hydrazine hydrate. Factors like growing demand for polymer foams from various industries, rising needs for fuel cells, and increasing demand for water treatment solutions contribute to the hydrazine hydrate market growth.

From October 2023 to September 2024, the World exported 1179 shipments of hydrazine hydrate.

The Agrochemical Sector is Powering the Hydrazine Hydrate Market

The growing agrochemical industry in various regions increases demand for hydrazine hydrate for the safety of plants. It is widely used as an active ingredient in the production of various pesticides like pyridazine, pyrazole, and triazole. It enhances crop yields and stimulates the growth of plants like cotton, rice, and wheat. Hydrazine hydrate produces nitrogen, an important component for the growth of the plant. It is widely used as fertilizer in some cases, and it has powerful reduced agent properties; due to this, it is widely used in various agrochemical reactions.

The growing utilization of polymer foams in the agrochemical industry helps in the growth of the market. Polymer foams are widely used in the agrochemical industry to enhance the efficiency of applications, control the release of active ingredients, and offer protection to agrochemicals. Polymer foams provide good thermal insulation for various agrochemical applications. The growing synthesis of various insecticides, herbicides, pesticides, and fungicides increases demand for hydrazine hydrate, which is a key driver for the growth of the hydrazine hydrate market.

Hydrazine Hydrate Market Trends

- Technological advancements: The growing technological research in hydrazine hydrate to enhance detection techniques, optimize production methods, and increase application in renewable energy leads to new applications of hydrazine hydrate in various industries.

- The growing demand for water treatment: The growing population in various countries increases demand for clean water. Hydrazine hydrate helps in water treatment by removing heavy metals and contaminants from the water. The growing clean water demand from commercial and domestic applications increases the demand for a reliable and efficient water treatment solution, such as hydrazine hydrate.

- The growing fuel cell application: The growing demand for clean energy production increases demand for hydrazine hydrate. It is used as a fuel source in fuel cells, which provides higher energy density.

- Rising pharmaceutical industry: The growing demand for pharmaceutical products helps in the growth of the hydrazine hydrate market. Hydrazine hydrate is used in the synthesis of pharmaceutical agents, the synthesis of indazoles, and the synthesis of certain drugs.

Hydrazine Hydrate Market Report Scope

| Report Scope | Details |

| Market Size in 2025 | USD 754.52 million |

| Expected Size in 2034 | USD 1,164.50 million |

| Growth Rate | CAGR of 2.45% from 2025 to 2034 |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| High Impact Region | Asia Pacific |

| Segment Covered | By Concentration Level, By Application, By Region |

| Key Companies Profied | Arkema Group, Japan Finchem Inc, Lonza Group Ltd, Otsuka-MCG Chemical Company,NIPPON CARBIDE INDUSTRIES CO., INC.,LANXESS AG,Weifang Yaxing Co. Ltd,Anbros Consultants And Engineers Capot Chemical Co. Ltd,Arrow Fine Chemicals,LCG Science Group Holdings Ltd,Alfa Aesar,Bayer AG,Fison,Lansdowne Chemicals Plc,Chemtex Specialty Ltd. Sandrine Corporation,Palm Commodities International, LLC,GFS Chemicals Inc. |

Hydrazine Hydrate Market Opportunity

Surging Polymer Foams Demand Engine for the Hydrazine Hydrate Market

The growing utilization of polymer foams in various end-user industries like packaging, automation, and construction increases demand for hydrazine hydrate. The growing urbanization increases demand for construction, which fuels demand for polymer foams. In construction activities, polymer foams are used for soundproofing and thermal insulation in buildings, which lowers the consumption of energy.

The growing automotive sector uses polymer foams to lower emissions and enhance fuel efficiency. The rapid expansion of e-commerce increases demand for protective packaging. The growing household goods demand utilizes polymer foams in furniture, mattresses, and bedding. The rapid industrialization fuels a surge in manufacturing, increasing demand for hydrazine hydrate. The increasing demand for polymer foams in various industries is creating an opportunity for the hydrazine hydrate market.

Hydrazine Hydrate Market Challenge

Rising Environmental Concerns Hamper the Hydrazine Hydrate Market

Despite several advantages of hydrazine hydrate, growing environmental concerns restrict the growth of the market. Concentrated solutions of hydrazine hydrate can cause harmful effects to aquatic life and the environment. The accidental release of hydrazine hydrate into waters can create problems for the aquatic plants, fish, and invertebrates. It degrades quickly in the environment and pollutes the soil, creating risks to plant life.

It releases toxic gases in fires and contributes to air contamination. The hazardous waste of hydrazine hydrate leads to various health problems, like cancer and systemic effects. The growing environmental concerns due to hydrazine hydrate can hamper the growth of the market.

Hydrazine Hydrate Market Regional Insights

Asia Pacific: Hub for the Hydrazine Hydrate

Asia Pacific dominated the hydrazine hydrate market in 2024. The well-established industrial sector and growing manufacturing processes increase demand for hydrazine hydrate, which helps in the growth of the market. The growing agrochemical sector in the region is fueling demand for herbicides and pesticides, which drives the market growth. The rapid expansion of the pharmaceutical industry increases the production of pharmaceutical intermediates and drugs, which fuels demand for hydrazine hydrate. The favourable government policies & regulations encourage innovation and industrial growth, which helps in the market growth.

The growing civilization in the region fuels demand for industrial and infrastructure projects that directly increase demand for hydrazine hydrate. Furthermore, the growing demand for clean water in the industrial, residential, and commercial sectors increases demand for water treatment, which contributes to the overall growth of the market.

Japan exported 1550 shipments and South Korea exported 1456 shipments of hydrazine hydrate.

China’s Growing Demand for Hydrazine Hydrate

China leads the hydrazine hydrate market in the Asia Pacific region. The growing population increases the demand for various goods, which helps in the growth of the market. The growing industrialization and the large agricultural sector increase demand for herbicides, insecticides & pesticides that directly fuels demand for hydrazine hydrate. The supportive government policies for agricultural & industrial development increase demand for hydrazine hydrate.

The well-established production facilities and chemical synthesis facilities help in the market growth. Additionally, a well-developed manufacturing base, growing demand from pharmaceuticals, and the presence of various companies that utilize and produce hydrazine hydrate support the growth of the market.

India’s Key Role in the Hydrazine Hydrate Market

India is a major contributor to the hydrazine hydrate market. The rapid growth in the agrochemical and pharmaceutical industry drives the growth of the market. The various government initiatives encourage the domestic production of hydrazine hydrate. For instance, the Atmanirbhar Bharat aims to encourage domestic production and lower dependence on imports.

The growing domestic production and development of indigenous technology help in the growth of the market. Furthermore, growing populations increase demand for clean water, which fuels demand for water treatment, contributing to the market growth.

Hydrazine Hydrate Expansion in North America

North America is growing at the fastest rate in the market during the forecast period. The presence of a strong chemical industry in the region supports the growth of the market. The well-established research and development sector fuels innovations in the hydrazine hydrate applications, which helps in the market growth. The presence of a key player in the region increases the production and distribution of hydrazine hydrate. The growing polymerization demand in the plastics industry fuels demand for hydrazine hydrate. Furthermore, the presence of well-established industries like water treatment, pharmaceutical, and agricultural industries increases demand for hydrazine hydrate for oxygen scavenging in water treatment, pharmaceutical synthesis, and agrochemical production, supporting the overall market growth.

Hydrazine Hydrate Demand Boosts in the United States

The United States is a key contributor to the hydrazine hydrate market growth. The presence of well-developed industrial infrastructure, including pharmaceutical manufacturing plants and water treatment facilities, drives the growth of the market. The growing demand from various industries like pharmaceuticals, agrochemicals, defense, and aerospace helps in the growth of the market. The presence of key players in the production and distribution of hydrazine hydrate drives the market growth.

Significant Rise of Hydrazine Hydrate in Europe

Europe is growing at a notable rate in the market. The strong manufacturing base in hydrazine hydrate drives the market growth. The growing industrialization and the growing demand from the water treatment and pharmaceutical industries support the growth of the market. The technological advancement in fuel cells and solar cells increases demand for hydrazine hydrate.

Countries in the region, France, Switzerland, and Germany, support the market growth. The presence of key players in the region, like Lonza, Arkema GROUP, and LANXESS, drives the growth of the market. States such as Pennsylvania, New York, and Illinois contribute to the market growth. France is the global leader and exported 2077 shipments of Hydrazine hydrate.

Hydrazine Hydrate Market Segmental Insights

Concentration Level Insights

The 60-85% segment dominated the hydrazine hydrate market in 2024. The growing demand for polymerization & blowing agents helps in the growth of the market. The 60-85% concentration is widely used in the manufacturing process of various foams and polymers. The growing requirement to produce various chemicals from various industries increases demand for a 60-85% concentration level.

The growing production of various veterinary drugs and the expansion of the aerospace sector drive the growth of the market. The growing utilization as the propellant in emergency power units for F16 fighter jets and single-engine aircraft fuels the growth of the market. It is a strong reducing agent and has higher potency. Furthermore, growing demand from various applications like agrochemicals, water treatment, polymer production, and pharmaceuticals contributes to the overall growth of the market.

Application Insights

The polymerization & blowing agent segment dominated and held the largest share of the hydrazine hydrate market in 2024. The growing production of various polymers like LDPE, PS, PET, PVC, PP, and HDPE increases demand for polymerization initiators like azodicarbonamide and azobisisobutyronitrile, which helps in the growth of the market. Hydrazine hydrate is widely used as a blowing agent and polymerization initiator.

The growing demand for polymer foams from various applications, such as packaging, automotive, insulation, cushioning, and construction, increases the demand for hydrazine hydrate. The widespread use of hydrazine hydrate derivative azodicarbonamide in the plastic industry for generating foam cores in pipes and other products helps in the growth of the market. The growing production of polymers with certain properties, including enhanced thermal stability, strength, and flexibility, increases demand for chain transfer agents, which supports the overall market growth.

The pharmaceutical segment expects the fastest growth in the market during the forecast period. The growing demand for various pharmaceutical products, like certain antibiotics and antifungal agents, helps in the growth of the market. The growing cancer problems increase the utilization of derivatives of hydrazine hydrate, like hydrazine sulfate. The growing production of a wide range of drugs drives the growth of the market.

The ongoing innovations I the development of new and improved drugs and treatments fuel demand for hydrazine hydrate. The growing production of active pharmaceutical agents, which are the active component in medications, increases demand for hydrazine hydrate. Additionally, rising disposable incomes, increasing healthcare spending, an aging population, growing healthcare access, increasing health issues awareness, and innovations in drug development contribute to the market growth.

Hydrazine Hydrate Market Recent Developments

Gujrat Alkalies and Chemicals Limited

- Contribution: In July 2023, the first consignment of hydrogen hydrate from the Dehej complex. Initially, hydrogen hydrate was developed at bench scale & laboratory in the CSIR-IICT at Hyderabad, and it was scaled up to a pilot plant with the GACL company. This development reduces import dependency

Gujrat Alkalies and Chemicals

- Contribution: In September 2022, Gujrat Alkalies and Chemicals started the manufacturing process of hydrazine hydrate at the Dehej complex. The manufacturing process started by providing raw materials to the process equipment. The aim is to reduce imports of hydrazine hydrate.

IICT

- Partnerships: In May 2022, IICT collaborated with Gujrat Alkalies & Chemicals for India’s first hydrazine hydrate plant development. This chemical is suitable for the agrochemical, pharmaceutical, and polymer industries. IICT developed a cost-effective hydrazine hydrate technology through the peroxide ketizine route. The raw material of the process is reused and recovered without any loss of yield. This project consists of more than a dozen scientists, and the process is environmentally friendly.

Hydrazine Hydrate Market Top Companies List

- Arkema Group

- Japan Finchem Inc

- Lonza Group Ltd

- Otsuka-MCG Chemical Company

- NIPPON CARBIDE INDUSTRIES CO., INC.

- LANXESS AG

- Weifang Yaxing Co. Ltd

- Anbros Consultants And Engineers

- Capot Chemical Co. Ltd

- Arrow Fine Chemicals

- LCG Science Group Holdings Ltd

- Alfa Aesar

- Bayer AG

- Fison

- Lansdowne Chemicals Plc

- Chemtex Specialty Ltd.

- Sandrine Corporation

- Palm Commodities International, LLC

- GFS Chemicals Inc.

Segments Covered in the Report

By Concentration Level

- 100%

- 60-85%

- 40-55%

- 24-35%

By Application

- Polymerization & Blowing Agents

- Pharmaceuticals

- Agrochemicals

- Water Treatment

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait